Search for a form by name:

Search form by content:

Forms

The forms are prepared in Word format and are completely ready for printing on A4 paper, less often A3 format.

If the form is in A5 size, then basically the layout will contain two forms on an A4 sheet. Accordingly, the A6 format form is repeated 4 times on an A4 format sheet. In some cases there will be a non-standard arrangement, for example 3, 6 or 8 forms on an A4 sheet.

Perhaps you will see 2, or maybe more forms with the same name. Look at everything and choose for yourself the most suitable design and design of the form you need.

Dear users, not all layouts of forms are prepared perfectly and if you find broken links, incorrect loading by layout name, and also if you see incorrect design of some layouts, please leave your comments, thereby you will save time for other users, because We are all working people and time is precious to us.

I spent part of my youth (and perhaps it has already passed) creating and uploading this database of layouts to the site for free download. Be critical and objective, feel free to leave comments. Perhaps my database of templates for forms and magazines has helped someone after all.

Invoice requirements are actively used in the activities of many organizations. What is this document for and who might need it? What forms are there? How are they filled out? What are the general design rules and what should you pay attention to? These and other questions will be answered in this article.

Dear readers! Our articles talk about typical ways to resolve legal issues, but each case is unique.

If you want to find out how to solve your particular problem, please use the online consultant form on the right or call. It's fast and free!

General design rules

The document contains the following information:

- The name of the organization between departments whose services transfer material assets.

- Date of preparation.

- Name of sender and recipient.

- Description of the transferred inventory items.

Representatives of each party put their signatures in the appropriate columns.

The cost indicators of the goods are entered into the invoice by the accountant.

More details about the procedure for filing claims-invoices can be found here.

There are several of them.

Form 434 (OKUD 0504234)

In 1999, Order of the Ministry of Finance of the Russian Federation No. 107n “On approval of the Instructions for accounting in budgetary institutions” approved a unified form 434, which is used when transferring inventory items within the named legal entities. That is, it is Form 434 that all public sector organizations work with .

Moreover, using this document, mat. values can be exchanged between different organizations within the same system that have a common accounting department.

The filling principles are similar to those indicated above.:

- information about values is indicated;

- their sender;

- their recipient.

The transfer of goods is authorized by the signature of the manager.

The shelf life of the invoice must correspond to what is specified in the Federal Law “On Accounting”. That is, it cannot be less than 5 years. This is due to the fact that the invoices discussed in this article are the primary accounting document.

It was approved by the State Statistics Committee in 1997. Not required for use. Meanwhile, why come up with something of your own if the state has already invented a unified form. The document is filled out according to standard rules .

It is used for the purposes that have already been mentioned.

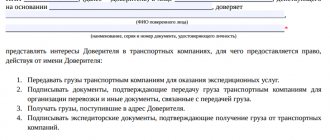

Who signs the receipt order

The law does not say who signs on the receipt order and in what order. Institutions resolve this issue independently. Alternatively, the order can be completed by a higher organization.

Who signs in the “Passed” line?

Signatures of third parties in the order

But third parties, for example a supplier’s representative, do not have to sign form 0504207. This conclusion follows from Appendix No. 5 to the order of the Ministry of Finance of Russia dated March 30, 2020 No. 52n.

At the bottom of the document, the institution’s accountant makes a note that he accepted a non-financial asset for accounting and reflected this transaction in accounting. In particular, he signs and dates it.

Useful video

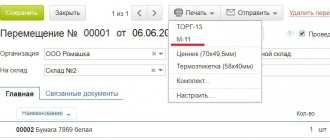

We invite you to watch a video about filling out a demand invoice in 1C:

Didn't find the answer to your question? Find out how to solve exactly your problem - call right now:

+7 (Moscow) +7 (St. Petersburg)

It's fast and free!

If you find an error, please select a piece of text and press Ctrl+Enter.

The demand invoice (form M-11) is an internal document of the organization - it is not transferred to either the buyer or the supplier. All movements of materials in the organization: between departments, from employee to employee - are accompanied by the execution of this document.

Unified forms for public sector organizations are defined in Order of the Ministry of Finance dated March 30, 2015 No. 52n, which specifies the form of the demand invoice (OKUD 0504204). This means that public sector organizations must only use Form 0504204.

- name of goods and materials;

- sender (structural unit or department, OKVED type of activity);

- recipient (structural unit or department, OKVED);

- accounting account (sub-account) (sender, recipient);

- quantity of inventory items;

- price.

Transfer of inventory items can be carried out in the following cases:

- return of balances to the warehouse (unused in the production process of goods and materials);

- return to the warehouse of defective products (production waste);

- issuing materials from the warehouse to the responsible person;

- moving between warehouses, etc.

What it is?

This is paper intended for indoor use. It is not transferred to either the buyer or the supplier. Using the document, inventory items within the organization are recorded.

Differences from conventional TN

Documents differ from each other in their purpose and appearance:

- As noted, the invoice requirement does not go beyond the organization. A consignment note moves along with certain material assets from one person to another.

- There are several unified requirements forms; moreover, an organization can develop its own. Yuumag commodity reporting forms have different forms that are filled out differently.

When is M-11 compiled?

Let's consider the movement of goods within the organization.

Inventory and materials arrive at the warehouse, and the storekeeper draws up a document reflecting the receipt: for example, receipt order M-4 (form according to OKUD 0315003). The data is also reflected in the materials accounting card, for example, in form M-17 (OKUD 0315008) (forms M-4 and M-17 can be downloaded below).

The goods are then stored in the warehouse until shipment. The warehouseman can ship goods to both contractors (suppliers, customers) and internal users (employees, owners, founders).

If there is a need to ship goods within the company, then in this case an M-11 invoice is issued. The basis for issuing a demand invoice is the request for material assets located in the warehouse.

The invoice should be printed in three copies:

- one is kept by the sender;

- the second is transferred to the accounting department;

- the third copy is in stock.

Sample of filling out the demand invoice according to form 0504204

As is known, the process of moving inventory items within an enterprise and between counterparties is subject to mandatory regulation and reflection in accounting.

Therefore, to record transactions involving the transportation of tangible assets in accounting, the requirement-invoice form 0504204 is used, a sample of which you will find in this article. This form has a legally regulated structure. In this regard, its content should not be adjusted or distorted by business entities.

The demand invoice form is established by the Ministry of Finance of the Russian Federation.

Its current version was approved by order dated March 30, 2020 under No. 52n. This regulatory act also establishes a list of recommended and unified forms to be used in accounting. The demand invoice is classified as a group of documents that government agencies are required to use.

This form is included in the list of 5th class documentation. You can download the template for this document from our website for free using the direct link below: The requirement in question - invoice form 0504204 and the sample filling reflect operations involving the movement of various material assets and fixed assets. This is confirmed by the provisions of the Order of the Ministry of Finance dated December 16, 2010 No. 174n.

This form is required for use on the territory of all constituent entities of the Russian Federation from the beginning of 2020. Also see “Form TORG-13: what it is and why it is needed.” The legislative gap in relation to form 0504204 is manifested in the following:

- there are no recommendations on how to form a document;

- The Ministry of Finance has not prepared an official sample for filling it out;

- The regulations do not specify the procedure for filling out the form.

Standard design rules apply to the demand invoice form.

Thus, entering information into the form can be done computerized or manually. In the latter case, we recommend limiting the choice of ink to black or blue. When a demand invoice form 0504204 is drawn up, the sample filling must contain the following set of information:

- OKPO coding;

- the value of the volume of the requested property;

- number assigned to the document upon registration at the enterprise;

- a list of property to be moved between the specified divisions;

- designation of the unit that needs the valuables to be moved;

- name of the institution;

- the valuation of the asset recorded in accounting;

- date of registration;

- units of measurement used to account for transferred fixed assets (reflecting the names of the meters and their OKEI code);

- for each type of valuables, enter item numbers and passport codes (if any);

- write down the positions of the responsible persons and affix their handwritten signatures (responsible persons are the employees who submitted an application for a specific asset and the employees who drew up the permit for the release of valuables);

- indication of the structural department that is responsible for sending valuables;

Details and filling procedure

Let's consider the procedure for filling out M-11. The invoice is drawn up by the employee of the department where the inventory items are stored and indicates:

- date of compilation;

- structural units of the sender and recipient;

- data on inventory items (name, item number, unit of measurement, quantity);

- if a transaction coding system is used, the corresponding code.

Data on inventory items can also be filled in by the person responsible for production.

The document is internal, therefore it is signed only by the employees responsible for the operation - materially responsible persons (hereinafter - MOL). The warehouse employee checks that the signature of the recipient or transmitter, as well as the person through whom the transfer is made, is present. MOLs must indicate their full name and position.

After this, the accountant fills out the “corresponding account” column and indicates the cost indicators of inventory items.

Request invoice, form 0504204, sample filling

Sample of filling out the demand invoice according to form 0504204

As is known, the process of moving inventory items within an enterprise and between counterparties is subject to mandatory regulation and reflection in accounting. Therefore, to record transactions involving the transportation of tangible assets in accounting, the requirement-invoice form 0504204 is used, a sample of which you will find in this article. This form has a legally regulated structure.

In this regard, its content should not be adjusted or distorted by business entities.

The demand invoice form is established by the Ministry of Finance of the Russian Federation. Its current version was approved by order dated March 30, 2020 under No. 52n.

This regulatory act also establishes a list of recommended and unified forms to be used in accounting.

The demand invoice is classified as a group of documents that government agencies are required to use.

This form is included in the list of 5th class documentation. From our website, the template for this document is available for free via the direct link below: The requirement in question - invoice form 0504204 and the sample filling reflect transactions involving the movement of various material assets and fixed assets.

This is confirmed by the provisions of the Order of the Ministry of Finance dated December 16, 2010 No. 174n. This form is required for use on the territory of all constituent entities of the Russian Federation from the beginning of 2020.

Also see "". The legislative gap in relation to form 0504204 is manifested in the following:

- The Ministry of Finance has not prepared an official sample for filling it out;

- The regulations do not specify the procedure for filling out the form.

- there are no recommendations on how to form a document;

Standard design rules apply to the demand invoice form. Thus, entering information into the form can be done computerized or manually. In the latter case, we recommend limiting the choice of ink to black or blue.

When a demand invoice form 0504204 is drawn up, the sample filling must contain the following set of information:

- OKPO coding;

- designation of the unit that needs the valuables to be moved;

- the number of valuables released in fact;

- indication of the structural department that is responsible for sending valuables;

- units of measurement used to account for transferred fixed assets (reflecting the names of the meters and their OKEI code);

- a list of property to be moved between the specified divisions;

- the valuation of the asset recorded in accounting;

- date of registration;

- number assigned to the document upon registration at the enterprise;

- the value of the volume of the requested property;

- name of the institution;

- write down the positions of the responsible persons and affix their handwritten signatures (responsible persons are the employees who submitted an application for a specific asset and the employees who drew up the permit for the release of valuables);

- for each type of valuables, enter item numbers and passport codes (if any);

Responsibility for drawing up and recording the invoice

Despite the fact that this document is internal, it accompanies the movement of values, and the persons who signed it are financially responsible. If something unexpected happens to the property: theft, damage, other loss, then MOL’s liability may even be criminal. Also, on the basis of M-11, warehouse and accounting are carried out. The storekeeper and accountant are responsible for the correct reflection of accounting data. Accounting data is used to carry out inventories and is also part of accounting and tax reporting.

Responsibility for the absence of a document is provided for in Art. 120 Tax Code of the Russian Federation.

New forms of primary documents

The demand invoice is drawn up in two copies, one of which serves as the basis for the transfer of values, and the second as the basis for their acceptance.3. The act of acceptance and transfer of completed work (rendered services), which formalizes the acceptance of work performed in an economic way. It is used to process settlements with employees (calculate remuneration).

Due to the fact that there is no unified form of the act of acceptance and transfer of work performed (services provided), it should be developed and approved in the accounting policy of the institution. In this case, the act must contain all the mandatory details specified in paragraph 2 of Art. 9 of Federal Law No. 402-FZ, clauses 6, 7 of Instruction No. 157n.

https://www.youtube.com/watch?v=https:tv.youtube.com

In addition, the act also indicates the consumables used in the manufacture of objects.4. Documents used to formalize the acceptance of manufactured fixed assets: - act of acceptance and transfer of fixed assets (f. 0504101). In accordance with Appendix 5 to Order No. 52n, the acceptance and transfer act is drawn up when registering, among other things, transactions for the acceptance (transfer) of investments in real estate;

— receipt order for acceptance of material assets (non-financial assets) (f. 0504207). In addition, an inventory card for recording non-financial assets is drawn up (f. 0504031, 0504032).5. Act on write-off of inventories (f. 0504230), which formalizes the write-off of consumables used in the manufacture of products.

It is used to formalize the decision to write off inventories and serves as the basis for reflecting in the accounting records of the institution the disposal of inventories from the accounting accounts. If the expenditure of material reserves is carried out on the basis of documents approved by the head of the institution, these documents are attached to the act on the write-off of material reserves.

This act is drawn up by the institution’s commission on the receipt and disposal of assets and approved by the head of the institution.6. Invoice for the internal movement of fixed assets (f. 0306032), which formalizes the transfer of manufactured objects into operation. It is used to reflect the internal movement of fixed assets and intangible assets between financially responsible persons in the institution.

Question: What primary accounting documents are compiled by a budgetary healthcare institution when reflecting operations for the movement of fixed assets?

Based on clause 9 of Instruction No. 174n, for registration and accounting of the movement of objects of non-financial assets, the following are used: - an invoice for the internal movement of objects of non-financial assets (f. 0504102), which is drawn up in the case of moving objects within an institution (from a warehouse to operation, from one financially responsible faces to another);

— an act on the acceptance and transfer of objects of non-financial assets (f. 0504101), used to reflect the external transfer of accounting objects by an institution to the party; — an invoice for the release of materials (material assets) to the party (f. 0504205), which is also used to account for the supply of material valuables from the sending institution to third-party institutions (organizations) - recipients, including with the involvement of companies engaged in transportation, on the basis of agreements (contracts) and other documents.