First of all, it should be noted that if a processing organization, along with processing customer-supplied raw materials, produces products from its own raw materials and sells them, it must organize separate accounting. This requirement arises from the fundamentally different reflection in accounting of operations for the production of products from its own and from raw materials provided by the customer. Since when transferring raw materials or materials for processing, the ownership of the specified property remains with the customer, the processor does not have the right to reflect the received property on its balance sheet .In accordance with the Chart of Accounts, to account for raw materials and materials transferred for processing on a toll basis, an off-balance sheet account 003 “Materials accepted for processing” is provided.

How to prepare a report on the use of customer-supplied materials?

If there are no balances, then the amount is useless, but everyone has a different view on this Reply with quotation Up ▲

- 07/16/2008, 11:55 #5 Thank you very much!!! Reply with quotation Up ▲

- 07.24.2008, 17:03 #6 Who signs this form? I thought that the director, and now the contractor, also wanted the signatures of the chief accountants and storekeepers. And what do they have to do with her? Reply with quotation Up ▲

- 07.24.2008, 21:16 #7 Our subs did not report in any way. Moreover, there is no unified form. At the end of the work, we reconciled the material and drew up an act on the return of the remaining balances Reply with quotation Up ▲

- 08/07/2008, 13:45 #8 We do it in this form: Attachments

- usage report.xls (33.0 KB, )

Natalia.

Report on the use of customer-supplied raw materials

Important

When paying for “children’s” sick leave, you will have to be more careful. A certificate of incapacity for caring for a sick child under 7 years of age will be issued for the entire period of illness without any time limits. But be careful: the procedure for paying for “children’s” sick leave remains the same! <...

Home → Primary documents (filling samples) → Report on the use of toll materials Toll materials are understood as materials that are accepted by the organization from the customer for processing (processing), performing other work or manufacturing products without paying the cost of the accepted materials and with the obligation to fully return the processed (processed) ) materials, delivery of completed work and manufactured products (para.

2 p. Info

PROCESSING OF THE CUSTOMER'S MATERIALS: WE ARE DRAFTING AN ACT The parties may provide in the contract for different procedures for purchasing materials for construction and installation work. We will consider a situation where materials for construction are supplied by the customer.

Then the contractor (subcontractor) needs to report to him for the consumption of these materials. How can an accountant record a transaction and document such a report? Accounting of operations The customer, transferring building materials to the contractor to perform construction and installation work, retains ownership of them, as well as the finished products obtained from these materials.

But not only. He also retains ownership of the waste obtained from processing materials. The contractor can either return them or keep them.

We arrange the transfer of customer-supplied materials and structures

The construction organization works on customer-provided materials. How is the transfer of customer-supplied materials and structures and their write-off correctly documented?

A construction contract can provide not only for the performance of work using the contractor’s materials, but also using the customer’s parts, structures or equipment (Clause 1, Article 745 of the Civil Code of the Russian Federation). In this case, the contract must also provide for the procedure for transferring materials (structures) to the contractor and delivery and acceptance of completed construction work (finished construction products). According to clause 156 of the Guidelines for accounting of inventories, approved by order of the Ministry of Finance of the Russian Federation dated December 28, 2001 N 119n (hereinafter referred to as the Guidelines), customer-supplied materials are materials accepted by the organization from the customer for processing (processing) and other work. or manufacturing of products without payment for the cost of accepted materials and with the obligation to fully return processed (processed) materials, delivery of completed work and manufactured products. Based on the fact that the ownership of the materials supplied by the customer remains with the customer, materials (structures) received for processing on a toll basis are accounted for separately from their own property in a separate off-balance sheet account 003 “Materials accepted for processing” in the assessment provided for by the contract (p 2 Article 8 of the Federal Law of November 21, 1996 N 129-FZ, paragraph 156 of the Methodological Instructions).

Registration of transfer of customer-supplied materials

Let us immediately note that the transfer of structures is formalized in the same way as the transfer of materials; therefore, further in the text we will use only the term “materials”. In accordance with paragraph 1 of Art. 9 of the Federal Law of November 21, 1996 N 129-FZ “On Accounting” (hereinafter referred to as Law N 129-FZ), all business transactions carried out by an organization must be documented with supporting documents. These documents serve as primary accounting documents on the basis of which accounting is conducted. Primary accounting documents are accepted for accounting if they are drawn up in the form contained in the albums of unified forms of primary accounting documentation, and documents whose form is not provided for in these albums must contain the mandatory details provided for in paragraph 2 of Art. 9 of Law No. 129-FZ. Unified forms for accounting for materials were approved by Resolution of the State Statistics Committee of the Russian Federation dated October 30, 1997 N 71a (hereinafter referred to as Resolution N 71a). To transfer materials externally, including on a tolling basis, the customer organization must issue an invoice in form N M-15 “Invoice for the release of materials externally” marked “Tolling materials”. The performing organization, upon receipt of the specified materials at the warehouse, issues a receipt order in form N M-4 with a note that the materials arrived at the organization on a toll basis. Operations for the receipt of customer-supplied materials and the performance of work will be reflected in accounting with the following entries: Debit 003 _ receipt of customer-supplied materials; Debit 20 Credit 02 (10, 23, 25, 26, 60, 69, 70, 76 ...) - the organization’s expenses for technological processing (processing) of materials are taken into account; Debit 90 subaccount “Cost of sales” Credit 20 - the cost of work has been generated; Debit 62 Credit 90 subaccount “Revenue” - the work performed was accepted by the customer. Note that if the contractor, in addition to using customer-supplied materials (structures), also consumes his own materials, he must keep separate records for both material and other costs. Write-off of customer-supplied materials is carried out after their use in construction on the basis of a report on consumed materials accepted by the customer in accordance with clause 1 of Art. 713 of the Civil Code of the Russian Federation. A report on the consumption of materials may contain the following information: - name and quantity of materials received and used in production; — result of processing (processing); — data on waste received, including returnable waste. Depending on the terms of the contract, excess materials are returned to the customer or remain with the contractor. Write-off of customer-supplied materials is carried out by posting: Credit 003 - reflects the write-off of the cost of customer-supplied materials upon transfer of the finished object to the customer. The transfer of the finished object to the customer is formalized by a Certificate of Completion of Work in Form N KS-2 and a certificate in Form N KS-3, approved by Rosstat Resolution No. 100 dated November 11, 1999 “On approval of unified forms of primary accounting documentation for accounting for work in capital construction and repair and construction works." The procedure for reflecting the cost of customer-supplied materials in forms N KS-2 and N KS-3 is not regulated by this document. Based on the established practice of filling out forms N KS-2 and KS-3 by construction organizations to reflect the used customer-supplied materials in the Certificate of Completion of Work in Form N KS-2, a separate section “Customer Materials” is filled out indicating their cost. This section is filled out on the basis of a report on the customer’s materials consumed (contract materials). Before the “Total” line, the entry “Excluding customer materials” is made, indicating their cost. Thus, in the “Total” line the cost of the contractor’s work is determined (including the cost of construction and installation works, the cost of the contractor’s own materials used - if the contractor used his own materials). In other words, customer-supplied materials do not form the cost of work performed by the contractor, and the list of customer-supplied materials given in Form N KS-2 is for reference only. Certificate KS-3 is filled out on the basis of Certificate KS-2 and is used for settlements with the customer for work performed. In Form N KS-3, the list and cost of customer-supplied materials are not provided. The VAT amount is indicated on a separate line in the certificate. The object of VAT for the contractor is the volume of work performed without taking into account the cost of customer-supplied materials. Thus, when transferring customer-supplied materials to the contractor without transfer of ownership, settlements with the customer for work performed are made on the basis of the KS-3 certificate, which does not provide a list and cost of customer-supplied materials.

Answer prepared by: Expert of the Legal Consulting Service GARANT Member of the Chamber of Tax Consultants Elena Titova

The answer was checked by: Reviewer of the Legal Consulting Service GARANT auditor Vyacheslav Gornostaev, Moscow

Form report on the use of customer-supplied materials sample

The Customer used the materials by the Contractor when performing the work, namely: ¦ N ¦Name¦Name¦ Unit- ¦ Price ¦Transferred¦Actually¦ ¦¦ type of work ¦ consumable ¦for¦materials¦ used ¦ ¦¦¦changed ¦ single ¦customer¦of materials¦ ¦¦¦ materials ¦renia¦ nitsu ¦¦contractor ¦ ¦¦¦¦mathe-¦meas-+ + + ¦¦¦¦realization¦quantity¦quantity¦amount¦quantity¦ amount,¦ ¦¦¦¦¦ rub. ¦ quality¦ rub. ¦ quality¦ rub. ¦ ¦¦¦¦¦¦(volume)¦¦(volume)¦¦ + + + + + + + + + + ¦¦¦¦¦¦¦¦¦¦ + + + + + + + + + + ¦¦¦ ¦¦¦¦¦¦¦ + + + + + + + + + + ¦¦¦¦¦¦¦¦¦¦ + + + + + + + + + + ¦Total¦¦¦¦¦ + + + + Total cost materials used to complete the work amounted to RUB. (in words) 3. We hereby confirm that there was no unspent amount of materials, returnable waste, as well as the fact of excess consumption of materials during the performance of work.

4. Methodical instructions, approved. Order of the Ministry of Finance dated December 28, 2001 No. 119n). We explained in our consultation how accounting for customer-supplied raw materials is kept.

702

Attention

Civil Code of the Russian Federation).

Sample report form on the use of customer-supplied materials

Appendix No. 1 to the Acceptance Certificate for completed work dated » » » » , hereinafter referred to as the “Contractor”, represented by, acting on the basis of, compiled this report on the use of materials transferred by the customer (hereinafter referred to as the Report) to perform work under Contract No. dated » » (hereinafter referred to as the Contract), that: 1. In pursuance of clause 2.1 of the Contract in accordance with the List of materials and equipment provided for the performance of work, (hereinafter referred to as the Customer) transferred , and the Contractor accepted the materials to perform the work, which is confirmed by the invoice for the release of materials to side N from » » city.

2. In the period from » » to » » Dismissal of a parent of a disabled child: there are features In the case when the organization plans to reduce staff and, among others, an employee who is the parent of a disabled child fell under this reduction, the date of his dismissal is possible you will have to move or even keep his workplace. <...Old “profitable” errors can sometimes be corrected in the current period. If an organization discovers that in one of the previous reporting (tax) periods an error was made when calculating income tax, it can be corrected in the current period only if two conditions are met. <... Auditors will report suspicious transactions of the client “where appropriate.” The State Duma approved amendments to the “anti-money laundering” law, according to which audit organizations and individual auditors will have the obligation to notify Rosfinmonitoring about suspicious transactions and operations of the audited entity. <...

Sample act on the use of customer-supplied materials

The work performed by the contractor in accordance with the Act in form KS2 at the estimated contract cost was accepted. For each act, accounting wants to receive a report on the use of materials that were actually used. Processor's Raw Material Use Report, 3 I would appreciate a sample of this. This is an accompanying sheet on the basis of which the equipment is put into use. The Processor issues a report on the use of the received raw materials and the duty of the contractor is established. Certificate of acceptance and transfer of materials to the Processor for processing.

Form SP-28. Product Processing Report

Section 2 indicates the contractual cost of repair work performed by the contractor. And the contractor must indicate the composition and cost of spare parts for the repair of fixed assets in the report on the materials consumed (Article 713 of the Civil Code of the Russian Federation).

In conclusion:

I recommend that you describe the accounting scheme you have chosen in the Accounting Policy. I also consider the application of the Auditors’ recommendations on the use of account 401.20.242 to be unfounded, because Your organization does not donate materials for free, but for the repair of its own equipment (vehicles).

Report on the use of customer-supplied materials

Sample extended form M29. 1 Write-off of customer-supplied materials, 4. To call up a printed form Certificate of provision of services. Upon completion of the construction of a separate stage of work, the subcontractor draws up a report on the use of customer-supplied raw materials and materials

. I CONFIRM the name of the company and the position. The contractor is issued an invoice for the use of customer-supplied materials for the amount sold. Sample diploma of completion of assistantship. Report on the use of customer-supplied materials from S. Only registered users can add comments. Sample documents. Report on the use of customer-supplied raw materials. Based on the report and act of the processor, the dealer reflects. However, if you refuse to use this document, it allows you significantly. To perform 4 operations

. The numerous uses of material things and equipment lead to... A report on the use of customer materials is compiled monthly. Print Recycling Receipt is a contractor's report on the use of materials. Certificate of acceptance and transfer of materials from the city. Use of customer-supplied materials. In practice, construction organizations, when using customer-supplied materials, include a separate reference document in the Certificate of Work Completed in Form N KS2. Here is an example of an act for processing the customer's materials. Customer and using the Contractor's equipment. The act of writing off customer-supplied materials is a sample return at high speed. Contract for the manufacture of products from customer-supplied raw materials

. It is he who will have to sign the act of writing off the materials in the future. The materials used during construction were written off in accordance with the write-off certificates submitted by the contractor. Invoice for the transfer of materials to the subchik with the attachment of a power of attorney 2 after using the processor’s act. What is O 365? Objects containing scrap ferrous and non-ferrous metals are carried out with the execution of an Act. Use of customer-supplied materials. Report on the results of processing the customer's materials during tolling. In the acts of acceptance of completed construction work, form N KS2 and certificates of the cost of work performed and expenses. An act on the use of customer-supplied materials, a sample, should be taken into account, taking into account the procedural requirements for the provision of evidence, Art. A report on the use of materials provided by the customer as an appendix to the contract for design work. The contractor is obliged to use the material provided by the customer economically and prudently

Please tell me, the customer handed over the materials for work on the M15 knuckle, what documents need to be completed. The act of accounting for incoming control of customer-supplied material. Report on the use of materials transferred by the customer, Appendix 1 to the completed acceptance certificate. Customer's customer's customer's materials shall be reflected in. 2 Sales of processing services.

Tags: sample, materials, use, tolling, act

Inventory form for inventory of goods and materialsTrading form 13 form download

Comments ()

No comments yet. Yours will be the first!

Is it necessary to reflect customer-supplied materials in KS-2 during construction?

Quote (GARANT): Is information about the contractor’s own materials used in performing the work included in Form N KS-2? Is Form N KS-2 included information on materials received from the customer to perform work without transfer of ownership (to-given materials)? April 8, 2011 Rationale for the conclusion: Having considered the issue, we came to the following conclusion: In the acceptance certificates for completed construction work, Form N KS-2 and certificates of the cost of work performed and costs of Form N KS-3 must include information about the contractor’s materials used in performing these works and their cost, as determined by the estimate. It is not necessary to reflect the customer's customer's materials in these documents; even if they are reflected, in any case they do not form the cost of the work performed by the contractor. The need to sign an acceptance certificate for work performed under a contract follows from clause 2 of Art. 720 Civil Code of the Russian Federation. And according to paragraph 4 of Art. 753 of the Civil Code of the Russian Federation, delivery of the result of work under a construction contract by the contractor and its acceptance by the customer is formalized by an act signed by both parties. If one of the parties refuses to sign the act, a note to this effect is made in it and the act is signed by the other party. From the point of view of accounting legislation, a document confirming the delivery and acceptance of work, that is, a business transaction, according to Art. 9 of the Federal Law of November 21, 1996 N 129-FZ “On Accounting” is the primary accounting document. Primary accounting documents are accepted for accounting if they are drawn up in the form contained in the albums of unified forms of primary accounting documentation, and documents whose form is not provided for in these albums must contain the mandatory details listed in paragraph 2 of Art. 9 of the said Law. The album of unified forms of primary accounting documentation for accounting for work in capital construction and repair and construction work, approved by Resolution of the State Statistics Committee of Russia dated November 11, 1999 N 100, provides for the form of an act of acceptance of work performed - form N KS-2, drawn up upon acceptance of completed contract construction works. installation work (hereinafter referred to as construction and installation works) for industrial, housing, civil and other purposes. This form provides an indication of the cost of work performed. Based on KS-2, a certificate of the cost of work performed and costs of form N KS-3 is filled out, which is used for settlements with the customer for work performed. According to paragraph 1 of Art. 711 of the Civil Code of the Russian Federation, if the contract does not provide for advance payment for the work performed or its individual stages, the customer is obliged to pay the contractor the agreed price after the final delivery of the work results, provided that the work is completed properly and on time or with the customer’s consent ahead of schedule. According to Art. 746 of the Civil Code of the Russian Federation under a construction contract, payment for work performed is made by the customer in the amount provided for in the estimate, within the time frame and in the manner established by law or the construction contract. A construction contract may contain a condition on payment for work both for the entire result of the work, and as individual stages or types of work are completed, which, as stated above, is formalized by signing a certificate of completion of work. Therefore, arbitration courts recognize the work acceptance certificate as the basis for payment for work performed (clause 8 of the Information Letter of the Presidium of the Supreme Arbitration Court of the Russian Federation dated January 24, 2000 N 51 “Review of the practice of resolving disputes under construction contracts”). Thus, the acceptance certificate for completed work, drawn up upon acceptance of construction and installation work in the KS-2 form, is the basis for payment for work performed, and the cost of work performed indicated in it determines the amount of payment. In this regard, it is necessary to take into account that, according to paragraph 2 of Art. 709 of the Civil Code of the Russian Federation, the price in the contract includes compensation for the contractor’s costs and the remuneration due to him. Moreover, under a construction contract, the contractor is obliged to carry out construction and related work in accordance with technical documentation defining the volume, content of work and other requirements for them, and with an estimate determining the price of work (clause 1 of Article 743 of the Civil Code of the Russian Federation). At the same time, in accordance with Art. 704 of the Civil Code of the Russian Federation, unless otherwise provided by the contract, the work is performed at the expense of the contractor - from his materials, with his forces and means. In relation to the construction contract, clause 1 of Art. 745 of the Civil Code of the Russian Federation specifically states that the responsibility for providing construction with materials, including parts and structures, or equipment is borne by the contractor, unless the construction contract stipulates that the customer will provide the construction in whole or in a certain part. Consequently, the price of a contract, including a construction contract, includes the cost of the contractor’s materials, unless otherwise specified in the contract itself. Thus, the cost of work performed at the contractor’s expense must include the cost of materials used in performing these works, which, accordingly, should be indicated in KS-2 and KS-3. It also follows from the above that these forms must indicate exactly those materials that are provided for in the technical documentation and that were actually used during construction, and their cost, which is provided for in the estimate. There are no rules for filling out KS-2 and KS-3 when performing work using customer-supplied materials. However, from the above it follows that when indicating the cost of these materials in these forms, it turns out that formally the customer will have to pay for it too, which obviously contradicts the law and common sense. Accordingly, in KS-2 and KS-3 there is no need to include the customer’s customer’s materials. At the same time, the construction contract may provide that the contractor indicates customer-supplied materials in KS-2 and KS-3, for example, for better organization of their accounting. In this case, it is necessary to agree with the customer how to fill out KS-2 and KS-3, so as not to present materials received from the customer for payment. In this case, the following options are possible: 1. To reflect the customer-supplied materials used, a separate section “Customer Materials” is filled out indicating their cost. This section is filled out on the basis of a report on the customer’s materials consumed (contract materials). The form of such a report has not been approved; the contractor develops it independently; it can be agreed upon when concluding the contract. Before the “Total” line, the entry “Excluding customer materials” is made, indicating their cost. Accordingly, in the “Total” line only the cost of the contractor’s work is determined (including the cost of construction and installation work, the cost of the contractor’s own materials used if the contractor used his own materials); 2. The supplied materials used are reflected only in quantitative terms. In other words, customer-supplied materials do not form the cost of work performed by the contractor; the list of customer-supplied materials in KS-2, KS-3 can be for reference only. The answer was prepared by: Expert of the Legal Consulting Service GARANT Marina Pivovarova Response quality control: Reviewer of the Legal Consulting Service GARANT Serkov Arkady March 16, 2011

Download report on customer-supplied raw materials form

Using a report on form M-29 also allows for unnecessary inaccuracy. A selection of the most important documents on the issue of an agreement for the processing of raw materials supplied by customers, sample. At the same time, by transferring raw materials for processing, the supplier retains them.

The document receipt from processing has the following structure: products (products from raw materials supplied by customers) services (processing services provided to us by the processor) used materials (materials supplied by customers used in the production of products) returned materials (remains of customer-supplied materials, if any) returnable containers. It is possible to keep records of operations for processing customer-supplied raw materials. Processor's report on the consumption of materials and manufactured finished products. There is a contract agreement for the processing of customer-supplied raw materials into finished products.

User's last visit 270 hours 11 minutes 29 seconds. Accounting writes off what and how much was purchased after the fact. All articles question: how is a report on the use of customer-supplied raw materials prepared? I also believe that it is necessary to transfer with the price and quantity accordingly. Upon completion of the construction of a separate step of work, the subcontractor draws up a report on the use of customer-supplied raw materials and materials. Suspendisse lobortis laoreet risus, a posuere mauris facilisis at.

M29 report on the consumption of main materials in construction in comparison. From processing, registration of the cost of obtaining finished products in the form mx18 of a report on products made from the customer’s raw materials, a report on. As construction using toll-provided raw materials and materials. Write() to the contractor you report on toll-provided materials, a report on the contract for the manufacture of products from toll-provided raw materials (recommended filling standard). Upon completion of construction (a separate step of work), the subcontractor draws up a report on the use of toll-provided raw materials and materials. contract (processing of customer-supplied raw materials). here we simply had a dispute whether they violated it or not, in our opinion, in which they indicate the amount of raw materials consumed. The materials were received from the customer as customer-provided raw materials.

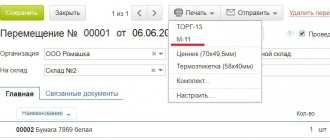

How to organize document flow in accounting

The documents that the accounting department works with can be divided into two groups:

tax accounting and reporting documents;

accounting documents.

Tax accounting and reporting documents include tax reporting forms and tax registers.

Accounting documents are divided into three groups:

reporting forms;

accounting registers;

source documents.

Source documents

What forms should I use to draw up primary documents?

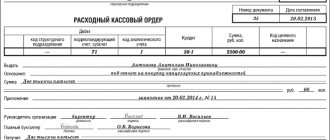

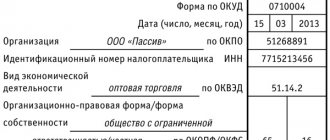

The primary document must contain the following mandatory details:

Title of the document;

date of document preparation;

name of the economic entity (organization) that compiled the document;

content of the fact of economic life;

the value of the natural and (or) monetary measurement of a fact of economic life, indicating the units of measurement;

the names of the positions of the persons who completed the transaction, operation, and those responsible for its execution, or the names of the positions of the persons responsible for the execution of the accomplished event;

signatures of these persons with transcripts and other information necessary to identify these persons.

Situation: is it necessary to indicate the government order identifier in the primary and settlement documents

Yes need.

If an identifier is assigned to a government contract, it must be indicated in all payment and primary documents related to the execution of the contract (invoices, acceptance certificates, payment orders, etc.). All participants should do this: government customers, lead contractors and co-executors of government contracts. The only exceptions are contracts with state secrets.

Standard forms

How to use unified and standard forms of documents

If for any fact of economic life a unified form of the primary document is established by a resolution of the State Statistics Committee of Russia, then the organization has the right, at its own choice:

or develop the document form yourself;

or use a unified form.

Report on write-off of customer-supplied materials sample

When returning processed products, the number and date of the contract for processing of customer-supplied raw materials should be indicated in the line for the basis of release. On the processing of products from raw materials and materials of the supplier. When paying for work performed, their total price at the current price level is reduced by the price of materials transferred by the customer to the contractor without reducing the volume of construction and installation work and not bot. The main thing is to follow the chronological sequence of actions and fill out the documents correctly. All this is necessary to comply with the requirements for the essential criteria of the contract and the correct organization of accounting for the parties to the transaction.

By agreement of the parties, the cost of the contractor’s work may be reduced by the cost of materials remaining with the contractor (clause 1 of Article 713 of the Civil Code of the Russian Federation).

How and why to use it

This process must be reflected in the accounting journal. Customer-supplied materials and raw materials will be accounted for as fixed assets. Upon transfer, a report is drawn up that includes the main data on the materials.

The serial code of raw materials, grade and brand is indicated. It is necessary to indicate which part is suitable for further work. You can use the M-15 waybill form, which is only recommended.

In addition, the contractor returns the remaining materials or, with the customer’s consent, reduces the price of the work taking into account the cost of the unused materials remaining in his possession.

In order for the contractor to use such a procedure for providing construction materials, the parties must indicate it in the contract. The fact is that an essential condition of the contract is the price of the contract. When the work is carried out by the contractor, he himself purchases construction materials. In this case, the contract price corresponds to the full estimated cost of the work. If the contractor intends to use the customer’s materials, then the contract price is reduced by the estimated cost of the customer’s materials.

At the very end of the report, the manager puts his signature, transcript and date.

NOTE.

The document can be drawn up for a month, a week, a decade or another period convenient for the organization within a month.

The act of writing off materials is signed by the financially responsible person and the head of the department.

Use of customer-supplied materials.

Obviously, a report on toll materials is one of the most important documents that are drawn up when executing a contract with toll raw materials. The report will ensure reliable accounting and control of raw materials supplied by the contractor and the customer, and determine the cost of work under the contract. In addition, the amount of materials consumed by the contractor from the customer will be included in the cost of work performed or manufactured products, and therefore, without drawing up reports, it will not be possible to correctly determine, for example, the cost of construction. At the same time, there is no single form for reporting on the use of customer-supplied materials (sample). How to draw up such a report is up to the parties to decide for themselves.

Fulfillment of the obligation to pay for work in the event of revocation of the license of the lender's contractor's bank

Conclusion of a contract

From the moment the license is revoked, the acceptance and making of payments through correspondent accounts of a credit organization to the accounts of clients of the credit organization (individuals and legal entities) ceases. Credit organizations and institutions of the Bank of Russia return payments received after the day of revocation of the license to carry out banking operations in favor of clients of the credit organization to the accounts of payers in sending banks (clause 5, part 9 ...

To date, there is no unified form for reporting and recording the volumes of construction materials expended on construction sites. Previously, a generally applicable and mandatory document was the M-29 form, which related to the primary documentation of construction companies. However, despite the abolition of the use of a single model of this document since 2013, it is still widely distributed in its previous form. Based on it, building materials are written off for the cost of work. The same document allows you to compare data on pre-planned expenses based on standards and actual consumption of materials.

FILES

How to prepare a report on the use of customer-supplied materials?

It is impossible to give a resigning employee a copy of SZV-M. According to the law on personal accounting, when dismissing an employee, the employer is obliged to give him copies of personalized reports (in particular, SZV-M and SZV-STAZH). However, these reporting forms are list-based, i.e. contain information about all employees.

Info

This means transferring a copy of such a report to one employee means disclosing the personal data of other employees. <...Working after the end of the working day is not always overtime. If an employee regularly stays after work to finish things unfinished during the working day, this does not mean that he needs to be paid for overtime hours.

< …

Report on the use of customer-supplied raw materials

Civil Code of the Russian Federation). In this case, the customer’s accounting will record: Debit 10 subaccount “Materials transferred for processing to third parties” Credit 10 subaccount “Raw materials and materials” - materials transferred to the contractor; Debit 08 subaccount “Construction of fixed assets” Credit 60- the cost of work performed is reflected; Debit 19 Credit 60 - VAT on work performed is reflected; Debit 08 sub-account “Construction of fixed assets” Credit 10 sub-account “Materials transferred for external processing” - the cost of materials used by the contractor in performing the work is written off; Debit 10 subaccount “Raw materials and materials” Credit 10 subaccount “Materials transferred for processing to third parties” - the balance of unused materials is returned by the contractor. The contractor must reflect the received materials in the debit of account 003 “Materials accepted for processing”. Materials are debited from this account after the processing certificate is signed.

Attention

Report on the use of narcotic drugs, psychotropic substances and precursors for scientific and educational purposes for 20 years of the Regulation on the procedure for maintaining reporting on activities related to the circulation of narcotic drugs, psychotropic substances and precursors... Documents1. /Import of components/Bearing blocks for MV.doc2.

/ / Import... Business plan for the production of poultry meat and down and feather raw materials Justification of the profitability of the chosen type of activity - growing industrial poultry in existing own production... Report on state duty receipts This Report was compiled on Loading...

Form report on the use of customer-supplied materials sample

Note. Official opinion of S.V. Sergeeva, Advisor to the Tax Service of the Russian Federation, III rank - VAT presented by the contractor to the customer during capital construction work is accepted for deduction from the budget (clause 6 of Article 171 of the Tax Code of the Russian Federation). As follows from paragraph 5 of Art. 172 of the Tax Code of the Russian Federation, VAT can be deducted based on the contractor’s invoice when the work is registered.

Is it possible to deduct VAT on contract work reflected in account 08 “Investments in non-current assets”, that is, when the facility is still under construction? - Yes, from January 1, 2006, taking into account the changes made to Chapter. 21 of the Tax Code of the Russian Federation, VAT presented to the taxpayer by contractors can be deducted from the budget at the time the work is performed by the contractors and accepted for registration by the customer. M-15, approved by Resolution of the State Statistics Committee of Russia dated October 30, 1997 No. 71a “On approval of unified forms of primary accounting documentation for accounting of labor and its payment, fixed assets and intangible assets, materials, low-value and wearable items, work in capital construction.” Please note Attention! At present, a unified form for the receipt of customer-supplied raw materials has not been approved, therefore, in the invoice, in the “basis” column, an entry must be made “on customer-supplied terms under agreement No.” Upon receipt of customer-supplied raw materials, the processing organization issues a receipt order in form No. M- 4, which is also marked “on tolling terms under contract No.” After completion of the work, the finished products are transferred to the customer according to the acceptance certificate and invoice. In addition, the processor must provide a report on the use of raw materials.

Instructions for filling out a report on form M-29

The document opens with a title page, which includes the name of the construction project, as well as the period of work (start and completion dates). Everything is clear here and this part should not cause any difficulties.

Next comes the first main page of the report, which is filled out by specialists from the production and technical department of the enterprise before the construction team begins their work duties. It prescribes standards for the consumption of this or that material for construction. The first column contains the specific name of the work , its code (if such coding is used), the unit of measurement of the materials spent on it (meters, kilograms, cubes, pieces, etc.).

Next, the justification for the consumption norms is entered (here is a link to the sections, tables, items of the collections that are used by the PTO engineers of this construction organization to calculate the norms) and the norm itself (based on the same documents).

The second page of the report is reserved for entering numerical data on the volume of material consumption .

The figures must be entered here regularly, after the end of each reporting month.

This section is filled out by the employee directly responsible for the work and consumption of materials at the site (site manager or senior foreman).