Who fills out the income statement for civil servants?

The list of positions of civil servants whose income declaration is mandatory is listed in Presidential Decree No. 567 of May 18, 2009. This list includes:

- persons holding public positions at the federal, regional and municipal levels on a permanent basis;

- state and municipal employees included in the lists of regulatory legal acts of the Russian Federation;

- employees of state corporations, the Pension Fund of the Russian Federation, the Social Insurance Fund of the Russian Federation, the Federal Compulsory Medical Insurance Fund;

- employees of organizations created on the basis of federal laws;

- employees of organizations created to carry out tasks assigned to federal authorities.

Report on earnings, in accordance with Art. 20 Federal Law No. 79-FZ “On the State Civil Service”, submitted upon admission to work and annually, based on the results of the expired period. It is filled out directly for the civil servant and his immediate family.

The legislator did not provide for the circumstances under which the responsible person is exempt from providing data on earnings. A business trip, illness, or vacation during the declaration period are not grounds for the absence of a report. In such cases, it is sent by mail.

INFORMATION ABOUT BANK ACCOUNTS.

According to paragraph 99 of the Recommendations, this section must reflect information about all accounts opened as of the reporting date, regardless of the purpose of their opening and use, including:

- accounts containing funds belonging to an employee (employee), a member of his family, and this person is not a client of the bank;

- accounts with a zero balance as of December 31 of the reporting year;

- accounts opened during the existence of the USSR;

- accounts opened for loan repayment;

- plastic card accounts, for example, various types of social cards (student's social card, student's social card), plastic cards for crediting pensions, credit cards;

- accounts (deposits) in foreign banks located outside of Russia.

https://youtu.be/bWhZGCw0Gg0

Deadlines for filing income statements for civil servants

Candidates applying for vacant positions of civil servants at all levels provide information about previous income before appointment. The certificate is part of the package of documents for the competition.

Annual declarations are submitted at any time, starting from January 1 of the current year following the reporting year:

- no later than April 1, the President of the Russian Federation, members of the government, the Secretary of the Security Council of the Russian Federation, and federal civil servants of the presidential administration submit information;

- no later than April 30 - civil servants of the federal, regional and local levels, other employees of government agencies and other organizations.

What to pay attention to when filling out the certificate

Have you collected the necessary documents and information? Are you ready to fill out the certificate? See what you need to pay attention to on the title page, in specific sections and columns.

On the title page Fill out the title page for your passport, order of appointment to a position, work book. Write your last name, first name and patronymic in the nominative case. Address – at the place of registration. If one of the family members lives at a different address, then indicate the actual address in brackets

In the column “Occupation” For the child, indicate the educational organization where he studies

In the column “Income from main place of work”

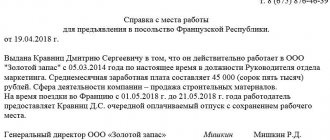

For a spouse: – write down the place of work and job title according to the employment order; – if the spouse does not work, then indicate “temporarily unemployed” or “housewife”; – if the spouse has registered with the employment service, specify “unemployed”;

In the column “Other income”

For a spouse: – if the spouse works under contracts, then make a note “performing work (providing services) in the field...” - instead of an ellipsis, indicate the name of the field; – if the spouse has several places of work, then reflect the main one, where the work book is located, you can indicate other places of work

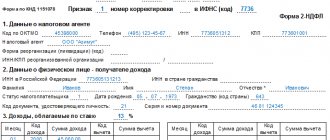

Reflect only the income from your main job - the total amount from the 2-NDFL certificate

Write down your salary and income from other jobs, as well as other income, for example, if you sold a car

In the “Real Estate” section, report on property, including those that have not passed state registration or have not been used for a long time. Do not forget about the exact address of the property and the type of ownership of it

In the "Vehicles" section

Indicate even dilapidated vehicles that cannot be used, and even those that have been stolen.

Income declaration form for civil servants

Civil servants have many privileges. They also have responsibilities. One of them is the annual provision of a certificate of income, expenses, property and property obligations - this is the official and more correct name of the document in which summary information about the family income of the reporting person is entered. The official declaration form for 2020 was approved by Presidential Decree No. 460 of June 23, 2014. The last changes were made to it in 2020. Annual information is carefully checked. Detected inaccuracies are grounds for conducting official investigations.

How to fill out the document

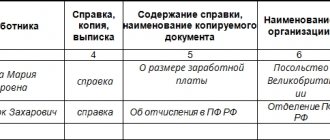

When filling out income certificates for civil servants, the employee will need the information received by him:

- in the bank;

- accounting;

- at the employer;

- in the traffic police;

- in the Unified State Register.

Return to contents

reference Information

Before starting work, you must carefully read the reference information. The left column contains icons, the right column contains descriptions of functions. Each pictogram must be carefully studied.

Return to contents

What to do next

When the program starts, a window will appear. In it, the employee will be offered to create a new one, or launch an existing package of documents.

It is recommended to start from scratch and create a new documentation package. First you need to get a certificate for yourself. To do this you will need to do the following:

- Select the “Create a file” item.

- Select "For me".

- Fill in all the data on the “Data about the person submitting information” page.

If the certificate is created for a spouse, then the algorithm of actions will be approximately the same. Only in the “Select” section you will need to click: “Certificate for your spouse.” Then you will need to fill out the information in the “Information about your spouse” section.

Return to contents

Filling out information

The field “Where the document is submitted” is selected using values from the list. This list is opened via the down arrow icon.

By clicking on it, you can get a list with values. Select the required item. If there is no such option in the list of values, you must select “Other”. Then the desired division is written manually.

The fields “Basic information” and “Additional information” are filled in by checking or ticking. Before doing this, you should select the appropriate value.

Next, you should pay attention to the point “Why is the certificate being submitted?” The checkbox is placed only opposite one of the values. When a new certificate is created, there is a checkmark next to the “Within the scope of declaration values” field. If the main certificate is generated, then this value should be left.

Sample of filling out information about the person presenting the information

Return to contents

Filling out the “Personal Information” block

Your full name you need to write manually. The “date of birth” field is filled in manually or selected from the calendar. To go to the calendar, click on the corresponding icon.

The fields “Series and number of the document that proves the identity” are recorded manually. It is very important that the passport is valid, otherwise the system simply “will not see” it.

The “Date of issue” field is filled in by analogy with the date of birth. Information about exactly where the document was issued is also entered manually.

The “Place of registration” field is filled in using the “ellipsis” icon. By clicking on it, you can see an additional tab for entering the address.

If you want to save time, then you need to immediately start with the “Index” field. After this, the “Region” and “City” fields will be filled in automatically.

It must be remembered that the address of actual residence may not coincide with the registered address. In this paragraph, you must indicate exactly the address at which the employee was registered.

When choosing a street name, you can use the auto-substitution function. After filling out all the fields in the “Address” window, you must click on the “Ok” button.

Next, enter information about the place of work or service. After this, the fields about income “from” and “to” are filled in.

Sample of filling out the “personal data” section

Return to contents

Filling rules

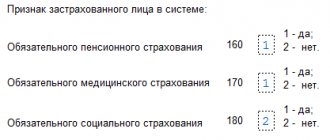

Certificates of civil servants are unified. Everyone uses the same forms for reporting. The rules for filling out income declarations for civil servants do not allow combining information on several family members in one document. Information is provided separately:

- for a civil servant;

- for your spouse;

- for each minor child.

IMPORTANT!

According to Art. 25 of the Family Code, marriage ends on the date of registration of its dissolution. Marital status is taken into account as of the reporting date - December 31. If the marriage is dissolved on this date, a certificate for the former spouse will not be issued.

Presidential Decree No. 82 dated February 21, 2017 specifies that all certificates are generated using special software - SPO “BK Certificates”. The current version of the SPO is posted on the website of the state information system.

It performs the following functions:

- Formation of printed forms in accordance with Decree of the President of the Russian Federation dated June 23, 2014 No. 460 and decrees No. 431 dated September 19, 2017, No. 472 dated October 9, 2017.

- Filling out the necessary information about the relevant persons for subsequent printing in the prescribed form.

- Entering and displaying entered data.

- Checking the correctness of data entry.

Design requirements:

- After printing, you should not add additional information to certificate No. 460;

- It is not allowed to make corrections using correction fluid, erasing letters, crossing out, correcting over errors, etc.;

- It is prohibited to use digital names and text fragments in the text that would make recognition difficult during verification;

- The form is printed on standard A4 format.

OBLIGATION WITHOUT EXCEPTIONS.

In paragraph 4 of the Recommendations, the Ministry of Labor noted that the requirements of anti-corruption legislation do not provide for exemption from the obligation to declare income. Even if an employee or employee is on vacation (annual paid, without pay or salary, for child care, etc.), on sick leave or absent for any other reason, a declaration must still be submitted.

The same applies to family members. If it is impossible to submit information regarding your spouse or minor children for objective reasons, the Ministry of Labor recommends doing the following. The employee needs to submit a corresponding application to the authority to which income declarations should be sent, and before the expiration of the deadline established for the submission of information (clauses 27, 28 of the Recommendations).

The Federal Ministry points out two important points here: the objectivity of the reason for non-submission of the declaration and timely notification of the authority. The courts also take these circumstances into account. In particular, the Supreme Court of the Russian Federation considered a dispute that arose due to the fact that the employee did not file a declaration for her husband due to the latter’s refusal to provide such information (see Determination No. 59-KG16-22 dated October 31, 2016). At a meeting of the commission created by the employer and conducting an investigation into the mentioned incident, the employee confirmed that the information could not be transferred due to its confidentiality. In turn, the commission decided to recognize the reason as biased and as a way of evading the provision of the specified information. The employment contract with the employee was terminated under clause 7.1, part 1, art. 81 Labor Code of the Russian Federation.

The trial court concluded that there were grounds for dismissing the employee, and the appellate court overturned this decision. However, the Supreme Court did not agree with the appeal and upheld the decision of the trial court.

The first anti-corruption laws in the Russian Federation

For the first time, the requirement to provide information about income and property in relation to civil servants in Russia was introduced in 1995. According to Art. 12 of the Federal Law of July 31, 1995 “On the Fundamentals of the Civil Service of the Russian Federation”, civil servants were required to provide relevant data to the tax authorities. However, all this information received the status of official secret, and was verified only by the tax service.

In 2006, Russia ratified the UN Convention against Corruption of October 31, 2003. Article 8 of the document states that States Parties to the Convention must “establish measures and systems requiring public officials to make declarations of non-official activities, activities, investments, assets and significant gifts or benefits that may give rise to a conflict of interest.”

Publication of declarations

Information on income and property has been published on the official websites of relevant departments and in the media since 2010. However, the public version of officials’ declarations differs significantly from the one that the official submits to the personnel service. The “open” version does not contain information about accounts and debt obligations, the exact location of the declared real estate and the year of manufacture of the car are not reported, there is no information about expenses, and the names of spouses and minor children are not reported. If there is real estate abroad, only the country where it is located is indicated.