Low-income families can qualify for benefits if their average total income is less than the subsistence level. The state provides financial support to the following categories of families:

- Incomplete (if the baby has only a mother or only a father).

- Benefits for large families (if there are 3 or more children. Find out what benefits are provided for 3 children).

- Full families with low income.

- Families whose members are serving in military service.

Financial assistance is paid according to the following scheme: the total income of all family members for the last 3 months is divided by 3. The final result is divided by the number of people living in the family.

Payments are due in cases where the total amount does not reach the subsistence level. It is determined for each region individually. Also, the poor have the right to social benefits or assistance. Such assistance may be in the form of:

- Providing food and medical supplies.

- Providing milk formula for babies.

- Preferential travel on all types of public transport.

- Free lunches in secondary educational institutions (including schools, lyceums, gymnasiums and colleges).

- Sewing or purchasing a school uniform (if the uniform is established by the charter of the educational institution) and a tracksuit.

Using the example of Moscow, we will show what the monthly child benefit for low-income families is like:

#1 To a single mother or father raising a child without a wife:

- if children under 1.5 years old and from 3 to 18 years old = 2500 rubles;

- children from 1.5 to 3 years old = 4500 rub.

#2 Single-parent families where the mother or father refuses to pay child support. And also for families in which the father is undergoing military service due to conscription, a monthly child allowance:

- if children are under 1.5 years old and from 3 to 18 years old = 1900 rubles;

- children from 1.5 to 3 years old = 3300 rub.

#3 For families receiving benefits as low-income and not eligible for the cases listed above:

- if children under 1.5 years old and from 3 to 18 years old = 1500 rubles;

- children from 1.5 to 3 years old = 2500 rub.

Find out in more detail who is entitled to child benefits under 18 years of age and what are the nuances of receiving them?

If a low-income family has a child studying full-time at a higher educational institution, then you can apply for a social scholarship if he:

- has certificates of disability (first and second groups);

- is an orphan;

- suffered from radiation;

- was injured during military service;

- served more than three years in the Ministry of Internal Affairs or served in the army.

You should find out about the amount of the scholarship from your higher education institution (the minimum benefit amount in 2020 will be at least 2,010 rubles).

What benefits and additional privileges are offered to low-income families this year?

- An applicant under twenty years of age, if he successfully passes the Unified State Exam (and entrance exams, if any), has the right to enter institutes and universities that have state licenses.

- The youngest child will be sent to kindergarten out of turn.

- A child under 6 years of age receives free medications if they have certificates confirming their need.

- Schoolboy:

- receives 2 daily lunches in the cafeteria of his educational institution;

- uses discounted travel tickets (the cost of using vehicles will be half the regular price);

- free access to art exhibitions and museum compositions of your choice once a month;

- in case of illness, once a year can visit a sanatorium with free wellness treatments.

Having dealt with payments for minors, let’s move on to the financial assistance that parents receive:

- Additional benefits and allowances for low-income families at the place of work (paid leave beyond the established period or, if necessary, part-time work).

- Providing mortgages on preferential terms.

- Possibility of purchasing an apartment or plot of land on the basis of a social tenancy agreement.

- Free registration of individual entrepreneurs.

Increasing benefits for the poor in 2020, timing and required income

“From January 1, 2020, we will extend this support measure not only to families with one and a half subsistence minimum per person, but to those families with two subsistence minimum per person,” he emphasized.

The head of the National Parents Committee, Irina Volynets, in a conversation with RT, also expressed hope that the decision will have a positive impact on the demographic situation in the country.

“This is actually quite decent money, especially for the regions. And I would like to hope that our mothers, when making the decision that they will become mothers for the second, third, and subsequent times, will be confident that the state will support them,” Volynets emphasized.

According to her, the decision was long overdue. The National Parents Committee at one time also took the initiative to increase these payments, she emphasized.

“What has now happened in relation to mothers of children aged one and a half to three years is very welcome news. It’s good that this resolution has now been adopted. The amount is very substantial, not even everyone believed at first that it was true. This is a huge help,” she added.

Volynets also recalled another measure that was adopted quite recently. On June 19, 2020, the State Duma adopted a law on partial compensation of mortgages for large families in which a third child or subsequent children were born after January 1, 2019.

Where should I submit the certificate?

The document should be brought along with a package of certificates to the social protection authorities, whose responsibilities include supporting low-income categories of citizens. Employees of the government organization, based on the submitted documents, conduct an assessment of the family’s well-being, which is compared with the established living wage at the current moment.

Social security workers have the right to visit family to make sure that applicants are not hiding their financial means. After reviewing the application and supporting documents, a decision is made.

How to obtain the status of a low-income family

One of the family members needs to contact the Social Security Administration or MFC and submit the following documents:

- passports or birth certificates;

- application created according to the sample;

- certificate of family composition;

- proof of income;

- document from the Employment Center (for the unemployed);

- Bank account number.

After submitting the documents, the applicant will be issued a certificate indicating the date of receipt of the papers, as well as a list of documents and the approximate date of the next visit.

The document is signed by a social security employee (or MFC). According to accepted standards, consideration of each specific case takes up to 10 days. At the end of the period, the applicant is notified of the decision. If a family is assigned low-income status, its representative will be told about benefits and how to receive them. It will also be possible to familiarize yourself with the reason for the refusal, if any, and appeal the decision.

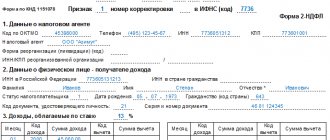

What does the certificate look like?

In 2020, there is no sample certificate from social security for receiving child benefits established by law, but an example of a correctly completed document that social security authorities will accept may be like this.

K1. Filling example

Usually the document is drawn up in the 1C program, where it is generated automatically when you specify the period for which you need to take into account income.

In some cases, filling out information may have regional characteristics. This must be taken into account when compiling. But the general requirements are the availability of information about the applicant, income and organization that filled out the form. Another important information required to be reflected in the form is the source on which it is provided. This could be a personal account, a cash order or a payroll.

The head of the organization is responsible for the information provided. This is regulated by legislative acts at the Federal level. The rules and the need to provide information at the employee’s request are approved in the order of the Ministry of Labor.

A sample certificate of income for child benefits for 3 months from the place of work is a mandatory document if the family wishes to receive additional money. Without it, social protection authorities will not accept the application for consideration.

Legal and information support

| Law number | Title, notes |

| FZ-255 (December 29, 2006) | “On compulsory social insurance in case of temporary disability and in connection with maternity” |

| Order of the Ministry of Labor of Russia dated April 30, 2013 N 182n | “On approval of the form and procedure for issuing a certificate of the amount of wages, other payments and remunerations for the two calendar years preceding the year of termination of work (service, other activities) or the year of applying for a certificate of the amount of wages, other payments and remunerations...” |

| Decree of the Government of the Russian Federation of August 20, 2003 N 512 | “On the list of types of income taken into account when calculating the average per capita family income and the income of a citizen living alone to provide them with state social assistance.” It approves a list of types of income that are taken into account when recognizing a person as low-income and providing him with social assistance. |

| FZ-44 (04/05/2003) | “On the procedure for recording income and calculating the average per capita income of a family and the income of a citizen living alone in order to recognize them as low-income and provide them with state social assistance” |

| Federal Law-178 (07/17/1999, last edition dated 04/01/2019) | “On state social assistance.” |

In various legislative acts you can find information on issuing a certificate, recognizing persons as low-income, and paying them benefits.

What should be in the certificate

The document is drawn up in the company where the citizen works. It should be noted that there is no unified form for such a certificate . The employer can approve it independently, but it is likely that the form has not been developed. Therefore, accountants to whom employees turn for help sometimes have difficulties - what exactly should be included in it?

Since the certificate is issued for social protection authorities, it is drawn up in accordance with their requirements. In general, it should indicate:

- basic details of the employer - name (for individual entrepreneurs - full name), OGRN, INN, KPP (for a legal entity), address, telephone;

- details of the certificate - date and registration number;

- to whom it was issued - the last name, first name and patronymic of the employee, as well as his position;

- the amount of the person’s income for the last three full months (the month of applying for the certificate is not included).

In addition, the certificate often states the period for which it is presented and the amount of the person’s average monthly earnings. The certificate must be signed by the manager and chief accountant.

Special requirements

As for the informational part, that is, directly the amount of the employee’s income, some social security authorities require this information to be presented in the form of a table. It looks something like this:

| Month | Total amount of payments (RUB) | Withheld (RUB) | Issued by hand (RUB) |

| October | 10000 | 1300 | 8700 |

| november | 10000 | 1300 | 8700 |

| December | 10000 | 1300 | 8700 |

| Total | 30000 | 3900 | 26100 |

So that the employee does not waste time, and the accountant does not redo the certificate again, it is better to find out in advance in what form the data should be presented.

Attention! One of the purposes of a salary certificate is to receive a subsidy for housing costs. In this case, it should contain data not for 3, but for 6 months . This is the requirement of paragraph 32 of the Rules for the Provision of Subsidies, approved by Decree of the Government of the Russian Federation of December 14, 2005 No. 761.

What kind of help can you expect?

Assistance to the poor is provided from budgets of all levels. In 2020, families with limited incomes receive 2 types of benefits from the federal budget:

- for the first-born in the amount of the regional subsistence minimum (the benefit is paid until the child is 1.5 years old);

- for the second child, cash payments are assigned from maternity capital, their size is also equal to the subsistence minimum, and the period of provision is 1.5 years.

The conditions for assigning federal benefits are somewhat different. In this case, the average per capita income should be no more than 1.5 times the subsistence minimum.

The amount of child benefits for low-income families can vary significantly depending on the subject of the Russian Federation. Let's give a few examples.

- In Moscow, 10,000 rubles are paid monthly for a child from a low-income family under the age of 3 years, and 4,000 rubles for those aged from 3 to 18 years.

- In the Moscow region, payments are 2250 rubles up to 1.5 years, 4290 rubles - from 1.5 to 3 years, 1126 rubles - from 3 to 7 years and 564 rubles - over 7 years.

- In St. Petersburg, 3,321 rubles are paid monthly for the first child, and 4,285 rubles for the second and subsequent children. Payment of benefits is carried out until children turn 1.5 years old. Then, from 1.5 to 7 years, its size decreases to 964 rubles, and during the school period - to 848 rubles.

USEFUL INFORMATION: Lawyer, lawyer for the division of property during divorce

In other regions, more modest amounts of child benefits are established. So, in the Krasnodar region it is 189 rubles, in the Republic of Tatarstan - 295 rubles, in the Novosibirsk region - 318.88 rubles, in the Samara region - 200 rubles.

In addition to monthly benefits, regions can establish additional support measures for children from low-income families. These include:

- natural types of assistance (food products, clothing, shoes);

- annual payments to prepare children for the school season;

- free school meals;

- benefits on utility bills;

- free medicines;

- tax benefits;

- compensation for kindergarten fees;

- discounts on public transport;

- rest in children's camps and sanatoriums on preferential terms;

- admission to a university without competition.

To avoid wasting time collecting certificates, calculate all your income in advance and divide it by the number of people in the family. Compare the amount received with the cost of living accepted in the region. Its value is approved quarterly and must be published on the official Internet resource of local authorities. If the comparison is not in your favor and you are not the happy owners of a variety of movable and immovable property, you can safely apply for status as a low-income family.

In what case is the form drawn up?

A certificate of average earnings can be submitted to social security for the following purposes:

- Registration of maternity benefits for pregnancy or for a child under 1.5 years old - is issued 2 years in advance and is necessary in some cases when child benefits are calculated by SZN based on income at the place of work (for example, in case of dismissal due to liquidation).

- Recognition of a low-income family and receipt of subsidies and benefits is completed 3 months in advance, this status is confirmed annually, so the employee will have to apply to his place of work more than once for a certificate of average wage.

As a rule, these are the main reasons for submitting a certificate of earnings to social security.

In some cases, you may need to report your income for the last 6 or 12 months, depending on the task at hand.

Six months' income may be of interest to social security in order to determine eligibility for certain types of subsidies.

Banks usually require 12 months’ salary when applying for a loan.

Low-income families with minor children

Poor citizens with minor children are often in difficult life situations due to a lack of means for subsistence. This circumstance is caused by the fact that after the birth of a child, one of the parents is forced to not work and care for the child. The state tries to maintain a decent standard of living and helps meet the needs of sections of society. The authorities finance targeted assistance, smooth out the inequality of citizens, and take an active part in providing material benefits to those in need.

The state seeks to help families with children, since their expenses inevitably increase, and incomes may only decrease

Types of payments

All kinds of subsidies are divided into two large groups: monthly and one-time.

Government institutions issue the following types of payments for children:

- monthly per child;

- for children of military personnel (paid every month);

- children whose parents evade paying child support (they are wanted or are in prison);

- monthly payments to single mothers;

- at the birth of a child;

- payments to low-income families;

- single mothers;

- large families;

- for the third and subsequent children until they turn three years old;

- unemployed who care for a child under 1.5 years old ;

- payments to disabled children.

The amount of such payments is controlled and approved by federal authorities, but in some regions additional payment is required.

A woman during pregnancy can count on the following help:

| If a woman registers early | This must be done before 12 weeks . For this, the employee can receive 576 rubles . |

| Free medicines | In the amount of up to 1 thousand rubles , if the prescription was prescribed by the attending physician. |

| For pregnancy and childbirth | You can apply for it starting from the 30th week of pregnancy. Paid at the place of work. Its size depends on average earnings over the last 2 years . Payments are made every month throughout the maternity leave. |

| Birth certificate | With its help, you can make a free appointment at the antenatal clinic and assign your child to the chosen clinic. |

| Additional benefits from local authorities | If a woman in Moscow registers before the 20th week of pregnancy, then she can receive an additional 600 rubles . |

After the birth of a child, you can count on the following payments:

| One-time payment | RUB 15,382 |

| Allowance for child care up to 1.5 years | In the amount of 40% of average earnings. |

| Child care allowance up to 3 years old | Now it is paid in 69 regions of the Russian Federation. |

| Maternal capital | Today its size is almost 500 thousand rubles. Every year its value is indexed. Families with two or more children have the right to receive maternity capital. |

| Free medicine package | According to the prescription of the local pediatrician. |

| For wives of conscripted military personnel | They can receive a one-time payment of 24 thousand rubles, and the monthly benefit will be more than 10 thousand . |

| For young parents | A tax deduction is provided, which is 13% of the tax collected. |

| For single mothers who are not working | Benefits are provided for children up to the age of sixteen. If the child continues his studies, payments will be extended until he reaches adulthood. The size depends on the region of residence. |

After the birth of the third child, the family is recognized as having many children, so benefits are assigned in accordance with the status received. If maternity capital was not issued for the second child, then it can be obtained for the third. If the amount of the one-time benefit remains the same, then the amount of the monthly child care benefit for up to 1.5 years increases. Most regional subsidies are intended specifically for large families.

To apply for social benefits, you should prepare the following documents:

- passport of one of the parents (most often the mother);

Certificate of income for an individual entrepreneur

The self-employed population conducting individual entrepreneurial activities can apply the taxation system. Depending on the reporting procedure to the tax office, an entrepreneur can confirm his income for the previous year:

- OSN is a general system. A 3NDFL declaration (in a copy) for the previous year is submitted to the social protection department;

- The simplified tax system is a simplified system and the Unified Agricultural Tax is a unified agricultural tax. Providing a copy of the reporting for the previous year.

If a person is an individual entrepreneur, he can issue a certificate to himself

For the previous three months, entrepreneurs operating under a license (patent system) will be able to confirm the amounts received, since they keep monthly records of income in the general ledger.

The certificate states:

- registration information about the entrepreneur, date of origin;

- date of registration with the tax authority;

- period of entrepreneurial activity;

- information on the total amount of income for the three previous months;

- monthly data on personal income amounts (can be displayed in table form: year, month, amount).

The certificate from the individual entrepreneur must indicate registration information, period of activity, as well as the amount of income

The validity period of the received certificate is not determined by the legislator. But in order to analyze the applicant’s income for three months and recognize him as low-income, the document must record the financial situation for the previous period before receiving the certificate. The certificate is valid for one month. Receipt of the document is confirmed by a receipt from the applicant, information about the issuance is entered into the document flow book.

The certificate is valid for a month from the date of issue

salary certificates in 2020

As a rule, this is necessary to obtain bank loans and travel to another country. A citizen is obliged to confirm the right to receive benefits and subsidies from the state by contacting the social service. Each case is exceptional and therefore has its own characteristics and nuances. That is why accountants, managers, civil servants and employees must have an idea of the correct execution of this document.

- name of the organization that issued the document and its details;

- passport details;

- average monthly salary;

- the amount of accruals and funds actually received;

- date of issue of the document;

- the locality in which the organization is located;

- confirmation that the person is an employee of this company;

- job title.

We recommend reading: Transition to USN Application Deadlines 2020

List of required documents to receive payments, allowances and benefits

- An application of the appropriate form for recognition of a low-income family is issued on the spot;

- Passports of all family members over 18 years of age;

- Birth certificates for minor children;

- Marriage certificate;

- A certificate confirming the income of each working family member;

- Certificate of family composition;

- Title documents for residential property;

- Certified work book for a working family member;

- Certificate of disability (if available);

- Bank details for transferring benefits.

Sometimes situations occur when the location of one of the family members cannot be determined. In this case, payments from the state can still be processed. To do this, you must first write a statement to the police so that a criminal case can be initiated to find the missing family member.

In order to receive due payments on time, you must comply with the deadlines for submitting documents:

- To receive payments for minors under 1.5 years old, you must apply no later than six months from the date of birth of the baby;

- for payments from 1.5 to 3 years, as well as from 3 to 18 years, the right to receive arises from the moment the child reaches the age of receiving the corresponding payments.

Within 10 working days after submitting all necessary documents, a special commission will review the application and make a decision.

TOTAL, from January 1, 2020, low-income families from all regions of Russia: Adygea, Altai, Bashkiria, Buryatia, Dagestan, Ingushetia, KBR, Kalmykia, Karachay-Cherkessia, Karelia, KOMI, Crimea, Mari El, Mordovia, Sakha (Yakutia), North Ossetia (Alania), Tatarstan, TUVA, Udmurtia, Khakassia, Chechnya, Chuvashia, Altai Territory, Transbaikal Territory, Kamchatka Territory, Krasnodar Territory, Krasnoyarsk Territory, Perm Territory, Perm Territory, Primorsky Territory, Stavropol Territory, Khabarovsk Territory, Amur Region, Astrakhan Region region, Arkhangelsk region, Belgorod region, Bryansk region, Vladimir region, Volgograd region, Vologda region, Voronezh region, Ivanovo region, Irkutsk region, Kaliningrad region, Kaluga region, Kemerovo region, Kirov region, Kostroma region, Kurgan region, Kursk region, Leningrad region, Lipetsk region, Magadan region, Moscow region, Murmansk region, Nizhny Novgorod region, Novgorod region, Novosibirsk region, Omsk region, Orenburg region, Oryol region, Penza region, Pskov region, Rostov region, Ryazan region, Samara region, Saratov region , Sakhalin region, Sverdlovsk region, Smolensk region, Tambov region, Tver region, Tomsk region, Tula region, Tyumen region, Ulyanovsk region, Chelyabinsk region, Yaroslavl region, federal cities - Moscow, St. Petersburg, Sevastopol, Jewish Autonomous Okrug, Khanty-Mansi Autonomous Okrug , Yamal-Nenets Autonomous Okrug, Nenets and Chukotka Autonomous Okrug - will be able to receive additional payments, benefits and benefits.

Sample certificate of income from the MFC for benefits for the poor

- the applicant’s passport, certified copies of passports of all family members; if the family has children under 14 years of age, a copy of the birth certificate is required.

- a copy of the marriage certificate or certificate of divorce.

- a certificate of income of all family members for the last 3 months, filled out according to the requirements.

- document form F9 or an extract from the house register.

- a copy of the document certifying the ownership of the property.

- extract from the Unified State Register for all family members.

- original certificate of disability, if there are incapacitated disabled people in the family.

- a document with the bank details of the applicant’s current account.

After waiting for the day of your turn, take with you a complete package of prepared documentation. Visit the MFC in person, receive a standard form from an employee and fill out the application in accordance with the official sample.

ABOUT EGISSO

The information resource was created on the initiative of the Pension Fund, which is the operator. The Pension Fund ensures uninterrupted operation and regulates the process of entering information into the system and exchanging information. The operator determines the amount of data required in the work and the type of electronic media.

In the Unified System (online portal for social security of citizens), the state places all information on decisions made on the provision of assistance and benefits, which can be obtained upon request in electronic form. The system has access to information located in territorial and state databases, to information stored in organizations and structures that provide social assistance.

The unified system performs the following tasks:

- forms a general information database on the services and assistance provided;

- identifies recipients of social support by category;

- provides information and legal services;

- exercises control over the quality and volume of services provided to the population.

On the EGISSO Internet portal you can find information regarding social assistance to the population

Includes information:

- about the person to whom services were provided as part of social assistance;

- personal information about social support measures;

- information about organizations that carried out social charges;

- legal framework within which state social policy is implemented;

- information on social support measures at the regional level;

- about resources where information about assistance provided to citizens is posted.

The functioning and volume of the information resource of the Unified Database is regulated by the Russian Government. Information on requests is provided in accordance with Federal Law No. 152 (07/27/2006) on personal data.

Information is provided in accordance with the law on personal data

Information constituting a secret (state or personal) is not included in the Unified System:

- the mystery of adoption;

- the mystery of medical diagnosis;

- state and commercial secrets.

USEFUL INFORMATION: Crises of family life by year: psychology and secrets of happiness

Who belongs to a low-income family

The very concept of “poor” in relation to the family is still relevant at the moment and is disclosed in Federal Law No. 178 of July 17, 1999. Having studied Article 7, which talks about who can receive government assistance, we can determine two principles by which Russians can be classified as low-income:

- income per family member should not exceed the minimum subsistence level established in the country;

- For a number of reasons, a person cannot provide himself with a decent income.

- All family members are required to run a joint household and live in a common area (for example, in an apartment or private house).

- The presence of family ties becomes important.

According to general rules, family members include:

- husband wife;

- children (including adopted children);

- sisters, brothers;

- grandchildren and other close relatives, as well as guardians.

Particular attention should be paid to the fact that if there are unemployed but able-bodied people in the family, that is, who are “parasites,” there is no point in determining the level of income, since such a unit of society will obviously be denied any benefits. Let us dwell on the concept of “living wage”: according to the law, this indicator can be used to assess the standard of living of a Russian and provide him with appropriate social assistance

Let us dwell on the concept of “living wage”: according to the law, this indicator can be used to assess the standard of living of a Russian and provide him with appropriate social assistance.

Sample application for recognition of a low-income family

Receiving social assistance from the state is not easy. First of all, you need to contact the Social Security Office of your city or district and submit an application with a request to classify yourself and your family as low-income. According to current legislation, each region has its own application form.

However, after filling out a printed sample form at home, you can safely go to the authority.

We have already informed you what kind of government support the poor can receive in 2020.

Rules for writing and ready-made application forms for recognition as low-income

Writing an application is quite simple.

The main thing is to follow the following scheme and remember to include reliable information about all members of your family:

- Design of the “Head” of the document. Typically, the application is submitted to the social protection department, so you should indicate either the full name of the boss, his position, or the name of the authority. In addition, you should indicate the address of the authority where you are submitting the application.

- Title of the document. In this case, you must indicate: “APPLICATION for recognition of a citizen (family) as low-income (poor) to receive state social assistance.”

- Indication of your data. Some people write personal information in the header, but it is better to write it down, indicating the request. Personal information includes full name, date of birth, address of residence and place of registration, as well as other passport data.

- Filling out information about all members of your family. Indicate your full name, date of birth, degree of relationship (who is this person to you - spouse, daughter, son), as well as passport details. You can also indicate the type of income and its amount for 1 year.

- In some samples, income is indicated in a separate table. It must indicate all the income that the family has. And the amount of income is indicated not for 12, but for 3 months. In this case, it is even better to indicate the total, additional and average per capita income of the family.

- Next, all property owned by the family must be entered into the table.

- A list of documents is listed with which you confirm your financial situation and family composition. Documents include a certificate of family composition, an extract from the house register, birth certificates of children, parents’ passports, certificates from work about income or from the employment center, confirming your plight.

- Signed and dated. It is advisable that the document contains not only your signature, but also that of all family members.

To avoid making mistakes when writing, collect all the necessary documents and only then begin to draw up the paper.

Here are a few examples of correct filling.

Samples of filling out applications for recognition of a low-income family:

Please note that after accepting the application and documents, you must be given a notification receipt, which will confirm your application to the Social Security Administration.

This is what the notification receipt looks like:

After this, you will be given a certificate and you and your family will be recognized as low-income.

With this document you can contact the administration, the same social protection department, guardianship and trusteeship authorities and demand social assistance and state support.

Where to get it

If a citizen works, he should contact his boss directly for information. When there is no management at the enterprise, the chief accountant should be responsible for issuing certificates.

If a citizen does not officially work, he can apply for a document to the Employment Center, which is located at the place of registration. This institution will issue a certificate stating that the person has had no official income for the last 3 months .

Read How to draw up an equipment rental agreement between legal entities

Individual entrepreneurs are not required to have income certificates. They must submit reports regularly. To do this, you can use any papers that confirm income for a certain period. The basis for a certificate to the social security authorities will be information from documents certified by the tax office.

How to calculate income

When calculating the amount of total income (and this indicator becomes the main one when determining the right to assistance from the state), it is necessary to take into account all the funds coming into the family budget, namely:

- all salaries of family members;

- possible benefits;

- pensions, etc.

To determine whether a family can be recognized as low-income, it is necessary to determine how much income falls on each of its members. It's easy to do:

- The total income for 3 months is calculated, taking into account the “contribution” of everyone. Moreover, only income that is documented is taken into account;

- the amount of receipts in kind is added to the result.

It should be noted that when calculating the average income, the funds of conscripts and students of military schools, as well as those serving sentences in prison and other persons on state support will not be taken into account.

The calculation formula looks like this:

Average per capita income is equal to 1/3 of income for the billing period (3 months), divided by the number of family members living in one house.

Child benefit

Information about income for 3 months is needed to receive a specific type of benefit - for low-income families or parents. This benefit should not be confused with maternity and child care benefits, since these payments are provided to all mothers regardless of income level.

In order for the Social Security authorities to recognize the official financial situation of a family, its members must provide documents on all income for 3 months. Based on these data, Social Security makes calculations - income for each member of the family and their ratio to the regional subsistence level.

The main income in a standard situation is wages, so first of all you need to provide a certificate of income from the employer’s accounting department or human resources department.

The extract has one type. It is compiled in the 1C program. Formation is carried out automatically after the employee sets the desired period for analyzing the profit received.

The management of the organization is responsible for the information provided. They must strictly comply with the sample certificate of income for 3 months for a child benefit for the MFC. This is regulated by current acts at the legislative level.

The calculation is performed based on the employee’s average monthly salary. To do this, its size is calculated for 1 day. It is multiplied by the number of days worked (21, etc.). The amount is multiplied by 3 months.

| Accrual period | Salary (thousand rubles) | Maternity benefits | Deductions | Total Income (excluding deductions) | |

| Personal income tax | Others | ||||

| June | 26000 | 11000 | 3380 | were not carried out | 33620 |

| July | 0.00 | 12500 | 0.00 | 12500 | |

| August | 0.00 | 11800 | 0.00 | 11800 | |

| total amount | 26000 | 35300 | 3380 | 57920 | |

The resulting final payment is divided by the number of dependents of the parent (usually the mother) and compared with the cost of living for each child. The final amount of social benefits depends on the actual salary of the employee. The template includes amounts of debts to the company - as material and (or) disciplinary liability. Pre-downloading will make it easier to calculate child benefits.

Attention!

- Due to frequent changes in legislation, information sometimes becomes outdated faster than we can update it on the website.

- All cases are very individual and depend on many factors. Basic information does not guarantee a solution to your specific problems.

That's why FREE expert consultants work for you around the clock!

- via the form (below), or via online chat

- Call the hotline:

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

Help form

A certificate of income is a document confirming the receipt of funds from various sources for a specific period. They happen in 3, 6, 12 months. It expires at the end of the month in which it is issued.

free

The legislation does not provide for a specific form, however, a sample social security certificate must include a number of important information:

- name of the organization, its data – TIN, KPP, BIC;

- full details of the person to whom this paper is issued;

- information about funds for each month;

- signatures of the accountant and manager;

- stamp and date.

It should also include a telephone number so that a social service employee, if he or she has questions, can quickly find answers to them.

The data listed above is mandatory for a certificate of income for social security in any form, but at the request of the compiler, data on deductible income tax can also be entered into it, the average income for the months can be indicated and a subsequent breakdown for each separately or the total amount, and for those for each month.

All accrued funds, travel combinations, bonuses, surcharges, etc. are included in the certificate. Sample certificate of income to the social service

Often, when you contact the accounting department for such a certificate, they provide it in form 2-NDFL.

In its current form, it has been applied since 2020 and was approved by Order of the Federal Tax Service of Russia dated October 30, 2015 MMV-7-11/485. The same order also approves the procedure for filling it out. In this case, all data must strictly comply with the prescribed rules; each column must contain a number corresponding to the law.

When writing it, you should pay attention that payment codes are clearly regulated by Order of the Federal Tax Service 09/10/2015 N ММВ-7-11/387. Certificate form 2-NDFL

The certificate takes into account income according to the list approved by Decree of the Government of the Russian Federation No. 512 of August 20, 2003. These include:

- salary;

- sick leave, student leave;

- benefits upon dismissal or liquidation of an organization;

- pensions;

- scholarships;

- funds paid to the unemployed;

- additional payments to the wives of military personnel in case of deployment where they cannot find professional employment;

- benefit from the use of property;

- remuneration for work under a civil contract;

- financial assistance to the employee from the organization;

- funds received for the results of intellectual activity;

- funds from being an individual entrepreneur;

- alimony;

- income from capitalization of deposits;

- donated money or inheritance;

- funds received as part of the provision of social guarantees and benefits;

- income from sick leave, maternity benefits, child care benefits, child benefits.

Income is taken into account with the amount of tax deduction, that is, as they say, “dirty”. The amount is reduced by paid alimony, payments in connection with damage caused to life, health, property, as well as the amount of social assistance.

USEFUL INFORMATION: Tax on gift of real estate

Rules and form of filling

Social security requires a certificate for three months of work preceding the month of application. Although the law does not establish a mandatory sample of a certificate of income for child benefit, in order to avoid errors in filling out, you must adhere to certain rules and standards.

The document can be drawn up on the form established by the company, but this is not a mandatory requirement. For convenience, accounting information is drawn up in a table that lists the months taken into account, the total amount of income and the withheld personal income tax. Another method of displaying information is also permitted.

The certificate must be certified by the chief accountant and manager of the organization. In the absence of the chief accountant, a corresponding note is made and only the manager’s signature is affixed.

Document receipt and validity period

After the employee applies, the document must be prepared within three working days. In fact, the certificate may be ready even earlier, but not later than the deadline established by law. The validity period of this paper in days is not established, but the information must be kept up to date, thus the certificate is valid until the end of the month in which it is issued.

Salary information for three months must contain all types of accruals, including scholarships, bonuses, insurance payments, and so on. To provide objective information, lump sum payments (such as maternity pay, vacation pay, pregnancy benefits) are also distributed by month. For example, if a vacation affects the end of one month and the beginning of another, you may be surprised to see that the amount is split into two columns. Deductions are indicated in a separate column: personal income tax and others.

The information obtained using the document will become the basis for the assignment of child benefits by social protection authorities. The earnings for three months of each family member are taken into account, so the certificate should be provided to both spouses. The data is summed up and divided by the number of people indicated in another document, including children. The resulting figure is compared with the standard of living wage established in the region. If the result obtained is less than the norm, then the application for a subsidy is approved.

Where to apply for benefits

In order to avoid walking around offices for a long time, it is recommended to go straight to the MFC. For those who are not yet in the know, MFCs are multifunctional centers operating throughout Russia.

The principle of operation is to simplify paperwork for the population. The applicant comes for a consultation and receives immediate answers to all questions. A repeat visit consists of handing over a package of papers to an MFC employee, who, in turn, forwards them to higher authorities.

You can make it even simpler and reduce the number of visits to one. All information about the preparation of documents can be clarified by calling the hotline or on the official website of the MFC or State Services. The answer can be found out through the same channels using the registration number that the employee will issue upon receiving your application.

As you can see, applying for child benefits through the MFC is the fastest and easiest way.

Conclusion

Income certificate is a document that is used to calculate the income for each family member. Based on the data provided by the employer, the issue of assigning child care benefits is decided.

Cases in which a certificate of income is not required:

- receipt of social benefits by a single mother;

- the parents of the newborn have developed before making a request for assistance.

All requirements are the same for individuals and individual entrepreneurs. You can obtain a sample certificate from the Pension Fund or on the official website.

Registration procedure

All low-income families in need of financial support should contact the social welfare department at their place of residence and present:

- statement of request to provide the necessary benefits;

- all necessary documents.

After submitting an application, a decision is made no later than 10 days after its adoption.

It must be remembered that under no circumstances should you try to deceive the social security authorities.

If social security finds out about falsification of documents, the family will not be automatically recognized as low-income, and in the future it will be impossible to resubmit documents.

So, the social protection department must provide a list of such documentation:

- original and copy of marriage registration certificate;

- application for recognition of a low-income family (written by the applicant in manual or printed form);

- originals and copies of birth certificates of minor children;

- applicant's passport (original);

- original extract from the house register about the complete composition of the family.

In addition, if necessary, you must provide:

- work book;

- certificate of disability;

- other documents that may be required individually.

In most cases, the social security authority requires a certificate of income, which confirms the status of a low-income family, so it is advisable to have it available when submitting all documents.

Download a free sample for Social Security

A citizen can obtain a certificate of income only from his employer. To do this, you need to contact the accounting department. An important condition is to indicate where exactly the document will be submitted, since the form of its execution depends on this.

Often it must be provided to the social protection authorities, where the citizen applies for benefits, subsidies or allowances. In this case, the document should be drawn up according to the general rules, and the destination should be designated “for submission to the social security department” or “at the place of request.”

Personal income tax

The salary certificate has several approved forms, among which the most common is 2-NDFL. Some organizations may have their own requirements, such as document execution on company letterhead, etc.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

+7 (499) 110-56-12 (Moscow)

+7 (812) 317-50-97 (Saint Petersburg)

8 (800) 222-69-48 (Regions)

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

2-NDFL has a more complex form than a simple certificate. The form of this form is approved by the tax service. Together with income for the last months, it lists tax deductions for this period (if any), as well as the amount of taxes and income.

The sample is issued in the quantity requested by the employee. The employer does not have the right to charge him a fee for issuing certificates, no matter how many are required.

In free form

The certificate can be issued in free form, since the legislation does not provide clear instructions regarding its type.

You can create a form in one of the following ways:

- take as a sample a document developed in the organization;

- write it yourself;

- download from the Internet.

If an employee has a debt at the place of work, this should also be indicated.

The document is drawn up according to the standard structure:

- in the upper left part you should write down the name of the organization and its details;

- a little lower - the address of the enterprise location;

- the date the document was written (if it is issued on letterhead, most of this information is already present);

- The word “Help” should be written in large letters in the center;

- the text must be written on a new line - indicate information about the employee (passport details, full name, information about work activity, position, date of conclusion of the employment agreement, its validity period);

- the second paragraph should contain data on income - they can be presented in free form (table or list);

- the exact amounts of income should be indicated;

- if you need to indicate information about deductions to extra-budgetary funds, you can create a new column in the table or create a new list.

Supervisory authorities very carefully check the documents received by them, so care should be taken to ensure the reliability of the information.

It is also not allowed to make corrections in such certificates. To make the form, you can use not only company-branded sheets of the enterprise, but also a regular sheet of A4 paper. Information can be entered in printed form or manually. The document must be signed by the head of the organization and the accountant.

Sample certificate of salary for 3 months for social security

Certificate of additional days off taken by the employee

An employee with whom a disabled child under 18 years of age lives has the right to take four additional days off every month, paid by the Federal Social Insurance Fund of Russia. Either one of the working parents or both can take advantage of the additional days off, dividing the allotted four days off per month among themselves. In this case, you can either take all four days in a row or use them separately (for example, one day a week). This means that you need to know how many such days the second parent used at his place of work (Article 262 of the Labor Code of the Russian Federation).

Therefore, a certificate from the second parent’s place of work stating that he did not use additional days off in the current calendar month or used them partially is needed whenever an employee writes an application for these days off. If your employee has asked you to issue him such a certificate, use the sample as a basis (see below).

What should be in the certificate. The main thing that should be in the certificate is the specific number of days off provided to the employee at the expense of the Social Insurance Fund in the current month. Or an indication that he did not take such days. There is no need to list unused additional days off for previous months. They are not carried over to the next month.

If the second parent does not work or provides himself with work, you will need a document (or a copy thereof) confirming this fact. For example, a work book. The absence of a valid employment record in it will confirm that he does not work anywhere.

Two more documents required for child benefits

Situation

Document

Explanations

One spouse wants to transfer his standard children's personal income tax deduction to the other

Certificate 2-NDFL from the work of the spouse who wants to transfer his right to the deduction. This document must be completed monthly

One parent may waive their right to the standard child deduction. Then the second, on the basis of an application, will receive in his company the right to a double deduction (subclause 4, clause 1, article 218 of the Tax Code of the Russian Federation). But this rule applies only when the parent who wishes to refuse the deduction receives income taxed at a rate of 13 percent. And this income has not exceeded 280,000 rubles since the beginning of the year. This must be confirmed by a 2-NDFL certificate. If the parent does not work and does not receive any income, then he has no right to a deduction. This means there is nothing to transfer. A typical example: your employee’s wife has taken maternity leave. She has no taxable income. In this situation, the employee does not have the opportunity to receive a double deduction

The employee did not join the company since the beginning of the year and has now taken sick leave to care for his child.

A certificate from the employee’s previous place of work stating how many days of care for this particular child have already been used this year

The time during which an employee is entitled to receive benefits for caring for a child or other family member is limited. So, for example, when caring for a child under 7 years of age, the Social Insurance Fund of the Russian Federation will pay for no more than 60 calendar days in a calendar year (clause 1, part 5, article 6 of the Federal Law of December 29, 2006 No. 255-FZ)

In this case, it is important how many days of care for a sick relative your employee has already used during the year. That is, it does not matter how long the child or other family member was sick

After all, not only your employee, but also another person could be with him. And it will have its own limit calculation. In this case, no certificates are needed from the second parent. All you need is a certificate from the employee’s previous place of work

Benefit calculation

Salary information for three months must contain all types of accruals, including scholarships, bonuses, insurance payments, and so on. To provide objective information, lump sum payments (such as maternity pay, vacation pay, pregnancy benefits) are also distributed by month. For example, if a vacation affects the end of one month and the beginning of another, you may be surprised to see that the amount is split into two columns. Deductions are indicated in a separate column: personal income tax and others.

The information obtained using the document will become the basis for the assignment of child benefits by social protection authorities. The earnings for three months of each family member are taken into account, so the certificate should be provided to both spouses. The data is summed up and divided by the number of people indicated in another document, including children. The resulting figure is compared with the standard of living wage established in the region. If the result obtained is less than the norm, then the application for a subsidy is approved.

Criteria for need when providing social support measures

The main criterion of need for obtaining status and benefits for the poor is material (average income per person compared to the minimum wage). But there are other conditions that must be met in order for a family to be recognized as needy. Among them:

- Cohabitation of a family (parents and children, single parent and child, guardians and ward, etc.), maintaining a common household. A family in which the father and mother are registered in the registry office, but actually live separately (or live together, but are not registered), will not be able to apply for recognition as low-income.

- Need due to circumstances beyond the family's control. A family in which the parents do not work due to drunkenness, drug addiction, or other reasons will not be recognized as low-income. To qualify for additional support, it is understood that all able-bodied family members must work, study or be in the employment service (with the exception of women on maternity leave).

There are also criteria that give priority in providing assistance based on need. These include the status of a large family, the presence of pensioners or disabled people in it - most often, for objective reasons, it is in such families that the average per capita income does not reach the minimum wage.

Low-income families

The structure of any society presupposes the presence of different segments of the population. Each of them has its own level of income and different social status from the others. In the Russian Federation, there are citizens who are part of a socially vulnerable category of the country's population that requires help and support. These include families with low income.

These social units, as a rule, are single-parent, have large families, or support people with disabilities. requiring special care and significant material costs. In 2020, families whose income per person is lower than the value of the consumer basket in the region can receive the status of “poor”.