What securities can be called valuable?

Securities are, first of all, shares and shares, bonds, bills, checks and mortgages. To make these terms more understandable, we can give them the following brief definitions:

- Shares secure the right of the owner of this security to claim part of the company's profits in the form of dividends.

- The bond allows the holder to claim its face value, as well as a specified interest.

- The share assigns to its owner the opportunity to receive part of the property assets of the enterprise.

- A bill of exchange is a document certifying that a certain person (citizen or organization) must pay a second person a specific amount of money within a limited time period.

- A check is a piece of paper that is directly associated with the bank. On a check, the owner specifies an amount and instructs the bank to pay that amount to a specific person or business.

Example of securities accounting

Securities, the information on which is presented above, can be divided into main and auxiliary. The first ones include shares and shares (account 58.1), and the auxiliary ones include the remaining papers (bills, checks, bonds, etc.) (account 58.2). Securities are primarily involved in the processes of acquisition, sale, disposal and accrual of interest. In some cases, it is possible to transfer and write them off.

Ordinary legal entities and entrepreneurs, as well as legal entities and individual entrepreneurs who are engaged in the movement of such securities at a professional level, can participate in the movement of securities on the market. In accounting, there are entire sets of operations for specific situations, where it is necessary to make a large number of transactions and identify absolutely all operations performed in a certain situation. Let's give an example involving securities.

The simplest example: a company purchased shares of a bank at a price of 1,500 rubles, although the par value of the shares was 1,000 rubles. The only forced expense is payment to the issuer. Meanwhile, the maximum maturity of bonds was only 2 years. The income on the bonds was paid to their owner every six months at a rate of 40% per annum. Next, we will create a table in which we will record all the operations that occurred in this situation.

| No. | The content of the action | Debit | Credit | Transaction amount |

| 1 | The value of the bonds is paid to their original owner (issuer) | 76 | 51 | 1500 |

| 2 | The book value of the bonds is reflected | 58.1 | 76 | 1500 |

| 3 | Dividends accrued | 76 | 91 | 300 |

| 4 | Dividends transferred | 51 | 76 | 300 |

| 5 | The share by which the bond price has decreased is reflected | 91 | 58 |

Similar transactions can occur with shares (which happens most often), and with bills, and with other types of securities. This example includes five transactions, but most often transactions in such examples can reach twenty. The main thing here is to correctly calculate the amount and debit with credit. In accounting, securities are reflected at their book value.

Bond accounting

A bond is another type of central bank, differing from the bill of exchange discussed above in the following features:

- may have a non-documentary form;

- makes it possible to receive not only money, but also other property;

- has an unconditional return (in the form of interest or coupon).

ATTENTION! The issuer of a bond reflects its debt to its holder as part of the debt on borrowed funds received, following the norms of PBU 15/2008 “Accounting for expenses on loans and credits”, approved by Order of the Ministry of Finance of Russia dated October 6, 2008 No. 107n.

Using accounts 66 “Settlements for short-term loans and borrowings” and 67 “Settlements for long-term loans and borrowings” for bond accounting, we should not forget about the need for separate accounting of such borrowed funds (raised by issuing and placing bonds) - this is directly indicated in instructions for the chart of accounts approved by order of the Ministry of Finance of Russia dated October 31, 2000 No. 94n.

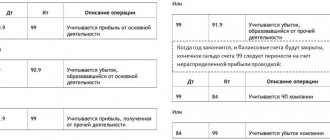

To reflect transactions with bonds in the issuer's accounting, the following correspondence of accounts can be used:

- Dt 76 Kt 66 (67) - debt on bonds is reflected at the time of placement at par value;

- Dt 51 Kt 76 - money for the bonds arrived in the current account;

- Dt 91 Kt 76 - expenses for brokerage services are reflected;

- Dt 66 Kt 76 - bonds repaid at par value;

- Dt 91 Kt 66 - coupon income accrued.

The material “Borrowed funds are...” will tell you more about accounting for borrowed funds.

The following entries are used in the bondholder's accounting:

- Dt 76 Kt 51 (50, 52, 10, 41) - the purchased bond has been paid;

- Dt 58 Kt 76 - the bond is accepted for accounting at its original cost (upon receipt by the company of a certificate of transfer of the relevant rights).

If the initial cost of the bond exceeds its face value, the difference is written off against the income received by the company and the following entries are made each time it is accrued:

- Dt 76 Kt 58 - the difference between the purchase and face value of the bond is partially written off;

- Dt 76 Kt 91 - income on the bond is accrued, reduced by the difference between the purchase and face value of the bond.

The material “Accounting for Financial Investments - PBU 19/02” will help you study the nuances of accounting for financial investments.

Common mistakes in securities accounting

It's no secret that accounting is a delicate matter, and you can't make a mistake. Even the smallest mistake will have consequences. Below we list the most common mistakes that accountants make when accounting for securities. The first common mistake is related to the execution of bills. Incorrect design will result in incorrect wiring.

The next mistake is in accounting for the buyer’s own bill. It is reflected by 58 scores. But here it is very important to know whether the buyer issued his bill or transferred it to third parties. In the first case, the bill must be reflected in the debit of account 62 (settlements with buyers and customers). And in the second case, you need to reflect the bill as a debit and assign it to the short-term debt account.

The third mistake is again related to bills. A bill of exchange (and any other security) can be obtained free of charge from the supplier (contractor). And many companies mistakenly believe that they do not have to report to the tax authorities for this. But this is not so, even for gratuitous receipts a legal entity is obliged to report to the Federal Tax Service. And the last common mistake is that the costs of selling securities are indicated in the expense item. This cannot be done; the costs of selling securities will not help reduce tax payments.

Content

Introduction

1. Theoretical and methodological aspects of accounting for shares, bonds and other securities

1.1. Federal Law of November 21, 1996 No. 129-FZ “On Accounting”

1.2. Regulations on maintaining accounting records and financial statements in the Russian Federation (approved by Order of the Ministry of Finance of the Russian Federation dated July 29, 1998 No. 34n)

1.3. PBU (Regulations on accounting for the securities market)

1.4. Classification of securities

1.5. Documents for registration of securities movement

1.6. Analytical accounting

1.7. Receipt/disposal of securities

2. The current accounting system for shares, bonds and other securities at enterprise “X”

2.1. Organization of accounting at enterprise "X"

2.2. Documents for registration of shares, bonds and other securities at enterprise “X”

2.3. Accounting technology at enterprise "X"

2.4. Main disadvantages of accounting

3. Directions for improving the current accounting system at enterprise “X”

3.1. Computerization of accounting

3.2. Implementation of additional controls

3.3. Possibility of introducing international standards

Conclusion

Bibliography

One way to invest temporarily free funds is to purchase securities. This method of investing can also be used by non-professional participants in the securities market, i.e. any legal entities.

Based on the Civil Code of the Russian Federation, securities include bonds (including government bonds), checks, bills, shares, bills of lading, savings and deposit certificates, as well as other documents issued in accordance with the law. All securities can be bearer, registered or order. When transferring a bearer security, only delivery of the document is sufficient.

Rights certified by a registered security are transferred in the manner established for the assignment of claims (assignment - assignment of a claim in an obligation to another person, transfer of one’s rights to something to someone).

The person transferring the right under a security is liable for the invalidity of the relevant requirements, but not for its failure to fulfill it. For an order security, the transfer occurs by making an endorsement on the paper - an endorsement. The endorser is responsible not only for the existence of the right, but also for its implementation. An endorsement made on a security transfers all the rights certified by this security to the person to whom or on whose order the rights under the security are transferred - the endorser. An endorsement can be a blank endorsement (without indicating the person to whom the execution should be made) or an order (indicating the person to whom or on whose order the execution should be made). An endorsement can be limited only to the assignment of an exercised right, certified by a security, without transferring these rights to the endorsee (authentic endorsement). In this case, the endorsee acts as a representative. According to Art. 147 of the Civil Code of the Russian Federation, the person who issued the paper and all persons who endorsed it are jointly and severally liable to its legal owner. Refusal to fulfill obligations under securities citing the absence of an obligation or its invalidity is not permitted. The owner of a security who discovers a forgery or forgery has the right to present a claim from the person who transferred the security to him for improper fulfillment of the obligation certified by the security and for compensation for losses. A person who has a special license can produce a fixed right secured by a registered or order security, including in book-entry form (using computer means). In this case, the person recording the right in a non-documentary form is obliged, at the request of the owner of the right, to issue him a document evidencing the secured right. In accordance with Art. 144 of the Civil Code of the Russian Federation, each type of securities has a specific form and mandatory details.

- Theoretical and methodological aspects of accounting for shares, bonds and other securities

In accordance with the order of the Ministry of Finance of Russia dated January 15, 1997 No. 2 “On the procedure for reflecting transactions with securities in accounting,” securities include: government bond, bond, bill of exchange, check, deposit and savings certificates, bearer bank savings book, bill of lading , shares, privatization securities and other documents that are classified as securities by securities laws or in the manner established by them. Reflection in the accounting records of organizations of transactions related to the circulation of securities is carried out in accordance with the requirements and rules established by the Federal Law of the Russian Federation dated November 21, 1996 No. 129-FZ “On Accounting”, by order of the Ministry of Finance of the Russian Federation dated July 29, 1998 No. 34n “ On approval of the Regulations on accounting and financial reporting in the Russian Federation”, by order of the Ministry of Finance of the USSR dated 01.11.91 No. 56 “Chart of accounts for accounting of financial and economic activities of enterprises and instructions for its application”, by order of the Ministry of Finance of the Russian Federation dated 15.01.97 No. 2 “On the procedure for reflecting transactions with securities, as well as other regulations, in accounting.

- Classification of securities

Securities are classified according to various criteria: by connection with the authorized capital, forms of ownership, terms of their validity, etc.

Depending on the connection with the authorized capital

A distinction is made between financial investments for the purpose of forming authorized capital and debt investments.

Investments in securities for the purpose of forming

the authorized capital

include shares of other organizations, confirming the share of participation in the investment fund and giving the right to receive income from the securities that make up the investment fund.

To debt securities

include bonds, mortgages, certificates of deposit and savings, treasury bills, bills.

By type of ownership

distinguish between government and non-government securities.

Depending on the period for which financial investments in securities were made,

they are divided into long-term (when their established maturity exceeds 1 year or investments are made with the intention of receiving income from them for more than 1 year) and short-term (when their established maturity does not exceed 1 year or investments are made without the intention of receiving income from them for more than 1 year ).

1.5. Documents for registration of securities movement

In accordance with the order of the Ministry of Finance of the Russian Federation dated January 15, 1997 No. 2, all types of securities stored in the organization must be described in the Securities Accounting Book. The securities accounting book must be bound, numbered, sealed with the seal of the organization and signed by the head and chief accountant of the enterprise, and also have the following mandatory details:

- name of the issuer;

- nominal price of the security;

- purchase price of the security;

- number, series, etc.

- the total number of securities purchased;

- date of purchase of the security;

- date of sale of the security.

Responsibility for organizing the storage of the Securities Book rests with the head of the enterprise.

Corrections to the Securities Accounting Book can be made only with the permission of the manager and chief accountant, indicating the date of the corrections.

In the case of maintaining the Securities Book using computer technology, the resulting information can be generated in the form of an output document on machine-readable media. Printing of information from machine-readable media is carried out as necessary or at the request of the authorities exercising control in accordance with the legislation of the Russian Federation.

If an enterprise uses the services of a depository to store forms of securities, then the securities continue to be listed in the accounting records of the owner’s enterprise with the depository details indicated in the analytical accounting.

1.6. Analytical accounting of securities

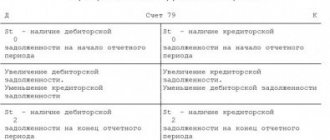

Analytical accounting of securities is carried out by type of investment (stocks, bonds, etc.) and the objects in which these investments are made (organizations that sell securities) with the obligatory receipt of data on financial investments in the country and abroad.

Long-term financial investments

accounted for in active account 06 “Long-term financial investments”, to which the following sub-accounts can be opened:

06-1 “Units and shares”;

06-2 “Bonds”, etc.

The debit of account 06 reflects the organization’s financial investments (for a period of more than 1 year) from the credit of the corresponding accounts (51 “Current account”, 52 “Currency account”). From the credit of account 06, financial investments are written off to account 48 “Sale of other assets.”

Short-term financial investments

accounted for in active account 58 “Short-term financial investments”, to which the following sub-accounts can be opened:

58-1 “Bonds and other securities”;

58-2 “Deposits, etc.

Funds from long-term and short-term financial investments transferred by an organization, for which documents confirming the rights of the organizations were not received during the reporting period, are accounted for separately in accounts 06 and 58.

Bond

A bond is a type of security that pays its owner an annual income, the amount of which is predetermined in the form of a certain percentage of the face value. Bonds may be issued by or under the control of the government, i.e. The issuer can also be joint stock companies, companies and organizations.

Government short-term zero-coupon bonds

Accounting for GKOs is kept in account 58 “Short-term financial investments” in subaccount 58-1 “Bonds and other securities”. Sales and disposals are reflected in account 48 “Sales and disposals of other assets”.

Treasuries

In accounting, there are features of reflecting transactions on KOs depending on the primary or secondary circulation. The primary appeal includes transactions that have not received the required number of endorsements (settlements), and the secondary appeal includes those that have received the obligatory number of settlements.

Accounting for transactions with KOs in the primary market

All mandatory settlements are made at face value, and transactions involving exchanges and redemptions for tax exemptions are made at face value. The primary holder of a KO, when purchasing at par, makes the following entry:

Debit 58 “Short-term financial investments”

Credit 96 “Targeted financing and revenues.”

When repaying accounts payable by transferring KOs, the KO holder makes an entry in the amount of their nominal value:

Debit 60 “Settlements with suppliers and contractors” (76 “Settlements with various debtors and creditors”, etc.).

Receipt of KOs against accounts receivable is reflected at par as follows:

Debit 58 “Short-term financial investments”

Credit 62 “Settlements with buyers and customers” (76 “Settlements with various debtors and creditors”).

Redemption of KOs from the last holder by transfer of funds is reflected by the entry:

- in the amount of nominal value:

Debit 51 “Current account”

Loan 58 “Short-term financial investments”;

— for the amount of interest on KOs:

Debit 51 “Current account”

Credit 80 “Profits and losses”.

If the repayment of a tax bill occurs through the issuance of a tax exemption, then an entry is made with the obligatory reflection in the analytical accounting of the details of the received tax exemption:

Debit 68 “Calculations with the budget”

Loan 58 “Short-term financial investments.”

When the KO matures, the primary holder makes the following entry:

Debit 96 “Targeted financing and revenues”

Credit 87 “Additional capital”.

Accounting for transactions with KOs on the secondary market

Sales, transfers, and other disposals of securities during their secondary placement are reflected in account 48 “Sale of other assets” in the manner established by the Instructions for the use of accounting accounts for financial and economic activities of enterprises, approved by order of the USSR Ministry of Finance dated November 1, 1991 No. 56. Moreover, if the purchase price of securities is less or more than the par value, then the difference between them is subject to additional accrual or write-off until the valuation is equal to the par value. The additional accrual (write-off) operation is carried out in equal monthly amounts across the following accounts:

Debit 58 “Short-term financial investments”

Credit 80 “Profits and losses”.

When selling KOs during their secondary placement, the following entry is made:

Debit 81 “Use of profit”

Credit 48 “Sale of other assets”.

Federal loan bonds with variable coupon yield

Federal loan bonds with variable coupon yield (OFZ) are registered coupon medium-term government securities and provide their owners with the right to receive the par value of the bond upon its redemption and to receive coupon income as a percentage of the par value of the bond.

Accounting for OFZ is carried out on account 58 “Short-term financial investments” in a separate sub-account, and disposal operations are reflected on account 48 “Sale and disposal of other assets”.

Government Savings Loan Bonds

State savings loan bonds (OGSS) are issued in accordance with the General Conditions for the Issue and Circulation of State Savings Loan Bonds of the Russian Federation, approved by Decree of the Government of the Russian Federation dated August 10, 1995 No. 812, on special bearer forms that have several degrees of protection. OGSS provide the right to receive interest income, accrued quarterly to the face value, and the face value itself upon redemption. First of all, the owners of OGSZ are individuals, less often legal entities. Accounting for OGSZ is carried out similarly to accounting for OFZ.

Domestic government foreign currency bonded bonds

Bonds of the domestic government foreign currency bond loan (OVVZ) were issued by the Ministry of Finance of the Russian Federation on May 14, 1993. The owners of these bonds are the owners of foreign currency accounts with Vnesheconombank. These bonds earn an annual return of 3% per annum.

In accounting, transactions on OVVZ are reflected as follows.

- During the initial circulation of bonds

- receipt of bonds in the amount of “frozen” currency, converted into rubles at the exchange rate of the Central Bank of the Russian Federation on this date:

Debit 06 Credit 52

- coupon income due to be received is reflected:

Debit 76 Credit 80 (83)

- income received, converted into rubles at the rate of the Central Bank of the Russian Federation on this date:

Debit 52 Credit 76

- The exchange rate difference is reflected according to the calculations:

Debit 76 (80) Credit 80 (76)

- The bonds of the Russian Federation Ministry of Finance were repaid, converted into rubles at the rate of the Central Bank of the Russian Federation on this date:

Debit 52 Credit 06

- The exchange rate difference on financial investments is reflected:

Debit 06 (80) Credit 80 (06).

2. When trading on the secondary market, the buyer and seller must separately take into account the coupon income, because it is not subject to income tax. The secondary market is operations for the early sale, gratuitous transfer of securities, as well as their transfer to the authorized funds of other organizations. Accounting with the seller:

1) write-off of the initial cost of the bond, calculated at the exchange rate of the Central Bank of the Russian Federation on the date of transfer:

Debit 48 Credit 06

2) write-off of costs of sale or transfer:

Debit 48 Credit 51 (52, 76)

3) reflection of proceeds from the sale:

Debit 51 (52, 76) Credit 48

4) write-off of interest previously recorded as deferred income:

Debit 83 Credit 80

5) reflection of the financial result from the sale taking into account coupon income:

Debit 80 (48) Credit 48 (80)

Buyer's account:

1) purchase price minus accrued (accumulated) coupon income:

Debit 06 Credit 52

Accrued (accumulated) coupon income:

Debit 76 Credit 52

If the par value and the accumulated coupon income are greater than the purchase price, then an entry is made for the difference:

Debit 06 Credit 83

2) reflection of the amount of coupon income due to be received:

Debit 76 Credit 80

3) receiving the amount of coupon income:

Debit 52 Credit 76

Bill of exchange

A bill of exchange is a written promissory note of a form strictly established by law, issued by the borrower (issuer of the bill) to the creditor (bill holder), giving the latter the right to demand from the borrower payment by a certain date the amount of money specified in the bill. Interest on bills is accrued and paid only when the bill is repaid.

Issues of reflecting transactions on bills of exchange in accounting are regulated by the letter of the Ministry of Finance of the Russian Federation dated October 31, 1994 No. 142 “On the procedure for reflecting in accounting and reporting transactions with bills of exchange used in settlements between organizations for the supply of goods, work performed and services rendered, as well as by order Ministry of Finance of the Russian Federation dated January 15, 1997 No. 2 “On the procedure for reflecting transactions with securities in accounting.”

1. Accounting for the enterprise that issued the bill (drawer) is kept on account 60 “Settlements with suppliers and contractors” subaccount “Bills issued” or on account 76 “Settlements with various debtors and creditors”. When posting to these accounts, an entry is made for the amount indicated on the bill. Analytical accounting for this account is maintained for each supplier who issued a bill of exchange whose payment is not due, and for suppliers for overdue bills of exchange.

2. Accounting for the recipient of the money on the bill (the holder of the bill) is carried out depending on the method adopted in the accounting policy of the enterprise for determining the proceeds from the sale of products (works, services).

2.1. As the products are shipped and payment documents are presented to the buyer, in account 62 “Settlements with buyers and customers” subaccount “Bills received” the amount indicated in the bill is indicated. The resulting difference between the amount specified in the bill of exchange and the amount of debt for the goods (work, services) supplied is reflected in account 83 “Deferred income” subaccount “Income on bills of exchange”.

2.2. As funds are received at the cash desk or into the current account of the enterprise - in analytical accounting to account 45 “Goods shipped” - the amount indicated in the bill of exchange is reflected with a separate reflection of the interest on this security. Analytical accounting for accounts 45 “Goods shipped”, 62 “Settlements with buyers and customers”, 60 “Settlements with suppliers and contractors”, 76 “Settlements with various debtors and creditors” should provide the necessary data on the amounts of bills received and issued and separately percent on them:

- on bills issued, the payment period of which has not yet arrived;

- on bills received, the payment period of which has not yet arrived;

- on bills issued with overdue payment terms;

- on bills received that are overdue for payment.

3. All arising claims related to the use of bills of exchange are reflected in account 63 “Calculations for claims” subaccount “Claims for bills of exchange”. Analytical accounting for this account is maintained for each debtor and individual claims.

4. The amount due for payment on the bill of interest for the goods (work, services) received, depending on the specific content of the business transaction, is reflected by the drawer at the time of issuance of the bill:

Debit 10 “Materials” (20 “Main production”, 44 “Distribution costs”)

Credit 60 “Settlements with suppliers and contractors” (76 “Settlements with various debtors and creditors”).

5. When receiving funds from the enterprise-bill holder in payment of the bill, entries are made depending on the method used to determine the proceeds from the sale of products (works, services).

5.1. When applying the method of determining revenue as products (work, services) are shipped, the following entry is made for the amount of debt for goods (work, services) drawn up by a bill of exchange:

Debit 50 “Cash” (51 “Currency account”, 52 “Currency account”)

Credit 62 “Settlements with buyers and customers” subaccount “Bills received”.

At the same time, an entry is made for the amount of interest due on the bill:

Debit 83 “Deferred income”

Credit 80 “Profits and losses”.

5.2. When applying the method of determining sales revenue, as funds are received at the cash desk or in the current account of the enterprise, an entry is made:

- for the amount of debt for goods (work, services) specified in the bill of exchange (minus interest on it):

Debit 50 “Cash” (51 “Currency account”, 52 “Currency account”)

Credit 45 “Goods shipped”;

- for the amount of interest received on the bill:

Debit 50 “Cash” (51 “Currency account”, 52 “Currency account”)

Credit 80 “Profits and losses”.

In analytical accounting for this operation, account 45 “Goods shipped” repays the debt on bills received.

6. In the case of transfer of a bill of exchange before the end of its maturity date from the bill holder who received it for the supply of goods (works, services), the receipt of funds for the bill of exchange is reflected:

Debit 50 “Cash” (51 “Current account”, 52 “Currency account”) – the amount of funds received for the bill;

Credit 46 “Sales of products (works, services)” – the amount of funds received minus interest on the bill;

Credit 80 “Profits and losses” – the amount of interest received on the bill.

If the amount of cash or other funds actually received is less than what the enterprise should have received under the bill, this difference is reflected:

Debit 81 “Use of profit”

Debit 46 “Product sales” - the amount of the actual cost of shipped products

Credit 45 “Goods shipped” – the amount of the actual cost of shipped products.

7. If the drawer fails to pay the bill within the established period, the debt held by the drawer in account 45 “Goods shipped” or 62 “Settlements with buyers and customers” is transferred to the debit of account 63 “Settlements on claims” subaccount “Claims on bills”. When accounting for the debt on the bill of exchange on account 45 “Goods shipped”, an entry is simultaneously made for the amount of the difference between the amount specified in the bill of exchange and the debt listed on account 45 “Goods shipped”:

Debit 63 “Calculations for claims” subaccount “Claims for bills of exchange”

Credit 83 “Deferred income” subaccount “Income on bills”.

Accounting methodology for reflecting bill interest on commodity and financial bills.

1. Interest on bills indicating terms without the clause “not earlier” monthly from the moment of issuance (acceptance) of the bill is charged by the drawer to account 31 “Deferred expenses” in correspondence with accounts payable. At the time of payment of the bill, accrued interest is written off and tax is withheld from it:

Debit 80 “Profits and losses”

Credit 31 “Deferred expenses”.

2. Interest on bills with the clause “not earlier” for a period determined before this date is charged to account 31 “Deferred expenses” in correspondence with accounts payable at the time of issuance of the bill. After the specified date, regularly accrued interest is charged monthly to account 31 “Deferred expenses” in correspondence with the accounts payable accounts. At the time of payment of the bill, accrued interest is written off and tax is withheld:

Debit 80 “Profits and losses”

Credit 31 “Prepaid expenses”

3. In the case of payment of interest on a protested bill (an officially presented demand for payment, confirmed by a notary), the specified interest is attributed by the avalist or the previous endorser in relation to the bill holder to account 63 “Settlements on claims”, and tax is withheld on the initial payment. The drawer who made a protest and receives payment on the protested bill shall assign the amount of interest:

Debit 83 “Deferred income”

Credit 80 “Profits and losses”

4. Payments in excess of the face value on protested bills are at the expense of the payer’s profit.

5. From the moment the bill is received, the monthly interest from the bill holder is charged to account 83 “Deferred income” minus a tax of 15%. At the time of payment of the bill of exchange, they are written off:

Debit 83 “Deferred income”

Credit 80 2Profits and losses.”

6. When a bill of exchange is sold at a price higher than its face value, the amount received in excess of the face value is income from non-operating transactions.

7. When selling a bill of exchange through endorsement at a price below par and interest on it, taken into account on the credit of account 83 “Deferred income”, the difference between the sale price and the specified amount is debited to account 81 “Use of profit”, and for tax purposes is taken the amount of the face value and interest on it.

You should pay attention to the features of accounting for financial bills. Receipt of a financial bill can already be considered the moment of payment for goods (works, services). VAT amounts on material assets in payment for which a financial bill was received are subject to reimbursement from the budget. Financial bills have several disposal channels.

1. Repayment of a financial bill according to the period specified in the bill.

2. The sale of bills of exchange for the purpose of obtaining working capital, as well as the repayment of bills of exchange, is reflected in account 48 “Sale of other assets”. A significant difference between these operations is that when a bill of exchange is redeemed, an amount equal to the nominal value is transferred to the current account, and upon sale the contractual amount is received; also, interest on the sale of bills of exchange is not reflected in accounting, unlike transactions for the redemption of bills of exchange (upon redemption, accrual and payment of interest on bills).

Certificate of Deposit

Any document, the right of claim for which can be assigned by one person to another, which is an obligation of the bank to pay off deposits placed with it, should be called a certificate of deposit.

Certificate of deposit is a written certificate of the issuing bank about the deposit of funds, certifying the right of the depositor (beneficiary) or his legal successor to receive, upon expiration of the established period, the amount of the deposit and interest on it.

Depository is a legal entity to which certificates of deposit are entrusted for safekeeping. Certificates of deposit are issued both one-time and in series. Like all securities, certificates of deposit can be registered and bearer. A special feature of a certificate of deposit is that it cannot serve as a means of payment or payment for goods sold or services provided. Cash payments for purchases and sales, as well as interest payments, are carried out by bank transfer on the basis of the letter of the Central Bank of the Russian Federation dated February 10, 1992 No. 14-3-20 “On deposit and savings certificates of banks.”

Issues of reflecting transactions with certificates of deposit in accounting are considered in the order of the Ministry of Finance of the Russian Federation dated January 15, 1997 No. 2 “On the procedure for reflecting transactions with securities in accounting.” In accordance with the above order, certificates of deposit, as well as savings certificates and checks, are recorded at the enterprise in account 58 “Short-term financial investments”. Depending on the type of security, a sub-account of the same name is opened for this account, and operations are carried out in the manner set out in the instructions for using the Chart of Accounts for accounting the financial and economic activities of an enterprise.

- Transfer of funds to deposit:

Debit 58 “Short-term financial investments”

Credit 51 “Current account” (52 “Currency account”).

2. If an exchange rate difference occurs when returning the deposit, the following entries are made:

- positive exchange rate difference:

Debit 83 “Deferred income”

Loan 58 “Short-term financial investments”;

- negative exchange rate difference:

Debit 58 “Short-term financial investments”

Credit 83 “Deferred income”.

Stock

One of the forms of raising funds to finance the activities of an enterprise is the issue of its securities, for example, shares.

A joint stock company is a commercial organization whose authorized capital is divided into a certain number of shares certifying the mandatory rights of the company's participants in relation to the company.

Shares can be registered or bearer, simple (ordinary) and preferred.

Registered - belong to a specific legal entity or individual, are registered in the book of owners and, as a rule, are issued in large denominations. The charter of the joint-stock company must state that registered shares are sold only with the consent of the majority of other shareholders.

Bearer shares are shares without indicating the name of the owner. They are issued in small denominations to attract funds from the general population, since they can relatively easily change hands.

Ordinary (ordinary) – most of the shares of the joint-stock company. Owners have the right to receive dividends, to participate in general meetings and management of the joint-stock company. Upon liquidation, they have the right to receive funds invested in shares at their nominal value, but only after satisfying the rights of the owners of bonds and preferred shares of the joint-stock company.

Preferred shares are shares that give the right to receive dividends regardless of the company's profit. There are types A and B. Type A shares do not have voting rights (except in cases of reorganization and liquidation of a joint stock company, as well as changes in the amount of dividends and the issue of type A shares). Type B shares have the right to receive dividends in the amount of 5% of net profit based on the results of the last financial year, divided by the number of shares that constitute 25% of the authorized capital of the joint-stock company. Moreover, if the amount of dividends paid by the JSC for each ordinary share in a certain year exceeds the amount to be paid for each type B share, then the amount of the dividend increases to the amount of the dividend on ordinary shares. The owner of preferred shares of type B is only the Property Fund. If the JSC has such shares, then the company does not have the right to pay dividends on ordinary shares in any form other than cash, or to purchase shares issued by it.

In addition to the above promotions, there is also a “Golden Share”. The owner of this share is the state. The share is not transferred to a pledge or trust. “Golden share” gives all the rights provided for owners of ordinary shares and the right of “veto” when the meeting of shareholders makes decisions on issues provided for in parts 1, 9, 10, 11, 12 of clause 6.3 of the Regulations on the commercialization of state-owned enterprises with simultaneous transformation into open joint-stock companies type.

Accounting for the presence and movement of investments in shares of a joint-stock company and in the authorized funds of other enterprises is carried out on account 06 “Long-term financial investments” subaccount 06-1 “Shares and shares”.

The acquisition of shares is reflected at the purchase price:

Debit 06 “Long-term financial investments” subaccount 06-1 “Units and shares”

Credit 51 “Currency account” (52 “Currency account”, other accounts for recording material and other assets in the event that payment for shares was made by providing material or other assets (except cash) for ownership or use to the selling company).

Long-term financial investment funds transferred by the enterprise, but for which documents confirming the rights of the enterprise were not received in the reporting period, are accounted for on account 06 “Long-term financial investments” separately.

The acquisition of shares can occur as a result of exchanging issued bonds for shares of other enterprises or exchanging one's shares for shares of another enterprise. Reflection of this operation at a negotiated price within the nominal value: