Pregnancy and motherhood are a wonderful and exciting time in a woman’s life. A young mother will face a lot of impressions and experiences; it’s very disappointing when they are complemented by problems from work. When going on vacation, a woman devotes herself to caring for her newborn, while her financial situation must be stable and decent. In our country, it has long been decided who pays for maternity leave - the state or the employer, and if the employee and employer act within the framework of the law, the expectant mother has certain social and financial guarantees.

What is maternity leave

Decree in our country is a fairly well-known concept, although it is not found either in legal or accounting practice. Maternity leave and parental leave for up to one and a half (or three years) are colloquially combined in one word - maternity leave.

Our country provides financial support for pregnant women and young mothers. Of course, the expectant mother is not concerned about the question of who pays for maternity leave - the state or the employer - it is important for her not to be left without money during such a difficult period.

Who pays maternity benefits - the employer or the state through the Social Insurance Fund?

Before finding out who pays for maternity leave - the employer or the state, let's figure out what maternity payments are. Maternity payments are accruals of funds for a child to mothers or other family members.

In particular, only the mother has the opportunity to receive such assistance in the event of pregnancy and childbirth. On the contrary, child care benefits can be provided to both the mother and the father or another relative who will take on the corresponding responsibilities for an appropriate period.

The very first small payment is due to the expectant mother who came for a consultation with a doctor when the pregnancy has not yet reached 12 weeks. The figure for such a benefit is 628 rubles. This amount encourages the pregnant woman to consult with specialists on the main issues related to her condition in a timely manner.

In the future, the woman receives the right to regular payments of maternity benefits. Moreover, absolutely all women, both employed and unemployed or students, have the opportunity to apply for it.

There are certain periods during which women are paid these maternity benefits:

- in the standard case - 70 days before birth and the same after (a total of 140 days);

- if the pregnancy is difficult or the birth itself had complications, then the duration of payments is determined by the condition;

- if the recipient is in contaminated territories of the Russian Federation - 90 days before the birth and 70 after;

- finally, if a woman is expecting two or three (or more) children, then the period is 84 days before and 110 after.

Important to know: A simple scheme for receiving maternity benefits.

The amount of maternity leave in 2020 is determined in accordance with the woman’s status before childbirth.

If she has a certain income, the average monthly value of which over the two previous years exceeds the minimum wage for this year 2020 (11,280 rubles), then she will continue to receive exactly her average monthly income.

In the case when this income is less than the minimum wage, she will be paid exactly 11,280 rubles. The unemployed can also claim this amount.

One-time payment after childbirth

Further, the very birth of a child gives the woman the right to receive a one-time payment. Moreover, this payment is not affected by the income of the mother or the family as a whole, nor by the presence of children in the family or their number. At the beginning of 2020, the value of this amount is 16 thousand 759 rubles.

Maternity leave up to 1.5 years

Paid maternity leave for up to 1.5 years can be provided to both mother and father. Its value also has a fixed figure only for the unemployed (see child care benefit for the unemployed), since it is also based on the minimum wage.

Such a child care benefit in 2020 for this category will be 4,512 rubles per month if it is accrued for the first-born. The benefit for, if it is paid for the second child and for all others, in the current 2020 is 6,284 rubles, and a similar value for 2020 has not yet been determined and will become known on January 1.

Persons who have a job in 2020 will receive such a benefit in the amount of 40% of the average monthly earnings for the last two years when they worked, but not more than 26 thousand 152 rubles.

Amounts of child care benefits from 1.5 to 3 years

Finally, paid maternity leave from 1.5 to 3 years involves charging the parent a symbolic amount of 50 rubles monthly, so it should not be taken into account.

Who pays maternity benefits: the employer's organization or the Social Insurance Fund?

Who pays maternity benefits, the state or the employer, is a question that actually does not have a clear answer. In fact, during this procedure, payments are made by both of these participants in the process.

https://www.youtube.com/watch?v=uTI3aJm1WIg

In general, the procedure can be described as follows:

- the employee provides the company with a sick leave certificate that was issued to her on the basis of pregnancy with subsequent childbirth, or she fills out an application for child care up to one and a half (or three) years;

- Having received these papers, the organization sends them to the accounting department, where they calculate what amount the employee is entitled to, taking into account her monthly income for the previous two-year period;

- the company transfers the due funds to her;

- then the same organization draws up a report and collects a package of documents required by the Social Insurance Fund and transfers these papers to the Social Insurance Fund;

- then the FSS itself establishes the authenticity of the documents sent to it and compensates the company for its payments.

As can be seen from this description, the answer to the question of who pays maternity benefits, the employer or the state, may be “both.” The employee directly receives funds from the cash register of her company, and what happens next is unimportant to her, so it is the company that pays for her maternity leave.

At the same time, taking into account the fact that this organization, if its actions are justified, has the right to full compensation for its costs, it allows us to give a different answer to the question of who ultimately pays for maternity leave. In fact, these expenses still fall on the state through its institution - the Social Insurance Fund.

Why can the Social Insurance Fund refuse to compensate an employer for maternity benefits?

Of course, one should not assume that the Social Insurance Fund automatically transfers funds to all enterprises that approach it with a request for compensation for funds transferred to employees as maternity leave.

All documents submitted to this organization undergo a scrupulous check. This assumes that both the correctness of the sick leave registration and the correctness of the calculation of the maternity leavers themselves are determined.

And if certain violations are revealed, the amount of compensation to the company may be reduced, and in extreme cases, it may be completely denied payment.

There are a number of circumstances that may prompt FSS employees carrying out the inspection to suspect something is wrong and refuse compensation to the company:

- the education received by the employee does not correspond to the workplace from which she went on maternity leave;

- the salary accrued to the employee is excessively high for similar jobs;

- the position was created in the company immediately before the employee was hired;

- Before going on maternity leave, the pregnant woman received a significant increase in earnings.

All these circumstances suggest that the company is distorting the situation with the intention of paying its employee and then demanding too much from the state.

Another circumstance in which FSS employees will be wary is the hiring of an employee immediately before going on maternity leave, including in a situation where she has never worked before or for a long time. This fact will be suspicious even if the position existed before and the salary of such a new employee was standard, and the position corresponded to her qualifications.

Of course, the Social Insurance Fund will also refuse to collect funds for the period of time when the employee was not on vacation.

How to act if maternity payments are delayed by the company

At the same time, there is a situation where the company itself refuses to pay the employee adequate funds during maternity leave. In this situation, the employee (or her husband) must take the following actions:

1. First of all, communicate directly with the employer, asking him to pay her the necessary funds and reminding her of her responsibility under the law. At the same time, it is necessary to clarify whether there has been a misunderstanding, for example, a typo in the bank account details.

2. If the previous stage did not lead to the desired result, you can contact the Social Insurance Fund directly. This organization has mechanisms to influence companies that violate the rights of workers.

3. Another option is to write an appeal to the prosecutor’s office. Such paper can be transferred to this organization in person at the department at the place of residence of the applicant, or by registered mail with an inventory and acknowledgment of receipt. In addition, this can be done on the prosecutor’s office portal on the Internet.

4. In addition, an employee may sue due to refusal to pay maternity benefits. This action can be taken immediately as soon as human rights have been violated.

https://youtu.be/-8pwobf9-F0

It is not necessary to first contact the FSS or the prosecutor's office. After this, the court makes a decision in favor of the employee, after which the bailiffs collect the appropriate funds. They are guaranteed to receive the money, unless the company ceases to exist.

What to do if the company no longer exists?

Of course, the situation when the company where the child’s mother worked before going on maternity ceased to exist is an extreme case, which is the least pleasant for her. In such a situation, it will not be legally possible to recover funds from this company.

For such cases, it is established that payments are made by the Social Insurance Fund. In such a situation, the applicant needs to come to the territorial office of this department. At the same time, she needs to take with her a package of documents with which she can confirm her own right to accrue maternity payments to her.

Source: https://promdevelop.ru/rabota/kto-platit-dekretnye-rabotodatel-ili-gosudarstvo-cherez-fss/

Documents for maternity leave

The more the expectant mother’s belly is visible, the more interested she is in how maternity leave is paid, what its terms are and how to get it. Documents for calculating benefits and legal absence from work are submitted to the accounting department or human resources department in several stages.

Before giving birth, a pregnant employee must provide:

- Sick leave. This document is given to the expectant mother in labor at the antenatal clinic. In it, the doctor indicates the expected due date and other important information.

- The employee writes a statement in her own hand stating that she will be absent from the workplace for known reasons.

- You also need to write an application for maternity benefits.

- Submit a certificate of registration in the early stages of pregnancy. It is also given out at the antenatal clinic.

Having received the documents, the employer prepares an order for the employee to go on maternity leave. After giving birth, the young mother will have to contact her employer again with another package of documents. A woman who is preparing to change her work routine to caring for a child needs to know how maternity sick leave is paid and remember to submit documents on time so that financial problems do not become a cause for concern.

After the birth, you need to transfer to the company:

- A copy of the birth certificate (show the original for comparison) of the child.

- Application for payment of benefits and provision of paid leave for up to one and a half years. If in the future the employee wishes to extend her leave until she reaches the age of three, she will have to write a new application.

- A certificate from my father’s place of work stating that he did not receive any payments.

Who calculates maternity benefits?

According to established legal acts, a woman’s temporary disability associated with maternity is considered an insured event, therefore the Social Insurance Fund is responsible for paying maternity benefits. All employers make certain contributions to the same fund, which are deducted from the salaries of employees.

Payment of benefits consists of the following nuances:

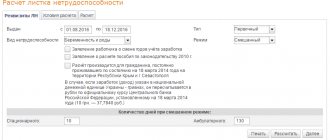

- The calculation of funds is carried out by the employer, regardless of who exactly pays the benefit.

- The employer must transfer all papers with payment reports to the Social Insurance Fund.

- The fund always credits a certain amount to the company’s account, from which all necessary benefits are paid to a woman going on maternity leave.

Papers with calculations of payments are transferred to the Pension Insurance Fund.

Payments of money can also be made in another way. It consists in the fact that the company’s accountant independently calculates the amount of benefits due to the woman and submits all ready-made calculations to the Social Insurance Fund. In turn, the Social Insurance Fund credits the organization’s account with the necessary funds, which are subsequently paid to the pregnant employee.

Even if a woman applies for payment of benefits not to the employer, but directly to the social services center, then all funds in any case are initially transferred to the company’s account.

Timing of maternity leave, or time to prepare for childbirth and care for the baby

After the manager signs the order, the pregnant employee can retire from work and devote herself entirely to preparing for the meeting with the baby.

The state has established how long paid maternity leave lasts. This period varies in the case of a complex or multiple pregnancy. All these nuances are reflected by the doctor on the sick leave. It is the basis for an employee to go on vacation not at the thirtieth week of pregnancy (as is the case with normal health and a singleton pregnancy), but at the 28th. Of course, if constant medical supervision is needed, it is better for a woman to prefer a hospital ward to work matters.

So, how many days of paid maternity leave:

- If pregnancy and childbirth proceed without complications, then payment will be made 140 days (70 days before the woman’s significant day and 70 after).

- If the birth was considered difficult, the woman is entitled to 86 days after birth.

- When several babies are expected, the mother is given 84 days before giving birth and 110 after.

Maternity benefits are paid at a time for all 140 days. Maternity leave is paid in the amount of 100% of the employee’s average monthly salary (with the average daily earnings not exceeding 1,335.62 rubles). The woman also has annual paid leave. She can give him time off before going on maternity leave or extend their maternity leave.

A mother can stay at home with her child for three years or go out at any time.

What documents will you need?

To receive benefits, you must follow a certain procedure. A woman needs to prepare the necessary documents and apply for receipt, since compensation is provided on an application basis.

The main document is the sick leave certificate issued to the woman at the medical institution where she is registered.

This document is issued at the onset of the thirtieth week of pregnancy. If the pregnancy is multiple, then the sheet is provided at the onset of the twenty-eighth week of pregnancy.

When there has been a change of job over the past two years, maternity benefits are paid at the last place of employment. In this case, you will need a certificate that the benefit was not paid elsewhere.

Having received sick leave, the employee submits an application for maternity benefits. As a rule, documents for benefits are submitted simultaneously with an application for maternity leave.

The head of the organization, based on the received application, issues an order to grant the employee maternity leave and pay maternity benefits.

For the order, form T-6 is used, approved by Resolution of the State Statistics Committee No. 1 of January 5, 2004. If the birth turns out to be complicated, the woman will receive additional sick leave.

It is also provided to the employer along with the corresponding application for extending leave and paying for additional days.

How to receive benefits for up to one and a half years

The last salary has long been spent, the first lump sum benefit has been received, what other payments can we expect from the employer?

Firstly, it is important for the mother to know how much maternity leave is paid. Secondly, she is interested in the amount and timing of payments.

The woman will be paid monthly for child care leave for one and a half years.

A happy mother does not need to worry about how maternity leave is paid for, but to broaden their horizons and be able to calculate their expenses, women want to understand this issue.

Please note that the young mother must provide the employer with the documents mentioned above in advance.

Until the child reaches one and a half years old, the employer is obliged to pay the employee monthly 40% of her average monthly earnings. For the calculation, the salary for the year preceding pregnancy is taken.

Payments for 2020

The program for indexing social payments in favor of the population is being implemented at the federal, regional and local levels. Therefore, the amount of benefits may change every year and even more often - by half-year or quarter.

Despite the budget deficit and the “freeze” of indexation of many important payments, maternity benefits increased by 2020 along with the minimum wage, which became equal to the subsistence level.

For pregnancy and childbirth

At the beginning of the third trimester, women expecting a baby or babies prepare to go on long-awaited and necessary maternity leave.

For some, the time to rest comes at 28 weeks - if the employee is expecting twins or more. Under normal conditions, this is 30 weeks. On her own initiative, a woman can take a vacation later - if she wants to continue working and such activity does not harm her health and position.

Depending on the duration of the vacation, the amount of maternity pay is determined. The standard vacation - from the 30th week of gestation - lasts 140 days. The employer's accounting department, based on the employee's average daily salary, calculates the payment - in the actual amount of the salary, if the pregnant woman has two years of work experience, but up to the established maximum, or in the amount of the minimum wage.

Minimum maternity benefits based on the minimum wage - 11,163 rubles in 2018:

- 51,380.38 rubles - general case;

- 57,252 rubles - complicated childbirth;

- 71,199 rubles - multiple births.

The sizes depend only on the number of days on vacation.

Maximums for 2020, based on the size of insurance bases in 2016-2017:

- 282,493.15 rubles - general case;

- 314,778.08 rubles - complicated childbirth;

- 391,454.79 rubles - multiple births.

But who pays the maternity benefit - the employer or the insurance company?

According to the document, the accumulation and distribution of funds for such an insured event as temporary disability due to maternity (pregnancy and childbirth) is entrusted to the Social Insurance Fund - the Social Insurance Fund.

The simplest explanation of how the insurance system works is that the employer submits personalized reports about employees to the Social Insurance Fund every period. Every employee who has an employment contract with an employer is an insured person, and his employer is an insured.

The employer pays insurance premiums for its employees every month. If an insurance situation arises, the employer pays the employee the required amount of “insurance”, and then the Social Insurance Fund pays him.

Thus, the nominal payer of maternity benefits is the employer, and the real payer is the Social Insurance Fund:

- the employee submits an application to the HR department;

- the employer issues an act granting leave and payments;

- a transaction is made to the employee’s account from the employer’s account;

- the employer sends an application to the Social Insurance Fund for reimbursement of the payment;

- The Social Insurance Fund makes the transaction to the employer's account.

In practice, situations are possible when the Social Insurance Fund refuses to compensate the employer for the insurance payment.

For child care

After the end of maternity leave - after 70 days (sometimes 86 or 110 days) - a woman can immediately go on maternity leave to care for her child.

Usually these two holidays flow into one another without interruption. Parental leave lasts one and a half years and is accompanied by a monthly allowance. USEFUL INFORMATION: Can a sister claim her brother's inheritance?

There are often cases when it is not the mother, but the father of the child who takes the leave. The legislation allows the employee's spouse or other close relatives - grandparents, children - to receive maternity leave along with benefits. The condition is official employment with deductions of insurance premiums.

Until the child is one and a half years old, the woman (or her husband/other close relative) receives a monthly allowance. The amount of the benefit depends on the order of the child (first or subsequent) and also on the average salary and has minimum and maximum limits:

- maximum benefit - 40% of average earnings;

- the minimum is 4465.20 and 6284.65 rubles for the first and subsequent children, respectively.

Like a one-time maternity payment, this benefit is provided by the employer with compensation from the Social Insurance Fund.

Why does such a system exist? Maternity payments are a state measure of assistance to families with children, encouragement of family and childhood, and demographic development, therefore the material support of the program is provided by the state extra-budgetary fund - Social Insurance. And the employer acts as an intermediary, an insurance agent.

In some regions, it is planned to introduce payments directly from government funds, bypassing the employer, as a pilot project. However, such changes will not yet be implemented throughout the country.

Return to the workforce. When is it possible to go to work?

Unfortunately, not all mothers have the opportunity to sit at home and take care of their beloved child. More and more often, mothers have to choose between a baby and a stable income.

The period of paid maternity leave is set to 1.5 years, and it cannot be extended. But a woman can extend her stay at home at her own expense. The workplace is assigned to a maternity leaver until her child reaches three years of age. It should be noted that these second year and a half are not included in the length of service.

A woman can go to work at any time without waiting for the end of maternity leave. But at the same time, if the child returns to work before the child is one and a half years old, the employee will lose the payments that are provided at this time. In other words, a woman can only receive one thing: a salary or an allowance.

We found out how much maternity leave is paid, let's figure out who has the right to take advantage of this leave.

Maternity leave is only for mothers?!

According to Russian law, any relative who actually cares for the baby can go on parental leave. If a mother is forced to go to work, she can leave the child with the father, grandfather or grandmother, while they will retain their jobs.

It is necessary to provide a “substitute” mother at the place of work:

- A copy of your birth certificate.

- A certificate from your mother’s place of work stating that she has returned to full-time work.

- Statement.

- Certificate of full payment of benefits.

It is important to note that a young mother can involve her parents or her husband’s parents on maternity leave only if they have not yet reached retirement age.

What should an employee’s employer do in an “interesting situation”?

Everyone says that in our country it is impossible to get a job while pregnant, and employers “don’t like” employees who go on maternity leave. Let's look at this issue through the eyes of the employer.

Firstly, pregnant women have guarantees and protection from the state. They cannot be fired or refused employment because they are pregnant, they can demand special working conditions and their job is kept for them.

Secondly, the employer wastes time and suffers losses when hiring a new employee. He trains her, waits for her to understand all the intricacies of production, and over time the employee leaves him, and he needs to find a temporary replacement for her and start all over again with new employees. One day the time will come, and it will be necessary to resolve the issue with the maternity leaver, return her, again give her time to devote herself to current affairs, or fire her.

Thirdly, submission of documents and financial settlements with the Social Insurance Fund and the employee. If the staff is small and there is only one accountant, his workload increases significantly with each maternity leave. Although in theory everything is not so complicated.

Taking into account the above, it can be assumed that employers do not like women on maternity leave, but the additional worries that they entail. It’s good if the employer is an adequate person and is humanly happy for his subordinate. A competent employer always takes care of himself and his subordinates. He promptly and accurately submits the necessary documents, complies with the law and hires a new employee for the position of the expectant mother in advance, so that she is the one who teaches him everything she can and does at the enterprise.

Can the fund refuse to reimburse the organization's payments?

The employer should remember that the state has the right to refuse to reimburse expenses to enterprises in connection with maternity payments to the employee. However, this happens only in cases established by law.

The circumstances preventing an organization from receiving compensation are specified in the Federal Law. Most often, this happens when there are signs of abuse of official position in the employer’s actions, as well as a desire to get rich off the employee.

Refusal to compensate for expenses incurred is possible if:

- identifying connections between the maternity leaver and the manager based on family relationships;

- lack of education that allows the employee to perform her functions;

- detection of the fact of adjustment of the staffing table before the registration of the employee (a new position is introduced that is not justified from an economic point of view);

- lack of replacement after an employee goes on maternity leave or the hiring of an employee with a salary lower than that of a woman on maternity leave;

- discrepancy between the salary of the employee and other persons filling similar positions;

- the woman has bonuses that exceed the amount of incentives for her colleagues;

- overestimation of the salary of a pregnant woman;

- the absence of documents indicating that the employee has fulfilled the duties provided for by the job regulations.

Question:

What to do when the fund refuses to transfer funds?

Answer:

If the papers transferred to the fund satisfy the latter in terms of meeting all requirements, then the FSS will pay compensation. Otherwise, specialists will easily identify facts of artificial employment of an employee.

The employer is given the legal right to appeal the refusal of the Social Insurance Fund in court. At the same time, it is worth understanding that the practice that has developed in the Russian Federation indicates the advantage of government bodies.

And yet, who pays for maternity leave - the state or the employer?

Pregnancy, childbirth and child care are considered an insured event, therefore the state pays for these expenses. It all happens as follows:

- the employer makes timely deductions from the employee’s earnings to the Social Insurance Fund, from the first salary she received at the enterprise and throughout the entire period of work;

- after the employee has brought the necessary documents, the employer makes a calculation and submits information to the Social Insurance Fund;

- The Social Insurance Fund transfers the required amount of payments to the employer’s account;

- the employer transfers or gives the employee the required amount in cash.

If the employer cannot pay the employee the required amount on time, citing the fact that the funds did not come from the Social Insurance Fund, the employee can contact the labor inspectorate or the procurator. Even if the Social Insurance Fund delays payments, the employer must pay the employee from its own funds, and then compensate them with income.

Delay in payments

If the employer does not pay maternity leave:

- you need to make sure that the submitted documents and application are correct and talk to your superiors;

- file a complaint against the employer with the Social Insurance Fund;

- if the Fund does not solve the problem, file a complaint with the court and/or the prosecutor’s office.

Can only working women count on maternity benefits?!

We found out who pays for maternity leave - the state or the employer, what the duration of paid maternity leave is and what amounts you can count on. It remains to figure out the categories of women who are entitled to benefits.

In fact, everything is simple here too, pregnant women will receive benefits:

- officially employed, including individual entrepreneurs;

- full-time students;

- on the labor exchange.