Non-promotion in "commerce"

Meanwhile, 25% of the employers we surveyed took a different route. They raised wages without raising them.

As is known, according to Art. 133 of the Labor Code should be paid no less than the minimum wage to those employees who have fully worked their normal working hours. If an employee works part-time, then his salary is paid proportionally.

For example, until May 1, 2020, employee Ivanov received a salary in the amount of the minimum wage in the amount of 9,489 rubles.

From May 1, with an 8-hour working day on a standard five-day week, his salary cannot be lower than 11,163 rubles. However, the employer, simultaneously with increasing the salary to the new minimum wage, transfers the employee to part-time work, formally complying with the Labor Code norms.

9489/11163*8=6.8 hours or 0.85 rate.

Thus, if you shorten an employee’s working day by 1 hour, making it 7 hours, then you can pay Ivanov not 11163, but 9767.63 (11163/8*7).

Let us note that the reasons for such a change in working hours at the initiative of the employer are limited by the provisions of Art. 74 TK.

However, the employee himself can take the initiative. If employees suddenly decide to switch to part-time work starting in May 2020, declaring this in writing, the employer has the right to grant their request.

https://youtu.be/FA9hv83fohQ

Establishing a minimum wage

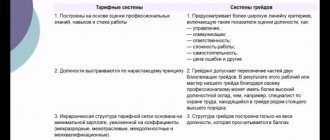

The main task of introducing a system for determining the minimum wage is to create conditions under which it is possible to adjust the salaries of employees depending on their experience, qualifications and quality.

Thus, the minimum wage is a specific amount in monetary terms, less than which the employer simply does not have the right to pay its employees. In order to provide its citizens with maximum protection of rights and interests, the state carefully monitors the issue regarding the minimum amount of labor.

This occurs through a combination of labor law provisions and federal regulatory instruments. All norms that in one way or another affect the procedure for determining and paying the minimum wage at enterprises are considered and regulated at the highest legislative level.

Our labor code states that the method of calculating the minimum wage can

Why does the government set a minimum wage?

Will this help reduce.

The state does this in order to balance a person’s income and expenses so that he can buy and pay for those goods and services that are charged to him (it is believed that the amount of the minimum wage can cover a person’s most necessary expenses for a decent life). But in fact, he is not very successful at this. The minimum wage (minimum wage) today is too low to compensate for all the necessary expenses of people.

It is unlikely that this minimum wage figure of 7,500 rubles will reduce the number of people below the poverty line, since the difference between the middle class and the population below the poverty line is in no way equal to seven and a half thousand rubles. Half of a person’s expenses come from taxes, so in order to reduce these expenses, something needs to be done with taxes. In order to make it more difficult to fall below the poverty line, it is advisable to establish a progressive tax rate, that is, a person will pay tax based on his income.

The higher the income, the higher the tax. Small income means little tax.

What threatens employers

For paying wages below the minimum wage, those who have worked the monthly norm are subject to a fine.

Fines for this case are prescribed in Part 6 of Art. 5.27 of the Administrative Code and are:

- for legal entities – from 30 to 50 thousand rubles;

- for officials - from 10 to 20 thousand rubles;

- for individual entrepreneurs – from 1 to 5 thousand rubles.

It should be noted that recently regulatory authorities have been paying a lot of attention to the work on legalizing wages. Under the leadership of the Ministry of Labor, interdepartmental commissions have been created in each subject of the Russian Federation to coordinate activities and monitor the situation to reduce informal employment, legalize “gray” wages and increase the collection of insurance premiums

In addition, for example, the Social Insurance Fund “leaks” to labor inspectors data on employers who charge contributions from wages calculated below the minimum wage.

The Pension Fund calls on citizens to provide information about employers who offer to receive part of their salary “in an envelope.”

Tax officials use a number of criteria to identify companies with shady salaries. For example, their attention will be sharpened if they notice that an employee’s salary at a new place of work is lower than at the previous one (according to 2-NDFL certificates), that is, he changed jobs on less favorable conditions.

Tax audits are becoming tougher. Learn to protect yourself in the Clerk's online course - Tax Audits. Defense tactics."

Watch the story about the course from its author Ivan Kuznetsov, a tax expert who previously worked in the Department of Economic Crimes.

Come in, register and learn. Training is completely remote, we issue a certificate.

>Minimum wage 2020: changes

How is wages regulated using the minimum wage?

The payment accrued to the employee for performing certain duties to the employer should not be less than the minimum wage . Also, the salary received in hand may be less than the minimum wage , since your employer acts as a tax agent and withholds personal income tax for further deductions to the tax office. The exception is part-time or part-time work. It is in such cases that wages may be less than the minimum wage .

Salary below the minimum wage: responsibility and fines

Why is the minimum wage important? For many reasons. First of all, wages depend on it. The employer does not have the right to pay full-time employees a salary below the minimum wage, as stated in Art. 133 of the Labor Code of the Russian Federation: “The monthly salary of an employee who has fully worked the standard working hours during this period and fulfilled labor standards (job duties) cannot be lower than the minimum wage.”

GIT on its official website clarifies that wages may be less than the minimum wage if the employee works part-time or part-time. “The salary may be less than the minimum wage. In addition to salary, wages include compensation payments, various bonuses and incentive payments (Article 129 of the Labor Code of the Russian Federation). Thus, taking into account all salary increases or incentives, the employee receives an amount greater than or equal to the minimum wage. If the employee’s salary is still less than the established minimum wage, the employer must make an additional payment up to the minimum wage.”

The employer must understand that he is at great risk if his employees receive wages below the minimum wage. The labor inspectorate may fine him. According to Part 6 of Art. 5.27 of the Code of Administrative Offenses of the Russian Federation, such a violation entails a warning or the imposition of an administrative fine on officials in the amount of 10,000 to 20,000 rubles; for legal entities - from 30,000 to 50,000 rubles.

For repeated violations, the fine for officials ranges from 20,000 to 30,000 rubles. or disqualification for a period of one to three years; for legal entities - from 50,000 to 100,000 rubles.

Economic basis

In Russia, the minimum wage and the living wage are interrelated concepts. In accordance with Article 133 of the Labor Code, the minimum wage is established in all regions simultaneously on the basis of federal law. Its value should reach the subsistence level of the working-age population.

The minimum wage for employees of budgetary institutions is financed from the budgets of the corresponding levels, extra-budgetary funds, as well as revenues from business and other profit-generating activities. Managers of other enterprises provide minimum wages to employees from their own capital.

The minimum wage is the salary that is guaranteed to an employee who has worked fully for 1 month. During this period, he must develop a standard time and fulfill his obligations under the contract.

Subjects of the Russian Federation may set their own minimum wage. This amount, however, should not be less than that established by federal law. A regional minimum wage may be provided for employees of all enterprises existing in the territory of the subject, with the exception of employees of budgetary organizations.

Insurance premiums and minimum wage

Since 2020, insurance premiums have been decoupled from the minimum wage. That is, from January 1, 2020, according to Federal Law No. 335-FZ dated November 27, 2017, the amount of insurance contributions for compulsory pension insurance and compulsory health insurance that individual entrepreneurs pay for themselves is not related to the minimum wage and tariff rate.

Individual entrepreneurs will have to pay the appropriate contributions to the above-mentioned extra-budgetary funds in the amount established by clause 77 of Art. 2 of the Federal Law of November 27, 2017 No. 335-FZ.

Insurance premiums for compulsory pension insurance for individual entrepreneurs in 2019 will be:

- if the payer’s income does not exceed 300,000 rubles, – 29,354 rubles. (fixed size);

- if the braider’s income exceeds 300,000 rubles, – 29,354 rubles. (fixed amount) + 1% of the payer’s income exceeding 300,000 rubles, but not more than 8 x 29,354 rubles.

The total amount of contributions to compulsory pension insurance should not exceed 234,832 rubles.

Insurance premiums for compulsory health insurance in 2019 will amount to 6,884 rubles. in a fixed amount.

Are you an individual entrepreneur and don’t understand accounting? An electronic accountant will prepare reports for you and calculate taxes, help with issuing invoices and other documents.

To learn more

Minimum wages by region: how does the federal indicator differ from the regional one?

The minimum wage (minimum wage) at the state level is approved by the relevant federal law. The minimum wage is valid throughout Russia and cannot be less than the subsistence level of able-bodied citizens for the 2nd quarter of the previous year for the purpose of calculating wages (Article 1 of the Law “On the Minimum Wage” dated June 19, 2000 No. 82-FZ).

- from 10,000 to 20,000 rub. on officials;

- from 30,000 to 50,000 rub. for legal entities;

- from 1,000 to 5,000 rubles. for individual entrepreneurs operating without forming a legal entity.

If previously neither the social nor financial departments of the Russian Federation, nor parliamentarians could establish compliance with the minimum wage to the subsistence level, then in March 2020 the President of the Russian Federation signed Law No. 41-FZ dated 03/07/2018, the norms of which determined that from 05/01/2018 the minimum wage will be equal to the subsistence level of the working-age population for the 2nd quarter of last year.

Thus, the minimum wage as of May 1, 2018 was 11,163 rubles. The Ministry of Labor approved the cost of living for the 2nd quarter of 2018 in the amount of 11,280 rubles. And since the cost of living for the 2nd quarter of 2020 is equal to the minimum wage for 2020, then from 01/01/2019 the value of the federal minimum wage is 11,280 rubles.

The same applies to the minimum wage for 2020. It is equal to the cost of living for the 2nd quarter of 2020, which is 12,130 rubles. (see order of the Ministry of Labor dated 08/09/2019 No. 561n)

The minimum wage regulates not only wages, but also the amount of benefits (including maternity benefits), and until the end of 2020, the amount of contributions for individual entrepreneurs. Let's look at how the minimum wage changed over the period from 2013 to 2020.

In Russia, there are two types of minimum wages: federal, approved annually by government decree, and regional, which is adopted at the level of constituent entities of the Federation. This right is granted to regional authorities by Art. 133.1 Labor Code of the Russian Federation. Along with them, representatives of trade unions and employers take part in determining the minimum wage for the regions, developing a tripartite agreement. The approved figure may differ from the federal minimum wage in Russia - but only upward!

Many regions use federal standards, for example, Kostroma, Arkhangelsk, Pskov, Novgorod, Orenburg, the republics of Kalmykia, Adygea, etc. And the authorities of some constituent entities of the Russian Federation have exercised their right to establish increased minimum wage indicators, for example:

- in the Moscow region – 14,200 rubles;

- in the Kemerovo region - 18,313 rubles;

- in the Omsk region – 12972 rubles;

- in the Tula region - 13,520 rubles.

Traditionally, the highest minimum wage by region in 2020 is noted in the Magadan region - from 19,500 to 21,060 rubles, after the application of northern allowances and the Republic of Kazakhstan, this amount increases from 33,150 to 35,802 rubles. respectively.

The minimum wage was used from November 29, 2002 to January 1, 2010 to regulate wages and determine the amount of temporary disability benefits.

Until November 29, 2002, it was used to regulate wages, as well as to determine the amount of benefits for temporary disability and payments in compensation for harm caused by injury, occupational disease or other damage to health associated with the performance of work duties.

| The period from which the minimum wage is established | Amount of the minimum wage (rub., per month) | Regulatory act establishing the minimum wage |

from 01.01.2020 | 12 130 | Draft Order of the Ministry of Labor of the Russian Federation |

from 01/01/2019 | ||

from 05/01/2018 | 11 163 | |

from 01/01/2018 | 9 489 | |

from 01.07.2017 | 7 800 | |

from 01.07.2016 | 7 500 | |

from 01/01/2016 | 6 204 | |

from January 1, 2020 | 5 965 | Federal Law of December 1, 2014 No. 408-FZ “On Amendments to Article 1 of the Federal Law “On the Minimum Wage” |

from January 1, 2014 | 5 554 | Federal Law of December 2, 2013 N 336-FZ “On Amendments to Article 1 of the Federal Law “On the Minimum Wage” |

| from January 1, 2013 | 5 205 | Art. 1 of the Law of December 3, 2012 No. 232-FZ |

| from June 1, 2011 | 4 611 | Art. 1 of the Law of 01.06.2011 No. 106-FZ |

| from January 1, 2009 | 4 330 | Art. 1 of the Law of June 24, 2008 No. 91-FZ |

| from September 1, 2007 | 2 300 | Art. 1 of the Law of April 20, 2007 No. 54-FZ |

| since May 1, 2006 | 1 100 | Art. 1 of the Law of December 29, 2004 No. 198-FZ |

| from September 1, 2005 | 800 | Art. 1 of the Law of December 29, 2004 No. 198-FZ |

| from January 1, 2005 | 720 | Art. 1 of the Law of December 29, 2004 No. 198-FZ |

| since October 1, 2003 | 600 | Art. 1 of the Law of 01.10.2003 No. 127-FZ |

| since May 1, 2002 | 450 | Art. 1 of the Law of April 29, 2002 No. 42-FZ |

| since July 1, 2001 | 300 | Art. 1 of the Law of June 19, 2000 No. 82-FZ |

| since January 1, 2001 | 200 | Art. 1 of the Law of June 19, 2000 No. 82-FZ |

| since July 1, 2000 | 132 | Art. 1 of the Law of June 19, 2000 No. 82-FZ |

The base amount used to calculate taxes, fees, fines and other payments, the amount of which, in accordance with the legislation of the Russian Federation, is determined depending on the minimum wage, as well as payments for civil obligations established depending on the minimum wage, from January 1, 2001 it is 100 rubles (Article 5 of the Law of June 19, 2000 N 82-FZ).

We invite you to read Consent to the divorce of the other spouse

What is the minimum wage?

According to the provisions of the current legislation, the minimum wage is the minimum possible salary for employees that the employer can set. The amount is determined at the federal level annually.

What the minimum wage will be for the next period depends on the following macroeconomic factors:

- price level in the country;

- unemployment rate;

- inflation rate;

- production indicators;

- the needs of workers from Russia and foreign countries.

As of January 1, 2019, the minimum wage in Russia was 11,280 rubles.

The minimum wage performs the following functions:

- Used to regulate workers' incomes.

- Serves as the basis for determining the amount of benefits for sick leave, pregnancy and childbirth.

- Used to calculate insurance premiums.

Important! Labor legislation does not allow the use of minimum wages for purposes other than those listed.

Art. 133 of the Labor Code of the Russian Federation states that the “minimum wage” cannot be set below the subsistence level, also determined annually at the legislative level. In practice, this provision is not met: in 2019, the spread between the indicators is more than 10,000 rubles. However, it is expected that in the future the values will become equal thanks to the efforts of the state’s economic policy.

Why do countries raise the minimum wage?

In the UK, on Friday, April 1, the minimum wage for people over 24 years of age is being raised from £6.7 to £7.2 (about $10) per hour. By 2020, the British authorities want to bring it to £9. Thus, by working eight hours, you can already earn $80 in one working day.

The authorities of the American state of California went even further. They want to raise the minimum wage to $15 by 2020. California currently has a minimum wage of $10, higher than the US minimum wage of $7.25. On Monday, Gov. Jerry Brown announced an agreement between lawmakers and union leaders.

“I hope that what is happening in California does not stay within our state borders and spreads to the rest of the country,” he said.

New York State Governor Andrew Cuomo has proposed setting $15 by 2019 in New York City and by 2021 throughout the state. During the presidential election campaign currently underway in the United States, many candidates also spoke out in favor of increasing the minimum wage to $12–15 per hour. Many developed countries are planning to increase the minimum wage one way or another. For example, Japanese Prime Minister Shinzo Abe believes that it should grow by 3% per year in the coming years.

Why are the authorities increasing the minimum wage?

There are two reasons. First, it reduces inequality and improves the living standards of the poorest groups. Secondly, raising wages stimulates consumer spending and inflation (businesses will transfer increased wage costs into the final cost of the product or service).

Russians continue to get poorer

Russians' incomes resumed their rapid decline in January after a December slowdown.

Year-on-year the decline was 6.3%. Real wages decreased by... → Consumer demand, which, for example, accounts for about 70% of GDP in the United States, is growing slowly in developed countries, and inflation cannot be brought to the target 2%.

According to the US Department of Commerce, American consumer spending rose 0.1% in February compared to January. The January growth rate was lowered from 0.5 to 0.1%. The PCE Core (Personal Consumption Expenditures, Excluding Food & Energy) index in February increased by 0.1% compared to the previous month and by 1.7% year on year. Inflation in the United States remains below 2%.

“Consumers are still cautious in their spending, but showing good resilience,” Sam Bullard, senior economist at Wells Fargo Securities LLC, said optimistically.

There is no inflation at all in the eurozone. There has been deflation for two months now. According to preliminary estimates from Eurostat, consumer prices fell by 0.1% year on year in March. In February the decrease was 0.2%. Cheap energy resources have an extremely negative impact on the price level. Core inflation, which does not take into account fuel prices and other most volatile parameters, amounted to 1% in March.

Central banks in the US, EU, Japan and other countries stimulate inflation, demand and economic growth through ultra-loose monetary policies. However, the set of measures has already been practically exhausted, since central banks have switched from quantitative easing programs to a policy of negative rates.

Helicopter money

Washington swims against the tide

On March 16, the US Federal Reserve will leave the key rate at the current level (0.25–0.5%) and will not abandon plans for its further... →

Economists say that in a little while the financial authorities, together with national governments, will switch to a policy of “helicopter money": one-time or regular direct financing by central banks of state and household expenditures, bypassing commercial banks as intermediaries. In particular, the Central Bank can immediately buy out the state’s debt obligations, and the state, receiving these injections, can increase social programs or reduce taxes.

The idea of “helicopter money” is attributed to the Nobel laureate in economics, the main monetarist of the 20th century, Milton Friedman. In fact, he did not offer such recipes, but modeled the situation of a sharp increase in cash in the economic system. “Suppose that one day a helicopter appeared over our hypothetical society and dropped one thousand dollars in the form of those same paper tickets, which, naturally, were immediately picked up...” - this is how one of the chapters of his work “The optimal quantity of money” began. of money), published in 1969.

The temptation to replace commercial debts with debt to the issuing center is very great. Representatives of the European Central Bank and the US Federal Reserve have recently regularly had to fend off questions on the topic of “helicopter money”. Thus, member of the ECB board of directors Benoit Couare recently said that the idea of such incentives is not being discussed by the bank’s directors.

Will “helicopter money” help increase spending? Most likely no. Amid the ongoing turbulence in the global economy since 2008, people are increasing savings rather than spending. In the US, the savings rate rose to a yearly high in February and amounted to 5.4% versus 5.3% in January.

Raising the minimum wage is a direct stimulation of demand and inflation, which, however, will not solve the accumulated problems. Yes, the incomes of the working poor will rise, but they will not offset the trend of declining middle-class incomes. In addition, there is a risk that an increase in business expenses on salaries will lead not to an increase in prices, but to a reduction in personnel.

Poor Russia

It is worth noting that Russia is also planning to increase the minimum wage. Prime Minister Dmitry Medvedev last week ordered to raise it from July 1 from 6,204 thousand rubles. up to 7.5 thousand rubles. This is being done in order to raise the minimum wage to the minimum subsistence level, which for the working population in the fourth quarter of 2020 amounted to 10,187 thousand rubles.

The corresponding bill was submitted to the State Duma on Wednesday, March 30. The head of the State Duma Labor Committee, Olga Batalina, said that the increase in the minimum wage will affect about 1 million workers. Of these, 87% are public sector employees, the rest work in the non-state sector of the economy.

Crisis is sweeping the planet

The global economy continues to give alarming signals.

This is not an SOS signal yet, but investors and politicians are becoming increasingly nervous. Indices... → According to her, in 2017–2018 it is planned to bring the minimum wage to the subsistence level. One could be satisfied with this, but in Western countries the minimum wage is on average 45–50% of the average salary. In Russia, even the increased “minimum wage” will not reach even a quarter of average earnings (about 33 thousand rubles in January - February of this year).

Numerous initiatives to introduce hourly wages or raise the minimum wage to 50% of the average salary are not yet feasible, since they involve large additional costs for businesses, since millions of workers will have to raise wages. According to Rosstat, in 2020 the salary is below 17 thousand rubles. per month (half the average salary in the country) were received by 29.4% of workers.

Russia is far behind developed countries in terms of minimum wages. The Financial Times newspaper calculated that if it now takes a resident of Foggy Albion 26 minutes to buy a hamburger at McDonald's, then after raising the minimum wage to £9, it will take only 18 minutes. But even so, they will not be able to catch up with the Danes with 16 minutes. But even now they are far ahead of the USA (41 minutes). In the EU and other developed countries, including South Korea and Japan, Spain has the lowest at 48 minutes. China's figure is 56 minutes.

But in Russia and developing countries the situation is much worse. Residents of Brazil have to work 162 minutes for a hamburger, Indians - 173 minutes, Russians - 191 minutes, Turkish citizens - 232 minutes, and Mexicans - as much as 280 minutes.

In general, you can, of course, worry about the Mexicans, who are worse off than the Russians. But this will be little consolation, as will the increase in the minimum wage to $110 per month.

What does the minimum wage consist of?

Art. 129 of the Labor Code of the Russian Federation states that the minimum wage includes the following transfers to the employee:

- salary determined based on the specialist’s qualifications, complexity and characteristics of the work;

- compensation payments (for example, due for harmful or dangerous working conditions);

- incentive payments (annual, quarterly, monthly bonuses, etc.);

- other additional payments received from the hiring company.

If an employee works as an internal part-time worker, i.e. In addition to the main duties, he performs additional ones, the latter are paid separately. The income of an external part-time worker depends on the agreements reached between him and the company.

If a person worked at 1.5 times the rate instead of one, he cannot receive a salary of one “minimum wage”. His income will be calculated in proportion to the time worked.

Labor legislation prohibits including in the calculation of the minimum wage payment for work overtime, on weekends and holidays. For this, separate transfers are required, which are determined at one and a half rates in the first two hours and at double rates thereafter. By agreement with a specialist, monetary compensation can be replaced by additional days of rest.

If an employee’s salary is less than the “minimum wage”, the employing company is obliged to make an additional payment. For example, if a specialist is assigned a salary of 5,000, and there are no compensation or incentive payments, the employing company is obliged to transfer him an additional (9,489 – 5,500) = 3,989 rubles. If it does not do this, regulatory authorities will apply penalties against the organization.

Minimum wage (minimum wage), principles, procedure and significance of establishment.

with inflation.

The state has established a unified tariff schedule for remuneration of public sector workers, and regional coefficients have been established to increase the size of tariff payments for workers in unfavorable natural and climatic conditions.

The concept of “remuneration” is broader than the concept of “wages”. The main principles are: steady growth of nominal and real wages, compliance of the measure of labor with the measure of its payment, material interest of workers in achieving high final results of labor, ensuring faster growth rates of labor productivity compared to the salary growth rate. Page 21 of 30 Adjacent files in the subject 10/03/2013636.42 Kb 10/03/2013185.34 Kb 10/03/2013651.78 Kb 10/03/2013651.78 Kb 10/03/2013578.56 Kb 10/03/2013622 .59 Kb 03.10.2013562.18 Kb 03.10.20131.15 Mb 03.10.2013702.46

What is the regional minimum wage?

According to the provisions of Art. 133 of the Labor Code of the Russian Federation, the authorities of the subject of the federation, in agreement with trade unions and organizations, have the right to introduce their own minimum wage on its territory. It must necessarily exceed the federal value. In 2020, 32 regions of the country take advantage of this opportunity. These include the Moscow, Bryansk, Kursk regions, the republics of Tatarstan, Khakassia, Buryatia, Trans-Baikal Territory and others.

Companies located in the territory of the subject where the “minimum wage” has been increased are considered to have silently acceded to the agreement, even if they did not take part in its discussion. Information about the decision made is published on the official website of the executive branch for public information.

If an organization does not want to join the initiative, it has 30 days from the date of publication of the decision to send a written refusal to the authorities, justifying the reasons. “Silence” obliges the commercial structure to submit to the innovation and raise workers’ wages to the level of the regional minimum wage. Failure to comply with this rule entails the same sanctions as ignoring the federal “minimum wage.”

How is the minimum wage set?

In the constituent entities of the Russian Federation, three parties participate in determining the size of the minimum wage: representatives of regional authorities, employers and trade unions. They enter into a tripartite agreement. The amount specified in it becomes mandatory for all employers in the region, even if they did not take part in the meeting or sign the document.

Those who disagree are given three days after the agreement is concluded. During this time, they can present their refusal to pay inflated rates, justifying the reasons.

In which constituent entities of the Russian Federation is a regional minimum wage established? A number of regions of the country have exercised the right to determine their minimum wage indicators. Many adhere to federal standards: Kaluga, Kostroma, Kursk, Novgorod, Arkhangelsk, Vologda, Pskov, Kirov, Orenburg and other regions, the Republic of Adygea, Mordovia

Why does the government set a minimum wage? Will this help reduce the number of people living below the poverty line?

Formulate your proposals for fighting.

Document. How to manage your capital. From the work of the Scottish economist A.

Smith, An Inquiry into the Nature and Causes of the Wealth of Nations. When the stock which a man possesses does not exceed a quantity sufficient only to support him for a few days or weeks, he seldom thinks of deriving any income from it... In this case his income is derived entirely from his labor... If the person possesses reserves sufficient to support it for several months or years, it naturally tries to extract income from the greater part of these reserves.

Therefore, stocks are divided into two parts. The part from which he expects to receive income is called capital.

The other part is that which goes for direct consumption... Capital can be used in two different ways in order to provide income, or profit, to its owner. Firstly, it can be used for the production, processing or purchase of goods for the purpose of resale at a profit... This kind of capital is correctly called working capital. Secondly, capital may be employed in the improvement of land, in the purchase of useful machinery and instruments, or other articles which yield revenue or profit, without changing from one owner to another, or without further circulation.

Such capitals can be called fixed capitals. ... That part of the farmer's capital that is spent on agricultural implements represents fixed capital, and that part that is used for wages and maintenance of his workers will be circulating capital.

He makes a profit from the first by keeping it in his possession, and from the second by parting with it. ...In all countries where there is a fairly stable order, every person with common sense tries to use the reserves at his disposal in order to obtain satisfaction of his needs in the present or profit in the future.

Questions and tasks for the document 1) What types of income does the text of the document introduce to citizens?

2) The author offers capital owners ways to generate income or profit.

Name these methods. 3) What part of income is capital? 4) The scientist believed that “stable order” is a necessary condition for every person “with common sense” to extract income from existing savings. Is it possible to agree with him? Describe the conditions in the modern Russian economy that stimulate or hinder the ability of consumers and producers to earn income from their capital.

5) How to maintain and increase your income? Formulate your proposals.

Responsibility for paying wages below the minimum wage

The legal minimum is required to be observed by firms of different fields of activity and scale. Evasion from the requirements prescribed by legal acts of the Russian Federation entails administrative liability.

In 2020, the amount of penalties for violators is set at the following levels:

- up to 50 thousand rubles. – for the organization;

- up to 5 thousand rubles – for the company management;

- up to 5 thousand rubles – for a private entrepreneur.

If the first punishment does not have the desired effect, and the violator continues to pay staff salaries below the required level, the fines will increase. The inspection inspectors will decide how much. For example, a legal entity will be required to pay 70 thousand rubles to the budget instead of 50 thousand.

If an organization does not comply with the minimum threshold, it becomes the object of increased interest from tax authorities. She is suspected of paying “grey” salaries and evading the transfer of personal income tax and insurance contributions. To “re-educate” unscrupulous employers, special commissions are created from representatives of regulatory authorities.

Among the numerous abbreviations that appear in news feeds and media publications, as well as on television screens, the minimum wage deserves special attention. When changes occur, this applies to the majority of citizens - both working and receiving various social benefits. Therefore, it is important to understand what is hidden behind this abbreviation, what its meaning is and where the corresponding indicator is used. This is exactly what will be discussed next.

We will tell you how the minimum wage is deciphered, why this indicator is required, who sets it and in what amounts.

What is the minimum wage - explanation

The abbreviation “minimum wage” has the following meaning: “minimum wage”. In other words, minimum wage. This is an indicator established by law, below which the salary of no employee in the country as a whole or in a separate subject of the federation should not fall.

One of the indicators that influences the well-being of citizens is denoted by the abbreviation minimum wage

Important: legal issues related to the minimum wage are regulated in Law No. 82-FZ of June 19, 2000 “On the Minimum Wage”, as well as in the Labor Code.

Based on the content of the legislation, the minimum wage is the following payments:

- The salary or other type of remuneration that an employee receives for his or her work based on qualifications.

- Compensatory payments, including additional payments up to the minimum wage for those who receive a lower salary.

Note: along with the minimum wage, an important indicator of the level of wages is the average wage in Russia. Surely everyone will be interested to know how this indicator should be calculated, as well as to compare the level of well-being of domestic working citizens with the average salary in America.

Code of Administrative Offenses

An example of a refusal to use the minimum wage as a “non-core” indicator is the norms of the Code of Administrative Offenses. Previously, the Code of Administrative Offenses used exclusively the minimum wage to calculate administrative fines. This approach was consistent with the economic situation that previously existed in the country. In the current version of the Code there is no mention of the minimum wage.

In 2007, the legislator decided to abandon the use of the “minimum wage” as a criterion for calculating fines and other amounts not related to earnings. As a result, adjustments were made to the Administrative Code, according to which the amount of the administrative sanction was established according to general rules in the form of a fixed amount expressed in rubles.

For example, previously, Article 15.5 of the Code provided for a fine of 3-5 minimum wages for violating the deadlines for submitting declarations determined by law. According to current regulations, the amount of recovery is 300-500 rubles.

Other regulations regulating economic activities have undergone similar adjustments.

It should also be noted that, according to the current tax legislation, the minimum wage is not applied in the calculation of fees, taxes, fines, and penalties.

Thus, the key purpose of the minimum wage is to regulate wages and determine the minimum amounts for compulsory insurance.

Why is the minimum wage necessary?

The minimum wage is the minimum state standard, a guarantee of the protection of working citizens from violations by employers. In accordance with the wording contained in the law, it is used to regulate wages. In other words, the state sets a minimum amount, less than which it cannot pay its employees who have fulfilled the monthly quota for their position. Otherwise, the employer will be held administratively liable. Moreover, this applies to all (without exception!) organizations of various forms of ownership, that is, both public and private.

But the minimum wage is used not only to determine wages. Based on this, some benefits are calculated:

- For pregnancy and childbirth.

- In case of temporary disability (sick leave).

The so-called “maternity benefits” are determined taking into account the minimum wage, if the length of service is less than six months, the average salary was below the minimum and in the case where the recipient of assistance has not worked for the last two years. Child care benefits until the child reaches 1.5 years of age must be set at an amount not lower than the minimum wage.

Unemployment benefits are based on the minimum wage if the unemployed person has dependents (children under 18 years of age or persons with limited legal capacity). For each of these dependents, the benefit increases by half the minimum wage. In addition, the maximum unemployment benefit is set at 1.5 times the minimum wage.

Note: find out what Putin's monthly salary is.

The indicator under consideration can be used to determine a number of other payments in the field of social insurance. The law prohibits the use of minimum wages for other purposes.

Minimum wage (minimum wage) - who sets it and what is included

The exceptions are:

- Kemerovo region - 14465 rub. for commercial enterprises.

- Kaliningrad region - 11,500 rubles;

- Volgograd region, where for non-budgetary enterprises the minimum wage has been increased to 11,600 rubles;

Employers from the Far North pay the minimum wage, taking into account the regional coefficients established for such areas. This is stated in such subjects as the Tyumen region, Yugra district and Yamalo-Nenets Autonomous Okrug. The most reliable information about the size and changes in the minimum wage in the regions can be obtained from the information regularly updated in the Consultant Plus ATP.

The law establishes that an employee who has worked a full month and fulfilled the labor standards in force in the organization at that time cannot receive for his work an amount less than the minimum wage. Moreover, each of the components of his earnings may be below this value.

Who sets the minimum wage?

The minimum wage in the country is established by the State Duma based on the proposal of the Government and is enshrined in the relevant legislative act. The current indicator is fixed in Law No. 82-FZ of June 19, 2000, as amended on March 7, 2020.

Starting from January 1, 2020, the procedure for determining the minimum wage will change. It will be established from January of each year in an amount equal to the cost of living for those citizens who are able to work for the 2nd quarter of the previous year. For example, from January 2020, the minimum wage in the country will correspond to the subsistence level for workers in April-June 2020.

Addition: find out the list of the most popular and highly paid professions in Russia.

The Labor Code provides for the ability to set their own minimum wages in the regions. These indicators apply to enterprises and institutions of the corresponding subject of the federation, except for those that receive funds from the federal budget. The regional minimum wage is set based on local economic indicators on the basis of an agreement between the government of a constituent entity of the Russian Federation, a public formation that unites business representatives, as well as an association of trade unions at the appropriate level and cannot be lower than the total for the country.

Note: look at the list of interesting professions for girls.

The agreement on determining the regional minimum wage is concluded for 3 years. The minimum wage, as a rule, does not include payments related to work in special climatic conditions, for example in the Far North (the so-called northern allowances and regional coefficients). Methods for calculating the minimum wage vary in different regions. If local authorities do not decide to determine such an indicator, the all-Russian minimum wage applies.

Why does the government set a minimum wage?

A mitigating circumstance was the record low level of inflation in the country. The minimum wage according to Russian legislation is established both at the level of the entire country and for each region.

Moreover, the regional minimum wage cannot be less than the federal one. The all-Russian level is proposed by the government of the Russian Federation, adopted in the form of a law by the State Duma, approved by the Federation Council and signed by the president. The regional size of the minimum wage is established by an agreement concluded for 3 years between the government of the region, territory or republic, the regional association of trade unions and the regional association of industrialists and entrepreneurs.

The minimum wage is regulated by several legal acts. 1Federal Law “On the Minimum Wage” (No. 82-FZ of June 19, 2000). A fairly outdated document, the main value of which is the definition