The purpose of the federal law on the minimum wage

Federal Law-82 “On the Minimum Wage” was adopted in 2000 and has some distinctive features from previous legislative acts that regulated the assignment and use of the minimum wage. This law has been in effect for quite a long time, and previously, with each increase in the minimum wage, a new legal act was adopted.

In Federal Law-82, for the first time, two concepts were separated: basic and conditional minimum wage. The basic minimum wage is used for the purpose of setting wages and minimum social payments.

The law also provides the concept of a conditional minimum wage, which is used as a value when assigning fines. Since 2001, the standard minimum wage has been set at 100 rubles. But after amendments were made to the Administrative Code in 2007, fines began to be calculated not based on the minimum wage, but in a fixed amount (all of them are indicated in the code).

Changes are regularly made to Federal Law 82, in particular, the minimum wage is revised. The latest changes to Federal Law-82 are dated December 2020.

The establishment of a minimum wage fulfills 2 tasks: it regulates labor and social relations, and also increases the country’s prestige in the foreign policy arena.

Login for clients

Federal Law of December 27, 2019 No. 463-FZ in Art. 1 of the Federal Law of June 19, 2000 No. 82-FZ “On the minimum wage”, amendments have been made, according to which the minimum wage from January 1, 2020 is 12,130 rubles. per month.

Let us remind you that, by virtue of Art. 133 of the Labor Code of the Russian Federation, the minimum wage is established simultaneously throughout the entire territory of the Russian Federation by federal law and cannot be lower than the subsistence level of the working population. The monthly salary of an employee who has fully worked the standard working hours during this period and fulfilled the labor standards (job duties) cannot be lower than the minimum wage. Thus, when determining the minimum wage from January 1, 2020, the minimum wage established by federal law must be observed.

Let's consider which payments, according to Law 463-FZ, are included in the minimum wage, and which are not included in it.

In accordance with Art. 129 of the Labor Code of the Russian Federation, wages (employee remuneration) has three components:

- remuneration for labor depending on the qualifications of the employee, complexity, quantity, quality and conditions of the work performed by him;

- compensation payments (additional payments and allowances for work in conditions deviating from normal, work in special climatic conditions, etc.);

- incentive payments (additional payments and bonuses of an incentive nature, bonuses and other incentive payments).

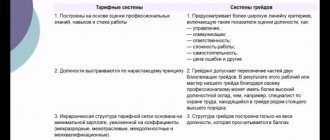

Remuneration for labor means a fixed amount of payment, which can be in the form of:

- tariff rate - a fixed amount of payment for fulfilling a standard of work of a certain complexity (qualification) per unit of time, excluding compensation, incentives and social payments;

- salary (official salary) - a fixed amount of payment for the performance of labor (official) duties of a certain complexity for a calendar month without taking into account compensation, incentives and social payments;

- base salary (basic official salary), base salary rate - minimum salary (official salary), salary rate of an employee of a state or municipal institution carrying out professional activities in the profession of a worker or position of an employee included in the corresponding professional qualification group, excluding compensation, incentives and social payments.

Thus, the salary (tariff rate) is the part of the salary that is included in the minimum wage. Labor legislation allows the establishment of salaries (tariff rates) as components of workers' wages in an amount less than the minimum wage, provided that wages, including incentive and compensation payments, which, within the meaning of Art. 129 of the Labor Code of the Russian Federation are elements of a salary not lower than the minimum wage from January 1, 2020 in accordance with Law 463-FZ.

Incentive payments are part of the salary. There are no special questions about which of them are included in the salary compared with the minimum wage. They can be bonuses based on the results of the organization’s work, bonuses for the quality of work performed, for the intensity and high results of work. At the same time, it is necessary to take into account that, according to the position of the RF Armed Forces, set out in Determination No. 310-KG17-19622 dated December 27, 2017, bonuses for holidays and anniversaries are not taken into account in salaries. As the Supreme Court noted, such payments are not stimulating, but social in nature, are not an element of remuneration, and are not determined by the qualifications of workers, complexity, quality, quantity and conditions of work.

Regarding compensation payments (surcharges and allowances), the following must be taken into account. Their goal is to compensate for the impact of unfavorable factors on the employee. The inclusion of these payments in wages is due to the presence of factors (production, climatic, etc.) that characterize the employee’s work activity.

The table below shows additional payments that are included in the employee’s salary, but are not subject to inclusion in the minimum wage, according to the explanations of the Constitutional Court.

Law 463-FZ.

| Pay | Minimum wage (RUB 12,130) |

| Regional coefficient | When comparing wages with the minimum wage, the salary amount does not take into account regional coefficients and percentage bonuses for work in the regions of the Far North and equivalent areas (see resolutions of the Presidium of the Armed Forces of the Russian Federation dated 02/07/2018 No. 4ПВ17, Constitutional Court of the Russian Federation dated 12/07/2017 No. 38‑ P) |

| Percentage surcharge | |

| Additional payment for combining professions (positions) | As indicated by the Constitutional Court of the Russian Federation in Resolution No. 40-P dated December 16, 2019, additional work in the order of combining professions (positions) is paid separately: the amount of additional payment is established by agreement of the parties to the employment contract, taking into account the content and (or) volume of additional work (Article 151 of the Labor Code RF). It is not included in the salary (part of the salary) of the employee, not exceeding the minimum wage |

| Extra pay for overtime work | As noted by the Constitutional Court of the Russian Federation in Resolution No. 17-P dated April 11, 2019, payments related to overtime work, night work, weekends and non-working holidays, unlike compensation payments of a different nature, cannot be included in regularly received monthly wages payment, which is calculated taking into account constantly operating factors of labor organization, production environment, unfavorable climatic conditions, etc. |

| Extra pay for night work | |

| Additional pay for working on weekends and holidays |

In conclusion, we note that when setting wages for 2020 (463-FZ), budgetary institutions should be guided by the Unified Recommendations for the establishment at the federal, regional and local levels of remuneration systems for employees of state and municipal institutions for 2020, approved by the Decision of the Russian Tripartite Commission on regulation of social and labor relations dated December 24, 2019 (protocol No. 11). The recommendations for 2020 contain information on the size of the minimum wage from January 1, 2020 (463-FZ), and contain instructions on the development of remuneration systems for employees of state veterinary institutions, as well as education, health care, culture and sports.

Budgetary organizations: acts and comments for accountants, No. 2, 2020

Establishment of the minimum wage

As of January 2020, the minimum wage is set at 11,280 rubles monthly. Since January 2020, the procedure for establishing the minimum wage has changed: if previously its value was determined by decision of the federal authorities and formalized in the form of a federal law, now the minimum wage is tied to the cost of living for the working population in Russia as a whole as of the 2nd quarter of the previous year. Thus, the process of gradually equalizing the minimum wage with the subsistence level has found its legislative completion.

Thus, in 2020, the minimum wage was already at the level of 85% of the subsistence level and amounted to 9,489 rubles . Now it is equal to the value indicated above.

It is worth noting that if the cost of living in the country is revised downward, it will remain at the level of last year.

According to the current ILO Convention “On the Establishment of Minimum Wages..” of 1970 No. 131, the minimum wage is set taking into account the economic development of the country.

On such a vast territory as the Russian Federation, different regions of the country have different rates of development. Therefore, the Labor Code stipulates the possibility of establishing in the regions their own minimum wage level, which exceeds the federal one (under Article 133.1 of the Labor Code).

The regional minimum wage is established by concluding an agreement between government authorities, trade union organizations and employers . It must be published in the media. Within 30 days, the employing company may send an official reasoned refusal to apply the regional minimum wage. If she does not do this, then she is obliged to apply the regional minimum wage in her work.

According to the explanatory letter of Rostrud No. 2705-TZ of 2014, the regional minimum wage indicator is also called the minimum wage, but regional.

Problems of applying the minimum wage

According to estimates by deputies of the State Duma of the Russian Federation from United Russia, in order to bring the minimum wage indicators to the official subsistence level, it will be necessary to allocate at least 33 billion rubles from the state budget annually, which will be too expensive for the state. Some of the large employer enterprises sent their objections to the State Duma, having learned that they were discussing the possibility of increasing the minimum wage to the subsistence level. According to the director of VCUZH, Vyacheslav Bobkov, lowering the minimum wage in Russia is a conscious government policy associated with slowing down wage growth[20].

And according to an FNPR member, living on the minimum wage (summer 2020) can be extremely difficult. After a month-long experiment, in the absence of payment for heating in an apartment (Arkhangelsk), the author lost 5 kg [21]. A similar result was obtained in the Far East.[22].

The minimum wage in Russia is one of the lowest in the world. This is due to the fact that in Russia the minimum wage is legally equal to the subsistence level, and not to a percentage of the average salary in the country, as in most countries of the world. If, according to official statistics, the average salary in Russia for 2020 is 39,335 rubles, then the minimum wage should be at least 40% - 50% of the average salary, or even 60%, as in France, Slovenia and Portugal, that is, 15,742 - 19,667.5 rubles, at the level of the city of Moscow (18,742 rubles) or even higher.[23][24][25] From 2020, it will be 9,489 rubles per month or about 161, (137) which is lower than in most Latin American countries[26][27][28][29][30][31][32] and lower than some African countries Sub-Saharan Africa, such as Gabon (270)[33][34] and Equatorial Guinea (224),[35][36][37][38][39][40][41][42] not to mention about the Arab countries of northern Africa Libya ($325)[43][44][45] and Morocco (from 265 to 310).[46][47][48] A bill from the A Just Russia faction was proposed to establish an hourly minimum wage of 100 rubles. per hour and, in addition, fix increasing coefficients according to territorial, sectoral and professional principles. Thus, with a 40-hour work week and payment of 100 rubles. per hour, an employee could count on approximately 16,000 rubles. per month - this is significantly more than the minimum wage established today (9,489 rubles). However, the initiative did not find support among other parliamentary factions, and the bill did not pass the first reading.[49]

In 2002, Academician of the Russian Academy of Sciences R.I. Nigmatulin wrote:

The minimum wage, according to UN standards, should be at least 3 dollars per hour (in the USA 5.5 dollars), which, in terms of purchasing power, provides payment for 10 thousand kilowatt-hours of electricity or 600 kilograms of bread per month. And in accordance with our prices (60 kopecks per kilowatt-hour and 10 rubles per kilogram of bread), the minimum wage should be 6 thousand rubles per month, not 600.

— Izvestia, 11/16/2002

Application of the minimum wage in regulating wages

In Art. 3 Federal Law-82 shows the areas of possible application of such an indicator as the minimum wage:

- wage regulation;

- determining the amount of temporary disability benefits;

- when calculating maternity benefits;

- for other social insurance purposes.

It is emphasized here that the use of minimum wages in other areas is prohibited.

Thus, today FZ-82 mainly regulates the assignment of social insurance benefits.

But workers who are employed under an employment contract are also not entitled to pay less than the minimum wage. This rule applies if the employee works full-time and has worked for the full period (month) and does not apply to part-time workers. This right of workers to receive payment in an amount not less than the minimum wage is stated in Art. 133 of the Labor Code.

If the accrued salary is less than the minimum wage, the employer can use several options to increase it:

- Establish an additional payment up to the minimum wage through the issuance of an order . This method is appropriate if the employee’s salary is not fixed and varies regularly.

- Raise workers' salaries to the minimum wage level . In this case, you need to take into account that the employee’s salary or tariff rate may be less than the minimum wage, and additional payments in this situation will not be required. The main thing is that the salary accrued to him with bonuses does not fall below the specified limit.

In any case, the employer does not have the right to pay his employees a salary of less than the minimum wage, otherwise he faces prosecution. For such a violation of the requirements of labor legislation, the employer faces administrative liability under Parts 6 and 7 of Art. 5.27 Code of Administrative Offenses or criminal liability under Parts 2, 3 of Art. 145.1 CC.

If an employee is a part-time employee or works part-time, then at the end of the billing period his salary may be less than the minimum wage. The minimum wage is calculated depending on the amount of time worked in relation to the established norm for a full working day. For example, an employee works at 0.5 rate. The minimum salary for him, taking into account the minimum wage in force in 2020, is 5,640 rubles. (11280 * 0.5). If his salary is lower, then he needs to be paid extra.

When the minimum wage can be lower than the minimum wage

The law on the minimum wage in the Russian Federation specifies some grounds according to which an employee can be paid an income below the subsistence level:

- An employee under an employment contract works part-time.

- The employee works part-time.

- The employee did not fulfill the standard working time, for example, due to absenteeism.

- Labor standards were not met or defective goods appeared during production.

- The employee has been declared temporarily disabled.

- Production is idle through no fault of the company's owners.

- The employee took leave at his own expense.

If, even if all conditions are met, the salary is still below the minimum wage, the employer will have to issue additional payments in order to bring the salary to the minimum level. In order not to add additional monthly payments, management can increase the salary and make changes to the contract with the employee.

Payment of social and other payments

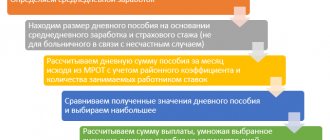

According to Art. 3 Federal Law-82, the minimum wage is used to calculate payments due to incapacity for work (on sick leave) and when calculating maternity benefits in connection with maternity. In all of these cases, the federal and not the regional minimum wage is used.

When calculating the amount of compensation for an employee on sick leave, you need to take into account the rules specified in Art. 7 FZ-255. These payments when an employee is injured or sick are paid in the form of a certain percentage of average earnings (from 60 to 100%), depending on length of service.

But if the employee’s work experience has not reached six months, then when calculating the amount of benefits, it is taken into account that it does not exceed the minimum wage for the current month. If in the area where the employee works there are regional coefficients, then the amount of the benefit cannot exceed the minimum wage, taking into account these coefficients under clause 6 of Art. 7 FZ-255.

Also, according to 255-FZ, the amount of disability benefits is determined according to the minimum wage, if the calculated amount of the benefit was less than the specified amount, or the citizen did not carry out labor activities during the billing period.

Based on Art. 8 FZ-255 establishes a temporary disability benefit in an amount that does not exceed the minimum wage for a calendar month in cases where the recipient of the benefit:

- prescribed for him by the doctor while on sick leave

- Failure to appear on time for a medical examination or examination without a valid reason.

- Injured while intoxicated after consuming alcohol , drugs or toxic substances.

A frequent area of application of the minimum wage is the calculation of maternity payments. They are calculated taking into account Federal Law-255 and Government Decree No. 375.

According to current legislation, if a woman who goes on maternity leave did not work in the previous two years, or her average salary turned out to be less than the minimum wage, then when determining the amount of maternity benefits, the value of the minimum wage under Part 1.1 of Art. 14 FZ-255.

Based on the minimum wage, benefits are calculated for women whose total insurance coverage has not exceeded six months. At the same time, living in areas where regional coefficients apply gives a woman grounds for increasing the amount of the monthly benefit by the corresponding coefficient under Part 3 of Art. 11 255-FZ.

In order to calculate the amount of maternity leave based on the minimum wage, you must first determine the minimum average daily earnings . It is calculated as the minimum wage * 24 / 730 (or 731 days - if one of the days was a leap day).

Taking into account the minimum wage of 11,280 rubles. Average daily earnings are calculated as follows: 11,280 * 24 / 730 = 370.85 rubles. Based on this and taking into account the standard duration of vacation of 140 days, the minimum amount of maternity leave according to the minimum wage in 2020 will be 370.85 * 140 = 51,918.9 rubles.

If there is a coefficient in the region, then the resulting average daily earnings according to the minimum wage are first multiplied by it, and then by the number of days . For example, the coefficient was 1.3. Average earnings will then reach 482.1 rubles. (370.85 * 1.3). And maternity leave – 67,494.7 rubles. (482.1 rubles * 140 days).

In case of multiple pregnancy or complicated childbirth, the number of days of maternity leave is greater, so it is paid at an increased rate (for 84 or 110 days, respectively).

Entrepreneurs and lawyers who voluntarily insure themselves with the Social Insurance Fund, when going on maternity leave, receive maternity payments from the fund, calculated according to the minimum wage. But in their case, the billing period is calculated slightly differently, and the minimum value of daily earnings is less (11,280 / 31 = 363.87 rubles). Consequently, the amount of maternity leave for them is slightly lower - 363.87 * 140 = 50,941.8 rubles.

Previously, the minimum wage was also used to determine the amount of insurance premiums for entrepreneurs for themselves. But with the adoption of changes to the Tax Code, the concept of “insurance contributions” for individual entrepreneurs was eliminated, and now it is replaced by a fixed payment. Its size is prescribed in the Tax Code and determined by the federal authorities, i.e. it is untied from the minimum wage.

It is still important in determining the cost of an insurance year for entrepreneurs who decide to voluntarily insure themselves with the Social Insurance Fund so that they have the right to receive sick leave payments and compensation for maternity benefits.

The procedure for correctly increasing wages to the new minimum wage in the regions

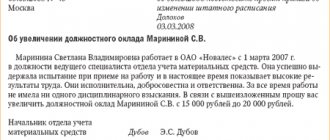

In accordance with the minimum wage law, from January 1, 2020, if payment for work activity is less than the approved minimum value, then the employer is obliged to carry out an increase procedure. The regulatory provisions establish two options for these activities, one of which the enterprise’s accounting department can use when making payments to personnel.

Method No. 1: increasing the salary

Raising your salary, although simple at first glance, is not the most convenient way. This is due to the fact that at the state level it is planned to increase the minimum wage every year. Accordingly, management and the accounting department will have to issue a decree on increasing wages every reporting period. In addition, you will need to replace contracts, schedules and other papers where the salary rate appears.

Method No. 2: additional payment to wages

This approach requires the accounting department to create a local document, for example, a separate order or an additional agreement to the employment contract. It is noteworthy that the comparison of the minimum wage is carried out not with the salary part, but with total payments.

Carrying out the event is simpler both in theory and in practice, since there is no need to make changes to contracts and other related documents every time the minimum rate changes. That is, it is enough to establish an additional payment once, for example, in a local act on the provisions of labor activity.