When the Federal Law “On Amendments to Increasing the Minimum Wage to the Living Wage” was adopted at the end of 2020, the smallest payment of 9 thousand 489 rubles is designated from 01/01/2018.

But, from 01/01/2019 and other years, the lowest payment for work will correspond to the size of the monthly salary of residents who are able to work in the Russian Federation in general for the 2nd quarter of last year.

In other words, they are introducing a mechanism to bring the minimum wage to the subsistence level of the country’s residents who are able to work.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

+7 (499) 110-43-85 (Moscow)

+7 (812) 317-60-09 (Saint Petersburg)

8 (800) 222-69-48 (Regions)

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

By Decree of the Government Bodies of the Russian Federation dated September 19, 2020 No. 1119, the size of the monthly minimum wage for the working population is fixed at 11 thousand 163 rubles. and the minimum wage in a similar amount must be established from 01/01/2019. Over the past 7 years, this value has increased one and a half times throughout the state.

Changes every year in the minimum wage in Bashkortostan in 2020 are associated with rising prices, as well as the need to equalize it with the cost of living, which is currently higher. Based on the minimum wage for labor, a wage fund is created, benefits and other social security payments are assigned.

general information

The level of minimum wage for labor is determined by law. At the state level, calculations of this value are carried out for employees of budgetary institutions. Below the resulting number, the minimum wage in the region cannot be assigned to those working in non-budgetary organizations and private firms. The plank in the subject will be governed by a tripartite agreement.

It will involve:

- regional administrations of the Russian Federation;

- trade union organizations;

- Union of Entrepreneurs.

After signing the agreement on the new minimum wage level, it will be published through the media in the region. This is required so that each manager knows how the minimum wage is changing, and increases the salary by receiving less.

From May 1, 2018, the minimum wage in the Russian Federation increases to 11 thousand 163 rubles.

The manager can calculate wages less than this amount only in certain situations:

- not worked for the whole month;

- labor standards are not met;

- The employee works part-time on a part-time basis.

No one can prohibit transferring wages in excess of the minimum wage:

- the director can set the salary in any amount, the most important thing is that it should not be less than the minimum amount;

- The minimum wage is increased by the regional coefficient and allowances in the North in those regional associations of Russia where such allowances are established;

- In most regions, local authorities set the regional minimum wage higher than the federal level.

This particular amount of bonuses must be higher than the minimum wage established in the subject. When working for a salary without increasing bonuses, it must be made higher after the start of the contract. The law provides for a number of options if an employee earns less than the regional minimum wage.

The lowest amount of payment for work in the region is not designated arbitrarily. This is the result of agreements between local authorities, representatives of trade union organizations and management communities. Because of this, the minimum wage in the subject is fixed by a tripartite agreement.

When identifying the minimum wage in the Russian region, the following rules will be taken into account:

- the value of the “minimum wage” must take into account the special characteristics in the economy, social sphere and climate of the subject;

- in the region it is designated by taking into account the district coefficient and northern allowances, which operate in certain regional associations of Russia;

- it cannot be lower than the federal one (the largest of several smallest payments will be taken into account).

To date, the minimum wage has been increased 2 times: from January 1 and from May 1. In certain regions, new trilateral agreements are not being signed in time. At the moment, the minimum wage at the federal level is in force in the represented regions of the Russian Federation.

Also, if the cost of living in the Republic has increased, then it is worth raising the minimum wage. This is concluded by a commission where a mutual decision is made. The commission includes associations of employers and trade union institutions of the subject.

In addition, the commission includes representatives of the Ministry of Agricultural Organizations, Labor, Health, Finance, Education, Housing and Public Utilities, Industry, Economic Development and many others.

The procedure for determining the living wage

The establishment of this indicator is regulated by federal law FZ-134 of October 24, 1997, which is called accordingly. There is also a separate law of the Republic of Karelia No. 73-ZRK dated August 16, 1995, but its provisions essentially repeat the norms of the federal law.

What you need to know about the formation of PM in accordance with Federal Law-134:

- There are several types of indicators, the main one is for the working population. However, for the sphere of regulation of social legal relations, indicators per child and per pensioner are of great importance. In addition, a certain average value of the subsistence minimum per capita is established;

- these indicators are determined once a quarter: for the Russian Federation as a whole and separately in each subject of the Russian Federation;

- The PM for the Russian Federation is determined by a decree of the Government of the Russian Federation, for a subject of the Russian Federation - by a decree of the regional government. These documents must be printed in the official publication and posted in the information space on the official websites of the Government;

- the living wage of a pensioner is established separately: once a year, by the Government of the Russian Federation as a whole for the Russian Federation and by the law of the subject of the Russian Federation for the region;

- the basis for calculating the indicator is the consumer basket (a list of necessary products approved by law) and average prices for goods established by official statistics.

The principle of operation of the PM is that the latest one adopted by government authorities is applied, since the generation of statistical data takes time.

Living wage in St. Petersburg in 2020 for pensioners, workers and children

When minimum wage doesn't matter

The minimum wage is the lowest threshold below which the salary cannot be. Most people who earn less than this amount per month for their own work believe that the laws do not apply.

However, the situation is such that the manager decides; he is able to pay less per month when the employee is not employed full-time. When a citizen receives less than the minimum wage, it is necessary to pay attention to the following points: affiliation with the organization and working conditions.

In the Republic of Bashkortostan there are several levels of minimum wage for workers in the budgetary region and for employees of private organizations. They differ significantly from each other, since changes are rarely made among state employees.

In the clause of the working conditions and in the contract there is a note about the rate. When an employee is hired on a part-time basis or has a short working day, the salary may be less than the minimum wage. In such a situation, payment for work largely depends on the manager.

Another situation is when the organization does not join the implementation of the regional agreement on the minimum wage. The manager has the right to refuse to execute a tripartite agreement when he has good reasons for this, based on Article 133.1 of the Labor Code of the Russian Federation.

In the presented situation, he needs to send a letter to the administration within a month. Very few such situations are recorded in Bashkortostan. On the contrary, businessmen are trying to increase wages in advance.

Article 133.1 of the Labor Code of the Russian Federation. Establishment of the minimum wage in a constituent entity of the Russian Federation

How is the minimum wage calculated in Bashkiria?

In addition to financial remuneration for work performed, the minimum wage takes part in the calculation of a number of social subsidies:

- payments in connection with pregnancy;

- sick leave;

- means for caring for a child under 1.5 years old.

The latest news reports that the Ministry of Finance intends to equalize the rights of employees who have foreign registration with local subordinates. From 2020, it is expected that this category of workers will also begin to pay 13% of profits to the tax authorities.

Change table

The minimum wage will constantly increase to be the same as the cost of living at the federal level. It is this kind of salary that all public sector employees can count on, including teachers, doctors and administration officials.

Often, low-skilled employees, graduates of educational institutions on probation and other personnel receive the minimum salary. Although in certain budget organizations, by decision of the manager, minimum wages can be established for the majority of employees.

The table of changes in the minimum wage for labor in the Republic of Bashkortostan is presented below:

| date | Value, rub. | Normative act |

| From 05/01/2018 | 11 thousand 163 rubles, when including allowances in the subject (the basic indicator, for all, when taking into account the allowance is 12 thousand 837 rubles 45 kopecks). | Article 1 of the Law of June 19, 2000 No. 82-FZ on the minimum wage. |

| From 01/01/2018 | 9 thousand 489 rubles, when including allowances in the subject (the basic indicator, for all, when taking into account the allowance is 10 thousand 913 rubles) | Article 1 of the Law of June 19, 2000 No. 82-FZ on the minimum wage. Agreement between the Government bodies of the Republic of Bashkortostan, the Federation of Trade Union Organizations dated April 20, 2016 “On the minimum wage in the Republic of Bashkortostan.” |

| From 07/01/2017 | 8 thousand 900 rub. for non-budgetary organizations. 7 thousand 800 rub. for budgetary enterprises. | Article 1 of the Law of June 19, 2000 No. 82-FZ on the minimum wage. |

| From 07/01/2016 | 8 thousand 900 rub. for non-budgetary organizations. 7 thousand 500 rub. for budgetary enterprises. | Article 1 of the Law of June 19, 2000 No. 82-FZ on the minimum wage. |

| From 05/01/2016 | 8 thousand 900 rub. for off-budget enterprises. 6 thousand 204 rubles. for budgetary institutions. | Agreement on the minimum wage in the Republic of Bashkortostan dated April 20, 2020. |

| From 01/01/2016 | 6 thousand 900 rub. for non-budgetary organizations. 6 thousand 204 rub. for budgetary enterprises. | Article 1 of the Law of June 19, 2000 No. 82-FZ on the minimum wage. |

| From 01/01/2015 | 6 thousand 900 rub. for off-budget enterprises. 5 thousand 965 rub. for budgetary institutions. | Article 1 of the Law of June 19, 2000 No. 82-FZ on the minimum wage. |

| From 10/01/2014 | 6 thousand 900 rub. for non-budgetary organizations. 5 thousand 554 rub. for budgetary institutions. | Agreement on the minimum wage in the Republic of Bashkortostan dated September 1, 2014. |

| From 01/01/2014 | 5 thousand 554 rub. basic indicator for everyone. | Article 1 of the Law of June 19, 2000 No. 82-FZ on the minimum wage. |

During the period of signing the agreement for extra-budgetary companies, the regional value exceeded the federal level by only 696 rubles. This is an insignificant gap; it does not correspond to the current situation in the market sphere, since this period coincides with crises in the economy.

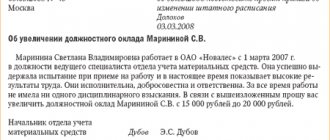

Increase from May 1

On May 1, 2018, the lowest wage will be equal to the subsistence minimum for the 2nd quarter of 2020. As a result, the minimum wage at the federal level will increase from 9 thousand 489 rubles. up to 11 thousand 163 rub. This means that directors will need to increase salaries to employees by 1 thousand 674 rubles.

As for the Republic of Bashkortostan, this will be the second increase in the minimum salary in a year. Since January 1, it has already increased. At the moment, the monthly salary cannot be less than 10 thousand 913 rubles, and from 05/01/2018 it will be equal, taking into account the Ural coefficient, 12 thousand 837 rubles.

Taking into account the Ural coefficient

Any subject must have its own minimum wage. It is designated by the regions of Russia by subject agreements on the minimum wage. The minimum wage in the region is usually higher than the federal level. However, it is not capable of being less, based on Article 133.1 of the Labor Code of the Russian Federation.

Enterprises must necessarily set a salary below the minimum wage in the subject when they join regional agreements.

Those directors who, within a month after the official publication of the agreement, have not sent a written refusal to join to the relevant body of the region of the Russian Federation, are considered to have acceded to the agreement in the region.

When the minimum salary is known from May 1, 2018, its value in different regions will be interesting for comparison. Thus, in Moscow it is equal to 18 thousand 742 rubles, and in the North-Evensky city o. Magadan region 21 thousand 060 rubles.

For workers with children

Consequently, the minimum wage for labor in Bashkiria is set at 12 thousand 837 rubles. 45 kopecks This does not mean that the employee has received this amount. The minimum wage is the minimum amount that a director can accrue to an employee. And then the accounting department will withhold personal income tax from the accrued salary.

Also from the cash register, the employee will receive wages, which are reduced by tax. Huge sums will be received by employees who have children under eighteen years of age. After all, such employees have the legal authority to take the usual child tax deduction. The more children a worker has, the higher the deduction amount.

Since the usual deductions for children are given differently in certain conditions, it is quite difficult to give examples. You can use a convenient service that shows what specific minimum payments employees with a child receive.

https://youtu.be/r561YfCokoE

Current PM indicators for Karelia

Thus, the PM is determined per person, but depending on his assignment to a certain category (in the law, this category is called a socio-demographic group). There are three such groups: children, pensioners and workers, which includes all able-bodied adults.

The current indicators in the republic were approved by Decree of the Government of Karelia No. 86-P dated March 16, 2020. Here are the indicators he established for socio-demographic groups:

- per worker – 14,495 rubles;

- for a pensioner – 11,179;

- per child (that is, a minor citizen) - 12,436.

Per capita PM is, in accordance with Decree of the Government of the Republic No. 86-P, 13,307 rubles.

These indicators were approved for the 4th quarter of 2020. They are currently being used, since the PM for the 1st quarter of 2020 has not yet been approved. It is expected in mid-May.

In addition, the resolution states that these are indicators for the republic as a whole. Indicators have also been approved for the northern part and the republic, with the exception of the northern part. The northern part includes the following areas:

- Loukhsky;

- Kemsky;

- Belomorsky;

- Kalevalsky;

- and the city of Kostomuksha.

| Type of indicator “living wage” | For the northern part in rubles | Across the republic, with the exception of the northern part in rubles |

| Per capita | 14 175 | 13 173 |

| For the working population | 15 373 | 14 360 |

| For children | 13 377 | 12 281 |

| For pensioners | 11 979 | 11 058 |