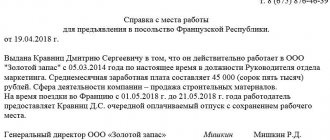

The introduction of quarantine throughout the Russian Federation significantly affected the usual way of life of Russians. In a number of regions, employees of continuously operating organizations and individual entrepreneurs who have not been transferred to remote mode and are forced to attend their workplace must have a special pass or certificate from their employer. This document confirms that the citizen goes to or returns from work without violating quarantine. A certificate of place of work, as well as income, may be needed in other cases (for applying for benefits, loans, visas, etc.). If a citizen works for an individual entrepreneur or is one himself, he will need a certificate of employment from the individual entrepreneur - we will tell you how to draw it up.

What is a certificate of employment from an individual entrepreneur?

A certificate of employment from an individual entrepreneur (a sample can be found below) is a document that certifies the fact that the person indicated in it actually works for an individual entrepreneur in the declared position, and, if necessary, indicates that he receives a certain salary . This certificate is of a confirmatory nature and should not be confused with the 2-NDFL certificate. The document must contain current and reliable information.

A certificate of employment is used not only during the quarantine period. In everyday life, it may be required when a citizen applies to various institutions and organizations:

- social protection authorities;

- banking and credit organizations;

- government agencies;

- law enforcement agencies;

- embassies of foreign countries, etc.

A certificate from the place of work (a sample will be given below) is requested:

- when receiving a loan from a bank to calculate the solvency of a potential client;

- for calculating social benefits when assigning child care payments;

- to assess a citizen’s solvency when applying for a visa, etc.

Internship with an individual entrepreneur, educational and production

Register Login. Mail replies. Questions: Marketplace leaders or advertising platform? Help me choose a name for a company that finishes wooden log houses 1 bid.

Regarding crowdfunding sites. Leaders of the Nikita Enlightened category. Prospero Artificial Intelligence. Dmitry Profi, closed 6 years ago Hello! I am an individual entrepreneur and have no experience working with employees. A friend asks to put a stamp in the intern's diary. There is no goal to earn money or make any contribution to the work; all you need is to do an internship at a university, and they ask for a seal. Does this need to be formalized somehow?

If yes, what actions are required on my part? Is it possible not to formalize it, but simply put a stamp and signature in the trainee’s diary? Thanks in advance for your answers! Best answer. Alexander Dzyubenko Enlightened 7 years ago There is no need to register anyone. This practice is a complete profanation. This is the order that has developed over many years. Everyone knows perfectly well that this is a fiction, but it is necessary for the student to have a stamp in his diary and in the review of an excellent internship.

But no one wants to take students for internships. This does not oblige you to anything. No one checks the authenticity, well, in the worst case, they will call and ask if such and such had an internship with you. And even that is very unlikely. Just put a stamp in the diary and on the review, which he will write to himself.

And any registration entails the payment of taxes and contributions to funds. Other answers. Marina Galkina Enlightened 7 years ago Check with the student whether he can do an internship with an individual entrepreneur.

This is prohibited at our university. If it is still possible, then your seal in the diary does not oblige you to accept it for work and formalize it. You can even draw up an order to accept such and such into practice, without payment, for such and such a period. Similar questions. They also ask.

Should individual entrepreneurs issue their employees with a certificate of employment?

If the individual entrepreneur is an employer and hires personnel, he has the right to issue his employees all the documents they need after receiving such a request from them. Of course, if we are talking about official employment with the conclusion of an employment contract and the payment of contributions to various extra-budgetary funds. If the entrepreneur has a personnel officer on staff, you can contact him to obtain a certificate of employment from an individual entrepreneur during quarantine and under other circumstances. If such a specialist is not available, the individual entrepreneur can independently draw up this certificate.

In accordance with the provisions of Art. 62 of the Labor Code of the Russian Federation, an individual entrepreneur must issue a certificate within 3 working days after receiving a corresponding written request from an employee. In accordance with the norms of current legislation, citizens of the Russian Federation have the right to obtain from their employer any information relating to their work activities.

Contents of the certificate and sample

Initially, you will need to enter the full name of the company. In addition, the address at which it is registered and actually located is indicated. This information can be found in the incorporation documentation. The company phone number is displayed at the top of the certificate. The following is indicated:

- the day when the authorized person formed the act;

- document's name;

- number assigned after registration of the certificate;

- information about the employee about whom information is indicated in the certificate (that is, his last name, initials, position and period of time while he works in the company);

- if the address is specified, then you can enter the details of the recipient of the act;

- signature of the head of the company.

Decryption of the signature is also considered a mandatory element.

The document form can be downloaded here:

A sample form is located here:

What information should be included in a certificate of employment from an individual entrepreneur?

The certificate does not have an approved form; in practice, it is compiled in a free format. To do this, it is recommended to use company letterhead. The validity period of the document depends on which institution it will be presented to. The content of the certificate is also determined by the requirements of the requesting organization, so the employee should clarify in advance what exactly should be displayed in this document.

The form for a certificate of employment from an individual entrepreneur must contain the following information:

- registration data of the individual entrepreneur who issued it;

- FULL NAME. and employee position;

- if required - the amount of wages for a certain period of time (usually indicate the amount of monthly wages or the amount of earnings received for 3-6 months);

- the duration of work for this entrepreneur (date of hiring);

- the phrase “works to date”;

- you can indicate the details of the order on the basis of which the employee was added to the staff;

- date of preparation of the certificate;

- place of presentation (you can specify “At the place of demand”);

- IP signature, seal (if available).

Sample free-form income certificate for 2020:

Practice with individual lawyer

Internship is a necessary element in the educational program of any educational institution:

- college;

- technical school;

- university;

- Institute.

The practice report allows you to assess the depth of knowledge acquired by the student in the chosen specialty and his interest in the profession. Completing an internship is a necessary element of consolidating the theoretical knowledge acquired at an educational institution. Moreover, the place of practice does not matter, because lawyers are needed everywhere, in any company:

- and in a limited liability company,

- and in a commercial company,

- in law enforcement agencies (in the Ministry of Internal Affairs, in the militia (police);

- and even in the Presidential Administration.

Lawyers and notaries need an assistant.

The trainee can independently determine where the internship will take place, or seek help from a supervisor who will help with the internship.

Let's look at the features of writing a practice report by law students - they have their own features related to the specifics of the work.

Lawyer practice report: writing features

The purpose of the practice is to learn to apply the knowledge acquired in an educational institution in practical activities, the ability to apply the law in emerging legal relations. To achieve the goal, it is necessary to solve the following tasks:

- study the activities of the enterprise, the organization of the work of the legal department, consider the features of state and municipal services;

- apply theoretical knowledge in the field of civil, labor, procedural law in practice;

- develop the qualities necessary to work as a legal adviser, learn to manage people using means of persuasion;

- take an active part in the activities of the legal department: draw up statements of claim and responses to them, participate in court hearings, appeal decisions, monitor the progress of execution;

- provide legal support for transactions;

- provide assistance in preparing legal documents.

The base of practice for a law student is determined taking into account the student's specialization. Students choose a place of practice also taking into account their prospects for employment in the profile of their chosen specialty.

But the future lawyer’s practice is always connected with the work of the legal department, legal service, or the independent work of a lawyer as a lawyer, notary

Internship allows you to acquire the necessary skills to work in a team and become familiar with the peculiarities of a lawyer’s work. The internship can be industrial (introductory) and pre-graduation.

Practice management at an enterprise can be carried out either directly by the head of the enterprise or by an employee to whom he entrusts this.

According to an unspoken rule, the trainee must carry out all instructions of the manager, maintain discipline, and avoid organizational conflicts

The employer has the right to establish a part-time working day for the trainee and a certain level of workload, and give his own instructions. But if a student misses even one day of practice, he must make up for it.

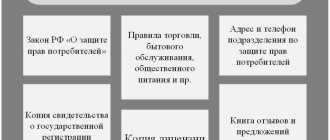

Every lawyer must:

- be able to appeal types of civil contracts

- know the features of contractual work, including concluding a contract for the provision of services for a fee, a purchase and sale agreement

- know the Constitution of the Russian Federation

- be able to apply in practice the provisions of the Civil Code of the Russian Federation (Civil Code of the Russian Federation), including distinguishing a legal entity from an individual, be guided by the norms of the Labor Code of the Russian Federation, Tax, Administrative Codes

- know the basics of civil and arbitration processes

- know the terms of application of the law “On Protection of Consumer Rights”

- be able to use electronic legal resources, such as “Consultant Plus”, “Garant”.

When writing a report, it is better to rely on textbooks, scientific literature, printed periodicals or their analogues on the Internet (Yurist magazine), but the year of publication should not be older than 5 years.

The results of the internship are documented in a report and diary, which is maintained by the trainee independently.

The total duration of the internship is determined by the educational institution, usually 4 weeks

.

In the introduction

the purpose of the passage and the tasks that need to be solved to achieve it are indicated, the object and subject of the study are determined.

In the main part

The report provides a brief description of the enterprise. The name and organizational and legal form (LLC, individual entrepreneur, preschool educational institution, State institution), last name, first name, patronymic of the head, what constituent document defines his powers are fully indicated. Necessary:

- reveal the structure of the organization,

- determine the conditions for ensuring the activities of the company,

- describe the functions of departments,

- give an analysis of the areas of work of the enterprise and its specifics, structure,

- indicate connections between departments.

It is advisable to indicate the date of creation and achievement. From a psychological point of view, a detailed study of the enterprise and everything connected with it can have a positive impact on the potential employer’s opinion of the trainee.

In the special part

The activities of the department in which the trainee directly worked are examined in order to identify problems on the topic discussed in the thesis in order to develop ways to solve them.

In custody

summarizes all the conclusions that the trainee made when writing the work, the experience gained, and also indicates shortcomings in the work of the legal department and suggests ways to solve them.

It is advisable to provide the internship report to the internship supervisor in advance.

Diary of a lawyer's practice

The diary is the document on the basis of which the student’s practical activities are assessed. The practical training diary, together with the report and characteristics, is the student’s admission to the exams.

Can an entrepreneur issue a certificate of employment to himself?

The individual entrepreneur’s certificate is issued to himself in the same manner. The document indicates information about the employer (the individual entrepreneur himself) and, if necessary, the amount of income received. Certification with a seal is not required; the entrepreneur’s signature with a decryption will be sufficient. If there is a seal, its imprint should be placed next to the signature. It should be noted that an individual entrepreneur can also confirm his employment and income level by presenting a state registration document (extract from the Unified State Register of Individual Entrepreneurs) and an income statement or bank statement.

A certificate from an individual entrepreneur to himself about his place of work may have the following structure:

- Full name is written at the top of the sheet. entrepreneur, tax identification number, address, contact phone number. For example: “Individual entrepreneur Kalinina Marina Nikolaevna, INN…, OGRNIP…, address…”.

- Next, indicate the date of issue of the certificate and the number assigned to it.

Why might such a document be needed?

The visa authority has certain requirements for people who want to obtain a visa. Income, citizenship, field of activity, country and purpose of the visit are taken into account. The legislation of the Russian Federation distinguishes several types of visa:

- One type is a one-time document. It can be issued only if a person needs a one-time trip. In the international passport this type is designated “01”.

- The second type is a multiple-entry visa. Such a document can be issued for a period of 30 to 90 days. This visa allows you to easily travel around different Schengen countries.

Visas are also divided depending on the length of stay abroad. The first type is a short-term document in which the maximum period is 90 days. A long-term visa allows you to stay outside your country for more than 90 days. Such documents are most often drawn up by people who are planning to go to work abroad.

In order to obtain a visa, an entrepreneur must contact a visa center. There a person will be able to obtain detailed information about what documents are required. The center’s specialists will also issue a questionnaire, which you will need to bring filled out along with the documents. You need to have with you:

- Two passports (civilian and foreign).

- Individual entrepreneurs need to make a copy of the registration of their activities.

- The financial side is also important. Therefore, you will have to provide a document confirming the movement of funds in the account for the last six months.

- Photo cards.

- Photocopy of ticket and confirmation of hotel reservation.

- Questionnaire.

Schengen documents for individual entrepreneurs are practically no different from those that an ordinary person must provide. But if in the second case it will be easy to obtain a certificate of income at your own enterprise, then a certificate for an individual entrepreneur for a visa from a place of work has its own characteristics.

Documents for individual entrepreneurs for visa

Work, study or go to a business meeting – it doesn’t matter why you need a visa. In any case, each document must be correctly executed. It is worth starting with a foreign passport, which must be intact, the validity period still allows you to travel to other countries and it is no more than 10 years old. It is also important to monitor the quality of the internal passport.

The employment certificate must meet the requirements of the organization in which the person works. This must be a form with the details and seal of the company. Each country has its own requirements regarding financial guarantees. Most often, it is enough to present an account statement. More details about this point can be found at the embassy.

A sample certificate for an individual entrepreneur for a Schengen visa can be found at the visa center. It is a mandatory document that is important to submit with the rest. It must contain all the information about the applicant and his field of activity. Visa center specialists will check that the certificate contains the following information:

- full name of the enterprise (in this case individual entrepreneur);

- job title;

- duration of work of the individual entrepreneur;

- salary data.

This form can be a handwritten statement or a document from the company. It is known that according to the legislation of the Russian Federation, individual entrepreneurs do not have a legally registered location. And such a document is proof of solvency. After all, people often hide behind entrepreneurial activity and go abroad to earn money.

Certificate for individual entrepreneurs for a visa from the place of work

Important! If an individual entrepreneur has a good and stable income, then the chance of obtaining a visa increases several times. It is also important to remember that such a certificate must be certified by a notary. This allows you to verify that the IP really exists.

Before you start applying for a visa, you should check with the embassy about the format of the documents. And it doesn’t matter at all whether it’s Italy, Spain or England. Each country may have its own special form. And in order not to redo documents several times, it is better to find out about it in advance.

How to write “individual entrepreneur” in a visa application? This is a very important question, because the application form is filled out in a foreign language and you can enter something incorrectly and end up getting rejected. Therefore, it is better to familiarize yourself in advance with the correct spelling of this parameter in different languages. The first thing every individual entrepreneur faces when filling out a questionnaire is the correct spelling of the company’s data.

Important! Translation with the help of a professional is not mandatory; most often the person does it himself.

The disadvantage of the phrase “individual entrepreneur” is that it can have several designations. The closest thing is the English phrase self-employed. This phrase translates as “self-employed.” Such workers include not only officially registered individual entrepreneurs, but also freelancers or those who do not work at all.

The application form must contain certain information. Some individual entrepreneurs turn to special companies that fill out all the necessary documents for them. But if an entrepreneur decides to do this on his own, then you need to know the following:

- most often the form is filled out in English, but there are exceptions;

- the next item contains information about the place of work and area of employment;

- The full name is entered into the application form in the same way as in the international passport;

- Next, citizenship is indicated;

- an identification number;

- the address where the individual entrepreneur actually resides.

This form can be filled out not only by hand, but also electronically. Moreover, the second option is even more convenient. When filling out the form, you cannot use a ballpoint or gel pen of any color other than blue.

Visa application form for individual entrepreneurs

If a person travels to another country, then he will have to fill out the form in the appropriate language. Therefore, if he does not speak a foreign language, then it is better to entrust this matter to a specialist. Filling out such a form will not be difficult. If necessary, you can use the help of the visa center specialists themselves.

In fact, if you provide all the necessary documents and if they are compiled correctly, there should be no problems. Schengen countries are interested in tourists. There may be problems with obtaining it only if the person is a serious criminal or does not have enough funds to travel.

We invite you to familiarize yourself with the Salary Certificate for the Employment Center

Those who are traveling abroad for the first time claim that obtaining a visa does not take much time. The main thing is to have an internal passport with you. With a Russian passport it is even easier to obtain permission to leave than with any other. Also, experienced travelers say that if you plan to go to a country where there is a big visa problem, then it is better to immediately apply for a visa in Russia.

A certificate from an individual entrepreneur differs only in information about the employer. The remaining content depends only on the requirements of the body or institution to which the certificate is submitted.

When the certificate is needed by the individual entrepreneur himself, he has the right to issue it to himself, however, most often, if confirmation of the individual entrepreneur’s employment and (or) his income is required, the entrepreneur submits a document confirming his registration as an individual entrepreneur (certificate or registration sheet in the Unified State Register of Entrepreneurs) and (or) income declaration (except for cases when an individual entrepreneur uses UTII or a patent taxation system).

Since an individual entrepreneur is not required to have a seal, its affixing is also optional. To certify the certificate, only the signature of the individual entrepreneur is sufficient. If there is a seal, it is affixed next to the signature.

If the employee who needs the certificate is himself the person authorized to issue the certificate, a document confirming the authority of the employee (for example, an order appointing a chief accountant) is attached to the certificate compiled in this way.

At first glance, the technical part of the task looks simple and understandable. Take an A4 sheet of paper, set it to portrait orientation and start filling it out.

Note! The legislation does not establish a uniform form of document execution, so it is not the location of the information that is important, but its essence.

Help example

In the work of individual entrepreneurs, there are 2 main subjects: the employee and the owner. An employee may request a certificate either orally or in writing. But it is the paper request that obliges the entrepreneur to issue a certificate of employment. Moreover, this action must be completed within three days from the date of submission of the request.

Additional Information. Although the request for a certificate is drawn up in any form, it is worth remembering that the document must clearly and directly indicate the will of the applicant to receive a certificate at the place of work of the individual entrepreneur.

If an individual entrepreneur misses the deadline for issuing a document, then this is the basis for extending the missed deadline in another place (where this paper was needed) or claims for compensation for damage caused if it is impossible or impractical to extend the deadline.

Certificate form

To myself

An individual entrepreneur is also protected by labor legislation on an equal basis with employees. In addition, a businessman is regarded as an ordinary citizen in all government bodies, and, therefore, is presented with equivalent demands.

The conclusion suggests itself. A certificate of employment with an individual entrepreneur for the individual entrepreneur itself is no different from that discussed above, with two exceptions.

The first is the name of the employer. Since the paper is issued to oneself, the employer and the employee act as one person.

The second is the need to have copies of extracts from the Unified State Register of Individual Entrepreneurs and the OGRN. This condition was initially established as a way to confirm the employment of an individual entrepreneur, but then became an accompanying document to the standard extract.

Questions and answers

- We received a letter where a former employee asks to provide him with a salary certificate for the period when he worked for us. He quit 3 months ago. Should we provide him with this certificate?

Answer: The legislation does not stipulate the fact that certificates should be issued only to working employees. If an application is received, you must provide the former employee with the necessary document within 3 days.

- The husband of an employee who is on maternity leave contacted us with an application for a certificate from her place of work. The application was not written by the employee, but by the husband himself, and he did not provide us with a power of attorney. Should we issue him the necessary certificate?

Answer: No, you do not have to issue a certificate to your spouse, because Information about an employee can only be provided to the employee himself. You can issue a certificate to the employee’s spouse, but only if you have a power of attorney drawn up in free form. There is no need to certify the power of attorney, but when issuing the document, it is necessary to verify the identity of the spouse by checking the passport.

Additional requirements for official paper

Typically, workers apply for documentary evidence of employment due to the need to provide it to certain organizations.

It could be:

- In the Pension Fund when assigning a pension.

- To the educational institution to confirm work.

- To the bank, when issuing a mortgage.

- To court.

- To the consulate upon receipt of a Schengen visa.

- To the wife's place of work when she goes on maternity leave.

Some of these organizations, in accordance with the goals achieved, require additional information to be included in the text of the document.

Thus, an enterprise where an employee’s wife is registered under an employment contract may request information about the provision of paid leave in connection with the birth of a child and about payments made related to this moment. In this case, maternity leave is understood as leave granted to care for children until they reach the age of one and a half years. Then, for example, the individual entrepreneur’s certificate to himself about his place of work will be supplemented with the following text:

“During his work, Romanov A.Yu. leave to care for a child, Andrey Romanov, born on December 27, 2017, was not provided until he reached the age of 1.5 years, and no benefits were paid.”

When applying for a Schengen visa, you must confirm your solvency and intentions not to stay in the country you are visiting. Therefore, the official paper is supplemented with information about the amount of wages and the provision of annual leave during the trip. It is very important that these moments coincide. Such a certificate from the place of work of an individual entrepreneur will not have any form of validity for himself. It must be confirmed by the company’s accountant and then, to the issued official paper, an order for the appointment of an authorized person to the position is attached.

A certificate to the Russian pension fund is needed only to confirm work experience, so no additional information is provided. This means you can use the standard form.

We recommend you study! Follow the link:

Certificate of income for accrual of sick leave

The court has several options when it is necessary to provide this document.

The most common ones include:

- during a divorce;

- the employee has debts;

- during the adoption procedure;

- for reinstatement at work.

In this case, a standard document is issued, but it must be indicated that the certificate was issued for submission to the court.

When applying for a mortgage, an additional certificate is required in addition to a document confirming the work activity of an individual, which is issued on a standard form, but about income. The designated official paper is 2 personal income taxes.

Many organizations have certain rules for the requested document. Therefore, the best option would be to contact the specified organization and request a sample for preparing the required document.

Help for the individual entrepreneur himself

In some situations, a citizen registered as an individual entrepreneur is also required to obtain the certificate in question. Then he has the right to write it out himself. A free format should be used. The amount of income received during the selected period is indicated.

Sometimes a declaration submitted to the tax authorities is used to confirm the level of income. But this method cannot be used by those who have installed a patent or a replacement system.