Basic filling rules

Certificate in form 182-n can be filled out in one of the following ways:

- Manually (the pen must be a ballpoint pen, always blue or black);

- On the computer.

When filling out, the following requirements must be taken into account:

- The document must not contain corrections or erasures.

- The company stamp is placed strictly in a certain place; it should not cover the signature of the company director.

- Information must be written clearly and easy to read.

- Numerical data is indicated in both numbers and words.

Introduction

By order of the Ministry of Labor of the Russian Federation in 2013. a new form of salary certificate was approved with clarifications and additional columns that allow you to enter information about periods of incapacity for work, maternity leave, as well as the time when the employee was released from work with the condition of maintaining earnings in whole or in part without charging insurance contributions to the Social Insurance Fund of the Russian Federation. The certificate is called Form 182n and is required to be issued by the employer upon dismissal of an employee, along with documents such as a work book and a certificate in Form 2-NDFL. During the period from the time of approval to the present, the form has not undergone changes, therefore, it is applicable for use in the current 2020. The article describes how to fill out the document, a sample of which, used in 2017, will be available for free download at the end of the article.

https://youtu.be/e7bmrGK77Mg

Document structure

The new certificate form 182-n includes four sections:

- The first section contains basic information about the employer, who is the policyholder and pays insurance premiums.

- The second section is intended to indicate information about the insured employee from whose salary contributions to the insurance fund were deducted.

- The third section reflects data on the amount of employee income separately for each year in which deductions were made.

- The last section is intended to indicate information about the employee’s temporary disability for each year.

The certificate form for sick leave 182-n is given below.

How to send a request to the Pension Fund?

If there is no certificate from the previous place of work to calculate sick leave, the former manager refuses to issue such a document, then the necessary information is obtained from the Pension Fund.

To do this, you need to send a request to this organization. It is important to understand how to correctly draw up such a document. The request must be made by the director of the company.

The employee must submit an application to the company administration with a request to receive information from the Pension Fund about his earnings for the last two years. Such a document is drawn up in free form.

After considering the application of a subordinate, the management of the enterprise instructs the secretary or an employee of the accounting department to draw up a request to the Pension Fund. Such a document is drawn up on a special form approved by the first appendix to the order of the Ministry of Health and Social Development of the Russian Federation No. 21n dated January 24, 2011.

https://youtu.be/_5ucL9dpTD0

The request must include the following information about the employee:

- first name, patronymic and last name;

- passport details;

- SNILS.

You also need to note the name of the enterprise, data on the earnings of the subordinate about which you need to obtain information. The document is signed by the head of the company.

A sample request to the Pension Fund is available.

https://youtu.be/b5ROTNvECxg

Deadline for issuing the certificate

Upon dismissal, an employee, along with other documents, is given a certificate for calculating sick leave. It is issued on the employee's last working day. A former employee can also apply for a certificate. In this case, it must be completed within three days from the date of receipt of the relevant application. For convenience, the certificate can be issued in two copies. In this case, when changing employer again, the employee will not have to apply for it again, and the employer will not have to draw it up again. It would also be a good idea to leave the certificate in electronic form, so that when an employee contacts you, you don’t have to draw it up each time (

Certificate 182n according to order No. 1n: procedure for obtaining

Certificate 182n for calculating sick leave received its name based on the order of the Ministry of Labor of Russia “On approval of the form and procedure for issuing a certificate...” dated April 30, 2013 No. 182n (hereinafter referred to as order No. 182n), by which it was approved.

Later, by order of 01/09/2017 No. 1n, some changes were made to the certificate for calculating sick leave due to the fact that after 2020, insurance premiums were established by tax legislation.

According to clause 2 of Appendix No. 2 to Order No. 182n, a certificate of payments must be given to each employee on the day of dismissal.

If for some reason the certificate was not given to the employee personally and not sent with his consent by mail, he, if necessary, can contact his former employer with an application for the issuance of such a certificate. Certificate 182n must be issued to a former employee within 3 days from the date of application.

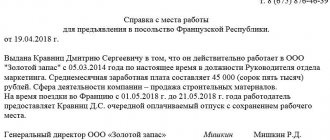

The certificate of payment amounts consists of 4 sections:

- Information about the policyholder. This section contains information such as the name, address of the employer, and the name of the insurer.

- Information about the insured person. The employee’s personal data is provided here, as well as the period of his work with the employer.

- Section 3 indicates the amounts of all payments from which insurance premiums were calculated for each year.

- Section 4 specifies the number of days when the employee did not work with pay, but insurance premiums were not accrued.

All information is entered into the certificate based on the employer’s accounting data, as well as its reporting.

The certificate is certified by the signatures of the head of the organization and the chief accountant, and the organization’s seal (if any) is affixed.

Note! The seal must not overlap the signatures of authorized persons.

Help 182n: calculation of average daily earnings

Since January 2013, a new rule for calculating the average daily earnings (ADE) has been introduced. The calculation formula is as follows:

SDZ = OSZ/CHKD – DIP, where: OSZ is the total amount of earnings for 24 months; NCHD – number of calendar days (for a period of two years); DIP – days of sick leave, maternity leave, and child care leave.

NEO

The total amount of earnings consists of funds accrued and received by the employee, from which contributions to the Social Insurance Fund and the Pension Fund were paid. The total salary is calculated for the twenty-four months worked by the employee before maternity leave (child care), or the period of incapacity for work.

CHKD

The NTC must include days for the twenty-four months worked that preceded:

- period of temporary disability;

- dismissal, termination of employment duties;

- at the time of applying for a salary certificate.

This does not exclude the possibility of filling out additional columns for other calendar periods in the event of maternity leave falling within them.

DIP

On days that fall during periods of temporary failure by the employee to fulfill his obligations (pregnancy, childbirth, child care, illness, etc.), the employee’s average salary is retained. The specified days are not taken into account in the billing period, since no deductions were made to social security and the Pension Fund from the benefits paid. Due to changes in the standards for calculating average daily earnings, where the indication of excluded days has become mandatory, a new form of salary certificate for two years has been introduced since April 2013.

Certificate 182n – why and who needs it

Correct calculation of benefits for child care, sick leave, maternity leave or care for family members requires the company's accountant to have information on the employee's average daily earnings. The period that is taken into account when determining the amount of compensation is 2 years preceding the year of the actual occurrence of disability. Documentary confirmation of information about earnings is a certificate in form 182n.

When changing jobs, information on average income is required by the current employer. According to regulatory requirements, data can only be provided on a special form, signed by the responsible person and sealed by the organization. The procedure for issuing the form is precisely defined by Order 182n. In particular, it says that:

- Issue is carried out by the employer on the employee’s last day of work.

- If issuance directly upon dismissal is not possible, the employee is sent by mail a notice of the need to appear in person or to confirm in writing his consent to receive a certificate by mail.

- If an employee applies for the form after dismissal, it is necessary to fill out an application for a certificate, and the information must be issued within 3 days (working days) from the date of registration of the application.

How does voluntary dismissal work?

Why do you need a certificate?

A certificate will be required if the employee has worked for different employers for the last two calendar years. It will be needed when calculating sick leave or other benefits. The form used to fill out the certificate was approved by Order of the Ministry of Labor No. 182n dated April 30, 2013. The certificate indicates all payments to the employee for the last two years.

Important! If such a certificate is not provided by the employee, then the benefit is calculated only on the basis of the payments that the employee received in the new company.

Reflection of part-time employment

Employees on parental leave have the right to work part-time. Such nuances often raise questions when filling out due to the fact that they are mutually exclusive, since the form must reflect information about both the amount of average earnings and the intervals attributable to parental leave. According to the explanations of the authorized persons of the Federal Social Insurance Fund of the Russian Federation, the time period during which a person was on parental leave and at the same time carried out work in a part-time mode is considered parental leave. Based on this clarification, it is necessary to exclude this gap when calculating the required benefits related to pregnancy and childbirth and subsequent care benefits. But the earnings themselves for the period during which the employee worked under part-time conditions are included in the total average salary. As an example, it is shown how combining care leave with part-time work is reflected in form 182n:

Important! Form 182n is issued free of charge.

https://youtu.be/hm9lL76Rd98

Post Views: 524

Instructions for filling out form 182n

We begin filling out the unified form for a certificate of average earnings by indicating the date and document number, observing the chronological order.

Fill out block No. 1. Information about the policyholder.

We indicate:

- full name of the institution;

- name of the FSS TO where the institution is registered;

- registration information of the insured organization (registration number of the Social Insurance Fund, Taxpayer Identification Number, KPP, actual address and telephone number).

Block 2. Information about the insured person.

We indicate:

- FULL NAME. the employee in full;

- passport data;

- place of residence (address);

- SNILS;

- periods of work.

Block No. 3. Amount of accruals.

We indicate the amount of accrued wages, as well as other payments that were subject to compulsory social insurance. In other words, we describe the amounts for which FSS insurance premiums were calculated. We provide information for the two calendar years preceding the date of dismissal, as well as for the period of work in the current year before the date of dismissal.

Block No. 4. Periods of incapacity for work.

We describe periods of incapacity for work in calendar days. For each case we indicate:

- VNiM case start date.

- Expiration date.

- Number of days of incapacity for work (in numbers and in words).

- Cause of disability.

We break down the information by year.

https://www.youtube.com/watch?v=useroksana0283

The most common mistake is the reflection of those payments that were not included in the taxable base for insurance premiums in case of temporary disability and in connection with maternity. With such a deficiency, the figure in section 3 of the certificate exceeds the maximum permissible value of the base established for the corresponding year (the limit for 2019 is 865,000 rubles, the limit for 2020 is 815,000 rubles, etc.).

It is also a mistake to fill out a document with a gel or fountain pen. Paragraph 5 of the procedure for issuing certificate 182n states that if an accountant draws it up by hand, you need to use a ballpoint pen with blue or black ink.

Finally, the shortcomings include the lack of documents that should be attached to the certificate if it does not have a seal. This is confirmation of the authority of the person who signed, power of attorney, etc. (clause 7 of the procedure for issuing certificate 182n).

How to fill out the form in 2020

The document must reflect aggregate information about the income of the insured person in the form of wages for the two-year period before the termination of employment or the fact of applying for the required document. In addition, the sheet contains data on periods of temporary disability, sick leave and maternity and child care leave, as well as periods of time during which the employee was released from work with full or partial salary, if retained by the employee. the amount of the salary was not calculated for insurance premiums. The legislator points out the following points that should be taken into account when drawing up and filling out:

- The form can be filled out either by hand or using a printing device. When filling by hand, use only blue or black ink. Changing the font size is acceptable;

- corrections or any kind of erasure are unacceptable;

- the certifying signature should not overlap with the seal; the seal is affixed in the bottom left corner.