Payment for employee study leave

If we talk about obtaining higher education in the evening or by correspondence, which does not duplicate the level of existing education, then leave must be paid, including the following sequential types of student activities:

- External training in the 2nd year lasting 50 days.

- The examination session in the 3rd and subsequent courses lasts 50 days.

- Examination session for 1-2 courses lasting 40 days.

- State final certification lasting up to 4 months.

- Mastering the training of teaching staff in graduate school, as well as completing a Ph.D. thesis - lasting 3 months.

- Mastering programs in graduate school, residency, and assistantship lasting 30 days, not including travel time to the place of study.

If we talk about obtaining secondary specialized education in evening or correspondence form, which does not duplicate the level of existing education, then leave is subject to payment, including the following sequential types of student activities:

- Examination sessions for 1-2 courses lasting 30 days.

- State final certification lasting up to 2 months.

- Examination sessions in the 3rd and subsequent courses last 40 days.

For employees studying at evening school, study leave is provided with preservation of wages on the following grounds:

- Final certification at the end of secondary school (11 grades) lasting 22 days.

- Final certification at the end of basic general school (9 classes) lasting 9 days.

Study leave is given and paid in calendar days. By default, study leave is granted only to employees studying in educational institutions with state accreditation.

Information about this must be indicated in the call certificate,

Calculation of the number of days of unused vacation upon dismissal

At the same time, the position of the Russian Ministry of Health and Social Development once again proves the illegality of the procedure for calculating the number of vacation days proposed by Rostrud. Since there is no need to use the value 2.33 as an intermediate value for further calculations, in this case the number 2.(3) would have to be rounded up, that is, to 2.34.

The duration of an employee's vacation is 28 days. The employee resigns of his own free will, having worked 6 months in the current working year. It seems obvious that, having worked exactly half of the working year, the employee has the right to exactly half of his vacation, that is, 14 days. However, if you apply the calculation method of Rostrud, you get a slightly different value:

Study leave: nuances of provision, registration and payment

In relation to certain categories of employees, the provision of educational leave is carried out taking into account the following features:

- Employees who combine work under fixed-term employment contracts with training have the right to receive study leave in the general manner established for employees signed under an employment contract for an indefinite period. The validity period of the employment contract does not affect the possibility of granting an employee study leave (Articles 58, 173 of the Labor Code of the Russian Federation).

- Part-time employee by virtue of Art. 287 of the Labor Code of the Russian Federation has the right to apply for study leave only at the main place of work. In this regard, if an employee combining work with training is registered on an internal part-time basis, he is granted paid study leave at his main place of work in accordance with the Labor Code of the Russian Federation, and if he is part-time, he must take leave without pay for the duration of the study leave.

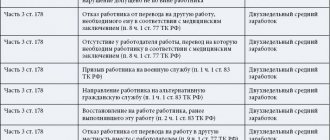

The duration of educational leaves, as well as the possibility of paying for them, depends on the level of education received by the employee and the purposes of providing such leaves (passing an intermediate, final certification, entering an educational institution, preparing a final work, passing final exams). We present in the table a list of persons entitled to paid (unpaid) educational leave, indicating their duration. Employees entitled to receive study leave Purposes of granting study leave Duration of study leave Possibility of paying for study leave Employees sent for training by the employer or enrolled independently for training in state-accredited bachelor's, specialist's or master's programs in part-time and part-time forms of study and successfully mastering these programs (Art.

173 of the Labor Code of the Russian Federation) Passing intermediate certification in the first and second years 40 calendar days Vacation is paid Passing intermediate certification in the second year when studying in a shortened time 50 calendar days

Study leave: procedure and nuances of provision

If an employee has not worked at a part-time job for 6 months, leave is provided in advance. That is, the employer for whom the employee works part-time is obliged to provide him only with annual paid leave simultaneously with leave at his main place of work.

The Labor Code does not provide for granting part-time workers study leave or annual paid leave simultaneously with study leave for their main job. Thus, in a part-time job, you can contact the employer with a copy of the summons certificate and a request only for leave without pay for the duration of the study leave.

And if the employer does not object, the part-time worker will take leave at his own expense during the training, the duration of which is determined by agreement between the employer and the employee.

The types and duration of vacations depending on educational programs and forms of training are presented in the table. Paid Professional higher education (bachelor's, master's, specialist's) Part-time or part-time 1.

Interim certification: – in the 1st and 2nd courses – 40 days; – in subsequent courses – 50 days. 2. State final certification – up to 4 months in accordance with the curriculum (Art.

173 of the Labor Code of the Russian Federation) Training of scientific and pedagogical personnel in graduate school, residency, assistantship-internship Correspondence 30 days during the calendar year plus the time spent traveling from the place of work to the place of study and back at the expense of the employer (Art.

173.1 of the Labor Code of the Russian Federation) For the academic degree of candidate or doctor of sciences – Preparation for the defense of a dissertation for the academic degree: – candidate of sciences – 3 months; – Doctor of Science – 6 months (Article 173.1) Professional secondary education Part-time or part-time 1.

Interim certification: – in the 1st and 2nd courses – 30 days; – in subsequent courses – 40 days. 2. State final certification – no more than 2 months (Art.

174 of the Labor Code of the Russian Federation) General basic part-time and part-time State final certification – 9 days (Art.

176 Labor Code of the Russian Federation)

Is maternity leave included in the calculation of annual paid leave?

I worked for the organization for 9 months and am going on maternity leave. I used the main vacation (28 days) and want to take an additional one (8 days - registered in the labor contract) Do I have the right to this? If I quit after maternity leave of up to 1.5 years, will the unworked days be withheld from me or will maternity leave be included in the period for calculating leave?

The right to use annual leave arises after 6 months of continuous work with a given employer (Article 122 of the Labor Code of the Russian Federation). When calculating the total duration of annual paid leave, additional paid leave is summed up with the annual main paid leave (Article 120 of the Labor Code of the Russian Federation), therefore you have the right to additional leave.

26 Jun 2020 stopurist 552

Share this post

- Related Posts

- Assignment agreement between LLC and LLC taxation

- Which bank can I get a loan from if I have no credit history?

- Is it necessary to ask for a document confirming the status of a parent with many children when applying to the Employment Service?

- Unified register of debtors for enforcement proceedings of the Republic of Kazakhstan

Calculation of payment for study leave in 2020

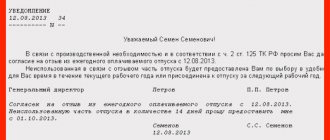

The application is written in any form.

It is also necessary to bring a summons certificate, which was already mentioned in paragraph 2 of this article. The call certificate is drawn up according to the established template. If an employee plans to defend a dissertation, then he must bring an extract from the decision of the dissertation council. Next, the accounting department issues an order for additional paid leave while maintaining average earnings.

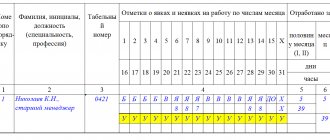

The order specifies the start and end dates of the vacation, the number of vacation days, and the number of paid vacation days. Vacation is marked in the working time sheet with the letter “U” or the number “11” (this is if the vacation is with pay), but if without pay, it is designated “UD” or “13”.

An entry is also made in the employee’s personal card in section VIII. Leave can be paid with or without pay.

If the vacation is paid while maintaining wages, then the employee receives payment according to average earnings, just like a regular vacation. Example 1. An employee is studying in his second year at the institute. He is receiving higher education for the first time.

The Institute is accredited. He provided the accounting department with a summons certificate indicating that the session lasts 20 days.

Over the previous 12 months, his salary amounted to 744,000 rubles. The accountant calculated his average salary to be 744,000/(12*29.3). It turned out to be 2,116.04 rubles. The amount of vacation pay in this case will be 2116.04*20= 42,320.82 rubles.

In accounting, the accountant made the following entries: Table 2. Posting Name Amount D 20 (23,25,44) / K 70 Accrued vacation pay 42,320.82 D 20 (23,25,44) / K 69 Accrued insurance premiums 12,823, 21 D 70 / K 68 Personal income tax withheld from the amount of vacation pay 5,501.71 D 70 / K 50 Paid the amount of vacation pay 36,819.11 It should be remembered that payment of vacation pay is made no later than three days before the start of the vacation. The employer does not have the right to refuse to provide a student with leave or to provide a leave of shorter duration than indicated in the summons certificate.

Providing study leave to an employee: 5 rules for an accountant

This is also discussed in. We recommend the video lecture “” Condition 3.

The educational institution in which the employee is trained must have state accreditation. The register of accredited educational organizations can be found on the website of the Federal Service for Supervision in Education and Science. Exception: the employer has the right to provide an employee with study leave who is studying at an educational institution that does not have state accreditation, provided that this is stipulated in the labor (collective) agreement.

Condition 4. Study leave can be granted only on the basis of a summons certificate from an educational institution. Condition 5. Study leave is granted for a duration not exceeding that specified in the Labor Code of the Russian Federation.

Exception: the employer can provide study leave of longer duration, provided that this is stipulated in the employment (collective) agreement. Please note that study leave is granted only at the main place of work (Art.

287 Labor Code of the Russian Federation). Therefore, during the session, a part-time worker must either continue to work in his free time from studies, or take leave without pay during this time (pay attention to rules 4 and 5).

The employee has two jobs: permanent and part-time. He combines work with obtaining higher education.

In this case, leave will be granted to the employee only at one place of work.

For example, in the organization in which he works constantly. An employee had a question: is it possible to undergo training and at the same time work in an organization that is a second place of work - part-time? In this case, the employee can contact the employer of the organization where he works part-time with a request to grant him leave at his own expense for the period of study.

But you must be prepared for the fact that the employer may refuse the employee’s request, citing the fact that this condition is not stated in the employment (collective agreement). In this case, the employer has the right to do so.

How study leave is calculated: calculation procedure, rules and features of registration, accrual and payment

This limit applies to payment. That is, based on a summons certificate, an employee can officially take unpaid leave.

But we are talking specifically about getting a first education. How is study leave calculated? Based on all documents.

To begin with, the employee must write an application for this type of leave and attach to it a certificate of summons from the educational institution. These documents must be submitted to the HR department.

Specialists issue an order in the T-6 form, on the basis of which a calculation note is made in the accounting department. This is where the work of the accounting department begins.

The timing of payment for study leave is not regulated by law, but it is assumed that the employee will receive vacation pay before it begins. However, at the end of the session, he is required to provide proof of his presence in the educational institution. If this document is not available, then the company has the right to withhold vacation pay.

How is vacation pay calculated for study leave? As in the case of regular annual leave: according to average earnings.

The billing period is twelve months.

If the employee is new to the company, then they take as many months as the employee has already worked. That is, if an employee came to the employer in June, and his vacation began in October, then the following months are taken for calculation: June, July, August, September, i.e. four in total. If he had fully worked twelve months, then the billing period included the months from October to September. When calculating, the employee’s salary is taken into account, minus one-time bonuses, financial assistance or compensation payments.

Also, the calculation does not include average payment amounts, that is, payment of rest days to donors, amounts for regular and additional vacations. At the same time, the number of days worked each month is equated to 29.3.

this is exactly the average value of each month. However, if the month is not fully worked, this figure decreases. But it is worth noting that if the employee is absent during this period, the coefficient remains full, equal to 29.3 days.

How to calculate study leave

August 29, 2011 Author KakSimply!

Among working young people there will always be one who is simultaneously studying in the correspondence department. Therefore, at the time of passing the sessions, the employer, in accordance with labor legislation, is obliged to provide him with study leave.

- How to apply for study leave

- Who is entitled to paid study leave?

The question is “how to post a Kaspersky update to 2 computers???” — 1 answer you will need

- Labor Code of the Russian Federation, Government Decree No. 922 of December 24, 2007. “On the peculiarities of the procedure for calculating average wages.”

Instruction 1 In order to begin accruing study leave to an employee, he must submit a certificate of summons from his educational institution and attach to it an application requesting such leave. Please be aware that study leave is calculated according to the same rules as annual paid leave.

If holidays occur during the study leave, these must also be paid. If an employee was sick during such leave, then the sick leave is not subject to payment and does not extend the leave for sick days.

2 First, calculate the employee’s earnings for the 12 months preceding the accrual of study leave. To do this, use Decree No. 922. It clearly defines all types of payments that should be included in the base for calculating such leave.

3 Next, calculate your average daily earnings.

To do this, divide the amount of calculated earnings for 12 months (if you worked for more than a year) by 12 months and by 29.4 days (the average monthly number of calendar days per year).

If an employee worked for 5 months before accruing study leave, then divide his earnings for 5 months by 5 and by 29.4.

These rules apply when all months are fully worked out. If the calculated period contains incompletely worked months, calculate the average monthly number of calendar days in such months. Those. Multiply 29.4 by the number of calendar days per hour worked and divide by the total number of calendar days of this month.

For example, in July an employee was on vacation until the 10th and returned to work on July 11th. 29.4 * 21 / 31 = 19.92 days. 4 For the final calculation of vacation, multiply the calculated average daily earnings by the number of days of study leave indicated in the call-up certificate. For example, the average daily earnings for 12 months was 680 rubles, the duration of vacation was 30 days.

Those. vacation will be accrued in the amount of: 680 * 30 = 20,400 rubles.

Please note: After the end of study leave, the employee is required to provide a confirmation certificate signed by the head of the educational institution.

Sources:

- Calculation of study leave in 2020

Is the advice useful? Yes No Related articles:

- How are vacation pay calculated for teachers?

- How to place an order for study leave

- What documents are needed to apply for study leave?

How to calculate vacation pay

The 2020 vacation calculation amount is the product of average daily earnings and the number of days of vacation requested and agreed upon. The amount of average daily earnings involved in calculating vacation is in normal cases determined as the total amount of all payments for the billing period, divided by 12 months and divided by 29.3 days (the average calculated number of days in a month). This formula is clearly applicable for those employees who have been working at a given place for more than a year.

Calculation of vacation in 2020, example 1

Ivanov P.A. wrote an application to grant him another paid leave from March 20, 2020 for a period of 14 calendar days. Ivanov’s work experience with this employer is more than 1 year. The monthly accrued salary in 2020 was 35,000.00 rubles, in 2020 - 40,000.00 rubles. In addition, in December 2016, the employee was awarded a bonus in the amount of 20,000.00 rubles.

Thus, the total amount of payments for the period from March 2020 to February 2020 will be:

35,000.00 x 10 + 40,000.00 x 2 + 20,000.00 = 450,000.00 rubles.

Average daily earnings will be:

450,000.00: 12: 29.3 = 1,279.86 rubles.

The calculation of vacation in March 2020 for 14 days of vacation will be:

1,279.86 x 14 = 17,918.04 rubles.

As we can see from the example, the calculation of vacation pay takes into account all wage payments, as well as additional bonuses and bonuses accrued to the employee in the pay period. At the same time, various social payments do not affect the amount of vacation pay, as well as amounts received by the employee for the period in which he did not actually perform his labor function, but at the same time, based on the current legislation, his average earnings were retained. Thus, payments for previous vacations, sick leave and travel payments will not be included in the calculation. The period for which such amounts were paid will also need to be excluded from the vacation calculation.

Calculation of vacation in 2020, example 2:

Let's use the initial data of the previous example and assume that P.A. Ivanov took paid leave in 2020 (from October 3 to October 16), and was also on sick leave from December 6 to December 12, 2020. Salary payments in October 2020 amounted to 18,333.33 rubles (35,000.00 x 11 working days worked / 21 total working days in the month), in December 2020 - 27,045.45 rubles (35,000.00 x 17 working days worked) days / 22 total working days in a month).

The total amount of payments for the billing period will be:

35,000.00 x 8 + 40,000.00 x 2 + 18,333.33 + 27,045.45 + 20,000.00 = 425,378.78 rubles.

This amount does not take into account payment for previous vacations and sick leave payments.

Next, you need to determine (adjust to the average value) the number of days actually worked in October and December.

In October:

29.3: 31 x (31 – 14) = 16.1

December:

29.3: 31 x (31 – 7) = 22.7

Thus, the amount of average daily earnings will be:

425,378.78: (29.3 x 10 fully worked months + 16.1 +22.7) = 1,282.03 rubles.

Next, to get the vacation calculation in 2020, in March, the resulting value must be multiplied by the number of vacation days:

1282.03 x 14 = 17,934.42 rubles.

Payments are calculated in a similar way if this is the employee’s first vacation, which he took after the first 6 months of work, that is, in a situation where the billing period, consisting of 12 months preceding the vacation, has not been fully worked out.

Calculation of vacation in 2020, example 3:

Petrov A.V. wrote an application for leave from April 3, 2020 for a period of 14 working days. He was hired on September 1, so by the time leave is granted he will have worked for the company for seven full calendar months. The monthly salary of this employee is 30,000.00 rubles.

The average daily earnings will be:

(30,000.00 x 7) / (7 x 29.3) = 1023.89 rubles.

The amount of vacation pay will be:

1023.89 x 14 = 14,334.46 rubles.

How study leave is provided and paid for part-time students in 2020-2020

However, within the framework of labor legislation there is no definition of such training, therefore it is believed that the employee should not have any tails. Attention!

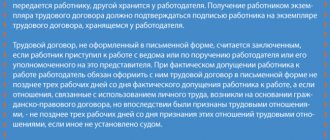

By law, a boss must not give his employee additional days off to retake exams. In addition, if such days are given, they are not paid. To obtain the right to pay for studies, the employee must write an application to his immediate superior, based on the received certificate of summons from the educational institution.

This document confirms that the person is actually going to study, and is not taking days off just to be at home. Payment for study time is made in the same way as for regular vacation.

To correctly calculate the average earnings of an employee, the accountant must add up all of his income received during his work activity, divide them by 12. After this, the finished number is divided by the average number of calendar days in a month. When carrying out this calculation, the average earnings of a specific employee for 1 day per month are obtained. year.

To determine the amount of compensation, you need to multiply the resulting number by the total number of days of future vacation. It is important to remember that compensation is provided only at the main place of work (Article 287 of the Labor Code of the Russian Federation).

If an employee studies in two educational institutions at once, then compensation is paid only for studying in one of them at his choice (Part 3 of Article 177 of the Labor Code of the Russian Federation). If the educational institution does not have state accreditation, then study leave can be granted if this provided for by an employment contract or a collective agreement. As a rule, citizens who carry out labor activities write an application for study leave only for the duration of the exam, since exams at institutes are held during working hours.

According to the code, a maximum duration is established for such periods. In particular, according to the law, for a person who is studying in a specialist or magistrate program, there may be

Step-by-step convenient instructions: how to calculate an employee’s educational leave. Formulas and visual examples

Rest time from December 25, 2020 to January 23, 2020. During 2020, Potapov was:

- on annual leave - from June 1 to June 28;

- on a business trip - from December 3 to 8.

- on sick leave - from September 10 to 20;

For 2020, Potapov received:

- travel allowances - 5000.

- salary - 360,000;

- bonus - 50,000;

- vacation pay - 30,000;

- sick leave benefit - 8000;

How to calculate study leave pay:

- Average daily earnings = 410000 / 307.84 = 1331.86

- Number of working days = 9 months.

* 29.3 + (2/30 * 29.3 + 19/30 * 29.3 + 25/31 * 29.3) = 307.84. - Payment = 1331.86 * 30 = 39955.8

- The period for calculation is from 01/01/2018 to 31/12/2018.

- Total income = 360,000 + 50,000 = 410,000 (all other payments are not taken into account).

It is possible that an employee was hired this year.

In this case, they have not worked out the full twelve-month pay period.

To calculate payment for study leave for such persons, you need to take into account the actual time spent working in the company from the moment you were hired as a full-time employee. The main difference in the calculation for an employee who has just got a job is the establishment of a deadline for payment. To correctly calculate the amount of payment, you need to take time from the moment of hiring to the day preceding the first day of the month on which study leave falls. For example, an employee got a job on February 10, 2020, and he is entitled to days off for study from June 10 to July 9, 2020. The calculated period in this example will be from February 10 to May 31, 2020. That is, the current month is not taken into account by analogy with the condition when the employee has worked for the company for more than a year. Otherwise, study leave is calculated according to the general rules. Conditions: Surikov was admitted to the company's staff since March 11, 2020.

From June 5th he was given 40 days. During his work, Surikov managed to go on a business trip - 4 days in May.

He worked all other months in full. During his working period, Surikov earned:

- salary - 120,000;

- payment

Is an employee's sick leave included in the calculation of vacation pay?

However, in practice, a person usually does not work absolutely all working days in a month, taking various vacations, time off, and sick leave. Therefore, these days are not taken into account in the total. In this case, the number of days worked is calculated for each month separately.

- accrued salary;

- piecework payment, if any;

- interest or commission charges;

- additional payments for education, scientific degree and title, advanced training, experience, combination, management, etc.;

- annual, quarterly and monthly bonuses, except for incentives from management.

Also read: How to fire an employee due to death

Calculation of study leave in 2020 (example)

→ → Update: August 16, 2020 In order for an employer to pay for educational leave to an employee who combines work with study in educational institutions of higher and secondary vocational education, it is necessary to know the terms of payment that are prescribed in labor legislation. To avoid mistakes, it is necessary to provide a calculation of study leave in 2017 (example).

The amount of study leave for those employees of the enterprise who combine their work activities with study is calculated based on the average daily earnings.

This indicator is calculated on the basis of total wages for the previous 12 months, this amount is divided by the number of months (twelve) and divided by a number reflecting the average number of days per year (29.3) (). For example, employee of MagnitWay LLC Lopasov I.N.

is studying at an institution of higher education that is accredited for the relevant undergraduate program. Lopasov I.N. receives higher education for the first time, studies by correspondence (in the 2nd year) and therefore has the right to paid leave to undergo intermediate certification in accordance with. Lopasov I.N. provided the HR department of MagnitWay LLC with a summons certificate in the established form from 04/03/2017 to 04/22/2017, i.e.

i.e. for 20 calendar days. When studying in the second year at a higher educational institution, 40 calendar days () are paid for passing the intermediate certification. The employee has been working at MagnitWay LLC since 2020, therefore, to calculate the average salary per day, the amount of earnings received by him for the period from 04/01/2016 to 03/31/2017 is taken - 268,569 rubles.

The accounting department of the enterprise calculates the average earnings per day: 268,569 / 12 / 29.3 = 763.84 rubles. Then, to find the amount of vacation pay for study leave, you need to multiply the amount of average earnings per day by the number of days of intermediate certification specified in the call certificate, i.e.

i.e. 20 x 763.84 = 15276.80 rubles.

Employee of StroyMir LLC Potapov V.N.

has been working in this organization since November 1, 2020. Potapov V.N. is studying at a secondary vocational educational institution (college) in the 3rd year of the correspondence department, submitted to the HR department of the enterprise a certificate of invitation to the session for passing exams, tests, coursework from 05/08/2017 to 05/26/2017, i.e. for 19 calendar days . The employer is obliged to pay for study leave because:

- the educational institution is accredited for this area of training;

- Potapov V.N. receives secondary vocational education for the first time;

- Potapov V.N. carries out training successfully, without debts;

- The employee is studying via correspondence courses.

Since the employee has worked for less than one year at this place of work, to calculate the average earnings per day, the amount of wages during his work at this enterprise (from 11/01/2016) is taken, i.e.

i.e. from November 1, 2016 to May 31, 2017 – 93,585 rubles. The accounting service of StroyMir LLC calculates the average earnings of an employee per day, for which the numerator reflects the amount of wages received for the period from 11/01/2016 to 05/31/2017 - 93,585 rubles, the denominator - the period of time for which this amount of wages was received (in our case, 6 months) and the number taken as the average number of days in a month (29.3): 93585 / 6 / 29.3 = 532.33 rubles. When calculating vacation pay for passing a session at an educational institution, Potapov V.N.

the calculated amount of average earnings per day (532.33 rubles) is multiplied by the duration of the session indicated in the call certificate (19 days): 532.33 x 19 = 10114.27 rubles. Also read:

Accountant forum: Share:

Subscribe to our channel at

Are vacation pay included in the calculation of average earnings?

Average earnings is the average salary of an employee for a particular period of time. This figure is needed in calculations related to vacation payments, cash benefits for disabled employees and when calculating the amount of pension savings.

- The salary that is accrued to an employee at the tariff rate, according to the official salary for the time that he worked

- Salary that is transferred to an employee for work done at a piece rate

- Salary, which is accrued to an employee in the form of a percentage of sales, proceeds, and also in the form of commission incentives

- Salary, which is issued not in the form of money, but, for example, in the form of food and goods

- Bonuses and allowances to the general rates that are paid to employees for length of service, for length of service, for rank, for keeping state secrets, and so on

- Bonuses and monetary rewards given to an employee by an employer in accordance with the generally accepted remuneration system

Also read: From What Amount Can Bailiffs Come to an Apartment for a Debt for an Apartment