Application of the act form T-73

The need to draw up a document arises when documenting the results of work performed once. Hiring an employee to perform one-time work should not bear the characteristics of an employment contract of an indefinite duration. The act is drawn up upon completion of the work or stage under the contract, which has:

- Limited validity period - the date or departure of the absent main employee.

- Characteristics of a fixed-term type of contract.

- A specific list of tasks.

A fixed-term contract is concluded when performing seasonal, temporary work, in the absence of the main employee, or in cases where the work requires certain skills that are not available to the company’s employees. A complete list of works for which a fixed-term type of contract is used is indicated in Art. 59 Labor Code of the Russian Federation.

If the employee violates obligations, the contract may be terminated early at the initiative of the employer. The basis is a violation of labor discipline, routine, labor safety rules, or failure to complete tasks on the part of the employee. Failure to fulfill obligations on the part of the employer is disputed in the labor commission and judicial authorities.

To organize personnel records in a company, beginner HR officers and accountants are perfectly suited to the author’s course by Olga Likina (accountant M.Video management) ⇓

Form of document indicating the completion of the task

Work or tasks performed under a fixed-term contract must be transferred by the performing party and accepted by the ordering party. To confirm the fact of transfer of labor results, an act of form T-73 or another document developed by the enterprise is used.

The unified form was approved by Resolution of the State Statistics Committee dated January 5, 2004 No. 1. The form used in the company must be approved in the annex to the accounting policy as part of working primary documents. Forms developed independently include the mandatory details necessary for maintaining primary accounting records. You must enter the following in the form:

- Data about the enterprise and structural unit.

- Document details – date of preparation and number assigned according to the registration log.

- Information about the contract on the basis of which the work was carried out.

- Information about the person, the task being performed, the deadlines for implementation.

- Information about the parties and persons responsible for the delivery and acceptance of completed work.

Based on the drawn up act, a settlement is made with the employee.

Albums of forms of primary accounting documentation (Order of JSC Russian Railways No. 2017r dated 09.12.11)

OS-1 Certificate of acceptance and transfer of fixed assets (except for buildings, structures) OS-1a Certificate of acceptance and transfer of a building (structure) OS-1b Certificate of acceptance and transfer of groups of fixed assets (except buildings, structures) OS-2 Invoice for the internal movement of fixed assets OS-3 Certificate of acceptance and delivery of repaired, reconstructed, modernized fixed assets OS-4 Certificate of write-off of fixed assets (except for motor vehicles) OS-4a Certificate of write-off of motor vehicles OS-4b Certificate of write-off of groups of fixed assets (except for vehicles) OS-6 Inventory card for recording fixed assets OS-6a Inventory card for group accounting of fixed assets OS-14 Certificate of acceptance (receipt) of equipment OS-15 Certificate of acceptance and transfer of equipment for installation OS-16 Act on identified defects in equipment FOU-Za Appendix to the inventory card for accounting for fixed assets FOU-4a Appendix to the inventory card for accounting for fixed assets (for group accounting) FOU-7 Inventory of inventory cards for accounting for fixed assets FOU-8 Inventory list of fixed assets (at their location, operation) FOU-14 Calculation of depreciation of fixed assets FOU-18 Defect sheet FOU-19 Act on conservation of a fixed asset object FOU-19a Act on conservation of groups of fixed assets FOU-20 Act on re-mothballing a fixed asset object FOU- 20a Act on the reactivation of groups of fixed assets FOU-22 Work order for the implementation of work according to the scientific and technical progress plan FOU-23 Certificate of acceptance of scientific and technical products FOU-24 Act on review of the results of completed research, development and technological work FOU -25 Certificate of acceptance and transfer of the results of work FOU-26 Certificate of commissioning FOU-27 Certificate of destruction of the prototype FOU-28 Certificate of acceptance and transfer of the prototype unsuitable for use as fixed assets FOU-29 Technical certificate of acceptance of the results of OS work -1 Certificate of acceptance and transfer of a fixed asset object (except for buildings, structures) OS-1a Certificate of acceptance and transfer of a building (structure) OS-1b Certificate of acceptance and transfer of groups of fixed asset objects (except for buildings, structures) OS-2 Invoice for internal movement of fixed assets OS-3 Certificate of acceptance and delivery of repaired, reconstructed, modernized fixed assets OS-4 Certificate of write-off of fixed assets (except for vehicles) OS-4a Certificate of write-off of motor vehicles OS-4b Certificate of write-off groups of fixed asset objects (except for vehicles) OS-6 Inventory card for recording fixed assets object OS-6a Inventory card for group accounting of fixed assets objects OS-14 Certificate of acceptance (receipt) of equipment OS-15 Certificate of acceptance and transfer of equipment for installation of OS -16 Act on identified defects in equipment FOU-Za Appendix to the inventory card for accounting for fixed assets FOU-4a Appendix to the inventory card for accounting for fixed assets (for group accounting) FOU-7 Inventory of inventory cards for accounting for fixed assets FOU-8 Inventory list of fixed assets ( at their location, operation) FOU-14 Calculation of depreciation of fixed assets FOU-18 Defect sheet FOU-19 Act on conservation of a fixed asset object FOU-19a Act on conservation of groups of fixed assets FOU-20 Act on re-mothballing a fixed asset object FOU-20a Act on the reactivation of groups of fixed assets FOU-22 Work order for the implementation of work according to the scientific and technical progress plan FOU-23 Certificate of acceptance of scientific and technical products FOU-24 Act on review of the results of completed research, development and technological work FOU- 25 Certificate of acceptance and transfer of the results of work FOU-26 Certificate of commissioning FOU-27 Certificate of destruction of the prototype FOU-28 Certificate of acceptance and transfer of the prototype unsuitable for use as fixed assets FOU-29 Technical certificate of acceptance of the results of work NMA- 1 Card for recording intangible assets FNA-2 Certificate of acceptance and transfer of an object of intangible assets FNA-3 Certificate of write-off of an object of intangible assets FNA-4 Certificate of internal movement of intangible assets M-2 Power of attorney M-2a Power of attorney M-4 Receipt order M-7 Act on acceptance of materials M-8 Limit card M-11 Request invoice M-15 Invoice for the release of materials to the side M-17 Materials accounting card M-35 Act on the recording of material assets received during the dismantling and dismantling of buildings and structures of the FMU -5 Log book for incoming fuel and petroleum products FMU-7 Certificate of acceptance of fuel and petroleum products to the warehouse FMU-8 Label for measuring petroleum products FMU-13 Invoice for delivery of manufactured products (repaired spare parts) to the storeroom FMU-20 Delivery note FMU-23 Statement supply of lubricants to locomotives FMU-24 Daily statement of supply of diesel fuel to locomotives FMU-25 Receipt for supply of petroleum products FMU-26 Requirement-invoice for the receipt and transfer of diesel fuel in the tanks of locomotives, when used by crews of other depots FMU-27 Requirement-invoice for the acceptance and transfer of diesel fuel in the tanks of locomotives, when they are transferred for repair/repair FMU-30 Limit and intake card FMU-31 Invoice for the issuance of products for a flight FMU-32 Distribution sheet FMU-36 List of persons registered for provision household fuel FMU-39 Statement of issue of household fuel FMU-40 Fuel card FMU-41 Fuel card accounting book FMU-45 Material label FMU-49 Register of acceptance and delivery of documents FMU-50 Record of remaining materials in the warehouse FMU-50a Insert sheet for form FMU-50 (large format) FMU-506 Insert sheet for the form FMU-50 (small format) FMU-54 Material report FMU-54a Insert sheet for the material report FMU-54b Insert sheet for the material report FMU-73 Act (universal form ) FMU-74 Statement of consumption of materials for the duty storeroom FMU-75 Daily statement of fuel supply for passenger cars FMU-76 Statement of write-off of material assets FMU-77 Record sheet of coupons for the free issuance of milk and other equivalent food products FMU-78 Report on the movement of coupons for the free distribution of milk and other equivalent food products FMU-79 Report on the movement of smart cards FMU-80 Log of the transfer of remaining fuel according to meter readings during shifts between financially responsible persons FMU-81 Log of the movement of alcohol FMU-82 Log of the receipt and consumption of alcohol at the workplace FMU-83 Logbook for the receipt and issuance of reusable liter fuel cards FMU-84 Report on the movement of fuels and lubricants on fuel cards FMU-85 Statement for the issuance of materials (mittens, soap, etc.) FMU-86 Act on the write-off of diesel fuel for non-traction needs FMU-87 Statement of diesel fuel (electricity) consumption for locomotive repairs FMU-88 Certificate of write-off of diesel fuel for train traction FMU-89 Logbook for the receipt and issuance of fuel cards FMU-90 Report on cash flows on fuel cards FMU-91 Act on the write-off of electricity consumed by high-speed trains FMU-92 Act on the condition of reusable materials capitalized during the repair (dismantling) of an old rail and sleeper grid FMU-93 Acceptance certificate FMU-94 Card of assets containing precious metals (accounted for 014, 020 off-balance sheet accounts) FMU-95 Act on the posting of reusable materials and scrap metal generated during repair, modernization, reconstruction and from write-off of fixed assets TORG-1 Act on acceptance of goods TORG-2 Act on the established discrepancy in quantity and quality when accepting inventory values TORG-3 Act on the established discrepancy in quantity and quality when accepting imported goods TORG-4 Act on acceptance of goods received without the supplier's invoice TORG-5 Act on the receipt of packaging not specified in the supplier's invoice TORG-6 Act on the curtain of containers TORG- 7 Journal of registration of inventory items requiring a cover of containers TORG-8 Order-selection list TORG-9 Packing label TORG-10 Specification TORG-11 Product label TORG-12 Waybill TORG-13 Waybill for internal movement, transfer of goods, containers TORG -15 Act on damage, damage, scrap of inventory items TORG-16 Act on write-off of goods TORG-18 Log book of goods in the warehouse TORG-19 Consumable plumb line (specification) TORG-20 Act on additional work, sorting, repacking of goods TORG-23 Product journal of a small retail trade worker TORG-26 Order TORG-27 Journal of accounting for the fulfillment of customer orders TORG-28 Card of quantitative and cost accounting TORG-29 Commodity report TORG-30 Container report TORG-31 Accompanying register of delivery of documents MX-1 Acceptance certificate- transfer of inventory items for storage MX-2 Log book of inventory items deposited for storage MX-3 Act on the return of inventory items deposited for storage MX-4 Log book of incoming cargo MX-5 Log book of receipt of products, goods - material assets to storage locations MX-6 Logbook for recording the consumption of products, inventory items in storage areas MX-13 Act on control checks of products, inventory items removed from storage locations MX-14 Act on random checking of the availability of inventory items valuables in storage locations MX-15 Act on markdown of inventory items MX-18 Invoice for the transfer of finished products to storage locations MX-19 Statement of inventory balances in storage locations MX-20 Report on the movement of inventory items in locations storage MX-20a Report on the movement of inventory items MX-21 Forwarder's report 3 Waybill for a passenger car 3a Waybill for a passenger car 3special Waybill for a special car 4 Waybill for a passenger taxi 4-c Waybill for a truck 4-p Waybill for a truck 6 Waybill for bus 6specials Waybill for a non-public bus 8 Logbook for the movement of waybills 1-T Consignment note Bill of lading ESM-1 Report on the work of a tower crane ESM-2 Waybill for a construction machine ESM-3 Report on the work of a construction machine (mechanism) ) ESM-4 Work order report on the work of a construction machine (mechanism) ESM-5 Card for recording the work of a construction machine (mechanism) ESM-6 Log book for the work of construction machines (mechanisms) ESM-7 Certificate for payments for work performed (services) FAU- 15 Vehicle operation registration card FAU-23 Vehicle tire inspection report FAU-30 Certificate of movement of vehicle fuel, lubricants and coupons FAU-31 Vehicle operation certificate FAU-32 Vehicle tire registration card MB-2 Special tools (devices) registration card MB -4 Certificate of disposal of special tools (devices) and special clothing MB-7 Record of issue of special clothing, special footwear and safety devices MB-8 Certificate of write-off of special tools (devices) and special clothing FIU-3 Certificate of acceptance and delivery of tools and equipment on locomotives and other machines FIU-4 Invoice for the issuance of bedding and soft equipment on a flight FIU-4a Invoice for the acceptance of bedding and soft equipment from a voyage FIU-5 Personal record card for work clothes, special footwear and safety equipment FIU-6 Record sheet for inventory, tools, bedding and workwear FIU-9 Invoice for the issuance of hard equipment for the flight FIU-9a Invoice for the acceptance of hard equipment from the voyage FIU-10 Certificate of write-off of assets with a useful life of more than 12 months, accounted for as inventories FIU-11 Book removable property of the car: passenger, dining car and service car FIE-16 Invoice for acceptance (delivery) of bed linen (incomplete) from the laundry (to the laundry) FIE-20 Invoice for issuance of bed linen for the flight and acceptance from the flight FIE-21 Invoice for issuance of incomplete linen on a flight and acceptance from a flight FIA-24 Replacement sheet for the movement of bed linen through the storeroom (workshop) FIE-25 Shift sheet for the movement of removable property through the storeroom FIE-26 Requirement for the issuance of uniforms FIE-27 Requirement for the issuance of workwear, equipment and instrument FIU-28 Statement for the delivery of revenue received for the use of bed linen on the train FIU-30 Requirement for the issuance of assets with a useful life of more than 12 months, accounted for as inventories

Situations often arise when an organization, in order to support its activities or fulfill a third-party order, needs to perform work that is not typical for the profile of such an enterprise. Or there may simply be a shortage of specialists who are busy at other sites at this particular time.

For example, an enterprise needs to prepare an exhibition of its own products, but there is no designer with the appropriate specialization on staff. Or you need to fulfill an urgent order for the installation of a structure, and the team is busy with other work.

In such cases, it is possible to conclude a fixed-term employment contract to perform certain specific work in accordance with Article 59 of the Labor Code. The unified form T 73 is an act of acceptance of such work and approved by Resolution of the State Statistics Committee of the Russian Federation dated January 5, 2004 No. 1. Corresponds to code 0301053 according to the All-Russian Classifier of Management Documentation (OKUD). The act form is filled out by the responsible person appointed by the head of the enterprise or organization. Entering data requires special care. The unified form T 73 refers to primary accounting documents reflecting the facts of the economic and business activities of the enterprise (Clause 1, Article 9 of the Federal Law “On Accounting” dated December 6, 2011 No. 402-FZ). Incorrect documentation of transactions in this case can lead to negative tax consequences for the business entity. Of course, based on information from the Ministry of Finance of Russia No. PZ-10/2012, from January 1, 2013, the unified form T 73 can be replaced by a form of the enterprise’s own design. But, in any case, your form must include all the necessary data for accounting.

Deadlines for drawing up an act of form T-73

When registering an employee to perform a specific task, the parties stipulate the deadline for completion and the procedure for accepting the work. The result of the work can be accepted upon completion of the work or in parts, with a report drawn up for each stage of implementation. Stage-by-stage execution of the act is required to make payments to the person. The form is drawn up in 2 copies, one of which is provided to the employee, the second is sent to the accounting department for calculation.

The form is drawn up by a person appointed by the manager to verify compliance with the requirements of the work performed and acceptance of the result. The act is approved by the head of the enterprise or another authorized person (for example, a deputy).

Procedure for drawing up form T-73

At the time of drawing up the act, the work under the contract (or part thereof) must be completed. Filling out the form is easy. All data is entered according to the request for each position.

| Procedure | Explanations |

| Filling in details | Enter information about the enterprise, contractor, contract |

| Assigning a number and date | Carried out in the program or according to the journal of registration of general documents |

| Data on types of work | Each type of work is indicated separately with data on quantitative and cost indicators |

| Carrying out acceptance | The act must contain a record of the absence of claims and acceptance of work |

| Signatures and approval | The document is signed by the parties to the contract and approved by the manager |

Next, the document is transferred to the accounting department for payment in accordance with the amount specified in the act. The transfer of the document to the accounting department is carried out by the responsible person who supervises the execution of the assigned task.

The composition of the act data is determined by the document itself. Filling out the document line by line according to requests ensures the complete composition of the required information. When entering data, important conditions are:

- Filling out the company details in accordance with the constituent documents.

- The persons indicated in the document must have the right established by the order or job description.

- When replacing the responsible person, the details of the employee temporarily performing the duties are indicated.

- The details of the work performer and the signature are entered manually by the person himself.

The act is completed manually or electronically using original or certified signatures of persons.

Act of partial, complete damage or loss of media items (mandatory form). Form No. FMU No. 73

Related documents

- Act of targeted examination on additional medical examination of citizens working in state and municipal institutions in the fields of education, healthcare, social protection, culture, physical culture and sports and in research institutions of outpatient care

- Act of loss of a historical and cultural monument of the Moscow region

- The act of losing the original appearance of a cultural heritage site

- Act of loss of the original appearance of a cultural heritage site (appendix to the Methodological Recommendations for determining the cost of work to preserve cultural heritage sites on the territory of the Russian Federation)

- Act of loss of the original appearance of a cultural heritage object (appendix to the General guidelines for the application of resource standards and aggregated prices for structures and types of restoration work of cultural heritage objects on the territory of the Russian Federation)

- Certificate of recycling of household appliances and household appliances

- Certificate of disposal of used seals by the commission (name of the territorial body) of the Federal Service for Environmental, Technological and Nuclear Supervision. Form No. 9

- The act of recycling badges of police officers

- Act of establishing the causal relationship of death (death), bodily injury or other harm to the health of an employee of the Investigative Committee of the Russian Federation in connection with the performance of official duties (recommended sample)

- The act of establishing and agreeing on the boundaries of a land plot

- The act of establishing a causal connection between the death (death), bodily injury or other harm to the health of an employee of the Investigative Committee of the Russian Federation with the performance of official duties

- Act on establishing fuel consumption standards (filling sample)

- The act of establishing the fact of a civil servant appearing at work in a state of alcohol, drug or other toxic intoxication

- The act of establishing the fact of a citizen appearing on alternative service in a state of alcohol, narcotic or other toxic intoxication

- The act of establishing the boundaries of maintenance and repair of automated systems, computer technology, data networks and communications

Use of electronic signatures when approving an act

Primary accounting documents are allowed to be generated electronically using an electronic digital signature, with the exception of information media that require special protection. The organization's records must define the procedure for maintaining electronic document management and the circle of persons entitled to receive an electronic signature.

In internal documents, a simple electronic signature (SES) is often used, confirming the creation of the document by the account owner who has access to the information system. In cases where additional protection of information is necessary to ensure that there are no changes after signing with an electronic signature, an electronic digital signature issued by a certification center is used.

When signing the T-73 act with an electronic digital signature, certain difficulties arise.

| Condition for drawing up the act | Description |

| Availability of digital signature (see →) | All parties involved in signing the document must have a certain type of key certificate |

| Type of digital signature of the performer | When signing a document, the executor must have a strengthened digital signature obtained from a specialized center |

| Form of the document provided to the contractor | To transfer a sample document to the contractor, a printed document on paper will need to be certified with the original signature of the manager and the seal of the organization |

The document is the basis for settlement with the employee, which is taken into account when ensuring the storage of documents. Forms T-73 relating to employee benefits require preservation for 5 years, and in the absence of personal accounts - 75 years. The duration of archiving is taken into account when creating documents in electronic form. Documents signed with an electronic signature must be stored in electronic document databases along with certificates confirming the authenticity of the signatures.

Errors that occur when filling out the form

The main errors when drawing up an act arise in the absence of the required details of the primary document.

| Document requirement | Required information |

| Company information | Information is entered that allows you to determine the organization, division |

| Details of the act | Documents are assigned a number and date of preparation |

| Information about the employee and the basis for drawing up the act | Provide information about the contract (number, validity period, date of preparation) and the contractor |

| List of works | The types of work performed are reflected, indicating the amounts, and the compliance of the result with the requirements is confirmed |

| Information about responsible persons | The persons confirming the acceptance and approval of the work done are indicated |

The form of the primary document, drawn up in violation of the requirements or completeness of the details, is considered invalid and cannot serve as a basis for including the amount in the confirmed expenses of the enterprise.

Features of drawing up an act in service programs

When making settlements with an employee hired under a fixed-term contract to carry out a certain amount of work, the fact that the hired person has all the rights along with regular employees is taken into account. The contractor under a fixed-term contract has the right to receive social guarantees, including employer contributions to funds that give the right to insurance. The settlement with the employee is made in the program that accompanies payroll.

Standard configurations of salary programs do not contain an act form. The form is filled out in an office program or the document is included in the forms used. For the program used by the organization, it is necessary to refine the list of available forms by creating an external printed document into which data will be entered from the working configuration. The form is added to the list of forms used through the additional reports function.

Answers to common reader questions

Question No. 1.

Is form T-73 used when accepting work under a GPC agreement?

The act of the unified form T-73 is used only when concluding a fixed-term contract for the acceptance and transfer of the result of work performed.

Question No. 2.

Can a proxy sign a deed on behalf of an employee?

The interests of an individual may be represented by a trustee. To create rights, a notarized power of attorney is required.

Question No. 3.

Is a T-73 form document the basis for filing claims against the employer, including filing a claim in court?

The T-73 form certificate is a full-fledged document for presenting rights, confirming the fact of work being carried out, subject to the availability of all required information. Additionally, it is necessary to have a contract on the basis of which the work was carried out.

Question No. 4.

How is the termination of a fixed-term contract carried out when performing work confirmed by the T-73 act?

The employer notifies the employee of the termination of the fixed-term contract. The fact of termination of the contract or performance of work is not grounds for terminating the labor relations of the parties. After drawing up the act, an order is issued to terminate the contract.

Question No. 5.

Is it possible to extend a fixed-term contract with a person if circumstances do not allow the completion of the work specified in the agreement?

The legislation does not contain provisions allowing the extension of fixed-term contracts. There is no direct prohibition on drawing up an additional agreement to the contract, but the best option is to conclude a new contract. Payment under the original contract must be made based on actual results.

Situations often arise when an organization, in order to support its activities or fulfill a third-party order, needs to perform work that is not typical for the profile of such an enterprise. Or there may simply be a shortage of specialists who are busy at other sites at this particular time.

For example, an enterprise needs to prepare an exhibition of its own products, but there is no designer with the appropriate specialization on staff. Or you need to fulfill an urgent order for the installation of a structure, and the team is busy with other work.

In such cases, it is possible to conclude a fixed-term employment contract to perform certain specific work in accordance with Article 59 of the Labor Code. The unified form T 73 is an act of acceptance of such work and approved by Resolution of the State Statistics Committee of the Russian Federation dated January 5, 2004 No. 1. Corresponds to code 0301053 according to the All-Russian Classifier of Management Documentation (OKUD). The act form is filled out by the responsible person appointed by the head of the enterprise or organization. Entering data requires special care. The unified form T 73 refers to primary accounting documents reflecting the facts of the economic and business activities of the enterprise (Clause 1, Article 9 of the Federal Law “On Accounting” dated December 6, 2011 No. 402-FZ). Incorrect documentation of transactions in this case can lead to negative tax consequences for the business entity. Of course, based on information from the Ministry of Finance of Russia No. PZ-10/2012, from January 1, 2013, the unified form T 73 can be replaced by a form of the enterprise’s own design. But, in any case, your form must include all the necessary data for accounting.

Description of the work acceptance form

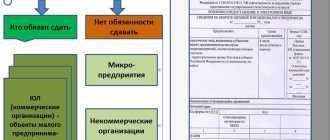

In accordance with Art. 58 of the Labor Code of the Russian Federation, an employer can hire a person for a certain period. Article 59 of the Labor Code of the Russian Federation contains the grounds for the urgency of an employment contract. All grounds for concluding a fixed-term employment contract can be divided into four groups, namely:

- a contract is concluded for a period when the end date is known;

- when the employment contract ends when the permanent employee returns to work;

- the urgency of the employment contract is determined by the agreement of the parties to the contract;

- when the contract is terminated due to the end of the work of a temporary person or the organization as a whole.

Certain jobs performed by a temporary employee may be varied, but should not fully or partially duplicate the job responsibilities of one of the permanent jobs. Work performed by an employee under a fixed-term employment contract must have a clear result and deadline. Otherwise, the employee has a reason to go to court to have the fixed-term contract recognized as indefinite.

A fixed-term employment contract may specify the procedure for accepting work. Both parties are involved in acceptance. Resolution of the State Statistics Committee of Russia No. 1 dated January 5, 2004 approved unified forms of primary labor accounting documentation, including form T-73.

The employer and employee, when concluding a fixed-term employment contract, can establish that the acceptance of work is carried out in stages or at the end of all work. Payment can also be, by agreement of the parties, in stages or at the end of all work. If there is a large amount of work performed by a temporary employee, phased acceptance is preferable.

The unified form T-73 (work completion certificate) is used by the parties to formalize the acceptance and delivery of work performed by a temporary employee. This act applies only if the parties enter into a fixed-term employment contract. Although some, on the basis of this form, create an act of acceptance of work under a civil contract.

Sample of filling out the unified form T 73

The act of acceptance of work under a fixed-term contract is drawn up in two copies, one of which is transferred to the accounting department for calculations and calculation of payments. In order to understand how to enter data correctly, you should consider a sample of filling out the form.

The procedure for filling out form T 73 of the act of acceptance of work performed under a fixed-term employment contract:

- at the top of the form in the first and second lines the name of the organization and its structural unit is indicated;

- OKPO - code according to the All-Russian Classifier of Enterprises and Organizations;

- OKVED - code according to the All-Russian Classifier of Types of Economic Activities;

- filling out the columns (graphs) corresponding to the number of the employment contract, the date of its conclusion and validity period;

- the number of the act, the date of its preparation and the reporting period in which the work was carried out;

- stamp of approval of the document indicating the position of the head of the organization and his signature, sealed;

- re-entering information about the concluded employment contract indicating the date of its execution and the full last name, first name and patronymic of the employee;

- filling out the fields of the table, which indicate the names of each type of work, the amounts accrued for their implementation and the total amount to be paid, including advance or prepayment;

- confirmation of the completion of the work and the absence of claims, indicating all the necessary characteristics (quality, volume, etc.) and the amount in words of monetary remuneration to be paid;

- personal signature of the employee on the fulfillment of labor obligations;

- signatures of three representatives of the employer, including the chief or senior accountant, on acceptance of work.

A sample of filling out the act allows you to clearly demonstrate the procedure for entering the necessary data in the T 73 form. This was done to simplify the process of drawing up the document and eliminate possible errors.

Enterprises often have to deal with the need to perform some work that does not correspond to the main profile of their activities. In such cases, naturally, the company will not have properly qualified specialists on its staff. A situation is also possible when a large order is suddenly received, for which your own employees do not have enough strength, but which you do not want to miss.

For example, when a company is preparing for an exhibition of its own products, it certainly needs the help of a designer, who makes no sense to keep on staff. Or, let’s say, due to some reasons, there was a delay in the completion of work at the site and in order to meet the deadlines, it is necessary to attract additional workers.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to know how to solve your specific problem

— contact a consultant:

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week

.

It's fast and FREE

!

In such situations, as a rule, they resort to signing an employment contract providing for the performance of strictly specified work.

Blank form

Form T-73 is approved by one of the Resolutions of the State Committee on Statistics. It is the same for all organizations. The main points in this act are the name of the work, their cost and how they were completed (on time or not, their quality). It looks like this:

Enterprises often have to deal with the need to perform some work that does not correspond to the main profile of their activities. In such cases, naturally, the company will not have properly qualified specialists on its staff. A situation is also possible when a large order is suddenly received, for which your own employees do not have enough strength, but which you do not want to miss.

For example, when a company is preparing for an exhibition of its own products, it certainly needs the help of a designer, who makes no sense to keep on staff. Or, let’s say, due to some reasons, there was a delay in the completion of work at the site and in order to meet the deadlines, it is necessary to attract additional workers.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to know how to solve your specific problem

— contact a consultant:

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week

.

It's fast and FREE

!

In such situations, as a rule, they resort to signing an employment contract providing for the performance of strictly specified work.

Description of the act

Acceptance of work entrusted to a specific employee in accordance with a fixed-term employment contract presupposes that a corresponding act is drawn up for proper registration and accounting.

This document assigns the following responsibilities to the employer:

- providing the employee with the agreed work;

- ensuring proper working conditions;

- timely and full payment of wages.

The employee’s responsibilities are as follows: personal performance of the labor function provided for by the fixed-term contract, as well as strict adherence to the labor regulations adopted at a particular enterprise.

The conclusion of a fixed-term employment contract, in accordance with the norms of the Labor Code, occurs in the following cases:

- required to perform the duties of a staff member who is temporarily absent;

- when temporary or seasonal work is necessary;

- a person goes to work abroad;

- when it is necessary to perform work that is not part of the company’s traditional activities or is associated with a temporary expansion of production or the list of services provided;

- when employees are accepted into an organization that will operate for a strictly defined time, to carry out clearly defined work;

- the person being hired is required to carry out some work, the completion date of which is unknown;

- when work is performed during practice or internship;

- when a person will hold an elected position or be a member of an elected body for a certain period of time;

- a person registered with the employment service is sent to perform temporary and public works;

- when a citizen undergoes alternative civilian service.

In some cases, it is possible for the parties to sign by mutual agreement a fixed-term employment contract, which does not specify the nature of the future work and the conditions under which it will be implemented.

An act of acceptance of work can be executed during the final or stage-by-stage payment under the employment contract.

This act must certainly contain:

- name of the completed works;

- from the cost provided for by the provisions of the agreement previously signed by the parties;

- the amount to be paid;

- conclusion regarding the volume, level and quality of completed work.

Drawing up the act is the responsibility of the employee who is responsible for accepting the work, after which it is approved by the manager or a person with due authority. It is required to fill out two copies, one of which is given to the person who carried out the work, and the second is sent to the accounting department for payroll calculation.

Form T-73, which is used to draw up an act of acceptance of work performed in accordance with a fixed-term employment contract, serves as the basis for a full or phased payment to be made to the employee. This form can be used by all organizations operating in the Russian Federation, except budget ones.

The act serves as the primary document, in accordance with which salaries are calculated and payments are made under fixed-term contracts, and expenses incurred are also reflected in.

In what cases is this document needed?

In some situations, a company does not have its own employees with the necessary qualifications to perform a certain one-time job, or there simply are not enough workers to complete a certain project on time.

Replenishing the staff with new employees for the sake of this does not make sense, since in the future they will have to pay salaries regularly, while they will not be fully loaded.

Similar situations may arise if it is necessary to carry out certain repair, construction and restoration work, design, agricultural and many others. The solution is usually found through the conclusion of fixed-term employment contracts between the employer and third-party employees.

After the work is completed, the above-mentioned primary document is drawn up, that is, an act on the basis of which all calculations and payment of due wages are made.

If the enterprise does not have the T-73 form provided for such cases, then the use of the T-55 form is permitted by law.

The application of the act is possible both in the case of cooperation between the employer and employees under employment contracts and civil law ones. It is planned to draw up an act not only for the final payment after completion of all work, but also for a phased one.

The form of this document is filled out with the obligatory entry of the following information:

- descriptions of the nuances of the work being carried out;

- their value stipulated by the contract;

- the total amount provided for payment to the employee;

- feedback regarding how well the work was carried out, in what volume and at what level.

All this information is entered into the act with reference to the agreement previously concluded between the parties. The completed form serves as the main basis for making payment for completed work.

This act is included in the category of primary documentation, the use of which has been optional for accounting since 2013. However, those primary documents that were established by the relevant authorities, as before, must be completed without fail.

“Steel fist” of Russia: why the T-72B3 is the best in the world

The T-72 is not a rookie. It was created back in 1973. Various modifications of the vehicle with the indices: B, B1, BA formed and continue to form the basis of the armored forces of Russia and more than 50 other countries around the world. Since the start of production, 30 thousand of them have been produced. The tank has been modernized many times. But only now, with the advent of the “B3” modification, one can say that it has reached the absolute. The car has been in this modification for five years and is still being improved.

During the latest modernization, the tank received a new 125-mm smoothbore gun, which allows the use of new armor-piercing sub-caliber projectiles of the Svinets-1 and Svinets-2 types. Thanks to the new Sosna-U sight and 1A40-4, shooting accuracy was increased, both from a standstill and on the move. The thermal imaging channel of the main sight ensures reliable operation of guidance devices in all weather conditions, regardless of the time of day.

A new modern digital ballistic computer allows you to reduce the time of calculations several times and increase their efficiency. This means that tankers not only detect targets faster and calculate the parameters of a shot, but also fire them faster. This point has already formed the basis for changes in the “Firing Requirements Courses” adopted for tank units of the Ministry of Defense.

A more significant innovation is the V-92S2F engine with a power of 1130 hp. Before this, the tanks had 780 horsepower diesel engines. Thanks to the increase in power, the tank became more mobile. For the driver, the Russian car now has a display system that allows you to control the operation of the mechanisms, and a rear-view television camera. The automated control system independently warns of damage and accidents, and the commander’s workplace is equipped with a panoramic sight. The modernized machine has enhanced hull protection. The T-73B3 will receive Relikt dynamic protection modules and lattice screens along the entire hull. This increases the resistance of the vehicle's side projection to anti-tank cumulative weapons.

Chief designer of the Ural Design Bureau of Transport Engineering Andrei Terlikov says that the updated T-72B3 combines the best that modern tank building has today: reliable protection, high mobility, 24-hour fire control systems, communications equipment, powerful weapons and, most importantly, extreme reliability. All this allows us to consider him one of the best in the world. This fact has been confirmed more than once by the military competition “Tank Biathlon”. Here the T-72B3 competed not only with the more advanced Indian T-90, but also with the Chinese Type 96A. And still he came out victorious.

The T-72B3 also compares favorably with foreign tanks. Its advantages include a new engine, modern digital communications, all-aspect protection, as well as a guided weapons system that allows you to fire a missile at ranges of up to 5,000 meters from a standstill, day and night. Due to the use of a two-stage air purification system and a highly efficient cooling system of the power plant, it can be operated in conditions of high dustiness and elevated ambient temperatures of more than fifty degrees. At the same time, despite all this, its mass did not exceed 50 tons.

The American M1A1 Abrams today weighs 70 tons. The vehicle is overloaded with “innovations”: additional protective modules made of armored steel and composite armor on the frontal projection. Because of this, its nose is overloaded, which leads to failure of chassis elements when driving over rough terrain. In addition, due to excess weight, the American also lost mobility. And this, as the experience of military conflicts in recent years shows, instantly leads to the fact that the vehicle becomes easy prey for the crews of anti-tank missile systems or tank gunners.

Military observer for the American publication The National Interest Dave Majumdar is confident that as a result of the massive improvement of the T-72B3, the Russian army received combat vehicles with characteristics that are not inferior to the latest models. At the same time, at an order of magnitude lower costs. And this is another main advantage of such high-tech and advanced Russian military equipment.

Sample of filling out the unified form T-73

The act of acceptance of work on the basis of a fixed-term contract must be drawn up in two copies, one of which is given directly to the person who performed the work, and the second is sent to the accounting department for the purpose of carrying out the appropriate calculations and accruing the amounts payable. To correctly and correctly fill out this document, it is advisable to download the established sample.

It is provided that the unified form T-73 is filled out in the following order:

- at the top of the form, the name of the enterprise and its department is written in two lines;

- company code taken from the All-Russian Classifier of Enterprises and Organizations;

- code provided by the all-Russian classifier of economic activities;

- the number is written in the corresponding columns (columns), the date when it was signed, and the period during which its validity is maintained;

- the number of the act, the date when it was drawn up, as well as the reporting period corresponding to the time the work was carried out are indicated;

- the stamp approving the document is affixed with an indispensable indication of the position occupied by the head of the enterprise, as well as his signature, supported by the company seal;

- Duplicate data entry is made regarding the concluded employment contract, indicating the date of execution, as well as the full name of the employee who performed the work;

- data is entered into tabular fields with a list of each type of work, as well as funds accrued for their implementation, as well as the total amount payable, including advance payment;

- the work performed is confirmed, and it is also noted that there are no claims against the author of the work. The required characteristics of the work must be indicated, as well as the amounts of monetary remuneration to be paid;

- the employee’s personal signature is placed regarding the implementation of his labor obligations;

- Finally, the document is endorsed by the signatures of three representatives of the employing company, which must certainly include the chief and senior accountant.

Thanks to the example of filling out the act, you can clearly see in what order and how the form of this document should be filled out. Due to this, the document preparation process is greatly simplified and the likelihood of errors is minimized.

In accordance with stat. 58 of the Labor Code, the employing company has the right to hire personnel not only for an indefinite period, but also with a reservation regarding the timing (volume) of work performed. For this purpose, a fixed-term employment contract (FTA) is concluded. Acceptance of work under a fixed-term employment contract concluded for a time is carried out on the basis of a special unified form T-73. In what order is this document completed? All details below.

Registration of STD is carried out by enterprises not in all cases of hiring personnel, but only if there are grounds according to the statute. 59 TK. For example, the need for a temporary specialist may arise during a short-term absence of the main employee, when an employee is sent abroad, when the employer has interns, interns, etc. According to the norms of stat. 79 STD must be concluded for a certain period, but not more than 5 years. If you do not specify the duration of the contract, the transaction is automatically recognized as unlimited.

When a specialist is hired by a company not on a permanent basis, but to perform certain work in accordance with the concluded STD and on the basis of Article 79 of the Labor Code, the employer should properly formalize the acceptance of the work performed. The specific acceptance procedure must be specified as a separate condition in the concluded contract. The form of the corresponding document, the certificate of completion of work, form T-73, was approved at the federal level in Resolution of the State Statistics Committee of Russia No. 1 of 01/05/04.

Note! According to special instructions for the application of this regulatory act, each enterprise has the right, but not the obligation, to use unified forms of documentation in accordance with Resolution No. 1. An employer can independently develop forms, but with the obligatory reflection of all mandatory details.

Consequently, we found out that when accepting work under a fixed-term employment contract concluded for the duration of certain work, the parties must sign an act f. T-73. How is this document compiled? First of all, in the STD itself, participants in labor relations must foresee at what point the work is accepted - at once or in stages. If the employer uses a form developed independently, the manager must approve the forms of the documents used in the order.

The act reflects data on the nature of the work, the total cost, the responsible specialist, the number and date of the technical documentation, the volume and quality of the results obtained. The form is filled out by an authorized officer of the company, approved by the manager, and payment is calculated by an accountant. The document is drawn up in 2 copies, one for each of the interested parties.

Time sheet (form T-13, form)

Fill out and print the Timesheet in the LS program · Timesheet and schedules

Form N T-13 “ Working Time Sheet”

» is used to record working hours.

It is drawn up in one copy by an authorized person, signed by the head of the structural unit, an employee of the personnel department, and transferred to the accounting department.

Notes in the report card on the reasons for absence from work, work part-time or outside the normal working hours at the initiative of the employee or employer, reduced working hours, etc.

are made on the basis of documents executed properly (certificate of incapacity for work, certificate of fulfillment of state or public duties, written warning of downtime, application for part-time work, written consent of the employee to work overtime in cases established by law, etc.).

To reflect the daily working time spent per month for each employee, the timesheet is allocated:

- in form N T-13 (column 4) - four lines (two for each half of the month) and the corresponding number of columns (15 and 16).

In form N T-13 (in columns 4, 6), the top line is used to mark the symbols (codes) of working time costs, and the bottom line is used to record the duration of worked or unworked time (in hours, minutes) according to the corresponding codes of working time costs for every date.

If necessary, it is allowed to increase the number of boxes to enter additional details according to the working hours, for example, the start and end times of work in conditions other than normal.

Working time costs are taken into account in the Timesheet either by completely recording appearances and absences from work, or by registering only deviations (absences, tardiness, overtime, etc.).

When reflecting absences from work, which are recorded in days (vacation, days of temporary disability, business trips, leave in connection with training, time spent performing state or public duties, etc.

), in the Table in the top line, only symbol codes are entered in the columns, and in the bottom line the columns remain empty.

Form N T-13 “Working time sheet” is used for automated processing of accounting data.

When drawing up a report card in form N T-13:

- When recording accounting data for payroll for only one type of payment and a corresponding account common to all employees included in the Timesheet, fill in the details “type of payment code”, “corresponding account” above the table with columns 7 - 9 and column 9 without filling out columns 7 and 8;

- when recording accounting data for payroll for several (from two to four) types of payment and corresponding accounts, columns 7 - 9 are filled in. An additional block with identical column numbers is provided for filling out data by types of payment, if their number exceeds four.

Form N T-13 report cards with partially filled in details can be produced using computer technology. Such details include: structural unit, last name, first name, patronymic, position (specialty, profession), personnel number, etc. — that is, the data contained in the directories of conditionally permanent information of the organization. In this case, the form of the report card changes in accordance with the accepted technology for processing accounting data.

·····

[1] Resolution of the State Statistics Committee of the Russian Federation dated January 5, 2004 N 1 “On approval of unified forms of primary accounting documentation for labor accounting and its payment”

Program: LS · Time sheet and schedules

Source: https://lugasoft.ru/blank/t-13-tabel-ucheta-rabochego-vremeni

Procedure for filling out form T-73:

- Header - here the exact name of the employing company is given, if there is a structural unit, as well as the main codes: OKPO, OKVED. The date and number of the contract concluded with the STD employee, as well as the period of its validity, are indicated separately.

- Act number and date – chronological data is entered. The document is approved by the head of the company.

- Information about the employee - information about the STD and the individual involved in performing the work is duplicated here.

- Tabular part - here information is provided on the list of work performed and their cost, previously issued advances are displayed, additional payments or overpayments are calculated.

- Information about the work - here it is indicated how much work was done, what quality/level it corresponds to, and the exact cost is assigned.

- Handover and acceptance - completed work is confirmed by personal signatures of the parties. At the end, the document is approved by the responsible persons - the manager and the chief accountant of the employer.

To avoid problems with inspectors, including liability and penalties for incorrectly compiled personnel documents, it is recommended to include a reference to the f. in the terms of a fixed-term employment contract. T-73 when accepting work from the contractor. It is better to agree on the form itself at the stage of signing the STD, so that in the future the employer does not have any misunderstandings with the specialist. Typically, filling out the form does not raise any questions, and a practical example will help you clearly understand the nuances of reflecting all the information. If the contractor performs various works, you need to enter information separately, broken down by type. This will allow you to accurately calculate the amount of remuneration to an individual and justify the expenses incurred to the employer for tax purposes.

Filling out the completed work form

The above-mentioned work acceptance certificate in form T-73 must be approved by the organization, like all unified forms approved by Resolution of the State Statistics Committee of Russia No. 1 of 01/05/2004. An album with unified forms is approved by order of the head of the organization. In this case, an addition may be made to the order with the approval of a new form.

Now let’s look at the form itself and how to fill it out:

- the header of the T-73 form indicates the organization and structural unit of the organization in which the temporary employee works;

- the form must contain information about the approval of the form by the manager;

- Next comes information about the fixed-term agreement under which this act is drawn up;

- then a table is filled in, which indicates the work directly performed and the amount due to the temporary worker for each of the works;

- after the table there are indications of the volume of work performed, its quality and level;

- then the signatures of the temporary worker and the employee authorized to accept work;

- At the end, the act is agreed upon by the head of the organization and the chief accountant of the company.

In a fixed-term employment contract, it is recommended to make a reference to the work acceptance certificate in form T-73, which will accept the work. This form can be attached to the contract as an annex so that the temporary employee can express his disagreement or proposal to change the form in advance. Agreeing on the act before signing the contract will allow the parties to avoid disputes directly during acceptance.

In accordance with stat. 58 of the Labor Code, the employing company has the right to hire personnel not only for an indefinite period, but also with a reservation regarding the timing (volume) of work performed. For this purpose, a fixed-term employment contract (FTA) is concluded. Acceptance of work under a fixed-term employment contract concluded for a time is carried out on the basis of a special unified form T-73. In what order is this document completed? All details below.

Registration of STD is carried out by enterprises not in all cases of hiring personnel, but only if there are grounds according to the statute. 59 TK. For example, the need for a temporary specialist may arise during a short-term absence of the main employee, when an employee is sent abroad, when the employer has interns, interns, etc. According to the norms of stat. 79 STD must be concluded for a certain period, but not more than 5 years. If you do not specify the duration of the contract, the transaction is automatically recognized as unlimited.

When a specialist is hired by a company not on a permanent basis, but to perform certain work in accordance with the concluded STD and on the basis of Article 79 of the Labor Code, the employer should properly formalize the acceptance of the work performed. The specific acceptance procedure must be specified as a separate condition in the concluded contract. The form of the corresponding document, the certificate of completion of work, form T-73, was approved at the federal level in Resolution of the State Statistics Committee of Russia No. 1 of 01/05/04.

Note! According to special instructions for the application of this regulatory act, each enterprise has the right, but not the obligation, to use unified forms of documentation in accordance with Resolution No. 1. An employer can independently develop forms, but with the obligatory reflection of all mandatory details.

Consequently, we found out that when accepting work under a fixed-term employment contract concluded for the duration of certain work, the parties must sign an act f. T-73. How is this document compiled? First of all, in the STD itself, participants in labor relations must foresee at what point the work is accepted - at once or in stages. If the employer uses a form developed independently, the manager must approve the forms of the documents used in the order.

The act reflects data on the nature of the work, the total cost, the responsible specialist, the number and date of the technical documentation, the volume and quality of the results obtained. The form is filled out by an authorized officer of the company, approved by the manager, and payment is calculated by an accountant. The document is drawn up in 2 copies, one for each of the interested parties.