Any receipt of goods must be documented with the appropriate primary document. The State Statistics Committee of Russia has developed a unified form TORG-1, which should reflect the receipt of material assets according to quantitative and cost estimates. The act of acceptance of goods is confirmation of shipment in accordance with contractual obligations. Responsibility for the timely and correct execution of such a primary document lies with the members of the commission appointed by the head of the company. In the article we will tell you about TORG-1 Certificate of Acceptance of Goods, and we will provide a sample for filling it out.

In what cases is an act drawn up?

Acceptance of goods according to the act can be carried out in the following cases:

- If the acceptance of inventory items is carried out not by the materially responsible person, but by a specially appointed commission.

- In the event that the qualitative and quantitative indicators of the goods do not correspond to the contractual terms;

- If such a procedure for the receipt of goods is determined by the company’s internal document flow.

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

Specifics and features of planning

You should not distribute time in such a way that the process of acceptance, quality and quantity assessment falls on the day or inventory period. These two processes cannot occur simultaneously, and interrupting one of them can create unnecessary complications.

Software tools will come in handy when accepting goods. So the acceptance committee, having familiarized itself with the data, will be aware of:

- Details regarding the purchased material assets: type, expected weight and volume of delivery, type of packaging (cardboard, paper, polystyrene foam).

- Dates or delivery times, the general quantitative value of the parties.

- What parameters must the arrived goods meet?

- Information regarding the package of documents that you need to have for acceptance.

- Rules by which the process with the supplier must be carried out.

Without knowledge of these nuances, employees will not be able to fully perform their duties in accepting goods.

Filling out the TORG-1 form

The obligation to fill out the unified TORG-1 form occurs upon the actual receipt of inventory items. The responsible person checks the completeness, quality and quantity with the information specified in the form. If inconsistencies and disagreements arose during acceptance, then such facts are reflected in the TORG-2 and TORG-3 acts. The act of acceptance of goods is controlled by a commission appointed by the head of the enterprise.

The TORG-1 form has a title header, a tabular part and a final section, which reflects the comments of the responsible persons and their signatures.

The title part of the document reflects the following information:

- Full name of the company;

- Details of the document on the basis of which the goods acceptance certificate is drawn up;

- The structural unit where goods are received;

- Information about primary accompanying documents (waybill, invoice);

- Information about the shipper (this information is especially important if the manufacturer and supplier are not the same person);

- Method of delivery of goods. This line indicates what type of transport the goods were delivered (by train, refrigerator, ship). If violations were committed during the transportation of valuables, then such goods may not be accepted according to the act.

- For food products subject to veterinary inspection, the date and number of the certificate received are entered.

- If the goods were insured, then the information of the insurance company is reflected in the form;

- Temperature conditions for products to be refrigerated;

- Date of arrival of inventory items.

The second section of the form lists the entire range of goods received, its quantity, weight and cost indicated in the supplier’s accompanying documents. Certification information is also provided for the product. The third section reflects actual data on the availability, quantity and weight of goods. The VAT tax rate and its amount are reflected in a separate column.

If various inconsistencies were discovered during the acceptance process, they are also recorded in the tabular section in the “Deviations” section. Moreover, negative values are reflected with a minus sign. The fourth page of the TORG-1 form contains the conclusion of the selection committee and the signatures of the responsible persons.

If a discrepancy is identified, an explanatory note is made in the form, on the basis of which the head of the company makes his decision on taking the necessary measures. A careful assessment of the received goods, as well as the entry of identified deviations, will become documentary evidence in the event of a dispute with the supplier.

Filling

At the top of the paper is the name of the company for which the goods were delivered, as well as the city of origin and date. The director also signs here as approval of the document.

Then they write down in detail:

- Address of the company and the actual place of receipt of goods (opening of packaging, etc.).

- Start time and end time of acceptance.

- Composition of the acceptance committee. The full name of each member and chairman, their positions and place of work (in the host company) must be indicated.

- Details of the supplier's representative: full name, position, organization represented. In addition, you need to indicate on the basis of which document it is acting (power of attorney, certificate).

How to correctly fill out a goods acceptance certificate

In order to avoid disputes with counterparties and tax authorities, the act of acceptance of goods must be drawn up in accordance with the law. For example, this is especially important when confirming the validity of the deduction of input VAT.

An incorrectly completed TORG-1 form may serve as a reason for refusing to reduce the budget payment.

In order to correctly draw up a document, you must follow the following rules:

- All columns related to a specific item must be filled out.

- The document must be signed by authorized persons.

- If the supplier is a person exempt from the accrual and payment of VAT, then this fact must be noted in the contract.

- When drawing up the act, it is necessary to check the availability of a veterinary certificate, invoice, and delivery note.

If an incorrect completion of the act was discovered, it must be redone. Particular attention should be paid to signing the document. Quite often, a facsimile signature is used in accounting documents, which is not always approved by the tax authorities. In accordance with Art. 160 of the Civil Code of the Russian Federation, such endorsement of documents is quite acceptable, but in order to avoid a conflict situation with regulatory authorities, such documents are not recommended to be taken into account.

How to draw up a goods acceptance certificate without errors

The Goods Acceptance and Transfer Certificate is a document that is used when the information specified in the invoice is insufficient and a detailed description of the assets being transferred is required.

Reception of goods according to the invoice confirms only the fact that the delivery of goods and materials was carried out by item in the specified quantity. Sometimes for optimal acceptance and transfer of goods and materials, the details in the invoice are not enough. In this case, use the form of the acceptance certificate.

The current legislation does not contain a unified form: it is a free form that describes in detail all the characteristics of assets, indicating characteristics, defects, quantity and cost.

But at the same time, every fact of economic life is subject to registration with a primary accounting document, which is determined by Art. 9 of Law No. 402-FZ “On Accounting”.

These circumstances give organizations the right to independently develop forms of primary accounting documents, including permission to develop an act of acceptance and transfer of material assets. Independently developed forms must be approved in the accounting policy.

Application of the document

Let's take a closer look at the cases when this document is drawn up:

- discrepancy in quantity and quality of material assets;

- receipt of goods without documents;

- transfer of material assets for safekeeping;

- transfer of assets under a commission agreement;

- transfer of values within the organization between structural divisions or financially responsible persons;

- transfer of valuables for temporary use (for several hours or days).

The sample below can be used simultaneously with the MX-1 form for acceptance and transfer of inventory items for storage.

Form of transfer act MX-1

The transfer of cases when changing responsible persons is formalized by an act of acceptance and transfer of cases, but in certain situations the given example of an act of acceptance and transfer of goods and materials is allowed to be used: for example, for the transfer of keys to a safe, valuable equipment, etc.

Required details

The form must contain the following mandatory details:

- Title of the document;

- place of compilation;

- Date of preparation;

- information about the seller and buyer (name of organization, full name of director or individual entrepreneur, passport details, addresses and telephone numbers);

- reference to the subject, number and date of the contract;

- a complete description of the quality characteristics of the product, indicating defects;

- signatures of responsible persons;

- press of organizations.

One of the required details is the cost of the transferred inventory. At the same time, the seller is obliged to indicate the amount of VAT or the reason for tax exemption. In this case, the buyer will not have any controversial situations with the possibility of refunding VAT or attributing the full cost to expenses for income tax purposes.

It is also necessary to indicate the amount of funds received on the date of transfer of material assets.

Indication of the prepayment received is not mandatory, but if used, it will facilitate further offsetting of mutual counter obligations, signing a reconciliation of mutual settlements, and in the case of transfer of payment for the supplier by third parties, it is mandatory to confirm the correctness of the calculations.

Legal subtleties

The document is drawn up in at least two copies for each party at the time of transfer of inventory items. Only authorized persons can sign it. If the buyer is a legal entity, then the powers of the representative, an individual, are confirmed by a power of attorney.

It should be noted that the obligation to transfer material assets with the execution of a deed is necessarily reflected in the contract. It is advisable to make the form itself as an annex to the contract.

In this case, a simple sample act of acceptance and transfer of goods has the same legal force as the contract itself.

If you have such a sample, you can familiarize yourself in advance with the main columns that must be filled out.

The presence of such a document as an act of transfer of material assets turns out to be very important for resolving controversial issues in court. It indicates the fact of acceptance and transfer of assets of proper quality and compliance with the entire procedure for the transfer and acceptance of goods. Proof of the absence of violations in the process of receiving goods is the following facts reflected in the document:

- material assets were inspected and accepted in the presence of an authorized representative of the supplier;

- there is no discrepancy in quality and quantity;

- delivery was carried out on time and without violation of delivery conditions;

- there are no claims against the counterparty (supplier, buyer, forwarder, intermediary).

Storage of primary documents

For tax accounting purposes, the primary record must be stored for 4 years (clause 8, clause 1, article 23 of the Tax Code of the Russian Federation). It should be noted that if a loss is incurred, then documents confirming expenses must be kept for 10 years (clause 4 of Article 283 of the Tax Code of the Russian Federation).

For accounting purposes, the primary record is stored for 5 years (Article 29 of Law No. 402-FZ “On Accounting”).

act of acceptance and transfer of goods

act of acceptance and transfer of property

act of acceptance and transfer of goods and materials for storage (xls format)

Source: https://ppt.ru/forms/tmc/akt-priema

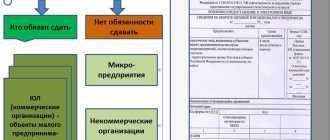

Is it possible to change the unified form of the act?

Until recently, it was possible to accept goods only using the unified TORG-1 form. With the entry into force of Federal Law No. 401-FZ, the rules for preparing primary documents have changed. Now companies have the right to independently develop convenient forms of documents that will best suit the specifics of their business. According to accounting rules, samples of such forms must be included in the accounting policy of the enterprise.

Mandatory and optional document details:

| Mandatory | Optional |

| Form name, date and document number | Shipping method |

| Name of company | Availability of a veterinary certificate |

| Product range, quantity | Information about the insurance company |

| Signatures of officials | Place of goods acceptance |

The finalized act of acceptance of goods will have legal force only if all required details are present.

Certificate of acceptance of goods: own or unified form

Until 2013, enterprises used unified forms of primary documents from the albums of the State Statistics Committee of the Russian Federation.

With the entry into force of the Federal Law “On Accounting” dated December 6, 2011 No. 402-FZ (hereinafter referred to as Law No. 402-FZ), significant changes were made to the rules for drawing up primary accounting documents. Organizations received the right to independently develop certain forms of primary documents and approve them in their accounting policies. Forms from albums of unified forms are no longer mandatory for use in accounting.

This does not mean that enterprises can no longer use unified forms developed by statistical authorities. Creating an album of your own forms of primary documentation in accordance with the law is a right, but not an obligation of the organization.

Own documents must have the required details, which are specified in Art. 9 of the current Law No. 402-FZ, for example:

- title of the document and its date;

- Name of the organization;

- nomenclature of goods, works and services (fact of a business transaction) and their measurement;

- Full name, position and signatures of the persons responsible for the transaction.

Currently, it is allowed to use an act of acceptance of goods in the TORG-1 form, which was approved by Decree of the State Statistics Committee of the Russian Federation dated December 25, 1998 No. 132. You can download a sample of the TORG-1 form for an act of acceptance of goods on our website.

Grounds for suspending acceptance of goods

The buyer may suspend acceptance of the goods and draw up an act of suspension for the following reasons:

- When registering the goods, a discrepancy in labeling, quality and quantity was discovered;

- The integrity of the packaging is compromised and does not meet the requirements of regulatory and technical documentation;

- Violation of contractual obligations;

- Errors in accompanying documents;

- The product has expired the expiration date indicated on the packaging or is simply missing;

If violations are identified, a report is drawn up that reflects the nature of the identified defects. At the time of the proceedings, the buyer must ensure proper storage of the goods, under conditions that preclude mixing with similar homogeneous goods and materials.

Acts of disagreement upon acceptance of goods, forms TORG-2 and TORG-3 - sample forms

In business practice, there are circumstances in which the parties to a transaction have disagreements regarding the volume of goods or their quality indicators. For example, the accompanying documents indicate one quantity, but in fact it turned out to be completely different. In such cases, an act of disagreement is drawn up upon acceptance of the goods.

Data is entered into this document according to the real state of affairs, and it must be signed by members of the commission being created and a representative of the supplier. It must be drawn up for each supplier with whom disagreements have arisen, and for each disputed batch of goods. After registration, the act must be transferred to the accounting department with all accompanying documents.

It is noteworthy that special forms are provided for such documents, and for goods of Russian origin one form is used - TORG-2, drawn up in 4 copies, and for imported goods - TORG-3, drawn up in 5 copies.

For an act of disagreement upon acceptance of goods, a sample TORG-2 form can be downloaded on our website.

In addition to this form, the TORG-3 form is also available for download on our website.

Shortage, surplus or mis-grading upon receipt of goods

Receiving goods is one of the most important procedures in the operation of a warehouse or store. If a shortage or excess quantity of products is not noticed during the receipt process, then in the future this will negatively affect its accounting.

The most common mistake that occurs when receiving goods is their shortage.

There are several reasons for this:

- the supplier made a mistake when loading transport at its warehouse;

- non-compliance with the quality characteristics declared by the supplier, including damage to the goods during transportation;

- error when posting goods.

If a shortage is identified due to a discrepancy in quality or quantity, it is necessary to fill out a report in the form TORG-2 (for Russian products) and according to TORG-3 (for imported supplies).

If you receive a quantity of products exceeding that specified in the contract, you can:

- draw up a notice of return of the surplus;

- accept all goods and agree to receive a discount;

- independently decide on the sale of excess quantity, taking into account the costs of finding a buyer and shipping products;

- return the products to the supplier if this condition is specified in the contract.

All actions that will be carried out after identifying a surplus must be agreed upon with the organization that shipped the products, or described in advance in the contract.

If a shortage of one type of product and a surplus of another is detected, it is necessary to draw up documents about the re-grading in the TORG-2 form (or TORG-3, if you are selling imports) and file a claim with the supplier. According to the rules for acceptance of goods, such delivery can be accepted in full, not accepted, or accepted partially.

For example, when ordering 100 packs of milk with 2.5% fat content, the store delivered 80 packs of 2.5% fat and 20 packs of 3% fat.

In this case, the rules for accepting goods in a store allow the following options:

- accept all delivered products;

- take 80 packs of 2.5% fat;

- refuse to accept all delivered products.

Form TORG-18. Journal of goods movement in the warehouse

The journal is used to record the movement and balances of goods and containers in a warehouse (storeroom). When automated processing of document data by means of computer technology, it is possible to use the proposed form in the form of a separate statement on paper and computer storage media. Entries in the journal are made on the basis of receipt and expenditure documents or accumulative statements for accounting for the release of goods and packaging for the day.

Form TORG-18. Instructions for filling

Who draws up the act of discrepancy and when?

A report on discrepancies upon acceptance of goods is drawn up by a commission created for this purpose, which includes representatives of the buyer and a representative of the party that transferred the goods to the buyer (for example, a carrier). It is advisable to include a representative of the supplier in this commission. It is assumed that a discrepancy report upon acceptance of goods is drawn up at the moment such a discrepancy is detected upon acceptance of goods. However, it is possible that such a discrepancy will be revealed later. This will not affect the order in which discrepancies are activated. At the same time, it is necessary to take into account that the discrepancy report will be the basis for subsequent filing of a claim with the supplier or carrier in connection with the shortage or detected defect. And if the contract does not provide for the buyer’s right to make a claim in connection with the subsequent identification of discrepancies, and such a discrepancy could have been established upon acceptance, it is unlikely to be able to recover losses from the supplier or carrier if discrepancies are discovered late.

Certificate of acceptance of goods by quantity and quality (Sample of filling)

The Commission is familiar with the Instructions on the procedure for accepting products for industrial and technical purposes and consumer goods by quantity ________________________________________________________________. Supplier name ______________________________________________. Name and address of the sender (manufacturer) ______________________. Date and invoice number _________________________________________________. Date and number of the waybill ___________________________________. Departure station (pier, port) and departure date _______________ __________________________________________________________________________. Destination station and time of cargo arrival ____________________________. The time of delivery of the cargo by the transport authority is ________________________________. Time for opening a wagon, container, van and other sealed vehicles _____________________________________________________. The time for delivery of products to the recipient's warehouse is _________________________. Number and date of the commercial act (act issued by the road transport authority) _______________________________________________________________. Conditions for storing products at the recipient's warehouse until acceptance are _________ __________________________________________________________________________. The determination of the quantity of products (goods) was carried out on working scales or other measuring instruments, tested in the prescribed manner by ________________________________________________. The condition of the containers and packaging at the time of inspection of the products, the contents of the external markings of the containers and other data on the basis of which it is determined in whose packaging the products are presented - the sender or the manufacturer ______________________________________________________________ __________________________________________________________________________. Date the container was opened ___________________________________________________. The procedure for selecting products for random inspection, indicating the grounds for the random inspection (standard, special delivery conditions, contract, etc.) __________________________________________________________________________. For whose weight or seals the products were shipped ________________________ ______________________________, the condition of the seals __________________________. (sender, transport) (serviceable, faulty) Contents of seal impressions ____________________________________________. (according to documents and actually) The weight of each place in which a shortage was found (actual and according to the stencil on the container (packaging)) _____________________________________________________. Marking of places ______________________________________________________________. (according to documents and in fact) Presence or absence of packaging labels and seals in certain places __________________________________________________________________________. Mark on delivery of cargo ________________________________________________. When checking the cargo it was established: ————————————————————————————— ¦Name¦Unit. ¦Price¦ According to ¦Actually received ¦ ¦ products ¦measured¦ ¦documents¦ ¦ ¦ ¦ ¦ ¦ deliveries ¦ ¦ ¦ ¦ ¦ +———-+——————————————— + ¦ ¦ ¦ ¦Quantity-¦Amount¦Quantity-¦Amount ¦ Fight ¦ Surplus ¦ Shortage ¦ ¦ ¦ ¦ ¦in ¦ ¦in ¦ +————+————+————+ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦Quantity¦Amount ¦Quantity¦Amount ¦Quantity¦Amount ¦ +————+—-+—-+—-+——+—-+——+—-+——+— -+——+—-+——+ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ +————+—-+—-+—-+——+—-+——+— -+——+—-+——+—-+——+ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ————- +—-+—-+—-+——+—-+——+—-+——+—-+——+—-+——- When checking the cargo, it was established: How was the quantity of missing products determined ____________ ________________________________________________________________________________ . (by weighing, counting places, measuring, etc.) Could the missing products fit into a container, wagon, container, etc.? __________________________________________________________. Conclusion on the causes and location of the shortage ___________________ __________________________________________________________________________. Persons involved in the acceptance of products (goods) are warned of responsibility for signing an act containing data that does not correspond to reality. Signatures of the commission members: 1. ____________________ 2. ____________________ 3. ____________________ 4. ____________________ Representative of the supplier (disinterested organization, public) ____________________ (signature)

Comments: