Working time recording (legislative basis)

Accounting for hours worked when employed according to a shift schedule

Remuneration under summarized accounting

How is the standard working time calculated for the reporting period?

Shortcomings in the summarized accounting of time worked

How is work paid if there are deficiencies due to the fault of the employer?

Payment for work in the event of deficiencies due to the fault of the employee

Payment for labor in the event of deficiencies due to reasons beyond the control of the parties

Working time recording (legislative basis)

According to Part 4 of Art. 91 of the Labor Code, employers are required to record the time worked by each employee of the team. At the same time, the same Art. 91 provides a standard standard for working hours of no more than 40 hours per week (that is, with 5 working days - no more than 8 hours per day).

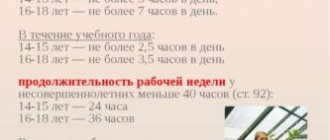

However, some groups of workers can legally work under reduced hours - then the normal duration of a work shift for them will be 24, 35 or 36 hours a week.

Accounting for working time for a specific employee makes it possible to identify the discrepancy between the actual time worked and the maximum standards established by law. In this way, both overwork and shortcomings are identified.

Time worked can be counted on a daily, weekly or cumulative basis. Daily accounting involves working every day for the same number of hours (for example, 8). Weekly accounting requires compliance with maximum standards for the duration of work activity per week (for example, no more than 40 hours), while the duration of day shifts may vary.

Summarized accounting is characterized by the presence of a pre-selected reporting period, which is a measure of compliance with legally established standards for the maximum duration of labor time. Moreover, within a period, the duration of working days and weeks may differ from each other and may not correspond to the legally established working hours.

conclusions

When working in the summary accounting mode, shortcomings may occur. This concept is usually understood as the difference between the time set for working and the time actually worked. A deficiency may arise due to the fault of any party to the employment relationship.

The technology of payment for unworked time depends on this factor. If the employer is to blame, the time is paid according to the average.

If the employee is at fault, payment is made according to the time actually worked. When terminating an employment relationship, similar rules must be followed.

Accounting for hours worked when employed according to a shift schedule

| Sample of filling out a shift schedule |

ConsultantPlus has many ready-made solutions, including how to pay for work on a “every three days” schedule. If you don't have access yet, you can get it for free, on a temporary basis! You can also get the current K+ price list.

When conducting work activities on a shift schedule, the method of recording the period worked becomes of particular importance. Due to the fact that during shift work, daily or weekly working time standards may not correspond to the limits established in regulations, a method of recording time worked is necessary in which the legal standard for working hours will be observed at least in a certain working period.

The summarized accounting method meets these conditions (Article 104 of the Labor Code of the Russian Federation). The selected reporting period in this case may correspond to a month, quarter, half-year or year, while for workers in harmful or dangerous work the reporting period cannot be more than 3 months. However, a special decision established by an intersectoral agreement and count. agreement, if, when using a quarterly reporting period, it is impossible to comply with legislative standards for working hours, the reporting period for such employees can be extended to a year.

Calculation of the standard duration of work activity for summarized accounting is made based on a certain maximum per week (for example, 40 hours). If summarized accounting is applied to a specialist for whom the Labor Code defines a shortened work week (24, 35, 36, etc. hours), then at the end of the reporting period the amount of hours worked during this time should not exceed the established norms. The procedure for introducing summarized accounting in relation to both the entire workforce and individual staff units is established by the internal documentation of the enterprise, in which it is necessary to indicate the scope of the reporting period.

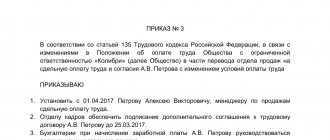

| Sample filling order to introduce a shift schedule |

Working time calculation

In addition to the number of working hours in a shift, the employer must also take into account the work activities of employees that deviate from the norm. In accordance with Art. 149 of the Labor Code of the Russian Federation, this concept includes overtime work, night work, as well as work on weekends and holidays. If an employee works in these circumstances, then the employee has the right to count on additional payments. When calculating working hours, those working hours during which the employee did not work, but his position was retained (including all types of vacations, as well as business trip time), are not taken into account. In addition, the hour by which working hours are reduced before the holiday weekend is also not taken into account.

Remuneration under summarized accounting

When using the summarized method of recording labor time, wages are calculated, as a rule, using hourly tariff rates or salaries. If the company uses an hourly tariff rate, then the payment at the end of the month is calculated by multiplying the rate by the number of hours worked.

For example, the tariff rate for a particular employee in October 2020 is 150 rubles. per hour in the “every three days” operating mode. Thus, this specialist worked 8 shifts, which was the full schedule. It turns out that the salary of this specialist for October 2020 will be 24 × 8 × 150 = 28,800 rubles.

If an official salary is established for an employee, then when a norm of shifts is developed in accordance with the schedule, this employee will receive a full salary (the same amount of money) every month.

Subscribe to our newsletter

Read us on Yandex.Zen Read us on Telegram

Calculation of working hours for a specific period

On August 13, 2009, the Ministry of Health and Social Development of the Russian Federation issued Order No. 558-, in which it explained the typical standards for calculating working hours:

- The number of hours worked per week for a particular employee is divided by 5 and then multiplied by the sum of days worked. Under the condition of a 40-hour normalized work week, the following is obtained: 40 / 5 * 21 = 168 hours per month (in which there are 21 working days);

- The hours that the employee did not spend at work together due to shortened working days (due to holidays or other circumstances) are deducted from the amount.

The same should be done when calculating the time standard in different reporting periods.

How is the standard working time calculated for the reporting period?

The rules for calculating working time standards for reporting periods of different lengths are established by order of the Ministry of Health and Social Development of Russia dated August 13, 2009 No. 588n. In accordance with this document, the calculation of the standard time for working activities is carried out as follows:

- The length of the working week established for the employee (40, 39, 36, etc. hours) is first divided by 5, then multiplied by the number of days of work according to the calendar based on the 5-day working week of the month in question. Thus, with a standard for an employee of 40 hours per week, the standard for October 2020 will be 40 / 5 × 21 = 168 hours.

- From the result obtained, it is necessary to subtract the number of hours by which pre-holiday days are reduced, if there are any in the desired month.

By analogy, the standard labor time is calculated for any other accounting period (quarter, half-year, year). As a result, if the company has established a summarized accounting of time worked and a quarter is selected as the reporting period, the standard working time for a 40-hour work week for the 3rd quarter of 2020 will be:

- July - 184 hours;

- August - 168 hours;

- September - 176 hours.

That is, in order to develop a standard according to the schedule for the 3rd quarter of 2020, the worker must ultimately work 528 hours.

Basic moments

In addition to the above, this article contains information about the standards governing the maximum amount of time that an employee must work (40 hours per week).

Also, specialists and employers are aware that for some groups of workers a shortened schedule has been introduced, which allows them to spend less time at work. In each individual case, it may happen that the actual time worked does not coincide with that which should be, taking into account the standards defined by the legislation of the Russian Federation. In this case, we observe a deficiency or overwork. It is important to understand that you do not have to work 8 hours every day to comply with the rules. There are different options for calculating time worked and different work schedules.

If time recording occurs daily, this indicates an even distribution of 40 working hours. Such employees work 5 times a week, 8 hours a day. Weekends may be variable.

Shortcomings in the summarized accounting of time worked

In the final calculation of the time worked by each member of the workforce in the reporting period, overtime or shortfalls may occur for various reasons. That is, it may be discovered that the specialist has worked excessively, or, on the contrary, there has been a lack of time worked in comparison with the norm.

It is important to take into account that the presence of overwork or shortcomings in the summary recording of working time can only be discussed at the end of the reporting period, since within it the hourly duration of a day, week or month of work activity may go beyond the standards.

Defects in summary accounting can arise both through the fault of the employer and the fault of the worker or circumstances beyond the control of both parties.

- Through the fault of the employer, shortcomings may arise primarily due to an incorrectly drawn up shift schedule.

- Due to the fault of the employee, shortcomings are possible due to vacation days without pay or sick leave.

Note: determining the cause of the deficiency is of fundamental importance, since depending on this, the amount of additional payment to the employee is determined, as well as whether there will be such an additional payment at all or not.

What is the threat?

It was noted earlier that with summarized accounting (SURA), an accounting period is established for employees working on a non-standard schedule.

Its duration is determined in each case individually. It is important to remember that the maximum duration of such a period is 1 year.

The phenomenon in which during this time the employee did not work the established norm is considered a deficiency.

This fact can only be revealed at the end of the accounting period, when data on time worked is entered into the time sheet.

A lack of time worked may arise due to several circumstances. The reason for this may be either the fault of management or the employee.

In the first case, shortcomings most often arise due to illiterate preparation of the work shift schedule. In the second situation - due to registration of unpaid leave or sick leave.

Shortcomings threaten the specialist with a reduction in wages.

It is also important to consider that the employer cannot always reduce an employee’s income due to failure to meet the established hourly rate.

Circumstances that do not affect workers' salaries must be indicated in internal documentation - in the company's accounting policies.

For example, the salary may not be reduced if the cause of the deficiency is a malfunction of the equipment on which the specialist works, which arose not through his fault, an accident or an emergency.

Payment rules

In accordance with Article 102 of the Labor Code of the Russian Federation, the head of an enterprise is obliged to provide workers with conditions under which they can work out the required hours.

In a situation where the employer does not provide such conditions, the defect is considered to be his fault.

In circumstances of this nature, the employee is entitled to mandatory payment for shortfalls. When determining its size, it is important to consider that it should not be lower than average. This rule is established by Article 155 of the Labor Code.

Shortfalls in cumulative working hours may arise through the fault of the worker. In this case, you must again be guided by the information reflected in Article 155 of the Labor Code of the Russian Federation.

It states that under such conditions, unpaid hours are not paid. An employee is paid based on the time actually worked.

In addition to all of the above, shortcomings may arise in the conditions of summarized time accounting due to the emergence of circumstances independent of any party to the labor relationship.

In this case, the management of the enterprise should pay attention to the same article 155 of the Labor Code of the Russian Federation. The normative act reflects that when such situations occur, payment for work is made proportionally, but not less than 2/3 of the official salary or the established tariff rate.

What to do with unworked hours upon dismissal?

According to current legislation, upon termination of an employment relationship, the employer must pay the employee all amounts due to him.

What to do in the case when a worker is assigned a summarized recording of working time?

If such situations arise, the accounting period, together with the standard hours to be worked, is calculated from the moment it begins until the day of dismissal.

To determine the amount of wages, it is important to take into account the reason for the occurrence of defects.

If, upon dismissal, a deficiency is determined to have arisen through the fault of the employer, the employee receives payment in an amount not less than the average.

In the case where unworked working time was due to the fault of the worker, the salary is calculated according to the time worked by the specialist.

How is work paid if there are deficiencies due to the fault of the employer?

According to Art. 102 of the Labor Code of the Russian Federation, the employer must ensure that the specialist produces total hours during the reporting period. If this does not happen, we can talk about shortcomings due to the fault of the employer.

When calculating an employee’s salary for such an unfinished period, it is necessary to follow the instructions of Art. 155 of the Labor Code of the Russian Federation, according to which, if an employee has a defect due to the fault of the employer, the specialist is entitled to an additional payment. Payment is made in the amount of no less than the average salary of the worker for the time actually worked.

For example, an employee has been assigned a summarized accounting of time worked and a month has been selected as the reporting period. The employee's salary is 25,000 rubles. In October 2020, normal working hours are 176 hours. According to the schedule, the employee must work 13 shifts of 12 hours each - a total of 156 hours per month. Accordingly, the shortfall will be 20 hours.

To determine the average salary of an employee, Art. 139 of the Labor Code of the Russian Federation and the Decree of the Government of the Russian Federation “On the Features...” of December 24, 2007 No. 922. Based on the requirements of paragraph 13 of the regulation approved by Decree No. 922, to calculate average earnings, you must first calculate the average hourly.

So:

- We determine the amount of payments for the billing period from October 2020 to September 2020: RUB 300,000. (salary for the past 12 months) + 10,000 rub. (overtime payment for the past year) + 54,000 rub. (total premium for the year) = RUB 364,000.

- We calculate the number of hours worked for the specified period: 1981 hours + 25 hours overtime = 2006 hours.

- We find the average hourly earnings: 364,000 rubles. / 2006 = 181.46 rubles.

- It remains to find the average earnings (additional payment) for shortcomings: 181.46 rubles. × 12 hours = 2,177.52 rubles.

Accounting for wages for unworked time

Accounting for payroll and deductions from it Read more: Accounting for remuneration of part-time workers

2.4.2 Accounting for wages for unworked time.

The procedure for paying vacations and compensation upon dismissal (types of payment: 040, 037).

Regular vacations are granted to full-time employees every year. The first is after 6 months of work. Subsequent ones - according to the schedule approved by the administration of the enterprise and agreed with the trade union committee. Annual basic paid leave is provided to employees for a duration of 28 calendar days (Article 115 of the Labor Code).

Part of the vacation exceeding 28 calendar days, upon the written application of the employee, can be replaced by monetary compensation.

Replacing vacation with monetary compensation for pregnant women and employees under the age of 18, as well as employees engaged in heavy work and work with harmful and (or) dangerous working conditions, is not allowed (Article 126 of the Labor Code).

The duration of the annual main and additional paid leaves of employees is calculated in calendar days and is not limited to a maximum limit. Non-working holidays falling during the vacation period are not included in the number of calendar days and are not paid.

When calculating the total duration of annual paid leave, additional paid leaves are summed up with the annual main paid leave (Article 120 of the Labor Code).

At the plant, the duration of vacation is calculated according to a 6-day working week. Annual main leave is granted for 24 working days (including Saturdays).

Payment for annual leave of employees of an enterprise is made based on earnings for the last 3 calendar months preceding going on leave.

Example: An employee of the main production went on vacation from October 16 to November 20 for 30 days (billing period July, August, September). October has 14 days and November has 16 days. Works under normal working conditions (8 hours a day, five days (40 hour work week)).

Table 5 - Calculation of bonus for vacation

| Period | Time scheduled, hour | Time actual, hour | Sum awards |

| July | 168,00 | 168,00 | 1500,00 |

| August | 184,00 | 184,00 | 1535,90 |

| September | 168,00 | 168,00 | 1580,10 |

| Total: | 520,00 | 520,00 | 4616,00 |

The bonus is calculated separately, in proportion to the time worked. In this example, the period is fully worked out, the bonus is taken in full.

Table 6 - Calculation of salary for vacation

| Period | Planned time, days | Actual time, days | Sum salaries |

| July | 26,00 | 26,00 | 1710,57 |

| August | 27,00 | 27,00 | 1944,05 |

| September | 26,00 | 26,00 | 1643,52 |

| Total: | 79,00 | 79,00 | 5298,14 |

Average daily wage = (Salary + bonus) h days worked

(5298.14 + 4616.00) / 79.00 = 125.495 rub. – average daily earnings

Let's calculate the amount of vacation pay:

Average daily earnings H number of vacation days

125.495 H 30 days = 3764.85 D 200 K 700.

In October: 125.495 H 14 days = 1756.93 D 200 K 700.

In November: 125.495 H16 days = 2007.92 D 200 K 700.

If an employee quits or is transferred to another company without using the next vacation, then he is awarded compensation. To do this, calculate the number of days of unused vacation: for each month of work, at least 2 days of vacation are required (24/12).

The calculation of average earnings is carried out similarly to the calculation for vacation.

Calculation of average earnings is necessary to pay for temporary stay on a business trip and perform government duties.

Calculation of temporary disability benefits (pay type 047).

All work on calculating benefits for State Social Insurance is carried out on the basis of the “Regulations on the procedure for providing benefits for State Social Insurance”, approved by the Regulations of the Presidium of the All-Russian Central Council of Trade Unions No. 12/10 - 1984 No. 13 - 6 and subsequent amendments and additions.

Benefits are issued only to those citizens who are covered by state social insurance, i.e. for citizens working under employment contracts.

The basis for granting temporary disability benefits is a sick leave certificate issued in accordance with the established procedure.

On December 1, 1994, a new instruction was put into effect on the procedure for issuing documents certifying the temporary disability of citizens, approved by the Ministry of Health on October 19, 1994. No. 21.

Sick leave is issued from the first day of incapacity for work;

— in case of injury at home (payment is made from the 6th day of incapacity for work)

— under quarantine (not paid).

Now the doctor has the right to issue sick leave for a period of 10 calendar days and extend it up to 30 days.

If previously sick leave could be issued for up to 4 months, and then a disability certificate was required, now, with a favorable outcome, sick leave can be extended until full recovery, but for a period of no more than 10 months, in some cases (for tuberculosis) no more than 12 months.

In cases where an illness or injury occurs due to alcohol intoxication, sick leave is issued, but is not subject to payment.

If temporary disability occurs during the period of administrative leave, maternity leave, or partially paid parental leave, a sick leave certificate is issued after the end of these leaves in the event of continued disability.

Sick leave for child care is not paid:

during regular vacation and vacation without pay;

during maternity leave;

during the period of partially paid parental leave;

if harm to your health is intentionally caused;

while in custody.

If the patient violates the regime, or does not show up for an appointment without a good reason, he is deprived of benefits from the day on which the violation was committed, for a period established by the Social Insurance Commission.

Benefits for temporary disability due to a work injury or occupational disease are issued in the amount of 100% of earnings.

The benefit is issued in the following amounts (except for work injury and occupational disease):

a) in the amount of 100% of earnings:

workers and employees with continuous service of 8 years or more;

having 3 or more dependent children under 16 (students - 18) years old;

if temporary disability occurs as a result of contusion, injury, injury while performing international duty;

and among Chernobyl victims (specially stipulated in the law on social protection of citizens of Chernobyl victims).

b) in the amount of 80% of earnings:

workers and employees with continuous work experience of 5 to 8 years;

from among orphans under 21 years of age with up to 5 years of experience.

c) in the amount of 60% of earnings:

workers and employees with continuous work experience of up to 5 years.

Allowance for caring for a child under 15 years of age:

from 1 to 7 calendar days - in the amount according to length of service;

from 8 to 15 days, and single mothers, widows (widowers), divorced women (men) and wives of conscripts from 11 to 15 calendar days are given 50% of earnings regardless of length of service.

When calculating the average earnings for sick leave, the amount of earnings includes all types of payments, except for payments and additional payments for work performed overtime, on holidays, part-time work, and for unworked time.

For workers receiving piecework wages, the benefit is calculated from their average earnings for the last two calendar months preceding the first day of the month in which the disability occurred, with the addition of the average monthly bonus amount to the earnings of each month (clause 74 of the Regulations).

The average daily earnings of workers receiving piecework wages is determined by dividing all types of wages in the billing period

(two previous calendar months), by the number of all scheduled working days in this period.

If in the specified two months the worker or employee did not actually work all the days, then to calculate the benefit, earnings for the actually worked days in each of these two months are taken, and the average monthly amount of bonuses in each month is taken into account in proportion to the time worked.

If in the indicated two months the employee had no earnings at all, then the benefit is calculated based on earnings for the days actually worked in the month in which the disability occurred (clause 74 of the Regulations).

Example: an employee was ill from July 20 to August 10, 2001. In July, 5 working days were missed due to illness, in August – 6 working days. Continuous employee experience 10 years. Let's determine the amount of temporary disability benefits if the employee's earnings for May amounted to 2,500 rubles. with 14 working days according to schedule, and for June - 3000 rubles. with 15 working days according to schedule.

(2500 rub. + 3000 rub.) / (14 + 15) = 189.66 rub.

The employee’s continuous work experience is 10 years, therefore:

189.66 * 100% = 189.66 – the amount of the daily allowance.

Now you need to check whether this amount does not exceed the limit established by Presidential Decree No. 508.

In July and August 2001, the minimum wage was 300 rubles. We multiply by 85 and the regional coefficient, we get 29,325 rubles. – the maximum amount of temporary disability benefits for the entire month. If the employee had not fallen ill, he would have had to work 15 days according to the schedule in July, and 14 in August.

29325: 15 = 1955 rub. – maximum daily allowance for July.

29325: 14 = 2094.64 rubles. - for August.

189 rub. 66 kop. less than the maximum permitted daily allowance.

The benefit amount will be: 189.66 * (5 + 6) = 2086.26 rubles.

Wiring: D 691 K 700

For employees who have a time wage (monthly salary, daily or hourly tariff rate), to calculate benefits, the monthly official or personal salary, daily or hourly tariff rate is taken, taking into account constant additional payments and allowances received on the day of the onset of disability, and the average monthly bonus amount ( clause 72 of the Regulations).

For time-based and monthly wages, the average daily wage is determined by dividing the amount of the monthly salary (taking into account additional payments and allowances and the average monthly amount of bonuses) by the number of all working days of the month of incapacity.

If temporary disability that began in one month continues in the next, then the amount of the benefit is determined based on the amount of the daily benefit calculated for each month separately.

Example: an employee’s monthly salary is 2,500 rubles. The employee was ill from February 15 to March 14, 2001. Working days in February - 20, in March - 21. Missed due to illness in February 10 working days, in March - 9 working days. Continuous employee experience 7 years. We will determine the amount of temporary disability benefits.

Average daily earnings in February are:

2500 rub. / 20 days * 80% = 100 rub.

Average daily earnings in March are:

2500 rub. / 21 days * 80% = 95,238 rub.

Maximum daily benefit for February:

200 rub. * 85 * 1.15 / 20 = 977.50 rub. – more than the average daily actual earnings of an employee in February.

Maximum daily benefit for March:

200 rub. * 85 * 1.15 / 21 = 930.95 rub. – does not exceed the average daily actual earnings of the employee in March.

The temporary disability benefit will be:

100 rub. * 10 days + 95,238 rub. * 9 days = 1857.14 rubles.

Wiring: D 691 K 700.

Since March 2002, the maximum limit on temporary disability benefits has been set at 11,700 rubles.

Maternity benefit.

Maternity benefits are paid for the period:

- 70 calendar days (in case of multiple pregnancy - 84 days) before birth;

- 70 calendar days (in case of complicated childbirth - 86 days; for the birth of two or more children - 110 days) after birth.

The basis for issuing maternity benefits is a certificate of incapacity for work. The benefit is assigned in the amount of 100% of earnings, but

limited to the maximum limit established by Presidential Decree. The procedure for calculating the amount of maternity benefits is completely similar to the procedure for calculating temporary disability benefits.

Maternity benefits are paid as a lump sum for the entire period of leave. Wiring: D 691 K 700.

State benefits for citizens with children.

Such benefits include:

— a one-time benefit for women registered in medical institutions in the early stages of pregnancy;

— one-time benefit for the birth of a child;

— monthly allowance for the period of parental leave until the child reaches one and a half years old.

All of them are paid from the Social Insurance Fund.

Wiring: D 691 K 700.

Accounting for payroll and deductions from it Read more: Accounting for remuneration of part-time workers

Information about the work “Accounting, analysis, audit of remuneration”

Section: Accounting and Auditing Number of characters with spaces: 217730 Number of tables: 33 Number of images: 9

Similar works

Pay audit

125877

9

0

... entrusted to the audit commission on a voluntary basis. This commission carries out various audits on the farm: audit of the cash register, materials in warehouses, livestock on the farm, etc. Chapter 3. Audit of wages at the enterprise 3.1 Brief organizational and economic characteristics of the enterprise Table 6 Indicators of the size of the farm and production Indicators Year 2005 to 2004 2004 2005 ...

Analysis of the remuneration system at CJSC IC "Elemte"

155512

13

3

... non-guaranteed, dynamic wage fund. In this regard, in the next chapter of the thesis, it seems appropriate to analyze the methodology for improving the remuneration system of JSC Elemte. CHAPTER 3. Improving the remuneration system of CJSC IC "Elemte" 3.1 Concept and methodology for developing a non-tariff model of remuneration The basis of the proposed non-tariff model of organizing wages ...

Accounting, analysis and audit of wage calculations at enterprises (using the example of Aksaykardandetal OJSC)

125345

40

0

... 2009 and the financial results of its activities for 9 months of 2009 based on the Federal Law “On Accounting” No. 129-FZ dated November 23, 1996. 3. Analysis and audit of wage calculations at OJSC Aksaykardandetal 3.1 Analysis provision of the enterprise with labor resources The indicators largely depend on the provision of the enterprise with labor resources and the efficiency of their use...

Accounting and audit of settlements with personnel for wages using the example of Voskhod LLC

199091

28

4

... accounts 69: Debit 69-1, 69-2, 69-3 Credit 51 - insurance contributions to extra-budgetary funds are transferred. Chapter 3. Audit of settlements with employees for wages using the example of Voskhod LLC 3.1 Goals, objectives, sources and methods of auditing settlements with staff for wages In light of recent changes in legislation, an analysis of the changes in the previous chapters was carried out. It should be clarified: since the audit...

Payment for work in the event of deficiencies due to the fault of the employee

If a deficiency in the reporting period occurred due to the fault of the employee, that is, as a result of his being on sick leave or on vacation without pay, then the salary for such a period, based on the provisions of Art. 155 of the Labor Code of the Russian Federation, must be calculated based on the time actually worked.

It means that:

- Shortcomings due to the employee's fault are not paid.

- Payment for work must be calculated minus unworked time.

If an hourly tariff rate is used when calculating an employee’s payment, determining earnings for the required period is quite simple: you need to multiply the tariff rate by the time worked.

If the employee’s work is paid through an official salary, when calculating wages for a period with shortfalls, you will first need to calculate the hourly tariff rate. There are several ways to do this. For clarity, let’s denote them with examples, based on the fact that the reporting period in the company is equal to a quarter, the employee’s salary is 25,000 rubles. and worked 160 hours for each month of the 3rd quarter of 2020.

To find your salary for September, you can:

- Divide the salary by the standard number of hours for 12 months. With the working time standard in 2020 at 1974 hours, the hourly tariff rate will be 25,000 rubles. / (1974 hours / 12 months) = 151.98 rubles. In this case, payment for September 2020 will be 160 hours × 151.98 rubles. = 24,316.8 rub.

- Divide the salary by the average standard working hours in the reporting period. The standard working hours in the 3rd quarter of 2020 is 528. Accordingly, the tariff rate will be equal to 25,000 rubles. / (528 hours / 3 months) = 142.05 rubles, and the salary for September is 142.05 rubles. × 160 hours = 22,728 rubles.

- Divide the salary by the standard hours in the desired month. With standard hours in September 2020, the 176 hour tariff rate will be equal to 25,000 rubles. / 176 hours = 142.05 rubles, wages for September - 22,728 rubles.

The law does not establish which method is necessary to calculate the hourly tariff rate to determine wages in the presence of a deficiency, so each organization has the right to decide on the calculation methodology independently.

Possible reasons for the defect

According to the law, the employer must provide the employee with work within the established employment standards.

NOTE! Working time standards may differ for different categories of employees and different working modes. The most common option is to work 5 days a week with two days off, when in total you need to work 40 hours per week. You can choose another accounting period - ten days, month, quarter.

Possible reasons that may violate the prescribed number of hours for work:

- breakdown of equipment and untimely bringing it into working condition;

- mastering new technological operations;

- a large percentage of defective products (for the piecework wage system);

- vacation at your own expense;

- absenteeism;

- accident, catastrophe or other emergency situation, etc.

REFERENCE! Being on a business trip is equivalent to working time, so the norm is reduced by the corresponding number of hours. But official sick leave and annual leave are excluded from the working time norm (Letter of the Ministry of Labor of the Russian Federation dated December 25, 2013 No. 14-2-337).

All probable reasons can be divided into three groups, which is why, in most cases, payment for the defects that have arisen depends:

- Shortcomings due to the fault of the employee: time off, absenteeism, tardiness, failure to fulfill the norm due to marriage, etc.

- Flaw caused by the employer: mostly simple.

- Defects due to reasons beyond the control of the parties: various force majeure circumstances.

A separate point can be considered a decrease in earnings due to part-time work or a week. But this is not exactly a situation of underperformance, since here there is a reduction in the standard working hours, and not a failure to fulfill it.

The employer is to blame for the shortcomings

If an employee is forced to temporarily suspend work for economic, technological or organizational reasons that the employer was unable to eliminate in time, as a result the employee will end up with a shortfall to the norm due to forced downtime.

This can happen, for example, in the following cases:

- the warehouse is out of raw materials, and timely delivery is not organized;

- equipment broke down and was not repaired by the start of the work shift;

- wage payment was delayed for more than 15 days.

IMPORTANT! If a downtime situation is caused by equipment breakdown or shortage of raw materials, the employee who discovers this fact must immediately report this to immediate management for possible timely action.

Since it is not the employee’s fault for the lack of work, he should receive payment for the time spent, even if it was not work. Some nuances are observed:

- For time not worked through no fault of his own, the employee will not receive the entire amount due for the norm, but 2/3 of the average earnings.

- If the downtime was not documented, but the employer admits his guilt in the shortcomings, then the employee must be compensated for the financial loss in proportion to the hours actually worked.

Failure to comply with the norm is the employee's fault

If the standard is not met due to the efforts (or insufficient efforts) of the employee, the situation with payment for the deficiency will be somewhat different. In most cases, such a defect is not subject to payment: downtime due to the employee’s fault is not paid in any way.

ATTENTION! When a defect arose due to the inexperience of workers in mastering a new technological line or changing the range of products, payment will depend on the will of the employer, enshrined in the company's accounting policy. It is recommended that employees maintain their average earnings for this period.

When it's no one's fault

If the cause of the shortcomings turned out to be insurmountable circumstances, and not the employee or the employer, the law guarantees employees payment in the amount of 2/3 of their average earnings, calculated in the usual manner.

Payment for labor in the event of deficiencies due to reasons beyond the control of the parties

If there is a deficiency in the reporting period for reasons beyond the control of one or the other party, the employee’s labor activity must be paid in the amount of at least 2/3 of the tariff rate or official salary based on the time actually worked (clause 2 of Article 155 Labor Code of the Russian Federation). That is, first, by analogy with the calculations above, it is necessary to determine the duration of the deficiency in hours. Next, you need to either immediately calculate 2/3 of the tariff rate, or (if the employee has a salary) find the hourly tariff rate and 2/3 of it, and then calculate the amount of additional payment to the employee by multiplying the unworked time by 2/3 of the rate.

Thus, the appearance of shortcomings in the reporting period during summarized accounting first of all requires clarification of the reasons that provoked such a situation. This will determine both the amount of the employee’s remuneration and the amount of additional payment in cases where such additional payment is due.

There are even more materials on the topic in the section: “Schedule and recording of working hours.”

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

Legal norms when an employee is guilty

The employee faces liability.

Article 157 of the Labor Code of the Russian Federation regulates payments to workers. If it is their fault that a work failure occurs, they are not paid for violations of the work program.

And only with the help of local standards does the employer improve the financial condition of its employees when such a situation arises.

The consequence of downtime can be an incident in production:

- improper maintenance of equipment resulting in breakdown;

- violations in terms of accessibility to the workplace - lack of medical examination, necessary TB instructions;

- the formation of situations that impede safe work.

The worker cannot be found guilty due to the following circumstances:

- force majeure;

- economic risk;

- extreme necessity of the enterprise.

The issue regarding the guilt of the workers is resolved with the help of a special commission created.

An independent board finds out that the work has been stopped not only for the employee against whom the action was taken, but also for his colleagues, and then, by definition, compensation will be paid to the rest of the group except the culprit himself.