Accounting for lawyer services

» » » Contents In this case, analytical accounting of income should be organized for each member. In tax accounting, these funds are classified as targeted revenues (subclause 8, clause 2, article 251 of the Tax Code of the Russian Federation). They do not increase taxable income and therefore are not included in income tax calculations.

Example. In July 2007, the cash desk of the Bar Association received 20,000 rubles. This is a fee for services provided by lawyer E.N. Isakov. Of this amount, 15,000 rubles. - accrued in favor of the lawyer, and 5,000 rubles - reflected in the income of the board. The accountant of the board reflected these transactions with the following entries: Debit 50 Credit 86 subaccount “Remuneration allocated to the income of the board” - 5,000 rubles.

— a fee has been received for legal assistance; Debit 50 Credit 86 subaccount “Remuneration due to the lawyer” -15,000 rubles. — a fee has been received for legal assistance; Debit 20, 26, 08, 10, etc.

If the pharmacy loses the dispute...

In case of loss, the pharmacy accountant on the date of entry into force of the court decision recognizes other expenses in the amount of legal expenses subject to reimbursement (clause 11, 14.2 of PBU 10/99). The debt is formed on account 76 “Settlements with other debtors and creditors”.

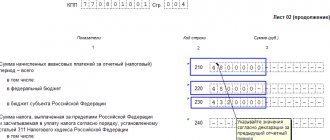

As of the same date, the accounting records of a pharmacy applying the general taxation regime reflect non-operating expenses in the full amount of legal expenses. As follows from Letters of the Ministry of Finance of Russia dated October 27, 2011 N 03-03-06/4/124 and dated April 8, 2009 N 03-03-06/1/227, in paragraphs. 10 p. 1 art. 265 of the Tax Code of the Russian Federation provides that non-operating expenses include legal expenses, which include, in accordance with Art. 101 of the Arbitration Procedure Code of the Russian Federation, costs in the form of state duties and legal costs, payable on the basis of a court decision that has entered into legal force.

A pharmacy using the simplified tax system applies a similar approach: based on paragraphs. 31 clause 1 art. 346.16 of the Tax Code of the Russian Federation, the single tax base is reduced by the amount of state duties and legal costs reimbursed to the plaintiff. The date of recognition of the expense is the moment of repayment of the specified debt.

Example 3. Limited liability company “Zdravushka”, which uses the simplified tax system, was a defendant in a case regarding the collection of overdue rent payments. According to the court ruling that has entered into force, Zdravushka LLC is obliged to repay the debt to SideNN LLC in the amount of 510,000 rubles.

On the date of transfer of funds, the single tax base is reduced by overdue debt in the amount of 510,000 rubles. and the plaintiff's legal expenses in the total amount of 33,600 rubles.

Interest awarded for the use of other people's funds in the amount of RUB 18,720. are not taken into account as expenses, since this type of expenses is not provided for in the closed list of expenses established by clause 1 of Art. 346.16 Tax Code of the Russian Federation.

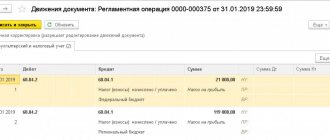

| Contents of operation | Debit | Credit | Amount, rub. |

| On the date of entry into force of the court decision | |||

| Interest accrued for using someone else's money | 91-2 | 76 | 18 720 |

| Debt for legal expenses reflected | 91-2 | 76 | 33 600 |

| On the date of repayment of the debt to the plaintiff | |||

| The principal amount has been transferred | 60 | 51 | 510 000 |

| Interest on the use of funds and legal expenses were reimbursed (RUB 18,720,33,600). | 76 | 51 | 52 320 |

A.M.Lopatina

Magazine editor

"Pharmacy: accounting

and taxation"

Provision of services – accounting entries

Author of the article Olga Evseeva 20 minutes to read 7,102 views Contents In this material we will look at the provision of services - accounting entries. We will find out how services are reflected in accounting, how services are accounted for by the customer/performer, as well as what are the features of the provision of services by an agent. We will answer frequently asked questions and analyze common mistakes. Service is a type of activity that cannot be expressed financially.

Its results are provided to individuals and legal entities for a fee or are used in the course of business activities within the company. When providing any types of services, the parties to the transaction are:

- Service Seller,

- Consumer (customer).

Services are:

- Informational;

- Communication services (telephone, postal, Internet provider)

- Auditing;

- Legal;

- Transport;

- Storage services;

- Educational;

Results

State duty - posting this payment in accounting has numerous features. The state duty can be attributed to expenses for core activities, other expenses or to an increase in the value of the asset.

When writing off state duty, postings are made using expense accounts in correspondence with the account. 68, to which the corresponding sub-account is opened. The fee for carrying out legally significant actions charged by private notaries is not a state duty, therefore, when carrying out such business transactions in accounting, invoice. 68 is not used.

If you have any unresolved questions, you can find answers to them in ConsultantPlus. Full and free access to the system for 2 days.

The organization hired a lawyer to defend the director in court

Source: Magazine The absence of a chief accountant, lawyer or personnel officer position on the staff of a small company today would not surprise anyone. But this does not mean that the organization does not keep accounting records, does not defend its interests in court, or does not comply with labor laws. Indeed, for these purposes, third-party organizations or citizens can be involved on a contractual basis.

But without a leader, a legal entity, as a rule, cannot exist. In fact, the director is responsible for everything that happens in the company. What if he missed something, overlooked something, didn’t control someone?

The law is inexorable: for dishonest performance of his duties, the manager bears administrative and sometimes criminal liability. It is good if the company has a legal service that can protect the interests of its chief officer.

We recommend reading: Reduction of staff at FGC UES

What if there is no such service? Does the organization have the right to take into account

Lawyer Accounting

Many lawyers, especially those who hold senior positions and own their own businesses, have not only a higher legal education, but also an economic one.

But often they do not have sufficient experience and practice in using economic education. As a result, they do not know the intricacies of accounting in a law firm. For accounting purposes, law firms either turn to accounting companies to outsource accounting or hire an accountant to join their staff.

The first method of accounting for a lawyer is usually more cost-effective and is performed professionally, since the accounting company employs accountants (more than one employee), in the absence of your accountant, another employee can perform your routine work, and your expenses are also minimized and your taxes.

The activities of lawyers and legal offices are based on the provision of services.

Determination of legal costs by the judicial authority

Recognition of costs incurred is carried out by the court in each specific case. Costs cannot be allocated to the losing party without filing a claim. The need to cover expenses must be addressed to the court and a request must be included in the statement of claim or in the form of additional demands stated during the hearing. When covering expenses, several repayment options arise.

| Procedure | Compensation of expenses |

| The fee was paid by the plaintiff, the application was not submitted to the court | Refunds are made by the territorial office of the Federal Tax Service before the expiration of 3 years. |

| The fee has been paid, the claim has been satisfied pre-trial | In some cases, the amount of fees and costs is returned in a separate claim. |

| The claims were partially satisfied | The costs incurred by the plaintiff are partially compensated, in part of the recognition of the claim or at the discretion of the court |

| The defendant has no obligation to pay state duty | Only expenses are subject to compensation; the amount of state duty to the plaintiff is not covered. |

Expenses incurred by the plaintiff in the course of pre-trial consideration of claims are not covered. Expenses often include costs for the services of lawyers. The courts do not recognize such expenses and do not attribute them to the losing party.

In some cases, the losing party may be able to avoid paying the winning party's costs. In order for the court to make a decision, it is necessary to apply to the court to provide documentary evidence of the difficult financial situation, the unintentionality of the motives for causing the damage, and to pay off the claims during the proceedings or upon receipt of a deferment.

Tax accounting of legal services

It is no secret that during inspections, the objects of close attention of tax authorities are the services provided to taxpayers - consulting, marketing, legal.

It is they, in the opinion of tax authorities, that are the “weak link” for which it is easy to prove non-compliance with the requirements of the Tax Code of the Russian Federation, mainly for inclusion in income tax expenses and in the VAT deduction. Judicial practice on this issue has so far been quite controversial, but on March 18, 2008, the Presidium of the Supreme Court adopted Resolution No. 14616/07, which formulated an unexpected and pleasant approach for taxpayers to assessing the legality of including legal services in expenses.

14 clause 1 art. 264 of the Tax Code of the Russian Federation).

What did the Presidium of YOU decide?

Considering the tax dispute, the Supreme Arbitration Court made the following important conclusions:

- Expenses associated with the need for an organization to carry out its activities, based on the current tax legislation, presuppose their recognition as economically justified (justified). The Tax Code of the Russian Federation does not contain provisions allowing the tax authority to evaluate expenses incurred by the taxpayer from the standpoint of their economic feasibility. Judicial control is also not intended to check the economic feasibility of decisions made by business entities, which in the business sphere have independence and broad discretion.

- The approach applied by the Supreme Arbitration Court is based on the norms of the Tax Code of the Russian Federation and is not new, however, against the backdrop of the trend that has developed in recent years of making decisions in favor of the Federal Tax Service at the slightest opportunity, it is practically revolutionary. In accordance with the proposed position, only the taxpayer can decide whether he needs to incur certain expenses related to the need to carry out the activity. Of course, there will also be unscrupulous taxpayers who will want to use contracts for the provision of legal services

as a means of illegal tax optimization, but in such a situation the Federal Tax Service has the opportunity to prove the unjustification of receiving a tax benefit. - Cases when representatives of the Federal Tax Service prove in court precisely the bad faith of taxpayers and judges agree that legal services

are included as expenses only for the purpose of reducing taxes are not so rare.

For example, in the Resolution of the Federal Antimonopoly Service of the Moscow Region dated July 16, 2007 N KA-A40/5768-07-2, the organization was refused to include in expenses legal services

that were provided to it by the contractor and his unscrupulous (who do not submit reports and do not pay taxes) subsuppliers, At the same time, the price of services was significant (RUB 19.5 million), and payments for services from the entire chain of suppliers were carried out in one bank on one day. - The tax inspectorate does not have the right to check the correctness of pricing under contracts for the provision of legal services

and question these prices in the absence of the provisions established by Art. 40 of the Tax Code of the Russian Federation grounds for monitoring the correct application of prices for transactions (transactions between related parties, barter, foreign trade transactions, sudden price changes). For tax purposes, the price specified by the parties to the transaction must be accepted; it is assumed that it corresponds to the level of market prices. - It is gratifying that the desire of the tax authorities to “cut everyone with the same brush” has been stopped - to determine a certain average (and preferably small) price for legal services, and to charge additional taxes to everyone who does not fit within this speculative framework. In their desire to replenish the budget, employees of the Federal Tax Service (and even the courts!) committed a clear violation of the provisions of tax legislation - after all, nowhere in the Tax Code of the Russian Federation does it say that “when determining the economic justification of expenses, one should adhere to the provisions of Art. 40 of the Tax Code of the Russian Federation." The provisions of this article can be applied - and therefore the indicated price for the transaction verified - only in strictly specified cases. At the same time, negative consequences based on incorrect pricing (in the form of additional tax charges) can occur only for the party that underestimated the selling price.

- In accordance with Art. 65 of the Arbitration Procedure Code of the Russian Federation, persons participating in the trial must prove the circumstances to which they refer as the basis for their claims, while in the case of acts of state bodies, the obligation to prove the circumstances on the basis of which the act was adopted rests with the relevant body. The taxpayer, who has confirmed the fact and amount of expenses incurred, cannot be assigned an additional burden of proving the reasonableness of these expenses.

- This conclusion of the BAC is one of the most useful for taxpayers. Recently, courts, when considering disputes, are increasingly placing on the latter the obligation to prove their innocence in committing tax offenses. A strange situation has arisen - the tax authorities, accusing the taxpayer, are supposed to have and provide evidence of his guilt to the court. But even if the Federal Tax Service does not have any, in order to make a positive decision, the court requires the taxpayer to completely refute (documentary, factual, etc.) any charges brought against him. Now that the Supreme Arbitration Court has clearly defined exactly what circumstances a taxpayer must confirm in order to include expenses for consulting services as expenses (only the fact and amount of expenses), taxpayers will be spared endless discussions with inspectors in court regarding the reasonableness, validity, feasibility, specific a detailed description of the content of the services received.

The procedure for classifying payments for legal services as expenses for the purpose of calculating income tax is established by the Tax Code of the Russian Federation and is not related to assessing the reasonableness of such expenses when distributing them as part of legal costs.

The cassation judges are also mistaken in believing that the approach established by judicial practice to the reimbursement of legal costs of the party in whose favor a judicial act was adopted can be extended to cases where the taxpayer accounts for legal services as part of income tax expenses

third parties. Once again, the Supreme Arbitration Court indicated that in tax legal relations only the norms of tax legislation should be applied (if any). It is unacceptable to use approaches developed in other areas of law enforcement practice when resolving tax disputes.

The basis and wording used by the Supreme Arbitration Court when overturning court decisions—violation of uniformity in the application of rules of law by arbitration courts—make Resolution No. 14616/07 extremely useful for all taxpayers. Of course, it is hardly possible to say that before the adoption of this act, judicial practice on legal services was the same. However, now, after unambiguously defining the approach that arbitration courts should follow on the issue of attributing legal services

in tax expenses, court decisions should become more uniform - after all, our courts still take into account the position of YOU when making decisions.

In addition, recently, in order to ensure uniformity in judicial approaches to resolving disputes, the Plenum of the Supreme Arbitration Court adopted Resolution No. 14 of February 14, 2008, which introduced a certain analogue of case law in the Russian judicial system. This document determines that, by way of supervision, a judicial act based on the provisions of legislation, the practice of application of which, after its adoption, is determined by the Supreme Arbitration Court of the Russian Federation in a resolution of the Plenum or Presidium, including one adopted based on the results of consideration of another case in the order of supervision. When appealing a decision of a court of first instance in an appeal or cassation, if after such a decision the Supreme Arbitration Court has formulated a different position on resolving the controversial issue, the court must also take into account the position of the senior arbitrators.

The only limitation for the supervisory review of a decision based on the interpretation of the law, which differs from the approach formulated later by the Supreme Arbitration Court, is the loss of the opportunity to file an application for supervisory review due to missing the deadline for filing (Clause 3 of Article 292 of the APC RF), which is 3 months from the date of adoption of the last contested judicial act.

Unfortunately, it is unlikely that tax officials will stop overly scrupulously analyzing the legal services provided to taxpayers during audits. One can only hope that the number of unjustified additional tax charges for such services will become significantly less - after all, the Federal Tax Service, when making decisions, now takes into account the established arbitration practice (this position was formulated in the Letter of the Federal Tax Service of Russia dated September 14, 2007 N ShS-6-18 / [email protected] ).

Provision of services: accounting entries

The source of income for an organization can be not only the sale of goods, but also the provision of services.

But first things first. What expenses for legal services do the tax authorities consider economically justified? Legal services are classified as other expenses associated with production and sales (clauses

Such activities have their own characteristics in accounting.

Let's consider how to reflect in transactions the provision of transport and accounting services to counterparties, the purchase of courier services, as well as transactions for the provision of gratuitous services. Contents Paid provision of services is an agreement between the customer and the contractor, according to which the contractor undertakes to perform the services specified in the contract, and the customer undertakes to pay for the services performed in accordance with the terms of the contract (Articles 779 and 781, Chapter 39, Part 2 of the Civil Code of the Russian Federation dated January 26, 1996 .

N 14-FZ ed. dated 05/23/2016). Free provision of a service is the provision of a service to a counterparty without receiving payment from him (Art.

We recommend reading: Semyon Slepakov how much money

423 of the Civil Code of the Russian Federation). The contract for the provision of paid services may indicate, for example, the following services: Transport services (example 1);

Accounting for legal expenses in accounting

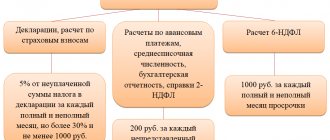

Author of the articleNatalie Feofanova 7 minutes to read4,793 viewsContents Resolution of controversial issues through judicial proceedings is accompanied by costs associated with the consideration of the claim. Legal costs include state fees and costs incurred in considering the claim.

The amount of payment and the order of acceptance of costs depend on the characteristics of the claim.

Before entering amounts into accounting and accepting them as expenses, you must have an idea of the procedure for their formation. In the article we will talk about accounting for legal expenses and give examples of accounting entries. The amount of state fees for each type of appeal is established by Chapter. 25.3 Tax Code of the Russian Federation. State duty is a fee collected when filing a claim in court.

The original payer is the plaintiff. The final payer of the amount is the losing party, who is awarded coverage of costs. The amount of the fee is established depending on

Recommendations

Taking into account the above, consideration of a tax dispute in court may entail significant financial costs for the organization, the largest part of which are the costs of attracting third-party specialists.

According to the author, in most cases, legal costs can be significantly reduced if the organization has a person on staff who has sufficient competence to represent the organization’s interests in court.

An analysis of arbitration practice shows that violations identified by tax authorities and, as a consequence, many cases considered by the courts are “typical” and do not necessarily require the involvement of tax lawyers.

Legal costs may be limited to the costs of preparing a statement of claim or providing legal advisory services. The involvement of specialists, as a rule, is necessary when considering extraordinary and particularly complex issues of tax legislation, as well as in the event of decisions by tax authorities to hold the taxpayer liable on a large scale.

Thus, the predominantly positive arbitration practice for taxpayers on many complex issues of tax legislation allows us to conclude that proving one’s position in court is more effective and expedient than meekly paying the amounts of accrued taxes and fines.

Question and answer: Reflection in accounting of legal services

QUESTION: Our organization paid a fee to a lawyer under an agreement for the provision of legal services. Subject of the agreement: representation in the arbitration court.

Question: what documents should we require from a lawyer to reflect legal services in tax and accounting, and in what period of time should we reflect these services in accounting (immediately or after the completion of the trial)?

ANSWER: Source: Article: Legal expenses for the services of a representative: full reimbursement model (Ovchinnikova O.V., Ovchinnikov V.V.) (“Judge”, 2020, N {ConsultantPlus} The list of documents confirming the incurrence of expenses has differences in depending on the form of the organization providing legal services.In the event of concluding a representation agreement with a legal entity, payment documents must be drawn up in accordance with the requirements of Federal Law dated December 6, 2011 N 402-FZ “On Accounting” and the instructions of the Bank of Russia dated March 11 2014

{ConsultantPlus} The list of documents confirming the incurrence of expenses has differences in depending on the form of the organization providing legal services.In the event of concluding a representation agreement with a legal entity, payment documents must be drawn up in accordance with the requirements of Federal Law dated December 6, 2011 N 402-FZ “On Accounting” and the instructions of the Bank of Russia dated March 11 2014

Composition of expenses in bankruptcy

The insolvency procedure is carried out under the supervision of the Arbitration Court. The body determines the stage of the procedure and the manager conducting financial control of the operations. Covering expenses is carried out at the expense of the debtor and is not compensated by third parties. Expenses subject to judicial approval include:

- Manager's remuneration.

- Payment for current activities in the form of postal, office, and transportation expenses.

- Amounts required for publication of notifications about the start of the procedure in the Bulletin.

- Funds spent on holding public auctions of the debtor's property.

- Payments for the services of appraisers, auditors, experts and others.

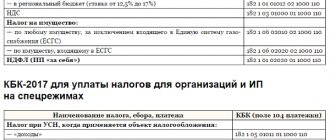

How to account for attorney's fees

Important 04 September 2008 19:44 Federal Tax Service for the Perm Territory Lawyering activities do not qualify as entrepreneurial activities. For the purpose of calculating personal income tax, lawyers are classified as a special category of taxpayers.

Depending on the legal profession the lawyer belongs to, the tax is calculated either by the lawyer himself or by the tax agent. The organization of advocacy in Russia is regulated by Federal Law No. 63-FZ of May 31, 2002 (hereinafter referred to as Law No. 63-FZ). Article 20 of this law lists the forms of legal entities: law office, bar association, law office and legal consultation.

The lawyer independently chooses the form of legal education and the place of practice of law, which he notifies the council of the bar association. Moreover, he can only be a member of one legal profession.