What is the essence and meaning of profit tax optimization?

The concept of “optimization” in the context of calculating income tax is very capacious. Relevant optimizations could be:

- actions aimed at reducing the financial burden on the enterprise;

- reduction of costs associated with the calculation of income tax;

- minimizing the payment of income tax through the use, whenever possible, of special tax regimes.

Let us agree that our enterprise is an inevitable payer of income tax and all costs for its calculation have been reduced. In this case, all that remains is to reduce the resulting financial burden. This can be done with:

- Legally justified reduction of the tax base by including additional expenses in its calculation.

This reduction can be achieved by:- creating a reserve for overdue debts;

optimization of schemes for cashing out profits in the form of salaries and dividends;

- application of the method of non-linear depreciation on fixed assets.

- Justified reduction of the calculated tax. Here, the taxpayer will be helped by optimizing the business model, aimed primarily at increasing the use of various tax benefits. The legislation of the Russian Federation allows a number of companies to pay profit tax at a zero rate.

- Reducing the inflationary burden on the enterprise while maintaining the same size of the tax base.

Here, the company will be helped by optimizing tax planning in terms of:

- creating conditions for the preferential use of the accrual method when accounting for income and expenses, on the basis of which the tax base is formed;

- developing a policy for relations with counterparties in terms of drawing up contracts adapted to the use of the accrual method when accounting for income (provided that such agreements will, in turn, be beneficial to counterparties).

These methods can be combined with each other, and sometimes complement each other.

Let's study how you can reduce corporate income tax using the above methods.

https://youtu.be/ZpAO2pY83Y4

Making useful supplies

Every company has the right to create reserves. It is assumed that they may be useful for paying for vacations, rewards for long service to employees, updating material and technical base and equipment, etc. This method makes it possible to correctly distribute expenses over tax periods, and it is precisely the competent justification of expenses that is the most important part of calculating income tax.

https://www.youtube.com/watch?v=ytpressru

You need to understand that the reserve cannot affect the total amount of income tax for the entire reporting period, but thanks to it, advance payments can be significantly reduced.

For many entrepreneurs, this is an excellent solution in situations where large expenses are expected in the near future, and taxes need to be paid today.

How to optimize the current tax base taking into account the influence of inflation?

It is more profitable to pay any tax as late as possible relative to the occurrence of the grounds for its assessment. This is primarily due to inflationary reasons: while the nominal payment remains unchanged, the purchasing power of the corresponding amount decreases over time.

You can “push back” the moment of tax calculation and payment by calculating income with maximum emphasis on the combination of:

- Accrual method (when tax is calculated “according to documents” - without reference to the period in which the revenue was received).

- Prepayment schemes for settlements with customers (in which the delivery of goods is postponed for as long as possible and at the same time a reasonable period that suits both parties).

Thus, the tax can be calculated much later than the receipt of revenue in the cash register of the enterprise. As a result, such revenue, temporarily exempt from taxation, can be put into circulation in order to maintain purchasing power.

With this scheme, the financial burden on the enterprise at the time of tax payment will be lower in terms of inflation than if the counterparty paid for the goods upon delivery (and income tax would have to be paid faster).

Read us on Yandex.Zen Yandex.Zen

The application of the accrual method must be timely: before the beginning of the year, it is enshrined in the accounting policy (Article 313 of the Tax Code of the Russian Federation).

Of course, the company's managers will also have to work on optimizing the expense recognition policy so that they are incurred at the most convenient moment. One of the possible tools for solving this problem is concluding supply contracts in conventional units at the “manual” rate. Let's study this option in more detail.

How to reduce tax using conventional units?

The taxpayer and his counterparty, when concluding an agreement in conventional monetary units, have the right to set their own exchange rate for them in terms of rubles (paragraph 3, paragraph 8, article 217 of the Tax Code of the Russian Federation, information letter of the Presidium of the Supreme Arbitration Court of the Russian Federation dated November 4, 2002 No. 70). At the same time, the parties are not prohibited from entering into additional agreements that will establish an adjustment course.

Thanks to this option, the taxpayer has the opportunity to:

- Deliver goods to the counterparty and agree with him to pay for the goods at an inflated rate in order to reduce economic risks.

- After receiving payment, enter into an additional agreement with the supplier to recalculate the exchange rate of conventional units in favor of making them cheaper relative to the ruble. As a result, the taxpayer will have the obligation to return part of the proceeds received to the counterparty.

Both actions can be performed in the same billing period. In this case, the taxpayer will be able to reduce the tax base for a given period by declaring “accrued” expenses under the relevant additional agreement.

The economic effect of such actions will be that:

- the taxpayer will receive more revenue in the billing period, which can be put into circulation in order to maintain purchasing power;

- the taxpayer will be able, if he agrees on this with the counterparty, to postpone making expenses (despite the fact that they will already be taken into account when calculating the tax) and also put the corresponding amount into circulation until it is transferred to the counterparty.

This scheme is a good way to protect against economic risks, protect the company’s capital from inflation, and build a trusting partnership with a counterparty.

How to apply expenses in the form of reserves for doubtful debts?

Another common way to optimize the tax base is the use of “quick” expenses, that is, those that can quickly reduce the corresponding base and thus reduce the calculated tax in the current period.

One of the most accessible methods of such optimization is the formation of reserves for overdue accounts receivable. The amounts used to form these reserves are included in the non-operating expenses of the company on the last day of the reporting period (clause 3 of Article 266 of the Tax Code of the Russian Federation).

Provisions for doubtful debts may be:

- 100% of the receivable if it is not repaid for more than 90 days;

- 50% of the receivable if it is overdue by 45–90 days.

The maximum amount of the reserve cannot exceed 10% of the company’s income for the tax or reporting period preceding the one in which the reserve is formed.

If the doubtful debt is nevertheless repaid, then the reserve is restored, which, in turn, generates income for the organization. The reserve cannot be restored or spent in any other way (clause 4 of Article 266 of the Tax Code of the Russian Federation).

If the existing reserve is less than the bad debt that should be written off, then the amount of such excess is also included in non-operating expenses (clause 5 of Article 266 of the Tax Code of the Russian Federation).

Of course, any company has the right not to use the reserve, but to write off bad debts recognized as such in the reporting period as expenses directly (subclause 2, clause 2, article 265 of the Tax Code of the Russian Federation). Choosing the optimal moment to write off such debt is another possible factor in reducing income taxes.

Documents to confirm expenses

Economic justification and documentary evidence are the main conditions for accounting for expenses. Documents can be:

- Bonuses, wages, incentives - payroll for the period in which costs are recorded.

- Rental payment is an agreement in which the monthly amount and payment period must be specified.

- CCP maintenance is an agreement indicating the amount of the fee and the frequency of its payment.

- Subscription to a printed publication - an act indicating the cost and period of receipt.

- Business expenses – checks, acts, invoices. The name of the product, its price, quantity in pieces or kilograms must be present.

- Payment of interest on loans is a bank agreement.

- Transport expenses that reduce income tax are waybills, route sheets.

- Costs of fuels and lubricants – waybills, receipts, invoice, which shows the cost of all fuels and lubricants purchased in the reporting period.

These primary documents must be preserved.

Nonlinear depreciation as a scheme for using “fast” expenses: nuances

The next common scheme for optimizing an organization’s income tax through “quick” expenses is non-linear depreciation of fixed assets. It allows you to write off depreciation amounts as expenses in volumes that significantly exceed the rate of normal depreciation.

The following amounts are calculated according to the formula (clause 4 of Article 259.2 of the Tax Code of the Russian Federation):

CA = TC × (K / 100),

Where:

CA is the amount of depreciation;

TC is the current value of an asset (group of assets);

K is the coefficient corresponding to the norm for a specific depreciation group (determined in accordance with clause 5 of Article 259.2 of the Tax Code of the Russian Federation).

Example

Innovation-Lux LLC bought a car worth 1 million rubles. It has a useful life of 36 months and belongs to the 3rd depreciation group, for which the depreciation rate is set at 5.6.

Nonlinear depreciation for the 1st month for it will be:

SA (1 MONTH) = 1,000,000 × (5.6 / 100) = 56,000 rub.

For the 2nd month:

SA (2 MONTH) = 944,000 × (5.6 / 100) = 52,864 rubles.

For the 3rd month:

SA (3 MONTH) = 891,136 × (5.6 / 100) = 49,903 rubles. 62 kop.

Thus, the company has the right to write off 158,767 rubles as expenses. 62 kop. for 3 months (let’s agree that this is the tax reporting period).

For comparison: with the linear method, monthly depreciation would be carried out in equal shares and amount to 27,777 rubles. 78 kop. For the first 3 months - 83,333 rubles. 34 kopecks could be written off as an expense.

ATTENTION! Taxpayers have the right to apply increasing factors to depreciation rates, but subject to the restrictions and requirements established by Art. 259.3 Tax Code of the Russian Federation.

The disadvantage of non-linear depreciation is that by the end of the useful life of the asset, its value will not be zero and depreciation will need to be continued until other grounds arise for writing off the asset at its residual value as expenses.

Algorithm for transferring losses in the accounting database

Currently there is no automatic transfer of losses in the programs. Therefore, we will transfer the loss using manual entries. Please note that the manual loss carry forward operation is carried out on December 31, after the close of the tax period, but before the balance sheet reformation.

Closing the tax period in which the loss was incurred

- We will forward the documents for December;

- We close the month, but skip the “balance sheet reform” operation. D 99.01 – K 90.09 The program must generate the posting independently.

- We create a manual loss transfer operation: D 97.21 – K 99.01 – the amount of loss carried forward to future periods. 97.21 “Other deferred expenses” 99.01 “Profits and losses from activities with the main tax system”

- For account D 97.21, we create the subaccount “Loss ... year” and configure this subaccount correctly. Type for NU - Losses of previous years Type of asset in the balance sheet - Other current assets Amount - Amount of loss Recognition of expenses - In a special order Write-off period - from XX.XX.XXXX

We are carrying out the “balance sheet reform” document

D 84.02 – K 99.01 D 90.01 – K 90.09

The program must generate the postings independently. The transfer of losses is carried out after the regulatory operation “Calculation of income tax”.

Write-off of losses from previous years

Now, in the new tax period, starting from the date specified in Subconto, if an organization makes a profit in tax accounting, it will automatically be reduced by part of the loss of the previous period or the entire amount. The write-off will take place monthly until the entire loss is written off. The operation can be seen in Menu – Closing the month – Write-off of losses from previous years. D 99.01 – K 97.21 – the amount of the written off part of the loss.

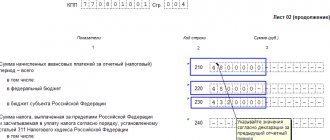

We reflect the transferred loss in the income tax return

On Sheet 02 of Appendix 4, you must indicate the year from which we are transferring the loss and the amount of the loss Total; the amount of the tax base; the amount of loss, but not more than 50% of the profit; the balance of the unwritten loss. We go to Sheet 02; the amount of the transferred loss should be automatically transferred to page 110.

—

Carrying forward a loss using an example

When calculating income tax for 2020, Mega LLC received a loss of 350,000 rubles. This loss can be carried forward to the future, forming from December 31, 2017. manual wiring operation D 97.21 – K 99.01 = 350,000 rub. In the 1st quarter of 2020, when calculating income tax for Mega LLC:

Income 1,200,000 rubles, Expenses 1,000,000 rubles.

The tax base was 200,000 rubles. (1,200,000 – 1,000,000), we can reduce it by the amount of loss, but not more than 50% of the profit. In our case, we reduce by 100,000 rubles. In the income tax return on Sheet 02, Appendix 4, we indicate: - the year from which we transfer the loss = 2020; — amount of loss Total = RUB 350,000; — tax base amount = 200,000 rubles; - amount of loss, but not more than 50% of profit = 100,000 rubles; — balance of unwritten loss = 250,000 rubles (350,000 – 100,000)

—

Deferred loss carryforward

There are situations when organizations do not want to reduce the tax base for losses from previous years in the current tax period, because carrying forward losses to the future is a right. But then a situation may arise when management needs to reduce the tax base, thereby reducing the tax.

Important! — If you do not apply PBU 18/02 and are sure that you will never carry forward the resulting loss, then you do not have to create a manual “Loss Transfer” operation at the end of the year. — If you apply PBU 18/02, then this operation will have to be created, otherwise the program will not allow you to close the first month of the next year.

In this case, we still recommend creating an operation to transfer the loss, but then without indicating the start date for writing off this loss.

How to do this: In a manual operation to transfer a loss, for account 97.21, we create a subaccount “Loss ... year” Type for NU - Losses of previous years Type of asset in the balance sheet - Other current assets Amount - Amount of loss Recognition of expenses - In a special order Write-off period - LEAVE LINE IS EMPTY Later, when you decide to reduce your tax base by the amount of the loss, you will need to indicate in the “write-off period” field the first date of the tax period from which you want to start writing off.

We suspend the write-off of losses for a while

It happens that an organization has written off a loss over a certain period of time, but this year does not want to reduce the tax profit for the loss of previous years and needs to stop writing off the loss for a while.

In this case, it is necessary to create a transaction entered manually with the posting: D 97.21 (sub-account “Balance of loss 2017”) - K 97.21 (sub-account “Loss 2017”) - the amount of the balance of the loss not transferred. We set up the subconto “Remaining loss 2017” as described above, i.e. We leave the dates of the write-off period blank.

Then, when write-off is required again, it will be necessary to post back:

D 97.21 (sub-account “Loss 2017”) - K 97.21 (sub-account “Balance of loss 2017”) - the amount of the balance of the loss not transferred.

Opening “preferential” branches as a way to reduce income tax

Russian legislation establishes preferential, or even zero, income tax rates for enterprises in many industries, for example:

- in education, medicine (the procedure for applying benefits in such areas is explained in Article 284.1 of the Tax Code of the Russian Federation);

- in investment management (Article 284.2, 284.2.1 of the Tax Code of the Russian Federation);

- in the field of social services for citizens (Article 284.5 of the Tax Code of the Russian Federation);

- in the field of tourism in the Far East (Article 284.6 of the Tax Code of the Russian Federation).

Many types of benefits are applied taking into account the provisions of regional legislation, for example, when determining the rate for enterprises participating in regional investment projects that have the status of a resident of the port of Vladivostok (Articles 284.3, 284.3-1, 284.4 of the Tax Code of the Russian Federation).

How to use these preferences in the context of a method for optimizing an organization's income tax?

Firms that do not have grounds for these benefits can nevertheless open subsidiary regions and transfer there the maximum possible part of their competencies. Afterwards, pay tax on the relevant areas of activity at a reduced, or even zero, rate.

One of the possible alternative scenarios is investments in companies located in “preferential” regions, on the terms of purchasing a stake in the management company (up to and including obtaining a controlling stake or votes). Afterwards, competences will be transferred to them through profitable outsourcing or within the framework of other partnership formats.

Part of the competencies, of course, can be transferred by the taxpayer for a “preferential” type of activity by opening a subsidiary (purchase of an existing business), which will be located in the taxpayer’s region and pay a reduced, if not zero, income tax.

conclusions

Any organization is created for the purpose of making a profit. But in market conditions, some make losses at the end of the year. Often such losses are covered by profits not distributed among participants or by reserve and additional funds. If losses exceed income, then the negative balance can be carried forward to later periods. You can reduce the tax base for income tax by the amount of losses that were received in previous tax periods. There is no time limit; losses can be carried forward until the resulting loss for all previous years is completely written off. Losses must be transferred in chronological order based on the fact of occurrence. It must be remembered that before reducing the tax base of the current year by the amount of losses from previous years, check the availability of documents that confirm the amount and period of occurrence of losses.

Firm maker, April 2020 Anastasia Chizhova (Konatova) When using the material, a link is required

Salaries instead of dividends: an example of tax base optimization

Salaries and contributions accrued on them can be fully taken into account by the income tax payer as expenses. In turn, dividends cannot be used for these purposes (clause 1 of Article 270 of the Tax Code of the Russian Federation).

No contributions are accrued on dividends. But it may be more profitable for business owners to withdraw cash not as dividends, but as a salary (or, alternatively, in the form of a bonus), if the amount of such salary is much greater than the maximum base for calculating pension and social contributions (in 2020 - 876,000 rubles and 755,000 rubles respectively).

But at the same time, business owners must fill out the documents correctly and be prepared to prove during an audit that the payment of a large bonus is economically justified and corresponds to their labor contribution to the company’s activities. Otherwise, the Federal Tax Service will not accept the corresponding expenses to reduce the tax base for income tax (resolution of the Moscow District Arbitration Court dated July 19, 2016 No. A40-118598/2015).

Let's consider an example of optimizing an organization's income tax using the approach in question.

Example

Ivanov A.S., owner of Innovation-Lux LLC, has the opportunity to cash out retained earnings in the amount of 10 million rubles in the 3rd quarter of 2020. The organization's income in this period amounted to 20 million rubles, expenses incurred - 4 million rubles.

If Ivanov withdraws profits as dividends, he will pay personal income tax on them to the budget in the amount of 1.3 million rubles. The calculated income tax will be 3.2 million rubles. The total tax burden is 4.5 million rubles.

If Ivanov withdraws the profit as a bonus (and can subsequently prove the economic justification of these expenses in court), he will pay to the budget:

- Personal income tax in the amount of 1.3 million rubles;

- contributions to compulsory pension insurance in the amount of 1,105,120 (192,720 + 912,400) rubles;

- contributions for compulsory social insurance in the amount of 21,895 rubles;

- contributions to the FFOMS in the amount of 510,000 rubles.

Total insurance premiums - RUB 1,637,015.

In this case, all salaries and contributions can be included in profit expenses, the total amount of which will be 15,637,015 rubles. (4 million rubles expenses + 10 million rubles premium + 1,637,015 rubles insurance premiums). In this case, the calculated income tax will be RUB 872,597. The total tax burden will be RUB 3,809,612. (RUB 872,597 income tax + 1,300,000 personal income tax + 1,637,015 insurance contributions) - significantly less than when withdrawing profits in the form of dividends.

***

Optimization of corporate income tax can be based on reducing the tax base, reducing the tax itself, preserving the purchasing power of capital used to pay the tax. The choice of one scheme or another may depend on the region of activity of the business entity.

Expenses not included in the tax base

Article 270 of the Tax Code of the Russian Federation contains a list of expenses that are not taken into account for tax purposes.

Non-operating costs that do not reduce profit - tax base:

- Dividend amounts.

- Transfers to the budget in the form of fines and penalties levied by government organizations.

- Payments for irregular emissions into the atmosphere.

- Contributions to partnerships: simple or investment in the form of authorized capital.

- Contributions to voluntary health insurance, non-state pensions.

- Expenses for completion, purchase of depreciable property, reconstruction, re-equipment, and so on.

- Guarantee fees.

- Voluntary contributions from members of public organizations.

- The cost of services and work performed free of charge.

Expenses associated with the activities of the enterprise:

- Expenses for remuneration, financial assistance, payment under collective agreements, pension supplements, bonuses, travel to work for employees, production of prizes.

- Payment of price differences when selling goods on preferential terms.

- Payment for treatment, vouchers, travel, organization of events for employees.

- The price of transferred shares, which are distributed among existing shareholders by decision of the meeting.

- Pledge in the form of property rights.

- Part of the entertainment expenses is above the norm.

Increased expenses and decreased income

To pay less taxes to the state, you can use a method that involves reducing the level of profits or increasing the level of expenses. The first option, as you yourself understand, will not lead to anything good, because a decrease in income is a deliberately disastrous matter. Old methods of hiding profits have always encouraged the tax officer to visit your

company. Still, there are a couple of ways to save money by increasing your spending level:

- To keep your profits, you can enter into an agreement with a company that provides marketing services. It is important to indicate exactly this wording in documents. Such funds can be included in current expenses and expenses can be increased.

- Purchase of fixed assets using a leasing transaction. The fact is that operations and transfers under leasing transactions are automatically considered expenses at the time of the transaction, that is, current, which means there can be no talk of any taxation.

Choosing a tax system

The first step to optimizing income tax is choosing a tax system. The tax system is a legally established procedure in which taxes are collected from individuals and legal entities.

Today, three taxation systems are legally defined for use by a wide range of individuals and legal entities, one for peasant farms and one for individual entrepreneurs - patent holders. Each of them carries advantages and disadvantages.

Let's figure out which system is right for you. To do this, let’s get acquainted with them in more detail, considering them in order of growth of the business of the proposed taxpayer.

Unified tax on imputed income (UTII)

This is the name of the preferential tax system, which is fundamentally different from the others. The difference is that the tax base is determined not on the basis of actual performance indicators for the period, but on the basis of the basic “imputed” profitability. To find out the amount of imputed profitability, refer to the Tax Code Art. 346.29 paragraph 3.

Income from the provision of household services is estimated by the state at 7,500 rubles per month. A little, right? There is one caveat - household services can only be provided to individuals.

Other types of activities also have quite reasonable “imputed” income. Veterinarians will have a tax base of 7,500 rubles, car mechanics - 10,000 rubles, sellers - 4,500 rubles, drivers - from 1,000 to 6,000 rubles.

The tax is calculated as 15% of the amount of imputed income multiplied by coefficients K1 and K2. The K1 coefficient is determined once a year by order of the Ministry of Economic Development, the K2 coefficient is determined by local authorities.

UTII is a good choice for individuals and organizations that have large incomes while using few resources. With proper calculation, it may turn out that paying 15% UTII will be less in absolute amount than 13% personal income tax.

Talented programmers, lawyers, doctors, advertisers and other freelancers can use UTII to minimize taxes

But there are also pitfalls here.

Firstly, only a small part of individual entrepreneurs and organizations can work with UTII. Among the permitted sectors of activity:

- passenger and freight transportation;

- catering services (with restrictions)

- maintenance, repair and car wash;

- rental of apartments and commercial premises;

- parking space rental services;

- retail trade (with restrictions);

- veterinary services;

- advertising services (with restrictions);

- certain paid services to individuals and others described in Art. 346 Tax Code of the Russian Federation.

Article 346.26 limits the possibilities of switching to the Unified Tax Fund even more. You cannot use UTII if:

- you have more than 100 employees;

- You have a share of more than 25% in another legal entity;

- You use simple partnership and trust agreements;

- local laws limit the use of UTII.

Secondly, you must be sure that you will receive sufficient income every month, because the tax is paid regardless of whether you actually worked and whether you earned a profit.

Finally, from January 1, 2021, UTII will be cancelled. Take this point into account when choosing a tax system.

Simplified taxation system (USNO)

The simplified tax system is also a preferential taxation system, but can be used much more widely than UTII. The simplified tax system is called that way because the methodology for calculating the tax base and tax is extremely simple.

In the first option, the tax is calculated as 6% of income. When using this option, you do not need to confirm expenses for the tax office.

In the second option, you pay 15% of the profit, that is, you take into account and confirm income and expenses.

An entrepreneur or organization using the simplified tax system is a single tax payer, which replaces part of the taxes: income tax, VAT, personal income tax (for the business owner), property tax. But other taxes: transport and land, personal income tax for hired personnel and, in special cases, property tax - will need to be paid.

Which taxation method to choose can also be calculated. To do this we use the inequality:

0.06 × Income - Deductible amounts < 0.15 × (Income - Expenses)

If the inequality is satisfied, then it is more profitable to choose a tax of 6% on income, but if not, then it is better to switch to 15% on profit.

However, there are certain restrictions when switching to the simplified tax system. You will not be able to use the benefits of the simplified tax system if:

- Your organization has branches.

- You are engaged in the production of excisable goods.

- You are engaged in pawnshop activities.

- You provide gambling services.

- More than a hundred people work for you.

- There are more than one hundred million fixed assets in your organization.

- You or your organization has a stake of more than 25% in other firms.

- The turnover of your organization over the past nine months has exceeded 45 million rubles, multiplied by the deflator coefficient.

It is worth noting that 6% and 15% are the maximum rates that can be reduced by the territorial laws of the constituent entities of the Russian Federation. Minimum rates are 0% and 5% respectively.

On the websites of regional tax services you can find all the necessary information on the legislative framework for reducing income tax.

Basic taxation system (OSNO)

OSNO is the most fiscally and administratively loaded regime. Organizations working in this system maintain full accounting and tax records, calculate and pay all taxes existing in Russian tax legislation.

For 2020, the income tax rate under OSNO is 20%.

Once you have decided on your tax regime, it's time to think about methods to optimize your income tax. Let's take a quick look at the special tax regimes.

Reduction of single tax with simplified tax system 15%

Those who have chosen the simplified tax system “income-expenses” have a much wider field for creativity in reducing taxes.

Accordingly, within the limits of allowed expenses, you can reduce the tax base. Let's see how this can be done.

It should be taken into account that income cannot be reduced by all expenses. Article 346.16 of the Tax Code of the Russian Federation describes in detail what expenses can be recognized.

Accounting for the minimum tax for the previous period

If last year you paid the minimum tax, then this year you can offset the amount by which the minimum tax exceeded the calculated single tax.

Accounting for past losses

If in one or more previous years you incurred a loss, you can offset the amount of the loss when calculating your tax base. You can use data for the past 10 years.

Increasing expenses within the limits allowed

Here are some extremely legal ways to increase your company's expenses without spending anything:

- Employment of company owners. Everything is simple here: by working in your own business, you increase the company’s expenses on your wages. If you only received dividends, you would not be able to reduce your tax base on them. The direct benefit, of course, will be small, since you will pay personal income tax in the amount of 13% of your salary and also social contributions. But how many opportunities will open up for you! You will be able to go on business trips for work, study, buy consumables and fixed assets to perform your duties. And all this will be included in the expenses of your business.

- Inclusion of the owner's property in fixed assets. For example, you work as a general director. And you buy yourself a new car so that you can drive it to work. Register your car as a fixed asset and you will reduce your monthly expenses by the amount of depreciation, fuel, maintenance and washing services.

- The acquisition by an organization of property actually necessary for the business owner. Let's say you earned a good profit, and you have a decent amount of money and an equally decent tax base. You can buy commercial space for your organization and rent it out to yourself for a nominal fee. You will then sublease it yourself. The “one pocket” principle works here. That is, you simply transfer money from one pocket to another, while reducing taxes.

- Bypassing regulated expenses. Some of the expenses listed in Article 346.16 of the Tax Code of the Russian Federation are regulated. That is, they cannot be more than a certain amount. These include: expenses for workwear and uniforms, entertainment expenses, interest on loans in excess of the norm, and others. These costs affect almost all types of businesses, so bypassing regulations has a strong positive effect.

A good example of circumventing the rules would be the replacement of compensation for the use of personal vehicles for business purposes with rental agreements for employees’ personal cars in taxi companies. It seems to be the same, but the tax base is smaller.

If, based on the results of calculations, the tax amount is less than 1% of the amount of income, 1% of the amount of income must be paid to the budget.

Video - White ways to optimize taxes

Reduction of income tax under OSNO

The greatest scope for imagination opens up for taxpayers in the general regime.

Firstly, they can use all methods to reduce the tax of “simplified” people by 15%. And they can add a lot for themselves. Read below about the variety of options, from the simplest to the most sophisticated.

Creating reserves for future expenses

A provision is a write-off in the current period of expenses that will definitely be incurred in a future period.

In accordance with the law, a company can create reserves for the impairment of overdue accounts receivable, for the payment of vacation pay to employees, for annual bonus payments to employees (only specified in the employment contract), and for the depreciation of securities. You need to understand that creating a reserve helps speed up the recognition of expenses, and does not increase expenses as a whole. And if there is no expense in the future, the reserve will need to be restored (read: included in income).

Overestimation of associated costs

Almost every company rents an office or warehouse. In rented areas, it is necessary to maintain life systems, clean, and maintain fixed assets and other labor tools in good condition. All of these expenses are suitable tools for inflating costs.

Personnel training, consulting services

All these items relate to other costs associated with the production of goods. Therefore, train your staff. And you will receive benefits in the form of added value to the business, and the favor of employees, and you will reduce taxes.

The use of any type of consultation from software implementation to marketing research also reduces taxes.

Depreciation of fixed assets

Everyone knows that depreciation of fixed assets is taken into account as an expense when forming the tax base. But not everyone knows that when writing off a fixed asset, you can include in expenses all non-accrued depreciation, as well as the costs of dismantling, recycling and removal of the fixed asset

Offset of overpayments on taxes

Well, let us remind you that advances on income tax may not correspond to the final estimated tax amount for the period. Therefore, the organization accumulates overpayments that need to be read out on time. Otherwise, after three years you will lose these amounts irrevocably.

Creation of a group of companies, some of which are “simplified”

Further - more interesting. You can create a group of companies, some of which will use preferential tax regimes. And show most of the profit in them.

Scheme of actions of the group of companies

The main thing here is either not to advertise the connection between the founders of the group companies, or to make the group model justified. For example, you can segment your business by areas of activity, or by regions of presence. But if the tax inspector discovers the connection and finds it suspicious, you will need to provide a clear argument as to why you did what you did.

Use of offshore companies

The scheme for using offshore companies is similar to the previous one and is absolutely legal, despite the created image of “dark dealings”. Here, as in the previous version, the main thing is to prove to the tax inspector the validity of the existence of a group of companies.

Traditionally, the argument in favor of creating an offshore company is the presence of an intangible asset (copyrights, patents, brand) that needs to be protected. The asset is transferred to an offshore company, and companies in Russia pay for the use of royalties (read: withdraw funds to a low-tax jurisdiction).

Attention! All payment transactions abroad are controlled by the bank's currency control. For carrying out currency transactions using forged documents, Art. 193.1 of the Criminal Code of the Russian Federation provides for criminal liability. Therefore, make sure that payment documents are not deliberately false.

Transfer of assets to a simplified person

Transfer of assets is also an option for creating a group of companies, only now the company’s assets – machines, equipment, offices and other means of labor – become the main protagonist.

Asset action plan

The advantages of this scheme include not only savings on profit tax in a company on OSNO due to inflated expenses, but also the absence of property tax in a company using the simplified tax system. Everyone enjoys the scheme.

Profit tax savings due to leasing

Leasing is truly a treasure trove of tax optimization methods. You can choose one of the proposed options or use both:

- Accelerated depreciation of the leased asset. You can enter into an agreement with the lessor in such a form that, according to all accounting rules, you will have to assign a useful life equal to the term of the agreement. And that's what you need. The useful life is reduced - depreciation increases - income tax is reduced. At the same time, you reduce property tax, since it is proportional to the cost of fixed assets.

- Leaseback as a means of saving on taxes. The essence of leaseback: a company transfers its property to a leasing company, and then receives it on lease, i.e. actually takes out a loan secured by equipment. Thus, the company solves several financial problems, one of which is to reduce income tax by inflating expenses, the second is to reduce property tax due to the lack of property (on paper).

Court decisions

Thus, the limited liability company “R” (hereinafter referred to as the company) applied to the arbitration court with an application to invalidate the decision of the tax authority to hold the company accountable for committing a tax offense.

By a court decision dated May 12, 2003, the application was rejected.

By the decision of the appellate court dated July 11, 2003, the court decision was canceled and the company’s demand was satisfied. In the cassation appeal, the tax authority asks to cancel the decision of the appellate instance and uphold the decision of the first instance court, citing the incorrect application of Articles 247 and 252 of the Tax Code of the Russian Federation. According to the complainant, the company unlawfully reduced taxable income by the amount of economically unjustified expenses.

The cassation court found no grounds to satisfy the tax authority's complaint.

As can be seen from the case materials, the tax authority conducted an on-site tax audit of the company, based on the results of which an audit report was drawn up and a decision was made.

By this decision, the company was held accountable for committing a tax offense provided for in paragraph 1 of Article 122 of the Tax Code of the Russian Federation. In addition, the company was assessed additional income tax, value added tax and penalties.

During the tax audit, it was established that, on the basis of a lease agreement dated February 1, 2002, concluded with CJSC “S”, the company leases non-residential properties for the purpose of organizing trade. The company subleased the rented space to trade organizations and individual entrepreneurs. In making the contested decision, the tax authority proceeded from the fact that the company subleased only part of the leased space, therefore, inclusion in expenses accepted for tax purposes of the entire amount of rent paid under the agreement is unlawful.

In accordance with paragraph 1 of Article 252 of the Tax Code of the Russian Federation, for the purpose of calculating income tax, the taxpayer reduces the income received by the amount of expenses incurred (except for the expenses specified in Article 270 of the Tax Code of the Russian Federation). According to subparagraph 10 of paragraph 1 of Article 264 of the Tax Code of the Russian Federation, other expenses associated with production and sales include rental (leasing) payments for rented (leased) property.

The conditions for including costs in expenses that reduce income are provided for in Article 252 of the Tax Code of the Russian Federation. According to paragraph 1 of this article, expenses are recognized as justified and documented expenses (and in cases provided for in Article 265 of the Code, losses) incurred (incurred) by the taxpayer. Any expenses are recognized as expenses, provided that they are incurred to carry out activities aimed at generating income.

According to the tax authority, the fact of incomplete sublease of the space leased by the company and, consequently, the lack of income from their use serves as the basis for recalculating expenses in the form of rent in proportion to the area of the retail pavilions being subleased.

The above argument of the tax authority was correctly assessed by the court of appeal, which indicated that, within the meaning of Article 252 of the Tax Code of the Russian Federation, the economic justification of the expenses incurred by the taxpayer is determined not by the actual receipt of income in a specific tax (reporting) period, but by the focus of such expenses on generating income, that is, the expenses are determined by the economic activity of the taxpayer.

Acceptance of expenses for tax purposes is not excluded even if the taxpayer receives a loss as a result of financial activities for the reporting (tax) period (clause 8 of Article 274 of the Tax Code of the Russian Federation).

(Resolution of the Federal Antimonopoly Service NWZ dated November 4, 2003 No. A56-11030/03)

Illegal tax optimization schemes. How can you not do it?

In our article, we considered exclusively legal methods of reducing income taxes.

Let’s touch on illegal methods so that readers don’t get into trouble in the heat of tax optimization.

Hiding income

All income of the organization, both income from the sale of main products and non-operating income, must be reflected in the organization’s accounting and documented. The creation of so-called “gray” cash registers, in which the movement of unaccounted funds occurs, is illegal.

Use of intermediary schemes

An intermediary scheme refers to actions when a company sells its product or service through an intermediary controlled by it. For example, a manufacturing company sells goods at a minimum markup to a commission agent. The same, in turn, resells it at a significant profit. The commission agent company itself can be either a one-day company or a “simplistic” company.

Transfer scheme

A fairly popular scheme, similar to the scheme of work of a group of companies, some of which are “simplified”. Only here the group companies, taking advantage of their affiliation, inflate the prices of sales of raw materials or services within the company. Companies on a low-tax regime sell goods (services) to companies on OSNO at a price significantly higher than the market. Transfer legislation suppresses these attempts.

Work through

is a company that is created not for business purposes, but to obtain tax benefits. As a rule, such a company does not exist for long, until the first tax audit.

Fraudsters can create a shell company as part of a group or use people whose illegal business is built on helping completely “white” companies inflate costs or launder money. Fly-by-night companies provide deliberately false information about services provided (most often) or goods supplied, receive money from the company and then return it in cash minus a certain percentage.

We have listed only a few of the most common illegal ways to reduce income taxes; in fact, there are many more of them. To avoid becoming a tax criminal, intentionally or unknowingly, check the optimization methods used according to the following scheme.