New reporting forms in 2019

The first months of the new year are the busiest time for an accountant, as preparations are underway for submitting reports for the past year.

Not only is it necessary to draw up correct reports, you must also meet the deadlines established by law and check whether new forms have been approved. When preparing reports for the year, the timing of its submission to regulatory authorities must be checked with particular care, since fines for failure to submit annual declarations are higher than advance payments that are prepared during the year.

For failure to submit a declaration within 10 days from the deadline, the tax authorities may block transactions on all current accounts of the taxpayer.

For violating the deadlines for filing declarations and paying insurance premiums, an official may be fined in the amount of 300 to 500 rubles.

The fine for violating the deadlines for submitting annual reports to statistics ranges from 20 thousand to 70 thousand rubles. for legal entities and from 10 thousand to 20 thousand rubles. for officials.

Now, in order for the submission of reports for 2020 to proceed without violations, we will describe in detail what the reporting deadlines for 2020 are for each taxation system, as well as for taxes paid regardless of the taxation system.

NPD and PSN

These two types can only be used by individual entrepreneurs and do not require the submission of any types of reporting.

The UTII declaration must be submitted quarterly by the 20th day of the month following the reporting period. The deadline for the 4th quarter of 2020 falls on Sunday, so it is postponed to 01/21/2019.

An updated form of this declaration was provided for downloading at the beginning of the article.

When applying the simplified taxation system, it is necessary to submit a declaration to the tax office based on the results of the tax period - the calendar year. The simplified tax system has two different objects of taxation: income and income minus expenses. The taxpayer chooses which one to use independently. The declaration form is the same for both cases, but different sheets are filled out depending on the object of taxation.

Deadlines for submitting reports for 2020 according to the simplified tax system:

- for organizations, the deadline for submitting a declaration is 04/01/2019 (since 03/31/2018 is Sunday);

- for individual entrepreneurs the deadline is 04/30/2019.

The general taxation system involves submitting the following reports to the tax office:

- VAT declarations. It is presented for the quarter by both organizations and entrepreneurs.

- Income tax returns. It can be submitted either monthly or quarterly, depending on the method of payment of advance payments for income tax. The composition of the declaration also depends on this. Only available to organizations.

- Personal income tax returns in form 3-NDFL. Rented by individual entrepreneurs on the general taxation system and by individuals in certain cases.

And also the forms of these declarations:

- VAT declaration form.

- Income tax return form.

- Form for the updated 3-NDFL declaration (given at the beginning of the article).

If an organization or individual entrepreneur has hired employees working under employment or civil law contracts, then it becomes necessary to report on employees’ personal income tax and insurance contributions, as well as submit other reports to the Pension Fund and Social Security.

As tax agents for personal income tax, individual entrepreneurs and organizations at the end of 2020 must report to the tax office within the following deadlines:

- Certificates in form 2-NDFL about the impossibility of withholding tax by a tax agent - until 03/01/2019. The updated form is given at the beginning of the article.

- Certificates in form 2-NDFL on income and tax amounts for individuals - until 04/01/2019.

- Calculation of tax amounts according to form 6-NDFL - until 04/01/2019 (03/31/2019 - Sunday).

There is also a single simplified declaration (USD), which can be submitted to the tax authority by individual entrepreneurs or organizations if they do not have an object of taxation according to the simplified tax system (USN, OSNO, VAT) and do not have cash flows through the cash desk or current account in the reporting period.

EUDs are submitted instead of declarations for those taxes for which there is no object of taxation.

The deadline for submission for the 4th quarter of 2020 is 01/21/2019.

Accounting statements for 2020 must be submitted before 04/01/2019 inclusive to both the tax office and the statistical authorities.

At the end of March 2020, no legislative changes regarding the filing of income tax returns have been officially published.

The current form of profit declaration was approved by order of the Federal Tax Service of Russia dated October 19, 2020 No. ММВ [email protected]

| Never worked in VLSI? Choose your discount! For users of Kontur-Extern, Argos and other programs |

The new form of the income tax return was approved by order of the Federal Tax Service dated October 19, 2016 No. ММВ-7-3/572 “On approval of the form of the tax return for the income tax of organizations, the procedure for filling it out, as well as the format for submitting the tax return for the income tax of organizations in electronic form."

This new declaration form came into force on December 28, 2016. In 2020, organizations must submit a declaration using this form. That is, for all periods of 2020, which you can see in the tables above, you need to use this particular income tax return form.

If reporting is submitted quarterly (Article 285, paragraph 3 of Article 289 of the Tax Code of the Russian Federation), a declaration on NP must be submitted before the 28th day after the end of the next quarter. The deadlines for submitting quarterly income tax reports in 2020 are as follows:

- for the 1st quarter - until April 28, 2018 (Saturday, April 28, 2020, working day);

- for the six months - until July 30, 2018 (July 28 - Saturday);

- for 9 months - until October 29, 2018 (October 28 - Sunday).

In turn, the deadline for submitting quarterly income tax reports in 2020 will be:

- for the 1st quarter - until April 29, 2019 (April 28 - Sunday);

- for the six months - until July 29, 2019 (July 28 - Sunday);

- for 9 months - until October 28, 2019.

If the company’s average quarterly income for the last four quarters is above 15 million rubles, it must switch to monthly payments under the NP, while remaining subject to quarterly reporting.

The company has the right, if desired, from the beginning of the next tax period to switch to monthly submission of income tax reports on actual profit (clause 2 of Article 286 of the Tax Code) with monthly transfer of advances. To do this, you need to report this to the Federal Tax Service by the end of the year.

| Reporting period | Deadline for submitting the NP declaration in 2020 | Deadline for submitting the NP declaration in 2020 |

| 1 month | 28.02.2018 | 28.02.2019 |

| 2 months | 28.03.2018 | 28.03.2019 |

| 3 months | 04/28/2018 (Saturday, April 28 – working day) | 04/29/2019 (April 28 - Sunday) |

| 4 months | 28.05.2018 | 28.05.2019 |

| 5 months | 28.06.2018 | 28.06.2019 |

| 6 months | 07/30/2018 (July 28 - Saturday) | 07/29/2019 (July 28 - Sunday) |

| 7 months | 28.08.2018 | 28.08.2019 |

| 8 months | 28.09.2018 | 09/30/2019 (September 28 - Saturday) |

| 9 months | 10/29/2018 (October 28 - Sunday) | 28.10.2019 |

| 10 months | 28.11.2018 | 28.11.2019 |

| 11 months | 28.12.2018 | 12/30/2019 (December 28 - Saturday) |

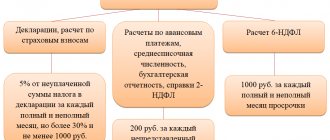

Late submission of accounting and/or tax reporting in Russia is considered a tax and administrative offense (Article 106 of the Tax Code of the Russian Federation, Article 2.1 of the Code of Administrative Offenses of the Russian Federation).

This definition also applies to violation of deadlines for filing income tax returns in 2020. In such a case, sanctions are regulated by Art. 119 of the Tax Code of the Russian Federation. Both taxpayers and tax agents for this tax are punished for this.

The penalty for late submission of a tax return report is calculated at 5% of the amount of tax payable from section 1 of the late declaration for each full and partial month from the date of violation of the deadline. The minimum fine is 1 thousand rubles, the maximum is 30% of the amount of non-payment. If the NP was paid on time, then the fine will be 1 thousand rubles. If the tax is not paid in full within the prescribed period, then a fine is charged on the missing amount. This rule applies to the annual report on NP.

If the delay occurred with interim reporting, then the fine is 200 rubles (Article 126 of the Tax Code of the Russian Federation).

In addition to the fine for being late in submitting a declaration for more than 10 days, tax authorities have the right to seize the company’s bank account (clause 3 of Article 176 of the Tax Code of the Russian Federation).

In addition, the court, at the request of the Federal Tax Service, may impose sanctions on company officials - a warning or a fine in the amount of 300 to 500 rubles under Art. 15.5 Code of Administrative Offenses of the Russian Federation.

The annual IR return must be sent by March 28 of the following year after the end of the reporting year - to all taxpayers and IR agents.

The interim report on NP is submitted to the tax office by the 28th day of the month following the reporting period by those who submit quarterly or monthly reports.

If the deadline for submitting the IR report falls on a weekend on the calendar, it is moved to the next working day after the weekend.

UTII

Transfer the calculated UTII amount no later than the 25th day of the first month following the expired tax period (quarter). That is, no later than April 25, July 25, October 25 and January 25 of the year. This is stated in paragraph 1 of Article 346.32 of the Tax Code of the Russian Federation. Payment of advance contributions to the budget for UTII is not provided.

The deadline for paying UTII may fall on a non-working day. In this case, the tax must be transferred to the budget on the next working day (clause 7, article 6.1 of the Tax Code of the Russian Federation).

Deadline for payment of UTII in 2020

| For the fourth quarter of 2020 | No later than 01/25/2018 |

| For the first quarter of 2020 | No later than 04/25/2018 |

| For the second quarter of 2020 | No later than July 25, 2018 |

| For the third quarter of 2020 | No later than October 25, 2018 |

Penalties for late submission of reports

If, instead of submitting a declaration in electronic form, you submitted it on paper, you will be fined 200 rubles.

Late or failure to submit an income tax return (Article 119 of the Tax Code of the Russian Federation) - a fine of 5 percent of the tax amount for each full or partial month from the date established for its submission, but not more than 30% of the specified amount and not less than 1,000 rubles

Company officials in accordance with Art. 15.5 of the Code of Administrative Offenses of the Russian Federation for failure to meet deadlines - a fine of 300 to 500 rubles.

NPD and PSN

New deadline for submitting income statements for the 4th quarter of 2020

Depending on the reporting period set for the organization, the deadline for submitting the profit declaration for the 4th quarter of 2020 varies. The article contains tables with dates for all taxpayers.

Attention!

To report income tax for the 4th quarter of 2020, you will need the following documents, which can be downloaded:

The BukhSoft program generates a profit declaration automatically. After preparation, the report is tested by all verification programs of the Federal Tax Service. You can check the report generated both in BukhSoft and in any other accounting program. Try it for free:

Submit income tax 2020 - Electronically and on time

Entrepreneurs in the modern world have many worries. In addition to running a business, you need to find time to account for taxes, correspond with tax authorities, submit applications and submit reports. Not everyone is able to personally handle documentation. After all, the process requires a lot of time to work with papers, go to tax offices and other distracting actions.

However, there is a way out of the situation. It is now possible to submit reports to the tax office via the Internet. Recently, this form was an unusual novelty, but has now become a common way of working. This greatly simplifies life, frees up a lot of time and eliminates the need to leave an enterprise or business unattended.

Income tax due dates 2018

No later than April 28, for the first quarter.

For the half-year, the deadline is July 30.

October 29 – end of payment for 9 months.

Organizations that pay an advance on actual profits every month must do so no later than the 28th of each month. The exceptions are June (until the 30th) and September (until the 29th). Sending reports via the Internet will help you avoid delays and the troubles associated with them. Contact our company and you won’t have to keep the rules of tax organizations in mind.

Our capabilities

Possibility to send income tax and any report via the Internet.

You can work remotely, from your office or home.

We will provide the necessary response documents.

We will check it, correct errors, or fill it out ourselves and send it to the file.

All information is securely protected, stored on the server and can be provided upon your request.

Qualified employees will advise on any questions that arise.

Submitting your income tax return for you at a minimal cost.

These are just some of the factors in favor of contacting us.

Necessary actions

One-time submission of reports via the Internet in Moscow may vary in cost. Depends on whether you have an electronic signature. In some cases, only a power of attorney is needed. We will clarify all points. You just need to fill out a form with your personal information.

After this, sign the forms: a power of attorney from the Federal Tax Service and an agreement concluded by the two parties. To ensure that your online report is successful, please send us the signed forms. You will also need a report file and a scan of the manager’s seal and signature.

After this, you will receive payment information.

To have access to fast and convenient electronic reporting Moscow, please contact ReportMaster. Call or order feedback, get answers to your questions! We will help you and free up time for relaxation!

For violating the deadlines for submitting reports, the manager or chief accountant will be fined, and failure to comply with the deadlines for submitting tax returns will entail fines imposed on the organization. Responsibility for this violation of the deadlines for submitting tax returns is provided for in Article 119 of the Tax Code of the Russian Federation.

Moreover, regardless of the period of delay with the declaration, the amount of the fine is 5% of the unpaid amount of tax, but not more than 30% of the untransferred amount of tax on the declaration and not less than 1000 rubles.

According to the Tax Code of the Russian Federation in Russia, there are different ways of calculating and paying taxes. One of the most common among them is payment of advance payments.

At the same time, when calculating advance payments, accountants do not always do everything smoothly, and, as they say, without a hitch. Sometimes, especially for beginners, some questions and problems arise.

Before proceeding to a detailed analysis of the schemes for calculating advance payments, let us define this concept itself.

The deadline for paying income tax for the 1st quarter of 2020 is April 28. Those who transfer monthly advances from actual profits pay for March no later than this date.

If monthly advances are made from the profits of the previous quarter, this is also the deadline for the first payment for the second quarter. Income tax on income from the main business (at a rate of 20%) can only be calculated based on the results of the tax period - the year.

This year, numerous amendments came into force that affected the work of companies.

But we already know about new tax and accounting changes from 2020. We have collected them in this article. So, in 2018 the following changes in legislation will come into force: Calculation of insurance contributions to the tax office. From 2020, insurance premiums will be administered by the Federal Tax Service.

The Tax Code establishes deadlines for paying taxes and deadlines for submitting tax reports.

Federal laws determine the deadlines for submitting financial statements.

reporting to the Pension Fund and Social Insurance Fund. If the average number of employees exceeds 100 people, tax returns must be submitted electronically. The exception is VAT returns.

Advance payments for income tax in 2020: who pays, when, what the consequences are for being late with advances. Examples of calculating advance payments and samples of payment slips for payment of advances.

The list of taxpayers who transfer only quarterly advance payments for income tax based on the results of the 1st quarter, half a year and 9 months is given in paragraph 3 of Article 286 of the Tax Code of the Russian Federation.

Tax changes introduced to the Tax Code by the Law of Ukraine dated December 24, 2014. No. 909-VIII, generally evoke positive emotions, although there was a small fly in the ointment. Judge for yourself: 1. From January 1, 2020, monthly advance payments have been cancelled.

But with one caveat - before December 31, 2020, you will need to pay one more advance payment in the amount of 2/9 of the tax amount determined in the declaration for the 3 quarters of 2020.

Advance payments for income taxes in 2020 can be paid in several ways, but the company does not always have a choice. We have discussed in detail all the methods of paying advances on profits in 2020 in this article.

At the end of each reporting period, taxpayers determine the amount of the advance payment for income tax (clause 2 of Article 286 of the Tax Code of the Russian Federation). In this case, different options for paying advance payments for income tax are possible.

Advances on profits must be calculated and transferred in a special order.

About the methods of paying and calculating advance payments for income tax in 2020, see this article. Advance payments on profits directly depend on the tax, which the company calculates from income reduced by the amount of expenses (Article 286 of the Tax Code of the Russian Federation). Let's tell you in more detail who pays advances on profits in 2020, what payments can be and how to calculate them.

The amount of advances for income tax is determined at the end of each reporting period (clause

2 tbsp. 286 Tax Code of the Russian Federation)

All companies and individual entrepreneurs need to submit some kind of statistical reporting. And there are so many forms of this reporting that it’s not surprising to get confused in them.

To help respondents, Rosstat has developed a special service. using which you can determine what statistical reporting needs to be submitted to a specific respondent.

However, unfortunately, this service does not always work correctly.

The Federal Tax Service has approved a new procedure for obtaining a deferment (installment plan) for payments to the budget.

Article 246 of the Tax Code of the Russian Federation defines income tax payers as:

- companies on OSN, regardless of the volume and availability of profit;

- foreign companies operating through representative offices in the Russian Federation;

- foreign organizations recognized as residents of the Russian Federation.

The profit declaration is submitted to the tax authority at the place of registration of the taxpayer on paper. If the average number of employees for the last year did not exceed 100 people, then the declaration is submitted using electronic reporting systems (clause 3 of Article 80 of the Tax Code of the Russian Federation), for example, SBIS Electronic reporting or 1C: Reporting.

Income tax declaration for organizations with branches and separate divisions. Organizations that have separate divisions at the end of 2020 must report income tax at their location and the location of each of their separate divisions. The taxpayer can submit these reports at different times, but the deadline for submission is March 28, 2019.

By the way, if a separate division is registered in the same subject of the Russian Federation as the parent organization itself, there is no need to report to the division’s inspectorate. It is enough to report only at the location of the organization itself, having previously submitted the appropriate notification to the inspectorate at the location of the unit, so that the tax authorities do not lose you.

Income tax return for a consolidated group of taxpayers. The responsible participant in the consolidated group is required to report to the Federal Tax Service. The general deadline for submitting the income tax return for 2020 is March 28. The Tax Code of the Russian Federation does not provide for any special features in this case.

If the consolidated group managed to change the participant responsible for filing reports and registered these changes with the tax authorities before December 31, 2020, then the obligation to report at the end of the year is assigned to the new responsible participant. If such a participant changed in January 2020, then he will make the first annual income tax calculation based on the results of 2020.

Declaration of a tax agent on income in favor of a foreign legal entity. If a Russian organization pays income to a foreign organization, then it is obliged to submit a special tax calculation on the amounts of income paid to foreign organizations and withheld taxes based on the results of 2020 in the form approved in Appendix 1 to the order of the Federal Tax Service of Russia dated March 2, 2016 No. ММВ-7-3/ [email protected] until March 28, 2020.

Similar requirements for the presentation of this calculation are imposed on foreign organizations registered with the Federal Tax Service on the territory of Russia.

This calculation is not related to the income tax return and is a separate document. However, the timing of their submission coincides.

Accounting forms

For state controllers (Rosstat, Federal Tax Service and Ministry of Justice) the date of provision is uniform. This period is equal to three calendar months from the end of the reporting financial year, or until March 31.

Please note that the deadline for submitting annual reports for 2020 in 2020 fell on a Sunday, and they were postponed, in accordance with the Tax Code of the Russian Federation, to 04/01/2019. However, inspectors of the Federal Tax Service do not recommend postponing the submission of accounting reports until the last day. This may result in fines.

In addition to state controllers, public sector employees are required to report to higher managers of budget funds, as well as send accounting reports to the founders. Specific deadlines for submitting reports for the 4th quarter of 2020, as well as annual forms of financial statements, should be clarified in advance with the founder or superior manager, if such information has not been communicated to your institution in the prescribed manner.

If the deadline for submitting reports falls on a non-working (weekend) day, submit it on the first working day following it (clause 47 of PBU 4/99).

March 31, 2020 is Saturday. Therefore, organizations (regardless of the applied taxation regime) must submit financial statements for 2017 to the Federal Tax Service and statistical authorities no later than 04/02/2018.

Russians were reminded of the deadline for paying taxes in October

The frequency of reporting for income tax depends on the frequency of payment of advance payments for this tax. In accordance with this, income tax payers are divided into those who:

- pays advance payments based on the results of each quarter plus intra-quarter monthly payments; the declaration is submitted quarterly;

- pays advance payments and submits returns quarterly. This can be done by companies whose sales income over the previous four quarters did not exceed an average of 15 million rubles for each quarter (60 million rubles per year), as well as budgetary, autonomous institutions, non-profit organizations that do not have income from sales;

- makes advance payments based on actual profits and submits a declaration monthly. The application of such a tax payment scheme must be reported to the Federal Tax Service before December 31 of the year preceding the tax period in which the transition to such an advance payment system takes place.

Quarterly payment of tax and submission of income tax returns in 2018

| For what period do we pay and rent? | Deadline |

| for 2020 | 28.03.2018 |

| 1st quarter 2018 | 28.04.2018 |

| 1st half of 2018 | 30.07.2018 |

| 9 months 2018 | 29.10.2018 |

| for 2020 | 28.03.2019 |

The deadline for submitting a profit declaration and paying the corresponding tax is the 28th of the next month.

The transfer rule also applies. Monthly payment of tax and submission of income tax return in 2018

| For what period do we pay and rent? | Deadline |

| January | 28.02.2018 |

| January February | 28.03.2018 |

| January March | 28.04.2018 |

| January - April | 28.05.2018 |

| January - May | 28.06.2019 |

| January June | 30.07.2018 |

| January - July | 28.08.2018 |

| January - August | 28.09.2018 |

| January - September | 29.10.2018 |

| January - October | 28.11.2019 |

| January - November | 28.12.2018 |

| January - December, i.e. for 2020 | 29.01.2019 |

Tax under simplified tax system

Transfer advance payments for the single tax no later than the 25th day of the first month following the reporting period (quarter, half-year and nine months). That is, no later than April 25, July 25 and October 25. This procedure is established by Article 346.19 and paragraph 7 of Article 346.21 of the Tax Code of the Russian Federation.

There are different deadlines for paying the single (minimum) tax at the end of the year. As a general rule, organizations must remit tax no later than March 31 of the following year, and entrepreneurs no later than April 30 of the next year. This follows from the provisions of paragraph 7 of Article 346.21 and paragraph 1 of Article 346.23 of the Tax Code of the Russian Federation. We present the deadlines for paying the simplified tax system in 2020 in the table.

Sample of filling out a declaration in 2020

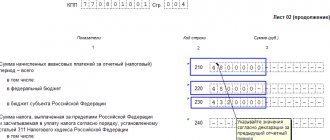

The income statement contains standard sheets that are required to be filled out by all taxpayers, as well as additional sheets and sections.

So, absolutely all organizations reporting income tax fill out:

- title page;

- section No. 1, subsection 1.1 with the amount of tax that the payer needs to pay to the budget;

- Sheet 02 with the calculation of income tax and its attachments;

- Appendix No. 1 to the second sheet with sales and non-sales income;

- Appendix No. 2 to the second sheet with production and sales costs, non-operating expenses and losses that are equivalent to these expenses.

| Completing applications and pages when conditions apply | |

| Appendix No. 3 to sheet 02 with calculations of all expenses for operations for which the results of financial activities are taken into account when taxing profits under Art. 264.1, 268, 275.1, 276, 279, 323 of the Tax Code of the Russian Federation, except those reflected in sheet 05 | filled out by organizations that sold depreciable property |

| Appendix No. 4 to sheet 02 with the calculation of the loss or part thereof, which affects the reduction of the tax base | filled out by organizations that transfer losses received in previous years |

| Appendix No. 5 to sheet 02 with calculation of the distribution of payments between the organization and branches | filled out by organizations with separate divisions (with the exception of those who pay tax for separate divisions at the head office address) |

| Sheet 03 | filled out by tax agents who pay dividends and interest on securities |

| Sheet 04 with the calculation of income tax at a separate rate (clause 1 of Article 284 of the Tax Code of the Russian Federation) | filled out by organizations that received dividends from foreign companies |

| Sheet 05 with the calculation of the tax base for organizations that carry out transactions with special consideration of the financial result (except for those that are in Appendix 3 to Sheet 02) | filled out by organizations that received income from transactions with securities, bills and derivatives transactions |

| Sheet 06 with expenses, income and tax base of non-state pension funds | filled by non-state pension funds |

| Sheet 07 with a report on the purpose of using property, money, work, and charitable services, targeted income and targeted financing | filled out by organizations that received targeted funding, targeted revenues, and only in the annual declaration |

| Sheet 08 | filled out by organizations that make independent adjustments to income and expenses received under controlled transactions |

| Sheet 09 | filled out by controlling persons (according to Article 25.13 of the Tax Code of the Russian Federation) |

| Appendix No. 1 to the declaration | filled out by organizations with income and expenses that are listed in Appendix No. 4 to the Procedure for filling out the declaration |

| Appendix No. 2 to the declaration | filled out by tax agents (according to Article 226.1 of the Tax Code of the Russian Federation) |

If the sample form does not open, please refresh this page.

Line 041 in the profit declaration is located in Appendix No. 02 to sheet 02 and discloses data on the amounts of tax payments accrued for the period that were included in indirect expenses. Line 041 includes taxes that are mentioned in paragraphs. 1 clause 1 art. 264 Tax Code of the Russian Federation. These are amounts paid to the state budget related to the production and sale of products, and therefore reduce the amount of profit.

| We include it in line 041 of the profit declaration | NOT included in line 041 |

| Property and transport tax | Income tax |

| Tax on land and water use | Pollution fees |

| Customs duties | All kinds of fines, penalties, sanctions fees |

| For mining and hunting resources | UTII |

| Insurance premiums for compulsory medical insurance, compulsory medical insurance and VNiM | Voluntary insurance and contributions for injuries |

| Government duty | Trade fee |

| Reinstated VAT, which is taken into account in other expenses (for example, tax restored when receiving an exemption from VAT under Article 145 of the Tax Code of the Russian Federation (clauses 2, 6, clause 3 of Article 170 of the Tax Code of the Russian Federation) | VAT and excise taxes that the company presented to the buyer |

When filling out line 041 of the profit declaration for the reporting (tax) period, indicate in it the amount of all taxes (advance payments for them) accrued during this period, fees and insurance premiums on an accrual basis, regardless of the date of their payment to the budget (letters from the Ministry of Finance of the Russian Federation dated September 12 .2016 No. 03-03-06/2/53182, dated 09/21/2015 No. 03-03-06/53920).

The profit declaration is submitted by the company to the Federal Tax Service at the location of its location and at the location of each separate division (clause 1 of Article 289 of the Tax Code of the Russian Federation).

To the Federal Tax Service at its location, the company submits a declaration drawn up for the organization as a whole with the distribution of profits according to “particulars”. That is, in addition to filling out the standard declaration sheets, which are common to all taxpayers, Appendix No. 5 to sheet 02 is additionally filled out in an amount equal to the number of “separate sections” (including those closed in the current tax period).

If the company's divisions are located on the territory of one constituent entity of the Russian Federation, you can pay tax (advance payments) for a group of “separate units” through one of them. In this case, the company submits a profit declaration to the tax authorities at the place of registration of the company’s head office and at the place of registration of the responsible “separateness”.

Another option, if the parent company and its divisions are located in the same region, may be to refuse to distribute profits to each “isolation”. The parent company has the right to pay full profit tax for its divisions and file one declaration only at its location.

It should be remembered that if a company decides to change the tax payment procedure or adjusts the number of structural divisions on the territory of the subject, or other changes occur that affect the tax payment procedure, then this should be reported to the inspectorate.

If the company is the largest taxpayer, then all declarations, including those for “separate tax returns,” are submitted to the specialized inspectorate for the largest taxpayers. In this case, information about the income tax attributable to “segregated units” is reflected in Appendix No. 5 to sheet 02 of the tax return, that is, the procedure for filling out the income statement does not change.

From January 1, 2020, the rules for reducing the tax base for losses of previous years were changed (Letter of the Federal Tax Service of the Russian Federation dated 01/09/2017 No. SD-4-3/ [email protected] “On changing the procedure for accounting for losses of past tax periods”):

- a reduction restriction has been introduced: the tax base can be reduced by no more than 50% (the restriction does not apply to tax bases to which certain reduced tax rates apply);

- The restriction on the limitation period for the transfer has been removed (previously it was possible to transfer only within 10 years);

- The new procedure applies to losses received for tax periods starting from January 1, 2007.

Taking into account these rules, the following lines must be completed in the profit declaration:

- line 110 of sheet 02 and line 010, lines 040–130, 150 of Appendix No. 4 thereto: in particular, the amount on line 150 (the amount of loss that reduces the base) cannot be more than 50% of the amount on line 140 (tax base);

- line 080 of sheet 05;

- lines 460, 470, 500, 510 of sheet 06: the sum of lines 470 and 510 (the amount of the recognized loss) must be less than or equal to 50% of the amount on lines 450 and 490 (tax base from investments).

The issue of reflecting symmetrical adjustments in the profit declaration is discussed in detail in the Letter of the Federal Tax Service of the Russian Federation dated October 24, 2017 No. SD-4-3 / [email protected]

When reflecting symmetrical adjustments in Sheet 08 of the declaration (provided that the code “2” or “3” is indicated in the “Type of adjustment” attribute):

- in column 3 “Attribute” the number “0” is entered if the adjustments made led to a decrease in sales income (line 010 of Sheet 08)/non-operating income (line 020 of Sheet 08);

- in column 3 “Attribute” the number “1” is entered if the adjustments made led to an increase in expenses that reduce the amount of sales income (line 030 of Sheet 08)/non-operating expenses (line 040).

In this case, in Sheet 08 you do not need to enter “0” or “1” in column 3 “Sign” on line 050. On this line you should indicate the total amount of the adjustment without taking into account the sign.

Income tax declaration for organizations on the OSN in 2019 (filling sample).

You can also fill out your income tax return using:

- Paid Internet services (“My Business”, “B.Kontur”, etc.);

- Specialized accounting companies.