Procedure and deadlines for paying UTII in 2020

Distinctive features of the UTII system

The imputed income tax system is distinguished by the following:

- The transition to paying UTII is possible for certain types of activities, the list of which is given in clause 2 of Art. 346.26 Tax Code of the Russian Federation;

- it cannot be applied to activities that require payment of a trade tax;

- its use is available only to taxpayers with a small number of employees (up to 100 people);

- it is chosen voluntarily, can begin and cease to be used in any month of the year, and allows for the possibility of combining with other modes;

- with it you need to register and deregister as a UTII payer;

- payment of UTII by organizations involves replacing the payment of several taxes: profit tax (for legal entities) or personal income tax (for individual entrepreneurs), VAT and property tax (except for that calculated from the cadastral value);

- payment of UTII does not exempt you from paying taxes other than those being replaced and submitting reports on them;

- The procedure for calculating and paying UTII is subject to the uniform rules established by the Tax Code of the Russian Federation, requiring quarterly reporting and quarterly payment of tax.

Find out about the rules for applying UTII in the material “Who can apply UTII (procedure, conditions, nuances)”

Single tax payment deadline (2020)

Organizations and individual entrepreneurs using UTII are required to submit a declaration to the inspectorate at the end of the tax period (quarter) and pay the tax.

The deadline for filing a tax return is set by the Tax Code of the Russian Federation until the 20th day (inclusive) of the month following the reporting period. The deadline for paying UTII does not coincide with the deadline for filing the declaration, falling on a later date of the same month.

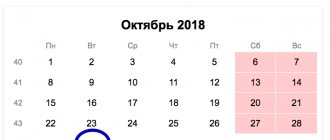

The deadlines for paying UTII are also specified in the Tax Code of the Russian Federation. In paragraph 1 of Art. 346.32 of the Tax Code of the Russian Federation it is noted that payment of UTII must be made before the 25th day (inclusive) of the month following the tax period. In this case, the rule applies to postponing the payment deadline and submitting the declaration to the next next working day in the case when the reporting date falls on a weekend or non-working day (clause 7, article 6.1 of the Tax Code of the Russian Federation).

What are the deadlines for submitting and paying UTII in 2020?

Reporting on it goes to:

- 01/21/2020 - for the 4th quarter of 2020;

- 04/22/2020 - for the 1st quarter of 2020;

- 07/22/2020 - for the 2nd quarter of 2020;

- 10.21.2020 - for the 3rd quarter of 2020.

Accordingly, the report for the 4th quarter of 2020 will be submitted by 01/20/2020.

The deadlines for paying UTII in 2020 are as follows:

- 01/25/2020 - for the 4th quarter of 2020;

- 04/25/2020 - for the 1st quarter of 2020;

- 07/25/2020 - for the 2nd quarter of 2020;

- 10.25.2020 - for the 3rd quarter of 2020.

And the deadline for paying UTII for 2020 (i.e. for its last quarter) will expire on January 27, 2020. Thus, payment of UTII in 2020 will be carried out on dates corresponding to the days established by the Tax Code of the Russian Federation, without their postponement due to coincidence with weekends, and for the last period of 2020 - taking into account the transfer, because 01/25/2020 falls on a Saturday.

Compliance with payment deadlines will allow you to avoid fines for late payment of UTII.

Procedure for paying UTII in case of suspension (termination) of activities

There are often situations when, for some reason, the activity of the imputed person in the tax period is suspended or terminated by the decision of the manager or individual entrepreneur. Is it worth paying UTII for such a period?

To be a payer of imputed tax, you must simultaneously comply with the following two conditions (clauses 1, 2 of Article 346.28 of the Tax Code of the Russian Federation):

- carry out activities that fall under UTII in accordance with the norms of the Tax Code of the Russian Federation and local legislation;

- be registered with the tax authority as a payer of imputed tax.

When an activity is suspended (terminated), the first mandatory condition is actually violated. The taxpayer then ceases to receive income. This situation can be misleading about the need to pay tax. However, it must be paid, since it is possible to terminate activities on UTII only in a certain order, and until the end of this procedure, the UTII payer remains imputed. After all, the tax for him is calculated not on real, but on imputed, i.e., potentially possible income (Articles 346.27, 346.29 of the Tax Code of the Russian Federation).

The procedure for terminating activities on the imputation is not limited to the cessation of receiving income from it. It is also necessary to submit an application to the tax office for deregistration as a UTII payer. And only after deregistration can you stop paying a single tax (Article 346.28 of the Tax Code of the Russian Federation).

Payment of UTII: judicial practice

It is with the suspension or termination of the imputed activity that controversial situations considered by the judicial authorities are most often associated.

The Supreme Arbitration Court of the Russian Federation noted that temporary suspension of activities is not a basis for exempting a legal entity (IP) from fulfilling the obligations assigned to it as a payer of UTII and from paying imputed tax (clause 7 of the information letter of the Presidium of the SAC of the Russian Federation dated 03/05/2013 No. 157). This position applies to cases when activities on UTII are suspended (except for cases of termination of activities due to loss of physical indicators).

Thus, organizations and individual entrepreneurs lose the obligation to file a declaration and pay UTII only after deregistration with the tax authorities as taxpayers. In other cases, the obligation to pay remains.

Read about the tax consequences in the event of suspension of an “imputed” activity in the article “Is it legal to demand payment of UTII if the activity was not carried out? ”

Results

The deadline for paying UTII in 2020 is set on the 25th day of the month following the reporting quarter. Failure to comply with tax remittance deadlines threatens the taxpayer with penalties.

To calculate penalties, use our calculator

Deadlines for submitting reports and paying taxes for the 1st quarter of 2020

Entrepreneurs-employers and organizations must pay monthly insurance premiums by the 15th day of the month following the month in which contributions were calculated. If the 15th falls on a non-working day, then the end date is considered to be the nearest working day.

The Tax Code establishes deadlines for paying taxes and deadlines for submitting tax reports . Federal laws determine the deadlines for submitting financial statements , reporting to the Pension Fund and the Social Insurance Fund.

Deadline for submission and payment of UTII

Organizations and entrepreneurs can voluntarily switch to a taxation system in the form of paying a single tax on imputed income (UTII) for certain types of activities, provided that this special tax regime will be introduced by local governments in the region in which such activities are carried out (Article 346.26, Clause 1, Article 346.28 of the Tax Code of the Russian Federation).

Those wishing to switch to paying a single tax must comply with the deadlines for submitting an application for UTII. Such an application must be submitted to the Federal Tax Service within 5 days from the date of application of the special tax regime (clause 3 of Article 346.28 of the Tax Code of the Russian Federation).

Organizations and individual entrepreneurs that meet the requirements set forth in Art. 346.26 of the Tax Code of the Russian Federation, and those registered as a single tax payer (clause 2 of Article 346.28 of the Tax Code of the Russian Federation) are required to comply with the deadline for submitting UTII and the deadline for paying UTII established by Ch. 26.3 Tax Code of the Russian Federation.

UTII: deadline for filing the declaration in 2020

The deadline for filing a UTII declaration is established by clause 3 of Art. 346.32 Tax Code of the Russian Federation. According to it, the tax return is submitted to the Federal Tax Service on a quarterly basis no later than the 20th day of the month following the quarter.

If the last day (deadline) for submitting the UTII declaration falls on a weekend or holiday, then this deadline is postponed to the next working day (Clause 7, Article 6.1 of the Tax Code of the Russian Federation).

Reporting (UTII): due date in 2020

| Period | Deadline for submitting UTII |

| 4th quarter 2020 | January 21, 2020 |

| 1st quarter 2020 | April 22, 2020 |

| 2nd quarter 2020 | July 22, 2020 |

| 3rd quarter 2020 | October 21, 2020 |

For failure to submit a tax return on time, a fine is charged in the amount of 5% of the amount of tax payable to the budget according to the declaration for each month of delay, but not more than 30% of this tax amount and not less than 1,000 rubles (clause 1 Article 119 of the Tax Code of the Russian Federation).

When should UTII be paid?

UTII: payment deadlines 2020

The single tax is paid to the budget quarterly no later than the 25th day of the month following the quarter (Clause 1, Article 346.32 of the Tax Code of the Russian Federation).

The deadlines for paying UTII in 2020 are as follows:

| Period | Deadline for payment of UTII |

| 4th quarter 2020 | January 25, 2020 |

| 1st quarter 2020 | April 25, 2020 |

| 2nd quarter 2020 | July 25, 2020 |

| 3rd quarter 2020 | October 25, 2020 |

For untimely transfer of a single tax to the budget, a penalty is charged on the amount of tax debt for each calendar day of delay, starting from the next day, according to the rules established by clause 4 of Art. 75 of the Tax Code of the Russian Federation, up to and including the day of payment of arrears. In this case, the total amount of penalties cannot exceed the amount of tax debt (clause 3 of Article 75 of the Tax Code of the Russian Federation, clause 5 of Article 1 of Law No. 424-FZ dated November 27, 2018).

You can find an online calculator for calculating penalties here.

For non-payment of the single tax, a fine is imposed in the amount of 20% of the amount of tax debt (clause 1 of Article 122 of the Tax Code of the Russian Federation). It threatens if the tax is incorrectly reflected in the declaration, leading to non-payment of tax.

What is the liability for late payment of tax liability?

Payment of all taxes without exception must be made within the time limits established for this by the Tax Code. Otherwise, the taxpayer will face sanctions from inspectors. UTII is no exception to this rule.

Let's find out how much it costs for the imputator to forget about timely payment?

Firstly, every day of delay is punishable by penalties. Penalties for entrepreneurs and organizations are calculated differently. This is due to recent changes in tax legislation. So, according to Art. 75 Tax Code of the Russian Federation:

- Entrepreneurs who fail to repay their tax obligations on time are assessed penalties in the amount of 1/300 of the refinancing rate of the amount of the arrears.

- For organizations, the amount of penalties consists of two parts. The first part - for the first 30 days of delay - is also calculated based on 1/300 of the refinancing rate of the amount. The second part is calculated for a period exceeding 30 days, based on 1/150 of the corresponding rate.

You can find the refinancing rate for the period you need here.

Our calculator will help you calculate penalties.

Secondly, failure to pay taxes may result in a fine:

- 20% of the tax amount, if the non-transfer was unintentional (clause 1 of Article 122 of the Tax Code of the Russian Federation);

- 40% of the tax amount, if it is recognized that non-payment was the intention of the taxpayer (clause 3 of Article 122 of the Tax Code of the Russian Federation).

ATTENTION! The penalty only applies if you have distorted the tax base. If the tax is calculated correctly and declared, there may only be penalties for non-payment, but not a fine. Read more about this here.

Deadlines for submitting and paying UTII tax

Hi all! Today the article will be devoted to the UTII tax, or rather the deadlines within which it is necessary to report on the UTII taxation, as well as the deadlines for paying the tax.

Quarterly UTII reporting

UTII tax reporting occurs quarterly

(once every 3 months).

In order to report UTII tax, you need to submit a UTII declaration to the Federal Tax Service (tax office), where you registered for UTII (at the place of business).

Please ensure that the UTII declaration that you will submit is up to date, since the form of the declaration itself changes periodically.

Deadlines for submitting UTII tax reports:

- First quarter: January, February, March – UTII reporting is due by April 20;

- Second quarter: April, May, June – UTII reporting is due by July 20;

- Third quarter: July, August, September – UTII reporting is due by October 20;

- Fourth quarter: October, November, December – UTII reporting is due by January 20 of the year following the reporting one.

Try to report on UTII (submit declarations) on time. If you submit UTII reports on time, you will be subject to a fine of 5% of the tax payable, but the amount of the fine cannot be less than 1,000 rubles.

As you can see, the amount is quite significant, especially for beginners.

The next point is to consider when the UTII tax must be paid.

.

UTII tax payment deadline

UTII tax must be paid in the same way as UTII reporting is submitted quarterly:

- First quarter: January, February, March – payment of UTII tax must be made before April 25;

- Second quarter: April, May, June – payment of UTII tax is made until July 25;

- Third quarter: July, August, September – payment of UTII tax is made until October 25;

- Fourth quarter: October, November, December – payment of UTII tax is made until January 25 of the year following the reporting year.

As can be seen from the information I provided, you have 5 days from the date of submission of reports to pay the UTII tax.

If you do not meet the deadline allowed by law, you will be charged a penny for each day of delay.

In order to pay the UTII tax, you need to know the payment details; they can be obtained from the tax office. It is advisable to pay taxes from your current account. If you do not have an account, you can pay at any bank on your own behalf (IMPORTANT! so that the payment occurs on your behalf).

That’s probably all I wanted to tell you about the deadlines for submitting and paying the UTII tax. What to do if the last day for submitting a report falls on a weekend.

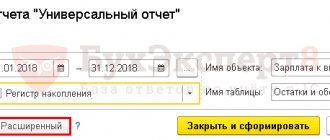

Currently, many entrepreneurs use this Internet accounting to switch to UTII, calculate taxes, contributions and submit reports online, try it for free. The service helped me save on accountant services and saved me from going to the tax office.

The procedure for state registration of an individual entrepreneur or LLC has now become even simpler. If you have not yet registered your business, prepare documents for registration completely free of charge without leaving your home through the online service I have tested: Registration of an individual entrepreneur or LLC for free in 15 minutes. All documents comply with the current legislation of the Russian Federation.

If you have any questions, then welcome to my VK group “Business Secrets for a Beginner”, we help everyone who needs it for free.

The nuances of filling out payment slips for paying UTII

When filling out a payment order for payment of UTII, you need to pay attention to the following points:

- In field “104” the KBK is entered. It should be noted that the imputation codes remain the same. You can view the KBK for UTII for indicating taxes, penalties, fines or interest on the payment in this and this materials.

- In field “105” the OKTMO code is recorded, which corresponds to the type of activity of the “imputed person”.

In the “110” field there is no need to indicate the characters “NS” or “PE”, as well as other previously provided abbreviations for this field. The need to cancel filling out this detail is due to the fact that this information can be seen from the KBK. For a sample of filling out a payment order for the payment of UTII, see here.

UTII deadlines for submission and payment

The single tax on imputed income is a special taxation regime in which the amount of tax paid does not depend on actual income. Only certain types of activities can switch to this special regime; a number of requirements apply to those wishing to apply this type of tax. In the article we will consider what this tax regime is, as well as what deadlines are established for paying this tax and submitting reports.

What is UTII

Unified income tax is a taxation regime in which tax is paid on imputed income. At the same time, imputed income does not depend on the profit received by the taxpayer; it is provided for by current legislation. This tax is not charged on the income actually received by the taxpayer.

Regulatory acts establish the basic profitability for certain types of activities for which UTII can be applied. Basic profitability is necessarily tied to physical indicators. For example, if the activity is related to cargo transportation services, then the basic profitability is established for each individual unit of transport. As for retail trade, the basic profitability is tied to 1 sq.m of area used in work. Thus, a company and individual entrepreneur will be able to influence the tax burden under UTII only if the physical indicator changes.

UTII for the 2nd quarter of 2020

- it is submitted to the tax office directly by the head of the company, or his officially authorized representative, or an individual entrepreneur;

- by registered mail (standard for such documents there should be a notification and a list of attachments);

- via the Internet, if the number of employees in the company is more than 100.

The title page, like all others, indicates the company’s Taxpayer Identification Number (TIN) and checkpoint. If an organization is simultaneously registered at the location of a separate division (branch) and at the place where it conducts activities subject to tax on imputed income, then the declaration must indicate the checkpoint assigned to the company as a payer of this tax, and not the checkpoint of the branch.

Interesting: How to register a child at the place of registration of the father through government services

Reporting on UTII in 2020

Calculation and payment of UTII tax

When to pay UTII tax

The deadline for paying UTII tax is until the 25th day of the month following the reporting quarter:

- for the 1st quarter until April 25, 2020

- for the 2nd quarter until July 25, 2020

- for the 3rd quarter to October 25, 2020

- for the 4th quarter to January 25, 2021

If the due date falls on a weekend or holiday, the last day of payment is postponed to the next business day.

Pay the tax to the tax office where you submitted the notification of registration. Usually this is the tax office at the address where the business is conducted.

In three cases, you need to register at the registration of an individual entrepreneur or at the legal address of the organization:

- delivery and distribution trade

- advertising on transport

- cargo transportation and passenger transportation services.

Calculation of UTII

UTII tax is calculated using the formula:

BD×K1×K2×(F1+F2+F3)×15% , where

- BD - basic profitability is determined according to Art. 346.29 Tax Code of the Russian Federation,

- F1, F2, F3 - the value of the physical indicator. For each type of activity in the same art. 346.29 of the Tax Code of the Russian Federation provides for its own physical indicator (for example, the area of the sales floor or the number of employees).

- K1 is the coefficient set by the government. In 2020 it is 1.915, in 2020 it is 2.009.

- K2 is a coefficient set by local authorities (it can be found at your tax office or at the municipal administration).

- 15% — UTII tax rate.

Kontur.Elba will help you calculate your tax. Select the type of activity and indicate the size of the physical indicators, and the system will automatically enter the value of the basic profitability and coefficients.

How to reduce the amount of UTII tax

- If you switched to UTII or stopped your business in the middle of the quarter, then pay tax only for the days worked on UTII.

- Reduce UTII tax by the amount of insurance premiums. – An individual entrepreneur without employees can reduce the amount of tax entirely on insurance premiums for individual entrepreneurs. – Individual entrepreneurs with employees and LLCs reduce the tax by no more than half.

- If you are an individual entrepreneur and bought an online cash register, reduce the tax on its cost. More about the deduction

Submit reports in three clicks

Elba is suitable for individual entrepreneurs and LLCs on UTII. The service will prepare a tax return, calculate the tax and reduce it by insurance premiums.

Declaration on UTII

When to submit the UTII declaration

The UTII declaration is submitted quarterly. Reporting deadlines are set until the 20th day of the month following the quarter:

- for the 1st quarter until April 20

- for the 2nd quarter until July 20

- for the 3rd quarter until October 20

- for the 4th quarter until January 20.

If the deadline falls on a weekend or holiday, the last day of delivery will be the next working day.

How is the amount of imputed tax payable to the budget determined?

The UTII regime is one of the special regimes provided for by the Tax Code (Chapter 26.3) for use by both individual entrepreneurs and organizations.

The amount of tax does not depend on the amount of income or profit received. It depends on the amount of imputed income (i.e., the income that an economic entity could receive by working under certain conditions).

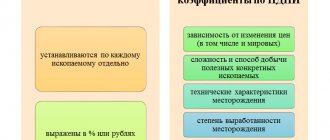

Imputed income, in turn, is calculated based on indicators such as:

- Basic profitability is the cost expression of monthly profitability for a certain unit of physical indicator. All its values are given in paragraph 3 of Art. 346.29 Tax Code of the Russian Federation.

- A physical indicator is a quantitative indicator characterizing a particular activity that falls under the imputation regime.

- Deflator coefficient K1, determined annually by the Ministry of Economic Development (in 2020 it is equal to 2.005).

- Base yield adjustment factor set by local authorities.

The single tax is calculated in the tax return quarterly, since the tax period for it is a quarter (Article 346.30 of the Tax Code of the Russian Federation).

Our UTII calculator will help you calculate the tax.

You can read about how to fill out the declaration for the 2nd quarter here.

And you can see a sample of filling out a UTII declaration for the 2nd quarter of 2020 in ConsultantPlus, having received trial access to the system for free.

Transfer deadlines for 2020: table

Transfer the calculated UTII amount to the budget no later than the 25th day of the first month following the expired tax period (quarter). This is stated in paragraph 1 of Article 346.32 of the Tax Code of the Russian Federation.

The deadline for paying UTII may fall on a non-working day. In this case, the tax must be transferred to the budget on the next working day (clause 7, article 6.1 of the Tax Code of the Russian Federation). The table below summarizes the deadlines for paying UTII in 2020:

| Deadlines for paying UTII in 2020 | |

| For the fourth quarter of 2020 | No later than 01/25/2018 |

| For the first quarter of 2020 | No later than 04/25/2018 |

| For the second quarter of 2020 | No later than July 25, 2018 |

| For the third quarter of 2020 | No later than October 25, 2018 |

Results

Taxpayers who have chosen imputation for themselves must timely, once a quarter, pay the tax corresponding to their regime, the calculation of which is carried out in a declaration, also submitted quarterly. The amount of tax does not depend on how profitable the taxpayer's activities are.

The tax payment date for the 2nd quarter of 2020 falls on July 25 of this year. You should not be late with the transfer of tax, since such a delay is fraught with punishment.

Payers of the Unified Tax on Imputed Income must not only pay the tax on time, but also submit a tax return on it. From the article you will learn in what time frame taxpayers need to pay UTII and submit a declaration for it in 2019-2020.

Changes in 2020

There were no fundamental changes in the timing of reporting, tax payment and the procedure for its calculation in 2020. But the indicator of the deflator coefficient K1, which forms the amount of tax, has changed. From January 1, 2020 it is equal to 1.868.

In addition, from July 1, 2020, LLCs and individual entrepreneurs (with hired staff) engaged in retail trade and catering are required to install online cash registers. The remaining UTII payers (including individual entrepreneurs without staff, working in the field of trade or catering) received a deferment for a year, i.e. they have the right to install a cash register system from July 1, 2020.

In connection with the obligation to install an online cash register, legislators have introduced a benefit for individual entrepreneurs on the “imputation” - a tax deduction for the purchase of a cash register and its maintenance in the amount of 18,000 rubles. per unit of equipment. The form of the declaration form is also being revised. It will have to contain lines intended to reflect information on cash registers, but for now entrepreneurs will attach an explanatory note to confirm the deduction.

How to fill out a UTII declaration for an individual entrepreneur for the 1st quarter of 2020: sample

Line 020 indicates the address of the place of business activity, and line 030 OKTMO corresponding to the address. Addresses are filled in in accordance with the address classifier, therefore the city of St. Petersburg is not written in the sample declaration, it is indicated with code 78, because itself a subject of the Russian Federation.

Line 060 indicates the coefficient K2; it can be found in the regulatory act that introduced the UTII tax in the territory of a particular city or district. Sometimes K2 consists of various subcoefficients, multiplying which results in a coefficient for calculating tax. Please note that K2 cannot be greater than one; if after multiplication the figure is greater, then K2 is equal to 1.