Amounts not subject to insurance premiums are determined by law in the form of a list that is not subject to broad interpretation. What articles of the Tax Code of the Russian Federation allow you not to pay contributions on individual payments and what needs to be done for this, find out from the article.

Payments to volunteers: what amounts are not subject to contributions under Art. 420 Tax Code of the Russian Federation

Non-taxable payments under Article 422 of the Tax Code of the Russian Federation

Private lessons and cleaning services: when fees are not paid

How to fulfill the obligation to notify tax authorities in order not to pay contributions

Saving on fees for an entrepreneur using a simplified approach

Results

Payments to volunteers: what amounts are not subject to contributions under Art. 420 Tax Code of the Russian Federation

Cases when the object subject to insurance premiums does not appear are described in Part 2 of Art. 420 of the Tax Code of the Russian Federation (paragraphs 4–7). The following payments are not subject to insurance premiums:

- produced by firms and individual entrepreneurs for the benefit of foreigners and stateless persons working in separate divisions of Russian companies located abroad;

- volunteers as part of the execution of contracts concluded in accordance with Art. 7.1 of the Law of August 11, 1995 No. 135-FZ on charitable activities;

- produced by the organizing committee "Russia-2018" and FIFA (as well as their subsidiaries) in favor of foreign citizens, stateless persons and volunteers (in situations listed in paragraph 7 of Article 420 of the Tax Code of the Russian Federation).

Some benefits may soon be reduced if the State Duma approves draft law No. 204728-7 (on the adjustment of Article 420 of the Tax Code of the Russian Federation). It is proposed to reduce the list of non-contributory amounts by excluding from it payments to foreign citizens and stateless persons under employment contracts and civil service agreements concluded:

- with FIFA subsidiaries;

- organizing committee "Russia-2018" or its subsidiaries.

Find out in a timely manner about important and useful news from the materials and messages of our website:

- “Changes in currency legislation since 2017”;

- “A new fiscal data operator has been registered”;

- “The list of preferential regions for individual entrepreneurs on the simplified tax system and PSN has been updated.”

We will consider further what other payments are not subject to insurance premiums.

https://youtu.be/nL9KZtD5mNc

Some features regarding the taxation of insurance premiums

The amounts of some payments for certain groups of recipients are still not included in the tax base in terms of compulsory pension insurance. Namely:

- Federal employees.

- Employees of the prosecutor's office.

- Justices of the peace.

Contributions to compulsory social insurance (sickness and maternity) are not subject to payments:

- For copyright work and alienation of copyright.

- Within the framework of a civil contract for the right to use works of literature, science, and art.

- Publishing, licensing agreements.

- Foreigners, stateless persons or those with the status of temporarily staying in the Russian Federation.

Bonus payments according to the rules of labor legislation are incentive accruals, rewards for the labor and production successes of employees. The frequency and timing of bonus payments are determined by a collective agreement or a local regulatory act of the organization.

In addition to bonuses for production and other labor merits, the employer has the right to pay incentives for holidays and anniversaries. Payments of this type are excluded from the tax base based on the commentary in the Resolution of the AS ZSO dated October 6, 2017 No. A45-9844/2016. But the tax authorities have the exact opposite opinion on this issue.

While the regulation of Law 212-FZ was in effect, it contained detailed lists of payments and incentives for the work duties of employees, in which holiday bonuses were not mentioned. Consequently, they were subject to insurance premiums.

After the transfer of control powers to the Federal Tax Service, Art. 420, 422 of the Tax Code of the Russian Federation, where in part 1 holiday and anniversary payments are not indicated as non-taxable accruals. The Ministry of Finance of the Russian Federation also points to this in its letter dated 02/07/2017 No. 03-15-05/6368. If the organization does not charge contributions from this type of premium, it will have to defend its position in court.

The following signs can be cited as arguments:

- The awards are one-time in nature;

- There is no motivation in relation to individual employees, i.e. are not an incentive or incentive measure for labor merit;

- Not directly related to work achievements;

- Paid to all employees without exception.

Although the types of bonuses dedicated to holidays and state anniversaries are of a clearly social nature, fiscal structures steadily recognize them as part of the tax base.

Types of payments for which insurance premiums are not charged are provided with separate items in the report. For this purpose, the declaration provides the corresponding appendices No. 1, 2 and subsections 1.1 and 1.2.

Inspection authorities require their reflection on the corresponding lines 030 and 040 (in some cases). Some organizations are of the opinion that since contributions are not charged, there is no need to mention it. This position is not always correct.

The Tax Service requires the generation of reporting on insurance premiums in accordance with the requirements of Art. 422 of the Tax Code of the Russian Federation and disclose accruals in full.

Before we find out which payments are not subject to insurance premiums, we will determine what premiums should be charged on. According to paragraph 1 of Art. 420 of the Tax Code of the Russian Federation, insurance premiums are charged on payments for labor (salaries, bonuses, allowances and other payments in connection with labor relations) and GPC contracts for the provision of services and performance of work, also under author’s order contracts, publishing licenses and agreements on the alienation of exclusive rights to works of science, literature and art.

If there is no taxable object, there is no need to pay insurance premiums. For example, are dividends subject to insurance contributions{q} Since dividends are a part of the company’s profit distributed among its participants, not related to labor relations, there is no object subject to insurance contributions here (letter of the Federal Insurance Service of the Russian Federation dated November 17, 2011 No. 14-03-11 /08-13985).

Firstly, these are payments to individuals, which the Tax Code does not at all recognize as an object of taxation:

- under GPC agreements (except for those listed above) on the transfer of ownership and other real rights, or the transfer of property for use (clause 4 of Article 420 of the Tax Code of the Russian Federation);

- Payments to foreign individuals working in foreign divisions of Russian companies are not subject to insurance premiums (clause 5 of Article 420 of the Tax Code of the Russian Federation);

- reimbursement of expenses to volunteers who have entered into GPC agreements, in accordance with the law on charity (Article 7.1 of Law No. 135-FZ of August 11, 1995). Volunteer expenses for food exceeding the daily allowance are subject to insurance contributions (clause 6 of Article 420 of the Tax Code of the Russian Federation);

- payments not subject to insurance premiums to foreigners and stateless persons who have entered into employment and GPC agreements with the organizers of the 2018 World Football Championship and the 2017 FIFA Confederations Cup, as well as compensation for some expenses incurred by volunteers of these events (clause 7 of Art. 420 Tax Code of the Russian Federation).

We invite you to read: Vacation after maternity leave: is annual paid vacation after maternity leave required by law, how to calculate days and vacation pay, examples of calculation

Secondly, Art. 422 of the Tax Code of the Russian Federation provides an exhaustive list of payments not subject to insurance contributions, consisting of 15 points. In particular, employers should not charge insurance premiums for the following payments:

- state benefits, including those paid for compulsory social insurance and unemployment;

- standardized compensation, incl. when dismissing employees (except for compensation for unused vacation), for compensation for harm to health, for expenses of individuals under GPC agreements, reimbursement to the employee of costs for professional training and advanced training, etc.,

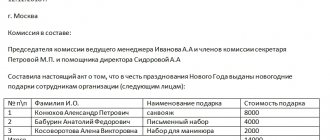

- one-time financial assistance to persons affected by natural disasters, terrorist attacks in the Russian Federation, in connection with the death of a relative or the birth (adoption) of a child;

- other financial assistance for employees up to 4,000 rubles. in year;

- The following payments to residents of the Far North are not subject to insurance premiums: payment for travel to the place of vacation, transportation of luggage up to 30 kg, or their payment to the point of crossing the state border of the Russian Federation when going abroad on vacation;

- payments for employees under annual medical care contracts, non-state pension agreements, etc.;

- amount not subject to insurance premiums, up to 12,000 rubles. per year per employee for an additional funded pension;

- other payments listed in paragraph 1 of Art. 422 of the Tax Code of the Russian Federation.

Thirdly, some payments are not subject to certain insurance premiums (clause 3 of Article 422 of the Tax Code of the Russian Federation):

- payments for student work for full-time students, as well as the maintenance of judges, prosecutors and investigators are exempt from “pension” contributions;

- Contributions in case of maternity and temporary disability are not subject to any GPC agreements, unless they contain a special clause that contributions will be accrued.

Hospital benefits are not subject to insurance contributions (Clause 1, Article 422 of the Tax Code of the Russian Federation). This applies to both the amount of benefits paid by the employer (the first 3 days) and the amount reimbursed from the Social Insurance Fund.

However, in some cases, sick leave is subject to insurance premiums:

- when the employer makes an additional payment from his own funds up to 100% of average earnings;

- when the amount of sick leave paid to an employee is not accepted by the Social Insurance Fund (letter of the Ministry of Labor of the Russian Federation dated February 26, 2016 No. 17-3/B-76).

In 2020, the procedure for taxing insurance premiums on daily allowances has changed (clause 3, article 217; clause 2, article 422 of the Tax Code of the Russian Federation):

- on business trips in Russia, 700 rubles are not subject to contributions. in a day;

- on business trips abroad, 2500 rubles are not taxed. in a day.

Other travel expenses, confirmed by documents, are not subject to contributions in full.

To reflect non-taxable payments in the calculation of insurance premiums, appropriate lines are allocated. Thus, subsection 1.1 of Appendix 1 indicates the amount not subject to mandatory “pension” contributions (line 040), in subsection 1.2 - the amount not subject to insurance contributions (line 040) for compulsory medical insurance, in Appendix 2 - the amount not subject to contributions for compulsory health insurance. case of illness and motherhood (line 030). The lines are filled in taking into account the provisions of Art. 422 of the Tax Code of the Russian Federation (Appendix No. 2 to the Order of the Federal Tax Service of the Russian Federation dated October 10, 2016 No. ММВ-7-11/551).

Cases when the object subject to insurance premiums does not appear are described in Part 2 of Art. 420 of the Tax Code of the Russian Federation (paragraphs 4–7). The following payments are not subject to insurance premiums:

- produced by firms and individual entrepreneurs for the benefit of foreigners and stateless persons working in separate divisions of Russian companies located abroad;

- volunteers as part of the execution of contracts concluded in accordance with Art. 7.1 of the Law of August 11, 1995 No. 135-FZ on charitable activities;

- produced by the organizing committee "Russia-2018" and FIFA (as well as their subsidiaries) in favor of foreign citizens, stateless persons and volunteers (in situations listed in paragraph 7 of Article 420 of the Tax Code of the Russian Federation).

Some benefits may soon be reduced if the State Duma approves draft law No. 204728-7 (on the adjustment of Article 420 of the Tax Code of the Russian Federation). It is proposed to reduce the list of non-contributory amounts by excluding from it payments to foreign citizens and stateless persons under employment contracts and civil service agreements concluded:

- with FIFA subsidiaries;

- organizing committee "Russia-2018" or its subsidiaries.

We will consider further what other payments are not subject to insurance premiums.

Amounts not subject to insurance premiums are listed not only in Art. 420 of the Tax Code of the Russian Federation, but also in Art. 422. These are payments:

- not within the framework of labor relations and civil process agreements (for example, financial assistance to relatives of a deceased employee, etc.);

- citizens under contracts related to the sale or transfer of property for temporary use (under lease agreements, transfer of money in debt, etc.);

- in the form of compensation provided for by federal and local legislation (for payment for special clothing, training, etc.)

- other specified in Art. 422 of the Tax Code of the Russian Federation.

Certain types of payments are not subject to insurance premiums if certain requirements are met and only for limited periods of time - we will discuss this in the following sections.

Find out what to do with contributions if an employee dies here.

See also: “ERSV: how to show payments that are not included in the contribution object or not subject to them” and “ERSV line by line: reflecting payments that are not subject to contributions.”

We invite you to read: Benefits for low-income families in Omsk in 2019

In accordance with Ch. 34 of the Tax Code of the Russian Federation, adopted in 2020, as well as Federal Law No. 125-FZ of July 24, 1998, the following are recognized as amounts subject to insurance premiums:

- employment contracts (for example, wages, allowances, compensation, bonuses, etc.);

- GPC agreements with individuals (for the provision of services or performance of work). Insurance premiums are not charged under GPC agreements with individual entrepreneurs, lawyers or notaries;

- copyright contracts;

- publishing licensing agreements;

- agreements the subject of which is the alienation of publishing rights to works of art, science and literature, as well as licensing agreements for the right to use these works.

Non-taxable payments under Article 422 of the Tax Code of the Russian Federation

Amounts not subject to insurance premiums are listed not only in Art. 420 of the Tax Code of the Russian Federation, but also in Art. 422. These are payments:

- not within the framework of labor relations and civil process agreements (for example, financial assistance to relatives of a deceased employee, etc.);

- citizens under contracts related to the sale or transfer of property for temporary use (under lease agreements, transfer of money in debt, etc.);

- in the form of compensation provided for by federal and local legislation (for payment for special clothing, training, etc.)

- other specified in Art. 422 of the Tax Code of the Russian Federation.

Certain types of payments are not subject to insurance premiums if certain requirements are met and only for limited periods of time - we will discuss this in the following sections.

Find out what to do with contributions if an employee dies here.

See also: “ERSV: how to show payments that are not included in the contribution object or not subject to them” and “ERSV line by line: reflecting payments that are not subject to contributions.”

Current changes in legislation

Where are the payments that are not subject to insurance premiums listed? Let's approach the answer to the question from afar. But this information is important for understanding the basic approaches to the calculation and payment of insurance premiums. So, since 2020, the administration of the mandatory payments under discussion has been transferred to the Federal Tax Inspectorate in order to increase the efficiency of the collection process. The Federal Tax Service controls the correctness of calculations and timely payment. Only deductions “for injuries” (as part of insurance against accidents at work and the occurrence of occupational diseases) are still made to the accounts of the Social Insurance Fund; all other fees must be made according to the tax details.

It is necessary to understand and take into account the new role of the Federal Tax Service, firstly, when preparing reports and making deductions. Secondly, it becomes clear why the rules governing the taxation of insurance premiums are now located in the Tax Code of the Russian Federation (Chapter 34). It also indicates which payments are not subject to insurance premiums. Such income is listed in Article 422 of the Tax Code of the Russian Federation.

Before considering the list of what is not subject to insurance premiums, it is necessary to point out that these payments are mandatory for all business entities, regardless of the form of ownership of the organization or enterprise. Individual entrepreneurs are also not exempt from this financial obligation, and they are required to make contributions both for employees and for themselves.

Private lessons and cleaning services: when fees are not paid

Law No. 401-FZ dated November 30, 2016 added clause 3 of Art. 422 of the Tax Code of the Russian Federation, a subparagraph that specifies payments that are not subject to insurance contributions.

This rule applies only to payments received by individuals in 2017–2018 and meeting the following conditions:

- income was received as a result of settlements between individuals (not individual entrepreneurs) for the provision of services for personal needs;

- the recipient of the income notified the tax authorities (the notification scheme is described in clause 7.3 of Article 83 of the Tax Code of the Russian Federation);

- the individual completed the work independently (without hiring hired labor).

The list of services for personal needs includes:

- cleaning of residential premises;

- housekeeping;

- tutoring;

- supervision of persons in need of constant outside care (children, elderly people, the sick - according to the conclusion of the medical institution).

This list may be expanded if regional authorities consider it necessary to include additional services of this kind (for personal, household and other needs) and adopt a corresponding law.

How regional legislation can influence the tax burden and the possibility of not using online cash registers is stated in the articles:

- “List of settlements exempt from online cash registers”;

- “List of property taxed at cadastral value”.

Types of bonus payments non-taxable

Bonus payments according to the rules of labor legislation are incentive accruals, rewards for the labor and production successes of employees. The frequency and timing of bonus payments are determined by a collective agreement or a local regulatory act of the organization.

In addition to bonuses for production and other labor merits, the employer has the right to pay incentives for holidays and anniversaries. Payments of this type are excluded from the tax base based on the commentary in the Resolution of the AS ZSO dated October 6, 2017 No. A45-9844/2016. But the tax authorities have the exact opposite opinion on this issue.

While the regulation of Law 212-FZ was in effect, it contained detailed lists of payments and incentives for the work duties of employees, in which holiday bonuses were not mentioned. Consequently, they were subject to insurance premiums.

After the transfer of control powers to the Federal Tax Service, Art. 420, 422 of the Tax Code of the Russian Federation, where in part 1 holiday and anniversary payments are not indicated as non-taxable accruals. The Ministry of Finance of the Russian Federation also points to this in its letter dated 02/07/2017 No. 03-15-05/6368. If the organization does not charge contributions from this type of premium, it will have to defend its position in court.

The following signs can be cited as arguments:

- The awards are one-time in nature;

- There is no motivation in relation to individual employees, i.e. are not an incentive or incentive measure for labor merit;

- Not directly related to work achievements;

- Paid to all employees without exception.

Although the types of bonuses dedicated to holidays and state anniversaries are of a clearly social nature, fiscal structures steadily recognize them as part of the tax base.

How to fulfill the obligation to notify tax authorities in order not to pay contributions

To obtain an exemption from paying insurance premiums, an individual performing services (clause 7.3 of Article 83 of the Tax Code of the Russian Federation):

- fills out the notification in the form specified in Appendix No. 1 to the order of the Federal Tax Service of Russia dated March 31, 2017 No. ММВ-7-14/ [email protected] ;

- transfers it to the tax authorities before the start of the specified types of services and after the termination of such activities.

The notification is submitted to any tax office - the tax authorities will register the individual at his place of residence (place of stay in the Russian Federation).

Appendix No. 3 to Order No. MMV-7-14/ [email protected] describes the procedure for filling out the notification. With its help, an individual informs tax authorities:

- information about yourself (full name, tax identification number, telephone number, gender, details of an identity document, etc.);

- coded sign of the beginning (“1”) or end (“2”) of the activity;

- type of activity from the proposed options.

If an individual provides other services, the type of which is prescribed by regional authorities, the last sheet of the notification is additionally filled out, which reflects:

- details of the law and code of the region that installed the service;

- Name of service.

The following materials will tell you about the powers of regional authorities in tax rulemaking:

- “What is the procedure for calculating corporate property tax?”;

- “Basic profitability under the patent tax system in 2017”.

When the cost of travel packages for an employee’s family is not subject to personal income tax and contributions

Let's focus on excess daily allowances. These amounts remained the same in 2020: from 700 rubles. within Russia and from 2.5 thousand for foreign trips. But in 2020, contributions will have to be calculated for exceeding these values.

This income tax rule also applies to large daily allowance contributions. Therefore, it is only a stretch to say about daily allowances that this is income not subject to insurance premiums.

For more information about this, see “How per diem is assessed in insurance premiums from 2020.”

Here’s something else that is not subject to insurance premiums and is directly related to business trips. These are the costs for:

- the path to the destination and back;

- airport taxes;

- commissions;

- way to the airport, train station (including transfers);

- baggage transportation;

- rental housing;

- mobile communications;

- fee for obtaining a foreign passport;

- visa fees;

- commission for currency exchange (check at the bank).

Similar rules on payments that are not subject to insurance premiums apply to members of the company's senior management bodies. When they come to a meeting of the board of directors, board, etc.

In 2020, insurance premiums are not imposed on payments under civil contracts, for the purchase of property or property rights. As, indeed, under lease, loan, leasing, donation and other agreements, under which property and property rights are transferred for temporary use. An exception is contracts for construction, paid services, as well as copyright agreements. Payments under these agreements are subject to contributions. This follows from paragraph 4 of Article 420 of the Tax Code.

There is no need to charge insurance premiums when issuing prizes to customers, supplementing pensions to former employees, or paying scholarships under student contracts (including to full-time employees).

Material benefit

There is no need to pay insurance premiums for the material benefit that the employee receives due to savings on interest when receiving an interest-free loan from the employer.

Let us repeat that Article 422 of the Tax Code of the Russian Federation establishes a closed list of payments that are exempt from insurance premiums in 2018. In particular, these are:

- state benefits that are paid in accordance with the legislation of the Russian Federation (subclause 1, clause 1, article 422 of the Tax Code);

- all types of compensation to employees determined by law within the limits established by the legislation of the Russian Federation. For example, severance pay within three times the average monthly salary (subclause 2, clause 1, article 422 of the Tax Code);

- amounts of one-time financial assistance to parents, adoptive parents or guardians upon the birth or adoption of a child. But only when such assistance is paid within the first year after birth or adoption and in an amount of no more than 50,000 rubles. for each child (subclause 3, clause 1, article 422 of the Tax Code);

- contributions for compulsory insurance of employees (subclause 5, clause 1, article 422 of the Tax Code);

- payment for training of employees for basic and additional professional programs (if the training is related to the professional activity of the employee and is carried out at the initiative of the organization) (subclause 12, clause 1, article 422 of the Tax Code), etc.

These are mainly social payments. For example, according to the law, insurance payments are not accrued for:

- state benefits paid in accordance with federal, regional legislation and decisions of municipal authorities, including unemployment benefits and social insurance;

- all types of compensation related to compensation for harm to health, with free provision of residential premises;

- payments in connection with the termination of an employment contract, with the exception of a number of payments (for example, insurance premiums are charged for severance pay and retained earnings during employment if these payments in total exceeded three average monthly earnings of the employee);

- expenses for training and retraining of an employee;

- the amount of one-time financial assistance provided by the employer in connection with natural disasters, the death of a family member, or the birth of a child;

- maternity benefits;

- daily allowances, except those that exceed the limits established by law;

- amounts of payments for compulsory insurance of employees.

So, the article indicates not only the object, the basis for calculation, but also the main payments that are not subject to insurance premiums; the full list can be seen in Art. 422 of the Tax Code of the Russian Federation.

In some cases, an organization needs to pay financial assistance to former employees, for example, due to difficult life circumstances. In this case, there is no need to accrue insurance premiums, because the base for calculating insurance premiums includes remunerations paid in favor of individuals subject to compulsory insurance under employment contracts or civil contracts (clause 1 of Article 420 of the Tax Code of the Russian Federation).

Example

The management of Sigma LLC decided to provide financial assistance to its former employee G.I. Likhovtsev in connection with the death of his wife. Payment in the amount of 32,000 rubles. was carried out two months after Likhovtsev’s dismissal. Such financial assistance is not subject to insurance premiums, so there is no need to accrue them.

The rules contained in Art. 20.1 of Law No. 125-FZ came into force on January 1, 2011, but even before this date it was not necessary to charge contributions for this type of financial assistance.

All employers are required to pay pension, social and health insurance contributions on employee benefits. True, not from everyone. This recommendation will help you determine which payments to charge insurance premiums for.

Accrue insurance premiums on benefits that you pay in cash and in kind:

- employees within the framework of labor relations;

- the head of the organization - the only participant, regardless of the existence of an employment contract with him;

- performers under civil contracts, the subject of which is the performance of work or provision of services;

- performers under copyright agreements.

Payments in kind, that is, goods, works or services, should be considered as their cost, including VAT and excise taxes.

Note: Point 7

Article 421

Tax Code of the Russian Federation.

Charge insurance premiums from the following payments and rewards:

- salary;

- allowances and surcharges. For example, for length of service, work experience, combination of professions, night work, etc.;

- bonuses and remunerations, including accrued to dismissed employees for the periods when they worked in the organization;

- remuneration for performing work under a contract;

- remuneration under a service contract;

- remuneration under the author's order agreement;

- remuneration under a license agreement for granting the right to use a work of literature or art;

- remuneration in favor of the authors of works, which are awarded to organizations that manage rights on a collective basis. For example, the Russian Union of Copyright Holders, the Russian Copyright Society, the All-Russian Intellectual Property Organization;

- compensation for unused vacation, both related and not related to dismissal;

- excess severance pay;

- excess payments for the period of employment;

- excess compensation to the manager, his deputy and chief accountant upon dismissal.

Note: This follows from

articles 420

, 422 Tax Code of the Russian Federation, paragraph 2 of part 1 of article 7 of the Law of December 15, 2001 No. 167-FZ, subparagraph 1 of paragraph 1

Article 2

Law of December 29, 2006 No. 255-FZ, subparagraph 1 of part 1 of Article 10 of Law of November 29, 2010 No. 326-FZ.

Average earnings

Employees also need to pay insurance premiums from their average earnings:

- during periods of military training;

- for the days of blood donation and rest days assigned to donors;

- during summonses to the court, prosecutor's office, investigator, etc. (as witnesses, victims, etc.);

- for additional days off provided to parents of disabled children.

Whether such payments are provided for in the collective agreement does not matter. Insurance premiums will still have to be charged.

In 2020, daily allowances paid when an employee is sent on a business trip, regardless of their size, are not subject to insurance contributions. In paragraph 2 of Art. 422 of the Tax Code of the Russian Federation states that daily allowances are exempt from insurance premiums within the limits established by the legislation of the Russian Federation: 700 rubles. — business trips within Russia; 2500 rub. - business trips abroad.

Note: The amount of daily allowance established by the policyholder in the collective agreement (other local regulatory act) will continue to not be subject to insurance premiums for injuries.

Insurance premiums are charged for payments under an employment contract regardless of whether the employee is registered as an entrepreneur or not. The fact is that employment contracts are concluded with citizens, and not with individual entrepreneurs. For example, it is impossible to hire individual entrepreneur Ivanov under an employment contract to perform work similar to what he does as part of his business activities - the person will perform a labor function in the organization, and not run his own business. You can conclude a civil contract with an entrepreneur for the performance of specific services or work.

Moreover, nothing prevents you from simultaneously concluding both an employment and a civil law contract with the same person. The employer will have to charge insurance premiums from payments under an employment contract, but not under a civil law contract, where the executor is an entrepreneur. Entrepreneurs pay their own fees (Clause 1, Article 23 of the Civil Code of the Russian Federation, Article 56 of the Labor Code of the Russian Federation).

Payments that are not subject to contribution are listed in Article 422 of the Tax Code.

An organization renting cars from individuals does not need to charge insurance premiums on the rental amounts. Moreover, regardless of whether the “physicist”-lessor is an employee of the company or not.

After all, payments under the GPA, the subject of which is the transfer of ownership or other proprietary rights to property, as well as contracts related to the transfer of property for use, are not subject to contributions. Accordingly, such rental amounts do not need to be reflected in the calculation of insurance premiums.

When drawing up such agreements, you need to be careful. If an employee has leased his car to his employer and continues to drive it, thus providing the company with driving services, the amount of remuneration for the provision of driver services and the amount of rental payment must be documented.

The fact is that, unlike rental payments, remuneration for working as a driver is subject to insurance premiums. And if it is impossible to determine how much money the employee received as a lessor and how much as a driver, according to the Supreme Court, contributions must be paid on the entire amount paid to him.

Pension contributions

| Type of contributions | Tariff, % | |

| With payments within the limit | With payments over the limit | |

| Pension | 22% | 10% |

| Social benefits in case of illness and maternity | 2,9% | – |

| Medical | 5,1% | 5,1% |

Saving on fees for an entrepreneur using a simplified approach

A simplified individual entrepreneur who pays mandatory pension contributions for himself determines his expenses for paying contributions according to the algorithm (subclause 1, clause 1, article 430 of the Tax Code of the Russian Federation):

if D ≤ 300,000 rub. → ∑SV = 12 × minimum wage × TSV.

if D > 300,000 rub. → ∑SV = 12 × minimum wage × TSV + 1% × (D – 300,000 rub.),

Where:

D - income for the billing period;

∑СВ — the amount of insurance contributions for compulsory pension insurance;

Minimum wage - the minimum wage established by federal law at the beginning of the year for which insurance premiums are paid;

TSV - the tariff of insurance premiums established by clause 2 of Art. 425 Tax Code of the Russian Federation.

After calculating the amount of insurance premiums in a situation where the income exceeds the border of 300,000 rubles, it is necessary to check whether the conditions are met:

If ∑SV > 8 × 12 × minimum wage × TSV → ∑SV = 8 × 12 × minimum wage × TSV

Thus, the amount of insurance premiums cannot exceed the product of 8 times the minimum wage (increased by 12 times) and the insurance premium rate.

Wherein:

- The income of an individual entrepreneur is determined according to the rules of Art. 346.15 Tax Code of the Russian Federation;

- expenses under Art. 346.16 of the Tax Code of the Russian Federation are not taken into account.

For the nuances of calculating simplified income, see the article “The procedure for calculating tax under the simplified tax system “income” in 2016–2017 (6%) .

This calculation algorithm is described in the letter of the Ministry of Finance of Russia dated 06/09/2017 No. 03-15-05/36277.

What will not be subject to insurance premiums

| What is paid | What standards are we referring to? |

| State benefits, incl. provision of all cases of insurance, unemployment | pp. 1 clause 1 art. 422 Tax Code of the Russian Federation |

| Employee compensation (within established standards): severance pay within three times the average monthly salary | pp. 2 p. 1 art. 422 Tax Code of the Russian Federation |

| Material benefits at birth/adoption, one-time financial assistance up to 50,000 rubles for each child | pp. 3 p. 1 art. 422 Tax Code of the Russian Federation |

| Payments for compulsory personnel insurance | pp. 5 p. 1 art. 422 Tax Code of the Russian Federation |

| Amounts of payment for training of employees as part of professional retraining (main and additional forms of training), if it occurs at the initiative of the employer | pp. 12 clause 1 art. 422 Tax Code of the Russian Federation |

| Contributions within the framework of the pension savings part of the provision, but not more than 12,000 rubles | pp. 6 clause 1 art. 422 Tax Code of the Russian Federation |

| Amounts of payments for daily allowance and other business travel needs | Clause 2 art. 422 Tax Code of the Russian Federation |

As before, the following benefits are not included in the base subject to insurance contributions:

- for temporary disability;

- child care up to 1.5 and 3 years old;

- one-time benefit for the birth of a child;

- for registration in a medical institution in the early stages of pregnancy;

- for pregnancy and childbirth (as well as in the case of funeral payments).

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

Rewards in favor of individuals are not subject to insurance premiums for various reasons. Some are simply not subject to taxation, and some were specifically exempted from taxation by the law “On insurance contributions to the Pension Fund of the Russian Federation, the Social Insurance Fund of the Russian Federation, the Federal Compulsory Medical Insurance Fund” dated July 24, 2009 No. 212-FZ (hereinafter referred to as the law No. 212-FZ).

However, one should be extremely careful with such payments, since non-accrual of contributions threatens increased attention from regulatory authorities and subsequent on-site inspection (attachment to the letter of the Pension Fund of the Russian Federation No. TM-30-24/13848, FSS of the Russian Federation No. 02-03-08/13-2872 dated 12/21/2010).

We also note that there are payments for which insurance premiums are not charged at all, and there are those that are subject to contributions only to some funds.

Let’s look at which payments are not subject to social insurance contributions.

- interest received by the employee under the terms of the loan agreement concluded between him and the organization;

- material benefit from savings on interest, if, under the terms of the contract, the loan issued to the employee is interest-free;

- a loan or part of a loan repaid under agreements;

- a gift transferred on the basis of a deed of donation.

It should be taken into account that if, if an organization issues a loan to its employee, part of the debt is forgiven, then it will already be subject to insurance premiums (letters from the Ministry of Health and Social Development of Russia dated 05.21.2010 No. 1283-19, dated 05.17.2010 No. 1212-19, FSS of the Russian Federation dated 17.11 .2011 No. 14-03-11/08-13985).

If the terms of the agreements listed above also provide for the provision of services (for example, a car rental agreement is accompanied by the provision of driver services), then questions may arise regarding the amount of services provided.

Previously, officials believed that payment for such services should be subject to unified social tax (letter of the Ministry of Finance of Russia dated July 14, 2008 No. 03-04-06-02/73). And since insurance premiums have, in fact, replaced the single social tax, the likelihood that the position of officials will remain the same is quite high.

For additional exemptions on contributions that may be introduced from 2020, read the article “New benefits on insurance premiums may appear.”

The legal provisions relating to the 2014 Olympics and Paralympics are applicable for the period from 01/01/2011 to 31/12/2016.

These costs include:

- expenses incurred when processing or issuing visas, invitations and other similar documents;

- costs of travel, accommodation, food, training, communications and transportation;

- expenses for linguistic support;

- the cost of souvenirs with the symbols of the Olympics and Paralympics held in Sochi in 2014.

In addition, the amounts of insurance premiums under insurance contracts that were concluded in favor of these persons are not subject to insurance premiums.

Such payments are:

- remuneration to foreigners and stateless persons within the framework of labor and civil contracts for the performance of work (provision of services) concluded with FIFA (Federation Internationale de Football Association), the organizing committee of Russia 2018 and subsidiaries of these organizations;

- reimbursement of the following expenses of volunteers incurred while performing their duties under civil contracts concluded with FIFA, the Russia 2018 organizing committee and their subsidiaries:

- expenses for processing and issuing visas or invitations;

- costs of travel, accommodation, food, sports equipment, training, communications, transportation, linguistic support;

- cost of souvenirs with the symbols of the 2020 FIFA World Cup, 2020 FIFA Confederations Cup.

We invite you to read: How to check a driver’s vehicle license using the Rosgosstrakh database

Results

The Tax Code provides for the payment of insurance premiums on a significant portion of the income received by citizens.

The payments listed in Art. 410 and 422 of the Tax Code of the Russian Federation. These are amounts not related to the performance of labor duties, compensation provided for by law, payment for services performed by individuals for the personal needs of citizens, etc. You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

If an employee is sent on a business trip, what is considered the base for insurance premiums?

The requirements of tax legislation, starting from 2020, are that insurance premiums must be calculated and declared from the amount accrued to the employee for each day of business travel (per diem). The established standard is excluded when calculating the base.

It has not changed in 2020 or in 2020 and amounts to preferential daily allowance amounts:

- Within the Russian Federation – 700 rubles per day;

- Abroad – 2,500 rubles per day.

On a note! If the organization’s personnel policy provides for other amounts of daily payments, then insurance premiums will have to be charged in full if this limit is exceeded.

Expenses incurred during business trips are not subject to contributions for pension, insurance, and medical insurance:

- For round trip travel;

- Directions to the station, airport;

- Airport, visa, fuel taxes;

- For moving and carrying luggage;

- Amounts for renting housing, hotel rooms;

- Mobile or Internet connection;

- Bank commission for currency exchange.

For the position or status of an employee who incurred travel expenses. For the heads of the organization and members of the board of directors, the above rules apply without exception. The main thing is that every cost fact is supported by documents.

General standards

In accordance with Article 420 of the Tax Code, for companies, entrepreneurs and individuals who do not have the status of individual entrepreneurs, the object of calculation of insurance premiums is the payments they make in favor of employees, provided for by the labor relations established between them and the terms of civil law agreements.

For taxpayers who do not pay any remuneration to other individuals, a fixed base for payment of contributions is provided, associated with the minimum wage.

Article 420. Object of taxation of insurance premiums

If certain payments are made in favor of employees that are not directly provided for by the terms of the contract, deductions of insurance contributions from them must still be made, since they take place within the framework of existing labor relations.

Common Questions

Question 1: The organization reimburses employees for the costs of kindergarten. Are contributions calculated for such compensation?

When answering this question, fiscal officials pay attention to the list of benefits for insurance premiums, Art. 422 of the Tax Code of the Russian Federation, where compensation for parental fees for maintaining a child in a preschool educational institution is not mentioned, which means that contributions are required to be calculated.

Question 2: The employer guarantees a package of social benefits: vouchers, treatment costs, medication costs, compensation upon retirement. Do I need to pay contributions for the social package?

It is necessary to pay contributions from these payments, since the social package is guaranteed within the framework of the labor relationship, and they are subject to contributions according to the general rule provided for in Art. 420 Tax Code of the Russian Federation.