Commission

Before drawing up the write-off act, a special commission meets. They must consist of at least three people. The chairman of this commission is elected. Each member of the assembled group must be informed that reporting false information in official papers is punishable by law.

All members of the commission check the compliance of the data specified in the paper with the real state of affairs. Their signatures in the documentation indicate that they have found a complete match. If one of the commission members has a special opinion about the presented figures, then he still signs, but formalizes his position in the form of a postscript or an appendix to the act.

https://www.youtube.com/watch{q}v=channel

Sometimes the creation of a commission is prescribed in the manager’s order on holding festive events in the organization.

Accounting for gifts to employees - regulatory issues

The owner of the salon can encourage his employee who effectively and efficiently performs his job duties in several ways - by declaring gratitude to him, paying him a bonus, awarding him with a valuable gift, a certificate of honor, introducing him to the title of the best in the profession, etc. (part one of Article 191 Labor Code of the Russian Federation). True, employees can receive gifts not only for work achievements, but also on holidays.

In accordance with Labor legislation, the head of a beauty industry enterprise is not at all obliged to regulate in local acts the procedure for issuing and keep records of gifts to employees. At the same time, by recording the grounds and conditions of the donation in internal documents, the manager will help himself.

- This will eliminate questions from the tax authorities. Read about how to calculate personal income tax on a gift.

- The document will eliminate possible errors when processing the issuance of gifts.

- This will help increase employee loyalty.

If the owner of a beauty salon decides to make a gift to a municipal or government employee, then he should limit the amount to 3,000 rubles. (Article 575 of the Civil Code of the Russian Federation). The law prohibits giving them gifts worth more than a specified amount in connection with their official position or performance of official duties.

Exceptions are cases of donation in connection with protocol events, business trips and other official events (Clause 2 of Article 575 of the Civil Code of the Russian Federation). But keep in mind that in this case, a gift worth more than 3,000 rubles will be considered the property of the state. The employee will be obliged to transfer them according to an act to the body in which he holds the position (clause 2 of Article 575 of the Civil Code of the Russian Federation).

A convenient tool for calculating wages for a beauty salon employee

Gifts for employees

On the eve of the New Year holidays, many employers are ready to give gifts to their employees and their children. In this article we will talk about documenting the issuance of gifts, their taxation and accounting.

According to the Civil Code, a gift is a gratuitous gift from the donor to the donee (Clause 1, Article 572 of the Civil Code of the Russian Federation). But in the system of relations between an employee and an employer, a gift can also act in a different capacity.

Gifts differ not only in their physical form and cost. From the point of view of labor relations, it is important why they are awarded, on what basis and for what reason.

Gift as a reward for work

The employer has the right to reward the valiant work of an employee in several ways. As a reward for labor achievements, an employee can be given a valuable gift (Part 1 of Article 191 of the Labor Code of the Russian Federation). In this case, the gift is one of the forms of remuneration in the remuneration system; it must be enshrined in local regulations or a collective agreement.

That is, the organization must have a regulatory document in force. It must indicate the production indicators for the achievement of which gifts are given, the circle of employees being rewarded, the value of the gifts or their material form (Approximately as in the bonus regulations or directly in its text).

Gift according to tradition

Following established traditions in society, an employer can give gifts to its current and former employees not in connection with work: for holidays (March 8, February 23, Victory Day, New Year, company birthday, etc.), in connection with anniversary, birth of a child, marriage, retirement. On New Year's Day it is customary to give gifts to the children of employees.

Labor legislation does not provide that the employer’s decision to give a gift for a holiday or special occasion must be regulated in regulations. However, the collective agreement may stipulate the employer's obligation to finance such gifts.

It must be taken into account that this cannot be a basis for recognizing such a gift as an element of the remuneration system. In this case, the gift does not serve as a reward for work. There is no production need for such costs; they cannot be considered economically justified.

Regardless of the reason for giving gifts, some requirements of civil law should be taken into account.

If the value of a gift to an individual is more than 5 minimum wages (currently 500 rubles), it is necessary to draw up a written gift agreement (clause 2 of article 574 of the Civil Code of the Russian Federation). It confirms not only the donor’s intention to transfer the thing free of charge, but also the recipient’s consent to accept it. Documents that reflect the will of both parties can be used as a written gift agreement.

Donation agreement in the form of an order. If the gift is intended for one employee, the head of the company issues an order (instruction). Form No. T-11 “Order (instruction) on employee incentives” was approved by the Decree of the State Statistics Committee of Russia dated 05.01.

2004 No. 1 “On approval of unified forms of primary accounting documentation for recording labor and its payment.” This form contains the column “The employee is familiar with the order (instruction).”

It is used if a gift is given for labor achievements on the basis of regulations on remuneration, bonuses or other documents establishing the grounds and procedure for giving gifts in an organization. For a sample of filling out an order in form No. T-11, see p. 50.

To encourage a group of employees, form No. T-11a is used.

Order and statement. If there are several recipients, another option is quite acceptable. Information about consent to accept a gift is given not in the order, but in the statement. In it, employees sign for receiving gifts.

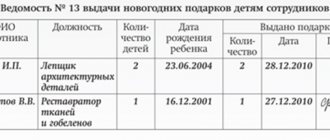

The same method is also suitable for issuing New Year's gifts to employees' children. For a sample order for issuing New Year's gifts to employees' children, see p.

52, sample form for receiving children's New Year's gifts - on p. 53.

Donation agreement and deed. If you need to reward a person who is no longer in an employment relationship with the organization, then the issuance of the gift should be recorded in a separate gift agreement. The direct transfer of gifts can be formalized by an act or statement indicating those to whom they were given.

When issuing gifts, in any case, it is necessary to accrue and pay some taxes. But depending on the reason for giving gifts, the taxation procedure differs.

Income tax

Special clothing and personal protective equipment include: overalls, jackets, gloves, respirators, goggles, headphones, gas masks, etc. Article 221 of the Labor Code of the Russian Federation obliges heads of organizations to provide employees with uniforms and personal protective equipment free of charge if they work:

- in hazardous production (for example, in chemical production for the purpose of protection from the influence of harmful substances, etc.);

- if contamination is possible during work (uniforms are needed so as not to stain the employee’s personal clothing);

- if the employee’s work involves exposure to unusual temperatures (high or low).

Information about the name and number of units of protective clothing received by the organization is entered into the PPE logbook. It is also used to issue uniforms at the warehouse. Information about the protective clothing received by employees is entered into a personal record card for the issuance of personal protective equipment.

The form of this document is established by the annex to the intersectoral rules, approved. by order of the Ministry of Health and Social Development dated 07/01/09 No. 290n.

Documents for gifts to employees and their children

In addition to the act of writing off gifts, the manager or other person organizing the holiday must draw up and submit for signature:

- Leader's order.

- Event program.

- List of participants at the gala lunch or dinner (if one is planned).

- Cost estimate for carrying out. It is first transmitted to the company's accounting department.

- List of gifts. The main part of it is a table with a list of recipients and their signatures. The statement is the basis for drawing up an act for writing off gifts.

Only after legally competent preparation of this documentation can you begin to draw up an act.

Each organization may have its own approach to the basic algorithm for donating material assets and writing them off. The main thing is that he:

- Took into account the requirements of tax legislation.

- Took into account the norms of civil legislation.

- Accounted for by the accounting department on off-balance sheet account 07.

- It was taken into account when the organization paid the required insurance contributions to the pension fund.

- Was reflected in the company's accounting policies.

But under no circumstances can you do without an act for writing off gifts.

Each employer decides independently whether to encourage employees, as well as their children, with gifts or not. In accordance with paragraph 1 of stat. 572 of the Civil Code, such a transaction is carried out free of charge. The form of concluding an agreement is oral or written. An exception is situations of transfer of property worth more than 3,000 rubles. or real estate (stat. 574 of the Civil Code).

You can draw up a contract for giving a New Year's gift to an employee's children orally, if the price of the item does not exceed 3,000 rubles. Otherwise, a written form of the contract is required (stat. 574 of the Civil Code). However, the legislation does not establish any restrictions on the price of property. You can give any items to your staff, including gift certificates and money.

Is it necessary to draw up a contract?

The gift agreement must be concluded in writing with all signatures and seals, if the price of the gift (gift certificate or simply donated funds) exceeds 3 thousand rubles.

If the cost of souvenirs, flowers, perfumes, etc. is less than 3 thousand rubles per person, then the agreement can be drawn up orally. But the rest of the documentation remains a prerequisite for the possibility of legal write-off.

Documentation procedure

In order to keep accounting records of gifts to employees, fix the conditions and procedure for issuance, it is not at all necessary to make a separate local act. The necessary points can be included in existing documents, for example, internal labor regulations, provisions on social guarantees, bonuses, or a collective agreement (if any) (part one of Article 8 of the Labor Code of the Russian Federation).

They should include all cases when the salon manager deems it necessary to make gifts, record the procedure for documenting gift giving, determine the categories of employees and the maximum cost of surprises. Thus, it is worth establishing that gifts worth up to 2,000 rubles are purchased for craftsmen, up to 4,000 rubles for cosmetologists, up to 6,000 rubles for managers, and up to 1,000 rubles for employees’ children.

Components

The act of writing off gifts does not have an established unified template. In accordance with the existing legislative framework, it is drawn up in free form. The main thing is that it is spelled out in the accounting policies of the organization and complies with accepted standards. All of them are spelled out in Article 9 of the Accounting Law.

The form and sample document offered for downloading contain the following parts:

- A cap. It includes: company details at the top (ideally, the act is printed on the organization’s letterhead), name of the document, its number, date of signing and city.

- Listing the composition of the commission. It must consist of at least five persons who have put their signatures on the paper. Your last name, initials and position will be enough (if the commission includes employees).

- A table describing the gifts, their value and who they were given to.

- An occasion for presenting gifts. In the attached example it is New Year.

- How many units were issued and for what amount.

- Mention of the possibility of writing off the listed values from the register.

- Signatures of the commission members. If possible, the seal of the organization.

It is worth noting that the write-off act will not have legal force without a statement of issue with the signatures of the donee.

Order for a gift to an employee - sample

To confirm the targeted nature of spending on gifts, you need to correctly register their purchase and issuance. Therefore, first of all, the head of a beauty industry enterprise is obliged to issue an order for holding a festive event and an order for a gift for an employee. It is better to buy gifts centrally under a sales contract. In it we indicate the following important parameters:

- on the name of the product (clause 3 of Article 455 of the Civil Code of the Russian Federation);

- on the quantity of goods (clause 3 of article 455, article 465 of the Civil Code of the Russian Federation);

- on the price of the goods (clause 2 of Article 494, clause 1 of Article 500 of the Civil Code of the Russian Federation).

Sample order for a gift to an employee

ORDER “___” ___________ 2020

No. ____ Moscow

About rewarding employees with gifts

Due to ____________

I ORDER:

1. Organize rewarding of employees with gifts according to the attached list.

2. The chief accountant ________ allocate funds for the purchase of gifts at the rate of 2,000 rubles. for each employee.

3. The manager __________ to purchase gifts and draw up a statement for their receipt.

4. The administrator _________ give gifts to employees based on the statement within the period from___ to ______

5. I reserve control over the execution of this order.

Director _________ (signature) ___________ (transcript)

Manager ________ (signature) _________ __ (transcript)

Administrator __________ (signature) _____________ (transcript)

Gifts purchased at retail must be confirmed by receipts and delivery notes.

We recommend that the fact of issuing gifts be recorded in the order of encouragement in forms No. T-11 and T-11a, and in the statement. The latter is compiled in any form. It is also worth making a record of the award in the work book and the employee’s personal card.

Sample statement for issuing gifts

REPORT OF GIFTS FOR ________ (event)

_______ (date of)

________ (address)

| № p/p | Full name | Job title | Gifts given out | |||

| Name | price | date | signature | |||

| 1 | Tropinina E.A. | cosmetologist | flash card | 1,500 rub. | ||

| 2 | Kolbina Yu.Yu. | masseur | statuette | 1,500 rub. | ||

| 3 | Trofimova N.A. | manicurist | suspension | 1,500 rub. | ||

In total, gifts were given out in the amount of 15,000 rubles.

Director _______________ (signature) ________ (transcript)

Accountant ________________ (signature) _________ (transcript)

Important parameters

An accountant needs to know what taxes and in what cases the income of personnel who have received gratuitous incentives is levied.

Personal income tax and insurance premiums

A gift given in cash or in kind to an employee is considered his income and is therefore subject to personal income tax. It is the employer's responsibility to calculate and withhold tax. Personal income tax is imposed on the value of property exceeding 4 thousand rubles. This limit is taken into account from the total amount of all gifts issued during the year. Exceptions to the rule are reflected in clause 8 of Art. 217 Tax Code of the Russian Federation.

Example. In March, the employee received a gift worth 1,200 rubles, in May another one worth 3,800 rubles, and in December a third one worth 2,500 rubles.

The accountant must withhold personal income tax from earnings for May from the amount of 1000 rubles. (1200 + 3800 – 4000). In December, the tax is calculated from 2500 rubles. If the employees are residents, then the personal income tax on the cost of gifts is 13%, and for non-residents - 30%.

According to Letter of the Federal Tax Service No. SA-4-7/16692 dated 08.22.14, the moment of withholding and payment of tax depends on the form of issuance of the gift.

Letter of the Federal Tax Service No. SA-4-7 16692

When rewarding with money, personal income tax is withheld and transferred on the day the amount is paid from the cash register or transferred to the card. If the gift is in kind, the tax is withheld and paid on the next day the money is paid to the employee, for example, an advance.

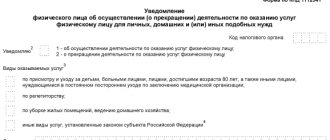

If the gift is given and the employee no longer receives any payments by the end of the year, the employer is obliged to notify the employee and the tax office about the amount of uncalculated tax and the impossibility of withholding it within one month of the next year. To do this, before January 31, you need to provide the Federal Tax Service with a 2-NDFL certificate with the symbol “2” in the “sign” cell.

In the certificate, the amount of each gift is indicated as income under code 2720, and amounts up to the limit of 4 thousand rubles. shown as a deduction with code 501. In order to determine whether insurance premiums need to be charged on the amount of the gift, you need to know which payment it relates to.

In accordance with Law No. 212-FZ, contributions are levied on payments to employees for labor, and are not assessed for remuneration under civil law agreements under which the owner of the property changes. The second option includes a gift agreement.

If a gift is given to an employee under a gift agreement, then it will not be subject to any contributions; if this agreement was not concluded, insurance premiums will be charged for the amount of the gift.

The gift agreement should not have references to the company’s local regulations and employment agreement. It does not need to establish the dependence of the value of the gift on the employee’s work activity, for example, on position, salary, work results. Otherwise, auditors may characterize the gift as an incentive for work and assess additional contributions.

Display in VAT and simplified tax system

The cost of gifts, the issuance of which is not related to the labor of personnel, is not included in the costs when calculating income tax (clause 16 of Article 270 of the Tax Code of the Russian Federation).

Legal Individuals and individual entrepreneurs on a simplified basis with the “income minus expenses” system also do not reduce the base for the cost of gifts. This type of cost is not included in the closed list (Article 346.16 of the Tax Code of the Russian Federation).

The cost of valuables issued as incentives for work are taken into account in wage costs both when calculating income tax and when determining costs under the simplified tax system.

According to Art. 146 of the Tax Code of the Russian Federation, the gratuitous transfer of ownership of goods is equal to sale and is subject to VAT.

Article 146. Transfer of rights certified by documentary securities

When calculating the tax on the cost of souvenirs, you need to take into account the following points:

- VAT is not charged on the amount given to an employee in cash as a gift;

- Enterprises and individual entrepreneurs must charge tax on UTII and the general taxation system;

- Legal entities and individual entrepreneurs using the simplified procedure do not pay VAT, including on the cost of gifts;

- The value of a present received by an employee for his work activity is not subject to taxation.

The purchase price of a gift is the VAT base. The tax is calculated at a rate of 18%. If there is an invoice, input VAT on transactions can be deducted.

The dependence of the calculation of taxes and contributions on the basis for receiving a gift is shown in the table:

| Type of tax/contribution | Donation is not related to the labor process | Gift - reward for work |

| Accrual (reflected in expenses) | ||

| Personal income tax | Yes | Yes |

| Contributions to funds | No | Yes |

| simplified tax system and profit | (No) | (Yes) |

| VAT | Yes | No |

Accounting certificate form 0504833 was developed for government agencies and government agencies, approved by a special Order of the Ministry of Finance of the Russian Federation on April 30, 2015, along with other forms of primary documentation and registers. A sample of filling out a message about the closure of a separate division can be found here.

Reflection in accounting

Valuables are given to employees or their children free of charge, under a gift agreement. It can be concluded orally. However, there are situations in which the document must be drawn up in writing: when donating real estate and property whose value is more than 3,000 rubles.

The basis for presenting souvenirs is the order of the director. In accounting, their cost is written off on the basis of primary documentation: invoices, orders, etc.

To control their receipt, a statement for the issuance of gifts is drawn up. It shows who received the promotion and when. The document is used when issuing valuables to a group of employees.

For all settlements with workers, except wages, account 73 “Settlements for other transactions” is used. This also applies to giving gifts. The correspondence of invoices depends on what exactly the employee received.

If the employee is given inventory items, the records will be as follows:

| Dt 73 Kt, 10, 41, 43 | The cost of donated inventory items has been written off. |

| Dt 91.2 Kt 73 | Staff debt for valuables received free of charge is taken into account as other expenses. |

The transfer is accounted for at actual cost.

If an employee is given tickets to a concert, the postings will be as follows:

| Dt 73 Kt 50.3 | The cost of donated tickets has been written off. |

| Dt 91.2 Kt 73 | Employees' debt is included in other expenses. |

Transactions for purchasing postcards depend on the order in which they were purchased:

| Dt 71 Kt 50 | The accountable amount has been issued. |

| Dt 10 Kt 71 | Greeting cards have been posted. |

When purchasing directly, the following entries apply:

| Dt 10 Kt 60 | Greeting cards have been posted. |

| Dt 60 Kt 50, 51 | Payment reflected. |

Postings for delivering postcards to employees:

| Dt 73 Kt 10 | The cost of greeting cards has been written off. |

| Dt 91.2 Kt 73 | The debt of workers is included in other expenses. |

Dt 99 “Permanent tax liability” Kt 68 “Income tax” - a permanent tax liability has been accrued. This entry is made because the cost of the postcards does not reduce the profit base.

Awards for memorable events and prizes for winning competitions are also taken into account as income when calculating personal income tax. Tax deduction in accounting is reflected as follows: Dt 70 Kt 68 - personal income tax is withheld from the employee.

Sample of filling out a form for issuing gifts