Paying wages to a foreign worker from the cash register - a violation or not

According to the text of sub. “a” and “c” clause 6, part 1, art. 1 of Federal Law No. 173-FZ of December 10, 2003, Russian organizations and individual entrepreneurs are recognized as residents of Russia. At the same time, according to sub. “a” and “b” clause 6, sub. “a” clause 7, part 1, art. 1 of the same legislative act, foreign citizens who have not issued a residence permit (residence permit in the Russian Federation), that is, who are in the status of temporarily staying and temporarily residing in Russia, are non-residents of the country.

Based on the provisions of sub. “b” clause 9, part 1, art. 1 of Law No. 173-FZ, it can be argued that the payment of ruble amounts by a resident in favor of a non-resident of the Russian Federation (including wages) is a foreign exchange transaction. And in parts 2 and 3 of Art. 14 of Federal Law No. 173-FZ dated December 10, 2003 and the explanations of Rosfinnadzor dated August 7, 2014 state that payments for currency transactions can be made exclusively in non-cash form

, that is, through a bank account in banks authorized to make such transfers.

Important!

Foreign employees who reside permanently in Russia on the basis of a residence permit can legally receive wages in cash from the employer's cash desk.

Instructions on how to get hired

If a company needs foreign experts and is ready to pay them high wages, we suggest focusing on the step-by-step registration of a highly qualified foreign specialist in 2020, prepared by the experts of the HR Club, taking into account the latest changes in legislation.

Step 1. Study how attracting HQS differs from the procedures in force for other foreigners

Employers (both legal entities and individual entrepreneurs) should begin preparing for hiring HQS by studying the regulatory framework. There are specifics to employing such employees. Among them:

- the employer does not need to have permission to attract and use foreign labor; he immediately submits an application to the Ministry of Internal Affairs (formerly the Federal Migration Service) to attract a qualified employee;

- there is no need to submit information about the vacancy to the employment center;

- there is no need to take into account the share of foreign workers allowed in certain types of economic activities;

- work permits and invitations to enter for highly qualified foreign specialists are issued without taking into account quotas;

- To obtain a work permit, a HQS is not required to undergo a medical examination and pass an exam on knowledge of the Russian language;

- the period for obtaining a work permit does not exceed 14 working days from the date of submission of documents;

- a work permit is issued for a maximum of 3 years, provided that such a period is specified in the employment contract;

- a work permit is sometimes valid on the territory of several constituent entities of the Russian Federation, and the HQS has the right to perform work duties on business trips in other countries or Russian regions;

- the personal income tax rate on all income is 13% from the moment of starting work;

- Insurance premiums are paid according to general rules.

Step 2. Determine whether you will be allowed to hire highly qualified foreign specialists

HQS has the right to invite:

- commercial organizations;

- scientific organizations and educational organizations with state accreditation;

- accredited branches and representative offices of foreign organizations.

At the time of filing an application to involve HQS in their work activities, employers should check two more facts:

- The company has no outstanding resolutions imposing administrative penalties for violating the regime of stay of foreign citizens in the Russian Federation or for violating the procedure for carrying out their work activities.

- The organization has not been subject to a ban on attracting foreigners to work in the Russian Federation as HQS.

Step 3. Check whether it is permissible to employ a foreigner for the existing vacancy

Law No. 115-FZ provides a list of highly qualified professions for foreign citizens that are prohibited for them. Foreign specialists cannot be registered under a GPC agreement or a work contract as:

- preachers, worshippers, persons engaged in religious activities and religious education (clause 1.2 of article 13.2 of law No. 115-FZ);

- municipal employees (clause 1, clause 1, article 14 of law No. 115-FZ);

- a member of a ship flying the state flag of the Russian Federation (clause 2, clause 1, article 14 of law No. 115-FZ);

- crew member of a Russian warship and aircraft (clause 3, clause 1, article 14 of law No. 115-FZ);

- chief accountant, if the foreigner does not have a temporary residence permit or residence permit in the Russian Federation (clause 3 of article 14 of law No. 115-FZ).

In addition, foreigners, including highly qualified specialists, are denied access to certain facilities and certain organizations in order to ensure security. We are talking about army facilities, organizations involved in the development and production of nuclear weapons and radioactive waste. The participation of the HQS in structures where they protect or use information related to state secrets is not permitted.

Step 4. Negotiate

In order for the employee to begin performing his duties, negotiations are held with him. The more issues the parties discuss, the easier it is to move on to the next stage - signing an employment contract.

Where and in what format to conduct negotiations is decided by the employer and the future employee. This can be done in any convenient format - via Skype, telephone, or in person.

If a foreigner is ready to come to Russia, he applies for a visa (if necessary), buys tickets, books a hotel and arrives in the country. For a working meeting, the 30-90 days that are given to foreigners to stay in the Russian Federation without additional permits are sufficient.

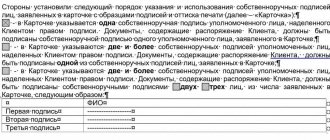

Step 5. Sign the employment contract

When the parties have resolved all the issues, they agree on a draft employment contract and sign the finished document. If necessary, the agreement is drawn up in two languages - Russian and English, so that the new employee can understand its content as accurately as possible.

The employment contract with the HQS must include:

- a condition on the entry into force of the contract after the foreign citizen receives a work permit;

- the amount of wages that meets the requirements established by law;

- conditions for providing a foreign specialist and his family members with medical care on the territory of the Russian Federation.

Step 6. Apply for a work permit

For an employer, obtaining a work permit for highly qualified specialists begins with submitting a package of documents to the migration authority:

- a petition to attract a foreigner to work as a HQS (see Decree of the Government of the Russian Federation dated June 30, 2010 No. 487);

- employment contract;

- a written obligation to pay the costs associated with possible administrative expulsion from the Russian Federation or deportation of the specialist involved (see Appendix No. 12 to Order of the Ministry of Internal Affairs of Russia dated September 21, 2017 No. 735);

- payment order for payment of state duty for issuing a work permit in the amount of 3,500 rubles;

- a copy of the TIN assignment certificate;

- copy of the OGRN certificate;

- a copy of the foreign citizen’s passport with a notarized translation.

Sample of filling out an application form to hire a highly qualified foreign specialist

If you have several invited experts, it will not be possible to include the entire list of highly qualified foreign specialists in one application. A separate application is submitted for each foreigner. Also, a state fee is paid separately for each person.

Although the company asks for permission, the employee picks up the completed document in person. Therefore, the employer should inform the specialist about the need to obtain a work permit from the relevant migration authority.

Please note that the period for consideration of an application to hire a highly qualified specialist is no more than 14 working days from the date of application. For the convenience of workers and employers, the Ministry of Internal Affairs has launched an online service that allows you to find out about the readiness of work permits in real time for free.

Employees of the Ministry of Internal Affairs have the right to refuse to issue a permit if:

- the employer provided knowingly false information about himself or a foreign specialist;

- The employer does not have the right to involve HQS.

Step 7. Notify the Ministry of Internal Affairs about concluding an employment contract with a foreigner

Within 3 working days after concluding an employment contract or a civil process agreement, the employer notifies the Ministry of Internal Affairs about this. For notification, use the form proposed in Appendix No. 13 to Order No. 363 of the Ministry of Internal Affairs of Russia dated June 4, 2019.

Read more: Notification of hiring a foreign citizen

Step 8. Report wages paid

Companies that have hired HQS to work quarterly, no later than the last working day of the month following the reporting quarter, notify the Ministry of Internal Affairs about the fulfillment of obligations to pay wages (remuneration) (paragraph 1, clause 13, article 13.2 of Law No. 115-FZ). The rules for transmitting reports and the notification form are presented in the order of the Ministry of Internal Affairs of Russia dated June 4, 2019 No. 363 (Appendices 5 and 6).

Step 9. If cooperation ends

If a contract with a HQS has to be terminated upon expiration of its term or by agreement of the parties, the dismissal procedure is standard. The only thing is do not forget to notify the Ministry of Internal Affairs about the termination of the employment contract. The notification form is in the same order of the Ministry of Internal Affairs dated 06/04/2019 No. 363.

When is it possible to make payments to foreign citizens in cash in rubles?

Organizations registered on the territory of the Russian Federation have the right to conduct cash payments in rubles with foreign citizens only in the following cases (Part 2 of Article 14 of Law No. 173-FZ):

- when carrying out retail purchase and sale of goods;

- if a foreign citizen in Russia is provided with hotel, transport or other services that can normally be provided to the population.

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

Contributions for compulsory health insurance

In accordance with paragraph 14, Chapter 13.2 of Federal Law No. 115, the employer, when hiring a highly qualified worker for a position, gives a guarantee for the provision of voluntary medical insurance on the territory of Russia for such a worker, and in addition for members of his family, based on an agreement concluded with a medical company. Failure to comply with this requirement will result in serious administrative consequences.

In addition, Chapter (Article) 10 of Federal Legislation No. 326 dated November 29, 2010. “On integral health insurance in Russia”, highly qualified workers are removed from the list of persons belonging to insurance.

Paying wages to a foreign worker from the cash register - judicial practice

As a rule, the courts take the side of employers in proceedings regarding the payment of wages to foreigners from the treasury.

It even happens that the court refuses to recognize such calculations as a violation. The courts justify their position as follows:

- The rules that govern the Labor Code apply to labor relations with foreigners, and the Labor Code of the Russian Federation provides for the payment of wages to employees in rubles at the place of work or by sending funds to the bank account specified by the employee, taking into account the provisions of a collective or labor agreement (Article 11 , 131, 136 Labor Code of the Russian Federation).

- All doubts, ambiguities and contradictions in acts of currency legislation that are irremovable must be interpreted in favor of residents and non-residents (Part 6, Article 3 of Law No. 173-FZ).

- A non-resident has the right to open a bank account in Russia, but is not obliged to do so (Part 1, Article 13 of Law No. 173-FZ).

- The law allows for currency transactions between residents and non-residents without any restrictions (except for individual transactions, but salary payments do not apply to these). Moreover, if the law does not establish a special procedure for conducting a currency transaction, it can be carried out without restrictions (Part 2 of Article 5, Article 6 of Law No. 173-FZ).

- If an employer delays wages to a foreign employee, he will be held liable as if the employee were a resident of the Russian Federation (Article 142 of the Labor Code of the Russian Federation).

Current legislation does not provide for the possibility and obligation of Russian employers to independently open bank accounts for the transfer of wages to non-residents of the Russian Federation, if they have not submitted the appropriate applications.

Read also the article ⇒ “Insurance premium rates for non-residents and foreign citizens in 2020“.

Foreign employees

Typically, the taxation of payments in favor of foreign employees has features related to their status. If a foreign citizen is a tax resident of the Russian Federation, then the procedure for taxing his income is similar to the rules for collecting personal income tax from Russians.

Highly qualified specialists are understood as foreign workers who meet a number of criteria. In particular, in the general case, the salary of such an employee cannot be less than 167,000 rubles. per month.

For some categories of foreigners, a lower salary threshold has been established. For example, for researchers and specialists in the field of information technology, the limit is set at 83,500 rubles. (Clause 1, Article 13.2 of the Federal Law of July 25, 2002 No. 115-FZ).

He must have experience, skills or achievements in a specific field of activity. His level of qualifications is determined by the employer or customer (clause 1, article 13.2 of the Federal Law of July 25, 2002 No. 115-FZ).

However, if such an employee is not a resident of Russia, then the taxation procedure will be different. Moreover, special rules apply to certain groups of foreign citizens working in our country. In particular, these include highly qualified foreign specialists. They pay personal income tax at a rate of 13 percent, regardless of what tax status they have.

These rules apply to all income of such employees from working in Russia (clause 3 of Article 224 of the Tax Code of the Russian Federation):

- for the salary stipulated by the employment contract;

- allowances provided for by the Labor Code (for work outside the place of permanent residence);

- remuneration to members of the board of directors.

Common mistakes

Error:

The taxpayer pays salaries to foreign employees in rubles in cash, inspired by judicial practice on this issue.

A comment:

You should comply with the requirements of currency legislation and pay wages to a bank account to avoid claims from Rosfinnadzor and litigation.

Error:

The employer refuses to pay foreign workers with a residence permit in Russia their wages in cash in rubles.

A comment:

Foreign citizens who have issued a residence permit have the full right to receive a salary in rubles from the cash register on the basis that they permanently reside in the Russian Federation.