Deadline for filing financial statements in 2020

Since 2020, the obligation to provide accounting records to statistical authorities has been abolished. The last time you need to submit a balance sheet, financial statements, appendices and explanations to Rosstat is for 2018 (Law No. 444-FZ of November 28, 2018).

The general deadlines for submitting balance sheet reports in 2020 are set until March 31st. Due to the fact that this date falls on a Sunday, reports to the Federal Tax Service Inspectorate and Rosstat for 2020 are required before April 1, 2020. In case of submission of accounting reports for 2020 to the Federal Tax Service Inspectorate, the deadline for submission is set until March 31, 2020.

Note! All accounting companies submit accounting reports. Individual entrepreneurs, private practitioners, and branches of foreign companies have the right not to keep accounting records, and therefore not to submit accounting reports (Clause 2 of Article 6 of Law No. 402-FZ of 12/06/11).

STS reporting in 2020 for 2020: table and deadlines for submitting declarations and reports

First, why the topic of reporting the simplified tax system in 2020 is so popular. Why do so many resources annually publish lists, tables, recommendations on declarations and reports?.. In fact, everything is obvious.

Ready-made declaration under the simplified tax system for 2020 for 149 rubles ►

One of the main responsibilities of individual entrepreneurs is reporting. Based on this data, taxes and contributions are calculated, so the Federal Tax Service strictly ensures that declarations and reports are submitted within the established deadlines, which change from year to year.

At the beginning of 2020, reports for 2020 are submitted, and throughout the year - monthly and quarterly forms. If you do not report on time, there is a risk of receiving not only a fine, but also blocking your current account.

This always happens unexpectedly and can completely paralyze a business. In order not to create unnecessary problems for yourself, you need to know your accounting calendar for reporting and paying taxes.

In this article we will talk about individual entrepreneurs’ reporting on the simplified tax system in 2020.

What kind of reporting does the individual entrepreneur submit?

Before moving on to the reporting submitted by payers of the simplified system, a little information about the types of reporting for individual entrepreneurs in 2020.

Tax reporting

These are declarations that correspond to the chosen taxation system. Each regime has its own declaration forms; they are filled out differently and submitted within different deadlines. The exception is the patent taxation system: individual entrepreneurs with a patent do not submit any declarations.

The tax is calculated here without their participation, based on the potential annual income established by the municipal legal act.

We wrote in detail about filling out declarations in the articles “Declaration under the simplified tax system for 2020 for individual entrepreneurs” and “Zero declaration under the simplified tax system” (we will write about UTII declarations in the future, stay tuned for updates on the website).

| ✏ Tax reporting can also include accounting books (KUDiR). Although you do not need to submit them, the Federal Tax Service may request KUDiR during an inspection at any time. |

Financial statements

Individual entrepreneurs are exempt from accounting on the basis of Article 6 of the law dated December 6, 2011 N 402-FZ, but no one prohibits doing it voluntarily. But usually accounting is carried out only by some entrepreneurs on OSNO, who have large turnover and expensive fixed assets. For individual entrepreneurs in special regimes, accounting is unnecessary.

Reporting for employees

Personnel reporting is very complex and voluminous; it is the same for all taxation systems. If you have or will have employees, find an accountant or connect to a specialized accounting service. It will be problematic to cope with reports for employees yourself, without special knowledge.

Free consultation on simplified tax system ►

Statistical reporting

This is the most incomprehensible reporting, because Rosstat checks the activities of individual entrepreneurs selectively. The exception is periods of continuous monitoring of small business activities, which are carried out every 5 years. The rest of the time, only those entrepreneurs who were included in the sample and received a request from Rosstat to provide information report.

| ✏ Unfortunately, Rosstat was able to insist on large amounts of fines for unsubmitted reports. According to Article 13.19 of the Code of Administrative Offenses of the Russian Federation, an entrepreneur can be fined in the amount of 10 to 20 thousand rubles, and for a repeated violation - from 30 to 50 thousand rubles. Formally, Rosstat must notify each entrepreneur in writing of the need to report. But it’s safer to periodically check this information on the department’s website. |

Property tax reporting

An individual entrepreneur remains an individual who may own transport or real estate. There are no special reports for this; the individual entrepreneur receives a notification about the payment of taxes from his Federal Tax Service. This distinguishes an entrepreneur from organizations that independently submit declarations for transport, land tax and property tax.

https://youtu.be/0YYKeoYa-m0

But although the list of types of reporting looks impressive, many individual entrepreneurs using the simplified tax system can easily cope with this. If an individual entrepreneur does not have employees, his tax calendar will be very short.

Individual entrepreneur reporting on the simplified tax system without employees

For the simplified taxation system, only one tax return is established. It is due at the end of the reporting year, no later than April 30 of the following year. There is no special calculation for advance payments.

The form of the annual declaration on the simplified tax system was approved by order of the Federal Tax Service of Russia dated February 26, 2016 N ММВ-7-3/ [email protected] The form for simplifiers with the object of taxation “Income” and “Income minus expenses” is the same, but different pages must be filled out. The individual entrepreneur does not report on insurance premiums for himself; information about the amounts paid is visible from the annual declaration.

All individual entrepreneurs who once submitted a notice of transition to this regime must submit a tax return under the simplified tax system on time. Even if activities are not carried out within the framework of the simplified system (the individual entrepreneur combines the simplified tax system with other regimes or is not engaged in business at all), it is still necessary to report. The declaration in this case will be zero.

| ✏ It is worth mentioning separately about the possible cancellation of the annual declaration for the simplified system. This can really happen, at least, such a norm is fixed in the main directions of budget, tax and customs tariff policies for 2019-2021. |

However, only those simplifiers who work on the “Revenue” option and spend all revenue through the cash register online can be released from this obligation. In any case, the relevant law has not yet been adopted, so all individual entrepreneurs must submit an annual declaration in 2020.

Source: https://vse-dlya-ip.ru/otcety/usn-otcety/otchetnost-ip-na-usn-v-2019-godu-tablica-i-sroki-sdachi

Filing tax reports in 2020 – deadlines

The list of tax and salary reports depends on the applied taxation system (OSNO, USN, UTII, Unified Agricultural Tax), the legal status of the business (individual entrepreneur, LLC, NPO) and the presence of hired employees. The calendar with reporting deadlines in 2020 was drawn up taking into account the provisions of the Government of the Russian Federation No. 1163 of October 1, 2018 (On the transfer of holiday dates).

Calendar for 2020 – reporting deadlines (table)

Note! The deadlines for submitting NPO reports in 2020 coincide with the general regulatory deadlines. As for entrepreneurs, when filing tax returns under the simplified tax system, the deadlines for submitting individual entrepreneurs’ reports in 2020 differ from the dates established for legal entities.

Other tax references

The Simplified 24/7 program has set up a personal calendar for you. Go to the program and check all the important dates for filing reports, paying taxes and paying employees.

View my 2020 calendar

| Reporting type | Where to rent | Who is renting in 2020 | Deadline |

Reports for the 4th quarter of 2020 and for the whole of 2020 | |||

| Monthly reporting in the SZVM form for December 2018 | Pension Fund | All employers | 15.01.2019 |

| Information on the average headcount for 2020 | Inspectorate of the Federal Tax Service | All employers | 21.01.2019 |

| Unified simplified tax return for 2020 | Inspectorate of the Federal Tax Service | Organizations and individual entrepreneurs that do not have movements on accounts and which do not have taxation objects | |

| Tax return by water tax for the 4th quarter 2018 | Inspectorate of the Federal Tax Service | Organizations licensed to use of subsoil | |

| Declaration on UTII for the 4th quarter of 2020 | Inspectorate of the Federal Tax Service | Imputators | |

| Log of received and issued invoices for the 4th quarter of 2020 | Inspectorate of the Federal Tax Service | Intermediary organizations | |

| Calculation according to Form 4-FSS for contributions for injuries for 2020 on paper | FSS | All employers | |

| VAT return for the 4th quarter of 2020 | Inspectorate of the Federal Tax Service | VAT payers | 25.01.2019 |

| Calculation according to Form 4-FSS for contributions for injuries for 2020 in electronic form | FSS | All employers | |

| Calculation of insurance premiums for 2020 | Inspectorate of the Federal Tax Service | All employers | 30.01.2019 |

| Transport tax return for 2020 | Inspectorate of the Federal Tax Service | Organizations with balance sheet vehicles | 01.02.2019 |

| Land tax return for 2020 | Inspectorate of the Federal Tax Service | Organizations with property land plots | |

| Monthly reporting in the SZVM form for January 2019 | Pension Fund | All employers | 15.02.2019 |

| Income tax return for January 2020 | Inspectorate of the Federal Tax Service | Organizations on a common system, paying income tax monthly | 28.02.2019 |

| Information about the inability to withhold personal income tax for 2020 | Inspectorate of the Federal Tax Service | Tax agents for personal income tax | 01.03.2019 |

| Information on the insurance experience of employees for 2020 according to the SZV STAZH form | Pension Fund | All employers | |

| Monthly reporting according to the SZVM form for February 2020 | Pension Fund | All employers | 15.03.2019 |

| Income tax return for 2020 | Inspectorate of the Federal Tax Service | Organizations on a shared system | 28.03.2019 |

| Income tax return for February 2020 | Inspectorate of the Federal Tax Service | Organizations on a common system, paying income tax monthly | |

| Tax return for corporate property tax for 2018 | Inspectorate of the Federal Tax Service | Organizations with property property | 01.04.2019 |

| Calculation according to form 6-NDFL for 2020 | Inspectorate of the Federal Tax Service | Tax agents for personal income tax | 01.04.2019 |

| Accounting statements for 2020 (balance sheet, etc.) | Inspectorate of the Federal Tax Service | All organizations. Individual entrepreneurs are not rented out! | |

| Certificate 2-NDFL for 2020 | Inspectorate of the Federal Tax Service | Tax agents for personal income tax | |

| Declaration on the simplified tax system of organizations for 2020 (individual entrepreneurs are submitted on April 30) | Inspectorate of the Federal Tax Service | Organizations on the simplified tax system | |

| Monthly reporting in the SZVM form for March 2020 | Pension Fund | All employers | 15.04.2019 |

| Confirmation of the main type of economic activity for 2018 | FSS | All organizations | |

Reports for the 1st quarter of 2020 | |||

| Unified simplified tax return for the 1st quarter of 2019 | Inspectorate of the Federal Tax Service | Organizations and individual entrepreneurs that do not have movements on accounts and which do not have taxation objects | 22.04.2019 |

| Tax return by water tax for 1st quarter 2019 | Inspectorate of the Federal Tax Service | Organizations licensed to use of subsoil | |

| Declaration on UTII for 1 quarter 2020 | Inspectorate of the Federal Tax Service | Imputators | |

| Logbook of received and issued invoices - invoices for the 1st quarter of 2020 | Inspectorate of the Federal Tax Service | Intermediary organizations | |

| Calculation according to form 4-FSS according to contributions for injuries for the 1st quarter of 2020 on paper | FSS | All employers | |

| Calculation according to form 4-FSS according to contributions for injuries for the 1st quarter of 2020 in electronic form | FSS | All employers | 25.04.2019 |

| VAT return for 1 quarter 2020 | Inspectorate of the Federal Tax Service | VAT payers | |

| Tax return for profit for the 1st quarter of 2020 | Inspectorate of the Federal Tax Service | Organizations on a shared system | 29.04.2019 |

| Tax return for profit for March 2020 | Inspectorate of the Federal Tax Service | Organizations on a common system, paying income tax monthly | |

| Declaration according to the simplified tax system for individual entrepreneurs (organizations submit on April 1) | Inspectorate of the Federal Tax Service | IP on the simplified tax system | 30.04.2019 |

| Calculation of tax on property of organizations for the 1st quarter of 2020 | Inspectorate of the Federal Tax Service | Organizations with property property | 30.04.2019 |

| Calculation according to form 6-NDFL for 1st quarter 2020 | Inspectorate of the Federal Tax Service | Tax agents for personal income tax | |

| Insurance settlement contributions for the 1st quarter of 2020 | Inspectorate of the Federal Tax Service | All employers | |

| Monthly reporting SZVM form for April 2020 | Pension Fund | All employers | 15.05.2019 |

| Tax return for profit for April 2020 | Inspectorate of the Federal Tax Service | Organizations on a common system, paying income tax monthly | 29.05.2019 |

| Monthly reporting SZVM form for May 2020 | Pension Fund | All employers | 17.06.2019 |

| Tax return for profit for May 2020 | Inspectorate of the Federal Tax Service | Organizations on a common system, paying income tax monthly | 28.06.2019 |

| Monthly reporting SZVM form for June 2020 | Pension Fund | All employers | 15.07.2019 |

| Calculation according to form 4-FSS according to contributions for injuries for the 1st quarter of 2020 on paper | |||

Reports for the 2nd quarter of 2020 | |||

| Declaration on water tax for the 2nd quarter of 2020 | Inspectorate of the Federal Tax Service | Organizations licensed to use of subsoil | 22.07.2019 |

| Unified simplified tax return for the first half of 2020 | Inspectorate of the Federal Tax Service | Organizations and individual entrepreneurs that do not have movements on accounts and which do not have taxation objects | |

| Declaration on UTII for 2 quarter 2020 | Inspectorate of the Federal Tax Service | Imputators | |

| Logbook of received and issued invoices - invoices for the 2nd quarter of 2020 | Inspectorate of the Federal Tax Service | Intermediary organizations | |

| Calculation according to form 4-FSS according to contributions for injuries for the first half of 2020 on paper | FSS | All employers | |

| Calculation according to form 4-FSS according to contributions for injuries for the first half of 2020 in in electronic format | FSS | All employers | 25.07.2019 |

| VAT return for 2 quarter 2020 | Inspectorate of the Federal Tax Service | VAT payers | |

| Tax return for profit for the first half of 2020 | Inspectorate of the Federal Tax Service | Organizations on a shared system | 29.07.2019 |

| Tax return for profit for June 2020 | Inspectorate of the Federal Tax Service | Organizations on a common system, paying income tax monthly | |

| Calculation of tax on property for the 2nd quarter 2019 | Inspectorate of the Federal Tax Service | Organizations with property property | 30.07.2018 |

| Insurance settlement contributions for the first half of 2020 | Inspectorate of the Federal Tax Service | All employers | |

| Calculation according to form 6-NDFL for half year 2020 | Inspectorate of the Federal Tax Service | Tax agents for personal income tax | 31.07.2019 |

| Monthly reporting SZVM form for July 2019 of the year | Pension Fund | All employers | 15.08.2019 |

| Tax return for | Inspectorate of the Federal Tax Service | Organizations on a common system, | 28.08.2019 |

| profit for July 2020 | paying income tax monthly | ||

| Monthly reporting SZVM form for August 2020 | Pension Fund | All employers | 16.09.2019 |

| Tax return for profit for August 2020 | Inspectorate of the Federal Tax Service | Organizations on a common system, paying income tax monthly | 30.09.2019 |

| Monthly reporting SZVM form for September 2019 | Pension Fund | All employers | 15.10.2019 |

Reports for the 3rd quarter of 2020 | |||

| Declaration on water tax for the 3rd quarter of 2020 | Inspectorate of the Federal Tax Service | Organizations licensed to use of subsoil | 21.10.2019 |

| Unified simplified tax return for 9 months of 2020 | Inspectorate of the Federal Tax Service | Organizations and individual entrepreneurs that do not have movements on accounts and which do not have taxation objects | |

| Declaration on UTII for 3 quarter 2020 | Inspectorate of the Federal Tax Service | Imputators | |

| Logbook of received and issued invoices - invoices for the 3rd quarter of 2020 | Inspectorate of the Federal Tax Service | Intermediary organizations | |

| Calculation according to form 4-FSS according to contributions for injuries for 9 months of 2020 on paper | FSS | All employers | |

| Calculation according to form 4-FSS according to contributions for injuries for 9 months of 2020 in in electronic format | FSS | All employers | 25.10.2019 |

| VAT return for 3 quarter 2020 | Inspectorate of the Federal Tax Service | VAT payers | |

| Tax return for profit for 9 months of 2020 | Inspectorate of the Federal Tax Service | Organizations on a shared system | 28.10.2019 |

| Tax return for profit for September 2020 | Inspectorate of the Federal Tax Service | Organizations on a common system, paying income tax monthly | |

| Calculation of tax on property for the 3rd quarter of 2019 | Inspectorate of the Federal Tax Service | Organizations with property property | 30.10.2019 |

| Insurance settlement contributions for 9 months of 2020 | Inspectorate of the Federal Tax Service | All employers | |

| Calculation according to form 6-NDFL for 9 months of 2020 | Inspectorate of the Federal Tax Service | Tax agents for personal income tax | 31.10.2019 |

| Monthly reporting SZVM form for October 2019 | Pension Fund | All employers | 15.11.2019 |

| Tax return for profit for October 2020 | Inspectorate of the Federal Tax Service | Organizations on a common system, paying income tax monthly | 28.11.2019 |

| Monthly reporting SZVM form for November 2019 | Pension Fund | All employers | 16.12.2019 |

| Tax return for profit for November 2020 | Inspectorate of the Federal Tax Service | Organizations on a common system, paying income tax monthly | 28.12.2019 |

Reports for the 4th quarter of 2020 and 2020 | |||

| Monthly reporting SZVM form for December 2019 | Pension Fund | All employers | 15.01.2020 |

| Information about average headcount for 2020 | Inspectorate of the Federal Tax Service | All employers | 20.01.2020 |

| Unified simplified tax return for 2019 | Inspectorate of the Federal Tax Service | Organizations and individual entrepreneurs that do not have movements on accounts and which do not have taxation objects | |

| Tax return by water tax for the 4th quarter 2019 | Inspectorate of the Federal Tax Service | Organizations licensed to use of subsoil | |

| Declaration on UTII for 4 quarter 2020 | Inspectorate of the Federal Tax Service | Imputators | |

| Logbook of received and issued invoices for the 4th quarter of 2020 | Inspectorate of the Federal Tax Service | Intermediary organizations | |

| Calculation according to form 4-FSS according to contributions for injuries 2019 on paper | FSS | All employers | |

| VAT return for 4 quarter 2020 | Inspectorate of the Federal Tax Service | VAT payers | 25.01.2020 |

| Calculation according to form 4-FSS according to contributions for injuries 2019 in electronic form | FSS | All employers | |

| Insurance settlement contributions for 2020 | Inspectorate of the Federal Tax Service | All employers | 30.01.2020 |

| Declaration of transport tax for 2019 | Inspectorate of the Federal Tax Service | Organizations with balance sheet vehicles | 01.02.2020 |

| Declaration of land tax for 2020 | Inspectorate of the Federal Tax Service | Organizations with property land plots | |

| Monthly reporting SZVM form for January 2020 | Pension Fund | All employers | 15.02.2020 |

| Tax return for profit for January 2020 | Inspectorate of the Federal Tax Service | Organizations on a common system, paying income tax monthly | 28.02.2020 |

| Information about impossibility withhold personal income tax for 2020 | Inspectorate of the Federal Tax Service | Tax agents for personal income tax | 01.03.2020 |

| Information about the insurance employee experience for 2020 | Pension Fund | All employers | |

| Monthly reporting SZVM form for February 2020 | Pension Fund | All employers | 15.03.2020 |

| Tax return for profit for 2020 | Inspectorate of the Federal Tax Service | Organizations on a shared system | 28.03.2020 |

| Tax return for profit for February 2020 | Inspectorate of the Federal Tax Service | Organizations on a common system, paying income tax monthly | |

| Tax return by corporate property tax for 2020 | Inspectorate of the Federal Tax Service | Organizations with property property | 01.04.2020 |

| Calculation according to form 6-NDFL for 2019 | Inspectorate of the Federal Tax Service | Tax agents for personal income tax | 30.03.2020 |

| Accounting statements for 2019 (balance sheet, etc.) | Inspectorate of the Federal Tax Service | All organizations. Individual entrepreneurs are not rented out! | |

| Certificate 2-NDFL for 2019 year | Inspectorate of the Federal Tax Service | Tax agents for personal income tax | |

| Declaration on the simplified tax system of organizations for 2020 (individual entrepreneurs are submitted on April 30) | Inspectorate of the Federal Tax Service | Organizations on the simplified tax system | |

| Monthly reporting SZVM form for March 2020 | Pension Fund | All employers | 15.04.2020 |

| Confirmation of the main type of economic activity for 2020 | FSS | All organizations | |

- insurance premiums,

- USN,

- Unified Agricultural Sciences,

- property tax,

- forms 2-NDFL (and in the new edition) and 6-NDFL.

Deadline for submitting statistical reports in 2020

Statistical reporting is submitted by companies to the territorial bodies of Rosstat. The organization/individual entrepreneur can find out the list of forms on which to report using the TIN code. If continuous observation is carried out, all participants in the study subgroup are required to provide forms. During selective observation, not everyone needs to submit forms, but only those included in the sample.

Deadlines for submitting reports to statistics in 2020

| Report name | Deadline for submission |

| Annual forms | |

| F. 1-T | 21.01.19 |

| F. 7-injury | 25.01.19 |

| F. 1-enterprise | 01.04.19 |

| F. 12-F | 01.04.19 |

| F. 57-T | 30.11.19 |

| Quarterly Forms | |

| P-4 (NZ) | Until the 8th |

| P-4 | Until the 15th |

| PM | Until the 29th |

| P-5 (m) | Until the 30th |

| Monthly Forms | |

| P-1 | Until the 4th day (working day) |

| P-4 | Until the 15th |

| P-3 | Until the 28th |

Note! Not all of the designated statistical forms need to be submitted. To find out which form is mandatory for your company, you need to consult the territorial division of Rosstat. You can check the information online on the Rosstat portal https://websbor.gks.ru/online/#!/gs/statistic-codes. To do this, enter the INN, OGRN/OGRNIP or OKPO of the subject.

Fines for failure to provide reports

All types of accounting reports according to Russian laws are required to be submitted to supervisory authorities, therefore, if you do not comply with the rule, do it at the wrong time, or make mistakes when filling it out, this will entail obvious penalties for payers in the form of fines. After all, errors, accidental or intentional, will lead to miscalculations in the payment of taxes and insurance premiums, or rather their failure to pay, which is especially bad for taxpayers using simplified tax accounting systems.

Usually they are not very large, and range from 1000 to 5000, depending on who is being punished - the head of the organization or an official, as well as making a discount for individual entrepreneurs, whose income is usually much less than that of legal entities.

At first, the size of the fine, even if it is calculated as a percentage of the unpaid tax, does not seem large, however, everything is not so simple. A recurrence of an offense can also lead to criminal proceedings, during which tax authorities will impose a fine amounting to tens of thousands of rubles. And this is the least that the court can order.

A calendar with reporting deadlines for an organization in 2020 is necessary for every accountant, otherwise he simply will not know when and what form needs to be submitted, which may entail fines for the company. Thanks to him, the accounting department always knows what data needs to be collected, which greatly simplifies the accounting and calculation of tax and insurance contributions. Accounting calendar tables can be downloaded from this article.

Environmental reporting due date in 2020

When submitting a report, the deadline for submitting annual reports for 2019 is set to 03/25/20. Reporting for 2020 is required before 03/25/19. The obligation to submit a report (Order of the Ministry of Natural Resources No. 74 of 02/28/18) applies to legal entities and Individual entrepreneurs who conduct business at objects of category I, as well as II and III.

Thus, there were no changes in the reporting deadlines for 2019. There have been no innovations in sanctions for non-compliance with legislative norms. For example, according to stat. 119 of the Tax Code for submitting a late declaration or DAM, you will have to pay a fine of 5% of the tax not paid on time, but declared in the document. The sanction is charged for all months of lateness, including full and incomplete. The minimum amount of the fine is 1000 rubles, the maximum is 30% of the amount unpaid according to the report.

Accounting statements - adjustments after the reporting date

Experience report

This is a new type of reporting that is worth mentioning first. For the first time, it had to be provided before March 1, 2020, using a special form SZV-STAZH, with the help of which information about the length of service of the organization’s employees is reported to the Pension Fund.

In 2020, the provision of SZV-STAZH is also set until March 1, along with reporting on the EDV-1 form, which supplements the data reflected in the SZV-STAZH form. This is reflected in the table with the calendar of deadlines for submitting accountants’ reports for 2020. You can familiarize yourself with the filling by downloading the document using the link.

Accounting calendar for 2020: when to send reporting documents

2019 2020

Quarterly tables were generated with the dates of submission of reports and indicating the types of documents. Study and choose a suitable calendar.

Today, a production calendar for 2019 is available, indicating holidays and weekends. Taking this information into account, we have created an accounting calendar for 2020.

In the starting quarter of 2020, accounting employees will begin submitting reporting documents for the last quarter of 2020, after which it will be time to send reporting documents for 2020. At your disposal is a quarterly accounting calendar indicating the type of documents. Choose the most convenient one!

Accounting calendar by quarters for 2020

First, let's look at the accounting calendar for 2020 quarterly. The deadlines for sending reporting documents are indicated taking into account the postponement of weekends and holidays.

If you do not meet the deadlines, you will have to pay quite significant amounts of fines. Downloading the accounting calendar for 2019 will protect you from missing deadlines. You have access to view and download quarterly schedules for submitting reports indicating the types of documents.

In the 1st quarter of 2020, it is necessary to prepare and submit the most reporting documents, since at this time organizations and private entrepreneurs must send final reporting documents for 2020. In the 1st quarter of 2020, the sending of reporting documents for this year will also begin.

Reporting documents for the starting quarter of 2019

| Date of dispatch of reporting documents | Document type | Reporting period | Sender |

| 01/15/2019 | SZV-M | Last month of 2020 | All policyholders |

| 01/21/2019 | Unified simplified tax return | 2018 | Firms without taxable objects and turnover by banking institution and cash desk |

| Data on the average quantity | 2018 | All companies | |

| Water tax declaration | Final quarter of 2020 | Firms and individual entrepreneurs mentioned in Article 333.8 of the Tax Code of Russia | |

| 4-FSS | 2018 on paper | Policyholders sending reporting documents on paper. The average number of employees is less than 25 people. | |

| Invoice book | Last quarter of 2020 in electronic format | Forwarders, intermediaries, developers | |

| 01/25/2019 | Value added tax declaration | Last quarter of 2020 | Taxpayers, tax agents |

| 4-FSS | 2018 in electronic format | Policyholders submitting reporting documents using electronic means | |

| 01/30/2019 | Calculation of insurance premiums | 2018 | All policyholders |

| 02/01/2019 | Transport tax declaration | 2018 | Companies that pay transport tax |

| Land tax declaration | 2018 | Firms owning land plots | |

| 02/15/2019 | SZV-M | First month of 2020 | All policyholders |

| 02/28/2019 | Income tax return | First month of 2020 | People who pay income tax and generate reporting documents on it every month |

| Tax calculation for income tax | First month of 2020 | Tax agents who calculate advance amounts every month based on the profits received after the fact | |

| 03/01/2019 | 2-NDFL certificates indicating the impossibility of withholding tax | 2018 | Tax agents for personal income tax |

| SZV-STAZH | 2018 | All policyholders | |

| 03/15/2019 | SZV-M | Second month of 2020 | All policyholders |

| March 28, 2019 | Income tax return | 2018 | Firms on the general taxation system |

| Income tax return | Second month of 2020 | Firms on the general taxation system sending reports every month | |

| Tax calculation for income tax | Second month of 2020 | Tax agents who calculate advance amounts every month based on the profits received after the fact |

Reporting documents for the second quarter of 2019

| When to send reporting documents | Document type | Reporting period | Sender |

| 04/01/2019 | Corporate property tax declaration | 2018 | Companies with assets on their balance sheets |

| Accounting reporting documents | 2018 | All companies | |

| Declaration of the simplified taxation system | 2018 | Firms on a simplified taxation system | |

| 6-NDFL | 2018 | Tax agents for personal income tax | |

| 2-NDFL with sign 1 | 2018 | Tax agents for personal income tax | |

| 04/15/2019 | Confirmation of the main activity of the Social Insurance Fund | 2018 | All companies |

| SZV-M | Third month of 2020 | All policyholders | |

| 04/22/2019 | Water tax declaration | Start quarter | Firms and individual entrepreneurs mentioned in Article 333.8 of the Tax Code of Russia |

| Book of invoices in electronic format | Start quarter | Forwarders, intermediaries, developers | |

| Unified simplified tax return | Start quarter | Firms without taxable objects and turnover by banking institution and cash desk | |

| 4-FSS on paper | Start quarter | Companies with fewer than 25 employees | |

| 04/25/2019 | Value added tax declaration | Start quarter | Taxpayers and tax agents |

| 4-FSS in electronic format | Start quarter | Firms submitting reporting documents using electronic means | |

| 04/29/2019 | Income tax return | Start quarter | Firms on the general taxation system |

| Income tax return | Third month of 2020 | Firms on the general taxation system that send reporting documents every month | |

| Tax calculation for income tax | Third month of 2020 or first quarter | Tax agents for income tax | |

| 04/30/2019 | 6-NDFL | Start quarter | Tax agents for personal income tax |

| 3-NDFL | 2018 | Private entrepreneurs | |

| Calculation of insurance amounts | First quarter | All policyholders | |

| Declaration under the simplified taxation system | 2018 | Individual entrepreneurs on a simplified tax system | |

| Calculation of property tax based on advance amounts | First quarter | Taxpayers on company property | |

| May 15, 2019 | SZV-M | Fourth month of 2020 | All policyholders |

| May 28, 2019 | Income tax return | Fourth month of 2020 | Firms on the general taxation system that submit reports every month |

| Tax calculation for income tax | Fourth month of 2020 | Tax agents who calculate advance amounts every month based on the profits received after the fact | |

| June 17, 2019 | SZV-M | Fifth month of 2020 | All policyholders |

| June 28, 2019 | Income tax return | Fifth month of 2020 | Firms on the general taxation system that submit reports every month |

| Tax calculation for income tax | Fifth month of 2020 | Tax agents who calculate advance amounts every month based on the profits received after the fact |

Reporting documents for the third quarter of 2019

| When to send reporting documents | Document type | Reporting period | Sender |

| 07/15/2019 | SZV-M | Sixth month of 2020 | All policyholders |

| 07/22/2019 | 4-FSS on paper | First six months | Firms with fewer than 25 employees generating reporting documents on paper |

| Water tax declaration | 2nd quarter | Firms and individual entrepreneurs mentioned in Article 333.8 of the Tax Code of Russia | |

| Unified simplified tax return | 2nd quarter | Firms without taxable objects and turnover by banking institution and cash desk | |

| Book of invoices in electronic format | 2nd quarter | Forwarders, intermediaries, developers | |

| July 25, 2019 | 4-FSS in electronic format | 2nd quarter | Firms submitting reporting documents using electronic means |

| Value added tax declaration | 2nd quarter | Taxpayers and tax agents | |

| 07/29/2019 | Income tax return | First six months | Firms on the general taxation system |

| Income tax return | Sixth month of 2020 | Firms sending reporting documents every month | |

| Tax calculation for income tax | Sixth month of 2020 or 2nd quarter | Tax agents for income tax | |

| 07/30/2019 | Calculation of insurance amounts | Six months | All policyholders |

| Calculation of property tax based on advance amounts | First six months | Persons who pay corporate property tax | |

| 07/31/2019 | 6-NDFL | Six months | Tax agents for personal income tax |

| 08/15/2019 | SZV-M | Seventh month of 2020 | All policyholders |

| August 28, 2019 | Income tax return | Seventh month of 2020 | Firms that send reporting documents every month |

| Tax calculation for income tax | Seventh month of 2020 | Tax agents for income tax | |

| September 16, 2019 | SZV-M | Eighth month of 2020 | All policyholders |

| September 30, 2019 | Income tax return | Eighth month of 2020 | Firms that send reporting documents every month |

| Tax calculation for income tax | Eighth month of 2020 | Tax agents for income tax |

Reporting documents for the 4th quarter of 2020

| When to send reporting documents | Document type | Reporting period | Sender |

| October 15, 2019 | SZV-M | Ninth month 2020 | All policyholders |

| October 21, 2019 | Unified simplified tax return | Third quarter | Firms without taxable objects and turnover by banking institution and cash desk |

| Water tax declaration | Third quarter | Firms and individual entrepreneurs mentioned in Article 333.8 of the Tax Code of Russia | |

| Book of invoices in electronic form | Third quarter | Forwarders, intermediaries, developers | |

| 4-FSS on paper | Nine month | Firms with fewer than 25 employees generating reporting documents on paper | |

| October 25, 2019 | 4-FSS in electronic format | Nine month | Firms submitting reporting documents using electronic means |

| Value added tax declaration | 3rd quarter | Taxpayers and tax agents | |

| October 28, 2019 | Income tax return | September or nine months | Firms on the general taxation system |

| Tax calculation for income tax | September or nine months | Tax agents for income tax | |

| October 30, 2019 | Calculation of insurance amounts | Nine month | All policyholders |

| Calculation of property tax based on advance amounts | Nine month | Persons who pay corporate property tax | |

| October 31, 2019 | 6-NDFL | Nine month | Tax agents for personal income tax |

| November 15, 2019 | SZV-M | Tenth month | All policyholders |

| November 28, 2019 | Income tax return | Tenth month | Firms that send reporting documents every month |

| 12/16/2019 | Tax calculation for income tax | Eleventh month | Tax agents for income tax |

| SZV-M | Eleventh month | All policyholders | |

| December 30, 2019 | Income tax return | Eleventh month | Firms that send reporting documents every month |

| Tax calculation for income tax | Eleventh month | Tax agents for income tax |

Tax calendar for 2020: when to send reporting documents to the Federal Tax Service Inspectorate

Most of all reports are sent to tax authorities. The number of reports sent to the Federal Tax Service increased in 2020, when the tax authorities were entrusted with the management of insurance amounts. Currently, almost all wage reports are controlled by inspectors.

Reporting documents to the Federal Tax Service in 2019

| Document type | Reporting period | Key date |

| Data on the average quantity | 2018 | 01/21/2019 |

| Transport tax declaration | 2018 | 02/01/2019 |

| Land tax declaration | 2018 | 02/01/2019 |

| Declaration under the simplified taxation system | 2018 The taxpayer is the company | 04/01/2019 |

| 2018 The taxpayer is an individual entrepreneur | 04/30/2019 | |

| Certificates 2-NDFL | 2018 If tax withholding is not possible | 03/01/2019 |

| 2018 If tax withholding occurred | 04/01/2019 | |

| 6-NDFL | 2018 | 04/01/2019 |

| Three months | 04/30/2019 | |

| First six months | 07/31/2019 | |

| Nine month | October 31, 2019 | |

| 3-NDFL | 2018 | 04/30/2019 |

| Calculation of insurance amounts | 2018 | 01/30/2019 |

| Three months | 04/30/2019 | |

| First six months | 07/30/2019 | |

| Nine month | October 30, 2019 | |

| Unified simplified tax return | 2018 | 01/21/2019 |

| First quarter | 04/22/2019 | |

| Second quarter | 07/22/2019 | |

| Third quarter | October 21, 2019 | |

| Value added tax declaration | Last quarter of 2020 | 01/25/2019 |

| First quarter | 04/25/2019 | |

| Second quarter | July 25, 2019 | |

| Third quarter | October 25, 2019 | |

| Invoice book | For the last quarter of 2020 | 01/21/2019 |

| First quarter | 04/22/2019 | |

| Second quarter | 07/22/2019 | |

| Third quarter | October 21, 2019 | |

| Company property tax declaration | 2018 | 04/01/2019 |

| Calculation of advance payments for corporate property tax | Three months | 04/30/2019 |

| First half of the year | 07/30/2019 | |

| Nine month | October 30, 2019 | |

| Water tax declaration | Last quarter of 2020 | 01/21/2019 |

| First quarter | 04/22/2019 | |

| Second quarter | 04/22/2019 | |

| Third quarter | October 21, 2019 | |

| Income tax return (every quarter) | 2018 | March 28, 2019 |

| First quarter | 04/29/2019 | |

| First six months | 07/29/2019 | |

| Nine month | October 28, 2019 | |

| Income tax return (every month) | January | 02/28/2019 |

| January February | March 28, 2019 | |

| January March | 04/29/2019 | |

| January-April | May 28, 2019 | |

| January-May | June 28, 2019 | |

| January June | 07/29/2019 | |

| January-July | August 28, 2019 | |

| January-August | September 30, 2019 | |

| January-September | October 28, 2019 | |

| January-October | November 28, 2019 | |

| January-November | December 30, 2019 |

When to submit accounting reports in 2019: table

Organizations submit accounting reporting documents to the Federal Tax Service inspection no later than 30 days after the end of the reporting year. The target date for dispatch in 2020 is March 30. This date is a weekend, so the dispatch date is postponed to the first weekday following it - 04/01/19.

Period for sending accounting reports in 2019

| Place of sending documents | Reporting period | Key date |

| To the Federal Tax Service | 2018 | April 1, 2020 |

| To the statistical office | 2018 | April 1, 2020 |

Reporting documents to the Russian Pension Fund in 2019

Although insurance amounts transferred to the Russian Pension Fund have been controlled by tax authorities since 2017, the Pension Fund of the Russian Federation still accepts personalized accounting information. Don't forget to send them every month; the target dates are displayed in the table.

Period for sending reporting documents to the Russian Pension Fund in 2020

| Document type | Reporting period | Key date |

| SZV-M | Last month of 2020 | 01/15/2019 |

| January | 02/15/2019 | |

| February | 03/15/2019 | |

| March | 04/15/2019 | |

| April | May 15, 2019 | |

| May | June 17, 2019 | |

| June | 07/15/2019 | |

| July | 08/15/2019 | |

| August | September 16, 2019 | |

| September | October 15, 2019 | |

| October | November 15, 2019 | |

| November | 12/16/2019 | |

| SZV-STAZH | 2018 | 03/01/2019 |

| 2018 | 03/01/2019 |

FSS submission period in 2020

Reporting documents on contributions in case of temporary disability and maternity (DAM reporting document) must be submitted to the Federal Tax Service inspectorate. Calculation of contributions for injuries must be sent to the Social Insurance Fund. The period for sending reporting documents is indicated in the table.

Period for sending reporting documents to the Social Insurance Fund in 2020

| Document type | Delivery form | Reporting period | Key date |

| 4-FSS | Paper carrier | 2018 | 01/21/2019 |

| Three months | 04/22/2019 | ||

| First half of the year | 07/22/2019 | ||

| Nine month | October 21, 2019 | ||

| 4-FSS | Electronic media | 2018 | 01/25/2019 |

| Three months | 04/25/2019 | ||

| First half of the year | July 25, 2019 | ||

| Nine month | October 25, 2019 | ||

| Confirmation of type of activity | 2018 | 04/15/2019 |

New rules in 2020

Regulates the innovations of Federal Law-444 dated November 28, 2018. Now:

- The need to submit reports to Rosstat will cease

- There will be a transition to electronic documentation

Until this point, organizations must send documents to the tax and government statistics agencies. And from the beginning of 2020, it will be necessary to send only mandatory reports to the Federal Tax Service. And if an audit was carried out, its results. And only those companies whose data relates to state secrets will continue to work with Rosstat.

In addition, from January 1, 2020, all these reports and audit results will be sent to the tax authority electronically. And only in it, and not as before - optionally in paper or electronic form.

Note: for entrepreneurs with no more than one hundred employees, a deferment is provided. They are allowed to completely switch to electronic document management starting in 2021.

What is it for? To simplify the submission of documents, as well as to be able to create a single database, the data from which will be partially open, and it will be possible to obtain it after sending a request (paid service).

simplified tax system

Experienced accountants know that working with the simplified tax system is much easier. And all because simplifiers do not pay the most difficult taxes to calculate: VAT, income tax and property tax. Only in exceptional cases can simplifiers become payers of these taxes (clause 2 of Article 346.11 of the Tax Code of the Russian Federation).

All workers and employees must submit data on insurance premiums. This means that, just like companies on OSNO, in 2019 they will submit calculations of insurance premiums to the Federal Tax Service.

Simplified workers also submit to the Federal Tax Service information on the average number of employees, accounting statements and income reports of employees and other individuals. persons according to forms 2-NDFL and 6-NDFL.

3 months free use all the features of Kontur.Externa

Try it

Land and transport taxes are paid by those companies that have these taxable objects.

The deadlines for mandatory reporting have already been given above for the general regime.

A specific report in this case is the annual declaration under the simplified tax system.

In order to meet the deadlines, companies must send tax for 2020 to the inspector’s bank account and declare their activities by 04/01/2019 (Article 346.23 of the Tax Code of the Russian Federation), and individual entrepreneurs by 04/30/2019.

Simplified tax advances are transferred to the account of the Federal Tax Service (Clause 7, Article 346.21 of the Tax Code of the Russian Federation):

- for the first quarter of 2020 - until April 25;

- for the first half of 2020 - until July 25;

- for 9 months of 2020 - until October 25.

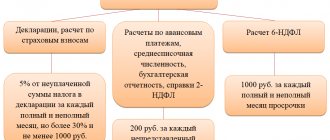

Late submission of reports: responsibility

So, the deadlines for submitting reports in 2020 have not changed, and the fines for failure to submit them have remained at the same level. According to the general rules, “lateness” in filing a declaration or “Calculation of insurance premiums” may entail a fine of 5% of the amount of tax reflected for payment, but not transferred, for each month of “delay,” incl. incomplete (Article 119 of the Tax Code of the Russian Federation). The maximum fine for failure to comply with reporting deadlines is 30% of the amount of tax unpaid according to the declaration, the minimum is 1000 rubles. (for example, if a zero declaration is not submitted).

Other forms of reporting provide for various measures of influence. Thus, failure to submit 6-NDFL is punishable by a fine of 1000 rubles. from the employer for each overdue month (clause 1.2 of Article 126 of the Tax Code of the Russian Federation). Impressive sanctions are also provided for late reporting to funds. For example, the fine according to the 4-FSS report will be 5% of the amount of contributions payable for each overdue month, but not more than 30% of contributions and not less than 1000 rubles. (Article 26.30 of the Law of July 24, 1998 No. 125-FZ). Such significant troubles can only be avoided by generating reports without violating the deadlines for their submission.

Tax calendar. Tax payment deadlines

- For OSN VAT is paid. For the 4th quarter of 2020 is paid by January 25, 2020, February 25, 2020, March 25, 2020.

- Further - in equal parts until the 25th day of each month based on the results of the past quarter.

- For 2020, payment must be made by July 15, 2020.

- Advance payments and tax under a simplified system Advance payment for the 1st quarter of 2020 – until April 25, 2020.

- Tax on imputed income is paid for the 4th quarter of 2020 – until January 25, 2020.

- The Unified Agricultural Tax tax is paid for 2020, paid until March 31, 2020.

Insurance premium deductions

Since 2020, articles on insurance premiums have been included in the Tax Code of the Russian Federation. Regional departments of the Federal Tax Service collect most contributions to non-budgetary organizations. Therefore, individual entrepreneurs and organizations need to pay even more attention to the timing of these payments than before.

Individual entrepreneurs who did not hire employees have a limited list of insurance contributions. Entrepreneurs only need to pay a fixed amount for themselves:

- to the Pension Fund - no later than December 31;

- in the Pension Fund (with an income of more than 300 thousand) - no later than April 1 of the next year;

- in the Federal Compulsory Medical Insurance Fund - no later than December 31.

Organizations, as well as individual entrepreneurs with employees, must pay contributions for employees:

- in the Pension Fund of Russia - no later than the 15th day of the month following the reporting month;

- in the Social Insurance Fund – the same period;

- in FFOMS - the same period.

As you can see, the tax payment deadlines in April 2020 were moved up by a day due to the weekend.

Personal income tax is also paid on employee salaries. The fee must be accrued no later than the day following the date of salary transfer. taxpayer.