Bookmarked: 0

What is the Federal Tax Service? Description and definition of the concept.

The Federal Tax Service is a specially created federal body representing the executive branch, which must carry out a whole set of special functions:

- control and supervision of compliance with the legislation of the Russian Federation on relevant taxes and fees;

- control and supervision of how correctly the calculation is carried out, the completeness and timeliness of taxes and fees being paid to the relevant departments of the budget;

- control and supervision over the correctness of the calculation indicators, completeness and timeliness of the process of introducing other types of mandatory payments into the relevant budget unit (in cases provided for by the legislation of the Russian Federation);

- control and supervision of the pace of production and turnover of tobacco products;

- functions of currency control authorities, which are within the competence of representatives of tax authorities;

- state registration of legal entities and individuals when they act as an individual entrepreneur, as well as a peasant (farm) enterprise;

- accreditation of branches, various types of representative offices of each foreign legal entity (except for representative offices of a foreign credit organization);

- provision in each bankruptcy case or bankruptcy procedure of a list of requirements for payment of mandatory payment and requirements of the Russian Federation in accordance with the terms of monetary obligations.

The Federal Tax Service (abbreviated as FTS) has the right to carry out its activities both directly and through the representation of its territorial bodies through interaction with representatives of other federal executive authorities representing constituent entities of the Russian Federation, local governments or state extra-budgetary funds, public associations and others organizations.

The head of the Federal Tax Service of the Russian Federation since April 6, 2010 is Mikhail Vladimirovich Mishustin, who replaced Mikhail Pavlovich Mokretsov in this position.

According to the data received on the total number of employees of the Federal Tax Service of Russia at the end of 2010, their number was approximately 170,000 people. However, already in 2011, the Federal Tax Service of Russia wanted to reduce its staff, reducing the number of its employees by at least 5 percent.

The professional holiday of representatives of this type of public service is the day of the tax authorities of Russia, which is celebrated on November 21.

History of the Federal Tax Service

The Federal Tax Police Service of Russia (abbreviated FSNP of Russia) is a law enforcement agency that reports directly to the president, and which existed from 1992 to 2003 inclusive.

According to Decree of the President of Russia of March 18, 1992 No. 262, the country created the Main Directorate for Tax Investigations, which was located under the State Tax Service with a staff of 12,000 people. The board was headed by former KGB general of the Soviet Union V.B. Yampolsky.

On May 20, 1993, a Law entitled “On the Federal Tax Police Bodies” was adopted, according to which a special Department of the Country’s Tax Service was established as a successor to the GUNR (in accordance with the content of the legal responsibilities of the State Committee of Russia). On the same day, the Supreme Council of the Russian Federation approved the Regulations on specialized service in bodies belonging to the tax police. The Council of Ministers of the Russian Federation issued a Resolution on October 11, 1993, which approved the Regulations on the Tax Department in Russia and confirmed the list of positions for which special titles should be awarded to tax employees. The staffing level of the federal tax police was also established: as of January 1, 1994, there were 21,500; exactly a year later - 43,800 (in the end, the staffing level reached 53,000 without taking into account service personnel). S. N. Almazov was appointed Director of the Department.

Federal Law No. 200-FZ, issued on December 17, 1995, amended the law “On Federal Tax Police Bodies”. In accordance with the new amendments, the Tax Police Department was renamed the Federal Tax Police Service of the Russian Federation (FSNP of Russia). As for the instructions on the staff, the director of the Federal Tax Service of Russia reached the established maximum special rank of Colonel General of the tax police, deputy directors and heads of key departments (including operational, investigative, tax audit, personal security, physical protection, personnel, organizational and inspection, operational -technical and search) could reach the rank of lieutenant general of the tax police.

The main task of the youngest law enforcement agency at that time, which was already vested with the right to conduct operational search, expert and investigative actions, was to fight various types of tax crimes and offenses, as well as to fight corruption among tax representatives organs.

The decree of the acting President of the Russian Federation Vladimir Putin, issued on March 16 in 2000 as a sign of recognition of the significant importance of the federal tax authorities in ensuring the proper level of economic security, established a professional holiday, which became known as Tax Police Day. The FSNP of Russia was a law enforcement agency that was capable of full reimbursement of the costs of its maintenance. During 2001, representatives of the federal tax police authorities initiated more than 36,000 criminal cases, the amount of damage that was compensated for each of the completed criminal cases amounted to about 27,000,000,000 rubles, and in total, as a result of the operational and official actions of the Federal Tax Service of Russia, more than 100,000,000,000 rubles. More than 150,000 various types of administrative

offenses, fines totaling several hundred million rubles were imposed.

Each tax police officer takes an oath.

The Federal Tax Service of Russia also managed to create the Tax Police Academy and a whole list of other educational institutions.

On July 1, 2003, the decree of the President of Russia V.V. Putin No. 306 of March 11, 2003 took effect; the Federal Tax Service of Russia was abolished without explaining any reasons. Most of the functions of the Federal Tax Service of Russia and the entire staff of 16,000 employees were transferred to the Ministry of Internal Affairs. The material base and 40,000 employees were transferred to the newly created State Drug Control Service.

Impact of taxes on the economy

The reasons for the need to set taxes can vary widely. With the help of manipulation, the state redistributes income of the population and eliminates a number of economic effects. Moreover, the impact is made both at the micro and macroeconomic levels.

In the second situation, contributions to the state make it possible to regulate aggregate supply and demand. To increase them, it is enough to reduce the tax burden. This will provide households with more income for consumption. As a result, its level will increase. This in turn will lead to an increase in aggregate demand.

The state uses the method to stimulate economic development. Typically, the procedure is used if there is a need to remove the state from the economic cycle. An alternative to the procedure is a restrictive policy. It is carried out to eliminate the so-called overheating. To complete the procedure, representatives of authorized bodies begin to increase the percentage of contributions to the state.

This is interesting! Faced with a similar phenomenon, manufacturers begin to reduce supply. The fact is that taxes entail additional costs. This affects aggregate supply, reducing it.

If the production of an indicator is assessed from the point of view of financial management, the tax burden can be direct and indirect. In the first case, formation is carried out at the expense level. Their calculation is carried out by the acting subject. Allowing the cost of repayment of borrowed funds to be included in the amount encourages the development of organizations that use an aggressive financial strategy. Firms that adhere to conservative methods will be forced out of the market. A reduction in interest rates will change the situation in the opposite direction. A company using an aggressive strategy will go bankrupt, while a company using conservative methods will begin to develop.

Conservative influence is exercised by increasing or decreasing the burden on capital providers. If you raise taxes, the cost of borrowing will increase. As a result, aggressive institutions are contained. If the load is reduced, the cost of capital will decrease. Companies with an aggressive strategy will begin to develop.

https://youtu.be/c4qsvejaFjE

Structure of the Federal Tax Service of Russia (for 2003)

- Department of the Main Operational Directorate

- Department of Main Management of Documentary Inspections

- Department of the Main Investigation Department

- Department of the Main Organizational Inspectorate Directorate

- Department of the General Directorate of Security, including the fight against corruption

- Department of the Main Directorate of Physical Protection

- Department of the Main Operational-Technical and Search Directorate

- Department of the Main Personnel Department

- Department of the Main Information Technology Directorate

- Department of the Main Directorate of International Cooperation

- Case Management Department

- Legal Department

- Department of Organizational and Mobilization Management

- Information Management and Public Relations Department

- Department of Financial and Economic Management

- Department of Regime and Information Security Management

- Expert Management Department

- Analytical Management Department

- Department of administrative and economic management

- Special Communications Department

- Medical Administration Department

- Investigation department

- Control and Audit Inspection Department

Educational institutions of the Federal Tax Service of Russia

Representatives of this government body could receive education in:

- Institute of Tax Police at the Financial Academy from the Government of Russia (using the rights of the Faculty of the Academy), which was created in February 1994.

- The Center for Training Tax Officers, which was located in St. Petersburg, formed in February 1994, which was transformed into a branch of the Tax Police Academy in this city in July 2000, since May 2002 it became the North-West Institute for Advanced Studies qualifications of full-time tax employees.

- The training center for full-time tax employees of the city of Khabarovsk, formed in April 1995, which was transformed and renamed the Far Eastern Institute for Advanced Training of full-time tax employees.

- Institute for advanced training of each managerial employee and every specialist from the federal tax authorities, which was created in February 1995 on the basis of the Institute for advanced training of workers holding managerial positions and specialists in consumer services (in 1996, as a branch, it was included in composition of the Tax Academy).

- Tax Academy of the Federal Tax Service of the Russian Federation. Was created in July 1996.

1990s

Throughout 1992-1993, the majority of Russian businesses did not strive to deviate from paying taxes. Often, enterprise managers did not need to take even completely legal measures to reduce the amount of taxes paid. From the beginning of the second half of 1993, enterprises lost hope of reducing the tax burden, and then began to look for ways to evade taxes.

On January 1, 1994, tax rates increased. This argument became one of the last for those enterprises that saw the benefit of a massive rejection of tax compliance. Small private enterprises were the first to avoid paying taxes. They used a variety of methods to avoid paying taxes:

- Several companies in a certain region registered one financial company, the list of authorized capital of which included all the finished products of each of these enterprises. This meant that the company that produced its products had no sales and was formally unprofitable, and therefore did not pay income tax and VAT.

- To reduce the size of income tax payments, the company tried to increase the reported share of costs. A fairly simple way to increase them was to increase the salary fund, for which most companies began to write out wages for a huge number of “dead souls” (persons who were on the list of employees, but who actually did not exist).

- To reduce the taxation of the wage fund, the enterprise could pay part of the money for its employees as a refund of health insurance through requests to insurance companies, financial assistance, etc.

- To avoid paying income taxes, enterprises were registered as small enterprises, which, according to the legislation of that time, were not required to pay this tax during the first two years of operation from the date of registration, in addition to which they also had other types of tax benefits. After two years, the enterprise self-liquidated and registered again, but under a new name, in order to gain the right to another two-year period of tax benefits.

- Most firms also used the services of various public organizations that had legislative privileges: “church organizations”, “Chernobyl victims”, “athletes”, “Afghans”, “disabled people”, “blind”, “deaf”, etc. To reduce their costs, the company conducted its operations (including foreign trade) not on its own behalf, but through the help of such organizations.

- The process of minimizing tax deductions by reducing enterprises' real financial turnover using various methods has become widespread. One of them was the conclusion of barter transactions, in which products were exchanged at an extremely reduced price. Another method was mutual settlements, which were very widespread at that time.

- Many enterprises reduced their real income from foreign trade transactions. For example, during export, the tax report indicated a greatly underestimated price of the product compared to the actual price, and the unaccounted profit could end up in the company’s account in one of the foreign banks. Another way to reduce taxes when concluding foreign trade transactions was the process of registering a completely controlled company abroad, for which an enterprise from Russia could supply its products at a reduced price, and that in turn could resell the products to a real foreign buyer at regular market prices. These types of foreign trade transactions, among other things, led to a significant outflow of monetary capital from Russia.

- In fact, since 1993, most firms began to evade paying taxes through a wide range of

the use of cash to pay with their partners, cash in foreign currency (mostly US dollars and German marks), due to galloping inflation. A significant part of this monetary turnover was carefully hidden from representatives of law enforcement agencies, so in everyday life the cash that was used for such transactions began to be called “black cash.” Virtually the entire “shuttle” business was built on the conclusion of cash transactions.

The consequences of massive tax evasion during the 1990s were varied. On the one hand, as tax evasion progressed, enterprises could retain an additional amount of financial resources that were necessary to maintain production rates, which means these processes counteracted the decline in production rates. In addition, tax components in the cost of products were reduced and enterprises could sell them at a cheaper price. Consequently, this could reduce the rate of inflationary dynamics in the body of the economy and ease the sales problems of companies. On the other hand, the chaos in the taxation process quite seriously undermined stability in the financial and budgetary economic sphere of Russia, reduced the opportunity for public investment and financing in the budgetary sphere, and reduced the level of efficiency of macroeconomic measures.

During the 1990s, the state used exclusively one way to solve the taxation problem - tightening tax laws and increasing pressure from tax authorities on enterprises. Despite all this, each time companies find new ways to counteract this policy trend and continue to evade taxes. This indicates that the tax rate during the 1990s was too high and unacceptable for companies.

Tax burden, tax burden

The tax burden is often measured as a share of government contributions to GDP. The level of the indicator varies depending on the state. Information is published periodically. The data is collected by the Organization for Economic Cooperation and Development. However, the institution provides data only on the countries that are part of it. The tax burden varies from 23.7% to 82% of GDP. The lowest rate is observed in Turkey. The parameter designation is highest in Russia.

The concept of the actual tax burden on the economy is separately distinguished. It represents the number of payments to the state that were made over a certain period. Statisticians determine the difference between the actual and rated load. The indicator allows you to understand how strongly individuals and legal entities evade the tax burden. The higher the indicator, the greater the number of people evading payments.

There are other variants of concepts associated with the indicator. So, there is a tax burden on the company. It represents the payments that the company made to the state in relation to the amount of income received. The real payer of contributions to the state is the persons who own taxable property, or the citizens and institutions using it. In the first case, the need to contribute the amount to the budget arises due to the very fact of the existence of the object. A person may not use it. However, this will not relieve the person of the need to perform the procedure. In the second situation, the need for deductions appears only if the company uses the taxable object.

In Russia, the tax burden indicator is used. It allows you to analyze the level of contributions made by business entities to the state. The procedure is performed to control the level of payments and identify persons evading payments. Tax calculation is carried out according to the formula. It represents the ratio of payments made and turnover. Data from local departments of the Federal Tax Service and Rosstat are taken into account. The limit values of the indicator are set annually. It directly depends on the sector of the national economy.

2000s

During the 2000s, a number of different amendments were made to the tax legislation system: a specific income tax limit was established, which was levied on individuals in the amount of 13%, the income tax rate was lowered to 20%, and a regressive scale was introduced for the unified social tax. , turnover taxes and sales taxes were abolished, while the total number of tax contributions was reduced by at least 3 times (from 54 to 15). The year 2006 was marked by the fact that Deputy Minister of Finance of Russia Sergei Shatalov published a statement that during the period of tax reforms, the tax burden decreased in size from 34-35% to 27.5%, and in addition, there was a redistribution of tax burdens in the oil sector. Tax reforms have also increased collection rates and stimulated economic growth.

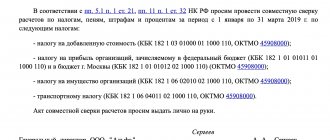

What is CRSB in tax

The taxpayer's KRSB is drawn up at the time of registration of an entrepreneur or organization and is a special form in which information about monetary contributions made to the budget is entered. Currently, in addition to taxes, the card takes into account transactions for paying insurance premiums.

KRSB is opened not only for direct taxpayers, but also for so-called tax agents who, in the course of their duties, withhold funds from taxpayers and transfer them to the tax budget of the organization, and then to the treasury. If an individual entrepreneur or LLC pays unified social tax and insurance premiums for pension insurance of individuals, then the Federal Tax Service opens an additional redundant insurance company with the corresponding purpose.

What information is contained in the card?

Three types of data are recorded in the budget settlement card:

- information on accrued amounts: taxes, fines and penalties on them;

- information about paid taxes, fines, penalties;

- the balance between accrued and paid amounts (negative value - debt; positive value - overpayment).

This information is entered into the CRSB from submitted declarations, decisions based on the results of desk audits, court decisions and other possible documents.

It follows from this that the card reflects the status of payments of funds to the budget coming from various economic entities. However, this information does not always correspond to the actual state of affairs. In addition, the CRSB may include so-called bad debts that are unrealistic to collect. They can remain in the document for years and greatly distort the balance value.

Filling Features

The information entered into the KRSB is systematized, so individual cards are formed according to the following criteria:

- tax payment deadline: there are KRSB for taxes paid currently and quarterly;

- KBC of the organization;

- OKTMO code;

- status of a taxable entity.

Filling out the KRSB form has its own characteristics, including the following rules:

- Only those personal income tax information that have passed the appropriate check are entered into the card (clause 1, section 10 of the Uniform Requirements dated January 18, 2012);

- Personal income tax amounts not withheld by the tax agent are not entered into the card (letter of the Federal Tax Service of the Russian Federation dated 08/04/2015);

- Tax arrears are calculated not only on the basis of the card, but also on other documents reflecting the amount of payments.

Payments are controlled by the Federal Tax Service, and a separate CRSB is created for them.

Criticism

The Russian tax system has regularly been and continues to be criticized by both business representatives and oppositionists. But recently, as the crisis worsened, structure-forming types of organizations began to express their lack of satisfaction with the existing tax collection system. So, for example, on December 20, 2015, through a publication in the Russian newspaper, the President of the Chamber of Commerce and Industry Sergey Katyrin made proposals to change the existing tax system. The essence of his initiative can be reduced to a change in the order in the process of adopting new types of taxes and to a new type of structuring and accounting of old ones in order to avoid double, and in some places, triple taxation.

We briefly examined the concept of the federal tax service: description of the concept, history, structure, educational institutions, tax system in Russia, criticism. Leave your comments and additions to the material.