Doing business is not possible without visits to the tax office, which take up valuable time. The Federal Tax Service is trying to keep up with the times, and in 2014 a new service was launched - a personal account for legal entities.

Personal selection of loans: Have you decided to buy a house, apartment, or car? Are you planning a renovation? Do you urgently need a certain amount of money?

Now every business representative can create an account there by fulfilling a number of conditions. After this, you can solve almost all problems without an in-person visit from the Federal Tax Service. You can also provide access to your personal account to other employees.

Cabinet features

The personal account of a legal entity is designed specifically for the needs of enterprises and organizations (CJSC, LLC, JSC). In essence, this is a remote office of the head of the company. The extensive functionality of the office makes most issues solvable without a personal visit to the Federal Tax Service. All you need for full-fledged work is registration of a personal account and a computer with an Internet connection. This greatly facilitates the manager’s work and allows him to devote more time to managing the organization.

Service capabilities:

- Registration of a legal entity.

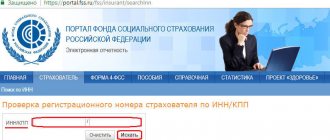

- Control of contributions to the Pension Fund.

- Sending messages in form C-09-6.

- Electronic extract from Unified State Register with a qualified signature.

- Submitting an application for amendments to the Unified State Register of Legal Entities.

- Monitoring the fulfillment of requests and deadlines for the provision of services.

- Timely notification of unpaid taxes, overpayments and unclear payments.

- Sending a request and receiving information about the current status of accounts, the presence or absence of penalties, interest, fines.

- Receiving a reconciliation report on taxes, fees, fines.

- Correcting errors in documentation.

- Deregistration/registration of an organization or enterprise.

Are there any alternative solutions

The personal account of a legal entity taxpayer is not the only option that allows an enterprise to instantly exchange information with tax authorities and submit reports without installation difficulties. Every entrepreneur can easily take advantage of the capabilities of services on the Internet. Here is a rough list of them:

- "My business";

- "Circuit EXTERN";

- "Sky".

The advantages of these solutions in comparison with the legal entity’s personal account on the Federal Tax Service website are obvious:

- simplicity of interface design, which does not require specialized knowledge in the IT field;

- no need to purchase an electronic digital signature;

- the ability to conduct operations in a “one-stop shop” mode - exchanging letters, sending reports to government agencies;

- Availability of advisory support on a daily basis, around the clock;

- low cost, equal to 3000 - 5000 rubles. in year.

If an entrepreneur cannot decide on the final version of the system, he can use several at the same time. To do this, you will need to go through the registration procedure for your personal account and activate virtual services. It is likely that some of the functionality will become indispensable, and all other actions will be performed promptly without any problems.

https://youtu.be/cEwIsO-1VrQ

Registration of LC LE

To start working with the service and monitor the organization’s affairs remotely, you need to create an account on the tax service website. Registering an account for a legal entity is somewhat different from creating accounts for individuals and entrepreneurs.

Registration of a management company

Here registration begins with obtaining a qualified electronic signature key. The production and issuance of electronic documents is carried out directly to the head of the organization. It can also be received by another official authorized to conduct the affairs of the company without a power of attorney. A third party also has the right to receive an electronic signature on the basis of a power of attorney with the seal and signature of the manager.

Important!

The issued electronic key is only suitable for gaining access to the personal account of a legal entity on the Federal Tax Service portal. It will not work for logging into other services.

Note!

The head of the organization has the right to allow other users to work with the account. In your personal account there is an “Administration” option, through which new persons can be connected.

Step-by-step account creation:

- Go to the registration page, read the user agreement, sign it using your digital signature and confirm.

- Enter your work email (newsletters and other important notifications will be sent to it).

- Then you need to enter the digital combination from the picture (confirmation that you are a real person and not a robot).

- Click the “Next” button.

- A window will open with the previously entered information, check the correctness of the specified data.

- Now you need to wait for the link to activate your personal account. It will arrive at the specified postal address, the waiting time may take up to 2 hours.

- When the letter arrives, open it and click on the link it contains to activate your account in your personal account.

Registration of a personal account by proxy

- The first point is no different from the previous method - you need to read the user agreement, put an electronic signature, indicate your email, enter the numbers from the picture.

- Now you need to decide how you will provide the power of attorney: manually or upload a message.

- Check the accuracy of the data again, enter the digital code.

- All you have to do is wait for the link to activate your account in your legal entity’s personal account.

Advice!

It happens that an email with a link automatically ends up in spam. If the activation link is not found in spam, you need to enter your email again and request resending.

Registration of personal account of an individual

The official website www tax ru is the main online resource of the tax inspectorate. The service is designed for:

- IP;

- individuals;

- companies.

There is a video on the website that shows in detail how to register in your personal taxpayer account.

You can do this in three ways:

- Fill out the registration card at the Russian Federal Tax Service inspection. To fill out the card you will need a passport.

- Using a qualified electronic signature, which is issued by the Certification Center. CryptoPro CSP software is required to use the key.

- Through the ESIA account. Having a valid account in the Unified Portal of State and Municipal Services, you can obtain a primary password. It will need to be changed to a complex version later.

https://youtu.be/cahqM6LWQGs

Let's look at how you can use the tax portal and digital key to register your personal account. Take the following steps:

- Fill out an application on the official website. User identification fields and other details are automatically read from the digital signature media. They are also loaded into the application form. Fill in the fields Phone number, e-mail manually.

- The next step requires you to set a password. You can log in to your account using an electronic signature or a login/password pair.

Try to get acquainted with the capabilities of the service in test mode. To do this, the taxpayer enters the login in the online form - 000000000000 and any password.

Login to your personal account

Authorization in the personal account of a legal entity requires the manager to have a qualified electronic signature. Also, special software must be installed on your computer or laptop. Details are available here.

Authorization using digital signature

This method is relevant for managers who have already received an electronic digital signature and are not logging into their account for the first time (account registration has been completed).

What you need to log into your personal account using digital signature:

- Connect the storage device with the electronic key to your computer or laptop. It is stored on a flash drive, floppy disk, removable hard drive - at your discretion.

- Follow the link, which will take you to the login page.

- A window will open in which the system will ask you to provide a certificate - specify the path to it on your device.

- Enter your PIN code.

How to connect a new user

The legal entity for which the account is registered has the right to provide access to other employees. This could be an accountant, deputy, secretary and other employees whose activities are related to tax documentation.

In your personal account, at the top, there is a menu item “Administration”. It is used to add or remove a user. If you click on it, you will see the “Add/Edit User” section. The only condition is that the employee who is granted access to his personal account must have an electronic signature.

In the same section you can see the total number of added users and see the number of logins completed. There is no limit on the service for connecting employees to their personal account.

How to log into the account of another institution from one device

Often, due to the type of activity, you have to use the services of several organizations. Accordingly, accounts are registered on the computer in the personal account of each of them. Also, the device already has an installed certificate from the company we need.

- Log out of your personal account using the corresponding button in the right corner.

- Clear browser cache. If you are using Internet Explorer, use the combination Ctrl+Shift+Delete. Yandex browser users can perform the procedure in its settings, or use special programs (CCleaner, Reg Organizer).

- Restart the browser.

- Connect the media with the electronic key to your computer, log into the account of the desired organization using the appropriate certificate.

Algorithm for registering a personal account on the Federal Tax Service website

So, if you have already gone through all the stages of gaining access to your personal account , then all you have to do is register it. This procedure is simple, as it does not require a personal visit to the inspection office.

To register in your Personal Account on the tax service website, you must go through a certain algorithm of actions:

- Connect the USB drive of the ES key (electronic signature) to your computer.

- Go to the website of the Russian Tax Service nalog.ru.

- Complete verification of compliance with the conditions for access to your personal account.

- Sign an agreement to provide access to your personal account with an electronic signature.

- Enter your email address and password information will be sent there.

- When prompted for a secret password , enter it.

- Click on the “next” button.

- Double-check that the information you provided is correct.

- Wait for the link to activate your personal account. She usually arrives within two hours.

- Start using your personal account.

Verification of a legal entity

Business entails risks to varying degrees. Blind trust in a potential partner is fraught with serious financial losses and problems with tax authorities. Experienced managers do not agree to cooperate “on word of honor”, preferring the principle of “trust, but verify.” But how to obtain reliable information without taking into account information from the words of the counterparty? There are two simple ways.

Verification of a legal entity by TIN

You can quickly find the desired legal entity using the TIN on the tax office website. Follow the link and in the window that opens, enter the individual legal entity number, consisting of 12 digits.

Check through the Federal Tax Service website

Any company manager or accountant can identify a potential partner on the Federal Tax Service website using the Taxpayer Identification Number (TIN). To quickly check, you need to follow the link and enter the TIN of the legal entity. In response, the system will provide information - the company’s registration address, OGRN and the date of its assignment, information about the termination of activities (if the organization has ceased operations).

Alternatives to your personal account

If you want to quickly exchange information with tax authorities, submit reports, not only to the Federal Tax Service, but also to the Social Insurance Fund and the Pension Fund of the Russian Federation, but you are afraid of the complexity of installing and using a personal account, we can reassure you: the taxpayer’s personal account is not the only possible option.

You can use the services of online services such as My Business, Kontur.Extern, Sky, etc. Their advantages are obvious:

- simple interface that does not require specialized knowledge in the IT field;

- no need to buy a special digital signature;

- you can do everything in “one window”: exchange letters with the Federal Tax Service, send reports to the Federal Tax Service, Pension Fund, Social Insurance Fund and other government agencies;

- there is consulting support;

- low cost: 3000–5000 per year.

Not knowing what to choose, you can try both: register a personal account of a taxpayer - a legal entity and use the services of online services, especially since some of them provide free promotional access. Perhaps some of the specialized functionality of the taxpayer’s account will be indispensable for your company, and you can do the rest quickly and without problems using online accounting services.

Requesting documents via the Internet

A manager or accountant can use his personal account to request a wide variety of documentation, which previously had to go to the Federal Tax Service. The option is available after authorization.

Obtaining an extract from the Unified State Register of Legal Entities

One of the functions of your personal account is to receive an extract about yourself from the register of legal entities. After authorization, there will be a “Request for Documents” section on the main page. It will contain the item “Request for an extract from the Unified State Register of Legal Entities.” The document is provided in PDF format with enhanced digital signature.

The statement can be presented in printed or electronic format. The statement received in your personal account is valid for 5 days.

Printout of the reconciliation report

In the office of a legal entity, a manager or accountant can request a reconciliation report for calculations of taxes, fees, fines, and interest. The received document can be printed if necessary; it is located in the “Information about documents sent to the tax authority” section.

To open and print text files in PDF format, you must have special software on your computer. Adobe Rtader X does the job well.

Personal account options for companies

The Federal Tax Service is traditionally one of the leaders among government agencies in the implementation of various services. The tax office has created a personal legal account. persons (LK LE) in order to make it easier to obtain information on debts and overpayments, send various documents to the inspectorate, etc.

The following opportunities are available to company representatives in LC LE:

- Obtaining information on settlements with the budget. Online, the user can view data on the amount of taxes paid, debts and overpayments.

- Sending requests and receiving various certificates about the status of tax payments. You can also request a reconciliation report or a certificate of fulfillment of obligations from the service.

- Request and receipt of an extract from the Unified State Register of Legal Entities. It is formed in relation to its legal entity. faces.

- Sending applications for offset or refund of overpayments. You can also view information about decisions made by the tax authorities on such applications or when independently clarifying the details.

- Register/deregister a company at the location of a separate division. You can also send an application to a separate unit using UTII forms-1, 3.

- Send various applications and receive responses to them. The service can also track the status of each document.

- Submission of documents for amendments to the Unified State Register of Legal Entities. The results of document processing can also be obtained electronically.

Access to the service is provided free of charge. The official taxpayer website for a legal entity also offers various additional tools.

For example, you can use it to check a counterparty’s statement or check whether an invoice is filled out correctly. All these tools significantly simplify the work of the manager, accounting department and other departments of the company.

System failures when working with the office

Like any service, the personal account of the Federal Tax Service for legal entities periodically does not work correctly. Let's find out what the cause of the problems is and how to fix them.

Problems with Windows Server devices

It happens that while working with your personal account, certain functions do not work, pictures and tables stop displaying, or the page does not load completely. Most likely, you will need to adjust your settings and disable the additional security option in your browser. Let's look at the main ways to solve the problem (provided that you are using one of the versions of Windows OS and the Internet Explorer browser).

- Windows Server 2003 - disable enhanced security by performing the chain of actions: Start - ControlPanel - AddorRemovePrograms - Add/RemoveWindowsComponents. In the last paragraph, uncheck the box. Everything is disabled.

- Windows Server 2008 - go to the Server Manager menu, select Configure IE ESC. The system will prompt you to select a category of users; you need to specify all users (you can select the option only for administration).

- Windows Server 2012 - in the browser menu, open Server Manager, then find IE Enhanced Security Configuration. As in the previous case, Enhanced Security should be disabled for all users.

EDS component not installed

To prevent this error when logging into your personal account, it is recommended to log in only using this Link. Afterwards, you need to go through all the stages of verification and safely start working with the office.

How to call the hotline

From September 1, 2020, a single telephone number for inquiries is available for all users: 8-800-222-22-22 . You can call for free from any region of the Russian Federation. By calling this number you can get advice on registering for the service as individual entrepreneurs, individuals and legal entities, receiving citizens and processing appeals.

If you are faced with corruption or inappropriate behavior of an inspector, you can file a complaint by calling the helpline +7 . The central telephone number of the Federal Tax Service of the Russian Federation also functions: +7 . You can contact both numbers 24 hours a day with complaints and claims. Author of the site Author of the site. Tax accounting specialist. Contact me

In 2014, legal entities were provided with an online personal taxpayer account. We did this to develop digital innovations of government bodies of the Russian Federation and simplify electronic document management.

The site offers an extensive catalog of open services that can facilitate the functions of tax assessments and calculations, and expand the conversion rate of interaction with the Federal Tax Service. Subscribers purchased a comfortable service for making payments and monitoring the tax burden directly from the office. In addition, the service provides access to a database for checking information about counterparties.

How to contact the hotline

From September 1, 2020, one telephone number will work as reference material for all users: 8-800-222-22-22 . You can call for free from any region of the Russian Federation. Using this number you can get advice on registration for servicing individual entrepreneurs, individuals and legal entities, receiving citizens and processing applications.

If you encounter corruption or improper behavior of an inspector, you can file a complaint by calling the helpline. +7 . There is also a central telephone number for the Federal Tax Service of the Russian Federation: +7 . You can file a complaint on any number 24 hours a day.

Features and potential of LC Legal Inspectorate of the Federal Tax Service

The number of sections and headings of the personal account of a taxpayer of a legal entity provides the service with multidimensional assets for working in the right direction. Clients have access to:

- Coordination of obligations, overpayments, transfers.

- Participation in and review of applications based on user requests, tracking deadlines for consideration and decisions by the tax authority.

- Submitting documents for state registration to the tax service, making changes to the Unified State Register of Legal Entities.

- Removal and registration of organizations in territorial branches.

- Organizational participation in form S-09-6.

- Submitting applications for clarification of payments.

- Receiving extracts from the USRN database.

Functions and capabilities of the LC of a taxpayer of a legal entity

Taxpayer's personal account face offers many convenient features that are accessible anywhere there is an Internet connection:

- obtaining an information extract from the USRN database;

- downloading form C-09-6 with subsequent participation in organizations;

- submitting an application for clarification of payments;

- obtaining information on obligations, the presence of overpayments and all transfers made;

- displaying a list of all processed written requests. Tracking the remaining time until one of the inspection bodies provides services and makes a decision regarding the submitted documents;

- entering data sent to the Unified State Register of Legal Entities, registration of state registration. registration, submission of requested papers to the competent tax authorities;

- registration and deregistration based on territorial affiliation with a specific body.

Registration in the personal account of a taxpayer of a legal entity

Going through the stage of registering a new user of a legal entity’s account differs from similar actions for individuals. persons in the direction of complication. Two options are identified, one of which will need to be completed at the start of commercial activity.

Design of a legal entity's office for a management company

To register, you need to sign an agreement to provide the organization with an electronic signature key - EDS. Either the manager or a person authorized by a power of attorney must submit documents containing information about the company for which the personal account is being created.

Then do the following:

- Open the registration page https://lkul.nalog.ru/check.php and sign the User Agreement with an electronic signature.

- Next, enter the email address and captcha verification characters.

- They recheck the data and continue registration.

- If the application does not contain errors, a letter with an activation code will be sent to your e-mail.

- From the letter follow the link to complete registration.

Initially, management of your personal account is given to one user - the manager. If you need to increase the number of employees who are allowed to log into your account, this is done in the “Administration” section.

Registration of an organization’s personal account by proxy

In situations where the owner of the company entrusts the registration of the account to an authorized person, registration of the personal account is carried out by power of attorney. When filling out the data, you will need to indicate how to enter the power of attorney. The rest of the registration process does not differ from the standard one.

Login to the personal account of a legal entity on the portal of the Federal Tax Service of Russia

Entry and work in your personal account is permitted to legal entities using a qualified digital signature. The key is issued by accredited certification centers, the list of which is posted at https://digital.gov.ru/ru/activity/govservices/2/.

How to log into your personal account using an electronic signature certificate

After receiving a qualified certificate for the electronic signature verification key and registering an account, the owner of the digital signature logs into the personal account. This is either the head of the company or a trusted representative. For authorization you need:

- Provide security certificates from the certification authority and the Ministry of Telecom and Mass Communications.

- Install the cryptoprovider program, the necessary drivers, and software components.

- Conduct diagnostics of PC characteristics on the page https://lkul.nalog.ru/check.php.

- Attach the key carrier.

- Launch the login page.

- Follow the prompts that appear on the screen.

Connecting new users to the personal account of a legal entity

New users are added to the personal account from the “Administration” section by the account owner by entering the TIN. There are no restrictions on the number of additional accounts. An electronic signature is required to join.

Log in to the personal account of another organization from one computer

The transition from the personal account of one enterprise to the account of another on a single PC is carried out subject to the existence of an electronic digital signature according to the following scenario:

- Turn off the key and leave the office.

- Open your browser settings and find the option to clear cache.

- Connect a second signature key carrier.

- Launch your personal account login page and log in using the required key.

Interaction with the tax authority on-line

Interaction with the tax authority on-line allows you to significantly optimize the organization’s activities. Read also the article: → “Insurance accounting: postings, documents, taxes”

To use this opportunity, you must perform a number of actions:

- the manager or authorized representative must obtain a qualified certificate of the electronic signature verification key (KSKPEP) from a certification center accredited in the network of trusted certification centers of the Ministry of Telecom and Mass Communications of Russia, of which the Federal Tax Service of Russia is also a member;

- make settings on the website www.nalog.ru;

- using a digital signature, draw up an agreement on access to the Personal Account of a legal entity;

- receive a link at the specified email address that requires activation;

- follow the link and activate your Personal Account.

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

Checking information about a taxpayer legal entity

The feasibility of checking the reliability of a partner at the start of cooperation helps protect the business from financial, legal, and moral problems. The service is contained in the personal account of a legal entity.

Search for a legal entity by TIN

Go to the TIN verification resource using the link https://www.nalog.ru/rn77/service/actual_inn_ul/. Please include the verification number in your request.

Free verification of the counterparty on the website using TIN

Verification of counterparties is performed free of charge. The head or accountant of an organization can perform a verification of a legal entity by TIN.

Check the counterparty by TIN on the tax website for free

Debts on financial responsibility of legal entities are checked after authorization on the State Services portal or in the legal entity’s account. Through the account they also receive information about overpayments. Draw up a 3-NDFL declaration.

Verification of legal entities

To quickly search for a legal entity, you can use the tax office website.

How to check a counterparty on the tax website using TIN

- Let's go to the section "PROVIDING INFORMATION FROM THE USRLE/USRIP".

- We enter the TIN in the first line.

- Let's select the desired region.

- Click on “Find”.

Check counterparty

Check through the official website of the Federal Tax Service

Clarify information about the legal entity. face can also be found on the website of the Federal Tax Service.

- You just need to go to the page with the valid TIN of the legal entity. persons,

- Enter the 12 digit taxpayer number in the field.

- Click "Search".

Check TIN

Request documents online on the tax website

Compose and send an application for obtaining information in the user’s personal account. To work, use the “Request for Documents” section.

How to obtain an extract from the Unified State Register of Legal Entities

The subsection “Request for an extract from the Unified State Register of Legal Entities” is located in the menu of the “Request for Documents” section.

Basic data fields are filled in automatically. Fill in the blank lines with the required information and click “Submit.”

How to print acts and reconciliations

To print a statement, you will need to format it into a file with a pdf extension. This can be done from the “Submission of Documents” tab using the “Information about Documents...” link.

Legal entity registration process

- Obtain a KSKPEP certificate from a certification center.

- Observe a number of technical conditions for working in your personal account. In particular, you will need to install software, download certificates, install a browser that supports encryption, and configure ports and hosts.

- Go through a short registration procedure on the Federal Tax Service website. To do this, you will need to enter a set of requested information into a special form.

After this, you can use the capabilities and options of the personal account, as well as connect branches and representative offices of the organization to the system.

Hotline

Throughout the Russian Federation there is a single toll-free federal number 8 800 222‒2222.

A call to this number will resolve mass issues related to the work of the personal account of a legal entity or individual. Our staff will quickly consider your request, provide detailed advice, and provide all possible assistance.

If you encounter rudeness, rudeness, display of incompetence or signs of corruption, call the helpline 8 (495) 913‒00‒70. The service operates around the clock and strict anonymity is maintained.

Electronic account services are being implemented everywhere, and the Federal Tax Service is no exception. In addition to providing access to information and reports to individuals, it also allows legal entities to carry out a number of tax actions without visiting a representative office.

LC for legal entities is an information service that saves clients time. It is online and all you need to access is a computer, internet and login information.

Registration

In order for a legal entity to use the service, it must register with the Federal Tax Service. Unlike individuals, the procedure for gaining access to the online office on the nalog.ru is unique and clearly regulated.

Stages of registering a legal entity in the personal account of the Federal Tax Service:

- Ordering an electronic signature key from a center accredited by the Ministry of Communications.

- Transferring tax data is the registration stage itself using a key.

- Providing access to employees of the organization.

All these actions can be performed by:

- Owner of the organization.

- A person who has the right to act on behalf of an organization without a power of attorney.

- A person who has the right to act on behalf of an organization with a power of attorney.

Other persons do not have the right to order a key according to the laws of the Russian Federation.

Centers that issue an electronic signature key are located in all regions of the Russian Federation. A complete list of items can be found here: https://minsvyaz.ru/ru/activity/govservices/2/ . The list is also available on the map: https://minsvyaz.ru/ru/activity/govservices/certification_authority/ .

After receiving the key, you need to connect it to your computer and go to the website https://lkul.nalog.ru/ . The key must be connected through CryptoPro CSP 4.0 or a version higher than specified. Additional technical configurations for successful interaction with the online office can be found here: https://lkul.nalog.ru/check.php

The registration itself goes like this:

- Sign the Agreement with an electronic signature on the website.

- Enter your email address.

- Enter CAPCHA - the code shown in the picture.

- Click "Next".

- Check data.

- Confirm your e-mail with the activation link that the Federal Tax Service sent to it.

If you are acting in accordance with a power of attorney, you must upload information about it after point 4. If your company has a management company, then it is the director of the management company who must indicate his signature key.

In order for a branch to gain access to a personal account, an authorized person must enter information about individual divisions in the “Administration” section.

Personal account of a taxpayer – individual entrepreneur

The Federal Tax Service launched a pilot project for the operation of the service “Personal Account of a Taxpayer – Individual Entrepreneur” (PA IP).