Payment of pension contributions for individual entrepreneurs through Sberbank Online

The best option would be to pay using a receipt, which means you need to receive it first.

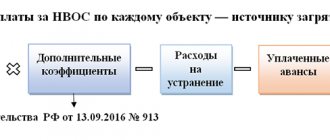

To do this, you need to either visit the local tax office, or simply go to the official website of the Federal Tax Service. It is clear that the best choice would be the second option - why even bother with online payment if you have to go to the tax office to get a piece of paper? It will be easy to receive a receipt on the Federal Tax Service website - go to the main page of the site, see a list of services on the right, and among others, one with the characteristic name “Pay taxes”. Click on it and continue according to the prompts. Payment details will be received shortly. The fixed portion must be paid by any individual entrepreneur, even one who does not conduct any activity. The contribution amount is now 27,990 rubles. As for the additional part, the calculation of income will depend on what taxation system is used by the individual entrepreneur.

The simplified tax system (USN) is the most popular tax system in private business.

The simplified taxation system has many supporters among individual entrepreneurs.

The simplified tax system replaces personal income tax, VAT and property tax (except for real estate tax) for individuals. Insurance payments under this taxation are also paid according to the tariffs of the Tax Code of the Russian Federation.

The attractiveness of “simplified” is explained by several criteria:

- reduction in taxes;

- reducing the volume of documentation, as well as tax reporting;

- simplified accounting, therefore reducing costs for accounting services;

- independent choice of the object of taxation (income or income minus expenses).

With a high level of costs, but a rapid turnover of goods and money for individual entrepreneurs, it makes sense to choose the difference “income minus expenses” as the object of taxation. The tax paid will be 15% of this amount. Quite a good option at the beginning of activity and at the stage of business development.

There are types of commerce, the costs of which are difficult to document. For example, purchasing food or goods from private individuals, paying for certain types of services, etc. This option involves paying a tax at a rate of 6% on the income received.

Another advantage of the simplified tax system is the submission of a tax return once a year, the deadline is April 30 of the year following the reporting year. It is possible to submit the declaration online.

Not all entrepreneurs can work according to the simplified system. The list of activities prohibited for the simplified tax system is enshrined in law.

If a significant part of clients are VAT payers, working under the simplified tax system may alienate them. An enterprise using the simplified tax system is not allowed to hire more than 100 employees, open branches and representative offices, or earn more than 150 million. In 2020, a new fixed limit was established for the transition to the “simplified system” for legal entities - their income for 9 months of the previous year should not exceed 112, 5 million rubles. There is no such “entry” condition for individual entrepreneurs.

A businessman will not be able to simply switch to the simplified tax system if he does not meet certain conditions

The simplified tax system is a clear and understandable taxation scheme that is favorable for small and medium-sized new businesses. More detailed information can be found on the official website of the Federal Tax Service of the Russian Federation.

Income minus expenses

Payment of pension contributions for individual entrepreneurs in 2020

Entrepreneurs pay contributions both for employees and for themselves to the Pension Fund branch of the region where the individual entrepreneur is registered at his place of residence. You can see this branch in the extract from the Unified State Register of Individual Entrepreneurs, and from it you can also find out your registration number.

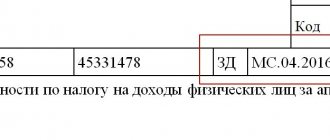

Despite the fact that contributions to compulsory pension insurance and contributions to compulsory medical insurance are transferred in full only to the Pension Fund, individual entrepreneurs must generate separate payments for contributions to the Pension Fund and contributions to the FFOMS (Part 8 of Article 15 of the Federal Law of July 24. 2009 N 212-FZ).

How to quickly pay taxes for individual entrepreneurs through the Sberbank Online system

Then you will need the same receipt from the tax service - the document index is indicated there. Select “Payment of taxes by document index”, indicate the card from which the debit will be made, and enter the index in the appropriate field. It is recommended to pay this way - no commission is charged this way.

Personal visits to the bank are becoming a thing of the past - now almost all procedures can be performed online via the Internet. In this article we will look at how to pay taxes for individual entrepreneurs through Sberbank Online. The method works, so use it for your pleasure.

Until what date do you need to pay individual entrepreneur contributions to the pension fund?

In general, the fee must be paid by December 31 for the year. But if it’s better for you to pay quarterly, then: with the simplified tax system, you need to pay before paying the simplified tax system for the first quarter. with UTII it must be paid before filing the UTII declaration for the first quarter