Basis and legal basis

The gambling tax is a regional direct tax.

It is regulated by Chapter 29 of the Tax Code of the Russian Federation, in force since January 1, 2004. For the purposes of determining this tax, it is established that the gambling business is an entrepreneurial activity in the organization and conduct of gambling, associated with the extraction of income by organizations in the form of winnings and (or) fees for gambling. Regional authorities have the right, by appropriate regional law, to introduce a tax on the gambling business and set its rate (taking into account the limits established by the Tax Code of the Russian Federation). However, if a regional law is not adopted, then the tax is still considered introduced and is fully regulated by the Tax Code of the Russian Federation. Unlike other regional taxes, the object of taxation, base, period and terms of payment of the tax on gambling business are fully regulated by the Tax Code of the Russian Federation and cannot be changed by the regional legislator.

https://youtu.be/9yoyV9pCn04

Basic Concepts

There are several basic concepts by which the gambling tax is calculated:

- Gambling business. Certain entrepreneurial activities that are not any sale of products, but are associated with generating income from participation in various games of chance in a gambling establishment. Income may also be generated from fees for such games, which will also be subject to tax.

- Gambling establishment. A specific enterprise that conducts all kinds of gambling on the basis of an appropriate license. Bets may be accepted on bets, which are also subject to gambling tax. Such establishments include various slot machine halls, sweepstakes, bookmakers, casinos, as well as any other gambling houses.

- Bet. An agreement to win between legal entities or individuals, which is based on risk. In other words, an agreement is considered a bet if its outcome directly depends on a certain circumstance that may or may not occur.

- Gaming table. A specialized place that is equipped in a gambling establishment and is intended for conducting various gambling games, regardless of the type of winnings. In this case, a gambling tax is collected from each such table. In this case, the establishment itself can also take part in gambling through its representatives as an organizer, observer, or even a playing party.

- Slot machine. Specialized equipment that is installed in the gaming room and is used to receive cash winnings. In this case, company employees cannot take any part in playing such machines.

- Cash register. A specialized place that is equipped with appropriate equipment. With the help of this equipment, the gambling establishment keeps records of the total amount of bets, and also determines the total amount of winnings that will need to be paid out. The only exception in this case is the totalizator, since it is a structural division of a unitary state enterprise.

All of the above concepts are taken into account in the process of calculating the gambling tax, and therefore it is important to remember them and use them correctly in the future.

Objects of taxation

The list of what is subject to taxation by the gambling business tax is established by Article 366 of the Tax Code of the Russian Federation. This:

- gaming table;

- slot machine;

- betting processing center;

- bookmaker's processing center;

- totalizator betting point;

- bet acceptance point of a bookmaker's office.

Each taxable object must be registered in the manner prescribed by law with the tax authority at the place of installation or location no later than two days before the date of its installation (opening). The taxpayer is also required to register any change in the number of taxable items within the same period.

The application form for registration of taxable objects was approved by Order of the Ministry of Finance of the Russian Federation dated December 22, 2011 N 184n.

Registration (submission of an application by the taxpayer) can be carried out in person, through a representative or by mail.

Tax authorities, within 5 working days from the date of receipt of the application, must issue a certificate of registration or make changes related to changes in the number of taxable objects to the previously issued certificate.

The procedure for registering gambling tax payers was approved by Order of the Ministry of Finance of the Russian Federation dated 04/08/2005 N 55n.

Legal regulations and taxpayers

To begin with, it is important to note that bookmakers and sweepstakes have the right to operate throughout Russia (also on the Internet), since they are types of bets and are legally different from slot machines, casinos, etc. The same applies to lotteries (No. 138-FZ), since their founders within the Russian Federation are the state.

The gambling tax is a direct regional tax. It was regulated by Ch. 29 of the Tax Code of the Russian Federation until 2006. Starting from 07/01/09, gambling establishments (except for bookmakers and sweepstakes) that do not have the appropriate permit no longer operate in Russia (Clause 9, Article 16 No. 244-FZ). At this time, entrepreneurial activities of a gambling nature can only be carried out in five (formally six) zones:

- Krasnodar region

- Altai region

- Primorsky Krai

- Kaliningrad region

- Krasnaya Polyana village, Sochi

- Crimea (approved, currently in the projection stage)

The gambling business in these territories was deregistered by decision of the tax authority (Article 26 No. 374-FZ). Carrying out the same business (with the exception of the varieties indicated above) in any other zones in Russia is illegal.

Carrying out such activities on the Internet and other telecommunications networks is also completely prohibited.

This gambling activity is based on obtaining the following types of profit:

- winning;

- bet;

- payment for carrying out.

The objects of taxation in accordance with legislation are:

- gaming table, machine;

- centers and betting points.

Taxpayers are various organizations that carry out relevant activities (Article 365 of the Tax Code of the Russian Federation). Individual entrepreneurs do not have the right to organize any gambling business (with the exception of the varieties mentioned). Organizers can only be legal entities that are registered in a special manner in accordance with the legislation of the Russian Federation.

Each of these objects is registered with the fiscal authorities no later than 2 days (not taking into account the red days of the calendar) before the date on which its establishment is expected. The same rule must be followed in situations where taxable objects undergo any changes (sale, liquidation, repairs, etc.).

Bookmakers' offices, sweepstakes and lotteries are not subject to prohibition if they are located outside the places established by law. But they are still taxed as gambling activities.

The tax base

The tax base for the tax on gambling business is determined for each object of taxation separately, based on their total number. The tax amount is calculated by the taxpayer independently as the product of the tax base for each object and the corresponding tax rate.

The tax is payable from the moment of carrying out licensed activities in the field of gambling business.

The procedure for calculating tax is explained in the Letter of the Federal Tax Service of the Russian Federation dated May 18, 2006 N GV-6-02/ [email protected]

How is the payment calculated?

When opening a gambling business, it is imperative to understand the procedure for calculating tax.

The tax on the gambling business (indirect or direct), or more precisely, the amount of payments that must be made to the federal budget and the constituent entities of the Russian Federation, is determined directly by the payer himself in accordance with the rate, as well as the total number of registered objects. The determination of the exact amount of payments, taking into account the total number or types of taxable items, must be provided by the payer himself to the tax authority located directly at the place of registration no later than the 20th of each month following the reporting month.

If a gambling establishment is engaged in any other types of activities that have nothing to do with the gambling business, this establishment must separately account for these payments, and then make payments separately in accordance with current legislation. The characteristics of the gambling tax were given above.

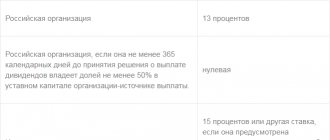

Gambling tax rates

Tax rates are set by regional authorities of Russia. However, they must not exceed the limits established in Article 369 of the Tax Code of the Russian Federation. These marginal rates are:

- for one gaming table - from 25,000 to 125,000 rubles;

- for one slot machine - from 1500 to 7500 rubles;

- for one betting processing center - from 25,000 to 125,000 rubles;

- for one processing center of a bookmaker’s office - from 25,000 to 125,000 rubles;

- for one betting point - from 5,000 to 7,000 rubles;

- for one betting point of a bookmaker's office - from 5,000 to 7,000 rubles.

Subjects of the Russian Federation determine specific tax rates for the gambling business. In the absence of relevant laws of regional authorities, the lower limit established by Article 369 of the Tax Code of the Russian Federation is applied.

Tax rates

The regional gambling tax is a specific rate for each gambling establishment on the territory of the constituent entities of the Russian Federation, which exceeds the established minimum level determined by current legislation. In the event that there is no regulatory act of a particular subject of the Russian Federation defining the exact amounts of tax rates, the minimum allowable rates are used for its calculation and further payment. It is worth noting the fact that the tax rate per year for each subsequent object above a certain number will be reduced by 20%, but only if the establishment has a total number of gaming tables of more than 30, and more than 40 slot machines are installed.

It should also be noted that the Russian gambling tax does not provide for any individual rates for certain categories of payers.

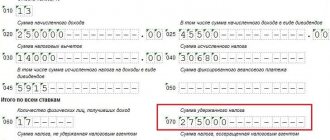

Procedure for paying tax and submitting a declaration

The gambling business tax is paid to the budget at the place of registration of the objects with the tax authority no later than the deadline for filing the declaration (20th day of the next calendar month). The tax amount is calculated by the taxpayer independently as the product of the tax base established for each taxable object and the tax rate provided for these objects.

Payment of tax if the organization has a separate division - at its location.

The gambling business tax declaration is also submitted monthly - no later than the 20th day of the month following the tax period. The declaration must take into account the change in the number of taxable objects in the expired tax period (month).

The declaration must be submitted to the tax authority at the place of registration of taxable objects. The largest taxpayers submit it to the tax authority at the place of registration as the largest taxpayers.

The tax return form and instructions for filling it out were approved by Order of the Federal Tax Service of the Russian Federation dated December 28, 2011 N ММВ-7-3/ [email protected] The declaration can be submitted by the taxpayer personally or through his representative, sent by mail with a list of attachments, or transmitted electronically form via telecommunication channels.

Please pay attention!

Taxpayers whose average number of employees for the previous calendar year exceeds 25 people, as well as newly created organizations whose number of employees exceeds the specified limit, submit tax returns and calculations in electronic form. The same rule applies to the largest taxpayers.

More information about submitting electronic reporting can be found here.

What is gambling tax reporting?

The main reporting document is the tax return. It is presented every month as a result of entrepreneurial activity in the calendar month, and is filled out according to the form (KND - 1152011), approved by Order of the Federal Tax Service No. MMV-7-3 / [email protected] dated December 28, 2011. Forms are issued free of charge by tax authorities. In the reporting document, the declarant must reflect the changes that have occurred during this time related to the number of all registered objects and separately for the number of gaming tables, as well as the actual calculation of the tax along with a separate calculation for gaming tables. Organizations indicate the TIN, KPP in the reporting document, and individual entrepreneurs indicate the TIN. Corrected errors in the document are confirmed by the signatures of managers and a seal indicating the date of the amendments.

The declaration must be submitted to the tax authorities by the 20th day of the month following the previous reporting period. The category of largest payers is reported to the tax office at the place of registration (Article 370 of the Tax Code). The declaration can be submitted in paper and electronic versions. The declarant has the right to submit reports:

- through telecommunication channels;

- personally;

- through a proxy;

- by mail (an inventory is included in the shipment).

When delivered by mail or telecommunications, the date of dispatch is the day on which the declaration is submitted. The transfer of the electronic version through communication channels is regulated by law. When a declarant submits reports directly or through an authorized representative, tax officials make a note on the date of acceptance of the declaration on its copy. For violation of the reporting deadlines, the declarant is fined.

Gambling tax in St. Petersburg

In St. Petersburg, the tax on gambling business is regulated by the Law of St. Petersburg dated July 3, 2012 N 395-66 - this document sets the tax rates. According to the Tax Code of the Russian Federation, only rates can be set at the regional level; all other aspects of the gambling tax are regulated by the Tax Code of the Russian Federation.

The rates are as follows:

- for one betting processing center - 125,000 rubles;

- for one processing center of a bookmaker’s office - 125,000 rubles;

- for one betting point - 7,000 rubles;

- for one betting point of a bookmaker's office - 7,000 rubles.

What's new in legislation in 2020

The conduct of any gambling in our country is regulated by several regulations.

The main one is the Civil Code, which sets out the basics of such business activities.

The restrictions imposed on the gambling business are currently listed in the law of December 29, 2006 N 244-FZ “On state regulation of gambling activities.” The last changes to it were made in 2020.

Taxation of any business, and gambling in particular, is regulated by the Tax Code. There is an entire chapter dedicated to this regional tax -.

According to the provisions of the Tax Code, this is a direct tax, which is introduced by the law of the constituent entity of the Russian Federation, where its rate is determined. The absence of such a law does not mean that entrepreneurs have no obligation to pay for running a gambling business.

In this case, the rate and payment procedure are regulated only by the Tax Code. Regions also do not have the right to change such aspects as the object and base of taxation, and the timing of payments. This is the prerogative of the federal authorities.

Changes made to the provisions of the Tax Code regarding the tax on gambling business are related to changes in the Central Bank refinancing rate. Since January 1, it has grown and become equal to the key rate, thus amounting to 11%. Penalties have increased accordingly, in particular, penalties imposed for late payment of taxes.

back to menu ↑

Gambling tax in Moscow

In Moscow, the tax on gambling business is regulated by the Moscow Law of December 21, 2011 N 69 - this document sets the tax rates. According to the Tax Code of the Russian Federation, only rates can be set at the regional level; all other aspects of the gambling tax are regulated by the Tax Code of the Russian Federation.

The rates are as follows:

- for one processing center of a bookmaker’s office - 125,000 rubles;

- for one betting processing center - 125,000 rubles;

- for one betting point - 7,000 rubles;

- for one betting point of a bookmaker's office - 7,000 rubles.

Taxation of gambling business (video)

This video describes in detail the objects that, according to the legislation of the Russian Federation, are subject to taxes, their registration, as well as the tax base and acceptable payment deadlines.

https://youtu.be/1Q_5FyLvo8c

Running a gambling business is a fairly serious matter that carries the same liability for violations. Correct and timely completion of the declaration, as well as adherence to legislative provisions regarding the payment of taxes, is the key to good business and the absence of possible problems associated with it.