Home / Taxes / What is VAT and when does it increase to 20 percent? / Rate and base

Back

Published: 01/31/2018

Reading time: 7 min

0

73

The standard VAT rate of 18% applies to most goods and services. To determine whether the products sold fall under its scope, other cases must be excluded.

- VAT and VAT rates at 10%

- VAT at 0% rate

- VAT at rates 18÷118 and 10÷110

- TN VED 2106909200

Dear readers! To solve your problem, call hotline 8 or ask a question on the website. It's free.

Ask a Question

The main point

So, value added tax (VAT explanation) is a fee paid by organizations that create an additional, additional market price for a product or service.

It is a small portion of the added value that arises from the difference between the revenue that the selling company received after selling goods or services and the amount of costs that it incurred to purchase specific raw materials, supplies, or products.

At the same time, this organization can produce products from purchased raw materials, or simply resell the goods, naturally at a higher price.

Value added tax appeared about a hundred years ago, replacing a sales tax paid on all revenue. However, in Russia it began to operate in 1992.

Why is it needed? The answer to this question is quite simple: today VAT is the main source of formation of the state budget, and the calculation of its final value (which we will consider in more detail a little later) frees organizations from double payment of fees to the budget.

What is the value of this bet?

According to Russian legislation, VAT is calculated at three percentage rates:

- Zero means that this fee is not charged on all products produced for export (gas, oil, precious metals, space).

- 10% - refers to the so-called preferential categories of goods: essential goods, socially significant (children's goods, medications, a number of food products).

- 18% is the most common rate, applicable to most goods and services (everything not included in the first two points).

Who pays it?

I wonder who really pays this tax, for whom is this tax burden? Of course, enterprises do this directly. But the statement that this burden falls only on business is incorrect.

Who pays for the product when it goes to retail?

That's right - the buyer, that means you and me. The company submits declarations to the tax office, and ultimately the buyer pays a higher price, increased by the amount of this fee, thereby indirectly reimbursing the costs incurred by the seller.

Let's take a closer look at the essence of value added tax by considering the logical chain of its definition:

- When one company buys materials, components, or simply finished goods from another, it pays them to the supplier, taking into account VAT included in their price.

- Then, when the future price of the product is determined, the cost includes the cost of previously purchased products (materials), reduced by the amount of tax (paid in the first point). This deductible amount of the fee is recorded as a tax credit, or, in other words, it is input VAT, an amount to be deducted in the future.

- When determining the final selling price of a product (taking into account the cost, desired profit, excise taxes) to the final buyer, VAT is added to the final price (this is what you and I pay, as buyers).

- Then, 18% is calculated from the revenue received for the product (the rates were discussed above), and a value called the tax liability is obtained.

- As a result, the company must pay the state an amount equal to the difference between the obligation (point 4) and the tax credit (point 2).

To make it even clearer, let's look at the calculation of this tax using a simple example:

The company bought doors from the manufacturer for the amount of 10,000 rubles. The amount of input VAT paid to the manufacturer will be equal to: 10,000 * 18% = 1,800 rubles.

Then this company sold the doors to customers in the store at a new price, taking into account its profit, and received revenue equal to 20,000 rubles. The amount of the obligation will be: 20,000 * 18% = 3,600 rubles.

Thus, this organization must pay the state: 3,600 – 1,800 = 1,800 rubles. Agree, it’s not as difficult to understand as it seems.

VAT and rates

VAT is an indirect tax levy fixed at the federal level. Its size is included in the total cost of goods and services sold in our country. Payment of VAT is the responsibility of the buyer at the time of purchase or receipt of the product. This fee is subject to transfer to the federal budget.

Most goods and services sold include VAT. A list of products that are exempt from this tax is established by law.

In accordance with paragraph 3 of Article No. 164 of the Tax Code (hereinafter referred to as the Tax Code of Russia), the VAT rate of 18% is in effect by default and applies to all types of goods and services, if they are not included in the list in accordance with which they are taxed differently, rates provided by law.

There are currently five value added tax rates, which are divided into two types:

- basic;

- calculated

To calculate the amount of the basic rate, you need to multiply the size of the tax base by the VAT rate. At the moment there are three rates that are considered basic:

- 18%;

- 10%;

- .

Estimated rates separate VAT from the total cost of a product or service, which already includes tax.

The Tax Code of Russia defines two types of such rates:

- 18÷118;

- 10÷110.

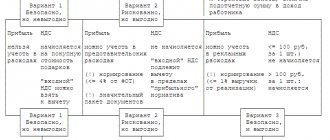

To exclude goods and services that are not subject to the 18% VAT rate, we will consider cases when it is necessary to use other rates.

VAT at the rate of 10%

Sales of socially significant products are carried out using a VAT rate of 10%. According to the Tax Code of Russia, these include:

- Food products according to the list specified in clause 1, clause 2 of Art. No. 164 Tax Code of Russia.

- Products intended for children, in accordance with the list specified in clause 2, clause 2 of Art. No. 164 Tax Code of Russia.

- Periodicals of any type, the frequency of publication of which is at least once a year, as well as book products, except for publications that are of an advertising or erotic nature. The list is indicated in paragraph 3 of paragraph 2 of Art. No. 164 Tax Code of Russia.

- Medical products, in accordance with paragraph 4, paragraph 2 of Art. No. 164 Tax Code of Russia.

- Work related to the transportation of passengers and luggage in Russia, except for the cases specified in clause 4.1, clause 1 of Art. No. 164 Tax Code of Russia.

VAT at 0% rate

Sale of exported goods and services, as well as those that are the subject of transit through Russia.

These include:

- Goods exported under the export system and subject to the free customs zone regime, subject to the conditions specified in Article No. 165 of the Tax Code of Russia.

- Services provided during the transportation of products between countries, taking into account work on support, organization, transportation, loading and unloading of goods.

- Services for the transportation of goods in the customs service area or in transit.

- Passenger transportation and luggage transportation, in cases where the places of departure and destination are located outside the territory of the Russian Federation.

VAT at rates 18÷118 and 10÷110

Estimated rates are calculated not as percentages, but in the form of formulas. The application of these rates is regulated by paragraph 4 of Article No. 164 of the Tax Code of Russia.

They are intended for taxation of goods and services sold using advance (preliminary) payments for future deliveries.

The following formulas are used for calculation:

- VAT amount = Amount of advance (preliminary) payment * 18÷118.

- VAT amount = Amount of advance (preliminary) payment * 10÷110.

Example: the advance payment is 236 thousand rubles. and is taxed at a rate of 18÷118. In this case, the VAT amount will be equal to: 236,000 * 18÷118 = 36,000 rubles.

In addition to advance payments, rates 18/118 and 10/110 apply in the following cases:

- During the sale of goods that were purchased from third parties and include the standard VAT rate.

- In cases of withholding of tax fees by tax agents.

- When selling vehicles whose seller was an individual.

- During the procedure for assigning rights to property.

- During the sale of product groups related to agricultural products.

Features of tax deduction

All companies are required to submit reporting – a tax return – every quarter, and no later than the established deadline (before the 25th of the next month). In case of delays, you will have to pay fines and penalties.

To fill out the quarterly report and to determine the amount that needs to be paid to the budget, as mentioned above, determine:

- tax base (all company revenue);

- tax deduction (or tax credit);

- the amount of tax to be reimbursed.

Tax deductions reduce the amount paid to the budget, since they have already been paid to the supplier. But they are accepted for deduction only if the following conditions are met:

- All purchased products for sale are subject to this fee.

- The organization has all correctly filled out primary documents (delivery notes for products) and invoices (these are provided by the supplier, from whom you need to require them to fill them out correctly).

- All products have passed accounting records in this company.

We’ve cleared up the deductions, now let’s figure out what the concept of VAT for reimbursement means.

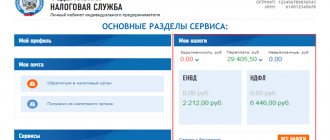

As we have already said, the amount that needs to be paid to the state is found by subtracting the deduction amount from the tax liability. So, if for a given quarter (by the way, there are 4 quarters in a year, as well as the season of the year) the amount of deduction is higher than the calculated tax, this will mean that this organization has actually overpaid the tax.

And therefore, she will have the right to reimburse this overpayment from the budget by submitting the appropriate declaration. After the inspection verifies the correctness of all calculations and documents, a decision will be made to reimburse the overpaid tax.

https://youtu.be/YfmIEg6Ftt8

Responsibility for tax offenses

Late payment of taxable items is a violation, as is evasion of contributing funds to the budget, delay in filing a declaration, etc. Every tax payer must contribute funds to the budget.

In case of failure to fulfill obligations or incomplete payment, a debt arises, in connection with which an audit by the fiscal authority may be organized. During the verification process, it is established why the person is evading payment of the fee, and whether there are any illegal actions on the part of the organization or individual entrepreneur.

Failure to make payment will result in a penalty. If there are no signs of intentional action, the sanction will be 20%, otherwise - 40%. Delay is accompanied by the accrual of penalties. Their size is affected by the period of delay, the amount of debt, and the refinancing rate.

https://youtu.be/soP5MXoei54