General provisions

A leasing agreement is a form of a rental agreement, and therefore paragraph 1 of Chapter 34 of the Civil Code of the Russian Federation will apply to the agreement. Article 624 of the Civil Code of the Russian Federation states that leased objects can be purchased by the lessee. The purchase is made at the full purchase price. The lease agreement may contain provisions regarding mutual settlements and the amount of the redemption price. If such clauses exist, the purchase is made on their basis, that is, at the cost specified in the contract. If there is no information in the agreement, an additional transaction is drawn up. An agreement is concluded which stipulates these points:

- Formation date.

- Details of both parties.

- Characteristics of the leased object.

- The volume of residual value (redemption value minus payments already made).

- Rights and obligations of participants.

- Payment method.

The agreement must contain the signatures of both parties. It is important to write down all points in detail. This will avoid possible disputes.

IMPORTANT! The leased object can be purchased both after the completion of the leasing agreement and during its validity.

Early repurchase of leased property

Article: How to correctly reflect in accounting the termination of a leasing agreement. The lessee buys out the property. When purchasing the leased asset early, companies sign an additional agreement.

The additional agreement determines the procedure and terms for paying off the debt remaining under the agreement.

Either the redemption price or the amount of the last payments may be increased by the amount of debt.

Example 4 In August 2009, the lessee, LLC Helicopter, decided to purchase equipment early from LLC LeasingInvest.

The lessee records it on the balance sheet at a cost of RUB 800,000.

The procedure for purchasing the leased asset

To purchase an object, the following procedure is relevant:

- Sending a notification to the lessor about the desire to purchase the property.

- The lessor provides written consent to the purchase.

- Conclusion of an additional agreement establishing the payment procedure.

- Conclusion of the purchase and sale document necessary for the official transfer of ownership.

- Issuing an invoice to the buyer.

- Drawing up a transfer and acceptance certificate.

- Transfer of accompanying documents to the lessee.

The procedure under consideration is advantageous in that it prevents the emergence of disputes between participants.

Features of graduation cost education

The graduation price can be formed in different ways. It all depends on the wishes of the parties to the contract. Let's consider the formation methods:

- Including cost in the leasing payment structure. The cost of the object in this case is initially included in the amount of leasing payments. Costs are evenly distributed over the entire period of lease payments. Therefore, the more payments have been made, the lower the redemption price.

- Separate payment. In this case, the redemption price is not included in regular payments. The lessee will have to purchase the property at the full cost specified in the contract.

Calculation of the redemption value is carried out on the basis of an agreement between the parties.

Entry into leasing in 1C 8.3: balance holder - lessee

At the time of transfer of property for leasing, the Lessor does not issue an invoice to the Lessee and does not present the VAT amount. Consequently, at the time of transfer of property for leasing, the Lessee does not have the right to deduct VAT from the cost of the leased property.

The Lessee's right to deduct VAT arises when:

- The lessor issues an invoice for lease payments;

- The lessor issues an invoice for the redemption price at the time of redemption of the property.

Document the receipt of leased property on the balance sheet of the lessee with the document Receipt into leasing from the section Fixed assets and intangible assets – Receipt of fixed assets – Receipt into leasing.

In accounting , the leased property recorded on the balance sheet by the Lessee is recognized by him as a fixed asset. Its initial cost is formed depending on the contract (clause 8 of PBU 6/01, Order of the Ministry of Finance of the Russian Federation dated February 17, 1997 N 15):

- from the sum of all leasing payments and the redemption price, i.e. the full cost of the contract, including VAT, if there is only one contract and includes the terms of redemption and the redemption price;

- from the amount of all leasing payments without the redemption price, i.e. the full cost of the contract, including VAT, if there is a separate purchase and sale agreement for the redemption value of the leased asset.

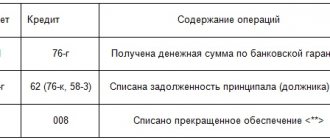

Postings

The document generates transactions:

- Dt 08.04.1 Kt 76.07.1 - lease liabilities in the amount of the cost of the asset taken onto the balance sheet;

- Dt 76.07.9 Kt 76.07.1 - rental obligations in the amount of VAT 18%.

Attention! Due to the increase in the VAT rate to 20% in 2020, VAT obligations will change!

Accounting

If the object is on the buyer’s balance sheet, the following accounting nuances need to be taken into account:

- Receipt of object. The cost of the received object must be recorded on account 08, subaccount “Purchase under a leasing agreement.” Correspondence – credit to account 76, subaccount “Rental Obligations”. Expenses for the purchase of an item must be written off from KT08 to DT01, subaccount “Rented objects”. The object must be accepted for balance sheet accounting in the structure of fixed assets. Associated expenses of the lessee (installation, transportation, etc.) are not included in the initial cost of the item.

- Leasing payments. Payments received to the lessor's account must be recorded in DT76, subaccount “Rental Obligations”. Correspondence – KT76, subaccount “Leasing debt”.

- Depreciation. Depreciation is calculated based on the cost of the asset. The accelerated depreciation method may be used. The coefficient should not exceed the value of 3. Depreciation charges should be recorded in the DT “Production costs” KT02, subaccount “Depreciation of the leasing object”.

- Redemption of a leased object. When the entire redemption amount has been paid, ownership has been transferred, data is entered into accounts 01 and 02 of accounting.

Each posting is confirmed by primary documentation.

Finding the object on the lessor's balance sheet

If the leasing object is on the balance sheet of the lessor, these transactions are used when purchasing the item:

- KT01. Write-off of an asset from off-balance sheet accounting.

- DT08 KT60. Capitalization of an asset (performed if the cost of the item exceeds 40 thousand rubles).

- DT19 KT60. VAT accounting.

- DT10 KT60. Capitalization of the leasing object.

In this case, the lessor keeps records.

Finding the item on the buyer's balance sheet

If the leased object is on the balance sheet of the lessee, you need to use these entries:

- DT08 KT76. Acceptance of the leasing object for accounting.

- DT19 KT76. Presentation of VAT by the person who provided the leasing.

- DT01 KT08. Acceptance of an item into the structure of fixed assets.

- DT76 KT51. Transfer of lease payments.

- DT76 KT76. Accounting for monthly lease payments.

- DT68 KT19. Acceptance of VAT deduction.

- DT20 KT02. Depreciation calculation.

- DT76 KT51. Transfer of redemption value.

- DT01 KT01. Transferring an item from rented to owned.

- DT02 KT02. Depreciation on an object that has become property.

Accounting is maintained, accordingly, by the person who acquired the leased property.

Features of accounting depending on the time of payment

If the redemption is made at the end of the lease agreement, accounting during the term of the agreement will be carried out in the standard manner. The postings will change at the end of the agreement. If the object was on the lessor's balance sheet, you need to write it off from off-balance sheet account 1. After this, the property goes on the balance sheet.

If the repurchase is carried out during the term of the agreement, lease payments must be recorded in accounting. In fact, they are an advance payment. In accounting, payments are reflected as advances issued.

IMPORTANT! To account for leasing payments, it is necessary to create subaccounts. They are used to reflect the purchase of an object and leasing payments.

On the early repurchase by the lessee of the leased asset listed on its balance sheet

In practice, it is not so uncommon for situations when, before the expiration of the leasing agreement, the parties agree on the

early purchase by the lessee of the leased property .

At the same time, it is quite logical that the total amount under the leasing agreement is recalculated downward. In the tax accounting of the lessee, the amount of expenses taken into account when calculating income tax in accordance with paragraphs. 10 p. 1 art. 264 of the Tax Code of the Russian Federation, will decrease. There will be no changes to the initial cost of the leased asset, since it is formed not by lease payments, but by the lessor’s expenses for the acquisition of property, which do not change.

But with accounting everything is much more complicated, because the initial cost of the leased property is formed based on the amount of all payments under the leasing agreement. What to do with its value if the size of payments for early redemption decreases?

It is no secret that accounting and tax accounting in relation to transactions under a leasing agreement can rarely be brought together; as a rule, both exist “on their own”. However, with the early repurchase of leased property, there may be cases where an incorrectly chosen accounting option can lead to adverse tax consequences. Which ones? You will learn about this from this consultation.

How to choose the right one from many options?

Let us remind you that the accounting procedure for leased property is regulated by the Instructions on the reflection in accounting of transactions under a leasing agreement

, approved

Order of the Ministry of Finance of Russia dated 02/17/1997 No. 15

(hereinafter referred to as

the Instructions

), which should be followed insofar as it does not contradict regulatory legal acts on accounting adopted later (

Letter of the Ministry of Finance of Russia dated 12/25/2015 No. 07-01-06/76484

).

In accordance with clause 8 of the Guidelines

the cost of leased property received by the lessee is reflected by posting

Debit 08-l Credit 76-ao

.

The costs associated with obtaining leased property and the cost of received leased property are reflected by posting Debit 01-ai Credit 08-l

.

When purchasing the leased property and transferring it into the ownership of the lessee, in the event of repayment of the entire amount of lease payments provided for in the leasing agreement

, an internal entry is made on accounts 01 and 02 (

clause 11 of the Instructions

):

Debit 01-os Credit 01-ai

,

Debit 02-ai Credit 02-os

.

How Directions

propose to reflect in the lessee's accounting transactions in the event of the purchase of property before the expiration of the leasing agreement?

According to clause 12 of the Directions

if, under the terms of the leasing agreement, the leased property is accounted for on the balance sheet of the lessee, then accrued payments ahead of schedule are debited either to the “Deferred Expenses” account, or if the lessee decides to use its own sources, to the debit of the organization’s own sources accounts (“Use of Profit” , “Retained earnings (uncovered loss)”) in correspondence with account 02-ai.

At the same time, the specified amount is taken into account as follows: Debit 76-lp Credit 76-ao

.

In other words, in the Directions

It is proposed to leave on account 01 the value that was formed based on the initial amount of the leasing agreement (and this despite the fact that, as a rule, in the case of early purchase of property, the total amount under the agreement is recalculated downward). At the same time, “early accrued payments” (read – the difference between the original amount of the leasing agreement and the new amount) are proposed to be written off at the expense of retained earnings, which, as we know, cannot be used without the decision of the owners.

Unfortunately, we have to admit that the Guidelines

only the order of entries in accounting accounts is given, but it does not contain rules for the recognition, classification, evaluation and write-off of assets and liabilities. As for the Russian standard for accounting for rental transactions promised by the Ministry of Finance, today it is at the draft stage.

Thus, the accountant has no choice but to develop and justify the accounting method in this situation.

How can a lessee obtain an early redemption of leased property if the terms of the agreement provide for a reduction in the amount of remaining lease payments? The author analyzed the opinions of experts in the field of accounting and taxation from various Internet sources and identified several accounting options.

Option 1.

Its supporters note that according to

paragraph 14 of PBU 6/01 “Accounting for fixed assets”,

changes in the initial cost of fixed assets in which they are accepted for accounting are allowed only in cases of completion, additional equipment, reconstruction, modernization, partial liquidation and revaluation of fixed assets funds. However, this rule applies only to those fixed assets that already belong to the organization by right of ownership, and does not apply to the leased asset that is on the balance sheet of the lessee.

In the lessee's accounting, the initial cost of the leased asset is formed based on the total amount of lease payments. Therefore, if their amount is revised downwards, then the initial cost of the object in accounting should also be reduced.

In accounting for the amount of this decrease, it is necessary to make an entry Debit 01-ai Credit 76-ao (reversal)

.

Option 2.

With this option, it is proposed that the reduction in the amount payable to the lessor upon early purchase of the leased asset be considered as a change in the contract price and the provision of a discount.

By the amount of the discount provided (excluding VAT), the lessee adjusts the initial cost of the leased asset, which entails the need to recalculate the amount of depreciation accrued by him in accounting for the entire period of validity of the leasing agreement.

Option 3.

It assumes that the initial cost of the leased asset established upon acceptance for accounting remains unchanged, and the difference arising in settlements with the lessor should be taken into account as part of the lessee’s other income (entry

Debit 76-ao Credit 91-1

).

This accounting option is justified by the provisions of clause 14 of PBU 6/01

on the immutability of the cost of the fixed assets at which it is accepted for accounting.

So, we present to your attention three options for accounting for the early repurchase of leased property, if the terms of the agreement provide for a reduction in the amount of remaining lease payments. Perhaps in a similar situation you will have your own, more reasonable option.

I would like to draw your attention to the third of the proposed options. Despite its obvious advantage (no need to reverse or recalculate anything), there is one subtlety that has consequences when calculating income tax. This will be discussed in the next section.

Property value affects the calculation of net assets

To understand how the third accounting option affects the calculation of income tax, let us take as an example a legal dispute that was considered by the Supreme Court of the Russian Federation in Determination No. 302-KG16-13937 dated October 25, 2016 in case No. A10-4521/2015

. The essence of the dispute was as follows.

During the period from July 2009 to May 2011, the organization (lessee) entered into leasing agreements under which it purchased several cars and excavators for financial lease. Until December 2011, the specified property was accounted for on account 01-ai (sub-account “Fixed assets received on lease”) at the cost indicated in the leasing payment schedule (RUB 2,206.6 million).

In December 2011, these fixed assets were purchased ahead of schedule from the lessor into ownership at a price of RUB 954.8 million. After that, they were transferred to account 01-os (sub-account “Own fixed assets”) by recording Debit 01-os Credit 01-ai

in the amount of RUB 2,206.6 million.

Based on the results of an on-site tax audit, the tax inspectorate assessed additional income tax to the organization. The inspectors considered that the incorrectly formed residual value of fixed assets in accounting

(in the amount of 2,206.6 million rubles instead of 954.8 million rubles) led to distortion of information about the property status of the organization, namely, an overstatement of the value of assets, respectively, and an overstatement of the amount of equity capital. As a result, the debt on borrowed funds, which had signs of being controlled, was not recognized by the organization as such and interest on the loan in tax accounting was taken into account in full, exceeding the maximum amount of interest taken into account for tax purposes.

The arbitrators of three instances did not accept the organization’s argument that fixed assets received under lease and listed on the balance sheet of the lessee, when redeemed from the lease, are not subject to revaluation at the redemption value, but are subject to accounting at the previously formed value. The following was noted.

The purchase and sale agreement serves as the basis for the lessee to acquire ownership of the leased asset. A lease payment is a single payment for the use of leased property. Unlike the lease payment, the redemption price of the leased asset is the amount of money paid by the lessee for acquiring ownership of the leased asset, and not for using the latter. Thus, property purchased from a financial lease into ownership is accepted for accounting at the cost of actual expenses incurred for its purchase.

In paragraph 8 of PBU 6/01

It is also stipulated that the initial cost of fixed assets acquired for a fee is recognized as the amount of the organization’s actual costs for acquisition, construction and production, with the exception of VAT and other refundable taxes (except for cases provided for by the legislation of the Russian Federation).

Thus, in accordance with the specified legislative norms, property purchased from a financial lease into ownership must be accepted for accounting at the amount of actual expenses incurred for its purchase.

In the situation under consideration, the basis for transferring ownership of the leased property is the early payment of the redemption price. After the transfer of ownership of the leased property, it must be registered by the enterprise in account 01 “Fixed Assets” at a cost equal to the early paid redemption price (excluding VAT).

Ultimately, the tax inspectorate assessed additional income tax for the audited period in the amount of about 6 million rubles. The basis was the inspection’s conclusion that the taxpayer unlawfully included in non-operating expenses incurred when calculating income tax during the specified period, interest on loans in the amount of 34.6 million rubles. due to failure to comply with the conditions for determining the maximum amount of interest on controlled debt under a debt obligation. The inspection noted that as a result of the lack of adjustment of the initial cost of fixed assets after their purchase into ownership, the total cost of fixed assets as of 01/01/2012 by the company was overestimated, and therefore, on the basis of clause 2 of Art. 269 Tax Code of the Russian Federation

The maximum interest rate on controlled debt was recalculated.

Based on the fact that the cost of financial lease objects purchased into ownership is reflected in the company’s accounting records as of 01/01/2012 in the amount specified in the financial lease agreement, instead of the redemption value, the inspectorate excludes from non-operating expenses interest on controlled debt in an amount exceeding the maximum amount of interest recognized as expense has been recognized by courts of all instances as lawful.

Ermoshina E. L., expert of the information and reference system “Ayudar Info”

Tax accounting

Let's consider the features of tax accounting of leasing objects:

- Receipt of leased item. If the leased object is on the buyer’s balance sheet, the lessee needs to include it in a suitable depreciation group (based on paragraph 10 of Article 258 of the Tax Code of the Russian Federation). The initial cost of an object is the total of the lessor’s expenses for the purchase of the item, delivery, installation, etc. The price does not include taxes that are subject to deduction (based on paragraph 3 of paragraph 1 of Article 257 of the Tax Code of the Russian Federation).

- Depreciation. The initial cost of items is included in expenses through deductions for depreciation on the basis of paragraph 2 of Article 253 of the Tax Code of the Russian Federation. For depreciation charges, you can use a coefficient not exceeding 3 (clause 2 of Article 259.3 of the Tax Code of the Russian Federation).

- Leasing payments. Monthly lease payments must be taken into account. Depreciation charges are deducted from them.

- Redemption of the leased object. When calculating the initial cost, VAT is not taken into account.

IMPORTANT! During the calculation of leasing payments, VAT can be deducted. The basis for the procedure is paragraph 2 of Article 171 and paragraph 1 of Article 172 of the Tax Code of the Russian Federation. You can also restore VAT, which was accepted for deduction from the prepayment.

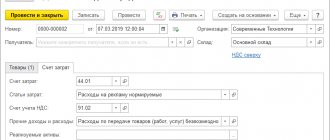

Calculation of monthly lease payment

1-12 leasing payment (from 02/01/2016 to 01/31/2017) is 68,440 rubles. (incl. VAT 18%), including:

- offset of the advance payment - 29,500 rubles.

- payable - RUB 38,940.

The amount of the leasing payment is 68,440 rubles. The lessor issues a monthly invoice.

Accrue the monthly lease payment using the document Receipt (act, invoice) transaction type Leasing services from the section Purchases – Purchases – Receipt (acts, invoices) – button Receipt – Leasing services.

Postings