How are rights and responsibilities distributed when issuing a bank guarantee?

A bank guarantee is an obligation that a bank or any other credit organization issues as insurance for the fulfillment of contractual (agreement, procurement) conditions (Article 368 of the Civil Code of the Russian Federation). It is provided in both electronic and written form. If the contractor violates a number of conditions, the bank pays the customer organization a documented amount of money.

In relations related to the provision of a guarantee, three participants are involved:

- guarantor (bank) - an entity that, for a certain fee, assumes the obligation to issue a guarantee;

- principal (executor) - a participant who initiates the issuance of a bank guarantee and is a debtor in accordance with the terms of the agreement;

- beneficiary (customer) - a person whose interests are protected by a bank guarantee.

In this case, the beneficiary and the principal are parties to the agreement, as when concluding a government contract. They act strictly in accordance with current civil legislation (Article 420 of the Civil Code of the Russian Federation). Their mutual settlements are made outside the jurisdiction of the relationship established with a third party - the bank that provided the guarantee.

The parties interact taking into account the current bank guarantee agreement - a document defining the legal relationship of all three parties: the guarantor, the beneficiary and the principal. The agreement on the provision of a bank guarantee must indicate that the guarantor bank will pay the guarantee only if the supplier-principal cannot fulfill the obligations established by the government contract to the beneficiary customer. The bank guarantee agreement necessarily stipulates the circumstances due to which situations of payment of bank collateral occur.

Bank guarantee - how to take it into account in accounting?

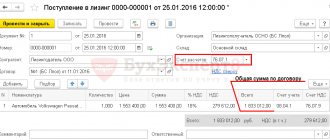

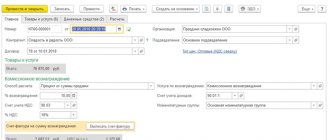

Today, a bank guarantee is one of the most popular services. With its help, they insure financial risks that sometimes arise when a counterparty refuses to fulfill its obligations in connection with the execution of a contract. On January 1, 2014, the new 44-FZ “On the contract system” will come into force. In it, the bank guarantee will be used in a much more expanded version, which means that the accounting department will have more questions about how to take into account accounting expenses, how and in what way to reflect transactions? First of all, we need to explain what a bank guarantee is? A bank guarantee is a written (or electronic) obligation of a bank (or a credit institution or an insurance organization), which it issued at the direction of another person, called the principal, to pay the creditor (beneficiary) a sum of money in accordance with the terms of the agreement. The guarantor pays the amount fixed in the contract if the beneficiary makes a request for this in writing. The validity of the bank guarantee begins on the day of its issue, and the validity period is specified in the contract. It can be concluded for any amount and for any period with both legal entities and individual entrepreneurs. In some cases, a bank guarantee must be provided. For example, it is provided before concluding government contracts; according to the new 44-FZ, it can also be provided to ensure participation in tenders, auctions and competitions. What documents can confirm the validity of accounting for a bank guarantee? Sometimes an accountant has a question: how can all this be documented? Of course, bills and invoices are provided along with the bank guarantee itself, but sometimes the guarantee is provided in the form of an electronic message. What to do with this option of providing a bank guarantee? The fact is that in accordance with paragraph 3 of the Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated March 23, 2012 N 14 “On certain issues of dispute resolution practice .....” a bank guarantee issued in the form of an electronic message using the SWIFT telecommunication system is identical to a bank guarantee in writing. And if, when issuing a bank guarantee, certain requirements, sometimes imposed by the beneficiary or guarantor on the form of the guarantee, were not met, then this is not a reason not to accept it for accounting. Interested parties can, quite legally, provide various evidence that can confirm this transaction. Bank guarantee - its distinctive features A bank, or a credit institution or an insurance organization always acts as a guarantor. Naturally, a bank guarantee is not issued to the principal free of charge, which means that the accountant will need to take into account the transactions carried out on the accounting accounts. A bank guarantee cannot depend on the underlying obligation. In addition, this guarantee cannot be revoked, that is, it is irrevocable. Rights under a bank guarantee cannot be transferred to another person, unless, of course, otherwise provided in the document itself. The bank guarantee must indicate the period for which it is issued. If the period is not specified, then it (bank guarantee) in accordance with Art. 432 of the Civil Code of the Russian Federation is considered not to have arisen. In this case, the guarantee period may be equal to, greater than, or less than the period for fulfillment of obligations. Typically, the guarantee specifies who the beneficiary is, but due to established dispute resolution practices, if the beneficiary is not indicated in the document, the bank guarantee is still considered valid. If a guarantor issues a bank guarantee to a beneficiary without a prior written agreement between the principal and the guarantor, the guarantee is not considered invalid. However, before issuing a bank guarantee to the beneficiary, the principal may enter into an agreement with the guarantor, which will stipulate the conditions under which the bank guarantee will be concluded. In the contract, the guarantor may stipulate, in particular, the right to demand from the principal, by way of recourse, a certain remuneration if he pays the beneficiary a certain amount of money in connection with the demands made. Neither the guarantor nor the beneficiary pays VAT when the guarantor fulfills obligations under the bank guarantee. That is, there is no need to pay VAT when performing such operations as payment under a guarantee, issuance and cancellation of a bank guarantee, and so on. Transactions that are carried out in connection with the repayment of obligations under a loan agreement are also not subject to VAT, since in accordance with current legislation all loan transactions are exempt from taxation. The exception is transactions that arise when issuing bank guarantees by insurance organizations - these services are subject to VAT. The guarantor is obliged to reflect the accounting entries when fulfilling obligations under the bank guarantee. As soon as the beneficiary receives money from the guarantor (in connection with the fulfillment of obligations), the accountant makes a corresponding entry in a special book in the debit of account 51 “Current accounts” and the credit of account 76 “Settlements with various creditors and debtors”. The principal's debt is recorded in accounting depending on the type of obligation. This may be subaccount 58-3 “Loans provided,” account 62 “Settlements with buyers and customers,” account 76 or 58 “Financial investments.” Below is an example of a table with accounts:

The letter “G” in the account indicates settlements with the guarantor, the letter “K” – settlements with counterparties. Accounting for the beneficiary's receipt of funds from the guarantor The beneficiary, upon receipt of funds from the guarantor (using the cash method), must recognize the proceeds from the sale of goods (works, or services), since the payment was secured by a guarantee. When securing obligations to pay interest under an irrevocable bank guarantee, the beneficiary reflects non-operating income in the form of interest on the loan. Methods for reflecting accounting records by the beneficiary when fulfilling obligations under a bank guarantee If the principal fails to fulfill the main obligation (or if performed improperly), the beneficiary makes a demand to the guarantor for the payment of funds in accordance with the guarantee agreement (in writing). This requirement must indicate what exactly the principal violated during the execution of the contract. The bank guarantee expires when the beneficiary receives the amount due to him under the agreement, or if the validity period of the bank guarantee expires. The guarantee itself is accounted for in off-balance sheet account 008 “Securities for obligations and payments received.” The amount in the account is equal to the figure specified in the contract. The amount is debited from the off-balance sheet account gradually as the debt is repaid. Simplified taxation system - features of accounting for a bank guarantee Under the simplified taxation system, the beneficiary who received funds from the guarantor is obliged to reflect in accounting the proceeds from the sale of goods and / or non-operating income in the event of receipt of funds from interest on the loan. As soon as the beneficiary receives funds from the guarantor (in accordance with the execution of the agreement), the accountant records entries in a special book in the debit of account 51 “Current accounts” and the credit of account 76 “Settlements with various creditors and debtors”. In this case, the principal’s debt is reflected in the debit of account 76 - in the credit of (58-3, 62, 76.78) accounts, depending on the type of obligations. This may be subaccount 58-3 “Loans provided,” account 62 “Settlements with buyers and customers,” account 76 or 58 “Financial investments.” In this case, the bank guarantee is accounted for in off-balance sheet account 008 “Securities for obligations and payments received.” The amount in the account is equal to the amount specified in the agreement. This amount is debited from the off-balance sheet account gradually as a result of debt repayment. Accounting for a bank guarantee from the principal First of all, you need to know that such a service as the provision of a bank guarantee by a bank or credit institution is a banking transaction, and in accordance with Federal Law No. 395-1, such a service is not subject to VAT taxation. But if the bank guarantee was issued by an insurance company, then such a service is subject to mandatory VAT taxation. In this case, the principal must accept VAT for deduction, having previously reflected this service in accounting. But at the same time, a bank guarantee must be provided to carry out transactions that are subject to tax. The principal cannot deduct input VAT if the transactions carried out in connection with the issuance of a guarantee do not incur VAT. If the bank guarantee is issued by a bank or credit organization, the amount of income tax is taken into account as part of non-operating expenses. When a bank guarantee is issued by an insurance organization, this operation is accepted for accounting for income tax. Accounting for remuneration to the guarantor This accounting will depend on the type of obligations. For example, if, when purchasing property, the buyer provides the seller with a bank guarantee, then this will be considered an expense that is associated with the acquisition of the property. The costs in this case will include the cost of acquiring property, interest paid on a loan provided for the purchase of property, various markups (surcharges), commissions, customs duties and payments, and so on. The amounts of remuneration to the guarantor are included in the actual cost of the acquired assets if the guarantee was issued before the assets were accepted for accounting. The postings in this case are as follows: The amount of remuneration to the guarantor, included in the actual value of the asset - debit account (01/07/08/10/41...) - credit account 76. Payment of remuneration to the guarantor: Debit account 76 - credit account 51. If a bank guarantee issued after the formation of the actual value of assets, the accountant must reflect the following entries: Debit account 91.2 - credit account 76. Borrowing expenses are recognized as other expenses if a guarantee is issued to secure debt obligations. Additional costs are included, if desired, evenly as part of other costs throughout the entire term of the contract. The accounting policy must reflect the chosen method of accounting for additional loan costs, either accounting evenly throughout the entire loan period, or at a time during the period when they arose. As a result, the following entries will appear in accounting: Debit of account 91.2 – Credit of account 76 (reflects the amount of remuneration to the guarantor). Debit of account 76 - Credit of account 51 (payment of remuneration to the guarantor is reflected) Bank guarantee issued to secure other obligations In this case, the tax amount is included either in non-operating expenses or in expenses associated with production and sales. Moreover, the organization itself decides which group of expenses to include this amount of remuneration (payment for guarantor services). Typically, in practice, other expenses include, for example, the customer’s obligation to pay for work (services), the supplier’s obligation to supply products, etc. As part of non-operating expenses, the amount of remuneration is taken into account, for example, to apply the application procedure for VAT refund, to ensure payment of customs duties, taxes, etc. Expenses under the guarantee are recognized for profit tax purposes, provided that these expenses are economically justified and confirmed, and they must also be aimed at generating income. In this case, the remuneration is taken into account for tax purposes in full.

Documents and grounds for accounting of bank guarantees

Bank guarantee transactions are regulated by civil and banking legislation. In the same regulatory legal acts one can find the answer to the question of whether a bank guarantee is registered.

In the Civil Code, the provisions regulating such a financial obligation are spelled out in Chapter 23 (paragraph 6, Articles 168, 169, 374-379, Article 429 of the Civil Code of the Russian Federation). The issuance of a bank guarantee by credit institutions relates to bank operations (clause 8, part 1, article 5 of the Federal Law of December 2, 1990 No. 395-1).

When concluding a supply agreement, it is not allowed to indicate a condition on a bank guarantee if there is no reason to assume that the guarantee obligations will be received from the guarantor under certain conditions (Determination of the RF Armed Forces in case No. 305-ES16-14210 of January 30, 2017). But when it comes to public procurement in accordance with the regulations of the Federal Contract System Law, the provision of a guarantee issued as security for the performance of the contract is mandatory. This is stated in Art. 96 44-FZ. The customer is obliged to include in the procurement documentation, notice of order, invitation to participate in the selection of a supplier in a closed way a requirement to ensure the execution of the contract (Part 1 of Article 96 44-FZ). The exception is the situations defined in Part 2 of Art. 96 44-FZ.

In Part 3 of Art. 96 states that such contract performance security is provided in the form of a bank guarantee. It must meet the requirements established in Art. 45 44-FZ. The supplier has the opportunity to provide a bank guarantee as security for the execution of a government contract and in the form of funds by transferring the required amount to the settlement (personal) account specified by the customer organization. The method of guaranteeing its obligations is determined by the procurement participant himself.

IMPORTANT!

From July 1, 2019, procurement participants will be able to provide a bank guarantee as security for the application.

How to reflect receipt and issue from the principal and beneficiary

The reflection of a bank guarantee in accounting is directly dependent on the type of financial obligation for which it was issued. There are a number of situations for which a guarantee is required:

- To ensure compliance with the terms of payment for acquired assets and property (MPS and fixed assets).

- To insure the fulfillment of loans, borrowings and other debt obligations.

- For guaranteeing the return of the advance payment, since many performers stipulate that an advance payment must be provided.

- To ensure the fulfillment of other responsibilities.

Postings for a bank guarantee in accounting are formed based on a complex system of legal relationships between the principal and the beneficiary. Postings are prepared for legal relations:

- issuance and use of a guarantee;

- entering into an agreement that is not legally binding but is secured by a guarantee.

Nuances

If security in the form of a deposit is used as a condition for providing a guarantee, when accounting for the bank guarantee in accounting, the corresponding account of the principal is debited and the passive account summarizing data on receipts from clients is credited (for example, 43001).

When a guarantee stipulated by law is written off, the following entry is generated:

Dt sch. 91315 Kt inc. 99998.

At the same time, the size of the reserve decreases:

Dt sch. 47425 Kt inc. 70601.

If the principal does not repay the debt to the beneficiary, the financial organization does it for him. This is how a bank guarantee appears in accounting. Accounting is carried out by generating the following entries:

Dt sch. 60315 Kt beneficiary account;

Dt sch. 91315 Kt inc. 99998 – write-off of payment.

In a similar way, the reserve is reduced using the given correspondence of accounts. At the same time, a new reserve is created to cover possible losses in the amount of the upcoming recovery from the principal:

Dt sch. 70606 Kt inc. 60324.

Accounting for the guarantee by the beneficiary

When the beneficiary has received a bank guarantee, he himself decides how to use it. The customer's choice whether to apply or write off bank collateral depends on whether the supplier principal has fulfilled its obligations.

Settlements between the customer and the supplier are regulated by the contract. The beneficiary receives a separate benefit when providing a bank guarantee, since the guarantor determines its payment obligations to the organization until mutual settlements are fully completed (clause 1 of Article 378 of the Civil Code of the Russian Federation). That is why for accounting purposes they use off-balance sheet account 008 “Securities for obligations and payments received.” The collateral is written off from the balance sheet if the parties fulfill their obligations. Analytics is carried out for each received collateral.

Example of transactions with a beneficiary: receipt and write-off of a guarantee

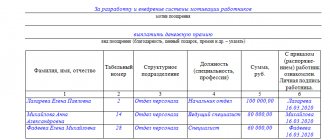

For commercial and non-profit organizations, it is necessary to use corresponding postings. Let’s imagine that LLC “Ideal Customer” purchased products from LLC “Ideal Supplier” in the amount of 500,000.00 rubles. The table shows how to reflect the collateral provided by the bank in the beneficiary's accounting records.

| Accounting records | Product cost, rub. | Operation description | |

| Debit | Credit | ||

| 008 | — | 500 000,00 | Accounting for the received guarantee |

| 62 | 90 | 500 000,00 | Delivery of products to the customer |

Let's say the buyer is late in payment, and the supplier contacts the bank with a demand to pay the principal's debt in the amount specified in the guarantee. The accounting entries will be as follows:

| Accounting records | Product cost, rub. | Operation description | |

| Debit | Credit | ||

| 51 | 76 | 500 000,00 | Receiving funds from the guarantor |

| 76 | 62 | 500 000,00 | Debt offset |

| — | 008 | 500 000,00 | Write-off of payment security from off-balance sheet |

If payment is made on time, the beneficiary does not need to contact the guarantor for debt reimbursement. Accounting records will be generated for the receipt and subsequent write-off of collateral on the 008 off-balance sheet account.

Write-off of a bank guarantee - postings on the beneficiary's side

In this scenario, the beneficiary applies the following entries:

- Dt 62 Kt 90 (amount corresponding to the selling price of the goods) - shows the beneficiary’s income from the sale of goods;

- Dt 90 Kt 41 (the amount corresponds to the cost of goods sold);

- Dt 008 (amount corresponding to the value of the bank guarantee) - reflects the fact of receipt of the guarantee by the beneficiary;

- Dt 51 Kt 62 (amount corresponding to the selling price of the goods) - reflects the fact of receiving payment from the principal;

- Kt 008 - the bank guarantee has been written off due to the principal fulfilling his obligations under the contract.

Now let’s study what accounting entries are used under the bank guarantee by the guarantor himself.

Accounting for the principal

Accounting for guarantees in the principal’s accounting department is based on two positions:

- The bank guarantee should not be taken into account by the principal. The logic is this: the guarantee is intended not for the principal, but for the beneficiary, and is issued by a third party - the bank. That is, the guarantee obligations are obtained for the lender and issued by the lending institution, and not by the principal himself. Therefore, it makes no sense for the principal organization to reflect these obligations on off-balance sheet accounts 008 and 009.

- Warranty obligations must be recorded in accounting.

This is necessary in order to reflect a change in the creditor organization in the event of transfer of obligations to pay the debt to the guarantor. Reflection of collateral in accounting allows for further operations to apply penalties to the debtor.

From an analytical point of view, reflecting the guarantee collateral is necessary, as this makes financial and accounting reporting more transparent and allows you to view the resulting accounts payable of the principal in the context of analytical accounting.

Accounting for bank guarantees for public sector employees

Accounting for bank guarantees in a budgetary institution has its own peculiarities. When conducting competitive and auction procedures for the supply of goods, works or services, the customer organization establishes a mandatory requirement for securing applications. It can be transferred by the procurement participant either by depositing funds into the customer’s current (personal) account or by providing a bank guarantee. Based on clause 351 of Instruction No. 157n, accounting for a bank guarantee received as security for an application is carried out in off-balance sheet account 10 “Security for the fulfillment of an obligation.” The Letter of the Ministry of Finance dated July 27, 2014 No. 02-07-07/31342 states that funds received as security for participation in a competition or closed auction, as well as as security for the execution of a contract, do not need to be taken into account in off-balance sheet account 10.

In a budgetary institution, a bank guarantee is recorded in the accounting department strictly on the day the guarantee liability occurs. The amount must match the value of those obligations whose performance is guaranteed. On the day of termination of the guarantee and financial conditions, the established amount is reduced on account 10 of the off-balance sheet.

Monetary "trust"

One of the most important engines of business relationships in business is, of course, an agreement (contract). This document contains all the basic rules and requirements that the parties put forward to each other. By signing a contract, the subject automatically assumes full responsibility for compliance with the obligations assigned to him. However, not everything can be taken into account in such a paper. Sometimes counterparties resort to the use of various levers of influence, which are also referred to as:

- guarantees;

- additional agreements;

- insurance.

To carry out competent accounting of a bank account, you need to know that bank guarantee documents come in several types. Organizations throughout all their development cycles face the following:

- guarantee for the application for participation in the tender;

- reliability of contract execution;

- guarantee of return of advance payment.

You may have heard of each of these types, but do you know how bank guarantee accounting is done? It's simple.

Postings for budgetary institutions

Funds received from a credit institution (bank) allocated for execution must be reflected in the accounting of a budgetary institution with the following entries:

| Debit | Credit | Operation description |

| 2.201.11.510 | 2.205.41.660 | Funds received into the personal account of a budgetary institution (payment to the beneficiary of the amount for which the bank guarantee was issued) |

| 2.205.41.560 | 2.401.10.140 | Accrual of income in the amount of security under a bank guarantee in the event of its receipt at the disposal of a budgetary institution |

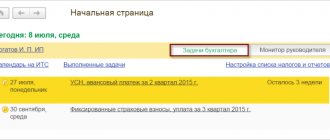

Tax accounting

The guarantee from the bank must be reflected in both the accounting and tax records of the organization. Tax accounting of bank guarantees is carried out in accordance with the norms of the Tax Code of the Russian Federation. The remuneration is taken into account as part of other costs associated with the production and sale of various products, and as other expenses.

The Tax Code of the Russian Federation requires the submission of reports to the Federal Tax Service, including the costs of a bank guarantee during the period of its actual provision, and not according to the timing of payment of monetary amounts under it. In tax accounting, the date of receipt of a bank guarantee is considered the day of signing the agreement (main agreement) on the issuance of guarantee obligations to the client.

Tax accounting of bank guarantees has a number of nuances. The purchase of goods, works and services under a contract is subject to VAT, with the exception of products not subject to value added tax. Operations involving the use of bank guarantees are not subject to VAT (subclause 3, clause 3, article 149 of the Tax Code of the Russian Federation).

After receiving payment of the guarantee for the obligations not fulfilled by the supplier from the guarantor bank, the beneficiary-customer includes it in income in the same way as the payment of the principal would be taken into account without the use of a bank guarantee.

The principal has the right to take into account expenses under the guarantee (commission to the guarantor) for tax accounting purposes either as other expenses or as non-operating expenses. In any of these cases, costs are recognized throughout the entire validity period of the bank guarantee in equal parts (Letter of the Ministry of Finance of the Russian Federation No. 03-03-06/1/4 dated 01/11/2011).

Lease legal relations

Separately, we should consider the situation when the principal at first clearly and according to the contract paid for all supplies to the beneficiary, but then one day he suddenly stopped doing this (while the guarantee continued to be valid). Such cases are common when renting commercial real estate.

Payments upon transfer of an object for paid use, made on time, are reflected in the entry Dt inc. 26 Kt. 76 in accordance with the frequency of deductions (for example, once a month).

It is advisable to account for the commission in tax accounting:

- Until the rent payment terms are violated - by synchronously debiting the commission with payments (monthly, for example).

- After the suspension of payments (and the application of the guarantee as a result) - by writing off the balance of the commission as expenses.

In accounting, the same entries are used as for rent, and the commission is written off as a lump sum immediately after the guarantee is applied.

Postings in the accounting of the principal in case of failure to fulfill an obligation

Situations often arise when the principal did not manage to fulfill his obligations under the contract, after which the beneficiary turns to the bank to receive the funds due to him under the contract from the guarantor. The guarantor notifies the principal about this and informs about the termination of the warranty obligations. The principal is obliged to reimburse the bank for the amount that it transferred to the beneficiary.

If the principal needs to recognize the bank’s regressive claim in accounting, then transactions in the event of failure to fulfill obligations are reflected in accounting entries:

| Debit | Credit | Operation description |

| 60 | 76 | Obtaining a guarantor's recourse claim |

| 76 | 51 | Repayment of debt to the bank |

Reflection of transactions under an independent guarantee in banking accounting: nuances

The main feature of the procedure in question is the use by the guarantor of special accounting accounts, those established by Bank of Russia Regulation No. 579-P dated February 27, 2017. The most typical transactions when applying a bank guarantee include:

- Dt 99998 Kt 91315 (in the amount of the guaranteed obligation of the principal to the beneficiary) - an independent guarantee issued by the bank;

- Dt 47423 Kt 70601 (in the amount of commission) - commission received from the principal;

- Dt 70606 Kt 47425 (in the amount of the guaranteed obligation and further in the transactions, unless otherwise indicated) - reserves have been formed in case of need for payment to the beneficiary.

If the security as a condition for issuing a guarantee is represented by a deposit, then the fact of its acceptance is reflected by the posting Dt (principal account) Kt (passive account for accounting for receipts from clients, for example 43001).

If a bank guarantee is written off as required by law, the following posting is applied: Dt 91315 Kt 99998. The reserve is immediately reduced: Dt 47425 Kt 70601.

If the principal does not pay the beneficiary, then the bank does this and reflects it by posting Dt 60315 Kt (beneficiary’s account). The payment is immediately written off by the bank from the guarantee: Dt 91315 Kt 99998. The reserve is similarly reduced using the above account correspondence. A new reserve is immediately formed for possible losses in the amount to be recovered from the principal: Dt 70606 Kt 60324.

Reimbursement of bank expenses from a previously credited deposit: Dt 99998 Kt 91312. Reduction of the reserve due to partial reimbursement of bank costs: Dt 60324 Kt 70601.

Reimbursement of the balance of bank expenses by the principal: Dt (principal's account) Kt 60315. Reduction of the reserve: Dt 60324 Kt 70601.

The most important nuance of a bank guarantee is taxation.

Accounting for payment of commission for issuing a guarantee

For the guarantor, the issuance of security under the contract is a source of income, therefore, the principal will have to pay a certain commission for the bank to issue the guarantee. Such a commission can be fixed, or calculated as a percentage of the contract amount or by other methods.

In the bank guarantee agreement, the bank has the right to stipulate various conditions for the payment of obligations. For example, an obligation may be established for the principal to make a one-time or evenly distributed payment over the entire period of validity of the guarantee.

Postings to reflect the commission on a bank guarantee

The procedure for reflecting the commission depends on the moment of acquisition and registration of the acquired property.

If the commission is transferred to the bank before the purchased assets are registered and before the funds are transferred by the principal, then the credit institution’s remuneration is included in the expenses for the acquisition of property - in its cost (clause 6 of PBU 5/01, clause 8 of PBU 6/01 ).

Let's show it with an example. Zarya LLC acquires the building from Aktiv LLC. The cost of the property is 1,500,000.00 rubles. Zarya LLC provides the seller with a guarantee from the bank. The guarantor's commission is 3% of the value of the property - 45,000.00 rubles. The fee must be paid in one lump sum. The commitment is issued for a period of one month. The transaction was completed, all mutual settlements were made on time, no warranty obligations were applied.

| Accounting records | Product cost, rub. | Operation description | |

| Debit | Credit | ||

| 76 | 51 | 45 000,00 | Transfer of commission to the guarantor |

| 08 | 76 | 45 000,00 | The commission amount is included in the cost of construction |

| 08 | 60 | 1 500 000,00 | Reflection of the cost of construction as part of non-current assets |

| 01 | 08 | 1 545 000,00 | Reflection of the cost of construction as part of the principal's fixed assets |

If the guarantee obligations were provided after the value of the property asset was formed, then it is no longer possible to change the amount of the recorded asset by including the amount of remuneration to the guarantor in the initial cost of the property.

If the bank commission, which was paid before the initial cost of the asset was formed, is included in other expenses, this may affect the calculated property tax. In 2020, property tax is calculated according to new rules. All movable property is excluded from the base. This means that when purchasing a property, writing off bank fees for other expenses may lead to a distortion of the tax base.

The accounting entries will be as follows: Dt 91.2 Kt 76 - accounting for the commission to the bank, the amount of which is not included in the initial cost of the purchased object.

Tax purposes

When preparing tax reporting, you should remember that VAT is not charged for transactions involving the use of bank guarantees. The rule does not apply to beneficiaries using SOS.

The possibility of working with VAT is possible if:

The bank's payment to the beneficiary is entered into the "income" section and is calculated on a general basis.

The principal classifies the expenses as other or non-operating expenses.

Which entries take into account the commission for issuing a bank guarantee. Even distribution of expenses

Much depends on the principal’s field of activity. Below is a list of codes:

- Inclusion of the guarantor's remuneration in deferred expenses immediately after the guarantee is issued: Dt 97, Kt 76 (commission amount);

- Part of the amount was written off according to the payment schedule: Dt 91.2 Kt 97 (part of the commission amount, calculated in proportion to the duration of the guarantee period)

Whether the commission is transferred in one payment or evenly split depends on the characteristics of the assets and depends on a number of criteria. The main dynamics of the ratio of income and expenses by reporting periods. You need to focus, first of all, on the characteristics of assets. If these are sequential supplies of raw materials and materials, the “uniform” approach in question is justified.

Features of accounting policies

The remuneration to the guarantor under the loan agreement must be reflected in the accounting policies of the organization. When concluding a loan agreement, one of the conditions of the agreement may be the mandatory execution of guarantee obligations. In such cases, the costs are borne by the borrower himself. The procedure is specified in PBU 15/2008 “Accounting for expenses and borrowings on loans.” The borrower is obliged to consolidate the chosen method in the accounting policy. Remuneration costs can be classified as other expenses (clause 7 of PBU 15/2008) or additional borrowing costs can be recognized evenly as part of other expenses (clause 8). This can only be done during the validity of the loan agreement itself. The correspondence of the accounting accounts will not change depending on the choice of cost distribution method and will be as follows:

| Posts | Operation description | |

| Debit | Credit | |

| 91.2 | 76 | Reflection of full or partial bank commission |

| 76 | 51 | Accounting for the amount of guarantor's remuneration paid |

The write-off methodology can be presented schematically:

Important points

Please note that the procedure for deducting commission to the bank - in equal parts or in one payment - is fixed in the accounting policy. The corresponding requirement follows from the provisions of PBU 1/2008.

You may be interested in: How to find out the balance of the Tinkoff card: all available methods

The key criterion for choosing a uniform distribution of costs is the dynamics of revenues associated with the corresponding costs. If income is distributed over several reporting periods, then expenses should be shown synchronously in accounting.

When choosing an approach, you should focus on the characteristics of the assets. If supplies of materials and raw materials are carried out consistently, then an even distribution of costs will be more justified.