How to switch from the simplified tax system to the general taxation system (OSNO)

The reasons for the transition from the simplified taxation system (STS) to the general taxation system (OSNO or OSN) can be varied, since these regimes have serious differences. You can learn more about them from the material on our website by clicking on the link: OSNO or simplified tax system - which is more profitable.

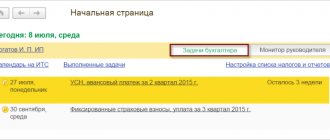

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

Before changing the tax regime, you need to take into account that for an LLC, the transition from the simplified tax system to the OSNO entails 2 types of consequences:

- Changes in tax accounting, types of taxes paid (and related tax periods, etc.).

- Changes in the essential terms of contracts executed by the organization (the need to allocate VAT as part of the price).

The Tax Code of the Russian Federation (hereinafter referred to as the Tax Code of the Russian Federation) gives a clear answer to the question of how to switch to OSNO LLC on the simplified tax system: in paragraph. 2 p. 1 art. 346.11 of the Tax Code of the Russian Federation states that this action is carried out voluntarily. Nevertheless, the option of transition is possible not in accordance with a premeditated decision, but involuntarily: the organization leaves the special regime if it no longer meets its criteria. Let's consider all situations and the mandatory procedure.

Transition to the simplified tax system in the middle of the year

As mentioned earlier, an individual entrepreneur or an enterprise can switch to using the simplified procedure only at the beginning of the year. However, in special cases it is possible to switch to the simplified tax system in the middle of the year. This opportunity is provided to newly registered companies. Within thirty days after registration of a legal entity or individual entrepreneurship. However, this restriction is quite relative, since they cannot refuse such an organization if it applies at a later date. Otherwise, the procedure for switching to the simplified tax system is no different from the procedure for switching to the simplified tax system according to the general scenario:

- An individual entrepreneur or legal entity determines the form of taxation and decides that it will apply the simplified tax system;

- Form 2-1 is filled out;

- The completed notification is submitted to the authorized body of the Federal Tax Service;

- A response from the Federal Tax Service is expected;

- If the answer is positive, a book of income and expenses is opened, and their accounting begins according to the rules of the simplified tax system.

Important ! When choosing a tax system, you should remember that the simplified tax system has two varieties: the simplified tax system “Income” with a single tax rate of 6%, as well as the simplified tax system “Income minus Expenses”, the rate of which is 15%. The sizes of the presented rates may vary by region, but their size cannot be less than 1% and 5%, respectively. Also, the amount of non-regional tax cannot exceed the established limits.

When can you switch from simplified tax system to OSNO

In Art. 346.13 of the Tax Code of the Russian Federation establishes the deadlines for the transition to a general taxation system with the simplified tax system for 2 options:

- On the organization’s own initiative - from January 1 of the following year, if the simplified tax system was used before this date. It is impossible to change the regime at your own discretion during the year (tax period) in which the simplified tax system is used (clauses 3, 6 of article 346.13 of the Tax Code of the Russian Federation).

- As a result of a situation when an organization no longer meets the criteria for the possibility of using the simplified tax system - from the 1st day of the quarter (reporting period) in which the corresponding fact occurred (clause 4 of article 346.13 of the Tax Code of the Russian Federation).

The event that makes up the second option sometimes occurs unplanned for the taxpayer, so they often use a peculiar turn of phrase: they say that he has fallen off the simplified tax system. This is mainly due to excess revenue, but there are many other reasons.

Thus, the timing of the beginning of the application of another regime is associated only with the onset of a certain period, and not with the date of performance of other actions (notification of the tax authority, receipt of any permit).

Organizations that will definitely be denied application of the simplified tax system

The Russian Tax Code provides for the transition to “simplified taxation” only for certain types of activities.

Thus, the following organizations are guaranteed to be denied the transition to the simplified tax system: (click to expand)

- Non-state pension funds;

- Insurance organizations;

- Credit and microfinance organizations;

- Pawnshops;

- Notary and legal offices;

- Brokerage houses and private brokers;

- Investment funds and other organizations engaged in investment activities;

- Casinos and other organizations representing the gambling business;

- Organizations engaged in the production and sale of excisable goods

How can you fly from the simplified tax system to OSNO?

You can automatically leave the special mode due to (clause 4 of Article 346.13 of the Tax Code of the Russian Federation):

- extracting total income in excess of the limit;

- making an entry in the Unified State Register of Legal Entities about the branch (subclause 1, clause 3, article 346.12 of the Tax Code of the Russian Federation);

- conducting an inappropriate type of activity, for example, providing personnel services under an outstaffing agreement (subclauses 2–7, clause 3, article 346.12 of the Tax Code of the Russian Federation, etc.);

- increasing the legal entity’s share in the authorized capital to over 25% (subclause 14, clause 3, article 346.12 of the Tax Code of the Russian Federation);

- staff number of more than 100 people (subclause 15, clause 3, article 346.12 of the Tax Code of the Russian Federation);

- exceeding the limit on fixed assets (subclause 16, clause 3, article 346.12 of the Tax Code of the Russian Federation), etc.

It is necessary to think in advance about how to switch from the simplified tax system to the OSN, since the OSN begins to apply from the first day of the reporting period in which one of the listed circumstances arose.

Let's look at some new legislation, procedures and necessary actions in case of a change in the taxation regime.

Method two is to return the entire advance amount to the buyer.

Before January 1 of the year from which the company will apply the simplified taxation system, it must:

- conclude an agreement with the buyer on the return of the advance payment or on termination of the contract;

- transfer to the buyer the entire advance amount, including VAT;

- register in the purchase book the invoice that the organization compiled when receiving an advance from the buyer (clause 22 of the Rules for maintaining the purchase book used in VAT calculations);

- deduct VAT from the amount of the advance payment returned to the buyer (clause 5 of Article 171 of the Tax Code of the Russian Federation).

This is interesting: Declaration of deduction for the purchase of an apartment 2020

Transition from simplified taxation system to OSNO in 2020: what has changed

Since 2020, the norms of the Tax Code of the Russian Federation regulating the use of the simplified tax system have undergone changes regarding increasing the limits:

- In terms of income - up to 150 million rubles. (law of November 30, 2016 No. 401-FZ).

- The cost of fixed assets is up to 150 million rubles. (Law dated July 3, 2016 No. 243-FZ).

Therefore, to determine whether a transition from the simplified tax system to the OSNO is needed in 2020 - 2020, you should use the specified data. The rest of the changes are not so significant. For example, with the simplified tax system taking into account expenses (at a rate of 15%), it became possible to include in expenses the costs of an independent assessment of the qualifications of employees (subclause 33, paragraph 1, article 346.16 of the Tax Code of the Russian Federation, as amended by Law No. 251-FZ dated July 3, 2016).

Simplified taxation system

• to pay for the services of specialized organizations for the production of documents for cadastral and technical registration (inventory) of real estate (including title documents for land plots and documents on land surveying);

(1) material expenses, as well as labor costs - at the time of repayment of the debt by writing off funds from the taxpayer’s current account, payment from the cash register, and in the case of another method of repaying the debt - at the time of such repayment. A similar procedure applies to payment of interest for the use of borrowed funds (including bank loans) and when paying for services of third parties. In this case, the costs of purchasing raw materials and materials are taken into account as expenses as these raw materials and materials are written off for production;

How to transfer an LLC from the simplified tax system to OSNO: informing the tax authority

The tax authority must be notified of the start of the application of the OSN. Despite the absence of a requirement in the Tax Code of the Russian Federation to adhere to the notification regulations, it is advisable to draw up a notification in Form 26.2-3, recommended by Order of the Federal Tax Service of the Russian Federation dated November 2, 2012 No. ММВ-7-3/ [email protected] Such a message is sent to:

- until January 15 of the year in which the use of the OSN began (clause 6 of Article 346.13 of the Tax Code of the Russian Federation);

- until the 15th day of the first month of the quarter following the one in which circumstances occurred that prevented the continued use of the simplified tax system (clause 5 of article 346.13 of the Tax Code of the Russian Federation).

In judicial practice, notification made in another written form, for example in the form of a statement, is recognized as proper (resolution of the FAS VSO dated September 12, 2007 in case No. A19-21365/06-40).

IMPORTANT! The notification must be sent in such a way as to have confirmation of sending (by registered mail, transmission via a connected telecommunications channel (TCC)).

The transition to OSNO is carried out by notification, so there is no need to expect any response from the tax authority.

If for some reason the organization has violated the given deadlines, then the organization cannot use the STS until the end of the tax period. See paragraph 4 of the review of judicial practice of the AS SKO dated 10/13/2017.

Regulatory regulation of the simplified taxation system

Taxpayers are organizations and individual entrepreneurs that have switched to a simplified taxation system. The transition to a simplified taxation system is carried out voluntarily by organizations and individual entrepreneurs. An organization has the right to switch to a simplified taxation system if, based on the results of nine months of the year in which the organization submits an application to switch to a simplified taxation system, income determined in accordance with Article 248 of the Tax Code does not exceed 15 million rubles. The specified value of the maximum amount of income of the organization, limiting the right of the organization to switch to a simplified taxation system, is subject to indexation by a deflator coefficient, established annually for each subsequent calendar year and taking into account changes in consumer prices for goods (work, services) in the Russian Federation for the previous calendar year. The deflator coefficient is determined and subject to official publication in the manner established by the Government of the Russian Federation.

Necessary steps to switch from simplified tax system to OSNO

In addition to the need to notify the tax authority about the transition from the simplified tax system to the OSNO, the timing and scope of some other responsibilities of the taxpayer may change:

- Submission of a declaration according to the simplified tax system:

- until March 31 (IP - until April 30) of the year from which the application of the STS began (subclause 1, clause 1, Article 346.23 of the Tax Code of the Russian Federation), i.e. within the usual period, if the STS will be applied not on the basis of a violation of the criteria of the simplified tax system, but on your own initiative;

- until the 25th day of the month following the quarter in which the forced regime change took place (clause 3 of Article 346.23 of the Tax Code of the Russian Federation).

- Payment of tax according to the simplified tax system is within the same period as the tax return is submitted in each of the above situations (clause 7 of article 346.21 of the Tax Code of the Russian Federation).

Due to the difference in the rules for calculating payments under the general and special regimes, some additional responsibilities arise.

Simplified taxation system

14) organizations and individual entrepreneurs whose average number of employees for the tax (reporting) period, determined in the manner established by the federal executive body authorized in the field of statistics, exceeds 100 people;

If, at the end of the reporting (tax) period, the taxpayer’s income exceeded 20 million rubles and (or) during the reporting (tax) period there was non-compliance with the requirements established by the Code, such taxpayer is considered to have lost the right to apply the simplified taxation system from the beginning of that quarter, in in which the specified excess and (or) non-compliance with the specified requirements was allowed.

Transfer from simplified tax system to OSNO: transition period

When changing the taxation regime from the simplified tax system to the OSNO, a transition period is inevitable, since it is necessary to bring the documentation into compliance with the OSNO:

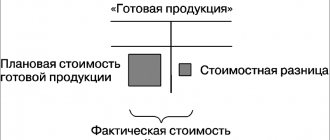

- For income tax:

- choose an accounting method (cash or accrual method) and determine in what period transactions are subject to accounting in accordance with clause 2 of Art. 346.25 Tax Code of the Russian Federation;

- determine the value of property as part of fixed assets in accordance with clause 3 of Art. 346.25 Tax Code of the Russian Federation.

- For VAT: from among current transactions, select those for which tax can be deducted, and also charge it if necessary. Difficulties may arise with this, since the beginning and end of execution under the contract in some cases are not simultaneous. In addition, difficulties arise with accruals under ongoing contracts, primarily supply contracts.

The transition to a simplified taxation system is carried out by organizations

34) expenses in the form of negative exchange rate differences arising from the revaluation of property in the form of foreign currency values and claims (liabilities), the value of which is expressed in foreign currency, including on foreign currency accounts in banks, carried out in connection with a change in the official exchange rate of foreign currency to the ruble Russian Federation, established by the Central Bank of the Russian Federation;

32) periodic (current) payments for the use of rights to the results of intellectual activity and means of individualization (in particular, rights arising from patents for inventions, industrial designs and other types of intellectual property);

Income

In their composition, the enterprise must include the amount of receivables generated during the application of the simplified tax system. The simplified method uses the cash method. Income is generated as funds are received, regardless of the date of sale. Accordingly, during the period of application of the simplified tax system, the cost of shipped but not paid for products (works/services) was not taken into account as part of income.

When using the accrual method, the procedure is slightly different. The entity includes the proceeds in income as they are shipped. Accordingly, after the transition to OSNO, the cost of products sold but not paid for is reflected in revenue.

Regardless of the date of actual repayment of receivables, the increase in income must be carried out in the month of transition to the general taxation system. When payment is received for goods (services/work) sold while using the simplified system, VAT is not charged after the transition to OSNO. This rule follows from the provisions of sub-clause. 1 and para. 2 subp. 2 2 paragraphs of Article 346.25 of the Tax Code, and is also confirmed by the explanations of the Ministry of Finance.