Home — Articles

Starting from the financial statements for 2011, the line “Deferred expenses” was removed from the newly approved form of the balance sheet , since the tax service and the Ministry of Finance recommend using these new forms directly from the statements for the first quarter of 2011 (Letter of the Federal Tax Service of Russia dated April 18, 2011 N KE -4-3/6116; Letter of the Ministry of Finance of Russia dated January 24, 2011 N 07-02-18/01). Subsequently, provisions relating to deferred expenses were excluded from the Regulations on accounting and financial reporting in the Russian Federation (Clause 65 of Regulations No. 34n). This state of affairs has caused mixed reactions and confusion in the accounting community. A huge number of questions and discussions arose about whether account 97 “Deferred Expenses” should be gotten rid of, and if so, what to do with the amounts that are listed on it.

Accountants find account 97 convenient, and they don’t want to part with it

The threat looming over account 97 showed how much our accountants love it. This love, of course, is based on purely pragmatic reasons: to account 97 you can write off amounts that now, for one reason or another, cannot (or do not want) to be recognized in current expenses. There may be several reasons. Reason 1. We are afraid to write off a significant amount of costs immediately as expenses. For example, the organization made expensive equipment repairs. Even if the accountant believes that the amount of expenses for these repairs can be fully recognized in current expenses, he is afraid to do so. Moreover, the reason for such fears is not only in possible claims from inspectors, but also in the reluctance to spoil one’s reporting and reduce current financial indicators (even if in the end we still make a profit). Reason 2. Hiding losses There is no need to particularly explain what we are talking about. Everyone knows that tax authorities do not like losses - they are even one of the criteria for selecting applicants for on-site audits (Concept of a planning system for on-site tax audits, approved by Order of the Federal Tax Service of Russia dated May 30, 2007 N MM-3-06 / [email protected] ) . Therefore, accountants (sometimes at the suggestion of inspectors) hide current expenses in account 97. And here it doesn’t matter at all how significant this or that amount of expense is. After all, even a few insignificant amounts accumulated during the year can ultimately lead to a loss. Everyone, of course, understands that this reflection of expenses is incorrect. But still, sometimes they consciously go for it. Reason 3. We are trying to “bring up” accounting for tax purposes. One of the common situations is the sale of a fixed asset at a loss before the expiration of its useful life. According to tax accounting rules, such a loss cannot be recognized immediately: it must be written off gradually over the remaining service life (Subclause 1, clause 1, clause 3, Article 268 of the Tax Code of the Russian Federation). Therefore, accountants prefer not to write off the result from the sale of fixed assets (the loss identified in subaccount 01-“Disposal of fixed assets”) to account 91 “Other income and expenses”, but to reflect it on account 97 “Deferred expenses”. And write off gradually over the same period as in tax accounting. Of course, this is convenient, but completely wrong. Another similar example is licenses to engage in certain activities. In tax accounting, accountants are wary of including the cost of expensive licenses as expenses. After all, there are Letters from the Ministry of Finance recommending that the amount of the state fee for issuing a license be written off evenly during the validity period of the license itself (Letters from the Ministry of Finance of Russia dated 08/16/2007 N 03-03-06/1/569, dated 05/31/2007 N 03-03-06/ 1/353).

Note There are other letters from the financial department in which the Ministry of Finance expresses a different opinion on the procedure for recognizing license expenses in tax accounting. In defense of the one-time recognition of the cost of the license as expenses, he gives the following arguments: - the provision of paragraph 1 of Art. 272 of the Tax Code of the Russian Federation on the distribution of expenses between periods can only be applied to expenses arising within the framework of civil contracts. And in relation to other expenses (for example, arising from the norms of the law) clause 1 of Art. 272 of the Tax Code of the Russian Federation does not apply. Therefore, there is no need to distribute the cost of the license over all periods of its validity (Letter of the Ministry of Finance of Russia dated October 15, 2008 N 03-03-05/132); — the state duty is a federal tax (Clause 2 of Article 8, Clause 10 of Article 13 of the Tax Code of the Russian Federation). Therefore, its amount must be recognized as expenses at the time of accrual (Subclause 1, clause 1, Article 264, subclause 1, clause 7, Article 272 of the Tax Code of the Russian Federation; Letter of the Ministry of Finance of Russia dated November 30, 2005 N 03-03-04/1/399; Resolutions of the Federal Antimonopoly Service of the Moscow Region dated August 12, 2009 N KA-A40/7313-09; Federal Antimonopoly Service of the Eastern Military District dated November 30, 2006 in case No. A28-3289/2006-109/21).

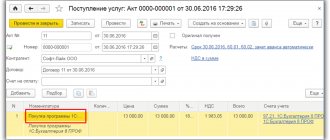

Reason 4. It is convenient for us to reflect all amounts that need (or simply decided) to be written off evenly over several months on account 97. Convenience, first of all, provides the ability to automatically write off amounts from account 97 on a monthly basis in the program. Such a mechanism is included in most accounting programs . There is no need to manually make entries every month - everything is done automatically. And what is important is that for such posting the program does not require entering the details of any document (act of work or provision of services, invoice, etc.). That is why some accountants deliberately take into account the amounts of some advances (for example, payments under insurance contracts) in account 97. In addition, some prefer to record all the amounts that need to be gradually recognized as expenses somewhere in one place (both the amounts that actually relate to future periods and the amounts of advances for services or rent and other obscurities). After all, if such gradually written-off amounts are scattered over several accounts (for example, one part is left on account 97, and the rest - on different sub-accounts to account 76 “Settlements with different debtors and creditors”), then the likelihood of an error increases - it is possible from some write them off, and forget from some accounts. Yes, and more work.

Conclusion So, as a result of an unsystematic approach to the use of account 97 in the accounting of many organizations, that very “garbage dump” was formed on it, which previously smoothly passed into accounting in the form of a completely unclassifiable amount, it is not clear what it meant. But this is wrong, because it does not give an idea of the real picture of assets, expenses and financial results.

Tax accounting RBP

such concept as “deferred expenses” in the tax code . However, it reflects the taxation of certain types of costs that can be classified as BPR.

According to Tax legislation, these are the following costs:

- produced for the development of natural resources (Article 261 of the Tax Code of the Russian Federation);

- for various engineering or development projects (Article 262 of the Tax Code);

- for compulsory or voluntary medical insurance for their employees (Article 263 of the Tax Code of the Russian Federation).

According to paragraph 6 of Art. 272 of the Tax Code of the Russian Federation, expenses of an enterprise that appeared after insuring employees under compulsory medical and voluntary medical insurance are considered expenses of the reporting period in which they arose.

If the contract was concluded for a period longer than the reporting period, and the contribution was a one-time payment, then the costs are distributed over the entire period of validity of the insurance contract.

If, according to the insurance contract, the insurance premium is paid in installments , then expenses are taken into account according to the periods of making payments to repay the installments, for example, a quarter or half a year.

RBP under simplified tax system

If an enterprise applies a preferential tax regime - the simplified tax system, then the accountant must reflect the RBP in the book of income and expenses. Also, an enterprise that applies the simplified tax system can reduce the amount of single tax payable by the amount of the RBP. But this is only possible if the tax base is “Income reduced by expenses.”

Account 97 “Future expenses” has not been canceled

Let's see what exactly happened in 2011 with deferred expenses in connection with the amendments that came into force on January 1 of this year. (!) Deferred expenses were “removed” from the reporting . The changes made by the Ministry of Finance are aimed at eliminating confusion in reporting and streamlining the amounts previously reflected as financial statements in the financial statements: - in the approved form of the balance sheet there is now no line to reflect deferred expenses; — clause 65 of Regulation N 34n now sounds like a reference norm: when determining the costs of the reporting period, it directs accountants to the relevant PBUs that regulate the conditions for recognizing various assets. Deferred expenses themselves are not mentioned.

Note If there is a faceless asset “BPO” in the financial statements, this complicates its transformation into an international one. Moreover, such a “reserve” cannot automatically be matched with assets/expenses according to the rules of international accounting (in the old form of the balance sheet, it was in the “Inventories” section that a line was provided to reflect future expenses). It is required to raise the analytics of account 97 and “sort out” what, where and when to assign. Therefore, supporters of a speedy transition to IFRS are advocating for the removal of the concept of “deferred expenses” from all accounting regulations, including the Chart of Accounts.

So now there simply shouldn’t be lines in the reporting that reflect a mass of heterogeneous amounts (if they are, of course, significant). And the materiality of the indicator must be determined independently (Clause 3 of Order of the Ministry of Finance of Russia dated July 2, 2010 N 66n), taking into account that the reporting provides users with real information to assess the financial position of the organization and the results of its activities (Clause 11 PBU 4/99 “Accounting statements of the organization ", approved by Order of the Ministry of Finance of Russia dated July 6, 1999 N 43n). (!) Deferred expenses have been preserved in accounting . These expenses are still named in several accounting regulations. Firstly, the mechanism for transferring costs to the future is still provided for by PBU 10/99 “Costs of the Organization” (Clause 9, 19 PBU 10/99 “Costs of the Organization”). This is the most important obstacle to eliminating account 97 from the accountant’s “combat reserve”. It still requires that carryover costs related to the generation of income in the future be reasonably distributed between reporting periods (Clause 19 of PBU 10/99).

Note By the way, there is a similar rule in tax accounting. When calculating the income tax base, expenses are recognized in the period to which they relate, regardless of their payment (Clause 1, Article 272 of the Tax Code of the Russian Federation). And for an accountant who does not particularly need to scrupulously follow the rules of international accounting, this is another serious argument for using account 97. Of course, everyone knows that accounting and tax accounting are two independent systems. But if in accounting you write off expenses one time, and in tax accounting - gradually, then the result is clear to everyone: hello, the differences according to PBU 18/02! But no one is happy about them, and everyone is trying to minimize them.

Secondly, reference to deferred expenses remains in other accounting regulations. Here they are: - clause 39 of PBU 14/2007 “Accounting for intangible assets” (Approved by Order of the Ministry of Finance of Russia dated December 27, 2007 N 153n); — clause 16 PBU 2/2008 “Accounting for construction contracts” (Approved by Order of the Ministry of Finance of Russia dated October 24, 2008 N 116n); — clause 94 of the Guidelines for accounting of inventories (Approved by Order of the Ministry of Finance of Russia dated December 28, 2001 N 119n); — clause 16 of the Methodological Instructions for the preparation of financial statements when reorganizing organizations (Approved by Order of the Ministry of Finance of Russia dated May 20, 2003 N 44n) (these Instructions show the costs of purchasing a license as an example of future expenses); — Chart of accounts for accounting and Instructions for its application (Approved by Order of the Ministry of Finance of Russia dated October 31, 2000 N 94n).

Conclusion Now the Ministry of Finance has taken only the first step: it forced the identification of deferred expenses when preparing financial statements (of course, if the amount of expense/asset is significant). Now there should be no significant impersonal amounts on the balance sheet. But for now we are not talking about eliminating account 97 “Future expenses”. Yes, this is impossible to do now - until the very mechanism of transferring simple costs (not related to the acquisition of depreciable property) to the future is abolished (Clause 19 of PBU 10/99). And if accounting regulations provide for the transfer of costs to the future, then you can use it until the Ministry of Finance puts its PBUs and other regulations in order.

Why are future costs necessary?

This means that the organization spent money now, but will write off the amount as expenses later. In this case, accounts receivable and accounts payable are closed in the current period. Such expenses include:

- property insurance costs;

- purchasing licenses;

- mandatory product certification;

- non-exclusive rights to software products;

- land reclamation;

- mining preparatory work.

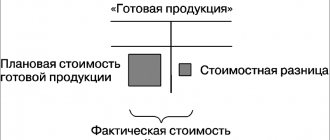

In accounting, account 97 is classified as active, so all expenses are written off to the debit of other accounts. Accordingly, loan turnover reduces the debit balance. Amounts are shown net of value added tax.

Read more: Filling out an empty envelope sample Russian Post

Note from the author! Active accounts are those whose balances can only be accumulated by debit. This has an impact on the structure of the balance sheet. In this case, “active” literally means an asset on the balance sheet.

Analytical accounting of deferred expenses (FPR) is carried out for each incoming asset. This means that each name will have its own card, which indicates:

- Name;

- contract amount;

- recognition of expenses in days or months;

- write-off period corresponding to the validity period specified in the contract;

- accounting account for writing off costs;

- cost item.

For each type of future expenses, its own subaccounts were provided:

- 97.01 is usually intended for labor costs for future periods (vacation, compensation for dismissal).

- 97.02 is used to account for the costs of voluntary insurance of employees.

- 97.21 is used for other expenses.

Reference! After the release of Order of the Ministry of Finance of the Russian Federation No. 186n dated December 24, 2010. RBP for wages are taken into account in account 96 “Reserves for future expenses”, and subaccount 97.02 is used for insurance of any type provided for in the organization. Paragraph 65 of the order states that costs can be written off in the same way as other assets. However, most enterprises prefer to continue to separately account for assets that extend into the future.

We decide what we will change in our accounting

It's no secret that not all organizations are sensitive to their financial statements. For many small enterprises, the users of reporting often include only the tax office and management (and even they are interested in the balance sheet purely formally). It is clear that accountants of such organizations do not have a serious incentive to keep accounting records perfectly. Of course, there are fines for incorrectly recording transactions (Clause 1 - 3 of Article 120 of the Tax Code of the Russian Federation), but for many they seem illusory (if only because tax inspectors, as a rule, do not know accounting very well). As a result, some accountants decided not to change anything at all in the accounting procedure for RBP - after all, this is not such a fundamental point as, for example, the limit on the cost of fixed assets. Some have found a compromise: to leave everything on account 97 as it was before (even if this is not an ideal accounting option), and in order to correctly fill out the reporting, significant amounts of costs included in the BPR are allocated and shown separately in the balance sheet. But those who still want the accounting of their own organization to meet the requirements will have to try. The confusion on account 97 can and should be gotten rid of. This means that changes need to be made to the accounting policies. To outline the range of such changes, you need to decide which business transactions you will account for differently than you did before. And for this you need to take inventory of your account 97: - leave what can be safely called assets in account 97. Each of these assets must be given specific names and for each group of homogeneous assets it is better to allocate a sub-account in account 97. This will make it easier to fill out accounting records ; — what fits our concept of expenses should not be on account 97. And in the future, you will immediately recognize such costs when calculating the financial result of the current period (they will be taken into account in the income statement).

Attention! If changing accounting requirements affect your operations, you will need to make changes to your accounting policies. And they must act from the beginning of the year.

Note that the concept of an asset in our accounting is very vague and almost everything in the world fits under it (assets are any economic assets over which the organization has gained control and which should bring it economic benefits in the future (Clause 7.2 of the Concept of Accounting in a Market Economy Russia)). Therefore, it is better to think more pragmatically. To classify a certain amount, you check that something to see whether you can sell it to someone else or not. If you can sell it, then you have an asset (for example, the costs of preparing for production will form the cost of the finished product, which you can sell). If you can’t sell something, it means you have the expense now, and not in some indefinite future. For example, you receive a license for your specific activity, and even if you stop doing it, no one will return the money to you, and it cannot be transferred to anyone else. This means that it is quite logical to recognize the license as an expense and not an asset. Changes in the accounting methods you use must be in effect from 01/01/2011 - after all, they are associated with the entry into force of Order of the Ministry of Finance of Russia dated December 24, 2010 N 186n, which amended the accounting regulations (Clause 10 PBU 1/2008 “Accounting Policy of the Organization” ). And since there are no transitional provisions in Order No. 186n, changes to the reporting, in an amicable way, need to be made retrospectively (Clause 14, 15 of PBU 1/2008). True, most organizations ignore this requirement (and some even despite the fact that their reports are checked by auditors). The reason is that the retrospective method is difficult because if you change accounting methods, you will have to restate the opening balances in the accounting accounts as of January 1. The reporting data as of 12/31/2009 and as of 12/31/2010 (these data appear in the current reporting for 2011) must be presented in an already recalculated form - as if your new accounting method had been used by you before. Those who do not want to apply the retrospective method will prefer to write off amounts that now need to be recognized in accounting as a lump sum as expenses of the current period (to account 91 “Other income and expenses”). Accountants explain this approach by the fact that Order No. 186n contains no transitional provisions on this issue, and it is quite difficult to clearly recognize the old procedure for reflecting amounts in accounting as an error as such. In addition, do not forget that small enterprises (except for issuers of publicly offered securities) can legitimately reflect changes in accounting policies prospectively - that is, in the current period (Clause 15.1 of PBU 1/2008). Which method (retrospective or not) you will use, if you decide to make changes at all, choose for yourself. But you will need to declare it in the explanatory note to the reporting.