The term “buy 1C: Accounting” indicates that the buyer does not purchase the software product itself, but the right to use it. The current provision in Russia, PBU 14/2007, classifies such software as an intangible asset that must be reflected in the balance sheet.

If payment for the purchase was made in a one-time payment, then the expenses incurred are classified as deferred expenses, after which the write-off will occur in installments throughout the entire term of the agreement for using the program.

In some cases, the license agreement does not establish deadlines. In such a situation, the user independently, taking into account his accounting policies, determines the period of operation of the purchased software.

For example, consider a situation in which a company purchased a license for the right to use the 1C program, paying 13 thousand rubles for it. The funds are charged to deferred expenses and will be written off to account 26 “General business expenses” with a write-off period of 24 months in equal installments.

Purchasing software

The fact of purchasing the software is reflected in the 1C program with the document “Receipt of goods and services”, and a note is made that the purchase belongs to the category of services. The corresponding item must be entered in the nomenclature directory, in this case “Purchase of the 1C program: Accounting version PROF”. The nomenclature should be based on service category.

In the “Accounts” column, you need to enter data on account 97.21 “Other deferred expenses”.

In the process of filling out the details “Deferred expenses”, you need to create a new expense item, specifying not only the acquisition cost, but also the period during which the write-off will be carried out (indicate the start and end dates, analytics parameters, and so on).

After this, the specified cost is immediately included in deferred expenses for the specified amount. After posting the “Receipt of goods and services” document, the system will generate the following transaction:

Debit 97.21 Credit 60.01

Taking into account the fact that the company in question is a VAT payer, the amount of tax on the purchase is entered as a separate entry Debit 19.04 Credit 60.01

How to reflect the purchase of 1C in accounting and tax accounting

Expenses for the purchase of 1C programs are considered expenses for ordinary activities and cannot be classified as intangible assets. The accounting automation system 1C: Accounting is no exception.

Accounting

Since 1C software products are often used by organizations for more than one month, and their payment is made in the form of a one-time fixed payment, in accounting it is reflected as deferred expenses with subsequent write-off as expenses during the period of use of the program. If the contract does not specify the period of use of the program, it should be set independently, based on the useful life of the program on the 1C:Enterprise platform or based on a letter from 1C, where the recommended service life of the program is 24 months. In this case, the maximum period during which the company can write off expenses is 5 years.

During this period, the amount of the one-time payment is evenly included in the expenses of the current period in account 26 “General business expenses”, because Software "1C:Enterprise 8" was purchased for the needs of accounting (clause 18, paragraph 3, clause 19 of PBU 10/99, Instructions for using the Chart of Accounts).

The following entries must be made in accounting:

- Debit account 60.01 – Credit account 51

- Debit account 97.21 – Credit account 60.01

- Debit account 26 – Credit account 97.21

If recording expenses for programs using 1C causes you difficulties, contact our 1C support specialists. We will be happy to help you!

In the 1C: Accounting program (rev. 3.0), the transaction of acquiring a non-exclusive right to use the software is reflected in the document “Receipt (act, invoice)”, as a service, because a software product cannot be entered into a warehouse as a product or material.

Fig. 1 The software is reflected in the document “Receipt (act, invoice)”

Fig.2 Accounts

Fig. 3 Deferred expenses

To view transactions, you must click the “Show transactions and other document movements” button (Dt/Kt)

Fig.4 Result of posting the document “Receipt (act, invoice)”

Result of posting the document “Receipt (act, invoice)”

To perform the operation of including part of the expenses in the current month, you need to create a “Regular operation” document with the operation type “Write off deferred expenses”. As a result of posting the document, the corresponding postings will be generated.

Fig.5 Creating and filling out the “Routine Operation” document

Fig.6 Closing the month

Creating and filling out the “Routine operation” document

Fig. 7 Result of carrying out the “Routine operation” document

The result of the “Routine operation” document

Amount of expenses written off:

- 10800/2/12 = 450 rub. per month

- 450 rubles / 31 = 14.52 rubles. in a day

- 14.52 * (31-5) = 377.42 rub. for December

Costs associated with the acquisition of the right to use computer programs under license and sublicense agreements are included in other costs associated with production and sales (clause 26, clause 1, article 264 of the Tax Code of the Russian Federation).

If the terms of the license agreement establish a period for using computer programs, expenses are taken into account evenly over this period. If the license period is not established, then the organization can independently set the period for writing off expenses for the program (paragraph 2, paragraph 1, article 272 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of the Russian Federation dated 08/31/2012 No. 03-03-06/2/95, dated 18.03. 2014 No. 03-03-06/1/11743) or take it equal to 5 years (letter of the Ministry of Finance of the Russian Federation dated 04/23/2013 No. 03-03-06/1/14039).

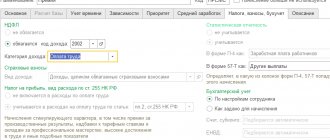

As a rule, the useful life of RBP for software in BU and NU is set the same so that the cost is repaid in equal shares:

Fig.8 NU

VAT deductions on future expenses (for the purchase of 1C programs) are carried out in the generally established manner if the following conditions are met:

- The goods have been accepted for accounting;

- VAT amounts have been paid to the supplier;

- The purchased goods are intended for use in activities subject to VAT;

- Availability of a supplier invoice with a allocated VAT amount.

If a taxpayer has received a program of the 1C:Enterprise family, then he has the right to deduct the entire amount of “input” VAT relating to them, regardless of when their cost is charged to costs. Those. the amount of VAT can be deducted in full in the period when the program was purchased and accepted for accounting on account 97.21.

Application of standards PBU 18/02

In accounting, the costs of acquiring 1C:Enterprise programs will be written off as expenses during the established period of use of the program, and in tax accounting - at a time during the acquisition period. Such a difference is reflected according to the rules regulated by PBU 18/02.

In accounting (for the period in which the programs were acquired), it is necessary to reflect a taxable temporary difference in an amount equal to the difference between the entire amount of expenses for the acquisition of programs and the amount that participates in the formation of accounting profit for the reporting period. The identified taxable temporary difference will be repaid gradually as expenses for the acquisition of programs are written off from account 97.21 (during the established period of use of the program).

Write-off of deferred expenses

This operation is a regulatory one. That is, it will be carried out automatically by the system based on the initially specified calculation parameters in the “Month Closing” document. In this case, 1C takes care of all the calculations of the amount of funds written off and the write-off itself.

After the document is posted, a posting is generated with expenses assigned to account 26, as was originally established. The write-off amount was calculated by the system based on the established start and end dates of the period of use.

By going to the document movement through the “Calculation of write-off of deferred expenses” tab, you can always see the main write-off parameters for the category being carried out.

The program will automatically write off monthly expenses until the expiration date for the write-off is set in the program. The user can view automatically created operations in the journal of routine operations, where they are stored. To do this, you need to go through the section “Operations” - “Closing the period” - “Routine operations”.

It is worth noting that in 1C this operation is open for creation in manual mode, and the use of the “Month Closing” document is not required.

Accounting Software: Postings

Reflection of the right to use a computer program by postings in accounting depends on the type of rights that are transferred.

Situation 1

If the exclusive rights to a software product are transferred to an organization under a licensing agreement, then if it meets the criteria of an intangible asset (IMA) (clause 3 of PBU 14/2007), it is reflected in account 04 “Intangible assets” (Order of the Ministry of Finance dated October 31, 2000 No. 94n) :

| Operation | Account debit | Account credit |

| Purchasing software | 08 “Investments in non-current assets”, sub-account “Acquisition of intangible assets” | 60 “Settlements with suppliers and contractors” |

| The software product was accepted for accounting as part of intangible assets | 04 | 08, subaccount “Purchase of intangible assets” |

If it is possible to determine the useful life of intangible assets, such an asset is depreciated in one of 3 ways provided for in clause 28 of PBU 14/2007:

Debit of accounts 26 “General business expenses”/44 “Sales expenses”, etc. – Credit of account 05 “Amortization of intangible assets”.

Is a license a product or a service?

On January 1, 2008, Federal Law No. 231-FZ of December 18, 2006 brought into effect Part Four of the Civil Code of the Russian Federation, which regulates the rights to the results of intellectual activity and means of individualization. Article 1225 of the Civil Code of the Russian Federation contains a list of protected results of intellectual activity (patent, computer program, etc.). The law recognizes the existence of intellectual rights that are not goods. Moreover, it is specifically stipulated that intellectual right is not associated with any material medium or with the right of ownership of a material medium . Transfer of intellectual property rights is a special type of service.

At the same time, the sale of a copy of the program on a tangible medium (sale of a disk or box) does not constitute a grant of the right to use it . The user, generally speaking, does not need a software license to install or use the program. However, even before using the program (namely, during installation), the user is asked to join the copyright holder's license agreement (the so-called EULA). At the request of the buyer (end client), the license agreement can be concluded in writing, with seals and signatures.

The key in this complex area is the concept of exclusive rights. No one can use the result of intellectual activity or a means of individualization without the consent of the copyright holder; such use is illegal. The exclusive right to the result of intellectual activity , as specified in Art. 1228, originally belongs to the author , whose creative work created such a result.

According to Art. 1229, the copyright holder may grant another person the right to use the result of his intellectual activity. The agreement is formalized either by an adhesion agreement (EULA) or a license/sublicense agreement.

License literally translates to “permission.” The granting of a right or permission is a service.

The concept of a license agreement is disclosed in Art. 1235 of the Civil Code of the Russian Federation. One of the parties to the license agreement, the holder of the exclusive right, is called the licensor . The licensor grants or undertakes to grant to the other party (licensee) the right to use the result of intellectual activity. The person to whom certain rights to dispose of the intellectual property of the licensor are is called a licensee . The agreement stipulates exactly how the licensee can use the subject matter of the agreement.

If the licensor (Cleverence) gives written consent to this (through a sublicense agreement), then the licensee (Partner) may grant the right to use the result of intellectual activity to another person.

Thus, the partnership (sublicense) agreement with Cleverens gives the Partner the right to provide services for granting other persons the right to use Cleverens programs.

I can't capitalize

In addition, when reselling licenses as goods, the transfer of rights is built “along the chain”. To provide the client with the rights to use the programs, the licensee needs to purchase such rights from the licensor, however, according to the Civil Code, if there is a sublicense agreement for the implementation of the programs, they are not required in principle. In the case of distribution of boxed software, its copy has already been put into public circulation through sale by the very first seller. Consequently, the right to reproduce and distribute copies has already been used, and sublicense agreements for the provision of rights to packaged software can be recognized by the Federal Tax Service as sham transactions aimed at obtaining tax benefits from the use of VAT benefits. For example, under the guise of software, you could resell equipment, evading paying VAT on the markup.

Thus, if you sell licenses “down the chain” according to a purchase and sale scheme, you may be accused of VAT evasion.

To exercise rights to programs, it is not necessary to acquire any additional rights other than those already legally granted by the sublicense agreement. The Federal Tax Service can rightfully consider capitalization to be confirmation that the contract was concluded retroactively, in order to hide the error of not charging VAT on the resale of tangible software media.

Correct reflection of license sales in accounting

Since the prices at which the partner sells may differ from the recommended retail prices of Cleverens (which are considered royalties), it will be more convenient to record mutual settlements for royalties in a special off-balance sheet account, for example 012:

| When selling licenses to a buyer: | ||

| Debit 51 - Credit 62.01 | – | payment has been received from the client for the transferred rights; |

| Debit 62.01 – Credit 91.01 (or 90.01) | – | revenue under the sublicense agreement is reflected; |

| Credit 012 | – | quantitative and total accounting of royalties on sold licenses. |

| When paying royalties to the licensor: | ||

| Debit 91.02 (or 90.02) - Credit 60.01 | – | the debt to pay royalties under the sublicense agreement is reflected; |

| Debit 012 | – | quantitative and total accounting of royalties on paid licenses; |

| Debit 60.01 – Credit 51 | – | remuneration was paid to the licensor in the form of royalties for the non-exclusive rights received. |