Power of attorney for another person to receive salary

As a rule, employers transfer employees' salaries to a bank card or hand it out from the organization's cash desk.

In this case, a situation may arise when the employee does not have the opportunity to personally receive wages. In this case, you should issue a power of attorney for another person to receive your salary. What a sample power of attorney looks like and how to fill out this document correctly will be discussed in our material today.

A power of attorney for the transfer of funds is a written authority where one person (the principal) transfers the right to another person (the attorney) to represent his interests before third parties.

Please note that a power of attorney for another person to receive salary is a legal basis for fulfilling the request of an absent employee. An employee, on the basis of paragraph 1 of Article 185 of the Civil Code of the Russian Federation, has the right to issue this document for any person. It is important to comply with the following conditions:

- obligations must be transferred voluntarily;

- the authorized person is legally competent and has reached the age of majority and has not been brought to criminal liability;

- at the time of signing the document, the authorized person is not under the influence of drugs or alcohol.

We will consider situations when it becomes necessary to issue a power of attorney for another person to receive an employee’s salary.

Registration of a power of attorney to receive salary may arise for various reasons. Among them:

- temporary absence of an employee (departure, absence from the city);

- undergoing inpatient treatment;

- absence from seeing the former manager.

These are the most common situations when an employee cannot personally receive wages.

Please note that if an employee receives money through a bank, then the power of attorney can be issued directly at the financial institution.

In order for a power of attorney to have legal force, it must be drawn up correctly, adhering to the rules for drawing up this document.

Let us remind you that a power of attorney to receive a salary by another person does not require mandatory notarization. The document does not have a set template and can be prepared either in simple writing or using a computer.

Based on paragraph 3 of Article 185.1 of the Civil Code of the Russian Federation, the principal can transfer his powers through such persons as:

- the head of the organization in which the principal works;

- administration employees (if the principal is a student of an educational institution);

- management of the medical institution (if the principal is located there).

When drawing up a power of attorney, you should adhere to the following rules:

- do not allow corrections or errors in the document;

- reliability of all information;

- text legibility.

It is necessary to carefully consider the validity period of the power of attorney and information about the right to receive money. Then the document is attached to the cash receipt order and (or) payroll.

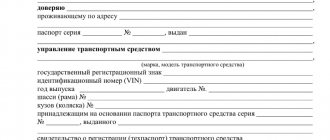

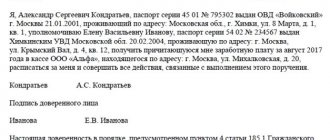

Despite the lack of a unified power of attorney form, there is a general template that most employees adhere to.

It is worth considering that in accordance with current Russian legislation, the principal has the right to revoke the power of attorney. The person, in turn, has the right to refuse representation. In such circumstances, the power of attorney to receive salary for another person terminates. Termination of the document may also occur for the following reasons:

- expiration date;

- liquidation of a legal entity;

- the attorney or principal is declared missing, dead or incapacitated.

Notaries advise issuing a separate power of attorney for each legal action. It should be noted that this approach is justified only if you have to contact with different forms of legal relations or with different institutions.

In all other cases, you should be vigilant: you should not overpay specialists for a power of attorney unless necessary.

Salaries are now most often transferred to the employee's bank account. But some organizations still pay out funds in person.

Sometimes an employee cannot receive his salary from the cash register on his own. But the money is required by law to be given directly to the recipient. In this situation, it is possible to issue a power of attorney, which gives the right to issue money to another person.

The document is drawn up both by the notary and by the principal himself. You can rely on a sample power of attorney to receive a salary by another person presented on the Internet.

What kind of document is this

A power of attorney is a document that gives a person certain rights and powers. If it is issued to receive a salary, then the citizen indicated in it can withdraw funds from the cash register.

In order for the paper to be rightfully used by a person, it must be drawn up correctly. It is important to note in the power of attorney what actions a person can perform on behalf of the principal.

Salary to an employee can be issued in two ways. In the first case, the transfer is made to the employee’s bank account. This method is the most common recently. After all, when performing a transaction, the accounting department does not perform other additional actions, since funds are transferred from the organization’s budget directly to the citizen’s account.

The second method, which has been used for a long time but is losing popularity, is issuing money through a cash register. In this case, the employee must be present when receiving the salary. If he cannot do this due to certain circumstances, then a proxy must be appointed.

Difficulties in obtaining funds may be due to:

- the employee is undergoing hospital treatment;

- the person’s departure to another city;

- the employee’s reluctance to see the employer (if the salary is issued after dismissal on a bad note.

If the rights to receive funds are transferred to another citizen, a power of attorney is drawn up. The document is officially approved at the legislative level. It prescribes the ability of a person to perform certain actions.

The rules according to which the right is transferred from one person to another are prescribed in paragraph 1 of Article 185 of the Civil Code of the Russian Federation. In order for a document to be recognized as legal, it must be drawn up in accordance with certain rules.

Article 185.1. Power of attorney

Registration procedure

The form of a power of attorney providing for the transfer of rights to receive funds can be drawn up arbitrarily. In this case, wages for a son or even a person who is not a relative can be issued to a person even without the official certification of a power of attorney by a notary.

These rules are contained in the Civil Code of the Russian Federation. But many lawyers still recommend contacting a notary office. This will allow you to avoid controversial issues when receiving your salary.

If the power of attorney is not certified by a notary, the employer may refuse to pay wages. These actions will be considered illegal. Therefore, the decision can be appealed to the courts.

Before creating a power of attorney, it is important to familiarize yourself with some basic steps.

Among them are:

- preparing the contents of the paper;

- studying an example of document preparation;

- filling out the form, focusing on a sample power of attorney to receive a salary by another person.

Paper composition has various features. It is important to take them into account so that the power of attorney can be accepted by the accountant.

Power of attorney form to receive salary

Currently, there is no unified form that could be used when drawing up a power of attorney to receive wages.

It is important to remember that some information must be included in the power of attorney. This is required by law.

- The date of compilation must be indicated. In accordance with Article 186 of the Civil Code of the Russian Federation, a document that does not contain the date, month and year of preparation will be considered invalid.

- The place of registration is indicated. The item is not on the list of mandatory ones, but it is advisable not to ignore it.

- When drawing up, indicate the most detailed information about the person who transfers the right to receive a salary. Not only your full name, but also additional information is noted here.

- The section on the authorized person is drawn up according to similar rules.

- The circumstances that require drawing up a power of attorney are described in detail.

- It is important to indicate how long the document will be valid. This will eliminate the possibility of a citizen receiving money for the principal in the future.

- Each party signs the document. In addition to the authorized person and the principal, a notary visa must be present. It is he who confirms the legality and legality of drawing up a power of attorney.

- If necessary, you can indicate the possibility of transferring rights.

- At the end of the document, a signature is placed confirming its certification.

The power of attorney must indicate the possibility of another person receiving wages for the employee. It is better to avoid general wording, as the employer may not take them into account and not issue the salary.

The text should be concise, but at the same time detailed. There should be no unnecessary questions about the document.

We invite you to read: Collection of debt for electricity from an individual

If a person cannot draw up a power of attorney on his own, he needs to contact a qualified lawyer. He will help prepare the text in accordance with legal requirements.

Previously, documents of this kind were required to be certified by a notary. Otherwise, they were declared invalid.

At present, the power of attorney does not need to be certified. To once again confirm the legality of another person receiving a salary, you can put a mark in the document in the personnel service at the principal’s place of work.

In most situations, employers practice charging wages to their staff to a bank card. An alternative option is handover in person at the accounting department.

| ★ Best-selling book “Accounting from Scratch” for dummies (understand how to do accounting in 72 hours) purchased by {amp}gt; 8000 books |

Screening test

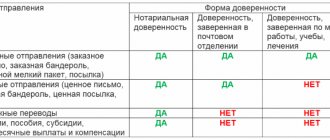

Mini-test for self-test. Where can I certify a power of attorney to receive a salary?

- only at a notary;

- both at a notary and at the place of work, study or treatment;

- The signatures of the principal and the attorney are sufficient.

Most employers transfer salaries to employees on a card or hand them out from the cash register in person. If for certain reasons a person cannot come to the enterprise, a power of attorney is issued for another person to receive wages. You will find a sample and drafting details in our consultation.

In some cases, an employee cannot independently receive wages from the company’s cash desk. Salaries must be issued only personally to the employee.

We suggest you familiarize yourself with how sick leave is calculated correctly

A power of attorney is a document, if necessary, certified by the employer, which gives certain rights and powers to receive funds to the person specified in the text of the power of attorney.

The power of attorney must contain information, a list of which we will consider below.

In this case, the attorney will be able to receive wages and other payments provided for in the employment contract for the principal.

We suggest you familiarize yourself with: Sample power of attorney for registering a child at the registry office

Typically, a power of attorney is needed when the transfer of earned funds is not made remotely, but, for example, to a bank card or current account, but directly at the organization’s cash desk.

When receiving a salary in cash, some situations may arise in which the employee will not be able to personally be present when the money is issued.

Here are just a few of them:

- being inpatient treatment in a medical institution;

- for personal or family reasons;

- departure to another city, region or country;

- reluctance to meet in person with the employer after dismissal.

The spouse must complete the document in accordance with the requirements below and provide it to the employer. After this, the wife will be able to receive funds by proxy directly from the company’s cash desk.

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) purchased by {amp}gt; 8000 books |

https://youtu.be/82cyWcDdS0g

What to include in a power of attorney

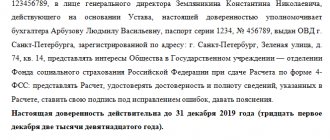

The power of attorney must clearly define who is the principal (this is an employee who trusts a third party to receive his salary) and the authorized person (this is the person receiving the salary instead of the employee), contain their passport details, registration address, scope of authority (for example, the right of sub-assignment) .

The power of attorney must contain the date of its preparation, because without it, the power of attorney will be considered invalid. But the validity period of the power of attorney may not be specified (in this case, the power of attorney is valid for a year) (Clause 1 of Article 186 of the Civil Code of the Russian Federation).

General

The general document for receiving money gives the trustee the opportunity for unlimited use of the customer’s accounts. He can withdraw money from his bank account in unlimited quantities.

The authority to receive money is also vested in a general power of attorney to represent the interests of the customer. In this case, the principal must specify what amounts his representative can withdraw.

If you liked the material, you can comment on it using a special form. Need specialist advice? Describe your situation using the feedback form.

Power of attorney form

The possibility of carrying out a transaction by proxy, including the receipt of wages by a representative, is provided for in Art. 182-189 Civil Code of the Russian Federation. These articles reflect the features of representation by power of attorney, as well as the requirements for the power of attorney itself.

Power of attorney, according to Art. 185 of the Civil Code of the Russian Federation is a written authority to represent a trustee before third parties on behalf of the principal. Part 3 Art. 185.1 of the Civil Code of the Russian Federation provides a list of authorized persons who can certify a power of attorney to receive wages. Such persons include:

- The organization itself in which the principal works.

- Administration of the medical institution where the principal is undergoing treatment.

Such powers of attorney are certified free of charge.

The signing of a power of attorney on behalf of a legal entity is carried out by the first person of the organization, or by a person who has such authority on the basis of the constituent documents of the organization - Part 4 of Art. 185.1 of the Civil Code of the Russian Federation.

A power of attorney for minor children under 14 years of age can be issued only by their parents, guardians or adoptive parents - Art. 28 Civil Code of the Russian Federation. A power of attorney on behalf of an incapacitated person is issued by his legal representative - Art. 29 Civil Code of the Russian Federation.

A power of attorney to receive wages must contain the following items:

- Full name and passport details of the principal and the person to whom the power of attorney is issued.

- Date of drawing up the power of attorney. According to Art. 186 of the Civil Code of the Russian Federation without the date of execution of the power of attorney, it is considered void.

- The period for which the power of attorney is issued. If the period is not specified, then it is considered valid for 1 year from the date of its commission - clause 1 of Art. 186 of the Civil Code of the Russian Federation. A notarized power of attorney issued to perform any actions abroad, without specifying the validity period, is considered unlimited and terminates when it is canceled by the principal - clause 2 of Art. 186 of the Civil Code of the Russian Federation.

- The scope of the powers of the trustee, that is, in this case, receiving wages monthly, or for a specific month.

- Signature of the principal.

- Signature of the notary or the person certifying the power of attorney indicating his official position.

If a power of attorney is issued with the right of substitution, this must be indicated in the power of attorney - Art. 187 Civil Code of the Russian Federation.

Important! If the person who transferred his powers does not notify the principal within a reasonable period of time about the transfer of powers to another person, then he is responsible for the actions of the person to whom he transferred the powers as for his own - Art. 187 Civil Code of the Russian Federation.

Repeated delegation, if this is not provided for by the power of attorney itself, is not permitted by law, and the powers of the representative who delegated the authority, unless this is stipulated in the power of attorney itself, are not lost by him.

The grounds on which the power of attorney is terminated are specified in Art. 188 of the Civil Code of the Russian Federation, these include:

- Expiration of the validity period specified in the power of attorney.

- Cancellation by the principal.

- Refusal of the authorized person from the powers granted by the power of attorney.

- Death of the principal, or recognition of him as having limited legal capacity, incapacity or missing.

The principal who issued the power of attorney and, for some reason, canceled it, is obliged to notify about this not only the authorized person for whom the power of attorney was issued, but also third parties for presentation to whom it was intended - Art. 189 of the Civil Code of the Russian Federation.

The law does not require a power of attorney to receive wages to be issued by a notary. A power of attorney in simple written form is sufficient, which can be certified by the employer (clause 3 of Article 185.1 of the Civil Code of the Russian Federation).

How to compose correctly

The drafting of a power of attorney is different in each individual case. Let's look at the main differences in writing a paper in each specific case.

Compiled in simple written form. The document form is also provided by an employee of the financial institution. It must bear the stamp of the organization that certified it and the signature of an authorized person.

We invite you to familiarize yourself with the Donation of funds: the procedure for registration between individuals, a sample form

The body of the document must contain a list of accounts and powers to which the authorized person has access.

A bank employee may oblige the principal to personally bring the document to his branch. To prevent misunderstandings, it is better for a person to fulfill his request.

If an employee cannot receive remuneration for his work for any reason, then he needs to draw up a power of attorney. In addition to basic information, it contains the following information:

- position of trustee;

- name of the structural unit and its address.

Pensions at the post office

The document can be drawn up at home or at the post office. The postal employee will issue you a special form in which you must fill out the appropriate fields. A mandatory condition is the personal presence of the pensioner at the time of its preparation.

It is necessary to indicate the period of receipt of the pension benefit and its amount. Such a document is certified completely free of charge.

Can be drawn up by a legal entity or an individual. In it, the principal transfers his powers to represent interests in enforcement proceedings. The following information must be provided:

- Personal and passport data of the parties;

- List of powers transferred by the principal;

- Information on State registration of a legal entity;

- Date of compilation;

- Validity.

We invite you to familiarize yourself with a sample employee application for a request to the Pension Fund for the provision of salary information

The authorized representative has the right to appeal against court decisions, draw up appeals and petitions. Such a document is drawn up, most often, for a lawyer, when it is impossible for the interested party to attend court proceedings.

Who needs a power of attorney to receive money for another person and why?

What kind of document is this

5/5 (2)

Regulatory legal acts regulate only the procedure and content, but do not establish the form of a power of attorney for the receipt of funds as wages by an outsider. In addition, the authority to receive wages for another person does not have to be formalized by a notary. A simple written form is sufficient.

Please note! A document that does not contain the following details cannot be considered valid:

- full name of the employee of the organization who receives wages. Abbreviations, errors and ambiguities in the first, patronymic or last name are not allowed in the text;

- information about the document confirming the identity of the employee, as well as the person who will receive his salary - passport, identity card or other identifier provided by the state that issued it;

- a document is not considered valid if the date of preparation is not indicated;

- a detailed listing of the representative’s powers. What is not mentioned in the document does not go without saying;

- the period during which the person’s powers are valid;

- signatures of persons.

We invite you to read: Paying salaries twice a month: labor and tax aspects

Attention! Our qualified lawyers will assist you free of charge and around the clock on any issues. Find out more here.

The good news is that a power of attorney to receive wages does not need to be issued by a notary; therefore, there is no need to pay a state fee or waste time visiting a notary’s office. It is easy to draw up such a document yourself or with the help of a lawyer.

Methods of transferring salary to an employee:

- non-cash transfer to the employee’s bank account;

- in cash at the company's cash desk.

If the enterprise operates under prehistoric rules and wages are still paid according to the payroll at the cash desk, it may be necessary to require the help of another person to receive wages.

How to issue a power of attorney to receive a pension for a disabled person?

If an employee is absent and does not have the opportunity to receive money on his own, he has the right to seek help from a person who enjoys his trust and entrust him with the appropriate powers.

Common reasons why an employee is not able to independently visit the cash register and receive a salary:

- for health reasons - treatment in a medical institution;

- physical absence – vacation, business trip;

- personal reasons - when receiving a salary upon dismissal and conflict with the employer at the former place of work.

The power of attorney is drawn up as confirmation that the employee really does not object to his money being given to another person. Representation of the interests of one person by another person before third parties is regulated by the Civil Code of the Russian Federation.

Algorithm of actions

Important! If an employee finds out that there are obstacles to independently receiving wages from the company’s cash desk, he can take the following actions:

- find a sample online or use the one presented above to familiarize yourself with the form and rules for drawing up the required document, as well as the information that must be included in order for it to be considered valid;

- searching for a suitable person who will agree to fulfill the employee’s request and receive money in accordance with the powers vested in him;

- prepare a paper, including in the document information about the employee, the person who provides him with the service, and the organization from whose cash desk it is necessary to receive funds;

- It is mandatory to affix the date of the document and the signature of the employee and the authorized representative - a feature of the type of power of attorney.

After all actions have been completed, the document is considered ready for use. The authorized representative remains to go to the enterprise and, in accordance with the established procedure, receive funds for the period specified in the document.

The power of attorney expires after the issuance of funds for the period specified in it.

Is it possible to refuse a salary card?

When drawing up a power of attorney, any adult capable person who has a passport or other identification document can be given powers. Friends, relatives, colleagues - it doesn’t matter, the main thing is the trusting relationships established between people.

The authorized representative, after receiving the salary at the enterprise's cash desk, is responsible for ensuring that the funds reach the principal in full.

Powers of attorney executed by a notary may contain an indication of the right of subrogation. However, it must be remembered that the transfer of trust occurs at the discretion of the trustee, and there is a possibility that a stranger will receive the money.

A power of attorney, prepared taking into account the requirements and rules for drawing up documents, is accepted by the employer upon simultaneous presentation of an identification document of the person who intends to receive funds. In this case, the employer does not have the right to refuse the authorized representative.

Remember! Before issuing wages, the cashier or accountant should check the passport data in the power of attorney, the period for which the money is required to be issued, and check the signature of the principal.

It is advisable that the principal first provide a similar power of attorney to the company or verbally warn about granting such powers to another person. As a last resort, employees of the organization should check the authenticity of the document and compare the signature with the sample stored in the personnel department.

Validity

The principal independently determines for what period the document is valid, as well as for what period the authorized person has the right to receive funds instead.

Note! If the power of attorney does not specify a validity period, the power of attorney is considered valid for one year from the date of execution. The date of execution in the power of attorney must be indicated; without it, the document is considered invalid.

Reasons why a power of attorney is terminated:

- termination of the validity period specified in the document, or issuance of funds for the period specified in the power of attorney;

- revocation of the power of attorney - the principal independently notifies the organization in which he works about this;

- refusal of the authorized person to fulfill the powers assigned to him in the power of attorney;

- liquidation of a legal entity that issued wages to the principal;

- death, incapacity of the principal or trustee.

How to draw up a power of attorney for the management and disposal of the property of an individual?

Executing a power of attorney for each legally significant action is considered additional insurance against dishonest actions of authorized persons.

In addition, this is required in case of interaction with several organizations. But a power of attorney to receive wages does not need to be issued by a notary, and, accordingly, additional and unnecessary expenses can be avoided.

To certify such authority, a power of attorney must be issued to the employee's representative.

A person with legal capacity can represent a person’s interests.

Such a need may arise when an employee cannot appear on his own to collect his salary due to illness, departure or other circumstances that deprive him of the opportunity to personally appear at the accounting department.

How to correctly draw up a power of attorney to represent the interests of a legal entity in court? The answer is contained in the link.

https://youtu.be/cCrxoPPBuwg

The reasons for the inability to personally collect your salary may be:

- disease;

- absence of a citizen (for example, when he leaves for another city);

- undergoing health and medical procedures in a hospital or sanatorium and others.

- The title of the document is indicated in capital letters.

- Date of registration. If it is missing, then, in accordance with Article 186 of the Civil Code, the document is considered void.

- Place of registration (locality).

- Full information about the principal and the authorized person (passport details, place of registration, full name, date of birth of each).

- Assignment. In this case, the order will be the transfer of rights to receive wages for a certain time in a specific organization from the principal employee to the authorized person.

- Salary amount in words and figures.

- Instruction to an authorized person to sign the salary slip instead of the principal.

- Validity period of the document. This clause is optional, but if it is absent, the power of attorney will become invalid after a year from the date on which it was issued.

- Signatures of both parties, transcripts of signatures.

- Possibility of transfer. If this is not noted in a separate paragraph, then the trustee will not be able to entrust the right to receive wages.

- Notes on certification of the power of attorney by third-party authorized persons (the list is given above).

We suggest you read: Can a credit card be seized?

Power of attorney for the right to sign documents: what it is and how to draw up such a document - find out by following the link.

How to draw up a power of attorney to receive a salary?

You can find out what a power of attorney to submit reports to the tax office is and how to correctly draw up such a document in this article.

Sample power of attorney to receive salary from another person.

How to issue a power of attorney to receive goods? Step-by-step instructions and a form to fill out are contained here.

What are the varieties?

| One-time | It is issued for an individual and gives the right to a one-time application to receive money. Most often, it is issued for financial transactions at Sberbank or VTB, such as receiving funds from closed deposits, or when transferring from another person. The peculiarity of such a document is that the right to perform any action is granted only once. The document must contain passport data. It is not necessary to indicate the specific amount that can be withdrawn, but the type of transaction and the period during which the interests of the principal can be represented must be recorded |

| Special | The execution of this document allows a citizen to receive funds from a legal entity. The same operation can be performed over a set period of time, be it a week or a month. At the same time, the period of use and the list of financial actions are negotiated separately between the parties to the agreement |

| General – general | The main purpose of using a power of attorney of this type is to record the transferred permission for a third party to use the rights of a specific citizen or head of an organization when receiving money. However, no specific amount of funds is provided for the transfer. The authorization document can be used every time there is a need to withdraw money intended for a company or individual. In addition, this document may determine the possibility of transferring these powers to another person within the period specified by the document |

Power of attorney to receive salary from another person: sample and procedure for drawing up

What kind of document is this

Earned money is paid to employees in cash or by transfer to a bank card. Recently, the second method has become more common. However, many employers practice payments through cash.

But what if on payday the employee cannot come for money for objective reasons - for example, due to illness or urgent departure? The easiest way out of the situation is to draw up a power of attorney in the name of a colleague, relative or friend.

The law does not prohibit transferring the right to receive wages to third parties; the Central Bank of the Russian Federation adheres to a similar opinion (see paragraph 2, clause 6.1 of the Directive of the Central Bank of the Russian Federation No. 3210-U dated March 11, 2014).

Advice from the editor. If an employee receives a salary on a card rather than in cash through the organization’s cash desk, at his request, you can transfer the entire payment or part of it to another person (for example, a spouse or other family member) or, for example, to a non-state pension fund.

In this case, a power of attorney is not needed; a written statement drawn up in free form is sufficient. But the condition on payment of wages to the account of a third party must be included in the text of the employment contract.

Read how to correctly prepare all the necessary documents in the electronic magazine “Personnel Affairs”.

A power of attorney to receive wages from another person can be issued in the name of any person chosen by the employee, not necessarily a family member or close relative.

For the transfer of obligations to be considered legal, the trustee must be appointed entirely voluntarily. Make sure that the principal is legally competent and is not under the influence of alcohol or drugs.

For minor workers, a power of attorney is signed by parents, adoptive parents or guardians (Article 28 of the Civil Code of the Russian Federation).

Since a special power of attorney form for receiving a salary by another person has not been approved by the legislator, the document is drawn up in free form. It states:

- passport details, exact registration address of the principal and authorized person;

- place and date of preparation, without which the power of attorney has no legal force;

- a brief description of the essence of the order listing all the rights and powers that the principal transfers to another person;

- validity period of the power of attorney.

The last point is especially important if the order is short-term or one-time. If the power of attorney does not indicate its validity period, it is automatically considered valid for a whole year from the date of registration (Article 186 of the Civil Code of the Russian Federation). The transfer of the right to receive a salary does not imply the possibility of reassignment (Part 5 of Article 187 of the Civil Code of the Russian Federation).

When drawing up a power of attorney for another person to receive salary, do not shorten words or use abbreviations. All details, including addresses and deadlines, are written down in full. Inaccuracies and corrections are not permitted.

The legislator does not provide a special form for registering the possibility of a representative’s right to receive funds. The form is drawn up in any written form.

The document can be written by hand or using a form used to prepare similar papers. The essence does not change from this.

A power of attorney issued to another person for the purpose of receiving a salary includes general requirements for such documents:

- A mandatory condition is the date of signing. Without indicating the date, the form is void and does not have any legal consequences;

- information about the employee’s representative (passport details of the person) and information about the principal are indicated;

- A feature of this category of power of attorney is the inclusion in the content of a description of the action entrusted to the representative - to receive wages in a certain amount from a specific employer. The text should be clear and concise and free of ambiguity;

- The validity period is indicated. If it is not specified, then the form is considered valid for one year from the date of its commission.

The power of attorney can only be used for the period specified in it. Violation of the deadline for contacting the employer deprives the representative of the opportunity to receive remuneration for the employee.

If the issuance of funds is an isolated case, then the power of attorney indicates the fact of receipt of wages for a specific period of work or in a certain amount.

If an employee wishes to transfer the right to receive his salary to another person regularly, then this fact is also reflected in the form.

The power of attorney is drawn up in any form by hand or on a computer. A mandatory requirement is compliance with a simple written form.

The employee can write the text of the document freely, or can use a standard form.

How to certify the form?

The power of attorney to issue wages to the representative must be certified.

The most common way is to contact a notary office. However, this is a paid service, which is not particularly encouraging, especially in the case of receiving one-time salary amounts.

In addition to the notary, the current legislation provides for a list of persons entitled to carry out certification.

At the request of the employee, his power of attorney can be certified by the following persons:

- The head of the enterprise in which the employee carries out labor activities. If the document is needed to receive a scholarship, the student can contact the educational institution.

- Housing maintenance organization located at the employee’s place of residence.

- If the employee is undergoing treatment in a hospital, the form can be certified by the chief physician of the hospital.

- For persons serving a sentence by a court sentence, the document is certified by the head of the correctional institution.

The authentication of the document is confirmed by the signature and initials of the principal. The signature and transcript are sealed by a notary or other organization.

The Civil Code of the Russian Federation states that actions transferred to a person in accordance with a power of attorney must be performed by that person.

If the document provides for the possibility of reassignment, then the receipt of funds from the employee’s salary can be entrusted to another person.

Features of compilation

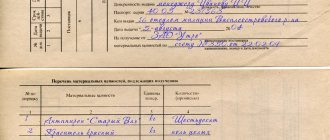

A document drawn up in accordance with all the rules has legal force. Notarization is not required. It is drawn up in simple written form, since the legislation does not provide for an established form of power of attorney for receiving salaries. However, the following details are required (see table).

| № | Props | What to indicate |

| 1 | Date of preparation | In the absence of this element, the document has no legal force, and the employer will not be able to issue funds to another person (Article 186 of the Civil Code of the Russian Federation) |

| 2 | Place of registration | Name of locality, address |

| 3 | Information about the principal and the person for whom the power of attorney for salary is drawn up | Indicate full name, date of birth, place of registration, passport details |

| 4 | Employer information | Write the name of the organization (IP), address |

| 5 | Action List | What should the recipient of a power of attorney to receive salary for another person do? |

| 6 | Amount of funds | In numbers and necessarily in words |

| 7 | Request to the employer | Transfer funds earned for a certain period in the organization to the person specified in the power of attorney |

| 8 | Signatures of interested parties | From this moment the document acquires legal force |

A power of attorney to receive wages is a document that gives the intermediary the right to accept money on behalf of the company employee who earned it. Its writing and application are regulated by Articles 185-188 of the Civil Code of the Russian Federation.

Only a legally capable citizen who has reached the age of majority can write a power of attorney. It is important that a person formalizes it voluntarily, without coercion from the outside.

The document is drawn up in free form. The law establishes only a list of information that must be contained in it. If the necessary information is missing in whole or in part, the power of attorney will not have legal force.

Notarization is not required, but depending on the agreement with the employer, the form may be signed by a third party. For example, the head of the employing company, a representative of the administration of an educational institution or medical institution.

The text can be handwritten or presented in printed form. It is imperative that it be completed without errors or corrections; the principal’s signature is made in person. Any inaccurate information will result in the assistant being denied the due payment.

It is recommended to fill out a separate instruction for each action of the representative if the power of attorney implies the right to receive other payments. When issuing the salary, the cashier has the right to pick up the document and attach it to the payroll. This measure allows you to justify the issuance of funds to an outsider in case of misunderstandings.

Certification rules

The employee can draw up the document manually or in printed form. In the first case, you must adhere to the general rules:

- no errors or corrections;

- legible handwriting;

- reliability of all information.

https://youtu.be/j8ybLH7d1Go

The employer must carefully study the contents of the document so that no claims arise later. Particular attention should be paid to the validity period and information about the right to receive funds. Subsequently, this document is attached to the cash receipt and/or payroll.

According to paragraph 3 of Art. 185.1 of the Civil Code of the Russian Federation, the form can be certified by the employer, as well as by a notary. Certification is also allowed at the place of study or treatment of a citizen (for example, if the employee is sick and is in a hospital). This service is provided free of charge.

In accordance with clause 4 of Article 185 of the Civil Code of the Russian Federation, a trust agreement does not have to be certified by a notary. According to the law, the following persons can certify a document:

- Head of the correctional facility.

- Head of the military unit.

- An employee of social security authorities or the chief physician of a medical institution.

- Employee of the housing organization at the place of residence.

- The head of the company or government agency in which the principal works.

- Director of the educational institution.

If the power of attorney was issued as a result of delegation, then it requires mandatory certification by a notary.