Registration of a power of attorney to receive goods

Here you can receive the goods for free. Such a power of attorney to receive valuables is valid, most often, for no more than 15 days. The specific period depends on a number of conditions, in particular, on the possibilities of transport delivery of the goods. These details are specified in the agreement or other document on the basis of which the power of attorney is issued. In the case of receiving inventory items in the format of scheduled payments, a power of attorney is often issued for a period of a calendar month. If an employee has not reported on a power of attorney that has expired, he is prohibited from issuing a new similar document.

A power of attorney is not needed if the goods are delivered to a warehouse that belongs to the customer. This is explained by the fact that warehouse workers are financially responsible employees of an enterprise or individual entrepreneur. Their job responsibilities include receiving goods, so a power of attorney is not issued for such employees.

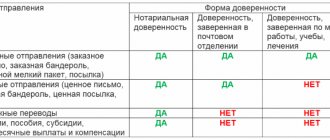

What form should I use to draw up a power of attorney?

A prerequisite for the execution of a power of attorney is its written form (clause 1 of Article 185 of the Civil Code of the Russian Federation). As for the form of the document itself, it can be arbitrary depending on what functions the trustee will perform. As an example in the figure, we have given a power of attorney to represent the interests of a legal entity; it is drawn up in simple written form.

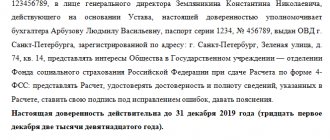

Sample power of attorney for an employee to represent the interests of the organization

Power of attorney for signing reports and submitting them to the tax office, extra-budgetary funds and statistical authorities

Moscow November 5, 2013

Limited Liability Company "Victoria", INN/KPP 7721765845/772101001, OGRN 1345867549834, location: 109444, st. Ferganskaya, 10 (hereinafter referred to as the Company), represented by General Director Alexander Yurievich Mikhailov, acting on the basis of the Charter and Art. 26 of the Tax Code of the Russian Federation, this power of attorney authorizes the chief accountant of the Company, Ekaterina Alekseevna Petrova, passport series 67 35 N 645875, issued on December 14, 2010 by the Altufevsky district branch of the Federal Migration Service of Russia in Moscow in the North-East Administrative District, Russian Federation citizenship, date of birth: 30.08 .1977, residing at the address: Moscow, Altufevskoye Shosse, 86, hereinafter referred to as “Representative”:

- sign tax and accounting reports, as well as reports to state extra-budgetary funds on behalf of the General Director of the Company;

- submit tax and accounting reports to the tax inspectorate and statistical authorities;

- submit reports to extra-budgetary funds;

- submit, request and receive from the tax inspectorate, statistical authorities and extra-budgetary funds the information necessary for filing reports.

This power of attorney has been issued for a period of five years without the right of subrogation.

Signature E.A. Petrova Petrova is certified by General Director Mikhailov A.Yu. Mikhailov

If we are talking about entrusting an employee with receiving inventory from the counterparty under an agreement, you can use the unified power of attorney forms NN M-2 and M-2a, approved by Resolution of the State Statistics Committee of Russia dated October 30, 1997 N 71a. These two forms are almost identical to each other. The only difference is that the N M-2 form has a tear-off spine. It is needed so that you can record all issued powers of attorney in the registration register and file the spines. Although this is, of course, not necessary. But accounting is desirable for internal control over accountable persons, especially if a lot of powers of attorney are issued. If this does not happen so often, records of issued powers of attorney may not be kept. Then the form of power of attorney for receiving goods and materials can be chosen without a counterfoil - N M-2a. Please note: the use of unified forms of powers of attorney to receive inventory items is not mandatory. You can choose either a unified form or one developed independently. In addition, from September 1, 2013, it became possible, which was not previously clearly enshrined in civil legislation, not to issue a power of attorney to receive commodity valuables in the form of an independent document (clause 4 of Article 185 of the Civil Code of the Russian Federation). But then the powers of the representative must be specified in the agreement (for example, in a commission agreement, assignment, etc.) or in the decision of the meeting of participants.

Registration and accounting of powers of attorney for receiving inventory materials in 2020

As practice shows, a power of attorney is not issued for the maximum period, because the list of material assets or the basis for obtaining goods and materials may change. Therefore, the enterprise makes one sample, and a power of attorney is issued based on it in each individual case. After shipment, the supplier keeps the original, attaches it to the invoice and transfers it to the accounting department.

All inventory items issued under a work order, invoice, contract, order or agreement require a power of attorney. In order to fulfill the obligation under the contract, it is necessary to transfer goods and materials, which become the property of the buyer. This can only be done by an individual, to whom the company issues a power of attorney to receive it.

We issue TORG-12: stamp or power of attorney

In conclusion, we emphasize that arbitration courts resolve the question of whether the fact of acceptance of goods has been proven or not based on the specific circumstances of the case, on the basis of a full and comprehensive study of the evidence available in the case (part 3 of article 9 and paragraph 2 of part 1 of article 287 of the Arbitration Procedure Code RF). As practice shows, the fact of acceptance of the goods can be proven even in the absence of a seal in the delivery note and (or) a power of attorney, for example, when the powers of the buyer’s representative were clear from the situation (see, for example, the decisions of the Ninth Arbitration Court of Appeal dated October 29, 2009 N 09AP-20120 /2009; FAS Moscow District dated January 26, 2011 N KA-A41/17482-10 in case N A41-2129/10; FAS North Caucasus District dated December 11, 2009 N A63-4450/2009; FAS Volga-Vyatka District dated December 1 .2008 N A82-10250/2007-38, FAS of the North-Western District dated 01/10/2006 N A56-1555/2005; decision of the Arbitration Court of the Krasnoyarsk Territory dated 10/08/2007 N A33-10128/2007).

Representation itself presupposes that actions are performed by a representative where and when actions cannot be performed by the principal himself, which in relation to a legal entity means by its bodies. This also presupposes the absence of the organization’s seal in a given place at a given time. However, as we see, the power of attorney itself must contain the signature of the head (body) of the organization, sealed with the seal of the organization.

Is it necessary for a legal entity to put a stamp on a power of attorney?

A power of attorney on behalf of a legal entity is issued signed by its head (clause 4 of Article 185.1 of the Civil Code of the Russian Federation). Previously, the obligation to stamp a legal entity on a power of attorney issued on behalf of the legal entity was established in paragraph 5 of Art. 185 of the Civil Code of the Russian Federation. The requirement for a seal remained for some types of powers of attorney, for example, for powers of attorney of procedural representatives.

With the adoption of Federal Law No. 82-FZ of April 6, 2015 “On Amendments to Certain Legislative Acts of the Russian Federation Regarding the Abolition of the Mandatory Seal of Business Companies,” even procedural powers of attorney in most cases can be issued without a seal, if the organization does not have one.

However, in paragraph 6 of Art. 57 of the Code of Administrative Proceedings of the Russian Federation establishes that a power of attorney on behalf of an organization must be sealed with the seal of that organization. A legal entity that decides not to use a seal will not be able to issue such a power of attorney.

Information about the presence of a seal must be contained in the company's charter. The absence of such information indicates that the legal entity does not have a seal.

If a seal is required by federal law, a seal impression, information about the presence of which is not in the charter, cannot be affixed to fulfill this requirement. However, there is no prohibition on the use of such a seal or liability for it.

Based on the above, the absence of a seal on a legal entity will not prevent the issuance of a power of attorney to complete a transaction or to represent a person in an arbitration court. For representation in some cases heard in courts of general jurisdiction (for example, in cases of challenging regulatory and non-regulatory acts), a seal will be required.

Power of attorney to receive material assets

But let's return to the question of the power of attorney itself. This document can be filled out by hand or using a computer - this is not important. But the signature of the head of the organization, who actually transfers his powers to the employee, is an integral element of this document. Without such a signature, as well as without the seal of the organization, the power of attorney will not be valid.

We recommend reading: Positive Solutions Torg12 With Stamp But Signature Of An Unauthorized Person 2020

A power of attorney to receive inventory items can be issued to any employee of the organization. In principle, a power of attorney can be issued to a third party, however, in this situation, controllers, if they discover this fact, may have questions about why this person is acting in the interests of the company for free. Simply put, the fact that there is no employment contract with the simultaneous performance of certain work in the interests of the company will most likely be associated with the payment of wages in an envelope.

The seal will replace the power of attorney

According to clause 11 of this Instruction, during the centralized delivery and delivery of goods and materials to enterprises, trade and other organizations, the release of goods and materials by suppliers (enterprises, wholesale organizations, etc.) can be carried out without a power of attorney. In these cases, the recipient of the goods (materials) is obliged to show the suppliers a sample of the seal (stamp), with which the financially responsible person who received the imported goods (material) affixes his signature confirming receipt of the said valuables.

We recommend reading: Test driving through unregulated intersections of unequal roads

By virtue of Art. 9 of the Federal Law of November 21, 1996 N 129-FZ “On Accounting”, all business transactions carried out by an organization must be documented with supporting documents that serve as primary accounting documents in accordance with which accounting is kept.

Power of attorney to receive goods

When drawing up a power of attorney to receive goods, you must adhere to the recommendations and standards established for writing such papers by the rules of jurisprudence and office work, so that the document does not subsequently raise doubts among the interested party. Here you need to enter the personal data of the representative (according to the passport), as well as carefully and in detail specify all the functions that are assigned to the representative and the list of documents that he is authorized to sign.

In small companies, the development of such documents can be carried out either by the managers themselves or by third-party specialists; in large organizations, the responsibility for drawing up powers of attorney is usually assigned to a lawyer or secretary. After registration, they give her signature to the boss (director). Until 2020, the power of attorney was required to be certified with the seal of the organization, but since January 2020, the presence of seals and stamps in legal entities. persons, as previously with individual entrepreneurs, has ceased to be a mandatory norm, so the document does not need to be stamped.

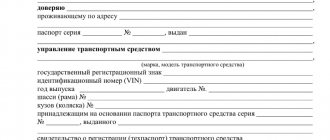

Power of attorney counterfoil

In practice, if goods are received from one supplier over a long period of time, then usually a power of attorney is issued for a period of one month; if necessary, a new power of attorney is issued at the beginning of the next month valid for another month. For a one-time receipt of goods, the duration of the power of attorney is selected from the conditions and deadlines for processing documents, receiving and exporting goods and materials and usually does not exceed two weeks.

Next, lines with information about the consumer and the payer of the goods and materials must be filled in; they indicate:

If the recipient and the payer are the same person, then “He” is written in the information line about the payer.

Next, the bank details of the payer are written down. The line below contains information about the employee to whom the power of attorney was issued. They indicate the position and passport details. Inventory and materials are issued if this data matches the passport data presented by the recipient.

The last bottom lines on the front side indicate the documents that serve as the basis for the supplier to issue inventory materials.

Receipt of goods and materials by the responsible person without a power of attorney

As an example, when a power of attorney is required despite the existence of an agreement indicating the powers of the representative, one can also cite Part 8 of Article 5.1 of Law No. 212-FZ, according to which, in relations with bodies of state extra-budgetary funds, a representative of the organization needs a power of attorney, including an accountant (despite the fact that the employer and the employee, for example, stipulated his powers to submit reports in the employment contract).

In addition, taking into account the provision of clause 4 of Article 185 of the Civil Code of the Russian Federation on the possibility of indicating the powers of a representative in an agreement, and not in a separate power of attorney document, provided that otherwise is not established by law or does not contradict the essence of the relationship, it is necessary to analyze the agreement that contains the powers representative So, for example, since the principal under the agency agreement must issue a power of attorney to the attorney, clause 4 of Article 185 of the Civil Code of the Russian Federation does not apply to the agency agreement (clause 1 of Article 975 of the Civil Code of the Russian Federation).

Is a power of attorney required if there is a seal?

This follows, in particular, from the provisions of Art. 312 of the Civil Code of the Russian Federation, according to which, unless otherwise provided by agreement of the parties and does not follow from the customs of business or the essence of the obligation, the debtor has the right, when fulfilling an obligation, to demand evidence that the fulfillment is accepted by the creditor himself or a person authorized by him to do so and bears the risk of consequences failure to make such a requirement.

Stamp or power of attorney upon receipt of goods

Incorrectly drawn up consignment note or other transport document, as well as their loss, do not affect the validity of the concluded contract. Note: After the goods have been shipped, the invoices indicate their acceptance for transportation. According to the explanation of the Ministry of Finance (section “On filling out forms of primary accounting documents” (question 3)), the lines “by power of attorney”, “issued” of invoices TTN and TN are not required to be filled out.

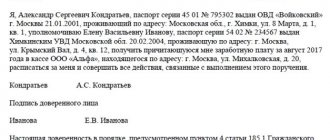

According to paragraph 1 of Art. 185 of the Civil Code of the Russian Federation, a power of attorney is a written authority issued by one person (principal, guarantor) to another (representative) to act on behalf of the principal before third parties. A power of attorney is issued to perform a specific action (for example, to submit reports to the tax office). Then it is called one-time. The next level is a general power of attorney, which defines the expanded powers of the representative in all areas (such as property management).

Note! A minor over 14 years of age can issue a power of attorney only for a limited range of actions: to manage his income, funds in the bank, etc. As a rule, a power of attorney can be issued to both relatives and other persons.

Sample power of attorney for a child in the camp

Hm. This is a difficult question. For example, I know several companies that simply give the right to enter into transactions on their behalf to other people (physicists). Those. people have press, the right to conclude contracts, etc. This is an absolutely legal business. And then the companies simply give them cash minus their %% for the services, and it turns out cheaper than working officially.

Accordingly, only persons who have the right to act on behalf of the organization without a power of attorney in accordance with the constituent documents, or individual entrepreneurs themselves, have the right to perform actions that are significant under the contract. If the execution of an action is entrusted to another person, then his authority must be confirmed. The Foreign Economic Activity-Declarant program will help you effectively prepare any documents related to the customs declaration of goods. Recommended for use by customs officers in Russia and the former CIS.

This is interesting: 2020 registration of a lease agreement by the owner

Article: Power of attorney to receive goods and materials (Emelyanova E

The subject of the power of attorney in question is the receipt of certain inventory items from a specific supplier. Therefore, in the power of attorney form there is the detail “Name of the supplier”, as well as “Name, number and date of the document”. Thus, it is specified that the citizen represents the interests of the purchasing organization not before an unlimited number of third parties, but only before a specific supplier and only in actions to obtain goods and materials for a specific document (invoice, invoice, agreement, along with, order, agreement, application). The instruction (clause 2) allows the issuance of one power of attorney to receive goods and materials from one supplier (from one warehouse) on the basis of several documents; the details of all these documents must be listed in the power of attorney. Accordingly, to receive goods and materials from several suppliers, a corresponding number of powers of attorney is required.

We recommend reading: Payments for 3 Children in 2020 in Voronezh

The date of issue of the power of attorney is one of the key details, since by virtue of clause 1 of Art. 186 of the Civil Code of the Russian Federation, a power of attorney that does not indicate the date of its execution is void. The validity period of a power of attorney is limited by the Civil Code to three years, and if this detail is not filled in, by direct instructions of the law, the power of attorney remains valid for a year from the date of its execution. Meanwhile, paragraph 4 of the Instructions establishes the validity period of the power of attorney for receiving inventory items (15 days, calendar month, quarter). There is no need to focus on them, since these provisions contradict the Civil Code of the Russian Federation. The validity period of the power of attorney is established in each case individually, based on the possibility of receiving and exporting specific goods and materials. After its expiration date, the power of attorney is invalid and cannot serve as a basis for obtaining goods and materials.

Is a power of attorney required if there is a seal?

In practice, to formalize the authority of a representative to receive goods, unified forms M-2, M-2a, approved by Resolution of the State Statistics Committee of Russia dated October 30, 1997 N 71a, are usually used, although their use is not mandatory, since a power of attorney is not a primary document and can be drawn up in free form in compliance with the requirements established by Art.

The rules for issuing powers of attorney have changed

According to Article 65 of the Arbitration Procedure Code of the Russian Federation, each party must prove the circumstances referred to. Within the meaning of Article 312 of the Civil Code of the Russian Federation 65 of the Arbitration Procedure Code of the Russian Federation, if a dispute arises regarding the issue of proper execution, the burden of proof rests in our case on the supplier.

In turn, Art. 312 of the Civil Code of the Russian Federation gives the debtor the right, when fulfilling an obligation, to demand evidence that the fulfillment is accepted by the creditor himself or a person authorized by him to do so. In other words, the supplier’s employees have the right to make sure that they are delivering the goods to representatives of the purchasing organization. How can they do this? Powers of attorney are issued to receive goods released by the supplier according to a work order, invoice, contract, order, agreement or other document replacing them.

Order of the Ministry of Finance of the Russian Federation dated December 28, 2001 No. 119n, a power of attorney on behalf of a legal entity based on state or municipal property to receive or issue money and other property assets must also be signed by the chief accountant of this organization. Taking into account the above, it can be assumed that if an agreement specifying the powers of a representative of a legal entity based on state or municipal property to receive or issue money and other property assets is not signed by the chief accountant, it also cannot be considered as a document confirming the powers representative to receive goods and materials. Is it possible to obtain trademarks without issuing a power of attorney? If the contract specifies a responsible person, then is a power of attorney needed?

Do I need a power of attorney if the seller releases goods using an invoice?

Bortnikov V.V., practicing lawyer The director, as the sole executive body of a legal entity, has the right to act on behalf of the organization without a power of attorney, including representing its interests and making transactions. The validity period of the power of attorney is established depending on the possibility of receiving and exporting the relevant valuables according to the order, invoice, invoice or other document replacing them, on the basis of which the power of attorney was issued, but, as a rule, no more than 15 days.

To make a transfer, the payer is required to present a passport or other document confirming the identity of the sender of the money. Upon completion of the operation, the payer is shown along the contour with a bold line, and the reverse is shown by the addressee upon receipt and also in the allocated space. If you send alimony by postal order from an organization, then when filling out the data, the details of the enterprise are indicated.

This is interesting: Kak accounts 210 03 in 2020

In what cases is a power of attorney required to receive inventory items?

I also think so, that’s why I demanded a power of attorney from them for the entire amount, but they told me that they “called somewhere, found out somewhere” and brought me a power of attorney only for the amount paid by bank transfer. Whereas I issue them an invoice for the entire quantity of goods. How to prove it.

This document is one of the main ones, confirming the fact that the supplier has fulfilled its obligations and at the same time protecting it in the event of various situations arising (After all, the document contains the full name of the recipient and other very necessary details). If there is a large assortment of goods supplied by you, I admit the possibility, in the power of attorney, to indicate the total amount of goods received by the buyer.

Receiving goods by proxy, is a seal required?

But is it possible to put a document stamp on a document certifying the authority to act on behalf of another person? Yes, you can. The principal has the right to use a round seal for internal documents if this does not contradict the requirements. The official (main) stamp is not considered mandatory.

In conclusion, we emphasize that arbitration courts resolve the question of whether the fact of acceptance of goods has been proven or not based on the specific circumstances of the case, on the basis of a full and comprehensive study of the evidence available in the case (part 3 of article 9 and paragraph 2 of part 1 of article 287 of the Arbitration Procedure Code RF). As practice shows, the fact of acceptance of the goods can be proven even in the absence of a seal in the delivery note and (or) a power of attorney, for example, when the powers of the buyer’s representative were clear from the situation (see, for example, the decisions of the Ninth Arbitration Court of Appeal dated October 29, 2009 N 09AP-20120 /2009; FAS Moscow District dated January 26, 2011 N KA-A41/17482-10 in case N A41-2129/10; FAS North Caucasus District dated December 11, 2009 N A63-4450/2009; FAS Volga-Vyatka District dated December 1 .2008 N A82-10250/2007-38, FAS of the North-Western District dated 01/10/2006 N A56-1555/2005; decision of the Arbitration Court of the Krasnoyarsk Territory dated 10/08/2007 N A33-10128/2007).

Legal advice: require a power of attorney when signing invoices

Judicial practice: Determination of the Supreme Arbitration Court of the Russian Federation dated March 2, 2010 No. VAS-1633/10. The court in the said case rejected the applicant’s reference to the repeated use of the company’s original seal when issuing receipts to confirm that the engineer had the proper authority.

However, attempts to recover payment for such an invoice through the court may be unsuccessful. The court will find out whether the person who signed the invoice and accepted the goods is an employee of the enterprise. If so, then in most cases the supplier will be able to recover payment for the invoice in question. If not, and the supplier does not have a power of attorney from the buyer for the person who signed the delivery note, then the court will assume that the goods were delivered to the wrong person. The fact that the seal was genuine will not have legal significance. Therefore, the demand to pay for the goods is unlawful.

Help: Executing a power of attorney to receive inventory items: have questions

documents confirming the authority of the manager (a copy of the order on the appointment of the head of a commercial (non-profit) organization, an extract from an employment agreement (contract) or a civil law agreement on the term of the contract, or a copy of the protocol or an extract from the protocol of a body authorized by the organization’s charter on the election of the head organizations);

Practical recommendations. Taking into account the above, as well as existing practice, business entities can be offered the following option. The organization receiving the goods must issue a power of attorney to the carrier's representative to receive the cargo based on the power of attorney of the carrier organization issued to its forwarding agent (driver).

We draw up a power of attorney in a new way

Without a power of attorney, only the general director can act on behalf of the company. His powers are confirmed by the charter or minutes of the general meeting on the election to the position of director (clause 1, clause 3, article 40 of the Federal Law of 02/08/1998 N 14-FZ and clause 2 of article 69 of the Federal Law of December 26, 1995 N 208-FZ ). An entrepreneur does not need a power of attorney if he acts independently. His authority is confirmed by a copy of the certificate of state registration as an individual entrepreneur (clause 2 of the Order of the Federal Tax Service of Russia dated November 13, 2012 N ММВ-7-6 / [email protected] ). But for all other persons (both employees of the company and citizens who are not on staff), a power of attorney will be needed. And if they begin to participate in any transaction without it, it will be considered that they are acting on their own behalf, and not on behalf of a company or merchant (Clause 1 of Article 183 of the Civil Code of the Russian Federation). From September 1, 2013, when writing a power of attorney, you should take into account the new rules for drawing up this document, which were introduced into the Civil Code of the Russian Federation by Federal Law dated May 7, 2013 N 100-FZ. Which is what we'll talk about next.

Power of attorney M-2 - indication of inventory items in total amount

When filling out a power of attorney using the unified form No. M-2, all mandatory details must be filled in. In particular, the specific name of the goods and materials received, their quantity and unit of measurement must be indicated. Indication in the power of attorney on form M-2 only the total cost of received inventory items is not provided. In this case, you have the right to develop your own form of power of attorney (containing the required details). In this form, you have the right to indicate the scope of authority and the list of goods and materials received in the way that is most convenient for you.

It does not follow from the provisions of Articles 185–189 of the Civil Code of the Russian Federation that the chief accountant must affix a power of attorney to receive inventory items with his signature, and the power of attorney itself must be certified by a seal. In this part, the unified forms of powers of attorney No. M-2 and No. M-2 contradict the norms of civil legislation. In addition, from April 7, 2020, LLCs and joint stock companies may not have seals at all (Articles 2 and 6 of the Law of April 6, 2020 No. 82-FZ).

08 Feb 2020 juristsib 756

Share this post

- Related Posts

- Regions In Which The Sale Of Energy Products Is Prohibited 2020

- Limit on the amount for personal income tax deduction for children in 2020

- Sample Payments According to Usn Income in 2020 for Individual Entrepreneurs Without Employees

- Deduction for previous years according to the 2020 declaration what to write

Do I need a power of attorney if there is a seal?

Starting from April 7, 2020 (the date of entry into force of Federal Law dated 04/06/15 No. 82-FZ), the presence of a seal of a particular JSC (LLC) can be found out from the company’s charter. If there is no information in the charter, then there seems to be no seal. “It seems” - because no one is forcing you to destroy a seal that has already been made.

Does the attorney need to give a power of attorney?

Since we are talking about written evidence, before you compose it, you need to find out how it is done. Unified forms have been developed only for powers of attorney to receive material assets (NN M-2 and M-2a). In other cases, powers of attorney are issued in any form.

45 Methodological guidelines for accounting of inventories, approved by Order of the Ministry of Finance of Russia dated December 28, 2001 N 119n. By virtue of clause 1 of Art. 181 of the Civil Code of the Russian Federation, a transaction made by one person (representative) on behalf of another person (represented) by virtue of authority based on a power of attorney, an indication of the law or an act of an authorized state body or local government body directly creates, changes and terminates civil rights and obligations represented.