Power of attorney to receive money is a document giving the right to the authorized person to receive funds from the principal . The principal grants a third party the right to receive funds through a trust of authority. In a specific situation, the principal is the entity who appoints any third-party fiduciary to perform the event of receiving funds in his name. Trustees can be both individuals and institutions of all forms of ownership. A trustee is considered to be an individual who can receive funds in a clearly designated place by the trustor.

Directions for using a power of attorney

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

Let's consider the main points where the issuance of money is possible only by proxy: (click to expand)

- issuance of wages by a third party;

- issuance of a pension by a third party;

- issuance by the buyer (customer) of money for a product sold, an item of trade, or services provided (at this point, the principal usually has a legal form of ownership - an enterprise, organization, and their employee, such as a manager, agent, carrier or driver, acts as a trustee );

- issuance of one-time payments of various nature to a third party.

It may be impossible to issue money to an individual due to a number of reasons, for example, a business trip or illness. It is necessary to take into account that the subject of the trustee must be legally capable, i.e. over 18 years old.

Sample document

The paper is filled according to standard requirements.

It indicates the name, full name and information from the passport of the parties, the day of signing, the place of registration, the period of validity and signatures. If the amount to be received is indicated, it is written as a number and in words. But there are a number of nuances:

- The information about the principal includes the name of the company, its legal form, legal address, registration information, full name of the head and position. There must also be the name and details of the paper confirming the authority.

- A document is indicated that serves as the basis for receiving funds (for example, an invoice, an agreement for the supply of goods, and so on). In addition, details are written down.

When registering, it is important to copy the information from the representative’s passport into the power of attorney, because the paper is accepted by a third party only upon transfer of the passport. In this case, the details must match the information specified in the executed document.

If money needs to be received in the interests of an organization, then a power of attorney can only be issued to its employee. Usually this is an accounting employee or another person chosen by the director.

A candidate to receive funds must be an adult and have:

- passport with registration in the Russian Federation;

- an employment contract with the organization, which specifies the employee’s position;

- a document confirming the employee’s financial responsibility for receiving money;

- the employee’s consent to carry out the assignment.

Upon completion of registration, the employee becomes responsible for representing the economic interests of the legal entity highlighted in the text of the document.

He also receives the following rights:

- ask for additional payment for representation if it is not part of the employee’s professional duties;

- request means of enforcement, such as transport or accompanying persons;

- demand the information and documents necessary to carry out the order.

If the employee’s job duties include acts of representation, a power of attorney must be drawn up.

The form of this type of power of attorney is free. However, such a power of attorney is always drawn up in writing (clause 1 of article 185, part 1 of the Civil Code of the Russian Federation of November 30, 1994 No. 51-FZ), and its sample must include the following details:

- Date of issue – it must be indicated in words. A power of attorney that does not indicate the date of its preparation is considered void (Clause 1, Article 186, Part 1 of the Civil Code of the Russian Federation).

- Place of issue (local area).

- Information about the principal: last name, first name, patronymic (hereinafter referred to as full name), passport details, place of registration.

- Information about the authorized person: Full name, passport details, place of registration.

- Description of the authority being transferred. In this situation, the trustee is given the right to receive certain funds or payments on behalf of the principal. The type of such payment is indicated (for example, wages, pension, money transfer, etc.), the amount, place of receipt (for example, at the cash desk of the employing organization, at a bank branch, etc.), the period of time for which the payment is accrued this amount (for example, for February 2016, etc.). When indicating the place of receipt, the name of the organization and its address, if necessary, are also indicated.

- Description of possible additional powers, for example, signing the necessary documents, receiving pay slips and certificates, etc.

- Duration of the power of attorney. This detail is optional. If the validity period of the document in question is not specified, then it is taken to be equal to 1 year from the date of execution of such a power of attorney (Clause 1, Article 186, Part 1 of the Civil Code of the Russian Federation). A power of attorney can be issued for a one-time receipt of money or for a certain period of time - this should be explained in the document itself.

- Possibility of transfer.

- Signature of the principal.

In this case, the legal entity acts as the principal. A power of attorney to receive money is also drawn up in a free version. It is acceptable, but not required, to be placed on company letterhead: often such a requirement is established by local office management instructions.

The structure of a power of attorney from an organization is similar to the structure of a power of attorney from an individual, but there are differences in some nuances:

- when specifying information about the principal, the name of the legal entity, its organizational and legal form, registration data, legal address, position, full name of the director, name and details of the document certifying his authority are indicated;

- when describing the transferred authority to receive funds, it is recommended to also indicate the document providing the basis for receiving money (agreement for the supply of goods, invoice, etc.) and its details.

Current civil legislation does not require that the power of attorney form to receive money also contain the organization’s seal, but in order to avoid disputes with the counterparty, it is recommended to affix the seal (if available). Similarly, the signature of the chief accountant is not currently one of the mandatory details of the power of attorney, but if possible, it should be affixed for the same purpose.

If in a power of attorney issued on behalf of an organization it is sufficient to affix the signature of the sole executive body or another person authorized to certify the power of attorney (Clause 4 of Article 185.1 Part 1 of the Civil Code of the Russian Federation), then the citizen as a principal cannot limit himself in this case to only his signature.

We invite you to read: Extension of temporary asylum for citizens of Ukraine in 2020

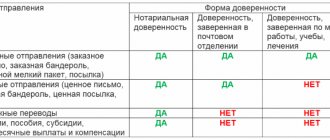

The document in question is subject to mandatory certification. There are two ways to certify a power of attorney to receive salaries and other related payments - to receive payment for the work of authors and inventors, pension payments, benefits and scholarships:

- have the document certified by a notary (the service is provided for a fee);

- to certify the document in the organization where the principal works, undergoes training or is in hospital treatment - certification is carried out free of charge (clause 3 of article 185.1 part 1 of the Civil Code of the Russian Federation).

So, a power of attorney to receive money on behalf of another person is drawn up in any form, but requires proper certification. The said power of attorney, executed on behalf of the legal entity, is issued signed by its director.

The content and structure of the samples will differ depending on the purpose for which the powers are granted to the authorized person. There is no unified form for simple writing; notaries use a special form. Each type of power of attorney must clearly indicate the powers vested in the representative.

It is worth understanding that a notarized document will have greater legal force in the event of any disputes or conflict situations.

POWER OF ATTORNEY

City _________, ____________________________

I, the undersigned ______________, _____________ year of birth, passport __________ N _________, issued by _________________________________, department code ____________, residing at the address: _______________________, authorize with this power of attorney

__________________, ______________ year of birth, passport ____ N _________, issued by __________________, department code __________, living at the address: _________________________________________________,

manage and dispose of all my property, whatever it may be and wherever it may be located;

enter into all transactions permitted by law for the management and disposal of property: buy, sell, donate, accept as a gift, exchange, mortgage and accept residential buildings and other property as collateral, make payments on concluded transactions;

accept or refuse an inheritance;

receive property, money (deposits), securities, as well as documents due to me from all persons, institutions, enterprises, organizations, including from branches of Sberbank and other banks of the Russian Federation, post offices and telegraph offices for all reasons;

manage accounts in Sberbank and other banks of the Russian Federation;

receive postal, telegraph and other correspondence of all kinds, including money and parcels;

conduct affairs on my behalf in all state institutions, cooperative and public organizations, as well as conduct my affairs in all judicial institutions with all the rights granted by law to the plaintiff, defendant, third party and victim, including the right of complete or partial waiver claims, recognition of a claim, changing the subject of the claim, concluding a settlement agreement, appealing a court decision, presenting a writ of execution for collection, receiving awarded property or money.

The power of attorney was issued for a period of _____________.

Principal: signature (Last name, first name, patronymic -

indicated by the principal by hand when signing the power of attorney)

On behalf of the Russian Federation:

City _______________

The sixth of August two thousand fourteen.

The power of attorney was signed by citizen _________________ in my presence. The identity of the principal has been established and his legal capacity has been verified.

signature of I.O. Surname

As a legal document, it has a wide range of actions and empowers an authorized person to perform certain actions and is regarded as a transaction on behalf of one person. This means that only one person is indicated as the principal, which can be either a legal entity or an individual.

In turn, the representative is vested with certain powers: to perform actions within the limits of his competence. Although a power of attorney confers rights, it still limits them to the limits of the powers that are prescribed in it. Thus, if a representative is only entitled to receive correspondence by mail, this fact does not mean that he has the right to open and read it.

We suggest you read: What to do if a child steals money

An authorized person may transfer his powers.

In this case, you need to notify the person who issued the permit earlier. For example, if a trusted person, due to certain circumstances, cannot perform the powers entrusted to him, he can entrust their execution to another person, but only with the consent of the principal. If this consent has not been obtained, the fiduciary will be personally responsible for the actions of the other person.

The right of subrogation is indicated in the text of the document itself.

When drawing up, it is necessary to take into account as many possible nuances as possible, and also choose the right authorized person who will certainly be able to cope with the goal on their own.

Power of attorney to receive money. Decor

Let's consider the main aspects when issuing a power of attorney to receive funds: (click to expand)

- Name of the document, date and place of preparation.

- The authenticity of the power of attorney is established by the full composition of its details. If the principal is an individual, the subject's full name, passport details and last place of registration are indicated. If the principal is an organization (legal entity), we write down its name, taxpayer identification number (TIN), reason for registration code (KPP), place of state registration, position and full name of the head.

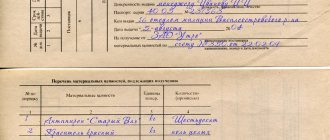

- Determination of the duties and powers that the principal assigns to the authorized person: to receive money, to sign the required documents, etc.

- If you need to receive money once, then in the power of attorney we indicate the specific amount to receive. If your representative must receive money by proxy systematically, for example, buyers give money to the agent, then there is no need to indicate the exact amount.

- The authorized person is required to sign the power of attorney form for receiving cash. The principal (individual) is also required to sign the form and also have the power of attorney certified by a notary. If the principal is a legal entity, the personal signature of the manager or the seal of the organization is sufficient.

In the process of issuing funds, the data of the authorized person’s passport is compared with the power of attorney, so all data must match the power of attorney form.

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

Kinds

This document can be drawn up under various circumstances. This has a significant impact on the type of power of attorney. Such a document has three types:

- A one-time power of attorney is issued to perform a specific action . For example, this could be receiving one salary, a scholarship, or a money transfer. The document specifies the event for which it was created.

- Special . The most common type of trust document. The company grants authority to the employee who receives regular transfers.

- Generalka . The document gives the representative all the rights that the principal also has. The holder of such a power of attorney is allowed to receive any amounts at any time. He can also be a representative of the principal in any transactions involving funds, both cash and non-cash.

Nuances of filling

When entering information into a document, you should pay attention to its accuracy. For example, information about the representative must be identical to the passport data. There should be no blots or corrections here. Any unreadable information may cause the document to be invalidated.

Also, do not forget that receiving funds is a rather serious procedure. In this regard, the document almost always must be notarized. It is quite logical that the party issuing the money will require a trust document from the representative. If there is no notary signature here, it is considered void. If for some reason this fact was not established and the money was received, the transaction can be challenged. The party that issued the money has the right to go to court, which will declare the transaction invalid.

https://youtu.be/cpkFv0T-4-8

( Video : “Executing a power of attorney to receive a pension”)

Although in some situations the services of a notary are not required. For example, under certain circumstances, a document may be certified by other authorities. When notarized, the trust document is recorded in the register of documents. It also contains information about which particular notary certified such a power of attorney.

Sample document

A power of attorney drawn up to receive funds in the interests of an organization must be certified using the company’s seal and the signature of the chief executive. Also, the text must be filled out correctly. A power of attorney issued to perform other types of financial actions is also confirmed by the signature of the organization’s chief accountant.

Since labor relations vary, powers can be transferred by various types of powers of attorney. The general form is used for transmission to accounting department employees. A simple form is issued for orders executed as needed, or for a one-time receipt of funds by an employee.

We invite you to familiarize yourself with: Household contract agreement between individuals for the installation of PVC windows

This type of document must be certified, at best, by a notary. The cost will be from 200 to 800 rubles, and depends on the area, the amount and purpose of monetary assets.

Notary offices are engaged in certification of such documents, but other legal entities can also act as certifiers:

- The director of the company has the right to assume these powers.

- An accountant, then only at his own enterprise.

- Authorized Bank Officials.

- Chiefs of military units and garrisons.

- Heads of medical and preventive institutions for military personnel.

- Heads of social security institutions (nursing homes, etc.).

- Heads of penal institutions.

The listed authorized persons can act as principals only in rare, strictly specified cases.

Duration of the power of attorney

The maximum possible validity period of a trust document is three years. A one-time power of attorney specifies a specific time period for performing actions. If this parameter is not set, then the default validity period of the document is set to one year. The principal may at any time exercise the right to revoke the document he has signed by notifying the trustee within a short period of time.

Registration cost

When issued at an institution, hospital or bank, the power of attorney will be certified free of charge, but you must pay for the notary service. The cost of notarization consists of a fixed state fee and a fee according to the specialist’s price list for drawing up, printing, and mandatory verification of the authenticity of the required documents (passports). The price of the service depends on the region and costs from 700 to 1000 rubles.