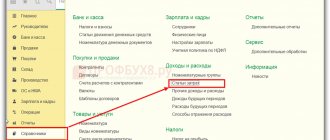

How to find the right area

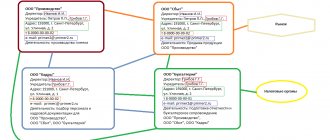

The page presents in the form of links types of activities according to OKVED with decoding. Select the area that matches the area you are looking for. The list is organized in a hierarchical structure. It is formed in accordance with the structure of OKVED numbers, so it will easily orient and direct you when searching for the required list in the most convenient way. By clicking on the appropriate link in the first list, you will be taken to the next page, where a clarifying list will be presented that allows you to narrow your search. Thus, you can easily and quickly find the entire list of organizations registered with the specified OKVED.

Also on the results page you can display organizations that have the required code listed as the main one, or those companies that simply included it in the list of codes, but as an additional one.

https://youtu.be/qR0hZpaDvKk

Expert opinion on the question of whether the Federal Tax Service’s requirement is justified

The current tax legislation of the Russian Federation does not establish any restrictions on the application of the tax regime of the simplified tax system by companies that operate in the field of law - the Tax Code does not say that the simplified taxation system cannot be applied if the code of the main activity of the LLC is OKVED 69.10 "Activities in the field of law."

As for the restrictions mentioned in the text of sub. 10 clause 3 art. 346.12 of the Tax Code of the Russian Federation, this norm does not say that all organizations with an activity code of OKVED 69.10 cannot switch to the simplified tax system - it says that specific entities cannot combine OKVED 69.10 and the simplified tax system, namely:

- notaries who have started private practice;

- lawyers who have established their own law office;

- other forms of legal entities.

The general quality of lawyers and notaries is the absence of the goal of making a profit and running a business. And the organizational and legal form of “LLC” presupposes the conduct of commercial activities (and carrying out commercial activities in the field of law is not prohibited by law). Please pay attention to the text:

- Articles 21 and 29 of the Federal Law of May 31, 2002 No. 63-FZ “On advocacy and the legal profession in the Russian Federation” (a lawyer’s office is not a legal entity, but a chamber of lawyers is a non-governmental non-profit organization that does not have the right to do business);

- paragraph 2 art. 1 of the Federal Law of May 31, 2002 No. 63-FZ “On advocacy and the legal profession in the Russian Federation” (the activities of lawyers cannot be entrepreneurial);

- Article 1 of the Fundamentals of the Legislation of the Russian Federation on notaries (approved by the Supreme Court of the Russian Federation on February 11, 1993 No. 4462-1) (the activities of a notary are not entrepreneurial and do not pursue profit-making purposes).

The Tax Code contains several provisions regarding the accounting of entities that do not have the right to apply the simplified taxation system on the basis of subsection. 10 tbsp. 346.12 Tax Code of the Russian Federation.

According to the instructions in paragraph 5, clause 2, art. 84 of the Tax Code of the Russian Federation, the tax service must register or deregister a private notary or lawyer at the place of their registration within 5 days from the date of receipt of information from the authorities authorized to provide it. During the same period, the Federal Tax Service must issue a corresponding certificate to the lawyer or notary.

Paragraph 6 of Article 83 of the Tax Code of the Russian Federation states that the registration of a notary who intends to engage in private practice is carried out by the tax service at the place of his registration on the basis of information that must be provided by authorized bodies.

Article 85 of the Tax Code of the Russian Federation talks about state bodies authorized to report to the Federal Tax Service Information related to the registration of lawyers and notaries. These are:

- Bar chambers of the constituent entities of the Russian Federation.

They must report to the Federal Tax Service the data on lawyers entered into the register of lawyers of a constituent entity of the Russian Federation in the previous month (including information on the form of lawyer education) or excluded from the register, as well as on decisions to suspend/renew the status of a lawyer made during this month. This must be done before the 10th of each month. You should contact the tax office at the location of the bar association. - Judicial bodies that grant powers to notaries.

They must report to the Federal Tax Service about individuals who have been appointed to the position of notary (private practitioner), or who have been released from such a position. This must be done within 5 days from the date of issuance of the appointment order.

Changes that have occurred in information about individuals not registered as individual entrepreneurs, about lawyers and notaries engaged in private practice are subject to registration by the Federal Tax Service at the place of their registration. Deregistration of a lawyer due to termination of his status or a notary due to termination of his powers is carried out on the basis of data received from authorized bodies.

It becomes clear that activity in the field of law is a broader concept than the activity of a lawyer and a notary, who are prohibited from using the simplified tax system.

According to the current new OKVED, the law and activities in this area have their own codes, which are declared if you want to provide legal services during the state registration procedure of a new business or individual entrepreneur, as well as when submitting almost any reporting on mandatory payments. In this review, we provide a breakdown of the main codes for legal activities, and also draw attention to some of their features.

How the OKVED code is formed

To make it easier to navigate the list and understand in which section of the given ones to look for certain types of activities according to OKVED, you need to understand how this numerical code is formed.

The OKVED code is a numeric identifier that has a hierarchical structure. In order from left to right, the numbers indicate groups and subgroups from the most general formulation to the most specific.

The first two numbers indicate the class, followed by a number indicating the subclass, the fourth position indicating the group, the fifth - the subgroup and the sixth - the types of activities. When registering a company, you only need to indicate the first four numbers, which is why the website provides this level of specificity.

This way you can find information about companies in any business field, even without knowing their names, easily and quickly.

Decoding

In practice, they most often declare for activities in the field of law OKVED 69.10. It has several derived codes that specify the services in question. For example, the OKVED code for legal advice is 69.10.

The table below presents the main OKVED codes for activities in the field of law.

| Activities in the field of law: current OKVED codes | |

| Code | What does it include |

| 69 | Activities in the field of law and accounting |

| 69.1 | Legal activity |

| 69.10 | Legal activities include: · representing the interests of one party against another party in courts or other judicial bodies (advice and representation in civil/criminal cases, as well as labor disputes); · providing recommendations and consulting on general issues, including the preparation of legal documents (certificates of registration; charters and similar documents related to the creation and activities; patents and copyright certificates) and legal acts - wills, powers of attorney, etc.; · government work notaries; notaries for civil matters; bailiffs; arbitrators; persons appointed by the court to take evidence from a witness; arbitrators, patent attorneys. |

| 69.2 | Activities to provide services in the field of accounting, financial audit, tax consulting |

| 69.20 | Services in the field of accounting, financial audit, tax consulting. Does not cover: · processing and generation of summary data (this is code 63.11); · management consulting on accounting systems, budget management (this is code 70.22); · collection of payments on bills (this is code 82.91). |

| 69.20.1 | Conducting a financial audit Covers the analysis of accounting (financial) statements of organizations and the provision of audit-related services (performed by audit firms and private auditors). |

| 69.20.2 | Services in the field of accounting. Cover: · maintaining and restoring records; · drawing up reports; · consulting; · acceptance, reduction and consolidation of accounting (financial) statements. |

| 69.20.3 | Tax consulting. Covers: · tax consulting; · representing the interests of clients before the tax authorities, as well as preparing tax documentation. |

OKVED trade in timber and building materials

In the first edition of the classifier, code 46.18 was used to designate the trading activities of agents and intermediaries selling building materials. In the new edition, this code is allocated for other wholesale trade of individual goods. It can be used by realtors, insurers and other companies, but those enterprises and entrepreneurs who sell building materials no longer use it.

Articles on the topic

Since July 11, 2020, the second edition of the classifier, OKVED-2, has been in effect. It differs from the first in the expanded detail of sections of economic activity. The document was approved by order of Rosstandart dated January 31, 2014 No. 14-st.

This means that each type of wholesale and retail trade now corresponds to a new OKVED code. The inspectors posted the same codes in the Unified State Register of Legal Entities and the Unified State Register of Individual Entrepreneurs. Therefore, when registering and re-registering, confirming the type of activity, as well as when preparing reports, organizations and entrepreneurs must now strictly take codes from the new OKVED.

According to OKVED, wholesale trade in construction materials is included in sections 46 and 47, which describe the classes of activity “wholesale and retail trade, excluding trade in motor vehicles and motorcycles.” One of the codes must be selected as the main economic activity. It describes those activities, the income from which is at least 60% of the total income. Each enterprise or entrepreneur, when registering an LLC or individual entrepreneur, may make a mistake when indicating the codes characterizing the type of its activity.

OKVED 2020 retail trade in jewelry and accessories

The entrepreneur will have to determine the type of activity code during initial state registration, as well as when introducing new directions or changing types of activities in an already registered business. Despite the complex multi-stage nature of the classifier, setting the activity type code yourself is much easier than it seems. To do this, you need to understand the hierarchy of codes.

This is interesting: Computer assembly shock-absorbing group 2020

I know that many individual entrepreneurs on PSN are very worried about the transition to online cash registers from July 1, 2020... They constantly write in the comments and ask questions about this. Therefore, I brought these two important news to the very top of the article. Of course, the main topic of the article will be a little lower.

OKVED code retail trade in timber and building materials

OKVED codes for trade in building materials are a large group of codes, including both retail trade in building materials and wholesale trade in building materials. To correctly select all codes, you must select codes for each client separately. There is no universal set for this type of activity, because the variety of materials is huge, plus many additionally sell tools, provide repair, installation, delivery services, etc. Therefore, if you need to register an individual entrepreneur or LLC, then contact the BUKHprofi company, the company’s lawyers will select all the required OKVED codes specifically for your type of activity, and quickly and inexpensively register your company on a turnkey basis.

OKVED "Retail trade in building materials" - transcript

First of all, it is impossible to fill out an application for registration of a legal entity or registration of an individual entrepreneur without specifying the code. Sheet I of the application in form P11001 for an organization (or sheet A of the application in form P21001 for individual entrepreneurs) contains a mandatory detail - OKVED code. Moreover, there must be at least one, and their maximum number is not limited.

This type of activity involves the purchase or sale of products for the purpose of their subsequent use in business activities. Goods purchased in bulk can be resold. However, it cannot be used for personal, household or family purposes.

OKVED codes for wholesale trade in 2020 and decoding

- Code for individual entrepreneurs and private companies: 46.73 (wholesale sales of building materials, timber, sanitary equipment). It allows wholesale trade:

- sheet glass;

- decorative flooring;

- products from primary processed forest;

- building materials from unprocessed wood;

- varnishes and paints;

- bulk building materials (crushed stone, sand, gravel);

- a variety of plumbing equipment (baths, toilets, sinks and other plumbing products);

- prefabricated products.

- Codes for intermediaries, agents and sales representatives. Agents who sell building materials wholesale must certify their activities with code 46.13. It allows the sale of building materials and timber at wholesale prices. 46.13 includes 2 subspecies. One of them is used by timber sellers, and the second by agents involved in the trade of building materials.

This is interesting: Notarization of real estate transactions

Wholesale concept

Code group 47.52 from OKVED-2 2020 is suitable for registering a business selling building materials at retail. This code has its own name: “Retail sales of paints and varnishes, hardware, glass products in specialized retail outlets.” In this category, for example, there is this: 47.52.7 “Retail sales of building materials that do not belong to other categories of goods in specialized retail outlets.” In addition, this group contains codes that allow the following products to be sold at retail:

Includes: wholesale trade in unprocessed timber; • wholesale trade in primary forest products; • wholesale trade in paints and varnishes; • wholesale trade in building materials such as sand, gravel; • wholesale trade in wallpaper and floor coverings; • wholesale trade in sheet glass; • wholesale trade in plumbing equipment, including: bathtubs, sinks, toilets and other plumbing equipment; • wholesale trade in prefabricated structures

OKVED Timber Retail Trade 2020

Stay up to date! There is too much accounting news and too little time to search for it. I give my consent to the processing of my personal data. Themes menu. The site uses cookies. They allow you to get to know you and receive information about your user experience. This is necessary to improve the site. If you agree, continue to use the site. If not, set special settings in your browser or contact technical support. Activities of wholesale trade agents.

Wholesale trade of building materials: OKVED in 2020

For sawmills, sawing wood, for retail and wholesale trade in timber, as well as wood products, you will need the following OKVED codes. Codes have been updated according to the new classifier! In case of a more expanded type of activity of your company, contact the BUKHprofi company for help; the company’s specialists will not only select OKVED codes, but also register your company on a turnkey basis, quickly and at a minimal cost. LLC registration. Registration of individual entrepreneurs. Oktyabrskoye Pole, 1st Volokolamsky Prospect, No. Copying is possible only with an active link. Accounting services. Accounting.

46.15.2 “Activities of agents in the wholesale trade of hardware, knives and other metal products.” It should be noted that the codes of this group do not include wholesale trade carried out on one’s own behalf, as well as retail trade, which is carried out by commission agents outside of stationary stores;

Today’s review reveals the topic of identification using the classifier of codes for trade in metal products, answers the main questions about determining the type of activity - in which section is trade in metal products presented in the OKVED 2020 directory, for which it is necessary to indicate OKVED codes during registration, which version of the directory is relevant.

OKVED: current version

One of the most extensive sections of the OKVED classifier is trade. The gradation of codes is divided according to three main characteristics: the type of trading activity (wholesale or retail), the composition of the trade assortment, and the type of trade (direct or agency).

This is interesting: Free trips to a sanatorium for children with parents 2020

At the buyer's request, he is obliged to issue a payment document, except in the case when BSO is issued when providing services to the public. The BSO is issued to the buyer instead of a check only when services are provided to the public.

OKVED: funeral services. It was approved by Rosstandart by order of the Document assigns unique cipher designations to all possible areas of activity of legal entities and individual entrepreneurs. The set of tax regimes and other preferences available to it depends on the type of activity code specified in the registration documents of a business entity. Businesses based on the sale of different types of goods are assigned a section in the classifier, designated by the letter G.

Retail trade – OKVED 2020

Thanks to this edition 1 and 1. Retail trade is classified primarily by type of trading enterprises: retail trade in general assortment stores - groupings with Retail trade in general assortment stores includes: retail sales of used goods grouping For retail sales in department stores further distinguish retail sales in specialized stores into groups with The above-mentioned groups are further subdivided according to the range of products sold. Non-general store sales of goods are classified according to forms of trade, such as retail sales in stalls and markets. The range of goods in this group is limited to goods generally referred to as consumer goods or retail goods.

If your enterprise or store decides to sell just such a set at its points of sale, then you do not need to look for the code for each subtype separately. You can specify a general one, and that will be enough. If, for example, you sell glass and products made from it, but do not have paint names, then you will only have to enter subclause 47.52.3, and only if the sale is carried out in specialized stores.

Features of legal codes

Now in more detail about OKVED in the field of law for 2020. Let us immediately note that the codes corresponding to this field of activity do not have strong differentiation depending on the type of legal service. That is, activities in the field of law in OKVED in 2020 are grouped quite compactly and generally.

At the same time, sometimes the legal activities of the state and its structures are separated into separate codes. For example: 84.23 – “Activities in the field of justice and justice.”

The provision of various types of legal services is not reflected by OKVED. That is, the term “legal services” itself does not appear in it. This entire area, according to OKVED 2020 codes, is activity in the field of law.

Another feature is that, according to the current edition of OKVED, services in the field of law go in conjunction with accounting services, as well as consulting:

- accounting;

- tax;

- financial;

- managerial;

- judicial

The code with the value 74.11 OKVED “Activities in the field of law” is outdated and is no longer used, since it is from a reference book in an edition that is outdated.