Temporarily staying

Based on Art. 2 of the Federal Law of July 25, 2002 No. 115-FZ “On the legal status of foreign citizens in the Russian Federation”, temporarily staying in Russia is a foreigner who has a visa (or in a manner that does not require a visa) and has received a migration card, but does not have a residence permit or temporary residence permit.

For temporarily staying foreign citizens, insurance premiums in 2019 are calculated in the following order (subclause 15, clause 1, article 422, article 426 of the Tax Code of the Russian Federation, clause 1, article 7 of Law No. 167-FZ, clause 1, article 20.1 of the Law No. 125-FZ, Part 1, Article 2 of Law No. 255-FZ):

- for compulsory pension insurance in the Pension Fund and injuries in the Social Insurance Fund - in the usual manner;

- for temporary disability and maternity - at a rate of 1.8%;

- for compulsory medical insurance - they are not charged.

Contributions are calculated according to special rules:

- employees who are citizens of EAEU countries (the same as Russians; with the exception of compulsory health insurance contributions for temporarily staying highly qualified specialists from the EAEU, they do not need to be accrued (letter of the Federal Tax Service dated November 22, 2017 No. GD-4-11/26208, dated February 14, 2017 No. BS-4-11/2686));

- for highly qualified specialists not from the EAEU (only contributions for injuries are calculated - letter of the Ministry of Finance dated January 29, 2019 No. 03-15-06/5081).

Insurance premiums and personal income tax: new rules for foreign workers

Since the beginning of 2020, there have been many changes in relations with foreign workers, including in terms of calculating insurance premiums and withholding personal income tax.

On January 1, 2020, amendments to the Federal Law of July 25, 2002 No. 115-FZ “On the Legal Status of Foreign Citizens in the Russian Federation” (hereinafter referred to as Law No. 115-FZ), introduced into it by the Federal Law of November 24, 2014, came into force No. 357-FZ. According to these changes, adult citizens who arrived in the Russian Federation in a manner that does not require a visa and are legally present on its territory can be recruited to work by an employer - a legal entity if such a foreign citizen has a patent issued in accordance with Law No. 115-FZ . To attract foreign workers who arrived in the Russian Federation in a manner that does not require a visa, the employer does not need permission (clause 1, clause 4.5, article 13 of Law No. 115-FZ).

ORIGINAL SOURCE

The labor activity of a foreign citizen is understood as his work in the Russian Federation on the basis of not only an employment contract, but also a civil law contract for the performance of work (rendering services).

— Clause 1 of Art. 2 of Law No. 115-FZ.

By virtue of paragraph 1 of Art. 97 of the Treaty on the Eurasian Economic Union (Astana, May 29, 2014), which entered into force on January 1, 2020, employers or customers of work (services) of a member state involve workers of member states in carrying out labor activities without obtaining a work permit. activities in the state of employment. Employers or customers of work (services) of a member state of the Eurasian Economic Union have the right to involve workers of member states in labor activities without taking into account restrictions on the protection of the national labor market.

Thus, at present, citizens from EAEU member states hired by a Russian organization under an employment contract are not subject to the requirement to obtain a work permit. When hiring such citizens, the same rules apply as when hiring Russian citizens.

IMPORTANT IN WORK

Law No. 115-FZ obliges employers, in established cases, to notify the territorial bodies of the Federal Migration Service, executive authorities in charge of employment issues in the relevant constituent entity of the Russian Federation, about the attraction and use of foreign workers, as well as other related facts.

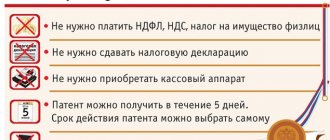

Patent

A patent is a document confirming the right of a foreign citizen who arrived in the Russian Federation in a manner that does not require a visa, with the exception of certain categories of foreign citizens in cases provided for by law, to temporarily carry out labor activities on the territory of the corresponding constituent entity of the Russian Federation (Clause 1, Article 2 Law No. 115-FZ).

GOOD TO KNOW

The form of the patent form issued to a foreign citizen who arrived in the Russian Federation in a manner that does not require a visa was approved by Order of the Federal Migration Service of Russia dated December 8, 2014 No. 638.

A patent is issued to a foreign citizen for a period of one to twelve months (Clause 5, Article 13.3 of Law No. 115-FZ). The validity period of a patent can be repeatedly extended for a period of one month. In this case, the total validity period of the patent, taking into account extensions, cannot be more than twelve months from the date of issue of the patent. The validity period of a patent is considered extended for the period for which personal income tax is paid in the form of a fixed advance payment. In this case, contacting the territorial bodies of the FMS is not required. Otherwise, the patent expires on the day following the last day of the period for which the personal income tax was paid in the form of a fixed advance payment.

According to paragraph 8 of Art. 13 of Law No. 115-FZ no later than ten working days before the expiration of twelve months from the date of issue of the patent, a foreign citizen has the right to apply to the territorial body of the federal executive body in the field of migration that issued the patent for re-registration of the patent. In this case, the number of applications for renewal of a patent cannot exceed once.

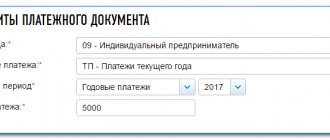

As established in paragraph 4 of Art. 227.1 of the Tax Code of the Russian Federation, a fixed advance tax payment is paid by the taxpayer at the place of activity on the basis of the issued patent before the start date of the period for which the patent is issued (extended) or reissued.

Thus, in order to renew a patent, a foreign worker must pay an advance payment for personal income tax before the start of the period for which the patent is planned to be renewed.

IMPORTANT IN WORK

From 01/01/2015, payments to foreign citizens must be made at the place of activity on the basis of a patent.

Foreigners paying personal income tax in the form of fixed advance payments

Until 01/01/2015, personal income tax was independently required to be paid by those foreign citizens who, on the basis of a patent, are employed by individuals under an employment or civil law contract, performing work (providing services) for personal, household and other similar needs (clause 1 of Art. 227.1 Tax Code of the Russian Federation).

Foreigners who have received a patent can also work in organizations and individual entrepreneurs (lawyers, notaries, and other persons engaged in private practice in accordance with the established procedure) from January 1, 2015. In this regard, they will also be required to pay personal income tax, but taking into account a number of features (clause 2 of article 1 of Law No. 368-FZ).

Let us conditionally divide the listed taxpayers into two categories:

- foreign citizens working for individuals;

- foreign citizens working in organizations and entrepreneurs.

Both must independently transfer fixed advance payments for personal income tax. At the same time, the rule that the advance payment must be made before the start of the period for which the patent is issued (extended) or renewed will remain unchanged next year (clause 4 of Article 227.1 of the Tax Code of the Russian Federation in the new edition). However, tax will need to be calculated and paid differently at the end of the year.

For the first category of taxpayers, nothing changes. As now, they must determine the amount of personal income tax for the corresponding calendar year based on the income actually received. In this case, the calculated tax is reduced by the fixed advance payments for personal income tax paid in the same year for the period of validity of the patent (Clause 5 of Article 227.1 of the Tax Code of the Russian Federation as amended).

In relation to the second category of taxpayers, the responsibility for calculating the annual amount of personal income tax rests with tax agents, that is, employers represented by legal entities and entrepreneurs (other self-employed persons) (clause 2 of Article 226 of the Tax Code of the Russian Federation as amended, clause 6 of Article 227.1 Tax Code of the Russian Federation in the new edition).

ORIGINAL SOURCE

The monthly fixed advance payment from 01/01/2015 is 1200 rubles.

— Clause 2 of Art. 227.1 Tax Code of the Russian Federation.

When calculating tax for the year, the tax agent must also take into account advance payments made by the employee. To do this, you will need the following documents (clause 6 of Article 227.1 of the Tax Code of the Russian Federation in the new edition):

- a written application from an individual to an employer with a request to reduce personal income tax for the tax period by the amount of the listed fixed advance tax payments. The application form is not specified. We believe that any form is allowed;

- documents confirming the payment of advance payments for personal income tax (tax payment receipts from the employee);

- notification from the tax authority at the location (residence) of the employer about the legality of reducing personal income tax by the amount of advance payments.

The tax agent must request such notification from the territorial inspectorate by submitting an application. It should be taken into account that the tax authority sends a notification to the employer once a year if there is information from the Federal Migration Service of Russia about the concluded employment (civil law) agreement between the tax agent and the foreign employee and that the foreigner has been legally issued a patent.

IMPORTANT IN WORK

The tax authority sends the specified notification within a period not exceeding 10 days from the date of receipt of the tax agent’s application, if the tax authority has information received from the territorial body of the Federal Migration Service about the fact that the tax agent has concluded an employment contract or a civil contract for the performance of work with the taxpayer ( provision of services) and the issuance of a patent to the taxpayer and provided that previously, in relation to the relevant tax period, such notification by the tax authorities in relation to the specified taxpayer was not sent to tax agents.

Unless otherwise provided by Art. 224 of the Tax Code of the Russian Federation, the tax rate is set at 13%. The same rate also applies to the income of foreign citizens working in the Russian Federation for hire in organizations, on the basis of a patent issued in accordance with Federal Law No. 115-FZ of July 25, 2002 (clause 2, clause 1, article 227.1, p. 3 Article 224 of the Tax Code of the Russian Federation).

The personal income tax amount is reduced during the tax period by only one tax agent at the taxpayer’s choice, provided that the tax agent receives from the tax authority at the location (place of residence) of the tax agent a notification confirming the right to such a reduction.

The tax agent will not need to check information about how many employers the employee works for and whether he has applied to any of them with an application to reduce personal income tax. After all, the tax authority must receive all information about issued patents and about existing labor (civil) contracts between foreign citizens and their employers from the territorial branches of the Federal Migration Service of Russia. Accordingly, if any employer has already applied for the mentioned notification in relation to the same foreign employee, the inspectorate will not issue this document again. This will mean that the personal income tax for such an employee is already reduced by the amount of advance payments at his other place of work.

IMPORTANT IN WORK

Starting from 01/01/2015, foreign taxpayers, when transferring a fixed personal income tax payment, are required to additionally multiply it by the regional coefficient. This coefficient should be established annually by the laws of the constituent entities of the Russian Federation. If the corresponding law is not adopted, then the advance payment will need to be adjusted only by the deflator coefficient, since in such a case the value of the regional coefficient is taken equal to 1.

In relation to the second category of taxpayers, the amount of tax payable will arise only when the personal income tax, calculated on the basis of the earnings they actually received, exceeds the fixed advance tax payments paid during the year. Otherwise, personal income tax does not need to be transferred at the end of the year. In this case, the excess of advance payments over the final amount of personal income tax will not be an overpayment. Accordingly, the employer will not need to take any action to return it to a foreign employee (clause 7 of Article 227.1 of the Tax Code of the Russian Federation as amended). Until January 1, 2015, similar standards were established regarding the procedure for calculating personal income tax at the end of the year by foreigners operating on the basis of a patent for individuals. In 2020, these standards will not change for this category of taxpayers.

ORIGINAL SOURCE

Amounts of payments and other remuneration under employment contracts and civil law contracts, including under contracts of author's order in favor of foreign citizens and stateless persons temporarily staying in the territory of the Russian Federation, are not subject to insurance premiums, except in cases provided for by Law No. 212-FZ and federal laws on specific types of compulsory social insurance.

— Clause 15, Part 1, Art. 9 of Law No. 212-FZ.

Insurance contributions to the FFOMS

Clause 15, Part 1, Art. 9 of Law No. 212-FZ determines that the amounts of payments and other remunerations under employment contracts in favor of foreign citizens temporarily staying in the territory of the Russian Federation are not subject to insurance premiums, except in cases provided for by Law No. 212-FZ and federal laws on specific types of compulsory social insurance.

Insured persons subject to compulsory health insurance are foreign citizens permanently or temporarily residing in the Russian Federation, stateless persons (with the exception of highly qualified specialists and members of their families, as well as foreign citizens working in the Russian Federation in accordance with Article 13.5 of Law No. 115 -FZ), as well as persons entitled to medical care in accordance with the Federal Law “On Refugees”, working under an employment contract. Foreign citizens temporarily staying in the territory of the Russian Federation are not named among the listed categories.

In turn, as mentioned above, clause 3 of Art. 98 of the Treaty on the EAEU establishes that social security (social insurance) (except for pensions) of workers from the member states of the Treaty and members of their families is carried out on the same conditions and in the same manner as citizens of the state of employment. At the same time, we remind you that compulsory health insurance refers to social security (social insurance) (clause 5 of Article 96 of the Treaty on the EAEU).

IMPORTANT IN WORK

An organization that has entered into an employment contract with a foreign employee from the EAEU temporarily staying in the Russian Federation is obliged to pay insurance contributions to the Federal Compulsory Medical Insurance Fund from payments accrued in favor of such an employee in 2020.

Insurance contributions to the Social Insurance Fund

On January 1, 2015, changes made to Law No. 212-FZ came into force. So, part 2 of Art. 12 of Law No. 212-FZ is supplemented with clause 2.1, which provides that in relation to payments and other remuneration in favor of foreign citizens and stateless persons temporarily staying in the Russian Federation (with the exception of highly qualified specialists in accordance with Law No. 115-FZ), a tariff of 1.8%, credited to the Social Insurance Fund of the Russian Federation.

At the same time Art. 2 of Law No. 255-FZ was supplemented with Part 4.1 as follows: “Foreign citizens and stateless persons temporarily staying in the Russian Federation (with the exception of highly qualified specialists in accordance with Law No. 115-FZ) have the right to receive insurance coverage in the form benefits for temporary disability, subject to payment of insurance premiums for them by the policyholders specified in Part 1 of Art. 2.1 of this law, for a period of at least six months preceding the month in which the insured event occurred.”

Thus, from 01/01/2015, in general, foreign citizens temporarily staying in the Russian Federation have the right to receive insurance coverage in the form of temporary disability benefits, subject to the payment of insurance premiums for them by the insured at a rate of 1.8% for a period of at least six months preceding the month in which the insured event occurred.

Consequently, payers of insurance contributions who have entered into employment contracts with foreign citizens and stateless persons temporarily residing in the territory of the Russian Federation, from January 1, 2020, are required to pay insurance contributions to the Social Insurance Fund of the Russian Federation from the 1st day of work of such persons in the Russian Federation regardless of the term of the contract.

At the same time, as we have already said, social security (social insurance) (except for pensions) of workers of the EAEU member states is carried out on the same conditions and in the same manner as citizens of the state of employment.

In connection with the above, from January 1, 2020, citizens from the EAEU states, including those temporarily staying on the territory of the Russian Federation, will have the right to receive all types of compulsory social insurance benefits in case of temporary disability and in connection with maternity (temporary disability benefits, maternity benefits, one-time benefits for women registered in medical institutions in the early stages of pregnancy, one-time benefits at the birth of a child, monthly child care benefits, social funeral benefits) from the first day of work on the territory of the Russian Federation, and employers will have to pay insurance premiums for them to the Federal Social Insurance Fund of the Russian Federation in the same amounts as for citizens of the Russian Federation. Similar explanations are given on the website of one of the territorial branches of the Foundation.

IMPORTANT IN WORK

The maximum base for calculating insurance contributions to the Social Insurance Fund of the Russian Federation is set for 2020 in the amount of 670,000 rubles.

Contributions to the Pension Fund

Until 2020, foreign citizens, including citizens from member states of the EAEU, temporarily staying in the territory of the Russian Federation, were subject to compulsory pension insurance if an employment contract was concluded with them for an indefinite period or a fixed-term employment contract (fixed-term employment contracts) lasting at least six months in total during the calendar year.

Since 01.01.2015, foreign citizens temporarily staying in the Russian Federation are considered insured, regardless of the duration of employment or fixed-term employment contracts concluded with them. Thus, from 2020, insurance contributions to the Pension Fund of the Russian Federation are calculated on payments in their favor, regardless of the term of the employment contract.

Pension provision for workers of the member states and members of their families is regulated by the legislation of the state of permanent residence, as well as in accordance with a separate international treaty between the member states (clause 3 of article 98 of the Treaty on the EAEU).

Currently, the same procedure and the same conditions under which pension insurance contributions are calculated for citizens of the country of employment have not yet been established for workers of a member state of the EAEU. We believe that work in this direction is underway. Thus, by decision of the Council of the Eurasian Economic Commission dated November 12, 2014 No. 103, the Concept of the draft international agreement on cooperation in the field of pensions was approved. The main goal of developing the draft Agreement is to ensure equal rights in the field of pension provision, the protection of pension rights acquired by workers in the territory of the EAEU member states, as well as the development of cooperation in the field of pension provision between the member states of the Union. The development of the draft Agreement involves solving, in particular, the problem of pension provision for citizens of the Member States, which should be carried out on the same conditions and in the same manner as citizens of the state of employment, including in terms of payment of insurance (mandatory pension) contributions. The development of the draft Treaty is carried out in accordance with the Plan for the Development of Acts and the Treaty on the EAEU during 2020.

Taking this into account, we believe that with regard to pension provision (insurance), and therefore pension contributions, one should currently be guided by the norms of Law No. 167-FZ, applicable to foreign citizens, and not to citizens of the Russian Federation.

In this regard, in our opinion, the provisions of paragraph 2 of Art. 22.1 of Law No. 167-FZ regarding the calculation of insurance premiums for payments in favor of foreign workers temporarily staying in the Russian Federation. Insurance premiums are paid at the rate established for citizens of the Russian Federation to finance an insurance pension, regardless of the year of birth of the foreign employee.

IMPORTANT IN WORK

The maximum base for calculating insurance contributions to the Pension Fund of the Russian Federation is set for 2020 in the amount of 711,000 rubles.

Social insurance contributions from NS and PZ

Based on Art. 5 of Law No. 125-FZ, individuals are subject to compulsory social insurance against accidents at work and occupational diseases:

- performing work on the basis of an employment contract concluded with the policyholder;

- performing work on the basis of a civil contract, if, in accordance with the specified contract, the policyholder is obliged to pay insurance premiums to the insurer.

At the same time, Law No. 125-FZ also applies to foreign citizens, regardless of their status, unless otherwise provided by federal laws or international treaties of the Russian Federation.

As already mentioned, in the situation under consideration, the norms of Russian legislation apply to insurance premiums. Thus, insurance of workers from the EAEU member states who have the status of temporary stayers against industrial accidents and occupational diseases is carried out on an equal basis with citizens of the Russian Federation.

- Back

- Forward

Finding out the status of the document

The fact that the calculation of contributions to extra-budgetary funds is closely related to the legal status of a foreigner is probably known to any accountant.

Finding information about exactly how a particular status affects contributions is also not a problem. The main problem is how to determine in real life exactly what status a foreigner hired has. It is for these purposes that our first cheat sheet is intended. In fact, determining the status of a foreigner is not difficult. After all, each of them has some kind of document certifying the legality of their stay on the territory of our country. It is on the basis of this document that the status of a foreigner is determined. This is done as follows.

- Residence permit of a foreign citizen = permanent resident.

- Passport with the stamp “Temporary residence allowed” = temporary resident (for stateless persons - a document proving their identity, and if there is none, then a separate document “Temporary residence permit” is issued).

- Passport with an open visa = temporary stay.

- Migration card = temporary stayer.

Are Belarusians a separate situation?

Accountants are already accustomed to the fact that citizens of Belarus are subject to special rules that differ from those that all other foreigners must follow. However, there are no such exceptions for contributions. Everything is traditional here: the payment of contributions from payments in favor of citizens of the Republic of Belarus also depends on the status of the employee. But there were some differences too. And it lies in documents confirming the status. Citizens of Belarus, in accordance with Article 4 of the Agreement of January 24, 2006 between the Russian Federation and the Republic of Belarus, have the right, immediately after registering for migration at their place of residence (without presenting a migration card), to apply for a residence permit. That is, they do not need to first obtain a migration card and a temporary residence permit in Russia.

In relation to our situation, this means that citizens of Belarus can present when applying for employment either a national passport, and then they will be considered temporarily staying in the territory of the Russian Federation, or a residence permit, and then they will be considered permanent residents.