To account for accrued insurance premiums in accounting. In accounting, a special account is used - 69 “Calculations for social insurance and security”. Analytics on it is carried out by type of insurance premiums, as well as for each employee. Account 69 corresponds with other accounts, both debit and credit. Let's take a closer look at the procedure and rules for drawing up standard correspondence on insurance premiums. Dear readers! Our articles talk about typical ways to resolve legal issues, but each case is unique. If you want to find out how to solve your specific problem, please contact the online consultant form on the right. Or call us by phone (Moscow) +7 (812) 490-76-58 (St. Petersburg) It's fast and free! Fundamentals of accounting for insurance premiums Insurance premiums to any extra-budgetary funds are reflected in a special accounting account. accounting - account

Procedure for paying penalties on insurance premiums for 2018

The negative consequences of non-payment of contributions are:

- reducing the possibility of obtaining investment income from investing pension savings;

- reduction in the amount of pension savings when indexing them.

Reflection of penalties for insurance premiums in accounting Clause 7 of PBU 1/2008 states that the enterprise itself has the opportunity to choose the method of reflecting expenses in accounting, if it is not expressly established by law. PBU 10/99 does not specifically specify the reflection of penalties for taxes and fees; it only indicates penalties for violation of the terms of contracts. Moreover, we draw your attention to the fact that the amounts of taxes and contributions additionally accrued during the audit can be attributed to past periods, and fines and penalties - to the periods when the decision was made on the audit report (court decision).

Basic entries when paying penalties on insurance premiums

Arrears on insurance contributions to the Pension Fund, Social Insurance Fund, Federal Compulsory Medical Insurance Fund: calculation of penalties." Posting penalties to the Pension Fund of the Russian Federation (to the Federal Tax Service): when to make the posting The day on which transactions to accrue the amount of penalties should be reflected is selected depending on whether the accountant paid the penalties himself or whether the obligation to pay them was discovered after an audit:

- when the accountant himself corrected the error and paid the penalty, the transactions are posted on the day of their calculation (and the day must be indicated in the calculation certificate);

- if a notice was received to remind you to pay penalties, the accountant makes an entry for the day when the decision to accrue them after the audit came into force.

Legislative acts on the topic It is recommended to study in advance: Document Title Federal Law of July 24, 1998 No. 125-FZ “On Compulsory Social Insurance” Norms for insurance premiums in cases of injury p.

Methods for collecting fines and penalties

Organizations can pay penalties voluntarily. To do this, you should send a payment order to the fund indicating the amount of the sanction. The document must contain the correct details, including the relevant BCC.

If the payer has not repaid the debt on his own, the regulatory authorities have the right to collect the arrears. The procedure can be carried out by government services using the following methods:

- send a collection order to the bank servicing the company;

- order the bailiffs to recover the required amount from the property of the debtor company;

- file a lawsuit to collect penalties and insurance premiums through confiscation of the payer’s assets, if he is an individual.

However, before taking radical measures, the services issue a demand to the company to pay the debt. The document indicates the period during which the company can independently repay the arrears. If the company does not transfer funds, then the regulatory authorities have the right to recover. In this case, penalties can only be written off from a current account opened on the basis of an agreement between the organization and the bank.

Legislators have developed a system of control measures for the timely payment of taxes and insurance contributions. Since 2020, collection of the bulk of insurance premiums (except for injuries) has become the prerogative of the Federal Tax Service. But the requirements for their payment have remained unchanged: they must be paid on time and in full, and in the absence of payment or part thereof, the payer is subject to the rules of legislative law that dictate the mandatory payment of arrears and penalties, which are considered as penalties for late payment of contributions .

This publication will tell you how to correctly account for the accrual and payment of penalties in a company’s accounting records.

Basics of accounting for insurance premiums and posting them

- Info

D 69 K 70 - payments to employees were accrued at the expense of the Social Insurance Fund; - D 69 K 51 - calculated amounts of insurance premiums are transferred from the current account;

- D 69 K 50 - vouchers were issued from the cash register to employees at the expense of the Social Insurance Fund.

- Reflection in 1C Before making insurance premiums in the 1C program, you should configure it correctly, for which you need to indicate the current premium rates in the directory. They are installed in the “Salaries and Personnel” tab, if the program is combined, or separately in the contributions tab, if the salary accounting program is separate. It is also necessary to indicate the limit values of the bases for calculating fear.

contributions so that they are calculated correctly. Insurance premiums are calculated immediately at the time of payroll or immediately after. In the second case, you need to create a document “Calculation of insurance premiums”.

Insurance premiums: typical postings and tariffs

Insurance contributions are levied on employee payments under employment contracts: wages, vacation pay, travel allowances, bonuses, wage compensation, additional payments.

Also, insurance premiums to the Pension Fund must be calculated for payments under civil contracts, author's orders, and licensing agreements. This category of payments is not subject to contributions to the Social Insurance Fund. Insurance contributions to the Funds: Pension, Medical Insurance and Social Insurance are calculated from the salaries of the company's employees. For entrepreneurs with employees and who are not employers, a fixed amount of contributions from the Pension Fund and the Federal Compulsory Medical Insurance Fund is established.

Arrears and its role in tax accounting

However, this in no way affects the accounting and postings that are compiled in the organization, and, therefore, the correspondence and rules for calculating contributions remain the same. New card for recording insurance premiums Interest rates When calculating insurance premiums, the following interest rates are taken into account:

- for pension insurance - within the limit of 22%, above the limit of 10%;

- for health insurance - 5.1%;

- for social insurance - within the limit of 2.9%, above the limit 0%;

- for accident insurance - from 0.2 to 8.5%; For disabled people, only 60% of the calculated insurance premiums is taken.

All calculated insurance premiums are reflected in account 69, only broken down by subaccounts. In addition, analytical records are also maintained for each employee individually.

Which entries reflect the payment of penalties for insurance premiums?

Thus, in other cases, the good will of the recipient is required to return the amount of benefits not accepted by the fund. However, voluntary contribution is rare in practice. As a rule, these amounts have to be written off at the expense of the organization’s own funds, corrections must be made in accounting and tax accounting, and the reporting forms already submitted must be adjusted.

The basic rules for filling out payment orders for transferring insurance payments have a number of distinctive features.

New insurance premium accounting card When calculating insurance premiums, the following interest rates are taken into account: How to generate an insurance premium accounting card in 1C: ZUP, see the video below: When carrying out transactions on insurance premiums, the following correspondence is generated for the account loan.

What entries should be used to reflect payment of arrears of insurance premiums paid on the basis of a submitted claim?

This document will save you from offensive fines and protect you from mistakes. The relevance is confirmed by Simplified experts. Register, download and immediately use it in your work! The main requirement remains the timely transfer of insurance payments in full. And if this requirement is violated, regardless of the reasons that led to the delay or partial payment of contributions, the payer will be obliged to pay the arrears and obey the sanctions for late completion of the money transfer - to pay the accrued penalties.

Expenses that are not accepted by the Federal Insurance Fund of the Russian Federation for offset due to the lack of supporting documents lead to arrears of mandatory insurance contributions. Recommendation: How to correct errors in accounting and financial reporting. Situation: how to reflect in accounting the amounts of VAT and income tax additionally accrued based on the results of an on-site tax audit.

Since expenses in the form of VAT amounts additionally accrued based on the results of a tax audit are not reflected in tax accounting, permanent differences arise and corresponding permanent tax obligations, p.

Accounting entries for arrears of insurance premiums

From the amounts allocated to the Social Insurance Fund, the state forms a budget for benefits.

- In the Pension Fund. The debt is formed from mandatory pension payments.

- In FFOMS. The debt is formed from mandatory payments for medical care.

The presence of debt involves the accrual of penalties at a rate corresponding to the current rate of the Central Bank of the Russian Federation.

An enterprise that has employees must pay contributions by the 15th day of the month following the reporting month. How is arrears identified? Arrears, in most cases, are identified as follows:

- A tax return is prepared.

- Tax is calculated.

- If the tax is not paid on time, arrears arise.

- The amount of the penalty is formed.

Arrears may be discovered as a result of a tax audit.

If debts arose to government agencies (tax authorities, Pension Fund, insurance companies), then collection usually occurs quickly. If the amount of debts does not exceed 50,000 rubles, then creditors can appeal to the magistrate’s court. The case is considered quickly and without the presence of the debtor.

Attention

However, the debtor can challenge the decisions. To do this, he needs to send the relevant document to the magistrate’s court, which made the decision. Summary Arrears are debts formed due to the fact that an enterprise does not make tax deductions, contributions to insurance funds, and the Pension Fund of the Russian Federation. Arrears are discovered during checks and errors in payment documents are discovered by the head of the company himself.

Subject to recovery in court. First, the creditor sends a demand for payment to the debtor. If the debtor does not respond to the demands, the creditor has the right to appeal to a judicial authority.

Arrears on insurance premiums until 2018 posting

As for the accounts in which they should be taken into account, the Ministry of Finance of Russia in its latest clarifications (letter dated December 28, 2016 No. 07-04-09/78875) recommends that penalties accrued on payments other than income taxes and the simplified tax system be attributed to accounts cost accounting: Dt 26 (44) Kt 69. Read more about the latest point of view of the Ministry of Finance in the material “Penalties and fines on taxes - what is the account in accounting?” In earlier recommendations, the Ministry of Finance proposed using account 99 to reflect penalties (letter dated February 15, 2006 No. 07-05-06/31). In the instructions for using the chart of accounts, approved by order of the Ministry of Finance of Russia dated October 31, 2000 No. 94n, account 99 is used to reflect tax sanctions. Penalties do not apply to tax sanctions, but the instructions say that account 99 can be used to reflect penalties for violation of deadlines for paying contributions in correspondence with account 69. How penalties are collected and what will happen for late payment. Often, the policyholder ignores the notice of payment of debts. If a notice of the need to pay a fine was delivered to the enterprise, but the payment was not made, the amount is collected forcibly:

- a collection order is sent to the banking institution where the payer’s current account is opened (funds will be debited as they are received until the debt is repaid);

- bailiffs receive a ruling on the need to collect debt by seizing the payer’s assets and selling them;

- if the debt is registered with an individual (not an individual entrepreneur), a lawsuit will be filed against him in order to withhold funds from his assets, after which a bailiff will be involved in seizing the debt.

When insurance contributions are not made on time, the pension rights of insured citizens are violated. In the process, coercive measures are implemented:

- Write-off of funds from bank accounts in the amount of debt.

- Seizure of property.

- Ban on traveling abroad.

If a debt is not paid for a long time, it is considered uncollectible and is cancelled. Peculiarities of calculating penalties Penalties are calculated daily. Its size is determined as a percentage of the debt.

For example, a person’s debt to the tax office is 1000 rubles.

How to reflect fines for tax offenses and penalties for arrears in accounting and taxation

To display the costs incurred that arise when fines and penalties are calculated, account 99 Profit and loss is used. For convenience, it is divided into two subcontos - penalties and fines. The debit of this account corresponds with the corresponding tax payment, which is displayed on the credit of accounts 68 and 69.

https://www.youtube.com/watch?v=videoseries

There are opinions in accounting circles that account 91 Other expenses can also be used to display accrued penalties and fines. However, in this case, a permanent tax liability arises, which somewhat complicates the process of accounting for them.

In addition, if accrued penalties and fines are displayed on 91 accounts, this will lead to a decrease in the tax base and will violate the authenticity of the information provided in the financial indicators of the organization.

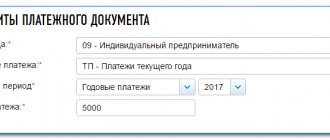

Payments for VNIM (compulsory insurance in case of temporary disability and in connection with maternity), compulsory pension insurance, compulsory medical insurance) are paid according to the details of the Federal Tax Service, each indicating its own BCC. The payment deadlines for all these payments are the same for payers making payments to individuals. For example, in 2020:

- for January - 02/15/2018;

- for February - 03/15/2018;

- for March - 04/16/2018;

- for April - 05/15/2018;

- for May - 06/15/2018;

- for June - 07/16/2018;

- for July - 08/15/2018;

- for August - 09/17/2018;

- for September - 10/15/2018;

- for October - November 15, 2018;

- for November - December 17, 2018;

- for December - 01/15/2019.

For payers who do not make payments to individuals, payment deadlines are different:

- until December 31 of the reporting year - from the amount of income up to 300,000 rubles;

- until 01.07 of the year following the reporting year, from an amount of income exceeding 300,000 rubles.

Tax control activities (camera settlements and on-site audits) have been carried out by tax authorities since 2020.

The correctness of the accrual of payments at the expense of the Social Insurance Fund is still checked by the Social Insurance Fund.

For late payments to OPS, OMS and VNiM, penalties are accrued in accordance with the general procedure established by paragraphs. 3, 7 tbsp. 75 Tax Code of the Russian Federation:

- for the first 30 days of delay for each day in the amount of 1/300 of the refinancing rate;

- starting from the 31st day of delay - in the amount of 1/150 of the refinancing rate.

For deductions for injuries, penalties are calculated differently: in the amount of 1/300 of the refinancing rate per day for the entire period of delay (clauses 3, 6 of Article 26.11 of Law No. 125-FZ).

Penalties accrued for insurance premiums (posting): Dt 99 Kt 69.

Penalties paid on insurance premiums (postings): Dt 69 Kt 51.

For the convenience of monitoring accrued penalties to account 69, it is advisable to open separate “penalty” subaccounts in the context of the insurance premiums for which they are accrued.

The amount of accrued tax sanctions does not form a conditional income tax expense (clause 83 of the Accounting and Reporting Regulations, clause 20 of PBU 18/02). Therefore, in accounting, reflect these amounts directly on account 99 “Profits and losses” in correspondence with account 68 “Calculations for taxes and fees” (69 “Calculations for social insurance and security”).

For accounting purposes, fines and penalties can be combined into one category of accounting objects - tax sanctions.* This approach does not contradict the objectives of accounting, in particular, providing complete and reliable information about the activities of the organization and the basic principles of its management - rationality and the priority of content over form (clause. 1 Article 13 of the Law of December 6, 2011 No. 402-FZ, clause 10 of the Regulations on accounting and reporting).

We invite you to familiarize yourself with the Agreement for the purchase of cattle from an individual

| ★ Best-selling book “Accounting from Scratch” for dummies (understand how to do accounting in 72 hours) purchased by {amp}gt; 8000 books |

Refusal to transfer funds is fraught with punishment - penalties and fines established by regulatory authorities. Amounts are calculated based on the length of the period of non-payment. A penalty is charged for each day of delay, starting from the end date of the permitted period.

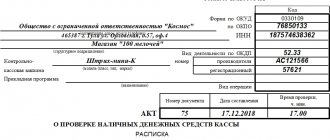

The day the debt is transferred is not taken into account in the non-payment period used to calculate the amount of the fine. According to Law No. 212-FZ, the obligation is considered fulfilled:

- from the moment a transaction related to the transfer of money to the relevant authorities is reflected in the enterprise’s account;

- from the date of presentation to the bank of a properly executed payment order;

- from the date of the supervisory authority’s decision to set off previously overpaid amounts;

- from the moment of depositing cash into the bank's cash desk, the administration to repay the debt to the relevant fund.

That is, if an organization transfers money for March 2020 on April 18, the accounting service should send to extra-budgetary funds an amount equal to mandatory contributions increased by the amount of the penalty. In this case, the amount of sanctions will be calculated taking into account 2 days of delay - April 16 and 17.

Fines are paid separately from insurance premiums. The transfer of debt does not exempt the company from penalties for missing the period established by law.

The amount of sanctions is calculated as a percentage of the amount of contributions payable. This indicator is equal to 1/300 of the refinancing rate of the Central Bank of Russia in effect on the date of delay. From January 1, 2020, it is 11%.

P = S*D*SR*1/300,

C - the amount of contributions to be paid;

D - number of calendar days of delay;

SR - refinancing rate.

Amounts that the company was unable to transfer for good reason are excluded from the calculations. Such situations include:

- suspension by court decision of all banking operations of the company;

- seizure of property belonging to the enterprise.

Insurance premiums are calculated monthly. Postings are created in the period to which the calculated amounts relate.

Accruals are displayed on account 69. Organizations must ensure analytical accounting of funds; for this purpose, appropriate sub-accounts are opened.

Typical accounting entries are provided in the table below.

| the name of the operation | Debit | Credit |

| Insurance premiums paid to the Pension Fund | 20 (25, 26, 29, 44) | 69.2 |

| Accrued for payment to the Social Insurance Fund | 20 (25, 26, 29, 44) | 69.1 |

| Accrued to the Compulsory Medical Insurance Fund | 20 (25, 26, 29, 44) | 69.3 |

| Late fee charged | 91 | 69 |

| The established amounts were transferred to the funds | 69 | 51 |

Ander LLC transferred insurance premiums for March 2020 on April 19. What amount should be paid if the debt is 10 thousand rubles?

The calculation for this situation will look like this:

- It is necessary to determine all unknown indicators of the formula:

- The refinancing rate from January 1, 2020 is 11%;

- The non-payment period is 3 days: April 16, 17 and 18.

- Calculation using the formula: P = S*D*SR*1/300 = 10000*3*11*1/300 = 1100 rub.

- Preparation of postings:

- Contributions in the amount of 10 thousand rubles have been accrued: debit 20, credit 69;

- A penalty of 1,100 rubles was assessed. for overdue: debit 91, credit 69;

- The debt on contributions is listed: debit 69, credit 51;

- Penalty paid: debit 69, credit 51.

We also recommend that you read the article: “Penalties on insurance premiums.”

Silfida LLC assessed mandatory payments in the amount of 15 thousand rubles. Of these, 10 thousand rubles. were transferred on April 13, and on the 5th - on the 18th.

P = S*D*SR*1/300 = 5000*2*11*1/300 = 366.67 rub.

Postings for the operation:

- Contributions in the amount of 15 thousand rubles were accrued: debit 20, credit 69;

- Paid 10 thousand rubles: debit 69, credit 51;

- A penalty was accrued for late payment in the amount of 366.67 rubles: debit 91, credit 69;

- The debt on contributions in the amount of 5 thousand rubles was transferred: debit 69 credit 51;

- Penalty paid: debit 69, credit 51.

Use the insurance premium penalty calculator in Excel.

For late submission of reports or submission of accounting information, for example, when opening a current account, or payment of taxes later than the due date, penalties are imposed, the amount of which is regulated by the relevant articles of the Tax Code.

A penalty is something other than penalties. It is a kind of security that encourages the timely fulfillment of their obligations regarding the payment of relevant taxes and fees.

The amount of the accrued penalty is regulated by Article 75 of the Tax Code of Russia, which states that it is accrued from the day following the payment deadline and ends on the day the arrears are repaid.

According to this article of the Tax Code, the amount of the penalty depends on three parameters:

- Overdue amount;

- Number of days overdue;

- From the refinancing interest rate of the Central Bank of Russia.

In accordance with the Chart of Accounts (Order of the Ministry of Finance dated October 31, 2000 No. 94n), the amounts of tax penalties due are reflected in the debit of account 99 “Profits and losses” in correspondence with the account for accounting settlements with the budget for taxes.

Penalty calculator

The penalty is set at 0.1%. The delay was 10 days. That is, the penalty will be 10 rubles. The arrears are determined based on the current Central Bank refinancing rate.

10.09.2014

Every company or organization may encounter emergency situations when it is impossible to pay mandatory government payments on time, in particular, mandatory insurance contributions. In this case, in accordance with the norms of current legislation, the state body administering such payments is obliged to calculate penalties for insurance premiums. Penalties can also carry out this operation independently. In this case, precious time is saved, which affects the amount of the overdue financial obligation.

We determine the period of delay and the time of occurrence of penalties

The calculation of penalties for insurance premiums depends on the number of days of delay . It should be remembered that even if, according to the taxation system chosen by the enterprise and the procedure for making mandatory payments, penalties for insurance premiums are calculated at the end of the reporting year, that is, even for a late advance payment, say, to the compulsory pension insurance body, the late payment will be fined with January 1, 2020.

If the government body independently assessed a fine in the middle of the year, immediately after the monthly advance payment was late, then such calculation can be appealed administratively or judicially.

Procedure for paying penalties on insurance premiums for 2020

Just remember that penalties are credited to the fund first, and only then the main payment amount . This is very important in the case when the social insurance authority incorrectly calculated the period for calculating penalties for insurance premiums and the entries in the payer’s accounting department do not match.

What information do you need to have in order to independently calculate the penalty:

- the amount of the overdue payment, if payments are monthly - it is necessary to add all obligations into the consolidated amount of debt;

- the number of days of delay for each amount is determined separately;

- refinancing rate of the Central Bank of the Russian Federation in effect at the time of delay.

The penalty is calculated according to the traditional scheme: the amount of additional accrued obligations is multiplied by the number of days of delay and the refinancing rate of the Central Bank of the Russian Federation. The resulting amount is divided by the number of calendar days in a year. Another important feature is that when calculating, weekends and holidays must also be taken into account.

If an accountant does not have time to independently calculate penalties for insurance premiums, you can use special computer calculator programs . However, before using them, you should check the correctness of the calculation yourself.

If during the period of calculating the penalty the Central Bank's refinancing rate changed, then you will have to calculate the penalties for each period separately and then add them up, not forgetting that in the calculation you should use the rates that were in effect for the period of delay, and not at the time of the calculation.

Well, in an ideal case, it is necessary to monitor the timeliness and completeness of all mandatory payments to the budget and targeted state insurance funds - the positive tax history of the payer depends on this.

lawyers!

Ask a Question

Quick response, free!

Fine PFR Postings Budgetary Institution

- The fine is assessed immediately when the above reasons occur. In addition, its size is clearly regulated by deadlines at the legislative level.

- A penalty is a penalty payment that is charged for each day of late payment as a percentage of 1/300 of the refinancing rate of the Central Bank of the Russian Federation.

In the course of their work, every accountant is faced with such concepts as fines and penalties, for example, when violating the laws on taxes and fees.

In this article, we will study where to include tax fines in accounting, as well as the main entries for the accrual and payment of penalties, fines for taxes: profit, VAT, insurance premiums.

Calculation of penalties in the Pension Fund of transactions in a budgetary institution

To account for settlements with suppliers for the amount of penalties, account 302.91 “Settlements for other expenses” is used.

Moreover, in a situation where penalties under agreements (contracts) are accrued as the execution of judicial acts of the Russian Federation, settlement agreements, CVR 831 “Execution of judicial acts of the Russian Federation and settlement agreements on compensation for harm caused” is used to pay them. In case of voluntary payment of penalties under agreements (contracts) with suppliers, KVR 853 “Payment of other payments” is applied.

In May 2002, the tax authority indisputably collected from the organization's current account the value added tax payable to the budget for the first quarter of 2002 in the amount of 10,000 rubles, as well as penalties in the amount of 153 rubles. for late payment of the specified tax to the budget.

Accrual of penalties for transactions with a budgetary institution in 2019

Concept, essence and reflection of penalties in accounting, postings First of all, let's look at the definition.

A penalty is a type of penalty, which is determined for failure to fulfill or improper fulfillment by participants in legal relations of their obligations under contracts and other civil legal acts.

This includes fines and penalties. Such a material sanction is other income for the receiving participant (clause 7

Based on the open list of expenses, a penalty must be displayed on account 91-2, along with this accruing a corresponding tax liability, which is permanent. In accordance with another position, the penalty is close in essence to a fine, and it must be displayed on account 99. The advantage of this method is the correspondence of accounting data and financial reporting indicators.

Calculation of penalties in a budgetary institution posting

Federal Law No. 402-FZ dated December 6, 2011 established a list of documents that should regulate the accounting procedure. According to its provisions, federal and industry standards are mandatory for application (Parts 1, 2 of Article 21 of this Law).

expenses for payment of insurance contributions to the Pension Fund.

Accordingly, its accrual and payment is subject to reflection on the same balance sheet accounts and registration in the same account intended for accounting for calculations for the payment of penalties for insurance premiums for compulsory insurance.

Therefore, the specific reporting of institutions must be comparable for a state (municipal) institution, regardless of its type, including for various financial (reporting) periods of its activities (clause 3 of Instruction No. 157n).

We recommend reading: Benefits for single mothers in the Russian Federation

Postings on an administrative fine in a budgetary institution

“accrued amounts of other taxes, fees, obligatory payments to the budgets of the budget system of the Russian Federation are reflected in the credit of the corresponding analytical accounting accounts of account 030300000 “Calculations for payments to budgets” (030305730, 030312730, 030313730) and the debit of the corresponding analytical accounting accounts of account 040120200 “Business expenses subject”, account 040110100 “Income of an economic entity”.

The control body imposed an administrative fine on the budgetary institution. It is unknown whether an internal audit will be carried out to identify the guilty employees, and what its results will be. However, there is an accrual method, and the accountant needs to reflect the accrual of the administrative fine.

Calculation of penalties for taxes: accounting entries

Accounting recognizes penalties as another expense, which in no way participates in determining the tax base when calculating income tax. Clause 83 of the PBU and the Instructions for the use of the standard chart of accounts make it possible to verify that obligations of this kind should really be reflected in account 99.

The “Profit and Loss” account is used to collect information and display the final result about the financial activities of the enterprise. It has an active-passive structure. The debit indicates the amount of losses, and the credit indicates the amount of income.

The account is closed before preparing annual reports. The ending balance on one side is written off to “Retained earnings (uncovered loss).”

Analytical accounting on the account is created in such a way that all the necessary data is then transferred to the financial statements.

Penalties on insurance premiums: example, postings, calculation

Refusal to transfer funds is fraught with punishment - penalties and fines established by regulatory authorities. Amounts are calculated based on the length of the period of non-payment. A penalty is charged for each day of delay, starting from the end date of the permitted period.

- from the moment a transaction related to the transfer of money to the relevant authorities is reflected in the enterprise’s account;

- from the date of presentation to the bank of a properly executed payment order;

- from the date of the supervisory authority’s decision to set off previously overpaid amounts;

- from the moment of depositing cash into the bank's cash desk, the administration to repay the debt to the relevant fund.

- Every month submit reports in the SZV-M form on the number of employees working at the enterprise. Important: the report in 2020 can be submitted until the 15th of the next month, and not until the 10th, as was the case in previous months;

- Once a year, submit annual reports on the insurance experience of each employee. Such a report is submitted before March 1 following the reporting period of the year.

In the Balance Sheet, the amount of tax sanctions participates in the formation of the indicator in line 1370 “Retained earnings (uncovered loss)” (clause 83 of the Regulations on Accounting and Reporting). In the Statement of Financial Results, the amount of sanctions can be reflected in line 2460 “Other”.

Penalties: postings

Alpha LLC, when transferring contributions for September 2020, violated the deadline for transferring a payment in the amount of 33,000 rubles in favor of the Pension Fund, since the debit from the account occurred not on October 15, but on October 16.

After filing reports for the 3rd quarter of 2020 on November 28, the company was charged a penalty of 11 rubles (33,000 x 10% / 300). The company paid them voluntarily on December 5, 2016.

The accountant will reflect the accrued penalties in the Pension Fund using the following postings:

We recommend reading: Article 228 part 2 of the Criminal Code of the Russian Federation 2019

Postings for the accrual of penalties for late payments to the budget are reflected in the debit of account 99 “Profits and losses”.

To reflect accrued penalties, a separate sub-account is opened in it.

But the correspondence in the loan will depend on which budget payment was overdue, that is, in connection with which certain penalties were accrued.

The organization paid an administrative fine: reflected in accounting

Expenses for ordinary activities are expenses associated with the manufacture of products and the sale of products, the acquisition and sale of goods. Such expenses are also considered expenses the implementation of which is associated with the performance of work or provision of services (clause 5 of PBU 10/99).

In accounting, an administrative fine is taken into account as part of other expenses, in the debit of account 91. When calculating taxable profit, the amounts of administrative fines are not taken into account and are not reflected on line 205 of Appendix No. 2 to sheet 02 of the income tax return.

Pension fund posting fine

- by registered mail. In this case, the request is considered received after six working days from the date of sending the registered letter;

- in electronic form via telecommunication channels.

The formats, procedure and conditions for sending claims for payment of arrears via telecommunication channels must be established by the Pension Fund of the Russian Federation and the Social Insurance Fund of Russia.If the request for payment of insurance premiums received by the organization does not contain any data from the above list, it is considered to have been drawn up with violations.

The organization should not comply with such a requirement. This follows from the provisions of paragraph 9 of part 1 of article 28 of the Law of July 24, 2009 No. 212-FZ.

Collection of funds in the Pension Fund of transactions

Answer: In accordance with paragraph 5 of Article 46 of Part 1 of the Tax Code of the Russian Federation (TC RF), tax can be collected from ruble settlement (current) and (or) foreign currency accounts of the taxpayer or tax agent, with the exception of loan and budget accounts. At the same time, according to paragraph.

6 of the Procedure for Payment of Insurance Contributions by Employers and Citizens to the Pension Fund of the Russian Federation (Russia) The Pension Fund of the Russian Federation and its bodies have the right to collect in an indisputable manner the amounts of arrears and penalties from all accounts of insurance premium payers - legal entities.

If a dispute arises regarding the application of a legal norm regarding the collection of funds from the budget account of the payer of insurance contributions, priority should be given to the Procedure for the payment of insurance contributions by employers and citizens to the Pension Fund of the Russian Federation (Russia), since in accordance with clause 1 of Art.

1 of Part 1 of the Tax Code of the Russian Federation, legislation on taxes and fees consists not only of this Code, but also federal laws on taxes and (or) fees.

Taking into account the above, the provisions of part one of the Tax Code of the Russian Federation are applied to the extent that they do not conflict with Law No. 38-FZ, adopted later than its current edition (the same point of view is shared by the Deputy Chairman of the Supreme Arbitration Court of the Russian Federation O Boykov .V. (Russian Justice, 1999, No. 11).

If a budgetary institution does not fulfill its constitutional obligation to pay legally established insurance premiums, then the Pension Fund and its bodies have the right to collect them in an indisputable manner. Based on the foregoing, the Pension Fund of the Russian Federation and its bodies have the right to collect in an indisputable manner the amounts of arrears and penalties from all accounts of insurance premium payers - legal entities, including from budgetary ones.

Source: https://yrokurista.ru/zhilishhnoe-pravo/shtraf-pfr-provodki-byudzhetnoe-uchrezhdenie