According to the latest data, more than 200 thousand self-employed people are registered in Russia. The number of people wishing to leave the shadow sector is growing inexorably.

Russian legislation classifies self-employed citizens as individuals and individual entrepreneurs who receive income without having an employer, intermediaries or employees. Their income should not exceed 2.4 million rubles per year .

About a year ago, as an experiment, a tax regime was introduced for the self-employed in four constituent entities of the Russian Federation (Moscow and Moscow Region, Kaluga Region and the Republic of Tatarstan). Since the beginning of 2020, 19 more regions have joined the payment of taxes. The media are already talking about this this summer; they plan to introduce it throughout the country.

The tax also includes insurance pension contributions. Initially, the tax rate of 4-6% (depending on the status of the counterparties to whom the person provides services) included only contributions to the compulsory insurance fund.

Since 2020, the deduction procedure has been significantly simplified. Now self-employed people will be able to pay contributions using a special application.

Who does the Pension Fund consider to be self-employed?

The Pension Fund classifies the following persons as self-employed (information from the official ]]>website ]]>department):

- IP;

- heads of peasant farms;

- lawyers, notaries;

- other persons (not individual entrepreneurs) with private practice;

- payers of professional income tax (based on Law No. 422-FZ of November 27, 2018).

The procedure for paying contributions for individual categories is different, so finding an answer to the question “do self-employed people pay to the Pension Fund?” requires a special approach.

What is pension and length of service?

A pension is a cash benefit that the state pays until the end of life to citizens who have reached a certain age. This age limit will increase until 2024 and will be 65 years for men and 60 years for women.

To obtain the right to payment of state benefits, in addition to reaching the established age threshold, you must have a certain length of work experience, which represents the total duration of work. In 2020, this period should be at least 10 years, in 2024 it will be 15 years. The amount of the pension benefit will depend on the length of service.

Who is recognized as the payer of contributions?

According to Art. 419 of the Tax Code of the Russian Federation, self-employed people pay contributions to the Pension Fund for themselves if they are:

- entrepreneurs on any taxation system (OSN, simplified tax system, UTII, patent);

- lawyers and notaries;

- appraisers;

- heads of peasant farms.

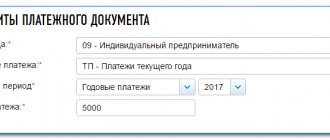

Insurance premiums for the self-employed in 2020 for these categories were approved in clause 1 of Art. 430 Tax Code of the Russian Federation:

- 29,354 rubles for income up to 300 thousand rubles, payment deadline - until the end of the current year;

- 1% when receiving income above the established limit; They must be paid no later than July 1 of the following year, 2020.

The maximum amount of such fixed contributions for the entire calendar year has also been established - 234,832 rubles (29,354 x 8).

Peasant farms do not pay 1% contributions, but the main contributions (29,354 rubles) are paid for each member (clause 2 of Article 430 of the Tax Code of the Russian Federation), including the head of the farm.

Conditions for assigning a pension to the self-employed

The main condition for receiving a pension is reaching a certain age:

- for social benefits, the age will gradually increase from 60 to 65 years for women and from 65 to 70 for men. The transition period is designed until 2028;

- for the insurance part, the increase will be from 55 to 60 years for women and from 60 to 65 for men.

- for payments under the funded part - 55 years for women and 60 for men. The reform did not affect this component.

Retirement dates will be increased gradually

If you have accumulated a lot of experience (42 years for men and 37 for women), you can retire 2 years earlier than expected. But not earlier than 60 and 55 years old, respectively. There are several preferential categories that have the right to receive an early pension due to working and living conditions, health conditions and large families.

There are additional conditions for receiving an insurance pension. You need at least a minimum experience and number of points. These indicators are listed year by year and will gradually increase until 2025. The pension begins to be paid from the moment you apply for it, that is, submit an application to the Pension Fund.

Table: minimum length of service and points for assigning an insurance pension

| Year of retirement | Minimum amount of pension points | Minimum insurance period |

| 2019 | 16,2 | 10 years |

| 2020 | 18,6 | 11 years |

| 2021 | 21 | 12 years |

| 2022 | 23,4 | 13 years |

| 2023 | 25,8 | 14 years |

| 2024 | 28,2 | 15 years |

| 2025 and beyond | 30 | 15 years |

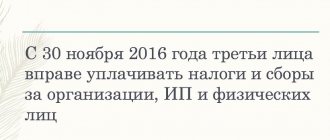

Contributions for other categories of self-employed

Article 419 of the Tax Code of the Russian Federation also names other persons engaged in private practice as payers of pension insurance contributions, to whom self-employed payers of professional income tax cannot be included according to Law No. 422-FZ (they are subject to special instructions). In fact, these are individuals who submitted a notification to the Federal Tax Service on the basis of clause 7.3 of Art. 83 NCs providing services on their own, without hiring employees, for the personal and household needs of customers. Law No. 401-FZ of November 30, 2016, some of these citizens registered with the Federal Tax Service, but who are not individual entrepreneurs, are exempt from paying contributions in 2020.

Self-employed people who are not payers of professional income tax do not make contributions to the Pension Fund if their activities consist of the following (clause 3, clause 3, article 422 of the Tax Code):

- providing supervision and care for children or the sick, as well as the elderly over 80 years of age;

- tutoring;

- cleaning or housekeeping.

There are no benefits for persons providing other services - the amounts of contributions for them are the same as for individual entrepreneurs.

A friend’s opinion about studying in general, having completed school completely

Once, in a telephone conversation, we were talking about studying at school, about how someone’s fate turned out later, and we just discussed this exciting question - is it worth going to 10th grade or maybe after 9th grade I can immediately go to college, for example , why finish 11 grades of school and how right it is...

Because I also decided to write this “article,” and as you know, truth is born in dialogue. By the way, a quote from our president. At least I heard it from him in some speech on TV.

By the way, a quote from our president. At least I heard it from him in some speech on TV.

In general, the conversation turned out to be interesting, although I listened even more than I spoke, because it was new for me to know about such a life experience when a person studied so much.

I tried both, gave up both, and eventually became a very wealthy man with good personal income from his business (millions a year).

His opinion is now clear and understandable: you need to leave after the ninth, because all training is a simple word “shit”

When a person does not have a serious goal of becoming such and such a specialist, and after school, you know, more children come out, the vast majority have no idea what they need from life now.

I will now give some short excerpts from the history of my comrade’s training to make it clearer why such an opinion was formed...

History of “training” and formation

This is the “eternal student”, as he was previously called in his circles

He himself completed eleven classes. In the 10th grade, I studied at the same time at a technical school from school, which was a novelty for me :), I got used to the fact that there is a standard system: you go to school either after 9th grade or stay until 11th and then go to college.

And here it turns out that you receive secondary specialized education as if by correspondence, you study in the 10th grade and attend school 1 day a week.

True, as he says, this approach is too limited, you can’t choose a normal specialty for yourself, and educational institutions provided “crazy” ones that were not considered for employment.

As a result, he studied like this for 1 year and in the 11th grade he stopped going to technical school.

After the 11th, I entered another technical program as a programmer and, realizing that there was not much of a specialty there, I quit after 2 years of study.

Speaks:

“Yes, there was some general education bullshit, some programming started only in the 2nd year, they taught no more than Pascal)) and too many disciplines that I really didn’t like, like drawing and electrical engineering, which is generally next to programming at the faculty IVT does not lie.”

In general, I dropped out of technical school, although there was a year left until I received a secondary specialized degree and a course with which I could study further, abbreviated at a tower or work...

I quit one thing, I quit another, while I was listening I was even surprised, because at that time I was afraid to quit anything, thinking that I was at great risk of losing years of training, that later they wouldn’t hire me, that I would fall behind my peers, and, in short, My thinking was kind of strange at that time :)) Probably formulaic, even “systemic”.

Nevertheless, he was already working when he quit as a technician, and then he took professional courses (two or three months at the state oil technical school) as an assistant driller and even completed an internship in oil fields, worked))) gives!

He says that during an accident due to pressure, the pipes fly out of the well like vermicelli and cover everyone who is in the “bush” (some oil term), and the drill assistant’s jaws are blown away by the pipes when the pipes are taken out of the well, if that’s not the case will do.

The pipe is heavy, it will show a little in the face with its weight and that’s it, such an injury is normal right away, or the driver will do something wrong... and someone works there in freezing conditions, in general, he says, it’s tough, friends later worked at Rosneft for 80 -120 tr were brought in in 2004, being 20 year old “boys”, and in his region near his house they received 40-60 tr...

In general, the profession is profitable, but he did not engage in this and did not even take the “crust”, so as not to pay the full amount of money for the training he completed, having decided that such a job was not suitable for him.

Next up is getting a higher education! 5 years of full-time study at the Faculty of MiM (Management and Marketing).

At the same time, as he says, he studied not according to a given program, but rather figured everything out on his own from books, magazines, practices, and his own observations, because he did not always attend all the lectures.

Because at the same time he worked in security, and a lot, on average 280-320 hours, maximum 420, he says, came from working for days: he started on Friday and until Monday for three days, then such a “rabtrip” brought him 72 hours.

A licensed security guard at that time earned 28-35 rubles per hour naked at the private security company where he worked (in 2006-2007).

It turns out that the nights were practically all spent at work, he worked for the last two years in a casino, paid hourly, so he worked as many hours as he needed.

There is a lot of turnover in security, so there was always a ton of work + I was the senior manager of the facilities, I made up the work schedule for myself and others, because I learned after six months of work, “learning” what and how is better and more in a few months at the training center of the Ministry of Internal Affairs to become a licensed security guard .

in a few months at the training center of the Ministry of Internal Affairs to become a licensed security guard .

With a TT, he says, he shot, went through various disciplines, including first aid, and subsequently saved a man’s life in an epileptic attack, thanks to the meticulous major, who forced him to simulate various unforeseen situations during training.

Some, he says, were transported wounded in a car, put on their knees, shook and depicted situations close to real ones, received bream for wrong actions)), who “during epileptic attacks” were taught to open their mouths...

After about 2-2.5 years of such work, he already started doing business (right in the 4th-5th year of university) and is still doing it to this day, and he tried out services and production, does a lot of things and is still trying a lot :), gives to many people with high-paying jobs.

So, his opinion is this: studying does not give anything, because all the basic programs are not built properly so that they can be applied in practice.

Only as a life experience, as a student experience! But is it valuable enough to waste 5 or more years studying? In my opinion, no.

Therefore, it is better to leave after 9th grade, go to some college or school in a field that is currently attractive (depending on your mentality, thinking), rather than stay at school until 11th.

The main thing is not to completely succumb to the opinions of your parents, because they definitely cannot know who you are and what you want.

But you need to listen to advice carefully, because parents will not give bad advice, we (children) are their flesh and blood. And they have been leading adult lives for a long time, they have seen a lot of things in life, they know and can!

And go try to work right away! Instead of studying, during these 5 years you can already earn money and gain experience; after school, you still can’t decide who exactly you will be, so you can try yourself in different niches where they will hire you at first.

Although the income will be, obviously, small, your experience will grow, and this is the most important thing!

And you can build your career growth faster, and not just decide on your work life, which eleven years and university does not provide, and in the same time frame, i.e. leaving after nine saves a lot of time and makes you grow up faster.

He says: if you are going to study, then from an enterprise, for example, through the bachelor’s degree system, in the direction that you need in a specific company, then most often the enterprise itself sets the training program for the university.

They tell you that you want to get promoted? Then you need to learn, go through such and such disciplines and you will become a master.

I agree 100% here!

Moreover, such training, unlike school or technical school, provides real knowledge needed for your profession, and not just a set of theories that first fill your head and then fly out of it without application.

Many people study just for the sake of getting a crust... that's why you need to study to be a manager for the sake of it and then work as a security guard or a salesperson with a higher education. Eh??

Eh??

As a result, they get “towers”, amuse themselves with this, but in reality they don’t know how to do anything - neither in their profession, nor in life, so they are not yet close to reality.

Therefore, I now believe that if a person is active, then where necessary, he will unlearn it himself when he needs it, when he himself understands it!

About contributions for persons receiving professional income

From 01/01/2019, individuals in 4 regions of the Russian Federation received the right to become payers of professional income tax (Article 1 of Law No. 422-FZ):

- Moscow:

- Moscow region;

- Kaluga region;

- Tatarstan.

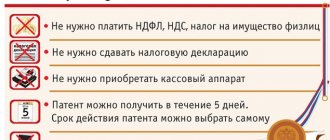

Self-employed people participating in the experiment and registered in the prescribed manner with the tax office are exempt from paying contributions to the Pension Fund (Clause 11, Article 2 of Law No. 422-FZ). That is, self-employed persons who pay professional income tax do not accrue or pay pension insurance contributions.

About school

Now I have mostly only warm memories of those school days, despite the fact that I received little pleasant things in the process of learning:

- constant homework, which sometimes had to be done until late in the evening

- constant stress because they will now call you to the board (I remember, even if I was well prepared, I still felt some kind of terrible jitters);

- eternal worry about grades;

- Sometimes there are troubles in the team...

- I remember when you come home and instead of resting and unloading your brain, you need to do homework, which sometimes was a lot.

The parents themselves were shocked by the amount of food given to their children and the heaviness of the backpacks.

And there was a certain agreement with my parents: I had to first complete all the homework, and then I could play the console for an hour or so, and then play LEGO and everything else, in short, relax.

And within the team, few people took me seriously, as a peer or classmate. So, there were only a few people, and there were only 2-3 friends, and there was only one real one at that time.

Due to my appearance (and I was the smallest in height in the class and with a very childish face, it seemed), even in the 9th grade, some people told me that I should study in the 5th grade. And someone called me “small.”

And someone called me “small.”

Well, I somehow got used to it and, apparently, I was lucky that I never took it seriously and no one ever bullied me. So, everything remained at the level of jokes and such light banter, and I didn’t worry...

Because some were spread rot, some themselves fell into a psychological trap and this, of course, is sad! It’s a pity when a student fails to fit in with the team...

And the education system was interesting in those 90s: many people seemed to “skip” grade 4, and so I studied at the same school (lyceum) from grade 1 to grade 3 inclusive, and then immediately “jumped” to grade 5. 1st grade and continued to study at a very ordinary school, a 5-minute walk from home.

Now there is some kind of nostalgia for all this, because school is long behind us and, thank God, there is no need to go to it anymore, so somehow I remember everything with a smile and even pleasantly.

so somehow I remember everything with a smile and even pleasantly.

I remember my sister telling me how she periodically, as an adult (over 25 years old), had nightmares about how everyone her age needed to go through the 10th and 11th grades again. She says she woke up with the thought: “Ewwww, damn it, this is a dream!”

It’s good that I never dreamed of such a thing, but after listening to my sister, I thought and thought: “Really, what good does school give you, besides communicating with peers, that you still have such dreams?!”

How does the established procedure for paying contributions affect pensions?

The period for which contributions to the Pension Fund were not transferred is not counted towards the insurance “pension” period. If a self-employed person does not make pension contributions due to the current legislation, then the Pension Fund of the Russian Federation does not take into account the length of his “self-employed” activity. Such citizens who do not have the necessary insurance experience can only count on a social pension.

The size of the future pension is affected by both the amount of the transferred contributions and the duration of the period for their payment. To prevent a person from losing the right to an insurance pension, you can use Art. 29 of Law No. 167-FZ of December 15, 2001 and conclude an agreement with the Pension Fund on the voluntary payment of contributions. The minimum amount that must be paid for 2020 for voluntary insurance is 29,779.20 rubles, and the maximum possible is 238,233.60 rubles (Clause 5, Article 29 of Law 167-FZ).

If a self-employed person, along with his activities, also works as a hired employee under employment contracts or enters into GPC contracts as a performer (outside of “self-employed” activities), then the insurance premiums under such contracts are paid for him by the employer/customer. In such a case, the pension insurance period will take into account the periods of employment, and there is no need for an additional agreement with the Pension Fund.

Thus, the answer to the question “does a self-employed person pay insurance premiums?” depends on which category the individual belongs to, as well as whether he has an additional agreement with the Russian Pension Fund.

What do contributions to the Russian Pension Fund provide, and why are they needed?

Such deductions guarantee receipt of a well-deserved, non-social (5 years later) pension, child benefits, free medical care and sick leave, and financial support from the state. At the beginning of 2020, M. Mishustin, head of the Tax Service, announced that insurance was not compulsory. Self-employed people pay 4% of their income and contribute to compulsory medical insurance. They retire due to age, but receive government assistance after 5 years. The money has been sent to the treasury, but there is nothing more to count on.

If the pension fund did not provide the self-employed population with the same pension as those with work and insurance experience, then Russia would cease to be a state.

- PF is a guarantee of a secure old age without hunger.

- A guarantee of receiving all the promised government benefits, discounts on car taxes, social contributions...

By the way, the largest tax is for the distant future, amounting to 22% of income for a secure old age. Is it a coincidence, but according to statistics, slightly more than half of middle-aged people survive to retirement age.

The budget of the “thrifty” can be disbanded if part of the fund is not in demand.

How is experience calculated?

The insurance period for self-employed volunteers will begin to count from the date they submit the application.

Moreover, the length of service also depends on the amount of contributions paid.

Even if the application was submitted at the beginning of the year (or even the previous year), but before December 31 the self-employed person paid contributions in an amount less than the established minimum, not the entire year will be counted toward his length of service. The Pension Fund will calculate the length of service in proportion to the contributions paid.

Thus, for 1 year of pensionable service in 2020, a self-employed person must pay 32,448 rubles .

How to become a self-employed volunteer

If you decide to pay contributions towards a future pension, you must first register with the Pension Fund of the Russian Federation - voluntarily enter into legal relations under compulsory pension insurance.

To do this, you need to submit to the Pension Fund at your place of residence:

- registration application;

- information confirming the fact of registration with the tax authority as an NPA taxpayer (obtained through the “My Tax” mobile application).

After submitting the application, the Pension Fund will register the self-employed person and issue him a registration notice.