Home page » Labor law » Procedure for transferring salaries to a bank card in 2020

Transferring wages to a card has a number of advantages, thanks to which more and more employers are looking to switch to this system.

- Government regulation

- Transfer order

- Pros and cons of transferring salaries to a card

- Which card is suitable for salary?

- Design and details

- Features of using the card

Wages, as a kind of remuneration for an employee for his work, can be transferred in cash or by bank transfer.

In the second case, a bank card is used as a salary carrier, to the account of which the funds are transferred.

Government regulation

In accordance with the Labor Code of the Russian Federation, wages must be transferred to employees at least twice a month.

Moreover, each payment has clearly defined deadlines. The first part is an advance payment, which is transferred before the end of the period.

Full payment is due by the 15th of the month. The law does not clearly establish in what form wages should be transferred. Everything must be regulated by the employer's company regulations.

Transferring funds to an employee’s card is not a prerequisite, but an additional option. It is available if the company’s rules provide permission for such actions, as well as if there is a written application from the employee.

In the same application, the employee must indicate the details to which funds will subsequently be transferred.

https://youtu.be/nvbEJLGjXQM

Design nuances

If there is a voluntary expression of the employee’s will to transfer the amounts of his earnings to a third party’s bank card, the company must obtain documentary evidence. The form of written confirmation of the employee’s wishes is a statement drawn up and signed by him personally. Application rules:

- The document is submitted to the employer before the date of payment of wages (submission deadline is 5 days before the day the funds are transferred).

- The wording should explain what types of payments are covered by the wish to transfer to another person’s account: salary, bonus, vacation pay, compensation accruals, or all types of income.

- It is prescribed in what amount income should be transferred to a third party: in full or as a percentage of the total amount of earnings.

- The frequency of payments is fixed: monthly, with each payment, once a quarter.

- For non-cash payments, it is not necessary to draw up a power of attorney, but the application must indicate the necessary personal data about the recipient of the funds: his last name and initials, bank details of the card or current account for crediting funds.

When considering an employee’s application, the employer is guided by the content of the concluded labor agreement and the collective agreement in force at the enterprise. If one of the documents provides for the possibility of going beyond the salary project and making transfers in favor of third parties (who do not have an employment relationship with the company), then the application may be granted. At the stage of agreeing on details, the issue of covering the costs of commission services is clarified.

REMEMBER! In situations with forced transfers based on court decisions or writs of execution, the employee is not required to complete an application. The document serving as the basis for payments is received directly by the employer from government agencies.

When generating a payment order for the forced transfer of funds in favor of third parties, the employer must indicate in the purpose of the payment:

- for whom the funds are transferred;

- the fact of making deductions;

- use as a base for withholding wages;

- what document is the basis for deductions.

In accounting, the transfer of an employee’s earnings according to the details he has declared will be reflected in account 76. It is necessary to open a separate sub-account for it, in which the amounts of settlements and deductions based on employee statements are supposed to be accumulated. The following invoice correspondences apply:

- D70 – K76 when deducting the principal amount from earnings;

- D70 – K73 – entry to reflect the withheld amount of bank commission for transferring funds in favor of other persons;

- D76 - K51 - when the salary, at the request of the employee, is transferred according to the details of third parties.

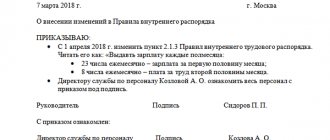

Transfer order

The initiator of the transition to non-cash payments can be any party to the employment contract. In this case, it will be enough for the employee to draw up a special application indicating the card details. For the organization, the process will become somewhat more complicated.

Article 136 of the Labor Code of the Russian Federation “Article 136. Procedure, place and timing of payment of wages” (.docx)”

Before starting to process salary transfers to the card, the organization must comply with the following formalities:

- Draw up an internal act on the transfer of employees to non-cash payment, indicating the exact date.

- Amend employment contracts with employees to include the possibility of non-cash payments.

Each employee has the right to independently choose a servicing bank.

In accordance with the law on transferring wages to a card, no one has the right to force an employee to make any decision. Violation of this rule is subject to administrative liability.

The dates for transferring funds to the cards must coincide with the salary payment dates established by the organization and not contradict basic legislation.

According to the salary project

A salary project is an agreement with a bank, according to which the bank opens its own personal account for each employee .

On payday, the organization transfers the wages of all employees to a special salary account in this bank in one amount .

In this case, a statement indicating the personal accounts of employees and the amounts to be paid . In accordance with this statement, the bank itself distributes funds to the personal accounts of employees.

At the same time, different banks have different capabilities and requirements for working with a salary project, if we are talking about electronic document management, that is, when we transfer money to a salary account through a client bank.

In this case (client bank), after sending the payment order to the bank, a letter is sent in any form with one of the following options attached (depending on the requirements and capabilities of the bank):

- printed and scanned statement of payments for personal accounts

- upload file directly from 1C

- upload file from a special program provided by the bank

If we send a statement to the bank in the form of a file (upload), then usually the bank responds by sending us a confirmation file, which we can also upload to 1C.

Creating a salary project

We go to the “Salary and Personnel” section and the “Salary Projects” item:

We create a salary project for Sberbank:

Here is his card:

We deliberately do not check the “Use electronic document exchange” checkbox in order to deal with the case when we send the bank statement in printed form.

We introduce personal accounts for employees

Let's assume that the bank has created a personal account for each of its employees. How to enter these accounts into the system? By the way, why do we want to do this? Then, so that in the statement that we will generate for the bank, opposite the employee’s full name, there will also be his personal account.

If we have a lot of employees, we can use the “Entering personal accounts” processing:

But in the example we have only 2 employees, so we will enter their personal accounts manually, directly into their cards (at the same time we will know where they are stored).

Go to the “Salaries and Personnel” section, “Employees” item:

Open the card of the first employee:

And go to the section “Payments and cost accounting”:

Here we select the salary project and enter the personal account number received from the bank:

We do the same with the second employee:

We calculate salaries

Go to the “Salaries and Personnel” section and select “All accruals”:

We calculate and process wages:

We pay salaries

Next, go to the “Salaries and Personnel” section, “Bank Statements” item:

We create a new document in which we indicate the salary project and select employees (note that their personal accounts are picked up):

We post the document and print out the statement for the bank:

Here's what it looks like:

Based on the statement, we generate a payment order:

In it, we transfer the total amount of the salary to the salary account of the bank in which we have an open salary project:

Along with this payment, do not forget to attach a statement (with a register of personal accounts and payments), printed above in the form required by the bank (usually this is an arbitrary letter through the client’s bank).

Uploading the register to the bank

Let's consider the possibility of uploading the statement (register) as a file to the bank. If your bank supports this option (or this is its requirement), then go to the “Salaries and Personnel” section, “Salary projects” item:

Open our salary project and check the box “Use electronic document exchange”:

We go again to the “Salaries and Personnel” section and see that two new items have appeared. We are interested in the item “Exchange with banks (salary)”:

There are three basic options for uploading to a bank:

- Payroll transfer

- Opening personal accounts

- Closing personal accounts

Let's focus on the first point. It allows us to upload our statement to a file, which is then sent by arbitrary letter through the client bank.

To do this, select the statement we need and click the “Upload file” button:

When a response comes from the bank, it will contain a confirmation file. You need to go into the same processing and upload this file through the “Download confirmation” button. Using this wonderful mechanism, we will be able to track which statements were paid by the bank and which were not.

Pros and cons of transferring salaries to a card

Crediting your salary to a card has both its advantages and disadvantages for each party.

For an employee, this method may not always be convenient, since life circumstances will force him to refuse to use bank accounts.

An example of such a situation is the presence of enforcement proceedings to recover funds. All money transferred to the account will be in danger of being withdrawn to pay off the debt. But such a case does not occur so often in practice.

The main advantage of non-cash payments is considered to be complete transparency of salary schemes.

Each transfer will be recorded in the bank and can serve as a tangible advantage for obtaining a loan, as it will confirm the applicant’s solvency.

The disadvantages of this method of receiving salary is the risk of blocking the card or account, which will completely lose access to funds.

In addition, no one is immune from technical failures in the banking system.

For the employer, such a system also promises some advantages. First of all, this is a significant simplification of the procedure for issuing salaries to employees, thanks to its automation.

This allows you to reduce the load on the cashier or completely abandon this position.

But it is worth noting that in order to switch to non-cash payments, it will be necessary to carry out a number of specific actions, which often frighten management with their volume.

Controversial issues with taxation and accounting for payments

Difficulties with transferring earnings to personal cards of employees or in favor of third parties are due to the confusing mechanism for accounting for commissions to banks and possible delays in transferring amounts through third-party banking structures. For an accountant, difficulties may arise due to different deadlines for crediting money to bank cards. If you send salaries to all employees on the same day with the simultaneous payment of personal income tax and contributions, it turns out that:

- some staff will receive money on the same day;

- employees whose income should be credited to others or to their personal cards, but in other banks, will receive money with a delay, which may cause conflicts.

The second nuance is payment of bank commission. If the employee has agreed in writing to withhold funds from his income and direct them to pay remuneration in favor of the banking organization for the transfer made by it, the employer has the right to take advantage of this. It is not prohibited to pay the commission at the expense of the employer.

Expenses for settlements with the bank must be included in the tax base according to the norms of clause 29 of Art. 270 Tax Code of the Russian Federation. If funds are transferred to card accounts that do not relate to the salary project, then the amounts for their servicing cannot be taken into account when calculating the income tax base. These amounts are equivalent to payment for goods intended for personal consumption by employees. Similarly, the funds spent on opening cards and their re-issuance are taken into account. The amounts of remuneration charged by the bank when transferring salaries reduce the income tax base (clause 25, clause 1, article 264 of the Tax Code). This position was voiced in the Letter of the Ministry of Finance dated March 22, 2005 No. 03-03-01-04/1/131.

Which card is suitable for salary?

In general, any plastic card linked to an account in a bank is suitable for salary.

An employee can change the bank or card for transferring funds at any time.

There are two possible scenarios:

- Attaching to the organization’s salary project;

- No salary project.

In the first case, the company has a special agreement with a certain bank, on the basis of which employee cards are serviced.

The costs of maintaining such cards are often borne by the employer or the bank itself. When hired, the employee must be notified of the existence of the project and indicate the servicing bank.

If everything is satisfactory, then a special card is issued to which the salary will be transferred. But the employee is not at all obliged to agree to the proposed conditions. It is possible to transfer funds to an employee’s card to another bank.

In this case, just as if the company does not have a salary project, the employee must write a written statement indicating the card details.

This must be done five days before the next payment. Otherwise, the funds will come in the same way.

An additional option is to transfer your salary to another person’s card. To do this, you need to draw up a corresponding statement and submit it to the company management.

The following types of plastic can act as salary carriers:

- Regular debit card;

- Credit card with debt repayment function;

- Social or pension card.

Can an employee receive a salary without connecting to a salary project?

Workers have the right to choose how they receive their wages.

If they don't have a bank card and don't want to get one, you'll have to pay them in cash from the cash register. And if they already have a bank account, you cannot impose a salary project and a specific bank card on them. The employee simply brings an application with his details to the accounting department, according to which you are required to transfer the money. But everything can be agreed upon. And if there are no obstacles to this, then it is better to avoid the first method (it is long and expensive). But paying for labor by non-cash method will provide a number of advantages for both you and the employee. For example:

- You do not need to adapt to the bank's operating hours. Money can be credited to an employee even on a day off when the office is closed.

- The risks associated with transporting large amounts are reduced.

- If an employee needs cash, he can withdraw it from an ATM at any time without a commission, while you will need to pay for cashing using a checkbook.

Design and details

Registration of transferring an employee’s salary to a card must be accompanied by the preparation of the following documents:

- Additional agreement to the employment contract (in the event that non-cash payment was not provided for in its original form);

- Written statement from the employee.

- An application for transferring wages to a card is drawn up in free form, in compliance with the basic rules for drawing up business documentation. It must contain the following details:

- Full name of the bank (credit organization);

- Bank identification code;

- Current account number;

- Payee's full name.

Only if this data is available, the organization will be able to legally transfer funds to the employee.

In some situations, an employee may request a salary transfer to several credit organizations at once. But this right is available only with the consent of the employer.

There is no legal basis for using multiple banks to receive your salary.

Payment order to an individual’s card

If the payment is drawn up for the transfer of an amount due to one employee, then it is filled out a little differently:

- the purpose of the payment is specific - in this field indicate the employee’s full name, a note about the nature of the payment (for example, “payment of wages for June 2020 to Alexander Mikhailovich Rebrov), his personal account number and amount;

- in the payee column reflect the full name of the employee;

- in the “Recipient's account” field indicate the employee’s account number at the bank institution.

An example of filling out a payment order to a Sberbank card when transferring money to an individual employee:

Accounting for expenses when transferring to cards

When using cards to transfer salaries to employees, the company bears the following costs:

- Card issue fee. Currently, many banks do not charge fees for issuing cards.

- For almost every card, the cost of its annual maintenance is charged. Such amounts are considered company expenses.

- At the time of transfer of funds from the company account to the employees’ accounts, the bank withdraws a commission from the employer’s account

All of the above operations are costs for bank services and are classified as other expenses in accounting. The following entries are made in accounting.

| accounting entry | Explanation |

| D91.2 K60(76) | Reflection of card issue costs |

| D60(76) K51 | Payment of funds for issuing cards for employees. The same posting is made when paying an advance for annual maintenance |

| D91.2 K60(76) | The posting reflects the monthly write-off of card servicing expenses |

It should be borne in mind that an employee, solely at his own request, can reimburse the company for the costs of opening a card. To do this, he must express his desire in a statement.

The employee does not want to receive payments on the card

Despite the fact that receiving salaries on a card is convenient and quite safe, some employees want to receive their money as before - through the organization’s cash desk.

According to paragraph 2 of Article 1 of the Civil Code of the Russian Federation, an employer cannot impose its will on an employee. Accordingly, it is impossible to force an employee to issue a card. Even if the organization has a salary project, you will have to adapt to the wishes of each employee if a compromise is not found that suits both parties.

Issuing bank cards for salary payments

Bank cards to which salaries can be transferred are:

- settlement (debit);

- settlement (debit) with overdraft.

Using a payment (debit) card, an employee spends money only within the amount in his account.

Using a card with an overdraft, the employee also spends money within the amount in the account. However, if the amount in the account is not enough, then the expenses are covered by the bank. That is, the bank provides an overdraft (credit) to the employee. The terms of the overdraft are stipulated in the agreement with the bank.

Such conditions for the use of bank cards are defined in clause 1.5 of the Bank of Russia Regulations dated December 24, 2004 No. 266-P.

In order to do so, you need to conclude an agreement with the bank for their release (issue) and servicing. An agreement for issuing and servicing a card can be concluded:

- with the bank in which the organization has a current account (the conditions for issuing and servicing cards can be specified in the bank account agreement, in an additional agreement to it or in a separate agreement);

- with a bank whose client the organization is not.

In addition, employees can get their own bank cards. In this case, the organization does not enter into any agreements with banks, but simply transfers employees’ salaries to their card accounts.

The general procedure for concluding agreements for the issuance and servicing of bank cards is established by the Regulations of the Bank of Russia dated December 24, 2004 No. 266-P and dated June 19, 2012 No. 383-P.

The list of documents required to conclude an agreement for the issuance and servicing of salary cards is established by the bank. Since the card is opened not for an organization, but for an employee, in any case you will need to provide information about employees (photocopies of passports, etc.) (clause 3.1 of Bank of Russia Instruction No. 153-I dated May 30, 2014).

After receiving the issued cards from the bank, they must be distributed to employees against signature.

What does the law say?

The answer to the main question of interest to employees and employers is this: transferring wages to third parties is completely legal. You just need to correctly formalize such operation(s) with reference to the current legislation. In this case, the recipients do not have problems, nor do the organizations and employees.

International law (Labor Organization Convention No. 95 of 1/07/49, ratified in our country) allows a citizen to use exceptions instead of receiving wages; one of the reasons is the desire of the citizen himself. This means that transfers to a third-party card are possible.

There is no prohibition on transferring “salary” amounts to third parties in the Labor Code of the Russian Federation. Article 136 provides for this option as an exception (paragraph 5), which is stipulated in the employment contract.

Is the administration obliged to accept this payment option? No, it is not obliged, since legal entities and individuals, when entering into contractual relations, freely express their will (Article 421-1 of the Civil Code of the Russian Federation).

Thus, transferring someone’s salary to a third party’s card is possible:

- if the parties have agreed on this;

- if the parties reflected the agreement in the employment contract.

In order not to re-sign the employment contract, the agreement is reflected in the additional agreement to the document.

Transferring to someone else's card is associated with additional bank expenses (commissions), additional labor costs (if wages are transferred in one payment to all members of the work team, and to a third party - in a separate document), and other “problematic” issues for the employer. This may be grounds for refusing the employee.

By the way! According to the ILO Convention, transfers to third parties on the card are also possible by court decision, for example, if we are talking about alimony.

Regulatory acts

According to the Constitution of the Russian Federation, any labor relations are regulated by law and other legal documents, including the Labor Code, resolutions of the President and Government, and federal laws.

The regulation of the wage system using plastic cards is carried out by the following regulatory documents:

- labor contracts;

- Labor (Article 44,136,73), Civil (Chapter 45,46), Tax Codes;

- Regulations of the Central Bank of the country on the procedure for carrying out non-cash payments by individuals (No. 222 dated 04/01/03) and on the issue (issue) of bank cards and transactions carried out using them (No. 266 dated 12/24/04).

According to an article of the Labor Code of Russia, the employer pays wages to its employees on time and in the amounts established by contracts (collective) and the provisions of the company’s labor regulations, which do not contradict the laws of the country.

The employer must timely issue wages due to employees through the company's cash department or in another way, including through payments to a bank card. The organization transfers money based on the written consent of the employee himself.

But in any case, the enterprise is obliged to comply with the provisions of the country’s laws (provisions of the Labor Code on the procedure and periods for paying wages, articles of the Tax Code on receiving income and on the peculiarities of tax calculations, the procedure for paying taxes).

This means that the issuance of wages in any form must be made at least 2 times a month, while the employee has the right to receive information in writing about all types of accruals and deductions made from the funds due to him. Failure to comply with the procedure for issuing earnings by the company entails administrative liability in accordance with the country's Code of Administrative Offenses, which is expressed in the imposition of monetary fines or suspension of the company's activities.

You can start an entrepreneurial activity using other people's money. Read how to get a grant for small business development. Even beginners can open a children's development center. Instructions here.

Is it necessary?

In accordance with the article of the Labor Code of the Russian Federation, payment to an employee of earned funds must be made at the place of his employment or transferred according to the details provided by him for transfer in accordance with the terms and conditions established by the collective agreement.

Crediting earnings to a bank account in the absence of provisions regulating the transfer of funds in the contract or in the absence of the employee’s will (statement) in writing is a violation of the country’s legislation in terms of the place and methods of payment of earned money.

In the legal sense, the unjustified transfer of an employee’s earnings to a card at a banking institution cannot be considered an issuance of earnings and entails criminal liability.

The provision on the possibility of issuing earned funds by crediting to a bank card must be reflected in the employment contract. Or this procedure can be formalized in an annex (additional agreement) to it, and also recorded in the employee’s personal statement. In such a situation, the employer has a legal basis for the specified method of making payments to employees.

If an employee of an organization refuses to receive a salary through a plastic card, the employer has no legal basis to force him to write a statement of consent. In this case, the employer must take measures to ensure that the employee receives the amount of money earned from the cash register.

How can an employer organize the transfer of wages to an employee’s bank card?

The norms of an employment or collective agreement may establish a condition for the payment of salary not only in cash at the place where the person performs his labor function, but also by transferring money to a bank (Part 3 of Article 136 of the Labor Code of the Russian Federation). But in any case, payments must be made at least 2 times a month (Part 6 of Article 136 of the Labor Code of the Russian Federation).

Almost any bank in its list of services provides a special opportunity for legal entities and individual entrepreneurs - a salary project. The initiator of concluding an agreement on this type of service is the employer. Having decided to pay wages by bank transfer, the employer must do the following:

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

- contact a financial institution with the intention of concluding an agreement;

- prepare documents: a list of workers, their applications for opening an account and copies of passports, constituent documents, as well as other documents of the company that may be additionally requested by the bank;

- conclude an agreement on the transfer of wages and maintenance of personal accounts of employees;

- organize the issuance of bank cards to employees.

Provisions that payments to the employee will be made by transfer to a bank account must be reflected in the local regulations of the company, in the collective agreement, as well as employment contracts. If such conditions are introduced as amendments, they are formalized by the corresponding additional agreements (Articles 44, 72 of the Labor Code of the Russian Federation).

What documents are needed to implement the salary project?

The rules for transferring funds between banks and organizations (individual entrepreneurs or citizens) are reflected in the regulation of the same name, approved by the Bank of Russia on June 19, 2012 No. 383-P (hereinafter referred to as the Regulation).

A representative of the employer can provide documents to the bank in person - in paper form or through electronic document management (clause 1.9 of the Regulations). The documents must be the following:

- A register of wage payments to be transferred to the bank, in the form agreed upon with it (hereinafter referred to as the register). The register contains information about credit institutions, the date of transfer, full names of employees, their personal accounts and payment amounts, as well as additional information necessary for carrying out transactions (clause 1.19 of the Regulations).

- Payment documents. The rules for their execution, as well as the procedure for transferring money, are regulated by the Regulations. It is worth noting that the amount of payments in the register must necessarily coincide with the final amount of the settlement document (clause 1.19 of the Regulations).

The register is compiled when transferring payments in bulk. If you need to issue remuneration to only one employee, it is enough to present to the bank a separate payment order completed in relation to this recipient.

Subscribe to our newsletter

Read us on Yandex.Zen Read us on Telegram