schet_bez_dogovora.jpg

Related publications

Paying an invoice without concluding an agreement is a common practice in many commercial organizations. However, sometimes you can hear that accountants categorically refuse such relationships with the counterparty, fearing problems with the fiscal authorities. To resolve this dispute, it is necessary to analyze the civil legislation of the Russian Federation.

https://youtu.be/0ldOOLeGMxk

Is it possible to issue an invoice without a contract?

Opponents of invoicing in the absence of an agreement refer to Articles 161 and 162 of the Civil Code, which states that, as a general rule, transactions must be concluded in writing, otherwise they will be declared invalid. The invoice may also be the same if the parties (supplier and buyer) act without an agreement.

But the usual form of concluding an agreement, when the parties agree on its terms and then sign, is not the only possible one. Article 434 of the Civil Code establishes that if a written proposal to enter into a contractual relationship is accepted by the opposite party, by fulfilling the conditions for payment, shipment, etc., the required (that is, written) form of the document is considered to be met.

Such an offer, in particular, is considered to be the issuance of an invoice by the company, which indicates what, in what volume and at what price the buyer can purchase from it. From the point of view of the law, this is an offer that clearly expresses the intention of the seller / supplier (Article 435 of the Civil Code ). Payment of the invoice without concluding an agreement means that the buyer agreed to the proposed conditions, that is, the parties entered into a contractual relationship. This action is equivalent to acceptance - acceptance of the offer (Article 438 of the Civil Code). The transfer of funds to the seller confirms that the contract has actually been concluded.

Transaction settlement

Transactions in writing must be concluded by drawing up a document that expresses its content and signed by the person or persons who make the transaction, or otherwise authorized by them.

Transactions between legal entities and citizens must be carried out in a simple form, that is, in writing. With the exception of transactions that require notarization.

For transactions of a legal entity between itself and citizens, the law provides for their mandatory conclusion in simple written form.

The written form presupposes that an act must be drawn up that expresses the content of the transaction, which is signed by the person making this transaction or by persons duly authorized by him.

The conclusion of an agreement through the exchange of documents via mail, telegraph, telephone, electronic or other communication, which makes it possible to reliably establish that the document comes from the party, is also equated to the written form of concluding a transaction.

https://youtu.be/nJYROD8JxKg

Important details

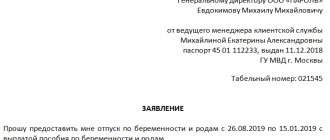

However, for an invoice to be recognized as an offer, it must contain the essential terms of the contract, namely:

- name/quantity of goods;

- in what units is it measured;

- tax rate (excise duty, VAT);

- method and term of transfer of products to the buyer / term of payment;

- total amount including tax:

- a separately allocated amount of taxes;

- name of the seller/buyer;

- bank details of the seller/buyer;

- name and signatures of company officials (with transcript);

- invoice date.

It is advisable to put the organization's seal on the document.

Who issues

The invoice is usually issued by an accountant. Next, it is handed over to the head of the organization, who certifies it with his signature.

If any errors were made during registration, it is better not to correct them, but to form them again.

It is possible, but in this case it must contain all the conditions that should be in the agreement. These include:

- procedure and terms of payments;

- name and quantity of goods/services.

In this case, it is an offer and has legal force.

Can an invoice be issued before the contract?

It is not an error to issue an invoice before the contract has been concluded. The main thing is that there is no discrepancy in dates - a document with a later date is indicated as the basis. If the invoice was issued earlier, then it should be mentioned in the agreement, stating that the agreement also applies to invoices issued before its conclusion. But in this case, a reconciliation report should be prepared, which states that the funds received are an advance payment under the concluded agreement.

Despite the fact that the law allows, under certain conditions, to pay a bill without an agreement, experts warn that it is easier to communicate with tax authorities when it is concluded. Especially when we are talking not about a one-time deal, but about ongoing cooperation. This can be done after payment of the invoice if the parties are committed to long-term work.

18.01.2018

There's just no money

As Izvestia found out, the head of the State Duma Committee on Housing Policy and Housing and Communal Services Galina Khovanskaya intends to appeal to Prime Minister Mikhail Mishustin with a request to pay attention to the situation with subsidies for citizens’ expenses for housing and communal services - it is necessary to make sure that this amount is included in the total family income reduced from 22 to 15%. According to her, earlier a proposal to allocate these funds from the federal budget was made by the Ministry of Construction and the State Duma. We are talking about amendments to Resolution No. 541 of August 29, 2005 “On federal standards for payment of housing and utilities,” which have already been submitted to the Cabinet of Ministers.

“We have been pushing this proposal for several years, and finally the Ministry of Construction last week submitted it to the government. Feedback from ministries is currently being received on this proposal. Everyone reacts positively, except the Ministry of Finance, which writes that there is no money allocated for these purposes in the federal budget. But if this measure is not taken, then it will work to reduce payments from citizens who can simply refuse them. After all, many have lost their jobs due to the crisis,” Galina Khovanskaya told Izvestia.

Khovan

Head of the State Duma Committee on Housing Policy and Housing and Public Utilities Galina Khovanskaya

Photo: IZVESTIA/Pavel Bednyakov

Stop valve: tariffs for gas and electricity were proposed to be fixed

The government will have to find a source of compensation for supplier companies, experts say

According to her, it was initially proposed to ensure that payments for housing and communal services did not exceed 10% of family income. Then we decided to stop at 15%. The deputy noted: this topic was discussed with the previous head of the Cabinet of Ministers, Dmitry Medvedev, who gave instructions to calculate the required amount of funds for subsidies throughout the country.

The parliamentarian added that at first the Ministry of Construction did not support this idea, but during the pandemic, the department changed its point of view, recognizing that there is no need to make defaulters on people who, through no fault of their own, but because of the crisis, lost their jobs.

— If the Ministry of Finance is against it, with a high degree of probability this means that the proposal will not be supported by the government as a whole. That’s why I want to send an appeal to the head of the Cabinet of Ministers, Mikhail Mishustin, who verbally responded to this initiative normally,” the deputy explained.

Ministry of Finance

Photo: IZVESTIA/Konstantin Kokoshkin

Are you cold: every tenth house in the Russian Federation risks not having time to prepare for winter

More than 70 billion rubles are missing for the necessary work

The press service of the Ministry of Finance told Izvestia that the issue is still being discussed. At the same time, the department did not deny that it had already sent a response with objections.

According to Rosstat, in 2020, 3.04 million families received subsidies to pay for housing and communal services, and 68.7 billion rubles were spent for these purposes. The average amount of support for one family was 1,483 rubles. If we talk about subsidization percentages, they are not the same in different regions. In 58 subjects, the maximum allowable share of citizens' expenses for utility bills is 22%, in 24 subjects - 15–21%, and in three subjects - less than 15%.

As the State Duma explained to Izvestia, the new number of citizens entitled to a subsidy can only be announced after an accurate count of those who have written an application for this benefit after the pandemic. Previously, an additional 30 billion rubles may be required for these purposes.

On what basis are the goods paid? Is it correct to pay without a contract and an invoice for the order?

First, you need a memo or purchase application endorsed by the manager. Then the supplier or the person performing these functions finds the goods and takes an invoice for payment. The manager issues the visa - PAY After that, make the payment. Otherwise, you will never prove what exactly you bought and for what purposes.

Anything is possible, but then you won’t find either goods or money ((

Invoice, delivery note and invoice are required. There must be originals with signatures and seals. Chapter 30 of the Civil Code of the Russian Federation, which regulates purchase and sale relations, does not provide for a mandatory written form of concluding a supply agreement. Consequently, the contract for the sale and purchase and, in particular, the supply of goods can be concluded orally. Concluding a supply agreement orally will deprive the parties of the right in the event of a dispute to refer to witness testimony to confirm the transaction and its terms (Article 162 of the Civil Code of the Russian Federation). In this case, the parties will be able to confirm the existence of a contractual relationship with written and other evidence. For example, they can be an invoice, an invoice for payment for goods, a delivery note, a written offer to accept goods (see, for example, the resolution of the Federal Antimonopoly Service of the Volga-Vyatka District dated April 18, 2008 N A39-3808/2006).

For the tax authorities, documents confirming the transfer of ownership of the goods are important. This is an invoice (act, agent report), customs declaration and shipping documents. And the bill is absolutely rubbish. An extra document that you may only need if something happens for a trial with a counterparty to prove the fact of the transaction. That's all

Necessity of writing

Any transactions of legal entities that are carried out among themselves and with citizens must be completed in ordinary written form. An agreement can be concluded by drawing up one document, which is signed and approved by both parties. In addition, it can be concluded by exchanging papers through mail, telegraph, teletype, telephone, electronic or other communications. The main thing is that, as part of the transfer of information, it is possible to reliably establish that the required document comes from the party to the contract.

In addition, according to the general rule, the written form of the contract is considered to be complied with if the person who received the offer within the period established for its acceptance took steps to implement the terms of the document that were specified in the offer.

Why, when delivering, sometimes an invoice for payment is not enough and an agreement is needed

There are several other ways to conduct business without affecting your main checking account. They are simple and well known. The problem is that you can't FORCE them to transact through your checking account. That is why your case is rotten, despite the trial you won. Nothing will appear on their account, and after a while they will eventually be liquidated. Rest assured, they have been operating through another legal entity for a long time. a person against whom there can be no claims.

This is not considered fraud; try applying to the bailiffs with a writ of execution.

Yes, there really is no fraud here. Submit a writ of execution, write an application to seize the property, as soon as they are not liquidated

Documentation of the transaction

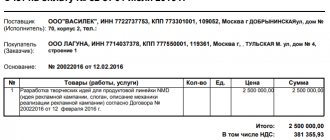

When completing a transaction, proper documentation is important. When completing a transaction, documents such as a contract and an invoice can be used; their features are presented in Table 1.

| Document | Description |

| Agreement | The agreement must be drawn up on paper; the following options for concluding an agreement are possible:

The contract must contain all the necessary details, signatures and seals. The contract can provide for discounts, payment terms, deliveries, etc. |

| An invoice for payment | An invoice for payment for goods, works, and services is an optional document, but it must contain the necessary details. Such details include the name of the buyer and seller, their addresses, names of their banks, account numbers for transferring funds, TIN, KPP, BIC, etc. Unlike a contract, an invoice for payment does not have to be drawn up on paper; it can be sent electronically by e-mail. |

The agreement provides for the issuance of invoices for payment

When drawing up an agreement, the parties may provide for the issuance of an invoice for payment. In this case, the invoice for payment must be issued after the date of signing the agreement on the terms and conditions specified in the agreement and within the specified time frame. It is not necessary that the dates of the invoice and the contract must coincide, but the invoice should not be issued on a date that is earlier than the date of conclusion of the contract. If the agreement between the parties specifies the issuance of invoices for payment and the issued invoice for payment indicates a date earlier than the date of conclusion of the agreement, then in this case it is recommended to issue the invoice again. That is, it is necessary to issue an invoice on a date later than the date of conclusion of the contract within the terms and conditions specified there.

Is it possible to pay without an invoice?

For example, when buying and selling, the essential conditions are the name of the goods, their price and quantity.

If the invoice does not specify all the terms of the transaction, then such a transaction will already exist, it is considered that it did not exist. The way out of such situations is considered to be the execution of a document upon completion of the transaction (invoice, act), in which all the terms of the transaction will still be clarified. In this case, the transaction will be considered concluded on the terms specified in these documents (invoice, services, work completion certificate).

Account without agreement

In some cases, an invoice for payment can replace an agreement, i.e., sometimes issuing only an invoice is enough; drawing up an agreement is not required. Issuing an invoice for payment without a contract is only possible if the invoice is an offer, i.e. the invoice contains information essential to the contract.

If payment on the invoice is made before the conclusion of the contract, then the invoice has legal force if it contains all the essential terms of the contract. For example, for delivery this is the price of the product, its name and quantity, the procedure and terms of payment. Such an invoice should be considered as an offer to enter into an agreement (offer). Payment by the buyer of the received invoice is an acceptance of the offer, that is, in this case, the contract will be considered concluded on the terms specified in the invoice.

Is it possible for a legal entity to pay an invoice without an agreement - Help from a Lawyer

List of messages IP/Host: 83.166.108. Registration date: 08/05/2008 Messages: 130 payment without an agreement, here’s the situation: 2 smart organizations verbally agreed to provide services to promote goods and pay for them. the contract was not concluded, but there is an invoice (in electronic form) with the name of the payment, the invoice was paid, but the services were not provided (no act or other confirmation).

we want to file a claim against the organization that issued the invoice but did not provide the service, in accordance with Art. 153, paragraph 3 of Art. 154, art. 158 Civil Code of the Russian Federation Art. 420 of the Civil Code, i.e. the Plaintiff and the Defendant carried out legal and actual actions to conclude the transaction (the subject of the transaction was determined by the parties, the Defendant sent the Plaintiff an offer (an invoice for the cost of services indicating the name of the services), and the Plaintiff made their payment, i.e. ., The Plaintiff accepted the Defendant's offer by payment in accordance with Article 433 of the Civil Code of the Russian Federation.

https://youtu.be/1zcOuCrG7Io

Message from if, along with the invoice..., there is a confirmed fact of payment of this invoice (i.e. acceptance), the judge does not recognize the invoice, even if it is in email. form and payment form as offer and acceptance? I wouldn't admit it. The invoice must be signed. Who forced you to pay for the bill? Dear court, our organization sent a draft invoice to the client for preliminary approval. It was you who decided to frame her. We filled out the invoice ourselves and paid for it.

For utility services, we pay directly to the resource supply organization (PKK is a production company). Can we, the owners, 28. Settlements for transactions not formalized by a supply agreement. VAT deduction does not depend on the existence of a supply agreement. A written transaction must be concluded by drawing up a document.

expressing its content and signed by the person or persons entering into the transaction, or persons duly authorized by them (clause 1 of Article 160 of the Civil Code of the Russian Federation). Transactions of legal entities between themselves and with citizens must be made in simple written form, with the exception of transactions requiring notarization (clause

It is not necessary that the dates of the invoice and the contract must coincide, but the invoice should not be issued on a date that is earlier than the date of conclusion of the contract. If the agreement between the parties specifies the issuance of invoices for payment and the issued invoice for payment indicates a date earlier than the date of conclusion of the agreement, then in this case it is recommended to issue the invoice again.

That is, it is necessary to issue an invoice on a date later than the date of conclusion of the contract within the terms and conditions specified there. Invoice without an agreement An invoice for payment in some cases can replace an agreement, i.e. Sometimes it is enough to issue only an invoice, no contract is required. Issuing an invoice for payment without a contract is only possible if the invoice is an offer, i.e. the invoice contains information essential to the contract.

The conclusion of an agreement by exchanging documents via postal, telegraph, teletype, telephone, electronic or other communication is also equivalent to the written form of concluding a transaction, allowing one to reliably establish that the document comes from the party under (clause Invoice-agreement for the supply of goods, clause Invoice-agreement can be drawn up as requiring the signature of both parties, or can be drawn up as an offer, in which confirmation of acceptance of the conditions (acceptance) is payment according to the details specified in the details.

Important: If the invoice payment is made before the conclusion of the contract, the invoice is legally binding if it contains all the essential terms of the contract. For example, for delivery this is the price of the product, its name and quantity, the procedure and terms of payment.

The contract can provide for discounts, payment terms, deliveries, etc. Invoice for payment An invoice for payment for goods, works, services is an optional document, but it must contain the necessary details. Such details include the name of the buyer and seller, their addresses, the names of their banks, account numbers for transferring funds, INN, KPP , BIC, etc.

In this case, the invoice for payment must be issued after the date of signing the agreement on the terms and conditions specified in the agreement and within the specified time frame.

We invite you to read: Almost everything about contracts in conventional units. Resolving disputes in practice. Part 1

Secondly, you can file a claim under the first scheme, allegedly the contract was not concluded in writing, but there is evidence of agreement on its essential terms. You fulfilled your obligations (transferred money), but your counterparty did not. Ask for a refund of the amount paid, interest under Art. 395. When indicating in the statement of claim erroneously transferred money. funds have the right to interest under Art. 395 Civil Code, because the receiving party knew about the receipt of money from you.

2008 Messages: 130 Re: payment without an agreement, that is, in fact, is the first scheme and the second one and the same in terms of the amount to be collected? those.

What needs to be done from March 12 to 16 In order not to forget about important accounting matters, you can keep a diary, install a special program on your smartphone that will remind you of plans, or stick stickers covered with notes on your work monitor. But the easiest way is to read our reminders weekly .{amp}lt; {amp}lt;

... Individual entrepreneurs should not rush to pay 1% contributions for 2020. Firstly, because from this year the deadline for paying such contributions has been postponed from April 1 to July 1. Accordingly, 1% contributions for 2020 must be transferred to the budget no later than 07/02/2018 (July 1 – Sunday). {amp}lt; ... The transition from one Federal Tax Service Inspectorate to another will not require mandatory reconciliation. The Tax Service has updated the regulations for organizing work with payers of taxes, fees, insurance contributions for compulsory pension insurance, as well as tax agents.

VAT deduction does not depend on the existence of a supply agreement

- Invoice instead of a separate contract

- Invoice agreement for the supply of goods

- What are the dangers of delivering goods on invoice without a contract?

Paperwork or legal requirements: is a supply agreement necessary? According to paragraph 1 of Article 420 and Art.

506 of the Civil Code, a supply contract is an agreement between the seller (supplier) and the buyer, according to which the seller (engaged in business activities) undertakes to transfer, within the agreed time frame, the goods purchased or produced by him to the buyer, which the latter uses in his business activities.

The supply agreement is a civil contract. ConsultantPlus: Forums 1. Is it possible to pay for the material 259 thousand without an agreement of the Civil Code of the Russian Federation? An agreement in writing can be concluded by drawing up one document signed by the parties, as well as by exchanging documents through postal, telegraphic, teletype, telephone, electronic or other communication that would made it possible to reliably establish that the document comes from the party to the agreement. According to paragraph 3 of Art. 434 of the Civil Code of the Russian Federation, the written form of the agreement is considered to be complied with if the written proposal to conclude an agreement is accepted in the manner provided for in paragraph 3 of Art.

- Why, when delivering, is sometimes there not enough invoice for - payment and - an agreement is needed

- Why, when delivering, sometimes an invoice for payment is not enough and an agreement is needed

- Claim delivery without contract

- Settlements for transactions not formalized by a supply agreement.

Important: If the amount of expenses is much larger, try to pay by barter. c) Deferment or installment payment If these methods do not suit you, you can try to get a deferment or installment payment of the tax. They are provided for a period of one to six months. The list of cases when a company can ask for a deferment or installment plan is strictly limited (Article 64 of the Tax Code of the Russian Federation).

We invite you to familiarize yourself with: Sample annual contract with monthly payment

Here are some of them: the threat of bankruptcy; damage caused to the company by a natural disaster; the seasonal nature of production or sale of goods (works, services); termination or delay of financing from the budget or payment of government orders. the act of mutual settlements for each operation (in the sense of when another pays for you office). It'll work just fine. current for a short period, it is better not to get involved, so as not to attract taxes... The Uzbek woman interprets correctly.

In addition, it should be borne in mind that pp. 7th and 8th Art. 9 of the Trade Law sets deadlines for payment of food products by the buyer to the seller.

However, this will most likely have to be proven in court. However, the company has several opportunities to conduct settlements with a frozen account. A) New account The easiest way out of this situation may be to open a new account in another bank. Fortunately, the Tax Code does not prohibit this, and banks do not require any certificates from the inspectorate from companies when opening accounts.

Within five days after the company has an account, the bank will notify the tax office where it is registered. Of course, having received such a notification, the inspectors will immediately send a decision to the bank to suspend operations on the new account. However, in this case, the calculation is made on the fact that by the time the notification from the bank reaches the tax office and from there the decision to freeze the account comes, the company will have time to carry out all the operations it needs. This method has one, but significant, drawback.

- Is it possible to pay a bill without a contract?

- Is it possible to pay bills without a contract?

- Accounting and legal services

- Is it possible to pay for the material 259 thousand without a contract?

- Is it possible to pay an invoice without a contract?

- Payment by invoice without agreement

- Is it possible to pay an invoice without an agreement under 44-FZ

- Is it possible to pay an invoice without an agreement under Federal Law 44?

- Is it possible to pay an invoice without a contract?

If the invoice is issued before the contract

If the agreement between the parties does not provide for invoicing, then issuing an invoice on a date earlier than the date of conclusion of the agreement is not an error. In this case, payment is made according to the contract, and not according to the invoice.

If an invoice for payment is issued earlier than the agreement is concluded, it is necessary to indicate in the agreement that the validity of this agreement also applies to this invoice, which was issued from an earlier date. In this case, it is recommended to draw up a reconciliation report, which will indicate that the amount received was received as an advance payment under this agreement.

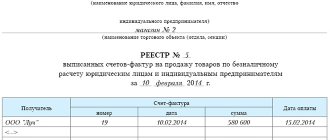

Invoice for delivery of goods

An invoice agreement can be drawn up as requiring the signature of two parties, or perhaps drawn up as an offer, in which payment according to the specified details is considered confirmation of acceptance.

But, in the opinion of many, an invoice agreement is a convenient form of contractual relations, especially among small and medium-sized businesses, which, due to its simplicity, does not require lengthy changes and approvals.

IMPORTANT! The most important thing to remember is that delivery of goods on invoice without a contract is dangerous for both suppliers and buyers.