BCC for land tax is a 20-digit identifier established by the legislator for land tax payments to the budget.

The BCC for land tax 2020 was established by Order of the Ministry of Finance. This is a required payment order detail for transferring the fee. Budget classification codes are necessary when making payments to the budget; they are needed for the correct distribution of funds and monitoring the fulfillment of the obligation to pay taxes. These indicators are not used in calculations between legal entities and individuals. The CBK “Land Tax” for 2020 was introduced by Order of the Ministry of Finance No. 132n dated 06/08/2018, but the indicators have not changed since 2020.

Objects and procedure of taxation

From the name it is clear that this fee is established for land owners. Since local authorities have a greater understanding of the land plots in their area of responsibility, this tax is local. The funds go to the budget of the corresponding municipality and local authorities are vested with great powers in regulating it: they set tax rates and payment deadlines; at the federal level, only their maximum and minimum limits are indicated.

In accordance with Art. 389 of the Tax Code of the Russian Federation, the objects of taxation are land plots. The following areas are not recognized as such:

- withdrawn from circulation or limited in circulation due to the location within their boundaries of water bodies of federal significance or particularly valuable objects of cultural heritage;

- members of the forest fund;

- located under apartment buildings.

Maximum bet:

- 0.3% - for agricultural land occupied by housing stock or its infrastructure, acquired for the purposes of horticulture and livestock farming;

- 1.5% - for all other areas.

This percentage is calculated from the cadastral value, which is the tax base in this case.

Existing tax rates

The required rates are established in accordance with the legislative acts of the constituent entities of the country or cities of federal significance, but it is prohibited to exceed the limits established by the government of the country of 0.3% for:

- lands exploited in agriculture by the state or lands used for the same purpose within populated areas;

- territories allocated to the country's housing fund, on which engineering facilities are located that ensure an adequate level of existence within residential complexes;

- areas allocated for individual farming, that is, vegetable gardens, gardens, farming and summer cottages.

One and a half percent is deducted from the tax base for land plots with other characteristics.

At the same time, municipal authorities have the right to differentiate the rates according to the characteristics of each land plot and the categories of citizens who own them.

Thus, benefits for the discussed tax deduction are given to the following representatives:

- heroes of the country;

- bearers of the Order of Glory;

- people with third degree disabilities who have lost their full ability to work;

- disabled people of the remaining two groups, whose condition was determined before 2004, who have not lost the ability to work;

- military veterans;

- persons who took part in eliminating the consequences of the Chernobyl accident, the Mayak Union, nuclear waste disposal on the Techa River and nuclear testing at the Semipalatinsk test site;

- persons involved in testing nuclear and thermonuclear weapons, as well as eliminating installations at military facilities;

- persons affected by radiation sickness.

In order for the base to be reduced, you need to provide the tax service with relevant documents that serve as confirmation.

Who is exempt from paying land tax?

In this article, we will consider in detail what land tax benefits exist, who is exempt from payment, and what objects are subject to taxation.

Video - Land tax for individuals

Code meaning table

BCCs for land tax in 2020 are presented in the table.

| Payment (location of land) | KBK Primary Obligation | KBK Peni | KBK Fine | KBK Interest |

| Within the boundaries of municipal districts of federal cities | 1821 0600 110 | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

| Within urban districts | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

| Within the boundaries of urban settlements | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

| Within urban districts with intracity division | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

| Within the boundaries of intracity districts | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

| Within inter-settlement territories | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

| Within rural settlements | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

Thus, the BCC of land tax depends on the location of the object of taxation. There are also special BCCs “Penalties for land tax 2020”; separate values are provided for the payment of fines and interest.

KBK land tax: penalties, fines, interest

If an enterprise does not pay the tax fee on time, it violates the law. As a result, penalties will be applied to him. A penalty is charged for each day of late payment. It can be canceled if the organization incorrectly indicated the KBK in the payment order and then submitted an application to clarify the payment details. That is, the code has been corrected. The fine is paid once for late or incomplete tax transfer. The amount of interest on the payment depends on the amount of tax collection.

Specifics for legal entities

Legal entities, like ordinary citizens, are taxpayers for this fee in favor of the state. The tax system does not matter in this case; simplified regimes do not exempt organizations from fulfilling the obligation to transfer a fee for land ownership. But unlike citizens who receive notifications from the tax office indicating the amount of tax and attaching a document for payment (or in their personal account on the government services portal), companies are required to independently draw up and submit a declaration to the regulatory authority at the place of their registration. Local authorities may provide tax benefits for certain categories of persons. These norms must be sought in the land tax laws of individual municipal districts.

Payers

Taxpayers are legal entities and individuals who have land plots at their disposal under special conditions. For individuals, these conditions are expressed as follows:

- The land was purchased, privatized or received as a gift, and the owner registered his rights with Rosreestr.

- The allotment is issued for indefinite use.

- The plot was inherited by the new owner on the basis of lifelong maintenance rights.

Organizations that have purchased land are also required to pay tax contributions annually. But if the plot is leased or provided for free use, then the tax should not be paid by the tenants.

The full list of taxpayers obliged to pay contributions for land is set out in Article 388 of the Tax Code of the Russian Federation,

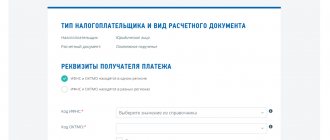

What is KBK, its composition

KBK stands for "Budget Classification Code". Essentially, this is a code that makes it possible to analyze the details of a payment received by the state treasury. Based on the numbers reflected in the BCC, you can determine the executor, destination, recipient of the payment and where the payment will go next.

The state budget is not an account where all the money received is accumulated. Here the funds are immediately redistributed to the required recipients. Taxes are collected by budget codes, which gives the Federal Tax Service the opportunity to analyze in what amounts they are accumulated in a particular budget. The OKTMO code, in turn, makes it possible to judge the distribution of payments on a territorial basis.

Thus, the state constantly has the opportunity to monitor payments under budget items and draw up cost estimates.

KBK consists of 20 digits, the digits of which include 4 blocks:

- administrative,

- profitable,

- program,

- classifying.

Administrative block - here the initial 3 digits of the code reflect the payment addressee. Taxes correspond to a combination of numbers 182, and contributions to the Social Insurance Fund - 393.

The income block consists of 4 groups:

- symbol 4 of the KBK reflects the type of income (payment related to taxes has code 1, gratuitous funds - 2, payment from an entrepreneur - 3);

- signs 5 and 6 reflect the purpose of payment (taxes and income correspond to the number 01, property taxes - 06, state duties - 08, fees for the use of nature - 12, fines - 16);

- signs 7 and 8 reflect the income item, and from 9 to 11 - sub-items of income according to the Budget Code of the Russian Federation;

- signs 12 and 13 indicate the budget (local, federal, regional).

A program block consists of 4 characters. Taxes and fees are reflected in the number 1000, penalties - 2100, interest - 2200, penalties - 3000.

The classification section consists of 3 characters reflecting different types of economic activity: 110 - tax revenues, 160 - social contributions, 153 - tranches from international financial institutions.

Thus, knowing how to read the BCC, you can understand from whom, where and what budget payment was made.

KBK codes for 2020

There are no changes in the use of budget classification codes. Consequently, organizations, entrepreneurs and ordinary citizens will have the right to use the codes approved for 2019.

We suggest using a simple and convenient reminder. All budget classification codes for land tax, including basic payments, fines, penalties and interest, in one file:

The article provides information on paying fees for land ownership: characteristics. When issuing a receipt for payment of the duty, the budget classification code is entered in field 104, which indicates the type of contribution - BCC for payment of land tax.

Citizens of the Russian Federation, businessmen and owners of Russian companies are required to pay a quarterly land tax. The tax is calculated on an accrual basis, so the reporting period is a calendar year. When filling out a receipt for payment of the duty, you need to enter the land tax code in the appropriate field.

How to find out the amount of land tax

The amount to pay land tax depends on the following factors:

- cadastral value of the territory;

- land tax rate for a specific region;

- the presence or absence of benefits from the owner;

- other factors - the share of ownership of the site, the time of its use.

Land tax rates

The Tax Code of the Russian Federation establishes the tax rate on land, or more precisely, its upper limit. Local authorities have the right to change rates, but not higher than those specified by the Tax Code.

NOTE. That is, regional authorities can reduce land tax rates (these are preferential rates), but not make them higher!

There are two rates, they depend on the type of site used:

- 0.3% of the cadastral value – the so-called. reduced rate. Applies only to types of land specifically designated by law - agricultural plots, subsidiary plots, gardening partnerships, as well as territories intended for the construction of residential buildings and communal complexes (clause 3 of Article 394);

- 1.5% of the total cadastral value is the rate applied to all other types of land.

You can find out the land tax rate specifically for your region by visiting the official website of the Federal Tax Service https://www.nalog.ru/rn77/service/tax/ or directly visiting the local tax office. For example, the tax rate for a subsidiary plot for the example with St. Petersburg, considered, will be 0.042%:

That is, in the search bar you need to enter the type of land, select the category of payers and the system will show you the desired rate.

IMPORTANT. If the region does not have its own rate, then the general rates indicated above are taken into account.

Calculation of land tax

The question of how to calculate land tax is almost the most popular on this topic. The final calculation will be made by local authorities after contacting them. Now you can independently calculate the amount to pay the land contribution using the following formulas.

Size ZN=KS*D*NS*KV

where KS is the cadastral value of a plot of land; D – share of ownership; NS – tax rate on land, specific for a certain region; KV is a coefficient that is used in the calculation if the land area has not been in use for a whole number of years.

Certain categories of citizens are provided with certain benefits; if any, the amount of land taxes will be calculated using the formula:

Size ZN=KS*D*NS*KV-L

where L is the land tax benefit.

IMPORTANT. For each individual land property, its cadastral value is calculated separately. If the plot is owned by several persons, the share of each is calculated separately.

Examples of land tax calculations

For clarity, let's look at a few examples of how to correctly calculate land tax using this formula. Let's say a certain citizen is the owner with the right of ownership of a certain territory of land in the St. Petersburg region, the tax rate for which is set at 0.3%, and the cadastral value is 2 million rubles.

- For a whole year of owning a land plot, he must pay: ZN = KS * NS = 2,000,000 * 0.3% = 6,000 rubles.

- If the plot was used for less than a full year, for example, 6 months, he will pay a land tax, the amount of which is equal to: ZN = KS * NS * KV = 2,000,000 * 0.3% * 0.5 = 3000 rubles, where KV = 0, 5=6/12.

- If he owns only part of the land plot, for example, 1/3, then the amount of land tax will be as follows: ZN=KS*D*NS*KV=2,000,000*1/3*0.3%*0.5=1000 rub.

To find out the land tax per hundred square meters, it is enough to divide the total accrual by the number of hundred square meters.

What is a notification?

Individuals pay tax on the land of individuals according to a tax notice from the inspection of the locality. The notification must be sent within 30 days before the next payment is due.

The notification includes the following information:

- The total amount of the duty, details of its calculation are written here.

- KBK land tax from individuals.

- The name of the object for which the land duty is levied.

- Information about the tax base.

- Deadline for payment of land tax for individuals.

The notification is delivered to the individual personally against a signature or delivered to his representative, sent by mail or sent in electronic format.

When sent by registered mail through the post office, the citizen must receive it within 6 working days, otherwise it will be automatically considered received. If errors were found in the notification or the letter did not reach the recipient, you must contact the tax office on a voluntary basis.