Main classification

There are these types of expenses:

- costs of raw materials and materials;

- for the labor of workers;

- capital expenses (depreciation, rent);

- funds spent on production services (insurance, mail, transport);

- special costs (deductions and taxes).

In modern economics, there are several classifications of expenses.

By type, the following types of expenses are found:

- Single element. This includes the costs of raw materials, resources and labor.

- Overhead or indirect costs. These include taxes, depreciation, various deductions, and administrative and business costs. This type is applied separately to each product to calculate the size that constitutes the costs.

- Special costs. These are the costs of making models, transportation and postage costs, as well as bonuses or commissions to employees.

Enter the site

RSS Print

Category : Pricing Replies : 2

You can add a topic to your favorites list and subscribe to email notifications.

« First ← Prev.1 Next → Latest (1) »

| SVETA (guest) [email protected] | |

| very urgently needed!!!!! help me write a certificate or some established form for deciphering general household expenses. I'M REALLY LOOKING FORWARD. URGENTLY | |

| I want to draw the moderator's attention to this message because: Notification is being sent... |

| Tanyusha [email hidden] Belarus, Grodno Wrote 285 messages Write a private message Reputation: | #2[2042] September 29, 2009, 2:16 pm |

Notification is being sent...

| economy2 [email protected] Belarus, Minsk Wrote 39 messages Write a private message Reputation: | #3[2045] September 30, 2009, 10:10 |

Notification is being sent...

« First ← Prev.1 Next → Latest (1) »

In order to reply to this topic, you must log in or register.

Budget expenses

Budget expenditures are part of the funds that are aimed at financially supporting functions, as well as some tasks that the state or local governments face.

Accounting for budget expenditures at all levels is based on a unified methodological basis, budgetary security standards, as well as monetary costs for the provision of public services, which are established exclusively by the government of the Russian Federation.

Classification

Based on the economic content, the types of budget expenditures are capital and current.

Capital expenditures serve to enable innovation and investment. They include:

- costs of investments made in existing structures or newly created ones;

- funds provided as budget loans to legal entities;

- costs of repair work or expenses associated with modernization or improvement of equipment;

- expenses due to which the property ownership of the Russian Federation or its municipal institutions, as well as other entities, expands;

- other costs that are included in Russia's capital expenditures in accordance with the official economic classification and current legislation.

The development budget is formed as part of capital expenditures.

Current budget expenditures are necessary in order to ensure the current functioning of local governments, state authorities, and any budgetary organizations. They are also intended for government support for entire sectors of the economy. For this purpose, grants, subsidies, subventions, etc. are created. This category also includes some budget expenditures that are not included in the capital category.

Opinion leaders on office expenses

“Office” expenses, if they are related to business activities, are taken into account when taxing profits in the period they are written off as expenses in accounting. Among others, such expenses include depreciation, as well as the cost of repairs and maintenance of fixed assets and items included in funds in circulation (hereinafter referred to as items), administrative and general business expenses (for example, for an office) <*>.

Which fixed assets are classified as used in business activities is decided by the commission on the organization's depreciation policy <*>.

Currently, the legislation does not establish any mandatory criteria that can be used to guide the division of fixed assets and items into those used and not used in business activities for the purposes of calculating depreciation, depreciation or write-off upon transfer or retirement.

If the connection of some fixed assets or items with production is obvious and, as a rule, does not raise doubts (for example, computers, office equipment, office furniture), then there are those on which disagreements with regulatory authorities may arise.

Specialists of the Ministry of Taxation explain that the main criteria for including expenses as expenses taken into account when taxing profits are the objective necessity and justification of such expenses in the production process <*>.

But what is a necessity and what is a luxury? Do you need a vacuum cleaner when you can sweep with a broom? To avoid disputes with regulatory authorities, the accountant must weigh all the risks, justify the necessity and connection of certain expenses with the production process.

To help the accountant with this, we asked opinion leaders in the field of taxation — leading experts in the field of taxation and accounting—to express their positions on this issue:

— Mikhail Abgaryan, Deputy Director of Privataudit LLC. Work experience in auditing - more than 15 years. Experience working with organizations of various forms of ownership and industry affiliation. Author of numerous publications in printed publications and electronic databases on accounting and tax legislation;

— Evgeniy Gershtein, Deputy Director of RSM Bel Audit LLC. Deputy Chairman of the Association of Audit Organizations. Member of the advisory board of the Ministry of Taxes and Taxes. Total experience - 35 years. Awarded with diplomas from the Council of Ministers, the House of Representatives of the National Assembly, and the Ministry of Taxes;

— Nekhai Natalya, leading auditor of Audit LLC. 13 years of experience in managing the methodology for taxation of legal entities of the Ministry of Taxes. Lecturer at numerous seminars, hotline consultant, author of a large number of publications on taxation;

— Vitaly Rakovets, auditor of AuditIncom LLC. 14 years of experience. More than 1,500 publications in the media and print publications;

— Viktor Statkevich, auditor. 12 years of experience as an auditor with the largest enterprises in Belarus. Author of numerous publications in printed publications and electronic databases.

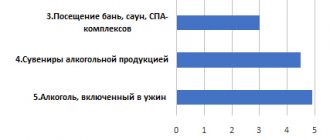

Let's take a closer look at the positions of opinion leaders on each of the nine types of expenses shown in the figure and determine what percentage of the experts surveyed admitted that it is risky to take expenses into account when taxing profits.

We invited opinion leaders to consider the most common types of office expenses, in our opinion.

At our request, they assigned each type of expense a degree of “tax risk” from 1 to 5 in ascending order, starting with the safest (1) and ending with the most risky (5).

So, the rating of “tax risks” of office expenses is as follows:

General initial data. A commercial organization purchased household appliances and interior items for office workers. All expenses are documented and economically justified.

Question. When taxing profits, can an organization take into account the cost written off as expenses (for an item as part of working capital) or depreciation (for a fixed asset):

1) by air conditioner or fan?

This type of “security” expense is ranked first. Basically, all survey participants believe that these expenses can be taken into account as part of the costs. Experts make this conclusion based on clause 6 of Art. 89 of the Labor Code, according to which employers are obliged to provide safe and healthy working conditions, including the necessary heating, ventilation, etc. Experts remind you that the requirements for optimal and permissible microclimate parameters in office premises are established by SNiP “Requirements for the microclimate of workplaces in industrial and office premises” N 33. Requirements for heating, ventilation and air conditioning systems are provided for in Chapter 6 of the Interindustry General Rules for Labor Safety N 70.

Vitaly Rakovets notes that air ventilation is important for organizing the production process, since polluted air and a stuffy atmosphere provoke rapid fatigue, decreased activity, ability and attention of workers. Thus, as the auditor notes, ensuring an appropriate air microclimate is a legal requirement that requires the installation of air conditioning systems to comply with this rule, i.e. their use in the activities of the organization. Consequently, the installation of an air conditioner in an office is aimed at meeting the requirements of legislation in the field of labor protection, so the cost of purchased air conditioners or depreciation on them can be taken into account when taxing profits as part of expenses.

At the same time Evgeniy Gershtein believes that when attributing these expenses to expenses taken into account when taxing profits, a small risk is still present.

Survey participants assigned the least points to this type of expense, and it is in 1st place in our rating for the safety of classifying it as an expense. Thus, tax risks in relation to these expenses, according to respondents, are minimal.

2) a vacuum cleaner?

According to most experts, the cost of cleaning office space is the cost of maintaining fixed assets. Thus, they note, according to clause 53 of Interindustry Rules No. 70, the procedure for cleaning premises is established depending on the nature of the pollution and the technological process being carried out. Taking into account the provisions of Art. 55, paragraph 6 of Art. 89 of the Labor Code, it is quite safe to take such expenses into account when taxing profits as expenses.

Mikhail Abgaryan and Natalya Nekhai note that the use of a vacuum cleaner for cleaning carpets, armchairs and chairs is provided for as part of the sanitary maintenance of administrative and public buildings (clause 4 of Interindustry Standards No. 104). So, using a vacuum cleaner is a necessity to comply with these standards.

According to Viktor Statkevich, the process of maintaining cleanliness in the premises and the assets used in this process (mop and rag, vacuum cleaner, scrubber dryers, etc.) are not limited by law. Article 131 of the Tax Code also does not establish any restrictions on the possibility of including expenses for the purchase, use, maintenance of a vacuum cleaner, etc. included in expenses that reduce taxable profit.

At the same time Evgeniy Gershtein believes that these expenses can be taken into account when taxing profits, but not as expenses, but as part of non-operating expenses.

Experts assigned a low degree of risk to this type of expense, and it ranks 2nd in our “tax security” rating. At the same time, all survey participants confirmed that they would take this type of expense into account when taxing profits.

3) an electric kettle, microwave oven, coffee maker?

According to the voting results, this type of expense was placed in 3rd place.

Most survey participants agreed that it is tax safe to take such expenses into account when taxing profits, but under certain circumstances. Thus, experts noted that every employee has the right to be provided with sanitary facilities equipped with the necessary devices and means <*>. At the same time, employers and trade union organizations are recommended to include in collective agreements the issues of creating conditions for food for workers <*>.

In this regard Vitaly Rakovets and Mikhail Abgaryan note that since, according to clause 72 of Intersectoral Rules No. 70, eating is permitted only in specially designated and equipped premises, then if there are documents on the organization of such premises, the cost (or depreciation) of a kettle, microwave -stoves and coffee makers can be taken into account when determining taxable profit as part of costs .

Natalya Nekhai and Vitaly Rakovets note that earlier in the letter dated 01/12/2009 N 2-2-15/12640 and letter dated 06/04/2010 2-2-10/11442 it was explained that the costs of purchasing a microwave oven are taken into account for tax purposes. Vitaly Rakovets recalls that in 2020, MTS specialists explained that the costs of purchasing (or depreciation) an electric kettle for the office do not relate to the costs taken into account when taxing profits, but they can be taken into account as non-expenses, since they are incurred in carrying out activities for maintaining normal working conditions. Evgeniy Gershtein also takes the position that the expenses specified in the question should be taken into account as part of non-expenses.

Natalya Nekhai and Viktor Statkevich recommend, in order to confirm the production necessity of the organizations under consideration, to document the creation of a special place for eating (meal room, dining room, etc.). This, they believe, minimizes the risk of recognizing such expenses as “non-production” costs. And if the office is not equipped with a room for meals or a rest room, then, according to experts, taking into account the above-mentioned expenses when taxing is dangerous. Viktor Statkevich also draws attention to the fact that the practice of inspections by tax and other regulatory authorities shows that electric kettles and microwave ovens have already become common assets for tax purposes, but coffee machines are still classified as luxury and excess, especially considering that Some of them are quite expensive.

Mikhail Abgaryan also believes that tax risks in relation to expenses associated with the purchase of a coffee maker are much higher .

Conclusion: if the organization has a room for meals, then it is quite safe to take these expenses into account when taxing profits. Experts assigned a risk level from 2 to 5 (see rating). However, most experts from this group single out a coffee maker, when attributed to costs the risks are much higher.

4) a set of upholstered furniture (sofa, armchair)?

In the “safety” rating, this type of expense took 4th place.

Evgeny Gershtein believes that the cost of upholstered furniture can be taken into account as part of the costs without any risk.

Mikhail Abgaryan, Natalya Nekhai, Vitaly Rakovets , referring to Art. 231 of the Labor Code, response of the Ministry of Taxation dated 06/04/2010 N 2-2-10/11442 “On taxation” to the request of the Association of Belarusian Banks dated 05/19/2010 N 03-02/305 (hereinafter referred to as the response of the Ministry of Taxation N 2-2-10/11442) , believe that if upholstered furniture is installed in a recreation room organized by the decision of the employer, then the cost of such furniture (depreciation) can be taken into account when taxing profits as part of expenses.

Natalya Nekhai and Vitaly Rakovets noted that if such furniture is located in an office, which is a place for working (meetings) with clients and (or) receiving representatives of other organizations (for example, the office of a travel agency, real estate company, office or reception room of the head of an organization), then depreciation (cost) can be included in costs since it is involved in business activities. At the same time Natalya Nekhai believes that if, for example, an accounting department is equipped with upholstered furniture, then its connection with entrepreneurial activity is not traceable.

Viktor Statkevich, on the contrary, believes that furniture (including upholstered furniture) installed in the organization’s office and used by the employees themselves or installed in the meeting room, the manager’s reception room for visitors, accounting, etc., is an asset that is intended for use in production activities of the organization. Thus, according to the expert, the cost of such upholstered furniture can be taken into account as part of the costs that reduce taxable profit in accordance with paragraph 1 of Art. 130 NK. But the cost of furniture that is installed in premises of a “non-production” nature (for example, in a rest room for employees), in his opinion, on the contrary, is not taken into account when taxing profits.

Thus, when attributing these expenses to expenses taken into account when taxing profits, certain risks are present (see rating).

5) indoor plants, ceramic pots, aquarium, paintings?

According to all respondents, the acquisition of this property is quite difficult to link with the business activities carried out by the organization. Therefore, it is impossible to take into account the costs of acquiring this property for taxation either as part of costs or as part of non-operating expenses <*>. In addition, letter N 2-2-10/8003 of the Ministry of Taxes and Taxes indicates the official position regarding the costs of purchasing interior items and other similar goods (houseplants, ceramic pots, soil, flowerpots, aquariums, paintings). According to the Ministry of Taxes and Taxes, such expenses cannot be taken into account for taxation <*>.

Viktor Statkevich noted that, on the one hand, the employer, in accordance with paragraph 6 of Art. 89 of the Labor Code is obliged to provide normal conditions for employees to comply with labor standards. And, of course, one could talk about the fact that the costs of purchasing indoor plants, ceramic pots for such plants, aquariums, paintings are aimed at creating a favorable and comfortable atmosphere in the office, indirectly affecting the productivity of workers and, as a result, on improving the financial results of the organization. However, he believes that the organization does not have a direct production need to carry out the expenses in question and such expenses, by their nature, are more social expenses for employees than expenses of a “production” nature. Natalya Nekhai shares the same opinion , noting that indoor plants, ceramic pots, an aquarium, paintings, rather, have a connection with the rest of workers and, as a result, should not be taken into account when taxing profits (subclause 1.7-1 of Article 131 of the Tax Code).

Vitaly Rakovets notes that although the legislation does not contain an obligation to bear these costs, it is obvious that negotiating and holding meetings within the organization itself is much more productive in a neat room containing interior items. In such a science as psychology, there is even a section “Labor Psychology”, which examines the psychological characteristics of human labor activity and the patterns of development of labor skills. Office and workplace design occupies an important place in this section of psychology. Home furnishings contribute to a positive impact on our morale and therefore increase productivity.

The auditor, citing information contained on the Internet, cites the results of an experiment that was carried out in two large office spaces in the UK and the Netherlands and showed that the addition of indoor plants helped increase productivity by 15%.

The expert also noted that often interior items hide defects on the walls, floors, and windows of premises, thus saving the organization’s resources for repair work. According to Vitaly Rakovets, it would be correct to take the expenses under consideration into account when taxing profits as expenses. However, since the tax authorities have a different opinion, tax risks in terms of attributing such expenses to expenses should be considered very high. And in the event that such expenses are included in the costs taken into account when taxing profits, organizations must be prepared to defend their position. Experts noted a high degree of risk (see rating).

Let's sum it up

When attributing to expenses taken into account when taxing profits, the expenses named in paragraphs:

from 1st to 2nd - there are almost no risks. At the same time, the organization needs to control that these expenses are economically justified, documented and related to the commercial activities of the organization;

from 3rd to 4th - there are certain risks;

5 – there are very high risks.

When attributing to expenses the expenses specified in paragraphs 3 to 5, you must be prepared to prove to the regulatory authorities the production necessity of these expenses. Therefore, those who nevertheless decide to take these expenses into account when taxing profits should pay more attention to the preparation of documents confirming their validity. For those wishing to protect themselves, it is advisable to seek official clarification from the tax authorities to clarify the official position <*>. Otherwise, regulatory authorities may deduct these expenses from expenses and charge additional income tax.

Reserve Fund

The expenditure side of budgets at all levels of the budget system of the Russian Federation provides for reserve funds. The size of this fund does not exceed 3% of approved federal budget expenditures.

Money from the reserve fund is spent in unforeseen emergencies. These include: emergency restoration work after natural disasters, emergencies at enterprises that entail dire consequences. The procedure for spending this fund is regulated by regulations of the Russian Government.

When new types of expenses appear, they are financed at the beginning of the next financial year and only if they are included in the budget. When establishing sources of financing, the option of increasing the budget deficit is excluded.

The structure of payments for residential premises and utilities is established by Article 154 of the Housing Code of the Russian Federation.

Thus, payment for living quarters and utilities includes:

1) payment for the maintenance and repair of residential premises, including

a) fees for services and work related to the management of an apartment building

,

b) content

common property,

c) current repairs of common property;

2) contribution for major repairs;

3) payment for utilities;

4) payment for the use of residential premises (rental fee) - for non-owners of residential premises.

This list is exhaustive, that is, all other names of services are only components of the above services.

Payment for services and work for managing apartment buildings is the AUR

(administrative and management expenses), or

AHR

(administrative and management expenses), or expenses for

AUP

(administrative and management personnel) in the income and expense estimates and receipts.

As you can see, “ AUR” (“AHR”, “expenses for AUP”)

and “

Maintenance of common property of apartment buildings”

are separate lines in the article

“Maintenance and repair of residential premises”

of the estimate of income and expenses of housing cooperatives.

Housing cooperatives and homeowners' associations have the right to develop financial reporting forms independently. Of the documents regulating the organization of accounting in housing cooperatives, there is only Letter of the Ministry of Finance of Russia dated October 29, 1993 N 118 “On the reflection in accounting of transactions in housing and communal services.” However, this letter does not say anything about what expenses the calculation of salaries for the chairman relates to. Therefore, here it is necessary to be guided by the documents recommended for keeping records in other non-profit organizations.

Thus, there are Recommendations on the organization of financial and accounting for homeowners’ associations, approved. By order of the Gosstroy of Russia dated July 14, 1997 N 17-45. In accordance with them, administrative and management expenses are the salaries of administrative and management personnel with accruals, overhead and other expenses.

Administrative and management costs may include:

— wage fund with accruals (contributions to the Pension Fund, Compulsory Medical Insurance Fund, Social Insurance Fund, Employment Fund, transport tax);

— maintenance of the office of the Board of the Partnership (heating, hot and cold water supply, lighting, telephone payment, etc.);

- office expenses;

— training of management personnel (training, acquisition of regulatory documents and special literature);

— maintenance of office equipment;

— information and legal services;

- official travel;

- other expenses.

Maintenance, maintenance and repair costs may include:

— wages with accruals for service personnel;

— costs for inventory and materials;

— costs for deratization and disinfection;

— costs for emergency lighting of public areas;

— payment under the contract for technical maintenance of the contractor;

— payment under contracts to specialized contractors (maintenance of elevator equipment, ventilation cleaning, emergency work, etc.);

— payment under an agreement for the comprehensive provision of services with the customer’s service;

- other expenses.

The housing cooperative is a non-profit organization, therefore the funds of the legal entity consist mainly of the income of the owners, which are of a targeted nature. Let's look again at the HOA analogy.

“The HOA estimate, approved at the next general meeting of HOA members, may contain the following sections:

- administrative and management expenses, including wages for HOA employees, certification of specialists and training of service personnel, payment for communication services, bank services, consumables;

- a reserve fund that includes unexpected expenses.

We believe that the cost of bonuses for the chairman of the HOA board can be included as a separate line in the “Administrative and management expenses” section of the estimate. However, if remuneration was not included in the budget for the year, but at the end of the year it was decided to reward the chairman for good work and pay him remuneration for the past year next year, it seems advisable to carry out these expenses through the item “Reserve Fund”1.

As an example, we can consider the estimates of other housing cooperatives posted on the website of the information portal of the Housing Committee of St. Petersburg.

In particular, the estimate of ZhSK-323 in the line “maintenance and repair of apartment buildings” contains the line “management of apartment buildings”; AUR are allocated separately - as part of other expenses, and “AUR from the reserve fund” is also indicated as a separate line.2

In the housing cooperative “Forward”, the costs of maintaining the AUP are allocated as a separate line, and not as part of the costs of maintaining and repairing residential premises.3

Housing cooperative "Zarya" allocated the AUR separately, and not as part of the costs of maintaining and repairing residential premises, while they indicated the AUR tariff, the "House Management" tariff and "Unused funds from last year" as part of the "AUR" line.4

Housing cooperative "Taiga" allocated AUR (salary to the chairman and accountant, as well as taxes) as part of the costs of maintaining and repairing the house; they included the costs of radio, printing receipts, account maintenance, etc. among other expenses.

As we see, not all housing cooperatives take into account the requirements of Art. 154 of the Housing Code. In our opinion, in the estimate of income and expenses it is most correct to reflect administrative and management expenses according to the principle of the Taiga housing cooperative.

Let's turn to judicial practice. GZHI issued an order to housing cooperatives to bring the structure of payments for residential premises and utilities for owners of building premises in accordance with Part 2 of Article 154 of the Housing Code of the Russian Federation; exclude from the payment for the maintenance and repair of residential premises for owners of premises who are not members of the housing cooperative, the costs of managing an apartment building related to the payment of salaries of the chairman of the board and the accountant of the housing cooperative, and expenses for the economic activities of the cooperative. This order was declared illegal and cancelled, since these expenses are mandatory for all owners of premises in an apartment building, without exception, regardless of membership in the housing cooperative. According to the position set forth in the Resolution of the Constitutional Court of the Russian Federation dated April 3, 1998 N 10-P “In the case of verifying the constitutionality of paragraphs 1, 3 and 4 of Article 32 and paragraphs 2 and 3 of Article 49 of the Federal Law of June 15, 1996 “On Owners' Partnerships” housing" in connection with the request of the Sovetsky District Court of the city of Omsk", the refusal of some homeowners to become members of the homeowners' association does not exempt them from participating in the necessary expenses associated with managing the condominium for the purpose of its maintenance and operation. Thus, the incurrence of mandatory expenses, including those for managing a condominium, is mandatory for all owners of residential premises, regardless of membership in the consumer cooperatives managing such a condominium.5

Please note that in the above judicial practice, administrative and management costs are also taken into account as part of the costs of maintaining and repairing residential premises.

S.A. Trofimova Journal “Housing and communal services: accounting and taxation”, N 6, June 2009 https://www.upravdomu...sj/15101021003/

https://www.gilkom-complex.ru/public/77/gsk-323/2013/smeta-13.jpg

https://www.gilkom-complex.ru/index.php?option=com_mtree&task=viewlink&link_id=792&Itemid=100

https://www.gilkom-complex.ru/index.php?option=com_mtree&task=viewlink&link_id=1336&Itemid=100

Resolution of the Federal Antimonopoly Service of the Moscow Region dated June 13, 2013 in case No. A40-95893/12-92-880

Forms of budget expenditures

The provision of budget funds has the following forms:

- allocations for the maintenance of municipal organizations and budgetary institutions;

- funds to pay for services and work performed by individuals and legal entities under municipal contracts;

- transfers for the population, social payments to citizens;

- appropriations for certain government powers that are transferred to subsequent levels of government;

- allocations to compensate for unplanned costs that arise as a result of government decisions;

- loans to foreign countries;

- funds to pay off state or other municipal debts;

- budget loans for legal entities, including tax credits, installment payments or other obligations;

- subventions, subsidies for legal entities and individuals;

- budget loans, grants, subventions, subsidies for budgets of other levels or state extra-budgetary funds of the Russian Federation.

Distribution of general business expenses

In order to distribute general business expenses, you need to draw up a separate statement. It is worth noting that most companies distribute general business expenses among all costing objects in accordance with the amount of the basic salary among production employees.

It is worth noting the fact that many costs that fall into the category of general business expenses have certain restrictions in the form of established limits or tax standards, cost control and other tasks.

In the process of writing off any such costs in any areas, first of all, they are distributed between finished products and unfinished production, and a separate part is transferred to the cost of services and work of auxiliary workshops.

Thus, depending on how certain production departments operate, different methods for allocating overhead costs may be used:

| Distribution in accordance with the basic salary of employees | The most optimal method for those companies that are characterized by different levels of automation and mechanization, since with its help it is possible to ensure a full accounting of the degree of these factors, as well as the labor intensity of the production of various types of commercial products. |

| In accordance with the costs of processing | The optimal solution for the oil refining and chemical industries. |

| According to the volume of products produced or extracted | Most often used in the metallurgy, construction materials and mining industries. |

In any case, the distribution algorithm is as follows:

- From the accounting registers the amount of general business expenses allocated by the company for the specified reporting period is determined.

- In accordance with the distribution base for such costs in the accounting policy, the summation of all elements that are included in it in ruble terms is carried out.

- The distribution coefficient is determined by dividing the results obtained in point “1” by those obtained in point “2”.

- The total amount of expenses that fall on individual elements of the base is calculated by multiplying each of them by the resulting coefficient.

Material costs

For the purpose of calculating income taxes, material costs are divided into:

- those that are used to purchase raw materials, materials that are used in the production of products or provision of services;

- those that are spent on the purchase of materials for packaging goods, pre-sale preparation, as well as testing or quality control;

- those that provide tools, equipment, devices, clothing and other means for individual and collective protection, which are provided for by law;

- providing components, as well as products that undergo installation, or semi-finished products that undergo additional processing by the taxpayer;

- those that allow you to purchase fuel, water and energy of all types, which is spent on heating premises and increasing production capacity;

- those that allow the use of third-party services: transport, cargo, postal facilities, product quality control, etc.;

- related to environmental conservation: destruction of hazardous waste, wastewater treatment, payment for permissible emissions.

Material costs are funds that cover production costs.

Direct expenses

The funds spent that are associated with the production of certain goods and relate to their cost are called direct costs. For industrial organizations, these are wages to workers, basic materials, resources, raw materials, semi-finished products, fuel energy, etc.

For agriculture, these are funds for wages, social insurance, planting material (seedlings, seeds), feed, fertilizer, and transportation costs.

In capital construction, direct costs include wages to workers, expenses for materials and raw materials, purchase of parts and building structures. This includes the costs of operating construction machines and other mechanisms.

Scientific organizations have their own direct costs. These include: the purchase of special equipment for scientific and experimental work, wages, costs of work performed by outside organizations or enterprises.

Composition of overhead costs

As a general rule, overhead costs include:

- Current repairs of buildings and structures, equipment.

- Salaries, training and maintenance of the administrative and managerial apparatus.

- Expenses for servicing vehicles on the company's balance sheet.

- Rent for office, product warehouse.

- Costs incurred due to downtime and defective products.

- Costs associated with the operation and maintenance of fixed assets.

- Costs of advertising, consulting services.

- Maintenance of the office, payment of utilities.

- Maintenance of main production.

- Expenses for communication services (telephone, Internet), etc.

Distribution of general business expenses. What are production overheads? The basis of their distribution.

Overhead costs can be more broadly grouped into four groups:

- Costs of production and its organization.

- Costs of maintaining the administrative apparatus.

- Staff service.

- Non-production expenses.

KEEP IN MIND

In the Tax Code of the Russian Federation, overhead costs are not designated as such, their structure is not defined. The same applies to accounting - there is no differentiation of overhead costs. Overhead costs are fixed by law only in such areas as construction, science, and medicine. Ordinary companies establish their own list of such costs.

For example, in trade organizations such expenses usually include costs associated with packaging, storage, transportation and marketing of products.

Organization expenses

The decrease in economic benefits due to the disposal of assets (in the form of money or other valuable property), as well as the occurrence of liabilities that lead to a decrease in capital, are called expenses of the organization.

Types of enterprise expenses are divided into assets and liabilities. Assets are capable of generating profit in the future, liabilities are not.

The organization's expenses are not:

- non-current and intangible assets;

- purchase of securities;

- financial investment in other organizations;

- repayment of loans;

- advance, deposit for work or services.

Analytical and synthetic accounting

Analytical accounting can be carried out through account 26 on several points:

- managerial;

- economic;

- the remaining costs that are required to purchase office supplies, as well as provide the company with energy, water and sewerage.

In this case, the costs for each specific company are set in accordance with the characteristics of its work.

Sample reflection of general business expenses

Synthetic accounting is one that is maintained in first-order accounts and includes data on any economic resources of the company, including the sources of their formation in cash.

Any transactions that are carried out on account 26 must be indicated as follows:

| Dt 26, Tt 02.05 | Calculation of the exact amount of depreciation established in relation to all fixed assets and intangible assets that were used to meet general business needs. |

| Dt 26, Kt 70 | Payroll calculation for management employees. |

| Dt 26, Kt 69 | Calculation of insurance premiums for the salaries of employees of non-production departments. |

| Dt 26, Kt 71 | Write-off of travel expenses based on advance reports. |

| Dt 26, Kt 20, 23 and 29 | Distribution of amounts to production cost accounts. |