Concept and types of advertising expenses

The main task of advertising is to attract and maintain the attention of potential buyers to goods, works and services. However, in order for the expenses incurred to be called advertising, they must satisfy the conditions of paragraph 1 of Art. 3 of the Law “On Advertising” dated March 13, 2006 No. 38-FZ, namely: to attract and maintain attention to the object of advertising among an indefinite circle of people in order to promote it in the market.

According to para. 2 p. 2 art. 346.16 of the Tax Code of the Russian Federation, “simplers” take into account advertising expenses in the same manner as income tax payers (according to the rules of Article 264 of the Tax Code of the Russian Federation). And in paragraph 4 of Art. 264 of the Tax Code of the Russian Federation provides that advertising costs are classified as non-standardized and standardized (clause 4 of Article 264 of the Tax Code of the Russian Federation).

NOTE! Advertising costs can only be taken into account by single tax payers with the object of taxation “income minus expenses” (clause 20, clause 1, article 346.16 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated April 20, 2010 No. 03-11-06/2/63).

Non-standardized expenses are fully taken into account for single tax purposes. Normalized items are taken into account in an amount not exceeding 1% of sales revenue, calculated in accordance with Art. 249 of the Tax Code of the Russian Federation.

Non-standard advertising expenses

Non-standardized expenses include:

- advertising expenses for events through the media and telecommunications networks, as well as for video and film services (including advertisements in print media, broadcast on radio and television);

- expenses for outdoor advertising, advertising stands, billboards, including illuminated advertising;

- expenses for participation in exhibitions, expositions and fairs, window dressing, sales exhibitions, image rooms, showrooms, production of advertising brochures, catalogs for products and services, including exhibited products, markdowns of goods, products that have lost their original qualities, commodity sign and service mark, and information about the company itself.

The list of non-standardized advertising expenses is closed.

Example

In the 4th quarter, Hermes LLC incurred expenses for the production of a leaflet in the amount of 8,000 rubles. The production of leaflets, like other printed advertising products, is considered a non-standardized expense (letter of the Ministry of Finance of Russia dated March 16, 2011 No. 03-03-06/1/142). Expenses will be fully taken into account when calculating the single tax on the basis of clause 4 of Art. 264 of the Tax Code of the Russian Federation as non-standardized advertising expenses.

Confirm your consumption

It is necessary to carefully store documents containing information about money paid for advertising. The tax authorities may require proof of expenses. If the company fails to do this, the tax will be assessed additionally. A fine will also be imposed. If the funds for advertising are significant, then the documents must be prepared especially carefully.

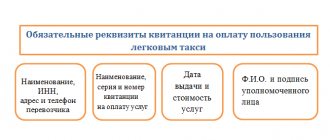

For each operation a set must be generated:

- Contract. It indicates the type of advertising being purchased. Details. This document is optional, but the information in it will clearly indicate which advertising you have paid for.

- Certificate of completion of work, which confirms the fact of completion of work. List the services provided in detail. If the contractor fails to submit a report, save email correspondence, especially those letters that contain confirmation. It is better to print it out and notarize it.

- Proof of payment: cash receipt and bank statement.

Standardized advertising expenses

Standardized advertising expenses include:

- expenses for the purchase of prizes for drawings during mass advertising campaigns;

- other expenses not related to non-standardized advertising expenses.

Other expenses may include any advertising expenses not specified in clause 4 of Art. 264 Tax Code of the Russian Federation. At the same time, they will be taken into account as part of the normalized advertising costs in an amount not exceeding 1% of revenue calculated in the manner provided for in Art. 249 of the Tax Code of the Russian Federation.

Example

Expenses for carrying out a promotional campaign for tasting advertising products are included in the normalized advertising expenses, classifying them as other advertising expenses (clause 4 of Article 264 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated August 16, 2005 No. 03-04-11/205).

All comments (9)

Good day, Natalia. Yes, that’s right, at NU you can write off the costs for the right to use the programs at a time after payment. Look at the material on this issue: How can an organization take into account the costs of purchasing software using the simplified tax system of 15%? .

Good evening, Tatyana! If the amount of subscription services includes VAT, then the amount including VAT should be distributed evenly throughout the year?

Natalya, are you asking about reflecting VAT in KUDiR? If yes, then VAT is also reflected at a time.

1. In NU we write off the entire amount including VAT at one time. And in the accounting department we distribute the amount to account 97 with VAT? Attached is a screenshot. 2. If the document is dated 02/25/19, and the period of use of the program is from 03/28/19, then what date do we receive the document in the program in February or March? The dates are indicated in the screenshot.

Rules for recording advertising expenses under the simplified tax system

The procedure for accounting for advertising expenses for organizations on the OSN and the simplified tax system is the same (paragraph 2, paragraph 2, article 346.16, article 264 of the Tax Code of the Russian Federation). However, with one amendment: advertising expenses under the simplified tax system are recognized after their actual payment (clause 2 of article 346.17 of the Tax Code of the Russian Federation).

Advertising expenses for accounting purposes are recognized as expenses for ordinary activities as commercial expenses (clauses 5, 7 of the Accounting Regulations “Expenses of Organizations” PBU 10/99).

Advertising costs are reflected as part of sales expenses in the debit of account 44 (instructions for using the Chart of Accounts for accounting financial and economic activities of organizations, approved by Order of the Ministry of Finance of Russia dated October 31, 2000 No. 94n).

For accounting purposes, there is no need to normalize advertising costs. They can be fully included in the costs of the reporting period in which they were incurred, if this is fixed by the accounting policy (clause 9, clause 20 of PBU 10/99).

Features of accounting for deferred expenses

Accountants classify as RBP those expenses for which there are no firm conditions for their reflection on the balance sheet in PBU, if they are planned to be written off over several years. Accounting rules provide for 2 ways to reflect RBP on the balance sheet:

- a separate article (line) in the “Inventories” group;

- a separate group of articles (lines) in the “Current assets” section.

NOTE! The balance sheet indicates only the total for the amount of RBP, that is, those funds that have not yet been written off in previous periods.

Analytical accounting of RBP

The organization's funds, which are accounted for as a financial statement, are collected in the analytical accounting accounts of account 1,401,50,000 “Future expenses” (clause 124 of Instruction No. 162n). They appear there at the moment of their receipt (accrual). Then they are gradually distributed:

- on the financial result during the designated period - the financial year when the report will be made (debit 1 401 20 0000);

- or for the cost of production at the end of the financial year (debit 1,109,60,000).

The procedure for their write-off is determined by the organization. They can be written off:

- evenly;

- in proportion to the volume (products, services, works) of the period in which they are planned to be written off.

The organization has the right to establish additional conditions independently (clauses 301, 302 of Instruction No. 157n).

Account for accounting of BPO

The chart of accounts, approved by Order of the Ministry of Finance of the Russian Federation No. 94n dated October 31, 2000, prescribes the use of account No. 97, specially allocated for reflecting information on the costs of subsequent reporting periods, for carrying out financial accounting on the balance sheet.

The credit of this account accumulates information about expenses, which will subsequently constantly fall into the debit of one of the accounts:

- 20 “Main production”;

- 26 “General business expenses”;

- 44 “Implementation costs”;

- 91 “Other income and expenses.”

For example , a company purchased licensed software for a PC, the service life of which is 7 years. This means that during these 7 years, every month you need to write off equal shares of the cost of the purchased software.

The debit of account 97 carries information about the costs incurred - those funds that have already been paid in this reporting period.

RBP: postings

To take into account and write off future expenses, you need to make the following accounting entries:

- debit 97, credit 51 “Settlements” (or 60 “Settlements with suppliers and contractors”) - funds are taken into account as deferred expenses;

- debit 20 (26, 44, 91), credit 97 - write-off of part of the funds relating to the current period as a share of expenses for future periods.

An example of calculating BPR for reflection in accounting

In May 2020, Brigantina LLC purchased a one-year insurance policy for its tangible property for 300,000 rubles, paid to the insurance agency in a lump sum. The agreement begins on June 1, 2020 and ends on June 1, 2020. The accountant will need to make the following notes in the reporting documents:

- June 1, 2020:

- debit 76.1 “Settlements with various debtors and creditors”, credit 51 “Current account” - 300,000 rubles were paid. as an insurance premium;

- debit 97, credit 76.1 – 300,000 rub. recognized as deferred expenses.

- June 30, 2020: debit 20 (44, 91...), credit 97 – 300,000 / 365 days a year x 30 days in June = 24,657 rubles, the amount is written off as insurance costs for the 2nd quarter.

- September 30, 2020: debit 20 (44.91...), credit 97 – 300,000 / 365 days in the year x (31 days in July + 31 days in August + 30 days in September) = 75,616 rubles, the amount is written off as insurance costs for the 3rd quarter.

- December 31, 2020: debit 20 (44.91...), credit 97 – 300,000 / 365 days in the year x (31 days in October + 30 days in November + 31 days in December) = 75,616 rubles, the amount is written off as insurance costs for the 4th quarter.

- March 31, 2020: debit 20 (44.91...), credit 97 – 300,000 / 365 days in the year x (31 days in January + 28 days in February + 31 days in March) = 73,972 rubles, the amount is written off as insurance costs for the 1st quarter of 2018.

- May 31, 2020: debit 20 (44.91...), credit 97 – 300,000 / 365 days a year x (30 days in April + 31 days in March) = 73,972 rubles, the amount is written off as insurance costs for 2 quarter 2018.

BPO inventory

Once a year, the accounting department must reconcile the movement of funds and balances on account 97 with primary documentation, that is, find out whether the turnover of future accounts is reflected correctly: how many of them have been written off and how many are still left. This process is called BPO inventory . It is carried out as part of the usual annual inventory. It is drawn up in a special act in form No. INV-11, which must reflect the following information:

- basis for conducting an inventory (order, management order);

- inventory start and end dates;

- date of drawing up the act;

- composition of the inventory commission;

- analysis of each type of expense (total amount in a given reporting period, write-off in previous periods, balance to be written off in future periods);

- signature of financially responsible persons on the presence of balances of funds (assets) in kind;

- signature of the economist confirming the correctness of the calculations.

The act is drawn up in 2 copies, one remains with the inventory commission, the second is transferred to management.

Calculation of the maximum amount of standardized advertising expenses

As mentioned, standardized advertising expenses can be included in costs in the amount of no more than 1% of sales revenue calculated according to Art. 249 of the Tax Code of the Russian Federation (subparagraph 20, paragraph 1, article 346.16, paragraph 5, paragraph 4, article 264 of the Tax Code of the Russian Federation).

IMPORTANT! When calculating the standard within which certain types of advertising expenses can be taken into account, taxpayers using the simplified tax system take into account the proceeds received from sales (clause 1 of Article 346.17 of the Tax Code of the Russian Federation) and the amount of advances received from buyers (letter of the Ministry of Finance of Russia dated 11.02) as part of income .2015 No. 03-11-06/2/5832).

Example

Vyuga LLC placed advertising posters in public transport in the 1st quarter. The cost of the service was 32,200 rubles. The company's sales revenue for the 1st quarter is 578,000 rubles.

Let's calculate the maximum amount of standardized advertising costs:

578,000 × 1% = 5,780 rub.

Consequently, normalized advertising expenses in the amount of 5,780 rubles can be included in the actually incurred expenses based on the results of the 1st quarter.

Thus, only a small part of the expenses incurred was included in expenses for tax purposes under the simplified tax system. The tax base under the simplified tax system is formed on an accrual basis from the beginning of the year (clause 5 of article 346.18 of the Tax Code of the Russian Federation). Consequently, with an increase in the volume of accumulated revenue, the size of the maximum amount of normalized advertising expenses to be included in the costs of the “simplified” tax will also increase.

During the reporting period, you can gradually include excess advertising expenses in the organization’s expenses for tax accounting. The remaining expenses cannot be carried over to the next year.

Example

Aphrodite LLC conducted an advertising campaign in the 1st quarter of 2020 to attract new clients through free cosmetic procedures. Information about the promotion was posted on the Internet, the cost of placement was 9,870 rubles. The cost of free cosmetic procedures was 86,400 rubles. Amounts are shown excluding VAT. There were no other advertising expenses in the current period. Expenses for advertising on the Internet are included in the expenses for holding an event through telecommunication networks, since the Internet is recognized as a public telecommunications network (letter of the Ministry of Finance of Russia dated 04/05/2010 No. 03-11-06/2/48, dated 07/15/2009 No. 03-11 -09/248, dated January 29, 2007 No. 03-03-06/1/41). Consequently, such expenses are not standardized and are recognized in full in the 1st quarter of 2020 (clause 4 of article 264 of the Tax Code of the Russian Federation).

Standardized expenses include expenses for free cosmetic procedures (clause 4 of Article 264 of the Tax Code of the Russian Federation). Consequently, the amount of expenses accepted for tax accounting should not exceed 1% of revenue.

1. Calculation for the 1st quarter of 2020.

Volume of proceeds received from sales: RUB 427,580.

Limit value of standardized expenses: 427,500 × 1% = 4,275 rubles.

Amount of recognized standardized expenses: RUB 4,275.

Amount of recognized non-standardized expenses: RUB 9,780.

The amount of the carryover balance of normalized advertising expenses: 86,400 – 4,275 = 82,125 rubles.

2. Calculation for the first half of 2020.

Volume of proceeds received from sales: RUB 947,300.

Limit value of standardized expenses: 947,300 × 1% = 9,473 rubles.

The amount of recognized standardized advertising expenses: RUB 9,473.

The amount of the carryover balance of normalized advertising expenses: 86,400 – 9,473 = 76,927 rubles.

3. Calculation for 9 months of 2020.

Volume of proceeds received from sales: RUB 1,458,700.

Limit value of standardized expenses: 1,458,700 × 1% = 14,587 rubles.

The amount of recognized standardized advertising expenses: RUB 14,587.

The amount of the carryover balance of normalized advertising expenses is 86,400 – 14,587 = 71,813 rubles.

4. Calculation for 2020.

The amount of revenue received from sales is RUB 2,248,500.

Limit value of standardized expenses: 2,248,500 × 1% = 22,485 rubles.

The amount of recognized standardized advertising expenses: RUB 22,485.

The balance of standardized advertising expenses: 86,400 – 22,485 = 63,915 rubles.

Aphrodite LLC will be able to take into account expenses for tax purposes under the simplified tax system for 2020 22,485 rubles. expenses for free cosmetic procedures and 9,870 rubles. expenses for holding an event via the Internet. The amount of advertising expenses is 63,915 rubles. will remain not included in expenses, and it cannot be transferred to the next tax period.

In the Book of Accounting for Income and Expenses, advertising costs are reflected in Column 5 “Expenses taken into account when calculating the tax base”, Section I “Income and Expenses”.

For information on the procedure for filling out the Book of Income and Expenses, read the article “The procedure for filling out KUDiR under the simplified tax system “income minus expenses.”

The following entries will be made in accounting:

1. Dt 44 Kt 10 – cosmetics written off for advertising procedures.

2. Dt 44 Kt 70 - wages accrued to employees for carrying out advertising procedures; Document - payroll.

3. Dt 44 Kt 60 – reflects the cost of the service for placing a promotion on the Internet.

Document-basis: act of acceptance and delivery of services provided.

4. Dt 90.2 Kt 44 – the cost of the advertising campaign has been written off.

Document: accounting statement-calculation.

EXAMPLE FROM JUDICIAL PRACTICE

The company implemented an advertising project.

A counterparty was brought in to implement the project, to which the company has no claims, as well as to the implementation of the project. But the tax authority considered that the counterparty could not carry out the advertising project.

Thus, in the resolution of the Arbitration Court of the Ural District dated November 26, 2015 No. F09-8316/15, the court came to the conclusion that the tax authority legally excluded expenses, since the counterparty did not have property and personnel, was not at a legal address, and the signatures of its director were falsified , in fact, advertising services were provided by another organization. The interviewed persons could not give any explanations regarding the actual participation of Sigma LLC in the provision of advertising services.

This situation can be avoided if:

- carry out an inspection of the counterparty, including requesting constituent documents, documents on registration with the Federal Tax Service;

- select a counterparty through a competition;

- obtain documents confirming the reality of the director’s signature, for example, a copy of the order of appointment or a power of attorney for the person signing the primary documents.

Unlimited advertising

The list of unlimited advertising is named in clause 4 of Art. 264 Tax Code of the Russian Federation.

Let's present the list of unlimited advertising in a diagram:

| Expenses on advertising events through the media (including advertisements in print, broadcast on radio and television) and information and telecommunication networks, for film and video services |

| Expenses for illuminated and other outdoor advertising, including the production of advertising stands and billboards |

| Expenses for participation in exhibitions, fairs, expositions |

| Costs for decorating shop windows, sales exhibitions, sample rooms and showrooms |

| Expenses for the production of advertising brochures and catalogs containing information about goods sold, work performed, services provided, trademarks and service marks and (or) about the organization itself |

| Expenses for the discounting of goods that have completely or partially lost their original qualities during exhibition |

POSITION OF THE MINISTRY OF FINANCE

When calculating the standard within which certain types of advertising expenses can be taken into account, taxpayers using the simplified tax system take into account advances received from customers as part of sales income.

— Letter dated February 11, 2015 No. 03-11-06/2/5832.

In order to make sure that the costs are indeed non-standardized, it is advisable:

Step 1. Find the appropriate position of the Ministry of Finance regarding the regulation of advertising costs.

For example, to expand sales, the company plans to broadcast videos both in Russia and in neighboring countries.

Based on clause 4 of Art. 264 of the Tax Code of the Russian Federation, advertising expenses include, in particular, expenses for advertising events through the media (including advertisements in the press, radio and television broadcasts) and information and telecommunication networks.

Thus, the expenses of an organization associated with the broadcast of commercials on a TV channel abroad of the Russian Federation can be taken into account for tax purposes of the organization’s profit as part of other expenses associated with production and sales in full (letter of the Ministry of Finance of Russia dated 04/07/2014 No. 03 -07-08/15480).

Step 2. View judicial practice regarding the recognition of expenses.

The absence of judicial practice may indicate the absence of risks. But the presence of positive solutions can also play a positive role. Even if expenses cannot be recognized as advertising expenses, in some cases it is possible to recognize them entirely as other expenses. For example, in the resolution of the Federal Antimonopoly Service of the Moscow District dated June 27, 2011 No. KA-A40/5826-11, the court came to the conclusion that the costs of satellite television broadcasting services for the purpose of calculating corporate income tax relate to the costs of information services, as well as to the costs of ensuring normal working conditions. Also, the taxpayer lawfully deducted the VAT paid on the cost of these services.

Step 3. Correctly document advertising expenses.

In accordance with Art. 252 of the Tax Code of the Russian Federation, expenses must be economically justified and documented. And advertising costs are no exception. In this regard, it is necessary to document advertising expenses.

GOOD TO KNOW

Expenses on outdoor advertising are not standardized.

Standardized costs

Standardized advertising is advertising for which costs can be recognized within the norms.

| Purchasing prizes for advertising campaigns |

| SMS advertising |

| Merchandising services |

| Organization and holding of conferences for advertising purposes |

| Costs of paying for postal services and courier agencies for the delivery and distribution of unaddressed advertising and information materials |

The standard for regulated advertising is 1% of sales revenue excluding VAT for the reporting period (clause 4 of Article 264 of the Tax Code of the Russian Federation).

ORIGINAL SOURCE

The object of advertising is a product, means of individualizing an organization or product, a manufacturer or seller of a product, results of intellectual activity or an event to which advertising is aimed at attracting attention.

— Part 2 art. 3 of the Law on Advertising.

In order to make sure that expenses are normalized, it is necessary to familiarize yourself with the position of the Ministry of Finance of the Russian Federation.

Step 1. Find the appropriate position of the Ministry of Finance.

Thus, if the purpose of concluding a paid agreement for the provision of merchandising services is the actions of the performer (buyer - retail trade organization) aimed at attracting the attention of potential buyers to the goods of the customer (supplier-seller) by using special technologies for displaying goods, therefore, such actions can be considered in quality of advertising services. The taxpayer's expenses under an agreement for the provision of merchandising services, if properly documented, are subject to accounting for corporate profit tax purposes within the limits of the standard calculated from the amount of revenue (letter of the Ministry of Finance of Russia dated April 22, 2015 No. 03-03-06/22913).

A similar conclusion was made regarding advertising in the form of pallet display. The object of advertising can be a product, a means of individualizing it, a manufacturer or seller of a product, to which the advertising is aimed at attracting attention. If the purposeful actions of the performer (buyer - retail trade organization) specified in the contract are aimed at and ensure attracting the attention of buyers to goods of a certain name sold by the customer organization (supplier-seller), then such actions are advertising services, which, with proper documentation confirmation are taken into account for profit tax purposes within the standard calculated from the amount of revenue (letter of the Ministry of Finance of Russia dated March 18, 2014 No. 03-03-06/1/11641).

Expenses for holding advertising conferences are also regulated expenses. Expenses of an organization engaged in the wholesale trade of pharmaceutical products for holding scientific conferences, thematic seminars, symposiums for healthcare workers are taken into account for profit tax purposes in an amount not exceeding 1% of sales proceeds (letter of the Ministry of Finance of Russia dated November 25, 2013 No. 03-03 -06/1/50586).

The expenses of an organization for sending advertising and information materials (leaflets, cards, booklets, brochures, catalogs) through addressless delivery on the basis of contracts for the provision of paid services are for profit tax purposes normalized advertising expenses, recognized for tax purposes subject to the restrictions established by clause 4 of Art. . 264 of the Tax Code of the Russian Federation (letter of the Ministry of Finance of the Russian Federation dated January 12, 2007 No. 03-03-04/1/1).

Step 2. Calculate the standard advertising costs.

The standard cost is 1% of sales revenue.

For example, for 2020, sales revenue is 10,000,000 rubles.

Accordingly, it is possible to spend 1% on regulated advertising, which is 100,000 rubles.

Step 3. Take into account advertising costs in the amount established by the standards.

GOOD TO KNOW

The costs of a company's participation in exhibitions and fairs are classified as advertising and are not standardized.

Example 1.

Individual entrepreneur A.K. Sharonov is engaged in dacha construction.

In order to increase the flow of customers, the entrepreneur held a lottery, according to the terms of which, during the construction of a house, the buyer could win a bathhouse as a gift. The cost of the bath is 400,000 rubles.

Since such a prize in a promotion represents a standardized expense, this expense can only be taken into account within the normal limits.

Accordingly, an entrepreneur can take into account expenses in the amount of 100,000 rubles.

300,000 rub. the entrepreneur will take into account at the expense of net profit.

Example 2.

Individual entrepreneur A.K. Sharonov advertises in the form of SMS mailings. The standard for advertising is the same 100,000 rubles.

The entrepreneur entered into an agreement with a telecom operator to carry out a mailing campaign to provide discounts on the purchase and construction of a house in the winter in the amount of 80,000 rubles.

Accordingly, these costs can be taken into account in full.

POSITION OF THE MINISTRY OF FINANCE

Some types of expenses cannot be taken into account for tax purposes. For example, the cost of paying for the right to install and operate an advertising structure, art. 346.16 of the Tax Code of the Russian Federation are not provided for, and, accordingly, such expenses cannot be taken into account by the taxpayer - the owner of the advertising structure when determining the tax base for the tax paid in connection with the use of the simplified taxation system.

— Letter dated September 1, 2014 No. 03-11-06/2/43627.

Documenting

There is no procedure for documenting advertising expenses in the legislation and business customs, so each company and entrepreneur independently records and documents advertising expenses.

Many companies currently have a marketing policy that sets out the procedure for carrying out promotions. Such a document often confirms and justifies the economic feasibility of such events. Marketing policy, in particular, allows you to confirm the focus of expenses on generating income, because a frequent complaint of inspectors is precisely the overestimation of advertising costs.

Also, local acts regulating the issue of conducting advertising campaigns and accounting for standardized and non-standardized expenses include accounting policies.

Fragment

Advertising expenses are taken into account as part of other expenses associated with production and sales, based on paragraphs. 28 clause 1 art. 264 of the Tax Code of the Russian Federation, taking into account the provisions of paragraph 4 of Art. 264 Tax Code of the Russian Federation.

The organization has the following types of expenses:

- expenses for publishing an advertising newspaper;

- advertising costs.

The company does not bear any other expenses.

Expenses for payment for services (in this case, advertising) provided by third-party organizations are recognized on the date of settlement in accordance with the terms of concluded contracts or on the date of presentation to the taxpayer of documents serving as the basis for making settlements (clause 3, clause 7, article 272 of the Tax Code of the Russian Federation) .

As stated in the accounting policy, advertising expenses are recognized on the basis of concluded contracts. In order for a third-party organization to provide advertising services, it is necessary to conclude an appropriate service agreement. Essential conditions include conditions that determine the specific type of service provided (clause 1 of Article 779 of the Civil Code of the Russian Federation). Accordingly, it is recommended to indicate in the contract:

- type of advertising;

- procedure for advertising;

- a clear description of advertising and its frequency.

Fragment

1. The Subject of the Agreement

1.1. The Customer instructs, and the Contractor assumes, the responsibility for preparing and posting the Customer’s advertising and information information on the WEB site to the extent and on the terms provided for in this Agreement and the Appendices to this Agreement, which are an integral part thereof.

2.1. The Contractor undertakes:

2.1.1. Bring the advertising information provided by the Customer to a form ready for posting on the website.

2.1.2. Update information on objects in accordance with changes.

2.1.3. Develop advertisements in accordance with the submitted advertising materials (brand name, logo, drawings, photographs, text, layouts, notice sheets, brochures, etc.).

2.1.4. Provide the Customer, upon his request, with all information about the progress of execution of this contract.

2.2. The performer has the right:

2.2.1. Receive from the Customer all necessary documents, including plans, designs, calculations, expert opinions related to the facility.

2.2.2. Receive from the Customer any title documents for the object.

2.2.3. Receive copies of documents for use in fulfilling obligations under this agreement.

2.2.4. Engage third parties to perform services under this agreement (use the services of any individuals and legal entities for the purpose of timely and high-quality fulfillment of obligations under the agreement).

2.2.5. Suspend the placement or not place the Customer’s advertising and information material if the Customer violates the terms of payment for services until the funds arrive in the Contractor’s bank account, as well as in cases where the necessary conditions for work are not available.

The confirming primary document will be the acceptance certificate.

It is advisable to indicate in the acceptance certificate:

- the date of drawing up the act and the date of the promotion;

- types of advertising that were provided to the customer;

- cost of advertising;

- the names of the positions of the persons responsible for the implementation of the advertising campaign.

Payment documents are also important.

GOOD TO KNOW

Costs for advertising events through telecommunication networks are classified as advertising expenses and are taken into account in the “simplified” tax base in full.

Results

Only single tax payers with the object of taxation “income and expenses” can recognize advertising expenses when calculating the single tax. Non-standardized expenses can be taken into account when calculating the single tax in the full amount of paid advertising costs, and normalized expenses can be taken into account only within 1% of the revenue received and advances received in the reporting period.

About the nuances of reflecting expenses and the requirements for expenses, read the article “Accounting for expenses under the simplified tax system with the object “income minus expenses” " .

Sources:

- Tax Code of the Russian Federation

- Law “On Advertising” dated March 13, 2006 N 38-FZ

- PBU 10/99, approved. by order of the Ministry of Finance of Russia dated May 6, 1999 N 33n

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.