What is the difference between standardized and non-standardized advertising expenses?

Non-standard advertising expenses

Standardized advertising expenses

When to apply the provisions of international agreements

Advertising costs are included in other expenses

Standardized advertising expenses: calculation of the maximum amount

How are advertising expenses reflected in accounting and reporting?

How to correctly take into account advertising expenses when increasing profits in the tax period

Results

Non-standard advertising expenses

It is allowed to include the following types of advertising expenses in the full amount of actual expenses:

- advertising that is placed through the media (television, radio, print, Internet);

- outdoor advertising (illuminated, billboards, stands, etc.);

Expenses on outdoor advertising are taken into account according to special rules. Which one? ConsultantPlus experts spoke about them:

Get free access to K+ and find out all the details on outdoor advertising.

- advertising carried out through participation in exhibitions, fairs, as well as through the design of shop windows, expositions, showrooms and sample rooms;

- production of advertising catalogs and brochures containing information about products, goods, services or work offered by the company, or about itself;

- deliberate reduction in price (markdown) of goods that have lost their quality during exhibition.

Is it possible for income tax purposes to include as advertising expenses for adhesive tape with the organization’s logo used to package goods? The answer to this question was given by 3rd Class Advisor to the State Civil Service of the Russian Federation Razgulin S.V. Get free trial access to the ConsultantPlus system and get acquainted with the official’s point of view.

There are some clarifications in the non-standardized part. The Ministry of Finance of Russia, using the provisions of paragraph. 4 p. 4 art. 264 of the Tax Code of the Russian Federation, included leaflets, booklets, leaflets and flyers among brochures and catalogues. The ministry’s specialists reflected their position in letters from the Ministry of Finance of Russia dated August 12, 2016 No. 03-03-06/1/42279, dated October 12, 2012 No. 03-03-06/1/544, dated November 2, 2011 No. 03-03-06/ 3/11 and dated 10.20.2011 No. 03-03-06/2/157. That is, the costs of producing such materials can be taken into account as part of non-standardized expenses.

Why do we need a standard for advertising expenses?

An organization can spend significant amounts on advertising; management decides which ones, taking into account the effectiveness of management decisions made in this regard and the financial capabilities of the organization. Since advertising is not only information, but also a business activity, it is reflected in appropriate accounting and is subject to taxation.

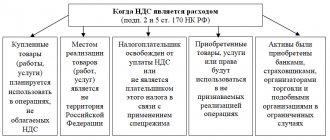

For this purpose, spending on advertising is usually divided into two types:

- normalized – those that are recognized as such only in accordance with certain criteria;

- non-standardized - unconditionally taken into account as advertising expenses, without limitation for tax purposes.

This division determines what amount of costs a company can take into account when determining the base for income tax: within limited limits or in full.

REFERENCE! Expenses intended for advertising are usually taken into account as part of “Other expenses” among expenses for the production or sale of goods.

Standardized advertising expenses

In an amount not exceeding 1% of the amount of sales proceeds (calculated in accordance with Article 249 of the Tax Code of the Russian Federation), the following types of expenses should be included in expenses:

- expenses for the production or purchase of prizes that are awarded during drawings during mass advertising campaigns;

- other advertising expenses.

The above list has one interesting feature. The fact is that the list of non-standardized expenses is closed and does not allow additions, while standard advertising expenses are not limited, and this list is always open.

For this reason, any expenses that bear signs of advertising expenses can be taken into account in expenses, even if they are not listed in the Tax Code. They will simply fall into the category of “standardized advertising costs.” Confirmation of this thesis can be found in the resolutions of the Federal Antimonopoly Service of the Moscow District dated March 21, 2012 No. A40-54372/11-91-234 and dated March 14, 2012 No. A40-63461/11-99-280.

An example is this type of advertising, such as promotional and informational materials delivered in the form of bulk and unaddressed mail. The costs of paying for courier or postal services can be attributed to advertising costs, and, in accordance with the provisions of paragraph. 5 paragraph 4 art. 264 of the Tax Code of the Russian Federation and letter of the Ministry of Finance of Russia dated January 12, 2007 No. 03-03-04/1/1, these will be standardized advertising expenses.

Accounting of standardized expenses

Advertising expenses are divided into advertising expenses, which are taken into account in full, and advertising expenses, which are recognized in an amount not exceeding 1% of sales revenue (clause 4 of Article 264 of the Tax Code of the Russian Federation).

Non-standardized advertising expenses (clause 4 of Article 264 of the Tax Code of the Russian Federation) include the following costs:

- for advertising events in the media, on the Internet and in general in information and telecommunication networks, cinema and video;

- for illuminated and other outdoor advertising (including the production of advertising stands and billboards);

- for participation in exhibitions, fairs, expositions, including the design of shop windows, sales exhibitions, sample rooms and showrooms, the production of advertising brochures and catalogs containing information about goods sold, work performed, services provided, trademarks and service marks and (or) about the enterprise itself, as well as for the markdown of goods that have completely or partially lost their original qualities after being exhibited.

Thus, non-standardized advertising expenses are:

- placement of information about the address, telephone number, services provided in databases of paid telephone reference and service services;

- costs of placing online advertising;

- website promotion costs;

- for the production of advertising brochures, catalogs, calendars, leaflets, booklets, flyers containing advertising information;

- entry fees for participation in exhibitions and fairs, etc.

These costs are taken into account in full.

The remaining advertising expenses are standardized and are recognized in an amount not exceeding 1% of sales revenue (paragraph 5, paragraph 4, article 264 of the Tax Code of the Russian Federation).

Examples of normalized advertising expenses:

- acquisition (production) of prizes awarded to the winners of drawings of such prizes during mass advertising campaigns;

- placement of advertising boards in station lobbies and on metro escalator slopes;

- placing advertising stickers on the walls, doors and windows of metro electric trains;

- sending advertising information via SMS messages to mobile phones;

- conducting product tasting;

- services for priority display of goods to ensure that buyers' attention is drawn to these goods.

When taking into account normalized advertising expenses, it should be remembered that as the volume of revenue increases during the year, the amount of the spending limit automatically changes, i.e. costs that were not recognized, for example, for the first quarter due to exceeding the standard, can be taken into account in the following reporting periods of the same year when the amount of revenue increases.

At the same time, advertising expenses that are not recognized at the end of the year are not carried forward to the next year.

In the first quarter, the organization sent advertising information via SMS messages to mobile phones.

The total cost of the service excluding VAT was 35,000 rubles.

The organization had no other advertising expenses in the first half of the year.

The organization's sales revenue excluding VAT amounted to:

- for the first quarter - 2,500,000 rubles;

- for the first half of the year - 4,000,000 rubles.

Limit amount of standardized advertising expenses:

- for the first quarter - 25,000 rubles. (RUB 2,500,000 x 1%);

- for the first half of the year - 40,000 (RUB 4,100,000 x 1%).

The organization recognizes advertising expenses:

- in the first quarter - in the amount of 25,000 rubles;

- in the first half of the year - in the amount of 35,000 rubles. (35,000 rubles {amp}lt; 40,000 rubles), i.e. will be able to take into account in the first half of the year expenses that were not taken into account in the first quarter in the amount of 10,000 rubles. (35,000 rub. - 25,000 rub.).

The list of such expenses is scattered throughout Chapter 25 of the Tax Code. When determining limits, you must also be guided by other regulatory documents. For example, when writing off material costs, the norms for natural loss from transportation or storage of material assets are taken into account according to Resolution No. 814 of November 12, 2002.

- Amounts spent by employers on voluntary health insurance for personnel (clause 16, article 255) – no more than 6% of total labor costs.

- Losses during transportation and storage of materials and materials (subclause 2, clause 7, article 254) - within the limits of the approved norms of natural loss.

- The amount of contributions to the funded part of the pension under long-term contracts, voluntary pension insurance contracts and/or NGOs (clause 16 of Article 255) is no more than 12% of the total labor costs.

- R&D costs (Article 262).

- Representation expenses (Clause 2 of Article 264) – no more than 4% of the enterprise’s expenses for payment for labor for the corresponding period (reporting or tax).

- Interest on borrowed obligations - ruble and currency standards are established in Art. 269.

- Standardized advertising costs (clause 4 of Article 264) – the types of costs are discussed below.

- Deductions for the creation of reserves in terms of doubtful debts (clause 4 of Article 266) - no more than 10% of revenue for the previous tax period or the current reporting period (whichever is greater).

- Costs for the formation of guarantee reserves (Article 267).

- Costs of creating reserves for OS repairs (Article 324).

- Other expenses by chapter. 25.

Advertising expenses, regulated and non-standardized - this, according to Art. 3 of Law No. 38-FZ of March 13, 2006, the costs of an enterprise for distribution in any form and in any way, through any media to unknown persons in order to attract attention to the object and for the sake of promoting it in market conditions.

- The organization's expenses for the production or purchase of prizes intended for presentation during drawings during mass advertising events are written off in the amount of no more than 1% of total revenue (clause 4 of Article 264).

- Other types of advertising not mentioned in clause 4 of Art. 264.

- The organization's expenses for advertising through any type of media, during film and video sessions, through telecommunication networks.

- Costs of outdoor advertising, including illuminated advertising, production of billboards and/or stands.

- Costs of participation in fairs and exhibitions, expositions, including the design of shop windows, demo halls, and sample rooms.

- Production of advertising catalogs and brochures with information about the company itself, the products it sells, and the services it provides.

We suggest you read: Is it possible to claim a tax deduction for the purchase of a new apartment?

Russian Tax Courier, N 16, 2007 Category: Income Tax

L.A. Maslennikova, expert of the Russian Tax Courier magazine, Ph.D. econ. sciences

The publication was prepared with the participation of specialists from the Income Tax Administration Department and the Indirect Tax Administration Department of the Federal Tax Service of Russia

Not all expenses can be included in the income tax base in full. There are costs that reduce the base only partially, within the normal limits. Accounting for each such expense has its own nuances. Firms applying different taxation regimes take into account standardized expenses differently.

- goods (work, services) were purchased for transactions recognized as objects of taxation under VAT; - goods (work, services) are capitalized; - there is an invoice from the supplier. However, paragraph 7 of Article 171 of the Tax Code of the Russian Federation contains one more condition. If expenses for calculating income tax are taken into account within the limits of the norms, VAT on these expenses is also subject to deduction in the amount corresponding to the norms.

The norms for some expenses are specified in the Tax Code (as a rule, as a percentage of a certain indicator), for others - in decrees of the Government of the Russian Federation (in the form of fixed values). In some cases, standards are established in a special manner. Let's talk about the most common types of regulated expenses and their accounting.

When calculating income tax, certain expenses are taken into account, the norms for which are established in a special manner. A typical example of such expenses is losses and shortages of inventories within the limits of natural loss norms. In accordance with subparagraph 2 of paragraph 7 of Article 254 of the Tax Code, they are equated to material expenses for tax purposes within the limits of natural loss norms approved in the manner established by the Government of the Russian Federation.

In accordance with the above norm, the Government of the Russian Federation adopted Resolution No. 814 dated November 12, 2002 “On the procedure for approving norms of natural loss during the storage and transportation of inventory items,” establishing the procedure for the development and approval of these norms by interested ministries and departments.

The resolution stipulates that natural loss standards are developed by ministries and departments taking into account the technological conditions of storage and transportation of goods and materials, climatic and seasonal factors affecting their natural loss. However, these standards have not yet been developed for most sectors of the economy.

At the same time, on the basis of Article 7 of the Federal Law of June 6, 2005 N 58-FZ, until the norms of natural loss are approved in the manner prescribed in subparagraph 2 of clause 7 of Article 254 of the Tax Code of the Russian Federation, the norms of natural loss previously established by the relevant federal executive authorities are applied. This provision applies to legal relations arising from January 1, 2002.

Taxpayers selling goods (performing work) can create reserves for upcoming expenses for warranty repairs and warranty service (Article 267 of the Tax Code of the Russian Federation). To do this, the accounting policy indicates the maximum amount of this reserve, which is taken into account in expenses. The reserve is accrued only in relation to those goods (works) for which, in accordance with the contract, repairs (maintenance) are provided during the warranty period.

The amounts of the accrued reserve on the date of sale of goods (performance of work) are recognized as expenses. The maximum amount of the reserve is determined as follows. This is the share of actually incurred expenses for warranty repairs and maintenance for the previous three years in the amount of revenue from the sale of these goods (performance of work) for the same period, multiplied by the amount of revenue from the sale of these goods (performance of work) for the reporting (tax) period.

When to apply the provisions of international agreements

In business practice, there are circumstances in which an international agreement on the avoidance of double taxation determines the accounting of advertising expenses on other principles that differ from those provided for by the Tax Code of the Russian Federation. In such cases, according to Art. 7 of the Tax Code of the Russian Federation, contractual provisions should be adhered to.

In particular, the agreement between the Russian Federation and Germany provides that advertising expenses incurred by a Russian organization with the participation of a company from Germany are allowed to be taken into account when calculating income tax in full. There is only one condition: the amount of such a deduction cannot exceed the amount of expenses of independent companies under similar operating conditions.

Confirmation of this statement can be found in letters from the Ministry of Finance of Russia dated 03/05/2014 No. 03-08-RZ/9491, dated 03/01/2013 No. 03-08-05/6124 and dated 01/11/2013 No. 03-08-05. The authors of the letters explain that if the above conditions are met, even normalized advertising costs can be taken into account in full. This principle must be observed regardless of the size of the German company’s share.

Priority product display services

Often, conflicts with tax authorities arise among manufacturers who pay retail chains for merchandising services.

An important component of such services is the special display of goods, forcing the buyer to pay special attention to the products of this particular supplier. For example, newspapers and magazines of a particular publisher are located in the central display window of a kiosk, food products of a particular brand occupy the first rows on the shelves of a supermarket, etc., etc. Payment for such actions, as a rule, arouses increased interest among inspectors. The fact is that Ministry of Finance specialists prohibit sellers from taking into account the cost of priority display in expenses, since it is not directly related to the supply agreement. And only if a separate agreement for the provision of marketing services is concluded between the supplier and the retailer, officials recognize the justification of the costs. But even in this situation, they are allowed to write off not the full amount, but only a part of it, which does not exceed 1 percent of the revenue. From the point of view of officials, services for special display of goods are nothing more than advertising, and advertising costs in general need to be rationed. This opinion is expressed, in particular, in the letter of the Ministry of Finance of Russia dated December 13, 2011 No. 03-03-06/1/818 (more about this in the material “When concluding a separate contract for the provision of services, the costs of priority display of goods can be taken into account when taxing profits ").

However, the officials' conclusions are not confirmed by arbitration practice. The judges attribute the special display not to advertising, but to marketing services. The main argument is GOST R 51304-99 “Retail trade services. General requirements" (currently replaced by GOST R 51304-2009). According to paragraph 4.2 of this document, display of goods is one of the main stages in the process of providing trade services. And paragraph 5.6 states that the displays are provided for by the requirement of aesthetics of trade services. For this reason, display has nothing to do with advertising and, therefore, the corresponding costs are not standardized. This is stated, in particular, in the resolution of the Federal Antimonopoly Service of the North Caucasus District dated March 29, 2013 A32-5215/2012.

Several years ago, one Moscow company proved in court that it is possible to fully take into account in the costs not only the cost of the display itself, but also the fee for training staff in the basics of display. The judges agreed that these services are also not advertising, but relate to marketing (Resolution of the Federal Antimonopoly Service of the Moscow District dated July 13, 2009 No. KA-A40/6444-09).

But despite positive arbitration practices, taxpayers should exercise caution. Before abandoning cost rationing, you should make sure that marketing services (including displays) are covered by a separate contract. In addition, it is better to issue an internal document (for example, a director’s order), which will clearly state that the display of goods is not for advertising purposes, but for the implementation of marketing policy. These measures will allow the supplier to protect itself from claims from tax authorities.

Advertising costs are included in other expenses

In accordance with sub. 28 clause 1 art. 264 of the Tax Code of the Russian Federation, advertising expenses should be included in other expenses that are associated with production and sales. Moreover, according to paragraph 1 of Art. 318 of the Tax Code of the Russian Federation are indirect. Depending on the accrual method, the moment at which such expenses are recognized will differ:

- If a legal entity uses the accrual method of accounting, then advertising expenses should be classified as other expenses in the reporting or tax period in which they were incurred. The moment of actual payment (in any form) does not matter here (clause 1 of Article 272 of the Tax Code of the Russian Federation).

- If the cash method is used, then advertising expenses should be recognized after the actual payment is made (clause 3 of Article 273 of the Tax Code of the Russian Federation).

Separately, it is worth pointing out that if advertising costs are due to payment for the services of third-party companies, then they can be taken into account in 2 different ways:

- at the time of presentation of documents on the basis of which calculations should be made (invoice and certificate of completion of work);

- on the last day of the reporting or tax period.

Both options are legal in accordance with clause 7.3 of Art. 272 of the Tax Code of the Russian Federation, which is confirmed in the letter of the Ministry of Finance of Russia dated March 29, 2010 No. 03-03-06/1/201.

Key cost grouping

All types of costs that an economic entity incurs in the course of its activities can be divided into two large groups. The first group should include all expenses that are associated with sales or production. That is, these are costs that are aimed at carrying out the main activity.

The second group is costs that are not directly related to sales or production. They are most often called non-operating transactions.

However, the provisions of the Tax Code of the Russian Federation provide for additional fragmentation of expenses of the first group. Thus, all costs associated with sales and production are divided into direct and indirect expenses.

For clarity, let’s define in a block diagram what the current classification of expenses in tax accounting looks like:

Now let's look at each of the groups in more detail.

Standardized advertising expenses: calculation of the maximum amount

As already noted, recognition of standardized advertising expenses in the reporting period is possible only in an amount that does not exceed 1% of sales revenue, determined, in turn, in accordance with Art. 249 of the Tax Code of the Russian Federation.

In paragraph 1 of this article there is a rule that requires the inclusion of proceeds from sales as income. However, in accordance with paragraph. 2 clause 1.2 art. 248 of the Tax Code of the Russian Federation, when determining the final amount of income, it is necessary to subtract from the received proceeds all amounts of taxes that are presented to the buyer. This refers to VAT and excise taxes.

That is, the maximum amount of standardized advertising expenses is calculated from the amount of sales revenue minus the amount of VAT and excise taxes. Confirmation of this thesis can be found in the letter of the Ministry of Finance of Russia dated 06/07/2005 No. 03-03-01-04/1/310.

Example

The organization received revenue from the sale of services in the amount of 530,000 rubles in the reporting period. (including VAT). First, let's determine the amount of VAT that is included in the revenue:

530,000 rub. × 20/120 = 88,333 rub.

Then let's find the difference:

530,000 rub. – 88,333 rub. = 441,667 rub.

Now, finally, let’s determine the amount of the maximum amount of advertising expenses:

RUB 441,667 × 1% = 4417 rub.

Within the limits of this amount, it is permissible to include advertising costs in expenses.

If you have access to K+, check whether you have determined the standard correctly. If you don’t have access, get free trial access to the system and go to the Ready Solution.

To learn how this limit is calculated under the simplified tax system, read the material “How to take into account advertising costs under the simplified tax system.”

Entertainment expenses

Situation: when calculating income tax, is it possible to include in entertainment expenses the costs of purchasing flowers for representatives of counterparties to decorate the place of negotiations?

No you can not.

The list of entertainment expenses taken into account when taxing profits is given in paragraph 2 of Article 264 of the Tax Code of the Russian Federation (subparagraph 22 of paragraph 1 of Article 264 of the Tax Code of the Russian Federation). It does not provide for the cost of purchasing flowers for representatives of counterparties to decorate the meeting place. Therefore, do not take these expenses into account when calculating your income tax. A similar conclusion was made in letters of the Ministry of Finance of Russia dated March 25, 2010 No. 03-03-06/1/176, Federal Tax Service of Russia for Moscow dated January 22, 2004 No. 26-08/4777.

Some arbitration courts support this point of view (see, for example, the resolution of the FAS of the Volga-Vyatka District dated March 15, 2006 No. A29-1822/2005a). They justify their position by the fact that the costs of purchasing flowers are not determined by business customs that must be observed when organizing meetings of business partners. This means that they are not economically justified (clause 1 of Article 252 of the Tax Code of the Russian Federation).

Advice: there are arguments that allow organizations to recognize expenses for the purchase of flowers for representatives of counterparties when calculating income tax. They are as follows.

An organization has the right to take into account expenses aimed at generating income when calculating income tax. In this case, expenses must be economically justified and documented (clause 1 of Article 252 of the Tax Code of the Russian Federation). Expenses for purchasing flowers for business meetings are aimed at establishing contacts with potential clients (partners) of the organization.

Therefore, such expenses can be considered economically justified. This conclusion is contained in the resolutions of the Federal Antimonopoly Service of the West Siberian District dated May 11, 2006 No. F04-2610/2006(22165-A46-40), the Northwestern District dated November 3, 2005 No. A56-9369/2005, the Volga District dated February 1, 2005 No. A57-1209/04-16.

Situation: when calculating income tax, is it possible to include in entertainment expenses the costs of purchasing tea and tableware intended for use during official meetings with the organization’s business partners?

Yes, you can.

Entertainment expenses, in particular, include the costs of holding official receptions for representatives of other organizations (business partners). An official reception means organizing a breakfast, lunch or other similar event. The location of the reception does not matter, so the organization can arrange it both on its territory and outside it. This follows from the provisions of paragraph 2 of Article 264 of the Tax Code of the Russian Federation.

A specific list of costs for conducting an appointment is not established by law. Consequently, these can be any economically justified and documented expenses directly related to the organization of such a reception (clause 1 of Article 252, clause 2 of Article 264 of the Tax Code of the Russian Federation).

Obviously, when holding a reception (breakfast, lunch) on its territory, an organization cannot do without tea and tableware. But in order to include the costs of purchasing tableware as entertainment expenses, you need to prove the connection between these costs and the entertainment events.

You can confirm the costs of purchasing utensils with cash and sales receipts. And the entertainment nature of expenses can be justified by an order (instruction) of the head of the organization, an estimate, as well as a report on entertainment expenses. The report must be accompanied by primary documents for each item included in the report (invoices, sales receipts, etc.).

If the dishes are reusable, the costs of purchasing them do not count as entertainment expenses. The cost of such utensils can be included in material costs on the basis of subparagraph 3 of paragraph 1 of Article 254 of the Tax Code of the Russian Federation. But for this you will have to prove that it is constantly used in the economic activities of the organization.

In arbitration practice, there are decisions that confirm the legality of including the costs of purchasing reusable tableware as entertainment expenses (see, for example, Resolution of the Federal Antimonopoly Service of the North-Western District dated June 9, 2008 No. A05-12045/2007). However, relying on the opinion of individual courts when writing off such costs is risky.

Situation: when calculating income tax, is it possible to include in entertainment expenses the costs of holding a corporate evening (organization anniversary)? The organization pays for the rent of the banquet hall, services for organizing the event, food, etc.

No you can not.

Representation expenses of an organization include the following expenses:

- for an official reception and (or) service (including a buffet) for representatives of other organizations, as well as officials of the organization itself;

- for transport support for delivery to the venue of the representative event and (or) meeting of the governing body and back;

- to pay for the services of translators (not on staff of the organization) during entertainment events.

Entertainment expenses do not include expenses for organizing entertainment, recreation, prevention or treatment of diseases.

Such rules are established by paragraph 2 of Article 264 of the Tax Code of the Russian Federation.

Therefore, the costs of holding a corporate party (company anniversary) are not considered entertainment expenses. Such expenses cannot be considered as advertising expenses. Similar explanations are contained in the letter of the Ministry of Finance of Russia dated September 11, 2006 No. 03-03-04/2/206.

We suggest you read: I bought a car from a reseller and how to get my money back

Advice: if an organization is ready for a dispute with the tax office, it can include the costs of holding a corporate evening as part of entertainment expenses. But for this you need to fulfill several conditions.

Firstly, the organizational documents need to clearly indicate the purpose of such an event. For example, in an order for an event, it is better to indicate that a corporate evening is held to summarize the organization’s work, maintain cooperation with business partners, and demonstrate to them the company’s achievements and prospects for its development.

Secondly, you need to invite representatives of other organizations (at least the largest business partners) to the holiday and record the fact of their presence in the report on entertainment expenses.

Thirdly, the costs of holding a corporate evening must be confirmed with primary documents. For information on what documents should be prepared and how to do this, see What documents should be prepared in order to safely recognize entertainment expenses.

Fourthly, the amount of expenses for holding the holiday together with other entertainment expenses must fit within the established standard (4 percent of labor costs for the reporting (tax) period).

If the above requirements are met, the organization has a chance to defend its position in court. In arbitration practice, there are examples of court decisions in which it is recognized as legitimate to write off expenses associated with the organization and conduct of corporate events as entertainment expenses (see, for example, the ruling of the Supreme Arbitration Court of the Russian Federation dated November 30, 2009 No.

Representation expenses of an organization are expenses aimed primarily at establishing and maintaining mutual cooperation, expenses incurred by firms in organizing official receptions and negotiations, including transportation costs for delivery to the venue of the official meeting of persons participating in negotiations (receptions), and expenses for translators if there are none on staff of the receiving organization.

In accordance with paragraph 2 of Art. 264 of the Tax Code of the Russian Federation, representation expenses also include the costs of holding meetings of the governing body. But the acceptance for tax purposes of expenses for organizing the reception of branch managers as representatives will most likely have to be defended in court. According to the Resolution of the FAS VSO dated 11.08.

The location of official meetings does not matter for the purposes of recognizing expenses when determining income tax (clause 2 of Article 264 of the Tax Code of the Russian Federation).

Representation expenses are included in expenses within 4% of the taxpayer's expenses for wages for the reporting (tax) period.

The Tax Code of the Russian Federation does not contain an exhaustive list of expenses of organizations that could be classified as representative without arising tax risks for income tax. When deciding this issue, the judicial authorities proceed from the economic justification of the expenses incurred (Resolutions of the Federal Antimonopoly Service ZSO dated 01.03.2007 N F04-9370/2006(30552-A81-27), dated 11.05.2006 N F04-2610/2006(22165-A46-40 ).

We can definitely say that entertainment expenses do not include expenses for organizing entertainment, recreation, prevention or treatment of diseases. Accommodation, “informal meals” (breakfast, lunch, dinner) of partner delegations arriving in order to establish and maintain mutual cooperation may also be excluded by the tax authorities from the representative list, since these expenses are travel expenses for the visiting party (Letters from the Ministry of Finance of Russia dated April 16 .2007 N 03-03-06/1/235, Federal Tax Service of Russia for Moscow dated July 14, 2006 N 28-11/62271).

As stated in subparagraph 22 of paragraph 1 of Article 264 of the Tax Code of the Russian Federation, entertainment expenses are taken into account as part of other expenses. These include costs associated with the official reception and services of representatives of other organizations participating in negotiations in order to establish and maintain cooperation.

The concept of “official reception” is disclosed in paragraph 2 of this article. This is breakfast, lunch or another similar event. In the same paragraph, hospitality expenses are detailed. These, in particular, include not only the costs associated with the official reception and (or) service of representatives of other organizations, but also participants who arrived at meetings of the board of directors (another governing body of the company) and officials of the receiving party.

Expenses for transportation of participants to the venue of the event and back, buffet service during negotiations, payment for the services of a translator who is not on staff - all these are also entertainment expenses. Is it possible to take into account the cost of alcoholic beverages purchased for the official event as part of entertainment expenses? Events? Yes, you can.

But provided that such costs meet the criteria established in paragraph 1 of Article 252 of the Tax Code of the Russian Federation. In other words, if they are documented and economically justified (see letter from the Ministry of Finance of Russia dated August 16, 2006 N 03-03-04/4/136). Often organizations pay for the accommodation of participants of the invited delegation in a hotel.

These costs cannot be recognized as entertainment expenses for profit tax purposes, since they are not mentioned in paragraph 2 of Article 264 of the Tax Code of the Russian Federation. This is indicated in the letter of the Ministry of Finance of Russia dated April 16, 2007 N 03-03-06/1/235. Costs for organizing entertainment, recreation, prevention or treatment of diseases also do not apply to entertainment expenses.

Paragraph 2 of Article 264 of the Tax Code of the Russian Federation stipulates that all types of entertainment expenses are regulated. Their cost can be included in the tax base in an amount not exceeding 4% of the amount of labor costs for the reporting (tax) period. Entertainment expenses are taken into account in a manner similar to that used to account for advertising expenses.

Labor costs are taken on an accrual basis from the beginning of the year and multiplied by 4%. The amount received is compared with the cost of entertainment expenses for the same period. Entertainment expenses within 4% of labor costs for the reporting (tax) period are included in the tax base. EXAMPLE 2 In June 2007, the expenses of Concor LLC for an official reception for the purpose of establishing cooperation amounted to 200,000 rubles.

(excluding VAT). Labor costs for January - June 2007 - 3,200,450 rubles. The maximum possible amount of entertainment expenses for the first half of 2007 is 128,018 rubles. (RUB 3,200,450 x 4%). The expenses incurred exceed this amount (RUB 128,018 {amp}lt; RUB 200,000). Consequently, only the amount of 128,018 rubles can be included in other expenses for the 1st half of 2007.

https://youtu.be/mIjFeA7f3N4

How are advertising expenses reflected in accounting and reporting?

In accounting, advertising expenses are expenses for ordinary activities that are reflected as part of business expenses. Sub-paragraph is aimed at such reflection. 5 and 7 of the accounting regulations “Expenses of the organization” PBU 10/99 (approved by order of the Ministry of Finance of Russia dated May 6, 1999 No. 33n).

As for the chart of accounts, it is recommended to reflect such expenses in the debit of account 44 “Sale expenses” (instructions for using the Chart of Accounts for accounting financial and economic activities of organizations, approved by order of the Ministry of Finance of Russia dated October 31, 2000 No. 94n). For accounting purposes they do not have a standardized nature.

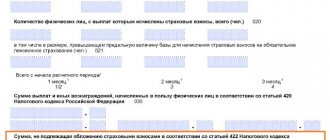

The amount of advertising expenses in the income tax return is always reflected in one place, regardless of the method used to determine income and expenses. This amount forms the data indicated in line 040 of Appendix 2 to sheet 02 of the declaration (approved by order of the Federal Tax Service of Russia on October 19, 2016 No. ММВ-7-3 / [email protected] ).

Costs associated with production and sales

Costs associated with production and sales are characterized by the fact that the company incurs them to conduct its own activities. They are inextricably linked with the main areas of business, and the company bears them, relatively speaking, of its own free will.

The list of production costs for income tax is given in Article 253 of the Tax Code, and they are described in more detail in Articles 254-264 of the Code. Thus, the main options for such expenses in tax accounting are material expenses, labor costs, amounts of accrued depreciation and other expenses.

The presence of the “other” item in the list of expenses makes this list not closed. This means that if a company can justify the need to incur certain expenses to carry out its business activities, then it also has the right to take them into account in the tax base.

How to correctly take into account advertising expenses when increasing profits in the tax period

The tax base for profit during the tax period is determined on an accrual basis (clause 7 of Article 274 of the Tax Code of the Russian Federation). Naturally, due to the gradual increase in the amount of revenue, the maximum amount of standardized advertising expenses will also increase, which can be taken into account when calculating the tax.

The letter of the Ministry of Finance of Russia dated November 6, 2009 No. 03-07-11/285 states that excess advertising expenses that could not be taken into account in the past reporting period can be taken into account during the calendar year in subsequent reporting periods (clause 44 of Art. 270 of the Tax Code of the Russian Federation).

In accounting, in such circumstances, a deductible temporary difference is formed, which is a deferred tax asset equal to the amount of excess advertising expenses (clauses 8–11, 14, 17 of the accounting regulations “Accounting for income tax calculations” PBU 18/02, approved. by order of the Ministry of Finance of Russia dated November 19, 2002 No. 114n).

Example

Circumstances:

, engaged in trade, spent 21,000 rubles on the production of prizes, which were then raffled off during the advertising campaign. (including VAT 3,500 rubles) The company is exempt from having to pay VAT in accordance with Art. 145 Tax Code of the Russian Federation.

Sigma's revenue by quarter was:

- for the 1st quarter - RUB 1,590,000;

- for half a year - 2,380,000 rubles.

Reflection in accounting:

According to paragraph 2 of Art. 285 of the Tax Code of the Russian Federation for income tax, reporting periods are considered to be 1 quarter, 6 months and 9 months.

If there were no other advertising expenses in the specified periods, the calculation of the maximum amount of normalized advertising expenses will look as follows.

- In the 1st quarter, since the amount of revenue is RUB 1,590,000:

- maximum amount of advertising expenses: RUB 1,590,000. × 1% = 15,900 rub.;

- the amount of advertising expenses that can be recognized in this reporting period is also equal to 15,900 (since it is less than the entire amount of expenses of RUB 21,000).

- maximum amount of advertising expenses: RUB 2,380,000. × 1% = 23,800 rub.;

- It will still be possible to admit: 21,000 rubles. – 15,900 rub. = 5,100 rub.

But it would be possible to write off a larger amount of advertising costs as expenses if their cost were higher. For the half year, this value was: 23,800 – 21,000 = 2,800 rubles.

In accounting, the above transactions will be reflected as follows:

Dt 10/6 Kt 60 – prizes in the amount of 21,000 rubles were capitalized. (VAT is included in their price, since the company operates without VAT);

Dt 44 Kt 10/6 – the cost of prizes (21,000 rubles) was written off as expenses.

In addition, at the end of the first quarter on March 31, you need to make the following posting:

Dt 09 Kt 68 - a recognized and deferred tax asset of 1020 rubles is reflected. ([21,000 – 15,900] × 20%).

And based on the results of the six months of June 30 of the current year, the following entries are drawn up:

Dt 68 Kt 09 - the deferred tax asset is written off in the amount of 1020 rubles.

Calculation of standards

Standards are established in the form of fixed amounts (compensation for the use of personal transport for business purposes, expenses for food for the crews of sea, river and aircraft, etc.) or are tied to certain indicators - the wage fund for the reporting (tax) period, revenue from sales, etc. (representation, advertising expenses, etc.). The standards that must be taken into account when including standardized expenses in the income tax base are given in the table.

Standards that are tied to specific indicators (revenue, labor costs, etc.) are calculated at the end of each reporting period for income tax (monthly or quarterly) (clause 2 of Article 285 of the Tax Code of the Russian Federation). To calculate income tax, you need to keep records of income and expenses on an accrual basis from the beginning of the year (Clause 7, Article 274 of the Tax Code of the Russian Federation). Therefore, standardized expenses, which at the end of the quarter (month) are above the norm, at the end of the year (the next reporting period) can meet the standard. Accordingly, in the following periods (until the end of the calendar year) they can be included in expenses that reduce taxable profit (letter of the Ministry of Finance of Russia dated November 6, 2009 No. 03-07-11/285).

Situation: how to determine revenue for calculating advertising expenditure standards: with or without VAT?

Determine revenue excluding VAT.

The list of advertising expenses that can be fully taken into account when calculating income tax is given in paragraph 4 of Article 264 of the Tax Code of the Russian Federation. It includes costs for:

- advertising events through the media (including advertisements in print, broadcast on radio and television) and telecommunication networks;

- illuminated and other outdoor advertising, including the production of advertising stands and billboards;

- participation in exhibitions, fairs, expositions, for the design of shop windows, sales exhibitions, sample rooms and showrooms, the production of advertising brochures and catalogues, for the markdown of goods that have completely or partially lost their original qualities during exhibition.

All other advertising costs are rationed. These include, in particular, the costs of producing printed materials with the organization’s symbols, organizing advertising shows, prize draws, etc.

The standard for advertising expenses is 1 percent of revenue from the sale of goods (works, services). Non-operating income is not taken into account when calculating the standard. Revenue must be taken for the reporting (tax) period in which the organization incurred advertising expenses. This follows from the provisions of paragraph 5 of paragraph 4 of Article 264 of the Tax Code of the Russian Federation and letter of the Ministry of Finance of Russia dated April 21, 2014 No. 03-03-06/1/18216.

When calculating the standard for advertising expenses, revenue from the sale of goods (work, services) is determined without taking into account VAT and excise taxes. This follows from the provisions of Article 248 of the Tax Code of the Russian Federation, according to which, when determining income, it is necessary to exclude from them the amounts of taxes presented by the taxpayer to the buyer (acquirer) of goods (work, services, property rights) (clause 1 of Article 248 of the Tax Code of the Russian Federation). Similar explanations are contained in letters of the Ministry of Finance of Russia dated June 7, 2005 No. 03-03-01-04/1/310, UMNS of Russia for Moscow dated May 17, 2004 No. 26-12/33228.

An example of how advertising expenses are reflected in tax accounting within the standard limits

In the first quarter, the organization’s expenses for producing T-shirts with its symbols amounted to 2,300 rubles. (excluding VAT). Revenue from sales of products for the same period is 236,000 rubles. (including VAT – 36,000 rubles).

The accountant determines the standard for advertising expenses based on revenue that does not include VAT. When calculating income tax, he took into account advertising costs in the amount of 2,000 rubles. ((RUB 236,000 – RUB 36,000) × 1%). The remainder of the normalized advertising costs is 300 rubles. (RUB 2,300 – RUB 2,000) – does not reduce taxable profit in the first quarter.

Situation: is it possible to include in the revenue for calculating the standard of advertising expenses the income from the repayment of a non-discount (interest-free) bill of exchange of a third party?

No you can not.

In tax accounting, proceeds from sales are equal to the sum of all receipts for goods, works, services, and property rights sold (clause 2 of Article 249 of the Tax Code of the Russian Federation). At the same time, VAT and excise taxes charged to the buyer are not included in the revenue (clause 1 of Article 248 of the Tax Code of the Russian Federation).

For tax purposes, sale is a transfer of ownership of goods, work or services (Clause 1, Article 39 of the Tax Code of the Russian Federation).

When a bill is redeemed, the debt obligation under it ceases. In this case, there is no transfer of the security to third parties. This follows from paragraph 1 of Article 408 of the Civil Code of the Russian Federation.

Thus, in tax accounting, amounts received in repayment of an interest-free (non-discount) bill are not taken into account when calculating revenue. A similar point of view is expressed by the Russian Ministry of Finance in letter dated February 15, 2013 No. 03-03-10/4006.

Previously, the financial department took a different position (see, for example, letter of the Ministry of Finance of Russia dated February 20, 2007 No. 03-03-06/2/30). However, with the advent of new clarifications, following such recommendations may lead to disputes with inspectors.

Situation: should income from the sale (resale) of debt claims be included in the revenue, based on the size of which the standard for advertising expenses is calculated?

Yes need.

Both during the assignment and during the assignment of the right to claim the debt (in other words, during the sale or resale), the creditor receives income, which for tax purposes is included in the proceeds from the sale (clause 2 of Article 249 of the Tax Code of the Russian Federation). Namely, revenue, determined in accordance with Article 249 of the Tax Code of the Russian Federation, is the basis for calculating the standard for advertising expenses (paragraph 5, clause 4, article 264 of the Tax Code of the Russian Federation). Thus, when determining the maximum amount of standardized advertising expenses for calculating income tax, also take into account the income from the assignment (assignment) of the right to claim the debt.

Similar clarifications are contained in the letter of the Ministry of Finance of Russia dated February 4, 2013 No. 03-03-06/1/2238.

Let us recall that the right to claim a debt is a property right that its owner can dispose of at his own discretion. For the first time, the right to claim the debt arises with the original creditor. For example, from a lender or from a contractor who completed the work but did not receive payment for it. Subsequently, the original creditor may assign his right of claim to a new creditor, and the new creditor, in turn, may assign this property right to another person. This follows from the provisions of paragraph 1 of Chapter 24 of the Civil Code of the Russian Federation.

An example of how standardized expenses are reflected in accounting and taxation. The amount of entertainment expenses exceeds the established standard. The organization pays income tax and uses the cash method

In February, director of Alpha LLC A.V. Lvov met with representatives of the partner organization in order to conclude an agreement for the supply of goods. During the meeting, the organization incurred entertainment expenses in the amount of 5,000 rubles. (without VAT). The amount of expenses is reflected in Lvov’s advance report and confirmed by primary documents.

The following entry was made in Alpha's accounting records:

Debit 26 Credit 71 – 5000 rub. – entertainment expenses are taken into account.

The organization uses the cash method and pays income tax monthly.

For January–February, the total amount of labor costs at Alpha amounted to 90,000 rubles.

The maximum amount of entertainment expenses is: 90,000 rubles. × 4% = 3600 rub.

The actual amount of entertainment expenses is more than the standard. Therefore, when calculating income tax for February, it cannot be immediately written off as a reduction in the tax base.

For the excess portion of entertainment expenses in the amount of 1,400 rubles. (RUB 5,000 – RUB 3,600) the accountant accrued the deferred tax asset:

Debit 09 Credit 68 subaccount “Calculations for income tax” – 280 rubles. (RUB 1,400 × 20%) – a deferred tax asset is reflected from the difference between entertainment expenses reflected in accounting and tax accounting.

Results

Advertising expenses can be taken into account in full when calculating profits if they are included in the list from clause 4 of Art. 264 Tax Code of the Russian Federation. If there are no advertising costs incurred, they are taken into account in an amount equal to 1% of revenue.

In accounting, advertising costs are written off in full. If the amount of standardized costs is more than 1% of revenue, temporary differences arise between tax and accounting accounting.

Sources: Tax Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

Standardized costs

Standardized expenses in tax accounting - such expenses are not included in the current classification, but they also occur. Thus, expenses in this category include those transactions that can be combined according to a general principle: standards have been approved for their recognition in tax accounting. In other words, costs can only be taken into account in a certain amount, but not more than the regulatory limit.

For example, entertainment expenses can be taken into account in the amount of 4% of labor costs for the same period. The costs of voluntary personnel insurance are no more than 12% of labor costs. Some advertising costs are up to 1% of sales revenue.

Types of standardized expenses used

When an enterprise incurs expenses related to normalization, accounting is carried out especially carefully. The accuracy of the calculations prevents underestimation of income taxes. A number of expenses are found in almost all businesses.

| Type of expenses | Consumption rate size |

| Pension and personal insurance of employees | 12% of the wage fund |

| Employee health insurance | 6% of the wage fund |

| Replacement of defective periodicals | 7% of the circulation cost |

| Loss of printed products | 10% of the circulation cost |

| Certain types of advertising | 1% of revenue |

| Representation needs | 4% of the wage fund |

| Provisions for doubtful debts | Art. 266 Tax Code of the Russian Federation |

Certain types of expenses are taken into account in a special manner:

- Paid for notarization of documents, taken into account in the amount of tariffs established by law.

- Spent on R&D in the form of other expenses depending on wages and amounts allocated for the formation of funds from the sales amount.

- Sent for the maintenance of transport in the amount of standards established by the Government.

- Arising in the form of losses from natural loss within the limits determined by the Government.

The standards established by the Tax Code of the Russian Federation, departmental acts or Government resolutions are regularly reviewed. Before applying standards, their relevance is determined.

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

Direct and indirect expenses in tax accounting

The distribution of expenses into direct and indirect is relevant for companies using the accrual method of income tax (Article 318 of the Tax Code of the Russian Federation). In this case, indirect expenses are taken into account in the tax base upon their occurrence and in the presence of relevant documents. Direct costs are reflected only as goods, works or services in the production of which they participated are sold.

The organization determines the specific distribution of costs for these two items independently. And in this regard, tax legislation leaves payers certain options for action, because often writing off expenses at a time without the need to distribute them proportionally to sales (that is, when costs are classified as indirect) is more profitable for the company. However, the general principles of cost distribution are still spelled out in the code, and they should be followed.

Thus, direct expenses in tax accounting are primarily material expenses. These include expenses for the purchase of raw materials and components for production purposes, as well as containers and packaging, and any additional materials in preparation of goods for transfer to the final buyer. Inventory and tools, which due to the specific nature of their use and low cost are not considered fixed assets, work clothes, payment for utilities, as well as the rental of production premises themselves are also included in material expenses. However, this is not their entire list. This subtype of costs includes any expenses arising in the implementation of the main activities of the company.

The next subtype of direct expenses is personnel costs. This article includes both the amounts accrued and paid to employees, and the insurance premiums paid by the employer for them.

If the production process involves the use of certain fixed assets, then in the company’s accounting it will be possible to distinguish another subtype of direct expenses within the framework of production and sales - depreciation expenses.

Tax accounting for other expenses that do not fall under any of the items related to direct costs means that the expenses are considered indirect. An important condition: they should not be considered non-operating expenses.