Meaning

The indicator under consideration, among other things, characterizes the rational use of material and labor resources. In general, accounting profit is the difference between the income and expenses of an enterprise.

| Profit indicator | Explanation |

| Positive | Evidence that the company has received financial benefits from its activities |

| Income equals expenses | The break-even point has been reached: no profit or loss has been made |

| "Negative profit" | There shouldn't be such a thing. After all, when expenses exceed income, we cannot talk about any profit. |

Based on the value of the PWB, calculations are made to assess the effectiveness of the activity. For example, analysis is carried out in relation to material resources using various indicators. But the general one for them is profit per 1 ruble. material costs . The resulting coefficient is equal to the quotient of the extracted profit from the main activity (P) to the amount of material costs (MZ):

The growth of this value positively characterizes the activity of the enterprise. In practice, specialists conduct such analysis in more depth, using various factor models and establishing the reasons for changes.

Approach: How to Calculate Accounting Profit

According to the Regulations on accounting and reporting in the Russian Federation (Order of the Ministry of Finance No. 34-n, clause 79), the indicator under consideration is the final financial result for the reporting period. It is determined based on:

- accounting documents for all business transactions;

- balance sheet items.

Thus, all sources of income are summed up. And the formula for accounting profit looks like this:

PRb = D – Zav

Where: D – the company’s income for the period under review; Claims are obvious costs, which include labor costs, equipment purchases, utility bills, etc.

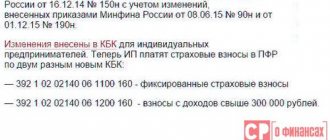

IV. Income tax accounting

20. For the purposes of the Regulations, the amount of income tax determined on the basis of accounting profit (loss) and reflected in the accounting records regardless of the amount of taxable profit (loss) is a conditional expense (conditional income) for income tax. The conditional expense (conditional income) for income tax is equal to the value determined as the product of the accounting profit generated in the reporting period and the income tax rate established by the legislation of the Russian Federation on taxes and fees and in effect on the reporting date. The conditional expense (conditional income) for income tax is accounted for in accounting in a separate subaccount for accounting for conditional expenses (conditional income) for income tax to the account for accounting for profits and losses.

21. For the purposes of the Regulations, current income tax is recognized as income tax for tax purposes, determined based on the amount of conditional expense (conditional income), adjusted to the amount of permanent tax liability (asset), increase or decrease in deferred tax asset and deferred tax liability of the reporting period . In the absence of permanent differences, deductible temporary differences and taxable temporary differences that give rise to permanent tax liabilities (assets), deferred tax assets and deferred tax liabilities, the contingent income tax expense will be equal to the current income tax. A practical example of calculation for determining the current income tax is given in the appendix to the Regulations.

22. The method for determining the amount of current income tax is fixed in the accounting policy of the organization. An organization can use the following methods to determine the amount of current income tax:

- based on data generated in accounting in accordance with paragraphs 20 and 21 of the Regulations. In this case, the amount of the current income tax must correspond to the amount of the calculated income tax reflected in the income tax return;

- based on the income tax return. In this case, the amount of the current income tax corresponds to the amount of the calculated income tax reflected in the income tax return.

The amount of additional payment (overpayment) of income tax due to the discovery of errors (distortions) in previous reporting (tax) periods, which does not affect the current income tax of the reporting period, is reflected in a separate item in the profit and loss statement (after the item of the current income tax ).

Types of accounting profit

It is customary to divide it depending on what revenues and/or costs are involved in the formation of the accounting profit .

| 1 | Gross | The amount of money received as a result of the sale of goods and services minus the costs of it: PRb = REVENUE - COST OF SALES |

| 2 | Profit (loss) from sales | Represents the difference between gross profit, selling and administrative costs |

| 3 | Profit (loss) before taxes | Sums up different indicators of types of income and subtracts expenses for them |

| 4 | Net income (loss) | The amount of money that remains after deducting all costs and taxes, fees, contributions |

Internal active use of profits

When using profits for the development of the organization and covering losses for previous years, its movement is taken into account only in analytical accounts. This movement is not reflected in any way in synthetic accounting. This fact is due to the fact that the profit received is not withdrawn from current turnover, but continues to work.

The purchase of fixed assets, intangible assets and other costs for optimizing the organization’s activities, made at the expense of profits, are accounted for in the usual manner without using account 84.

And in order to understand how much of the profit received is aimed at optimizing activities, and what remains unclaimed, it is recommended to open at least the following sub-accounts for account 84 “Retained earnings”:

- subaccount 1 “Profit received”;

- subaccount 2 “Profit in circulation”;

- subaccount 3 “Loss of previous years”.

And when the organization’s participants make a decision on the use of profits, record them with internal postings to account 84:

- Dt 84-1 Kt 84-2 - the profit received is used to purchase new equipment.

- Dt 84-1 Kt 84-3 - the profit received is used to cover the losses of previous years.

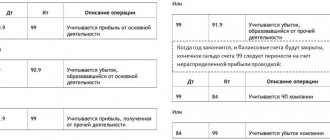

Reflection of the organization's profit in accounting

To determine this indicator, you need to be guided by information from synthetic accounting accounts.

Complete information on profit or loss for the reporting annual period is contained in account 99 “Profits and losses”. It is formed due to:

- receipt of revenue from sales (account 90);

- other income and expenses (account 91).

Such recommendations are contained in Order No. 94-n of the Ministry of Finance of 2000.

The “Profit and Loss” account also reflects various transactions every month throughout the year:

- financial receipts from sales or ordinary activities (Dt 90.9 – Kt 99);

- losses from sales or ordinary activities (Dt 99 – Kt 90.9), etc.

Taking into account profit from other sales and non-operating income and expenses, balance sheet profit (in million rubles) as the final financial result of the enterprise in our example will be as follows, presented in table.

64. From table. 64 shows that the presence of non-operating losses led to a decrease in balance sheet profit by 0.8 million rubles. When analyzing profits, one is not limited to establishing only the profitability or unprofitability of a particular activity, but carefully analyzes the reasons that caused the deviation of actual profit from the planned one. The reasons for the formation of losses are especially carefully revealed. At oil and gas industry enterprises, losses from the sale of target products and services of auxiliary workshops and farms [p.419] Low oil prices distort the idea of the efficiency of the oil-producing industry. Since the effectiveness of capital investments is determined taking into account profits (which is associated with the price level), the development of a large number of new fields cannot be justified, since the payback period for capital investments is much longer than the standard (with a capital investment efficiency ratio of 0.12). [p.148] Features of planning and accounting for profit in drilling organizations are determined by the nature of their activities. Since drilling organizations carry out capital construction, creating fixed assets for oil and gas production enterprises, their products are assessed at an estimated cost. The revenue of drilling organizations from the delivery of work to customers includes 1) the estimated cost of work delivered according to acceptance certificates, taking into account the rate coefficient established in the planned year (the estimated cost is adjusted to the actual geological and technical conditions of drilling wells) 2) compensation for costs received in excess of the estimated cost, not included in the estimates. [p.176]

Taking into account profit from other sales and non-operating income and expenses, balance sheet profit as the final financial result of the enterprise in our example (in million rubles) looks as shown in table. 52 (in million rubles). [p.367]

The impact on profit of all these factors is summed up. Profit from the production of comparable products in the planned year is determined taking into account the profit calculated at the first and subsequent stages. [p.58]

If the designed device is manufactured in a laboratory or at a factory for its own needs, the book value is determined at cost without taking into account profit. [p.62]

In 1995, decisive steps were taken towards separating the accounting of profits from their taxation. In fact, a new direction is emerging - tax accounting, which is built on the basis of accounting, as well as specially organized operational and analytical accounting of the data necessary for calculating taxable profit. As distinctive features of accounting and tax accounting, for example, we can cite different approaches to the formation of cost indicators. The expenses recorded in the accounting accounts and reflected in the financial statements include all costs associated with the production and sale of products, works and services. The cost taken to calculate taxable profit includes the costs incurred only within the established limits, norms and standards, i.e. they are subject to adjustment. [p.48]

The general procedure involves keeping records of the profit of the reporting period remaining after settlements with the budget in account 88 in subaccounts 88/1 Retained earnings (loss) of the reporting year and 88/2 Retained earnings (loss) of previous years. Amount of undistributed financial [p.475]

The second method of accounting for profit is the so-called stock method. The economic content of the funds is that this is the net profit of the reporting year or previous years, distributed among the funds for its intended use. With the publication of Order No. 4n dated January 3, 2000 on the forms of financial statements of organizations, the consumption fund and the accumulation fund were excluded from the balance sheet. This means that now all expenses associated with the activities of the organization are attributed either to cost or to profit. Thus, now there is no longer the concept of expenses incurred at the expense of profits remaining at the disposal of the organization as not characteristic of a market economy and distorting the financial result of activities. Thus, if in an organization all or part of its profit is sent to the social sector fund, then line 411 reflects the data from account 88-2 Retained earnings of previous years and account 88-4 Social sector fund. [p.252]

Name what options exist for accounting for profit. [p.254]

Profit accounting is not only useful to the management of the company, it is also important for the purposes of accountable management, establishing [p.331]

In Soviet times, accountants sought (and managers encouraged them) to distribute the complex income of an enterprise between its structural divisions. Here there was a priority of form over content, a desire to create the appearance of on-farm calculations. These games with self-financing led to a distortion of reality, subordinating it to the cabalism of symbols to the extreme limits of absurdity. In particular, at factories and research institutes, as a rule, artificial prices were introduced, simulating transfer prices. Each division sold its work to another division, and wages were calculated by division, taking into account the sum of the profits of all divisions always turned out to be greater than its value for the enterprise as a whole. Thus, with the help of accounting methodology, conditions were created for the legal and even encouraged theft of public funds. [p.481]

Turnover tax was levied on state industry associations, enterprises and organizations selling goods of their own production and procurement. For each industry association, a single tax rate was established as a percentage of the planned turnover. Of the total tax received by the budget, 78% was contributed by industrial enterprises and 22% by wholesale distribution centers. As a rule, the tax was calculated as a difference in prices. Budget revenues obtained using this method accounted for 83% of the total amount of turnover tax; the rest was paid at rates as a percentage of turnover and in fixed amounts per unit of production. The size of the rates was determined based on approved retail prices, production costs and taking into account the profit left at the disposal of the enterprise. [p.268]

This formula can be presented in a generalized form, taking into account the profit on an investment in different periods. Thus, if the initial investment D gives income AI at the end of the first year, A2 - at the end of the second year, etc., then the general formula for calculating r looks like this [ p.150]

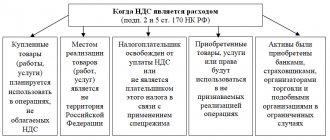

Since 1995, the concept of tax accounting began to be used everywhere when determining revenue from the sale of goods (works and services), and the accounting of profits was finally separated from its accounting for tax purposes. The profit indicator reflected in the financial statements for statistical authorities, shareholders and investors began to differ significantly from the profit indicator accepted for calculating the actual amount of income tax. In addition, when calculating income tax (clause 2.5 of the Instruction of the State Tax Service of the Russian Federation dated August 10, 1995 No. 37, as amended on February 12, 1996, On the procedure for calculating and paying to the budget the income tax of enterprises and organizations [14]), tax value added tax (VAT) (clause 9 of the State Tax Service of the Russian Federation of October 11, 1995 No. 39, as amended on April 2, 1997, On the procedure for calculating and paying value added tax [13]) and other taxes calculated from revenues from sales of goods (work, services), recalculations of the tax base began to be made if an organization sold goods (work, services) at a price below cost. [p.199]

With the introduction of the new Chart of Accounts for accounting the financial and economic activities of the organization, account 81 Use of profit, which previously performed the function of adjusting balance sheet profit, part of which was separated to account for profits withdrawn to budget revenue, was excluded. Now such an adjustment is carried out directly on account 99 Profit and loss. [p.196]

Turnover - accounting for profit of the reporting period [p.122]

The average return on invested capital was 12%. But when determining profitability, the costs did not include the cost of fertilizers, depreciation of equipment (they had no idea about it at all, but they assessed the depreciation of property) and some other expenses, since this, according to Roman lawyers, reduced profitability. It can be understood that there was no accounting for profit on the account, and income was determined outside the system by comparing accounting data - proceeds from sales and expenses for different accounts, and not all of them. “On the farm, nothing was valued except the capital invested in it” [135, vol. 1, p. 789]. [p.203]

The tax authorities, as a representative of the state, essentially advocated the creation of their own information system - tax accounting of profits, thus implicitly recognizing that another information system, in particular, the accounting system, does not fully satisfy their fiscal goals. [p.7]

Equity transactions calculate the change in net worth after taking into account profits (losses) and dividends using the formula above. If the balance does not add up, the shares have been sold or purchased. [p.248]

Let's consider a payment plan (marketing plan) for distributors, which allows you to return in the form of bonuses a significant share of the total volume of their wholesale purchases without taking into account the profit from selling products at retail prices. [p.378]

The use of expressions (1-1) - (1-2) when choosing the optimal option for capital investments according to the criterion of minimum reduced costs assumes the simultaneity of occurrence and equality of the resulting economic effect not only with constant, but also temporary operation. Therefore, when the compared options are not identical in this regard, it is necessary to first bring them to a comparable form. This reduction with different times and different scales of temporary operation can be carried out by taking into account the profits received throughout its entire period. When facilities are put into permanent operation at the same time, the following expressions can be used for these purposes when bringing costs to the start of construction - [p.12]

In this case, profit and the level of estimated profitability for determining economic incentive funds are taken without taking into account the profit received on account of the additional task. [p.216]

The selling price (taking into account profit) is equal to (xy)-2.2 + [x-(7-y)]-2.2-Vr [p.46]

Note. The need for additional investments in Table 7 is an investment, the value of which is not affected by the results of the production and economic activities of the enterprise, which can be obtained as a result of the implementation of the production program, i.e. the increase in fixed and working capital is calculated without taking into account profit. [p.191]

Income center is a structural unit or association of units whose activities are aimed at generating income and do not include profit accounting. [p.498]

The above amount of the fine can be applied for failure to account for profit if the final result of the enterprise’s activities has not been formed, as well as the amount of profit subject to taxation (taking into account the amounts of actual costs and expenses taken into account in accordance with the law when calculating income tax benefits). [p.656]

For the absence of profit accounting or its incorrect maintenance, or for untimely submission of reporting data, 10% of the amount of taxes or other obligatory payments is collected from the joint-stock company. [p.36]

The price must be set taking into account the profit that the product can bring to the consumer throughout his life; contracts concluded over many years must be targeted; in addition, there are many short-term trade projects that can be implemented in the current year. [p.263]

First, the total capital investments are determined, reduced to the beginning of 1978, taking into account the profit received by the plant in 1976 and 1977, as well as the amount of sales of dismantled equipment. [p.29]

The current system of planning and accounting for profit provides for the allocation of the following parts of profit from the sale of products, works (services) of an industrial nature, profit from the sale of works (services) of a non-industrial nature, and proceeds from non-sales operations. Profit is determined separately by type of activity for the main activity, capital construction, carried out in an economic way, and non-sales operations. [p.47]

Seven rules for accounting 13. profit, paid-in 14. capital, reserve capital, 15. treasury (purchased 16. own) shares and dividends, 17. accounts receivable, inventories and 18. replenishment of inventories (1939) 19. [ p.55]

It is also useful to look at a company's operations from an income statement perspective. The income statement shows the income and expenses associated with operations and the resulting gains or losses. It is important to understand that profit accounting is usually not the same as cash flow in a company. Moreover, while all companies strive to maximize cash flow (as a means of paying bills, repaying loans, paying salaries and dividends, etc.), not all companies strive to maximize profits. In fact, many private enterprises try to minimize declared income in order to reduce taxes. And since most financial statements are structured around income rather than cash, it's important to look at the income statement and cash flow cycle and determine the relationship between the two. [p.90]

The total turnover for the upcoming budget period is determined by the cost of goods and services shipped (released) in accordance with the sales forecast of an enterprise or company at actual selling prices (including all mandatory calculations with the budget from turnover to the road fund, for housing maintenance, etc.) for external consumers. Total turnover includes VAT1 and all other sales taxes, as well as customs duties and excise duties. For production structures, the total turnover also includes the increase in work in progress (semi-finished products for subsequent use in intra-plant circulation) at planned (standard) costs. The cost of semi-finished products in the BD&R is reflected at so-called transfer (domestic) prices, which, naturally, should not take into account all types of taxes and payments to the budget from turnover. An independent problem in this case is accounting for the profit of an individual business or structural unit in transfer prices (there may be cases when the transfer price does not contain profit and is determined only by the full cost of production). In any case, solving this problem is the task of the managers of a particular enterprise or company. [p.118]

Accounting for profits from logistics in the financial performance system. Based on practical experience, firms came to the conclusion that logistics operations, such as transportation, warehousing and others, are best assessed by accounting and costing departments or other structural bodies that measure the results of operations by the profit received. This tactic is successfully used by some American companies. One of them that has managed to strengthen its financial position is Xerox Corporation. By providing service for individual orders, this company received significant profits in the sale of products. At the same time, the company’s logistics structures guarantee the level of service required by the heads of production departments. [p.60]