| On the website BukhPomoshchnik.Ru you will find useful information on what type and form to submit applications, certificates, letters, notifications, explanations, all those documents that may be required by tax authorities or extra-budgetary funds. If you need help with tax or accounting issues, you need to get advice or useful advice, ask a question, we will definitely answer. |

Our news blog

| Internet business for beginners | |

| Free Internet business school for beginners Training invites you to undergo training. | |

| 11.09.2012 | read more |

Tax calendar

October 2018

| Mon | VT | SR | Thu | PT | SB | Sun |

| 1 | 2 | 3 | 4 | 5 | 6 | 7 |

| 8 | 9 | 10 | 11 | 12 | 13 | 14 |

| 15 | 16 | 17 | 18 | 19 | 20 | 21 |

| 22 | 23 | 24 | 25 | 26 | 27 | 28 |

| 29 | 30 | 31 | ||||

| << | >> | |||||

It is necessary to inform the inspectorate of the number of employees, which determines the reporting procedure

What document will you need for the tax office?

It is necessary to submit to the inspection information about the average number of employees for the calendar year. This document must be submitted to all companies without exception at the beginning of each year. Regardless of the number of employees and legal form. Those companies whose average number of employees does not exceed 100 people have the right to submit tax reports on paper. All other organizations are required to transmit declarations electronically via telecommunication channels (clause 3 of article 80 of the Tax Code of the Russian Federation).

What form should I use?

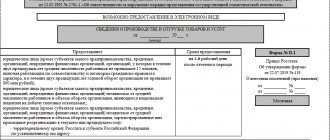

The form of information on the average number of employees was approved by order of the Federal Tax Service of Russia dated March 29, 2007 No. MM-3-25/174 @. Official recommendations for filling it out can be found in the letter of the Federal Tax Service of Russia dated April 26, 2007 No. CHD-6-25/ [email protected]

When should I send it to the inspectorate?

As a general rule, information must be submitted no later than January 20 of each year for the previous calendar year. If the company has just been created or reorganized, then you need to submit information on the same form no later than the 20th day of the month following the month in which the new organization was registered or the reorganization was carried out. We especially note: in the latter case, at the end of the year (no later than January 20), you will need to submit the information again. It must be said that for failure to submit this document to the tax authorities, the fine for the company is small - 200 rubles (clause 1 of Article 126 of the Tax Code of the Russian Federation). The manager or chief accountant may also be required to pay an administrative fine on the basis of Part 1 of Article 15.6 of the Code of Administrative Offenses of the Russian Federation. But it’s easier, of course, to send the paper than to complicate relations with the tax office. What must be in the document Questions when filling out the form usually arise when generating data on the average headcount itself and the date as of which it should be reflected. The date as of which the average number of employees is indicated is January 1 of the year following the calendar year based on the results of which the indicator was calculated. An exception is provided only for newly created (reorganized) companies. In this line they indicate the 1st day of the month following the month of creation or reorganization (that is, state registration). The average number of employees is calculated in accordance with the instructions for filling out the federal state statistical observation form No. 1-T “Information on the number and wages of employees” (approved by Rosstat order No. 258 dated October 13, 2008). The indicator is determined as follows: the average number of employees for all months of the reporting year is summed up, the resulting amount is divided by 12. Note that the last action, when submitting information based on the results of the year, must be carried out even if the company was not created from the beginning of the year (clause 11.6 of the order No. 258). And to calculate the average number of employees per month, add up the number of employees for each calendar day of the month, including holidays (non-working days) and weekends, and then divide the result by the number of calendar days of the month (p.

Information on the average number of employees, deadlines for submitting information

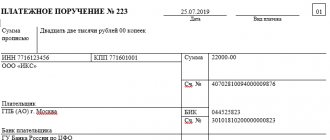

Form KND 1110018 “Information on the average number of employees for the previous calendar year” (approved by order of the Federal Tax Service dated March 29, 2007 No. MM-3-25/) must be submitted to the tax authority no later than the 20th day of the month following the reporting year.

Newly created or reorganized organizations report no later than the 20th day of the month following the month in which the organization was created (reorganized). At the same time, based on the results of less than a full year, they also transmit this information within the general time frame - until January 20.

Therefore, you need to report on the SSC for 2020 no later than January 20, 2020.

Looking for the average

The average number of employees is the total number of employees of an enterprise for a certain period of time. This period can be a year, a quarter, a half-year or a month.

When calculating the average headcount, we must not forget that the requirements of Rosstat and the tax inspectorate for the SSC report differ from the requirements of the Pension Fund and the Social Insurance Fund. In the first case, the information does not include external part-time workers and those who work under a contract or civil contract. Internal part-time workers are counted only once - at the main place. Information on the average number of employees submitted to the Pension Fund and the Social Insurance Fund includes both of these categories of workers. In this case, part-time workers take into account both the main and additional workload.

https://youtu.be/chon5wn-BQI

Current report form and recommendations for filling it out

The form can be filled out on a computer or manually. If you choose to fill by hand, use black, blue, or purple ink. Corrections using corrective means are prohibited.

Now let’s learn more about the rules for filling out the contents of the KND form 1110018. The following are required to be filled out:

- Basic details of the organization: INN, KPP, full name or INN and full name. individual entrepreneur.

- Details of the territorial division of the Federal Tax Service to which the report is submitted: full name of the department and four-digit code.

- The date as of which the main indicator was calculated. Many questions arose about this, and now the form itself contains a hint: if the report was prepared for the past calendar year, it is necessary to indicate January 1 of the current year, and recently registered enterprises indicate the first day of the month following the month of registration.

- The number of employees, calculated taking into account the requirements of the Instructions approved by Rosstat Order No. 772 dated November 22, 2017.

Who to include in the headcount for the report

The calculation of the average headcount in 2020 is carried out in accordance with the Instructions approved by Rosstat Order No. 772 dated November 22, 2017. The Instructions list the categories of workers who are included in the number for the report, and those who are not taken into account in the calculation.

A lot of controversy arises regarding the inclusion in the SCR of information about the only founder who works without an employment contract and does not receive a salary. Should he be taken into account in the number of employees, since he performs administrative functions for the management of the LLC? No, it’s not necessary, there is a clear answer to this question in paragraph 78 (g) of the Directives.

The average headcount is calculated only for personnel hired under an employment contract. This is the main difference between this indicator and reports to funds, which also take into account employees registered under a civil law contract. In this case, the duration of work under the employment contract does not matter; everyone who performs permanent, temporary or seasonal work is included in the information of the SCH. Separately, those who are employed full-time and those who work part-time are taken into account.

Read more: How to calculate the average number of employees

In general, the average payroll number is determined by adding the number of employees on the payroll for each month of the reporting year and dividing the resulting amount by 12. The final result is indicated in whole units, because it means the number of working people in the state.

Free program for preparing declarations

To quickly and correctly prepare a reporting form, there are many special programs. The Federal Tax Service recommends us one of these free software - Taxpayer Legal Entities. Next, we will consider the algorithm for filling out a report in this resource.

The first step is to check if there has been a new update for the program since it was installed on your computer. It is no secret that some tax changes are constantly being made, and naturally, the program is being finalized.

The most reliable way to check this is to go to the official website of the federal tax service. Here you can download the installation file of the current version of Taxpayer Legal Entity.

There is a small caveat: if you download the latest update, it may not install on your version. Therefore, the current version must be installed before updating. As of the end of 2020, the root version 4.64 and the update to it 4.64.3 are current.

Average number of employees in 2018

Companies receiving such invoices are required to switch to transmitting the average number of employees in electronic form from 01/01/2015.

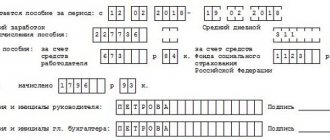

The average number of employees is submitted to the Tax Inspectorate when opening a limited liability company in Form No. 1-T (one of the forms of state statistical observation). As a general rule, the information in the form is filled out by the taxpayer. Some columns at the end of the form are filled out by a Tax Inspectorate employee.

Lawyers have been working in this field for several years. Our company’s lawyers offer you qualified legal assistance in the following areas:

- Lawyer consulting;

- Preparation of documents;

- Representation of interests in court;

- Representation in government bodies;

- Dispute resolution.

For qualified legal assistance, contact lawyers.

Algorithm for filling out the SSC using the Taxpayer Legal Entity program

When the desired employer is selected (entered), we set the reporting period. To do this, click the change reporting period button in the upper right corner of the main window. In the table that opens, select the following parameters: 2020: exactly the year, since the report is annual and not quarterly (otherwise the required form will not open).

Then in the right part of the top panel select “Documents”, and in the menu that opens - “Tax reporting”

Next step: Click the “Create” button and open a table of all annual reporting forms. Select: Information on the average number of employees for the previous calendar year.

Double-click on the selected form or click the “Select” button at the bottom right. The required form opens in front of us with the basic details already filled out.

There are literally two lines left to be filled in manually.

Let's count heads

The average payroll number is based on the payroll number. This data summary shows the full composition of employees, including those who are on sick leave, on vacation or on business trips. The payroll does not include only employees who are on maternity leave, maternity leave and unpaid educational leave.

The headcount is always compiled for a specific date: the first or last day of the month. Weekends and holidays are counted according to the previous working day.

The Kontur-Personnel program can generate information on the average number of employees for each month in the period, broken down by type of personnel, categories of employees

To learn more

Information on the average number of employees 2019 sample

The program provides a preliminary check for the correctness of filling out the document. To do this, on the main panel you need to click the “Control” button.

Once the form has been completed correctly and verified, it can be saved, printed, or downloaded to be sent electronically.

Information on the average headcount of an organization should, as a general rule, be submitted electronically, but if the organization employs less than 25 people, reports can be submitted both via the Internet and on paper.

Calculation for full working days

We will step by step consider how to calculate the average number of employees of an enterprise. Start with the number of employees working full days. We summarize the data for the month and divide the resulting amount by the number of calendar (!) days of the month. That is, in January we divide by 31, in February - by 28 (29) and so on, regardless of how many holidays/weekends/working days there were.

An example of calculating the average number of employees: the organization employs 47 people, in July 29 of them worked 31 days, 15 people worked 20 days, 3 people worked only in the last 4 days.

The average will look like this: (29 * 31) + (15 * 20) + (3 * 4) = 1211 / 31 = 39.06

Do they submit the average payroll when registering (opening) an individual entrepreneur?

Many individual businessmen are concerned about the question of whether they submit the average payroll when opening an individual entrepreneur. The rules for filing this reporting for employees apply to absolutely all individual businessmen, regardless of the tax regime under which the work is carried out.

However, in 2014, some changes were made to the requirements for individual entrepreneurs, according to which businessmen working independently are now freed from this need. This is quite logical, since if the individual entrepreneur does not have employees, there is no one to apply for the average number of employees.

Other entrepreneurs will have to submit this document, which must be submitted for review to employees of regulatory organizations on a certain form. The report must be submitted only on the form KND 111 10018.

There is nothing difficult about filling out this document. However, there are cases when the average number of employees causes difficulties for individual entrepreneurs. To avoid receiving a fine for incorrectly filling out a document and providing incorrect data, you should seek help from a professional.

Should the founder and entrepreneur be taken into account?

As a general rule, the owner is included in the average payroll only if he works in his company under an employment contract and receives a salary. The founder, who is paid dividends but not a salary, must be excluded from the calculations.

In practice, the following situation is common: the director is the owner appointed by the general meeting of founders (without an employment contract). There are no clear instructions as to whether such a director should be included in the average headcount. Typically, in such circumstances, directors are counted as a unit, despite the absence of an agreement.

But if the only founder acts as a director, then, in our opinion, he cannot be taken into account in the average headcount. The fact is that the only founder is not able to hire himself and pay himself a salary. This was also recognized by the Russian Ministry of Finance (see “Ministry of Finance: the director - the only founder should not pay his own salary”). This means that such a manager a priori cannot relate to the company’s personnel.

An individual entrepreneur is also not taken into account in the average headcount, because, like the sole founder, he is not able to conclude an employment contract with himself.

Why is the average headcount submitted when creating an organization?

At the legislative level, the requirement to provide this report is enshrined in clause 3 of the statute. 80 Tax Code of the Russian Federation. Why do control government agencies need this information? First of all, information on the number of personnel for the past year helps to justify the format for submitting declarations and other forms to the Federal Tax Service, Social Insurance Fund and Pension Fund. If a company’s total capital indicator exceeds 100 people, it will only have to report electronically. If the value is less than 100 people, paper reporting is also allowed.

In addition, calculating the number of businesses makes it possible to justify the legality of using special regimes. For example, running a simplified business is permitted if the number does not exceed 100 people. SSC when opening an LLC is mandatory for all enterprises, regardless of the legal status of the company and the types of OKVED. Moreover, this norm is also true for entrepreneurs. True, in the latter case there are exceptions. If the individual entrepreneur does not have hired employees, you do not need to fill out and submit this report.

Average number of employees of individual entrepreneurs without employees

How to calculate the average headcount for newly created organizations

The average composition of employees is determined by a simple formula, depending on the period of calculation. This indicator should initially be calculated daily, and then, based on these data, the number for the month will be determined. Subsequently, the indicators for each month are used to calculate the NPV for the quarter and then for the year. The results are indicated in units:

For example, to calculate the average number per month, you need to add up the number of employees on the payroll for each day and divide by the number of months.

Let's give an example of calculating the average headcount when opening an LLC.

Let's say Kometa LLC was registered on 04/01/2017. On this date, only the founder was in the company, however, on 04/18/2017 an accountant was hired, and on 04/21/2017 the manager entered into an agreement with the driver.

Let's calculate the average headcount for Kometa LLC for April 2020:

- for the first 18 days, the NSR is 0 people, since the founder is not taken into account in the calculations;

- from April 18 to April 21, 2020, the NFR (3 days) was 0 + 1 = 1 person - an accountant was hired;

- from April 22 to April 30, 2020, the NFR (8 days) is equal to 1 +1 = 2 people – the driver was hired;

- Let's use the formula and calculate the overall indicator. The average number of employees of Kometa LLC for April = (0* 18+ 1*3 + 2*8)/30 = 19/30= 0.6 people. Round up and get 1 unit.

Submission methods

The number of employees under an employment contract is important not only when calculating taxes, but also when choosing the method of submitting the CHR report: paper or electronic. Typically, information about the average headcount of a newly created organization is submitted in paper form, because the number of employees hired in the first month rarely exceeds 100 people.

The rule of Article 80 (3) of the Tax Code of the Russian Federation states that only taxpayers with no more than 100 people have the right to submit tax returns and calculations in paper form. If we take it literally, then this article should not apply to the report on the average headcount, because it is not taxable. However, tax officials insist that if the number of employees exceeds 100 people, information about their number should also be submitted in electronic format.

In fact, this requirement does not cause any particular difficulties, given that since 2020, insurance premium payers are required to submit reports on insurance premiums in electronic form, starting from 25 people. That is, if the number of employees in your enterprise exceeds 25 people, you will still have to issue an electronic digital signature, which can be used to sign all reports.

A report on the number of employees is submitted to the tax office at the place of registration: at the registration of an individual entrepreneur or the legal address of an LLC. If the document is drawn up on paper, then you can submit the report in person to the Federal Tax Service or by mail with a list of the attachments.

How to fill out a report

The procedure for filling out the SHR form for newly opened enterprises is no different from the standard procedure for filling out the form for existing organizations.

Here are the basic rules for filling out the document:

- The form is filled out manually with black paste or submitted electronically.

- The name of the organization is indicated in full, according to the statutory documents.

- When specifying your Taxpayer Identification Number (TIN), you must fill in all the cells. If the TIN number is shorter, then you must put “0” at the beginning of the number.

- The average number of employees is indicated as a whole number. If the calculation results in a fractional number, then it must be rounded according to mathematical rules.

- The reporting date is set according to the fact. If the reporting is annual, then the date is set to “January 1”.

- Reports must be submitted to the tax authority in the prescribed manner and within the deadlines.

- Reporting can be submitted manually only for enterprises with up to 100 employees. If the number is larger, then the report form is filled out electronically.

The report form must be signed by the head of the organization or an authorized person and certified by the seal of the LLC.

The official reporting form is available.

The completed sample is shown below:

How to count the number of employees?

The need to submit a report gives rise to another question: how to calculate the SCH when opening an LLC, and who should be included in this document? Calculations must be made in accordance with the instructions given by Rosstat. They are displayed in letter No. 428 dated October 28, 2017.

The document indicates which categories of employees are accepted for accounting and which should be excluded in the calculations. For example, if in a company the only founder serves as the general director without concluding an employment contract, then the average number of employees when opening an LLC should not include him.

When calculating, you need to take into account only those employees who work for the company under an employment contract. And if a person performs duties in accordance with the GAP, then he is not displayed in the SSC report.

The general calculation procedure involves adding up the number of employees for each month of the reporting year. This figure is then divided by 12 and rounded to the nearest whole number. The average headcount when opening an LLC is calculated even more simply - data is taken on persons who worked at the enterprise for more than 1 day on the first day of the month following registration.

Responsibility for late submission

Responsibility is provided for violation of the deadline for submitting the average number of employees for 2020. Each case entails a fine of 200 rubles. on the basis of paragraph 1 of Art. 126 of the Tax Code. And officials can be charged 300–500 rubles. (Article 15.6 of the Code of Administrative Offenses of the Russian Federation).

It is now clear why it is important to know and comply with the deadlines for submitting information on the average payroll in 2020. This will help not only avoid fines, but also guarantee the preservation of tax status (for example, simplified tax system).

If you find an error, please highlight a piece of text and press Ctrl Enter.

Who represents and how

There are two ways to form legal entities: reorganization of existing enterprises and establishment from scratch. When using both methods, it is considered newly created. Tax legislation requires the submission of information regardless of the form of the company - joint stock company or limited liability and the composition of participants - individuals and firms, government agencies.

We observe the evolution of the average rate of involuntary net turnover across firm size ranges. Groups: micro, small, medium and large companies. To make the classification, a measure of long-term average size is used, in which the average firm size is determined taking into account the entire observed period. This figure shows that the evolution of welding labor is very similar across different firm size groups, strongly indicating that changes in the macroeconomic environment affect turnover similarly in firms with different characteristics.

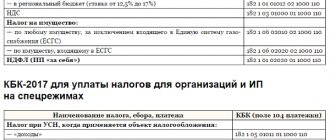

Initial information about the average headcount of a newly created organization is necessary for the Federal Tax Service to establish the status of the enterprise and determine the method of obtaining reports. A staff of up to 100 employees defines a company as a small or micro-enterprise with benefits for the preparation and transmission of reports:

- It is possible to submit declarations (excluding VAT), payments on paper through personal presentation, or by post; remember that a number of reports (2-NDFL certificates, form 4-FSS) can be submitted in paper form only if there are no more than 25 employees;

If at the time of generation the report on the average headcount of the newly created organization contained the number of working personnel within 100 units, then it can be transmitted on paper.

In addition, this measure shows lower average turnover for larger firms, as predicted by organizational theories. Again, there is an evolution in the average forced net turnover rate, but now disaggregated across 13 major industry subsectors. Again, the evolution of foaming labor is quite similar for firms with different characteristics, reinforcing the idea that the macroeconomic environment changes in a similar manner across firms. The mining subsector that has the lowest turnover on average is the one that has had a more varied trajectory than others.

Attention! The absence of staff does not exempt you from submitting information (letter of the Ministry of Finance No. 03-02-07/1/4390 dated 02/04/2014). The provision is based on the mandatory presence of a manager in legal entities at the time of registration.

New companies

In Russia, new enterprises open literally every day. At the same time, both large and small organizations (legal form and size do not matter), registered already in January 2020, are not required to submit information for the 2017 year.

It is quite logical that the deadline for submitting the average number of employees for new organizations in this case falls on February 20, 2020 (this will be Tuesday). This is established by tax legislation. And then according to the same principle: the month of creation, followed by the month of submission of information on the number of personnel.

Many individuals seek to create their own business in order to offer their services in various fields of activity. Registration as an individual entrepreneur opens up a lot of opportunities, but also obliges you to complete certain formalities. All businessmen who plan to use hired labor as part of their activities should know when to submit information about the average headcount.

Thus, upon receipt of an entrepreneurial certificate in 2017, the report in question is submitted to the Federal Tax Service no later than January 22, 2018.

Table with deadlines for submitting reports in 2020 in the 1st quarter

You can DOWNLOAD THE SCHEDULE FOR SUBMISSION OF REPORTS IN THE 1st QUARTER using the links further in the article

| When to take it | What's for rent | Who rents |

| January 15 | SZV-M for December 2020 | All policyholders |

| January 20th | Unified simplified tax return for 2020 | Organizations that do not have taxable objects and have no bank and cash flows |

| Information on the average headcount for 2020 | All organizations | |

| Water tax declaration for the 4th quarter of 2020 | Companies and individual entrepreneurs from the list of Article 333.8 of the Tax Code of the Russian Federation | |

| 4-FSS for 2020 on paper | All policyholders with an average number of employees of less than 25 people | |

| Invoice journal for the 4th quarter of 2020 in electronic form | Freight forwarders, intermediaries and developers | |

| Declaration on UTII for the 4th quarter of 2020 | All companies on UTII | |

| January 27 | VAT return for the 4th quarter of 2020 | VAT payers and tax agents |

| 4-FSS for 2020 in electronic form | Insurers with an average number of employees of more than 25 people | |

| January 30 | Calculation of insurance premiums for 2020 at the Federal Tax Service | All policyholders |

| February 3rd | Transport tax declaration 2020 | Companies that have vehicles |

| Land tax return for 2020 | Companies that own land plots | |

| February 17 | SZV-M for January | All policyholders |

| 28th of February | Income tax return for January | Companies on OSNO that submit reports monthly |

| Tax calculation for income tax for January | Tax agents calculating monthly advance payments based on actual profits received | |

| 2nd of March | 2-NDFL certificates indicating the impossibility of withholding tax | Tax agents for personal income tax |

| SZV-STAZH | All policyholders | |

| 6-NDFL for 2020 | Tax agents | |

| 2-NDFL for 2020 | Tax agents | |

| March 17 | SZV-M for February | All policyholders |

| 30th of March | Income tax return for 2020 | Companies on OSNO |

| Income tax return for February | Companies on OSNO that report monthly | |

| Tax calculation for income tax for February | Tax agents calculating monthly advance payments based on actual profits received | |

| Organizational property tax declaration for 2020 | Companies that have property on their balance sheet | |

| March 31 | Accounting statements for 2020 | All companies that maintain accounting |

What to indicate in the report if the average headcount is zero

A common situation is when the average headcount of a small company or individual entrepreneur, calculated according to all the rules, after rounding takes the value 0. The question arises, is it possible to indicate a zero figure in the reporting intended for the Federal Tax Service and the Social Insurance Fund?

Unfortunately, not a single regulatory legal act provides a clear answer. In practice, tax officials strongly recommend putting 1 instead of zero. This is explained by the fact that, according to the internal regulations of the Federal Tax Service, if there is “zero” information about the average headcount, the inspector must close the personal income tax card. And then, when an organization or entrepreneur begins to report income taxes, difficulties arise.

In our opinion, it is easier for employers to follow the advice of officials than to subsequently provide additional explanations. Moreover, such an overestimation of the average number of employees does not threaten any unpleasant consequences.

True, artificial inflation is unacceptable for individual entrepreneurs without staff and for organizations where there are no other employees except the sole founder. As mentioned above, entrepreneurs and sole founders are not taken into account in the average headcount. Therefore, rounding to one in this case will greatly distort the real state of affairs.