Mandatory product labeling brings business not only procedural and technological difficulties. It also affects the taxation system. UTII and product labeling in 2020 are incompatible : entrepreneurs selling such products will lose the right to apply imputation and patent. In this article, we analyzed all the details: for whom and from what moment the ban applies, what to do after that, and whether the marking allows you to combine different special tax regimes.

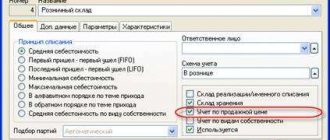

MySklad is a convenient accounting system and cashier program with free labeling support. We have everything ready to work with labeled goods: it’s convenient to order and print codes, it’s easy to put goods into circulation, sell, and issue returns. You will easily master the simple interface and be able to train staff. When labeling affects UTII, separate accounting is useful: in MyWarehouse you can apply different taxation systems for labeled and unlabeled goods. Everything is legal: within the framework of one sale, separate receipts are printed indicating the required system. Try it now: it's free!

Try MySklad

The abolition of PSN and UTII for marking became known in September 2019. Federal Law 325-FZ of September 29, 2019 amended the Tax Code, according to which retail trade for the purposes of applying these special tax regimes does not include trade in certain goods that need to be labeled:

- medications,

- shoe goods,

- products made from natural fur: clothing and accessories.

As soon as an entrepreneur sells at least one such product, he must switch from UTII to the general regime, from a patent to the general regime or simplified tax system.

The changes came into force on January 1, 2020. This is the main official information on UTII and labeling, and then the nuances begin.

UTII and shoe labeling in 2020

The issue of using UTII is most acute for shoemakers. The implementation of shoe labeling is moving to the final stage: as of July 1, 2020, trading without codes will be completely prohibited. When do you need to abandon UTII: from January 1, 2020, when new changes to the Tax Code come into force, from March 1 (the initial deadline for labeling) or from July 1?

The Ministry of Finance provided official clarification on this issue in a letter dated November 28, 2020 No. 03-11-09/92662. Since the circulation of unmarked shoes was planned to be finally stopped on March 1, 2020, until that day it is still possible to legally put into circulation, sell, or remove footwear products from circulation without applying codes to them. Thus, according to the instructions of the Ministry of Finance, UTII can be used in the retail trade of footwear until March 1, 2020. After the postponement of the final deadline for labeling from March 1 to July 1, it is likely that the deadline for applying special regimes will also be postponed, but there has been no official clarification on this issue yet.

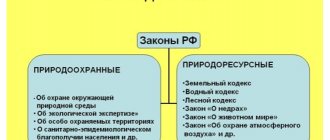

Tax system for retail trade

Third step

. Determine the optimal taxation system. There is a great temptation to choose the system with fewer mandatory payments. This is logical, but not always correct. It is often more profitable to reduce profits today in order to achieve a global goal tomorrow. For example, if you plan to actively attract investments and expand your business in the future, then it is better to immediately choose an LLC and work according to the general system.

- At a profit

. From the amount of the difference between income and expenses - 20% or 13% personal income tax for individual entrepreneurs. - For property

. If the organization owns real estate. - Value added tax

. Typically amounts to 18% of goods and services sold. VAT can be reduced by the amount of VAT you paid to the supplier.

Also read: Sliding work schedule is according to the Labor Code of the Russian Federation

Labeling of clothing and UTII

Another common question concerns clothing. Is it included in the list of goods incompatible with UTII and PSN?

The Ministry of Finance clarifies this issue in letter dated November 7, 2020 No. 03-11-11/85747. Retail trade for the purposes of applying UTII and PSN no longer includes the sale of only a limited group of goods: medicines, footwear and products made from natural fur. At the same time, the Government Decree on the labeling of fur products dated August 11, 2020 No. 787 contains a list of goods that belong to “clothing items, clothing accessories and other products made from natural fur” and which must be labeled. This is only clothing made from mink, nutria, arctic fox, fox, rabbit, hare, raccoon, sheepskin and other types of fur.

If an entrepreneur on UTII or PSN retails clothing that is subject to labeling, but is not made of natural fur, then the ban on using special modes does not apply to him. He may continue to apply the patent or imputation.

Retail trade on the simplified tax system

But reflecting 15% of expenses in the tax base using the simplified tax system requires a more careful approach and is associated with the fulfillment of some additional conditions. First of all, all expenses taken into account in tax reduction must meet the closed list provided for in Article 346.16 of the Tax Code. Expenses not included in this list cannot be reflected in tax accounting. Regarding some types of expenses, there are also direct explanations from the Ministry of Finance on whether tax deductions can or cannot be reduced due to them. Therefore, if a specific type of expense is in doubt, then it is better to check the availability of such explanatory documents authored by specialists from the financial department. But still, the main types of costs associated with running a business, such as the purchase price of goods, the services of third-party contractors necessary in the activity, material costs, labor costs, do not raise questions when including such amounts in the KUDiR.

As can be seen from the example, calculating the tax base in the simplified tax system with the object “income minus expenses” is much more labor-intensive, requires care, and also requires the organization of inventory accounting at the enterprise. Without such a system that would make it possible to reflect both purchases and sales in the context of each individual type of goods, it would be extremely difficult to organize correct tax accounting, especially with a large product range. However, in the end, this approach can pay off by minimizing tax deductions, and proper management of document flow and accounting in general will relieve the businessman of any possible questions from controllers.

Who will receive tax refunds?

On March 5, 2020, the State Duma adopted in the first reading a bill on compensation to taxpayers in the event of a forced change of the tax regime. This also applies to the refusal of UTII and patents when trading labeled goods. For entrepreneurs who had to switch to another taxation system not voluntarily, but on the basis of new rules, the bill proposes to allow them to take into account purchase costs during the period of application of the imputation and PSN of goods that were not sold before the transition to another tax regime. This also applies to labeled goods: shoes, medicines, fur products.

The innovation concerns legal relations that arose from January 1, 2020. Both individual entrepreneurs and organizations will be able to use the compensation.

IP USN INCOME reports for retail trade

In accordance with clause 4 of the Decree of the Government of the Russian Federation dated May 6, 2008 N 359 “On the procedure for making cash payments and (or) payments using payment cards without the use of cash register equipment,” there is no such statement, it just says that “ document form ( there we are talking about BSO

) is produced by printing method"

In accordance with Art. 346.15 Tax Code of the Russian Federation and Art. 249 of the Tax Code of the Russian Federation, for the simplified tax system, income from sales is taken into account, under which proceeds from the sale of goods (works, services) both of one’s own production and those previously acquired and proceeds from the sale of property rights are recognized. And proceeds from sales are determined based on all receipts associated with payments for sold goods (work, services) or property rights, expressed in cash and (or) in kind.

Is it possible to combine UTII and simplified tax system?

You can use the single tax on imputed income - UTII - until the beginning of 2021. From this moment on, it ceases to be valid completely, and the government does not expect to renew it. But is it possible to continue to use UTII until 2021, combining it with another taxation system, if an entrepreneur sells not only labeled goods that are incompatible with special regimes, but also other products that are not included in this number?

This situation can be interpreted in two ways.

The Tax Code states: if, during retail trade, a taxpayer allowed the sale of goods that do not relate to retail trade (taking into account new changes in the Tax Code, this applies to labeled shoes, medicines, fur products), from that moment he is considered to have lost the right to apply UTII and switched to BASIC. The transition is considered from the beginning of the tax period in which this sale was made.

Thus, according to the Tax Code, even a one-time sale of a labeled product from any of these three groups deprives the entrepreneur of the right to apply UTII.

The Ministry of Finance, however, issued its own clarification on this issue. The letter dated November 13, 2020 No. 03-11-11/87500 states that entrepreneurs who apply UTII for certain types of activities can apply the simplified tax system for other types (clause 4 of Article 346.12 of the Tax Code). And although 325-FZ excludes from retail trade for the purposes of UTII / PSN the sale of labeled medicines, shoes and natural fur, this does not mean a ban on keeping separate records if the requirements of Chapters 26.2 and 26.3 of the Tax Code are met. According to the position of the Ministry of Finance, a simplification can be applied for the listed goods that are subject to mandatory labeling, and along with this, for other goods - UTII.

It is noticeable that there is a discrepancy between the position of the Ministry of Finance and the norm specified in the Tax Code. When making a decision, it is worth considering that the opinion of the Ministry of Finance is not a legal norm, and the letter is explanatory in nature and is not a normative act.

Retail trade: choosing the optimal tax system for individual entrepreneurs

Individual entrepreneur retail trade is the activity of selling goods for personal use. Buyers of products are individuals and representatives of enterprises who purchase material assets not for sale. Sales are carried out under a retail sales agreement, which is represented by a cash register receipt or other document replacing the form.

The taxpayer has the right to choose the form of accounting independently, subject to compliance with restrictive standards. When choosing the most profitable system, it is necessary to determine what conditions of taxation and additional expenses are present in each of the regimes.

Businessmen on imputation

The overwhelming number of individual businessmen pay UTII from retail trade through their mini-retail outlets. As a rule, they do not have the financial resources to maintain significant retail space.

The classification of such outlets is quite diverse. It can be:

- tents at fairs;

- points in shopping centers;

- vending machines;

- stalls;

- trade trailers;

- hand carts, trays, etc.

When calculating UTII from the listed objects, the following criteria are used (see table).

| Retail outlet and how UTII is calculated from it | |

| Retail method | Indicator for taxa |

| Sales of goods occur through: • a stationary facility without retail space; • mobile point with an area of up to 5 square meters. m | Number of retail outlets or their working area |

| Selling goods by distribution or delivery | The number of implementers, taking into account the individual entrepreneur himself |

| Sales through vending machines | Their number |

Also see “Accounting for individual entrepreneurs on UTII in 2020: what to expect.”

Accounting for VAT on purchased goods under the simplified tax system

VAT is accounted for separately, the write-off conditions are the same as for the goods themselves - the goods must be paid for and sold. If not all goods are sold, but only part of them, VAT is written off as expenses, calculated in proportion to the cost of the goods written off for sale.

Expenses for the purchase of goods under the simplified tax system

Expenses associated with the purchase of goods can be written off immediately upon payment. Such expenses are the costs of delivering goods from the supplier, the costs of storing them and maintaining them in good condition. On the other hand, such expenses can also be taken into account as part of material expenses. Then it will be possible to take them into account as expenses are paid off as debts are paid to suppliers.

Costs of selling goods under the simplified tax system

Such expenses include the costs of delivering goods to customers, costs of pre-sale preparation, packaging and other similar costs. Such expenses can be taken into account immediately after they are paid. With regard to transport costs for delivering goods to customers, the position of regulatory authorities is not clear.

The Ministry of Finance believes that the cost of goods passes to the buyer at the time of sale, the cost of subsequent delivery (delivery of someone else's property, according to the Ministry of Finance) can be taken into account in expenses only if the cost of such delivery is included in the sale price of the goods, or delivery costs are separately reimbursed by the buyer.

Typical accounting entries when selling goods at retail at sales prices

Typical wiring is shown in Table 1: (click to expand)

| No. | Contents of operation | Debit account | Credit account |

| 1 | Goods received | D 41 | D 60 |

| 2 | Trade margin reflected | D 41 | K 42 |

| 3 | Payment to supplier reflected | D 60 | K 51 |

| 4 | Revenue from goods sold at retail | D 50 | K 90.01 |

| 5 | The sales value of goods sold is written off | D 90.02 | K 41 |

| 6 | REPLACEMENT reflects the trade margin on the goods sold | D 90.02 | K 42 |

| 7 | The financial result from retail sales has been determined | D 90.09 | K 99 |