Trade margin value

In order to obtain the planned profit, the seller, when selling goods, forms the cost using the amount of markup on the original cost. The resulting difference must cover all estimated costs, including the following:

- VAT and other indirect taxes;

- sales costs (third-party services, employee salaries);

- other expenses.

At the same time, the markup ensures not only the covering of expenses, but also the profit of the seller. At the same time, the value of the trade margin should not impede the further competitiveness of the product on the market in comparison with other similar items.

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

https://youtu.be/eLOQf78dP9A

Typical postings for account 42

To reflect generalized information about the amounts of markup on goods, account 42 is used. According to Kt 42, the amounts of accrued trade margins are carried out, according to Dt 42 - write-off of the margin in connection with the sale of goods, reduction of the amount of the margin, etc. Let's look at typical transactions for account 42:

| Dt | CT | Description | Document |

| 41 | 42 | The accrual of the amount of trade margin is reflected | Register of retail prices |

| 90.2 | 42 | The amount of markup on goods sold is written off | Register of retail prices |

| 91.2 | 41 | Write off the excess of the markdown amount over the markup | Register of retail prices |

Creating a markup on a product - example

LLC "Velikan" purchased from LLC "Magnit" a consignment of goods (150 irons) worth 324,500 rubles, VAT 49,500 rubles. The trade margin on the goods was 35%. When determining the amount of the trade margin and the sales price for the goods, the accountant of Velikan LLC made the following calculations:

- The trade margin for a consignment of goods is RUB 96,250. ((RUB 324,500 - RUB 49,500) * 35%).

- The selling price of the consignment is RUB 371,250. (RUB 324,500 - RUB 49,500 + RUB 96,250).

- Retail price of a product unit (one iron) is RUB 2,475. (RUB 371,250 / 15 pcs.).

Reflecting transactions in accounting, the accountant of Velikan LLC made the following entries:

| Dt | CT | Description | Sum | Document |

| 41 | 60 | A consignment of goods was received from Magnit LLC (RUB 324,500 - RUB 49,500) | 275,000 rub. | Packing list |

| 19 | 60 | The amount of VAT on the received goods is reflected | RUB 49,500 | Packing list |

| 60 | 51 | Funds were transferred to Magnit LLC as payment for the goods | RUB 324,500 | Payment order |

| 68 VAT | 19 | VAT is accepted for deduction | RUB 49,500 | Invoice |

| 41 | 42 | The amount of accrued trade margin on the product is reflected | RUB 96,250 | Register of retail prices |

Postings for writing off margins on goods sold

Rynok Plus LLC operates in the retail trade sector. According to the accounting policy, goods at the enterprise are accounted for at their selling price.

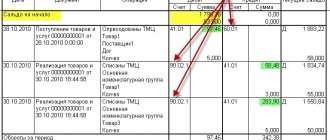

As of 02/01/2016, in the accounting records of Rynok Plus LLC, the balance for Dt 41 is 471,200 rubles, for Kt 42 - 193,000 rubles.

During February 2020, Market Plus LLC carried out the following operations:

- Goods were purchased for the amount of 942,000 rubles. without VAT. Trade margin - 403,000 rubles. Selling price - RUB 1,345,000. (942,000 rub. + 403,000 rub.).

- Goods sold for the amount of 1,418,300 rubles, VAT 216,351 rubles. Costs for selling goods - 88,200 rubles.

The cost of the goods, the balance of which is listed as of February 29, 2016, amounted to 397,900 rubles. (RUB 471,200 + RUB 1,345,000 - RUB 1,418,300).

The average percentage of markup applied to sold products was calculated by the accountant at Rynok Plus LLC as follows:

((RUB 193,000 + RUB 403,000) / (RUB 1,418,300 + RUB 397,900) * 100%) = 32.81%.

The following entries were made in the accounting of Rynok Plus LLC:

| Dt | CT | Description | Sum | Document |

| 50 | 90.1 | Revenue for February 2020 went to the cash desk of Rynok Plus LLC | RUB 1,418,300 | Receipt cash order |

| 90.2 | 41 | The selling price of goods sold is reflected in expenses | RUB 1,418,300 | Implementation report |

| 90.2 | 42 | Reversal of trade margin on goods sold (RUB 1,418,300 * 32.81%) | RUB 465,345 | Register of retail prices, accounting certificate-calculation |

| 90.3 | 68 VAT | The amount of VAT accrued on the goods sold | RUB 216,351 | Implementation report |

| 90.2 | 44 | Selling costs are reflected as expenses | RUB 88,200 | Expense report |

| 90.9 | 99 | At the end of February 2020, the amount of the financial result is reflected (RUB 465,345 - RUB 216,351 - RUB 88,200) | RUB 160,794 | Turnover balance sheet |

Video lesson. Account 42 in accounting “Trade margin”: examples

Video lesson on accounting for account 42 “Trade margin”. The lesson is taught by the chief accountant, expert, site teacher Gandeva N.V. Typical situations, examples and wiring are considered ⇓

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8000 books purchased |

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

Postings for accounting of goods in retail at sales prices

- 60,000 rubles) - the financial result from sales for the first quarter was revealed.

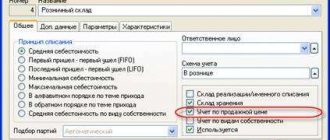

Goods purchased by an organization for sale are assessed at the cost of their acquisition. However, retail trade organizations are allowed to evaluate purchased goods at their selling price, taking into account markups (discounts), i.e. the organization can reflect on account 41 “Goods” the price that is indicated on the price tag (in the price list) and is payable by the buyer.

The trade margin related to the cost of goods sold is called gross income.

The methodology for calculating trade margins is fixed by law, therefore a trade organization has the right to use any methodology approved by the organization, namely, it establishes:

- first the selling price, and then calculate the trade margin;

— for a specific product (group of products) a trade margin in the form of a fixed amount (used when the organization is a dealer of the product manufacturer);

— for a specific product (group of products) a trade margin in the form of a fixed percentage.

The size of the trade margin on goods can be any. The exception is goods for which state price regulation is carried out. For them, the maximum amounts of retail markups to the actual selling price of the manufacturer are established (for example, for medicines).

In order to identify the financial result from sales, not all revenue should be debited to account 90, but only the cost of purchasing goods. It is defined as the difference between the cost of goods at retail prices and the trade margin related to the goods sold. To do this, simultaneously with writing off the sales value, the amount of the trade margin attributable to the goods sold (realized trade overlay) is written off from account 90. Therefore, the main thing when accounting for goods at sales prices is the correct calculation of the amount of markup on goods sold.

Let us consider how, with different methods for determining the accounting price of goods, transactions for the sale of goods are reflected in accounting.

Date of publication: 2015-07-22; Read: 179 | Page copyright infringement

Determination of trade margin

To determine the final cost of goods in wholesale and retail trade, different algorithms are used.

When selling wholesale, the trade margin is the difference between the wholesale selling price and the purchase price.

To account for retail trade, it is allowed to accept goods not only at cost, but also at final selling prices. Such actions are permissible, since sometimes it is impossible to determine the natural value of a unit of goods. An exception is a unit of large products, for example, household appliances. But when selling smaller goods (office supplies, food), detailed accounting is impossible. In retail companies, it is preferable in such cases to account for goods at selling prices.

The selling price of a product consists of the cost price and an added margin. The latter value can be established by organizations independently, with some exceptions indicated below.

It is allowed to set a markup using the Register of Retail Prices, approved by the manager. For any type of product, information is provided about the supplier, the purchase price, the amount of markup in % terms, and the final market price. Each place of subsequent sale can have its own price.

The approved register may look like this:

| Product | Provider | Cost price | Markup 1 | Retail price 1 | Markup 2 | Retail price 2 |

| Pen | LLC "Prestige" | 45.00 rub. | 30% | 58.50 rub. | 35% | 60.75 rub. |

| Pen | LLC "Titan" | RUB 54.00 | 30% | 70.20 rub. | 35% | RUB 72.90 |

| Pencil | LLC "Dream" | 25.00 rub. | 30% | RUB 32.50 | 35% | 33.75 rub. |

The markup can also be uniform for all types of goods or depend on their type. It is recommended that the chosen method of determining retail prices be fixed in the current accounting policy.

Since the retail price is the sum of the supplier’s price and the trade markup, the primary accounting documentation must contain a document linking these two prices and providing documentary evidence of the calculation of the retail price.Such a document is the register of retail prices. The register of retail prices must contain the following details: • name of the organization; • date of compilation; • serial number of the register; • signature of the head and seal of the organization. The register must reflect: • name of the product; • supplier price for this product; • trade margin (as a percentage of the supplier’s price and in monetary terms); • retail price.

In accordance with the Methodological Recommendations for Accounting and Registration of the Movement of Goods (52), changes in retail commodity prices are made by order of the head of the enterprise and are documented in an inventory act. The inventory list-act must contain the following information: • date of price change; • name of the revalued product; • quantity of revalued goods; • old price for the product; • new price for the product; • the amount of revaluation (discount) - the difference between the cost of goods in old and new prices.

The inventory list-act must be certified by the signature of the head of the enterprise and the seal of the organization.

The Methodological Recommendations for Accounting and Registration of the Movement of Goods (52) does not provide a strict procedure for drawing up inventory records and acts, so an accountant can draw them up in any form. Here is the most common example in practice for filling out an inventory report. It can be formatted like this:

JSC "Raduga"

January 15, 2004

Inventory list - act of revaluation of goods

| № p/p | Name of product | Product quantity (pcs.) | Old price (RUB per piece) | New price (RUB per piece) | Amount of revaluation (+) of devaluation (-) of goods |

| 1. | Shampoo | 7 | 19,5 | 20 | +3,5 |

| 2. | Soap | 10 | 7 | 6 | -10 |

| Total revaluation: | 3 rub. 50 kopecks | ||||

| Total markdown: | 10 rub | ||||

| CEO ____________________ _____________ / / | |||||

The data of the inventory list - act is recorded in retail price registers containing information about the product that has been overpriced. In the registers, opposite the name of the revalued product, additional columns are entered: • new price with the date of its introduction; • new size of trade margin; • date from which the price of the product changed.

The accrual of the trade margin is reflected by the entry: Debit 41 Credit 42 - the trade margin has been accrued on the capitalized goods. The trade margin includes the income of the trading organization, VAT and sales tax. In this case, taxes are included in the trade margin only if the goods sold are subject to these taxes. Example.

The Manufactured Goods store purchased 10 teapots at a price of 1,180 rubles/piece. (including VAT - 180 rubles). The total cost of the batch of teapots is 11,800 rubles. (including VAT - 1,800 rubles). Teapots are subject to VAT at a rate of 18 percent. The markup on goods (excluding VAT) is set at 40 percent.

The store accountant made the following entries:

| No. | Contents of operation | Account correspondence | Sum | |

| Debit | Credit | |||

| 1. | goods received from the supplier are capitalized; | 41 | 60/1 | 10 000 |

| 2. | VAT on goods received is taken into account; | 19 | 60/1 | 800 |

| 3. | goods paid to supplier | 60/1 | 50 | 11 800 |

| 4. | VAT tax deduction was made on goods received and paid for. | 62/2 | 19 | 1 800 |

| 5. | reflects the trade margin on capitalized goods | 41 | 42 | 6 520 |

The amount of the trade margin (excluding VAT) was 4,000 rubles. (RUB 10,000 x 40%). The amount of VAT included in the sales price of goods will be: (RUB 10,000 + RUB 4,000) x 18% = RUB 2,520. The total amount of the trade margin will be 6,520 rubles. (4000 + 2,520). Thus, the selling price of a batch of teapots will be 16,520 rubles. (10,000 + 6,520). The teapots are reflected in the balance sheet at their purchase price—RUB 10,000. The amount of the trade margin on disposed goods is written off. The margin on goods for which the price has been reduced is also written off. The amount of the trade margin on goods sold is reversed in correspondence with account 90 “Sales” subaccount “Cost of sales”. This operation is reflected by the entry:

Debit 90-2 Credit 42

— the realized trade margin was reversed.

Example.

Let's go back to the previous example. The Manufactured Goods store sold all 10 teapots, the accountant made the following entries: Debit 50 Credit 90-1 - 16,520 rubles. — proceeds from the sale of goods were received by the store’s cash register; Debit 90-2 Credit 41 - 16,520 rub. — the accounting value of goods sold is written off; Debit 90-2 Credit 42

6 520

the realized trade margin was reversed; Debit 90-3 Credit 68/2 “VAT calculations” - 2,520 rubles. (RUB 16,520) x 18%: 118%) - VAT is charged and must be paid to the budget. The store's income will be 4,000 rubles. (6,520 – 2,520).

Write-off of markup when marking down goods

The amount by which the product needs to be discounted is written off from the previously established trade margin: Debit 41 Credit 42 - the amount of the trade margin is reduced by the amount of the product markdown. If the amount of the markdown exceeds the size of the trade margin, then the difference that arises is included in other expenses: Debit 91-2 Credit 41 - the excess of the amount of the markdown of goods over the trade margin is written off. The amount of markdown of goods is not taken into account when taxing profits.

The calculation of the amount of the trade margin of goods sold is made at the end of the month, and if a trade organization uses a natural-cost scheme for accounting for goods (using bar codes, soft checks, etc.), then the entry during the month is made on the basis of information on sales specific products with specific purchase prices. If a trade organization uses a cost scheme for accounting for goods, then the cost of goods sold at purchase prices (P) is calculated using the formula:

P = O1 + P – O2,

where O1 is the balance of goods at the beginning of the period; P - receipt of goods for the reporting period; O2 - balance of goods at the end of the period.

The receipt of goods for the reporting period is determined in the amount of debit turnover of account 41 on the basis of incoming documents. The balance of goods in value terms is calculated: 1) on the basis of an inventory of financially responsible persons about the balance of goods in physical terms; 2) the accountant enters prices for each item of goods in the inventory based on the method of valuing goods used in the organization.

To determine the amount of the realized trade margin, you can use the formula for calculating gross income (GI) for the range of remaining goods given in clause 12.1.7 Methodological recommendations for accounting and registration of the movement of goods (52):

VD = (TNN + TNP - TNV) - TNK,

where TNN is the trade markup on the balance of goods at the beginning of the reporting period; TNP - trade markup on goods received during the reporting period; TNV - trade allowance for retired goods (disposal of goods in this case means the so-called documentary expense (return of goods to suppliers, write-off of damaged goods, etc.)); TNK - trade markup on the balance of goods at the end of the reporting period. The trade markup for the assortment of remaining goods can be determined at the end of the month in the following order: 1) materially responsible persons draw up an inventory of remaining goods (balance sheet) in physical (or in physical or value) terms; 2) the accountant puts a markup on each item of goods; 3) the amount of markups on the balance of goods is determined.

Example. An enterprise engaged in the sale of household appliances received and paid for equipment worth RUB 354,000 from suppliers in the reporting month, incl. VAT 54,000 rub. (all products are subject to VAT at a rate of 18%). Goods are accounted for at sales prices. The trade margin is set for each item of equipment individually. The resulting equipment was put on sale at a price of RUB 560,000. Revenue for the reporting month amounted to RUB 4,720,000, incl. VAT 72,000 rubles, distribution costs amounted to 130,000 rubles. The trade margin on the balance of goods at the beginning of the month is 20,000 rubles, and at the end of the month on the balance of unsold goods - 10,000 rubles. In accordance with the accounting policy, the trade margin on goods sold is determined by the assortment of the remaining goods.

In this case, there are no disposed goods, the trade margin at the beginning of the month is 20,000 rubles, the trade margin on incoming goods is 260,000 rubles. (560,000-300,000), trade margin on the balance of goods - 10,000 rubles. The realized trade markup in the reporting month will thus amount to RUB 270,000. (20,0000). In accounting, a reversal entry is made for this amount under Debit account 90/2 “Cost of sales” Credit, 42 “Trade margin”

State regulation of pricing

Prices for certain products are controlled by the state. The government determines the acceptable price for certain goods that have special social significance. If a product is on the List of Price-Controlled Products, then their final cost, including markup, must be formed in accordance with current laws and regulations at the federal and local levels.

If there is a steady increase in prices for goods of social importance, the Government has the right to temporarily limit their maximum limit. But this can be done if the price increase level exceeds 30% over a 30-day period. The maximum permissible value of the cost of such goods, established by the Government, can be maintained for up to 90 days.

Socially significant goods include the following: meat, milk, sunflower oil and butter, flour, eggs, sugar, salt, bread, cereals, potatoes, some types of fruits and vegetables. In addition to food products, the list of goods for which control over selling prices can be established includes children's products, medicines, medical products, goods intended for sale in the Far North and regions equivalent to it.

If cases of overpricing are detected for goods regulated by states, the responsible persons and organizations will face fines. For management, fines of up to 50,000 rubles are provided, for legal entities - in the amount of twice the amount of revenue exceeded as a result of overstatement for the entire period of overstatement, but for a total duration of no more than a year.

Postings for accounting for trade margins in retail trade

Synthetic accounting of retail sales of goods is maintained on account 90 “Sales”. The credit of the account reflects the sales value of goods sold (including VAT), and the debit reflects the cost of goods sold, selling expenses, and VAT.

Based on the cashier’s report, daily entries are generated reflecting the amount of revenue from the sale of goods:

D 50 “Cashier” K 90-1 “Revenue”.

When closing the reporting period (month), the trading organization makes the following entries:

a) charges VAT:

D 90-3 “VAT” K 68 “Calculations for VAT”;

b) writes off sales expenses for the reporting month:

D 90-2 “Cost of sales” K 44 “Sales expenses”.

Next, you should write off the cost of the goods and determine the gross income from trading activities. The reflection of these transactions in retail trade depends on the method chosen by the organization for valuing inventory (at purchase or sales prices).

Example 3.1. In the first quarter of 2010, the trading enterprise received revenue from the sale of goods through the retail network (the enterprise does not conduct other types of activities) in the amount of 660,800 rubles, including VAT - 18%. The company keeps records of goods at purchase prices. The cost of goods sold during the reporting period was 420,000 rubles, sales expenses amounted to 60,000 rubles.

The following accounting entries will be made:

D 50 “Cashier” K 90-1 “Revenue” - 660,800 rubles. — revenue from the sale of goods is reflected;

D 90-3 “VAT” K 68, subaccount “Calculations for VAT” - 100,800 rubles. — VAT is charged on the cost of goods sold;

D 90-2 “Cost of sales” K 41 “Goods” - 420,000 rubles. — the cost of goods sold is written off;

D 90-2 “Cost of sales” K 44 “Sales expenses” - 60,000 rubles. - sales expenses are written off.

In accordance with the Instructions for the use of the Chart of Accounts, an organization can, at its discretion, clarify the contents of sub-accounts, exclude and combine them, introduce additional sub-accounts based on the specifics of the activity and in order to obtain comprehensive information for reporting and making management decisions. In the example, a trading organization decided to account for sales expenses written off from account 44, separately from the cost of goods sold. To summarize information about expenses associated with the sale of goods, the organization uses account 90:

D 90-9 “Profit/loss from sales” K 99 “Profits and losses” - 80,000 rubles. (660,800 rub. - 100,800 rub. - 420,000 rub.

Accounting in trade postings

The sale of essential food products is also subject to state regulation. In relation to other products, it is allowed to establish a trade margin in any amount.

Attention

But in this case, the pricing process is greatly influenced by competition, which restrains the growth in the cost of goods. Trade enterprises have the right to set either a single markup for the entire assortment or use different values that determine prices for individual product groups.

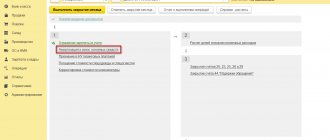

The chosen method will need to be fixed in the accounting policy. Get 267 video lessons on 1C for free:

- Free video tutorial on 1C Accounting 8.3 and 8.2;

- Tutorial on the new version of 1C ZUP 3.0;

- Good course on 1C Trade Management 11.

Postings for accounting for trade margins Postings for sales transactions give an idea of the profit received.